Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Popt: I know you're trying to be funny...

- KEYO common share were permanently terminated in 2011. That means they don't exist

- Keyon is not a company

- Keyon does not exist.

- There was no CCRA NHMD exchange.

- It was just a simple symbol change.

- In KEYO's case, there are no existing shares.

lesn: I think you are trying to be funny.

- KEYO has common shares

- KEYO has preferred shares

- NANT has private shares that will be exchanged for those KEYO shares

- KEYO was publicly traded and NANT will be publicly traded after...

- KEYO has its symbol changed

heidib: Check out his Twitter presence...himself, NantKwest, NantWorks, NantHealth. NantKwest point to following himself and NantHealth, nothing else...just points to those. NantWorks is the least updated. NantHealth, the most, his seems the most personal.

I wonder who keeps up on these for him or the companies?

Hmmmmm.....

lns

Blue-Eyed Jesus is burning bright.

Nantworks "Social" box is down. Being worked on? Being moved to new page? Hmmm...

Constantly SPINNING! LOL! ![]()

Rock On KEYO Shell / NANT-Works "RTM" for the US Stock Market BEST EVER "reverse merger" in HISTORY about to go down THIS YEAR!

I know right! Obviously still does NOT GET IT for some reason! LMAO!

It's only been explained multiple times over and over in depth to correct the non-Factual KEYO/Shell hearsay rubbish being injected to the board!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121568009

Rock On KEYO Shell / NANT-Works "RTM" for the US Stock Market BEST EVER "reverse merger" in HISTORY about to go down THIS YEAR! ![]()

Popt: Yes, in the pancake deal, preferred and common shares were exchanged in the end and the symbol changed.

In KEYO's case:

- KEYO has common shares

- KEYO has preferred shares

- NANT has private shares that will be exchanged for those KEYO shares

- KEYO was publicly traded and NANT will be publicly traded after...

- KEYO has its symbol changed

lns

lesn: Yes, in the pancake deal, preferred shares were exchanged for common shares and the symbol was changed.

In the KEYO scam:

-None of the companies have commons shares;

-None of the companies have preferred shares;

-None of the companies are publicly traded;

-None of the companies have a symbol to change.

Popt: The CCRA 10 filing for a registration of securities, points out that:

This is an Exchange Act registration statement and not a registered offering of securities.

Duh. What do you think it says right on top of the Form 10 what it is?

FORM 10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Popt: If there was not a common share for share exchange in Nate's plan then surfkast and investor229 would not have confirmed that they had their CCRA common stock symbols in their accounts changed to NHMD with no additional filing stating such.

Afterall, everybody knows that a stock symbol merely represents the underlying company on a stock certificate.

lns

Popt: You misunderstand how the common shares got exchanged, which they did. Yes, you may suggest it was shady but it occurred and it's what always occurs in a reverse merger transaction where a public shell is used to take a private company public...

Shares are exchanged.

lns

Popt: No. Just illustrating again that if he wanted to raise money in conjunction w/ him going pubic he has no need to pay for a WallSt./TBTF traditional underwritten IPO to do so, which would cause him to lose a lot more control of his company than going public the most logical way given his means...RTM using his KEYO shell.

lns

lesn: If there was a common share for share exchange in the pancake plan, there would be a filing stating that.

There is not.

It was just a simple symbol change. There is no remote similarity between the pancake plan and the KEYO scheme.

Popt: Yes, again, there was a share exchange, both common and preferred. Otherwise, how did these two common shareholders, surfkast and investor229, have their common share symbols changed in their accounts if the underlying common shares the symbols represent weren't exchanged as well?

A stock symbol represents the name of the company on the underlying stock certificate

HOW DO YOU SUPPOSE THAT HAPPENED TO THEIR COMMON STOCK SYMBOLS in their accounts if they weren't exchanged? Explain to us what exactly you think happened to the underlying stocks certificates represented by the symbols in their accounts?

In the case of KEYO, the same thing will happen as did w/ CCRA.

All share types will be exchanged and all share symbols will change from the former shell symbol to the new public company symbol.

surfkast and investor229 were never CCRA Preferred shareholders. They were CCRA common shareholders. They had their common CCRA shares exchanged for NHMD shares and that was evidenced by them by the CCRA symbol and CUSIP in their accounts changing to NHMD and its new CUSIP.

Do you think they are not telling the truth?

lns

lesn: The CCRA 10 filing for a registration of securities, points out that:

This is an Exchange Act registration statement and not a registered offering of securities.

https://www.sec.gov/Archives/edgar/data/1409446/000147793214005261/nate_1012ga.htm

If I understand the new KEYO scam, the belief is that the new company would register new shares.

lesn: You can't possibly believe Soon-Shiong plans a PIPE deal.

lesn: Yes, there was a share exchange in the pancake plan. Preferred shares were exchanged for existing common shares. In the KEYO scam, neither company has any shares. Therefore, there can be no exchange of shares.

Popt: Forget that a RTM is a type of RM? Also forget that a RTM is the tax-free re-organization way to go public for an LLC and it's the most common? Forget as well that money can be raised, if wanted, via a RTM in conjunction w/ a PIPE and it's called an APO, absolving the need for a WallSt. underwritten (and costly) traditional IPO, which would also cost him less control after going public?

Forget also that it was reported by FORBES after months of interviews and close investigation that NantHealth, LL was expected to go public as tracking stock?

Forget that a tracking stock issued is considered an IPO as well, just not your normal IPO? Forget also that tracking stocks are issued as a new class or series of stock from the parent company's A/S? Forget as well that this means the parent company must be public, and public first, before issuing tracking stock for one of its subs or divisions?

lns

Popt: Arguing that doesn't change the FACT that the Form 15's filed by CCRA and KEYO are identical and the same outcome will occur as it (KEYO's) will be followed up, when Dr.SS is ready, by a Form 10 being filed and subsequent symbol change in our (well, not yours) accounts from the former shell symbol (KEYO) to the new public (once private) company's new symbol (NANT) will occur.

Just like when Nate was ready, a Form 10 was filed and subsequent symbol change in folks accounts from the former shell symbol (CCRA) to the new public (once private) company's new symbol (NHMD) occurred. Oh, and behind the scenes, there was a share exchange as well.

Two long-term CCRA/NHMD shareholders even attested to that FACT.

They weren't lying.

lns

OMG...the wheels on the bus go round and round...

lesn: Oh, it happened in 2011. All common shares in KEYO were terminated. See here:

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 15

CERTIFICATION AND NOTICE OF TERMINATION OF REGISTRATION UNDER SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SUSPENSION OF DUTY TO FILE REPORTS UNDER SECTIONS 13 AND 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission File Number 001-33842

KeyOn Communications Holdings, Inc.

(Exact name of registrant as specified in its charter)

7548 West Sahara Avenue #102, Las Vegas, Nevada (702) 403-1246

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Common Stock, par value $0.001

(Title of each class of securities covered by this Form)

N/A

(Titles of all other classes of securities for which a duty to file reports under section 13(a) or 15(d) remains)

Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to terminate or suspend the duty to file reports:

Rule 12g-4(a)(1) x

Rule 12g-4(a)(2) o

Rule 12h-3(b)(1)(i) x

Rule 12h-3(b)(1)(ii) o

Rule 15d-6 o

https://www.sec.gov/Archives/edgar/data/1335294/000143774911009778/keyon_form15-122311.htm

17 CFR 240.12g-4 - Certifications of termination of registration under section 12(g).

https://www.law.cornell.edu/cfr/text/17/240.12g-4

RDY:

BEST EVER reverse merger in HISTORY

LNS: what truly looks FOOLISH is the OBSESSION with massive amounts of FALSE KEYO "SHELL" info being injected to the board when not owning KEYO "SHELL" shares and non-PUBCO status! ROTFLMAO!

Locked-In or Locked-Out now so how can it be the so called scam? That makes ZERO sense! LMAO!

We that own shares know the KEYO "SHELL" is currently non-PUBCO and shares still in brokerage accounts. I see them EVERY day! ![]()

We also know a non-PUBCO SHELL can trade again and have provided proof to the board. I have yet to see any PROOF a non-PUBCO SHELL cannot trade again, because it CAN! So to say it cannot is just utter nonsense and FALSE!

Do I think we will see the KEYO ticker trade again? NOPE! But I do think we will see a NANT ticker for the Parent Company NANT-Works instead! ![]()

Rock On KEYO Shell / NANT-Works RTM for the US Stock Market BEST EVER reverse merger in HISTORY about to go down THIS YEAR! ![]()

The FACTS on the board when comprehended correctly show this IS POSSIBLE!

Popt: That never happened. It's proven fact and the truth that Tom W. only VOLUNTARILY filed the cert of dissolution w/ the DE SOS in 5/22/14. It's total and complete fabrication to state that Soon-Shiong VOLUNTARILY filed to terminate all KEYON common shares in 2011. In fact, it's a outright lie to state they were terminated at all because they still exist in my brokerage accounts.

Same thing will happen here as happened with CCRA...

Again, it's already been noted that the way the forms were filled out and the reason checked are exactly the same. So...

If CCRA, why not KEYO? ![]()

No reason except if one were to make things up as to why not. And, actually, Dr.SS using KEYO makes complete sense vs. a traditional IPO where he'd lose the control he has and it would cost him a lot for nothing because Dr.SS already told us he is well funded and doesn't need to go public for that reason. And, raising funds is the only reason to go public via a traditional WallSt./TBTF bank underwritten IPO.

Besides which, Dr.SS already told the world what his IPO Inspiration for NantHealth is and it is NOT to raise funds one-time via the proceeds from a traditional IPO. It is NOT to fund NantHealth directly. It's so a huge portion of NH shares will be used to fund the NantHealth Trust for years to come. Taking NantHealth public will enable that in a sustainable way.

Had NOTHING to do w/ 'going public' via a traditional IPO. NOTHING.

lns

lesn: So what do you think happened in 2011, exactly, when Soon-Shiong VOLUNTARILY filed to terminate all KEYON common shares? What was the outcome, in your opinion?

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 15

CERTIFICATION AND NOTICE OF TERMINATION OF REGISTRATION UNDER SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SUSPENSION OF DUTY TO FILE REPORTS UNDER SECTIONS 13 AND 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission File Number 001-33842

KeyOn Communications Holdings, Inc.

(Exact name of registrant as specified in its charter)

7548 West Sahara Avenue #102, Las Vegas, Nevada (702) 403-1246

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Common Stock, par value $0.001

(Title of each class of securities covered by this Form)

N/A

(Titles of all other classes of securities for which a duty to file reports under section 13(a) or 15(d) remains)

Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to terminate or suspend the duty to file reports:

Rule 12g-4(a)(1) x

Rule 12g-4(a)(2) o

Rule 12h-3(b)(1)(i) x

Rule 12h-3(b)(1)(ii) o

Rule 15d-6 o

https://www.sec.gov/Archives/edgar/data/1335294/000143774911009778/keyon_form15-122311.htm

17 CFR 240.12g-4 - Certifications of termination of registration under section 12(g).

https://www.law.cornell.edu/cfr/text/17/240.12g-4

Popt: It still is KEYO shares exist because they're in my account. KEYO shares were never terminated. The broker won't change the CUSIP until KEYO's symbol changes to NANT.

lns

lesn: It used to be KEYO shares existed because they still traded. Now, the threshold has dropped to the broker has yet to delete the CUSIP from your personal account (yet).

And yes, KEYO is still trading...

Popt: There was a share exchange evidenced by the symbol and CUSIP change. In KEYO's case, shares exist because I have them in my brokerage accounts.

lns

lesn: There was no exchange. It was just symbol change for existing shares.

In KEYO's case, there are no existing shares.

Popt: You did answer it but the answer was still 100% wrong and fabricated because it is inherent how reverse mergers work...the shares are exchanged, both preferred and common.

THEY WERE EXCHANGED 1 FOR 1

Both surfkast and investor229 both owned common shares, not preferred. Both had their shares in their brokerage accounts EXCHANGED. Their evidence? The CUSIP of the stock they now had in their account had changed as well as the symbol.

You still didn't address these. Will you do so now?

If one did have CCRA paper common stock certificates (which they could if they wanted) in their possession then how would they have gotten their NHMD paper common stock certificates for the 1:1 swap?

Just scribble over the ticker symbol and company name on the cert w/ crayon and call it good?

Or, exchange them w/ their brokerage firm 1:1 for newly printed CCRA stock certificates?

lns

lesn: I have answered your inquiries. There was no common share exchange. This very sleazy company does not solve the deep problems with the bizarre scheme where someone comes along and gives former KEYO shareholders new shares to a totally different company. For free!

Nate's was originally purchases by CCRA. Then, using Obama's JOBS Act, Nates did a reverse merger with its acquirer by doing a common stock to preferred stock exchange. In both cases, the exchange occurred between existing shares (albeit the preferred shares were showroom new). Then the symbol was changed, but they kept the share structure of CCRA. Using Obama's JOBS Act is a very unusual move - the first time I have seen it and it is not legal (yet).

What you seem to be proposing is common stock to common stock exchange in the absence of existing common stock shares for either company.

There really is no similarity between the RTM scheme and Nate's.

Read more here:

There is no public market for our Common Stock… There has not been a market for our Common Stock.

We are an “emerging growth company,” as defined in the JOBS Act.

This is an Exchange Act registration statement and not a registered offering of securities.

For the period ending May 31, 2014, the Company had $3,500 in operating expenses. These expenses related to setting up the company after the reverse merger. On May 19, 2014, the acquisition closed and under the terms of the agreement Nate’s Pancakes was the surviving entity. The Company selected May 31as its fiscal year end.

Sale of Unregistered Securities.

On May 12, 2014, the Company executed a reverse merger between the Company and Nate’s Pancakes whereby Nate’s Pancakes was the surviving entity and become a wholly owned subsidiary of the Company. The Company issued 148,115 shares of its Series B Preferred Stock in exchange for the 148,115 shares of Nate’s Pancakes.

Item 11. Description of Registrant’s Securities to be Registered

(a) Common Stock.

The Certificate of Incorporation, as amended, authorizes the Company to issue up to 300,000,000 shares of Common Stock ($0.0001 par value). As of the date hereof, there are 61,200,000 shares of our Common Stock issued and outstanding, which are held by 11 shareholders of record. All outstanding shares of Common Stock are of the same class and have equal rights and attributes. Holders of our Common Stock are entitled to one vote per share on matters to be voted on by shareholders and also are entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors in its discretion out of funds legally available therefore.

https://www.sec.gov/Archives/edgar/data/1409446/000147793214005261/nate_1012ga.htm

Shady.

Gee imagine that - once again WRONG! ![]()

Digging that hole DEEP - LMAO!

Rock On KEYO Shell / NANT-Works RTM for the US Stock Market BEST EVER reverse merger in HISTORY about to go down THIS YEAR! ![]()

Popt: Care to address the direct refutes by investor229 and surfkast to the claim that...

CCRA shares were terminated. They did 'become' anything. If investors wanted new shares, they bought them.

If there had been a share exchange, there would be a 13 filing indicating such. There was no such filing.

investor229:

- Hey! It was CRRA and it was simply a ticker change for me.

- I am saying my share count remained unchanged and the ticker symbol changed from CRRA to NHMD. I didn't have to do anything. Everything was done automatically by Fidelity.

surfkast: THEY WERE EXCHANGED 1 FOR 1

They lived it. Do you think they are not telling the truth about their experience?

lns

Popt: hahaha. Duh. How many people actually ever hold onto paper stock certificates anyway? loL!

Yeah, like all that money the Fed 'prints' is in a vault somewhere. ROTF.

Yes, just a ticker symbol on my brokerage statement and online. That's all most ever see. But, if one did have CCRA paper stock certificates (which they could if they wanted) in their possession then how would they have gotten their NHMD paper stock certificates for the 1:1 swap?

Just scribble over the ticker symbol and company name on the cert w/ crayon and call it good?

Or, exchange them w/ their brokerage firm 1:1 for newly printed CCRA stock certificates?

lns

lesn: There was no CCRA NHMD exchange. They simply changed the ticker symbol.

There is absolutely no correlation between your wild RTM proposal and pancakes.

Most GET IT! ![]()

KEYO Shell Shares still in my account too! ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121473228

The possibility DOES exist the KEYO Shell, a non-PUBCO Trading clean debt-free shell worth 30MM NOLs can be used. Watching for that NANT-Works/NANT ticker for NANT Rocket Ship Blast-Off! ![]()

Popt: Nope because it'll be just like the CCRA shares which were un-registered in 2011 according to the same boxes being checked in their Form 15 then re-registered in 2014 as NHMD shares when they filed their Form 10. In KEYO's case they un-registered in 2011 and will re-register sometime before 5/22/17 as NANT shares when they file their Form 10.

Remember, just like investor229 and surfkast attested to (TRUTH)...

Their CCRA shares were exchanged for NHMD shares. No shares were ever terminated, just temporarily un-registered.

And, KEYO shares aren't terminated either. That is why they still show in my account and their CUSIP is merely suspended until a new CUSIP is issued along w/ the "Super 8K" bomb and the share exchanges.

lns

lesn: KEYO fails on the second word of the definition. KEYO is not a 'registrant.'

Popt: Yes, a clear misunderstanding. Look at it again. See where the scheme you presented is a wrong understanding of the Delaware statue?

lns

Popt: Yes, you can answer but that answer was a 100% fabricated, false answer.

No. CCRA shares were terminated. They did 'become' anything. If investors wanted new shares, they bought them.

If there had been a share exchange, there would be a 13 filing indicating such. There was no such filing

It was 100% WRONG.

Want proof?

Here, tell that to posters investor229 and surfkast.

investor229:

- Hey! It was CRRA and it was simply a ticker change for me.

- I am saying my share count remained unchanged and the ticker symbol changed from CRRA to NHMD. I didn't have to do anything. Everything was done automatically by Fidelity.

surfkast: THEY WERE EXCHANGED 1 FOR 1

They lived it. Do you think they are lying?

Their shares were exchanged. Not terminated. And, they didn't lose their CCRA investment prior to the "Super 8K" and they didn't have to re-purchase new NHMD shares on the open market after the "Super 8K" to get back their previous position. Pure and simple.

TRUTH

lns

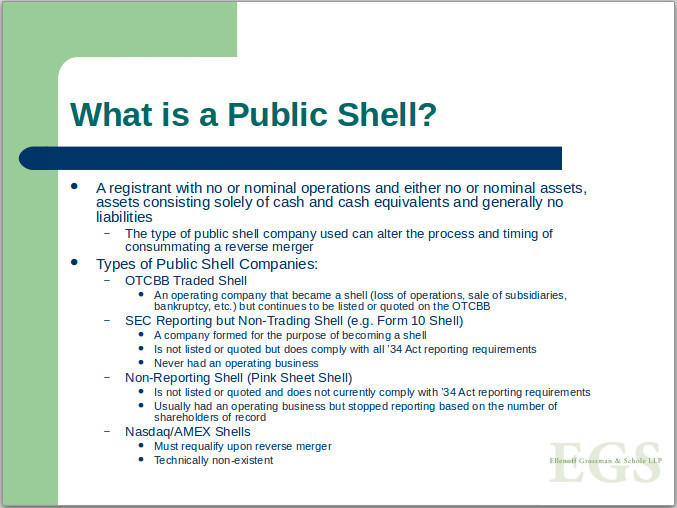

Popt: So, what? Doesn't change the fact that KEYO is a

http://www.egsllp.com/AlternativePublicOfferings-ReverseMergers.PPT

To make it more clear for you...

Non-Reporting (Public) Shell (Pink Sheet Shell)

- KEYO is not listed or quoted and does not currently comply with '34 Act reporting requirements

- KEYO had an operating business but stopped reporting based on the number of shareholders of record

- KEYO's DE SOS status is "Dissolved" not "Cancelled" meaning it has not completed winding up, terminating its legal existence or in other words, fully dissolving.

KEYO (undeniably) still in play!

Dude, this is BEYOND ridiculous now. Still insist the KEYO can't be used?

lns

lesn: So, I went back and read the 10 filing. Nate's was originally purchases by CCRA. Then, using Obama's JOBS Act, Nates did a reverse merger with its acquirer by doing a common stock to preferred stock exchange. In both cases, the exchange occurred between existing shares (albeit the preferred shares were showroom new). Then the symbol was changed, but they kept the share structure of CCRA. Using Obama's JOBS Act is a very unusual move - the first time I have seen it and it is not legal (yet).

What you seem to be proposing is common stock to common stock exchange in the absence of existing common stock shares for either company.

There really is no similarity between the RTM scheme and Nate's.

Read more here:

There is no public market for our Common Stock… There has not been a market for our Common Stock.

We are an “emerging growth company,” as defined in the JOBS Act.

This is an Exchange Act registration statement and not a registered offering of securities.

For the period ending May 31, 2014, the Company had $3,500 in operating expenses. These expenses related to setting up the company after the reverse merger. On May 19, 2014, the acquisition closed and under the terms of the agreement Nate’s Pancakes was the surviving entity. The Company selected May 31as its fiscal year end.

Sale of Unregistered Securities.

On May 12, 2014, the Company executed a reverse merger between the Company and Nate’s Pancakes whereby Nate’s Pancakes was the surviving entity and become a wholly owned subsidiary of the Company. The Company issued 148,115 shares of its Series B Preferred Stock in exchange for the 148,115 shares of Nate’s Pancakes.

Item 11. Description of Registrant’s Securities to be Registered

(a) Common Stock.

The Certificate of Incorporation, as amended, authorizes the Company to issue up to 300,000,000 shares of Common Stock ($0.0001 par value). As of the date hereof, there are 61,200,000 shares of our Common Stock issued and outstanding, which are held by 11 shareholders of record. All outstanding shares of Common Stock are of the same class and have equal rights and attributes. Holders of our Common Stock are entitled to one vote per share on matters to be voted on by shareholders and also are entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors in its discretion out of funds legally available therefore.

https://www.sec.gov/Archives/edgar/data/1409446/000147793214005261/nate_1012ga.htm

Shady.

Popt: My gosh. Really? So, shares of CCRA in the account the next day were NHMD shares, in this case, 1:1, so no shares were even cancelled as would have been done if a reverse split were involved.

Are you suggesting shareholders of CCRA stock prior to the reverse merger lost their stock after the reverse merger and if they wanted NHMD stock in exchange they were screwed and had to re-purchase NHMD stock new on the open market if they wanted their 1:1 position back?

Is that how it worked in your opinion?

lns

lesn: There is a clear misunderstanding of the Delaware statute. As I first pointed out, if a company voluntarily dissolves a corporation, they have three years to revoke the dissolution. However, during that period, the company is fully dissolved. It does not exist. Keyon does not exist.

Now let's take the macro perspective that VOLUNTARILY destroying a company is good for shareholders. The current argument is that Soon-Shiong VOLUNTARILY;

-Shut down all Keyon operations;

-Removed all executives;

-Removed the Board of Directors;

-Sold his interest at 30 cents on a dollar;

-Terminated all common shares in 2011;

-Dissolved Keyon;

-Let KEYO stopped trading.

While no one has bothered to pull the Certificate of Dissolution, let's assume that everything Soon-Shiong did was both voluntary and for a smart reason. How exactly is this a good thing that Soon-Shiong totally and completely ended any possibility that KEYO could trade again? Why would he not keep KEYO trading if he need a publicly traded company for this mythical RTM? Why terminate the shares? Why dissolve the very company he is supposed to need? Why sell his interest?

For everyone holding KEYO shares, the VOLUNTARY actions by Soon-Shiong is a total loss of capital. In 99.9% of investors' estimation, this is a very bad thing.

The "facts" supporting a RTM are all unrelated to Keyon. You have your Pancake Plan. You have the Forbes Plan. However, there are no facts directly associated with Keyon that remotely suggest a RTM or that KEYO is not completely dead.

However, sticking to the last possible hope of a voluntary dissolution ignores the other deep problems with this scheme.

Popt: Don't dodge the question...

If KEYO's entity status w/ the State of DE SOS is currently "DISSOLVED" and not "CANCELLED", what does that mean for KEYO and it's role in any future, possible reverse merger scenarios?

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121468865

https://icis.corp.delaware.gov/Ecorp/FieldDesc.aspx

C - Cancelled - A certificate of Cancellation has been voluntarily filed by the entity to terminate its existence. This certificate is filed when an entity has dissolved and at the completion of winding up the entity.

D - Dissolved - A certificate of Dissolution has been voluntarily filed by the corporation to terminate its legal

RDY: Clearly, the 'due diligence' in KEYO led to a total loss of capital when KEYO stopped trading forever. KEYO will never trade again.

BTW, the term 'due diligence' refers to research done BEFORE making an investment, not after a total loss.

lesn: Yes, I can answer the question.

CCRA shares in the account became NHMD shares.

lesn: Since 2011, Keyon operations were closed, KEYO shares terminated, Keyon Communications Holdings, Inc dissolved and finally, KEYO stopped trading.

These are bad signs for investors. KEYO is the definition of bagholder.

Popt: Not even a comment on the KEYO status being Dissolved and not Cancelled?

PROVING KEYO STILL IN PLAY!...

Now, let's go to KEYO's status w/ the DE SOS..."DISSOLVED" and let's compare that to "CANCELLED". BTW, "CANCELLED" in w/ the DE SOS is equivalent to "PERMANENTLY REVOKED" in NV...the business is gone for good. Forever. Never to return. NO LONGER A COMPANY. EXISTENCE TERMINATED..

https://icis.corp.delaware.gov/Ecorp/FieldDesc.aspx

C - Cancelled - A certificate of Cancellation has been voluntarily filed by the entity to terminate its existence. This certificate is filed when an entity has dissolved and at the completion of winding up the entity.

D - Dissolved - A certificate of Dissolution has been voluntarily filed by the corporation to terminate its legal

Popt: Can or will you answer any of these questions...

How did CCRA shareholders then get their NHMD shares after NHMD filed their "Super 8K"? Where did they come from? CCRA shares in the account became NHMD shares.

How did CCRA shareholders then get their NHMD shares after NHMD filed their "Super 8K"? Where did they come from? CCRA shares in the account became NHMD shares.

Nobody swapped the CCRA shares for NHMD shares? If not, what happened to the CCRA shares and how did those NHMD shares show up in the account?

There was no share swap.

Really? What would you call it then? A share exchange? I mean, afterall, that is what happened. The CCRA shares were exchanged, or swapped, for NHMD shares.

You say "No"? If not, please explain so we can understand your logic.

lns

|

Followers

|

75

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

10055

|

|

Created

|

10/18/08

|

Type

|

Free

|

| Moderators | |||

**********ALERT: KEYO (DE Corp) shell 80% OWNED BY BILLIONAIRE DR. PATRICK SOON-SHIONG....DISSOLVED 5/22/14 AND IS NOW A CLEAN SHELL******

http://images.investorshub.advfn.com/images/uploads/2014/7/6/nufezKEYO_DE-status.JPG

http://www.nantworks.com

In 2011 Dr. Patrick Soon-Shiong invested in KEYO to build out his national healthcare dream. The company was poorly run and Shiong took control, leaving it as a shell for his use. At the same time, he managed a Leveraged BuyOut of the National Lambda Rail. They needed cash, and the $100M he gave made him the control. Its the NLR that supports most of the Nantworks family of companies today.

http://www.flinn.org/news/1015

"KeyOn Communications’ largest and controlling shareholder is California Equity LLC, an entity controlled by Dr. Patrick Soon-Shiong. Dr. Soon-Shiong, having built and sold two multi-billion dollar pharmaceutical companies in the past few years including Abraxis BioScience to Celgene Corporation (NASDAQ: CELG), is a physician, scientist and philanthropist who has made clear his intention to develop a comprehensive “health information highway system” throughout the United States. "

Soon-Shiong, 62, has a lot to show. First, he walks him through a mock-up of a futuristic hospital room: There’s a patch that measures a patient’s heart rate, temperature and blood pressure, and a 3-inch white cube, called an HBox, connecting every device to a computer network. He shows off a darkened room covered in computer screens: a control center from which a handful of doctors can monitor hundreds of patients, even when those patients are at home. And finally he calls up several computer programs that make sure doctors know, up to the latest scientific-journal article, the best treatment available. It’s a sweeping assemblage of data-driven toys–fueled by $1.3 billion worth of furtive acquisitions, almost entirely using Soon-Shiong’s own money.

This dizzying demonstration wows Sanford, who seems extra-rumpled next to Soon-Shiong, in his crisp tailored blue shirt and suit pants, which he fills sleekly (he owns part of the Lakers and plays hoops regularly on an indoor court at his house). “I think it’s exactly what we need in this world,” Sanford says. “I also have a hospital group. I think we’re at 40 hospitals and 150 clinics, but costs are just going crazy, and the lack of communication between these organizations is just paramount to correct.” Soon-Shiong jumps in for the close: “The hospitals aren’t organized, funded or even have the skill sets to create this kind of communications infrastructure. Frankly, the government should have done it.”

As evidenced by the incompetent ObamaCare rollout, perhaps it’s better that Soon-Shiong did, and Sanford is taking whatever this doctor prescribes. They shake hands eagerly on a deal to deploy the technology at a children’s hospital in Phoenix, Ariz.

Even after the demonstration, though, exactly what Sanford is buying remains unclear. As seen over Soon-Shiong’s shoulder, the demos look fantastic. But no outsider I spoke to had actually laid hands on all the pieces of the technology. There is no real business plan. No pricing model. All they have is Soon-Shiong’s word, which is a tricky thing. While he’s undeniably brilliant, Soon-Shiong is equally undeniably a blowhard, a view shared widely across the medical spectrum (his Twitter TWTR +4.17% handle:

@solvehealthcare). “The marketing is three years ahead of the engineering,” says John Halamka, one of the first people to ever have his genome sequenced and the chief information officer of Beth Israel Deaconess Medical Center in Boston. “What works on paper, what works in the lab and what works in a complex academic medical center are very different things.” He later adds: “Patrick is a showman of sorts, and for him to claim, ’I have solved the problems that everyone else over the last 20 years hasn’t been able to solve…’ ”

It bothers me, too. Soon-Shiong’s sparkling headquarters, a futuristic amalgamation of metal and glass where some of his 800 employees scurry about, sits in L.A.’s Culver City neighborhood, which has birthed dozens of Hollywood fantasies, including The Wizard of Oz. Accordingly, I’ve spent the past ten months trying to pull back the curtain. Soon-Shiong has allowed me an exclusive, detailed look inside his efforts–the Manhattan Project of medicine–just as he was closing the deal that will see them put into action for the first time at Providence Health & Services, a 34-hospital, not-for-profit Catholic health ministry in Oregon, California, Alaska, Washington State and Montana. And I talked to dozens of outsiders.

What was universal: the scope of Soon-Shiong’s undertaking. “When we went to see him and got a look at what they’re planning to implement, we were dazzled,” says Gillies McKenna, head of the department of oncology at Oxford University. “If you can make this work, and I agree it will be very difficult, he’s looking at an exponential increase in the amount of data we can base decisions on.” Soon-Shiong explains it this way: “We will have more information at our fingertips than we ever had in the history of mankind–every day. Not once a month, a week. Every day.” Such omniscience has the potential to reverse the perverse incentives–which emphasize treatments rather than results–driving America’s annual health costs past $3 trillion. It could also cure most of what ails us, even cancer.

Soon-Shiong is accustomed to doubters, as the son of Chinese immigrants in apartheid-era South Africa. He graduated high school at 16 and medical school at 22. His first patient, an Afrikaner, refused to be touched by him, but after Soon-Shiong drained his infected sinus, he told everyone, “That Chinaman. Make sure you get him to examine you.”

Soon-Shiong left South Africa in the late 1970s and arrived at UCLA in 1980. Stephen Nimer, a hematologist who would later serve on the board of directors for one of Soon-Shiong’s companies, remembers him as an “unbelievable surgeon” who was always willing to take on the most difficult cases. “It’s in his blood to help people,” Nimer says.

So is a deep streak of P.T. Barnum showmanship–and a talent for pissing off investors and colleagues alike. As a surgeon at UCLA he grabbed headlines transplanting insulin cells into a diabetic. The president of the American Diabetes Association called it “inappropriate hype,” saying it was “far too early to view this as a cure or even a therapy.”

In 1990 he started a company to commercialize his diabetes work and got a deal with Mylan to explore transplanting pig organs into people but backed out because he decided it might be unsafe. He ended up in a legal feud that included, among others, his own brother.

Then, in 1991 he invented the drug that made his fortune: Abraxane, which packages the top-selling cancer drug, Taxol, inside the protein albumin. The idea was that tumors would eat the albumin and get the poison.

Top oncologists called it “old wine in a new bottle.” But Soon-Shiong was convinced he was on to something big. He decided on a novel–and personally risky–approach to fund Abraxane’s development. Rather than sell stakes to venture capitalists, the traditional route to bankrolling biotech research, he instead took out loans to buy a small, publicly traded generic drug business, which he renamed American Pharmaceutical Partners, folding his Abraxane initiative inside it. A physician buying group, which purchased drugs from APP, invested in it. Some said this was a conflict of interest; Soon-Shiong says the group contributed to help prevent drug shortages and sold its shares as soon as APP went public. But his reputation had been dinged again.

In 2005 he won a huge victory: The FDA approved Abraxane, defying short-seller interest, which ran as high as 100%. Shares jumped 47%. But once again Soon-Shiong became the center of controversy when, a few months later, he merged APP with a private vehicle he owned. Brian Laegeler, an analyst at Morningstar, called it a “raw deal for minority shareholders as it serves only to line the pockets of Patrick Soon-Shiong.” The stock dropped 18% the day the deal was announced. Soon-Shiong says the long-term rise of the shares vindicated the move.

Then in 2007 the stock soared again. The firm was the only maker of the blood-thinner heparin whose product did not have to be recalled because of contamination that killed 81 people. Soon-Shiong split and sold the company, saying it was “two unique businesses.” The generics business, including heparin, went to Fresenius in 2008 for $4.6 billion. In 2010 the drug business, Abraxis, was bought by biotech giant Celgene for $4.5 billion. Soon-Shiong owned some 80% of each.

Another multibillion-dollar windfall soon followed. Despite Soon-Shiong’s insistence that Abraxane was “a breakthrough,” by 2011 sales were just $386 million–a middling success in the booming biotech sector. Then last year a study showed the drug extended the lives of pancreatic cancer patients by 1.8 months. Sales jumped 90% and are projected to hit $2 billion by 2017. Celgene’s stock–Soon-Shiong remains the largest individual shareholder–surged in lockstep.

Cleverness, determination and luck had left Soon-Shiong with enormous wealth–we put his current net worth at $12 billion. But it also left him with a reputation as more of a wheeler-dealer than a scientist, which pains him, say confidants. “He has recognition in the business community,” says Michael Crow, the president of Arizona State University, another institution Soon-Shiong is talking about working with. “But that’s very different from the recognition that this was the man who built the intellectual fabric that allowed cancer survival rates to be increased 80%.”

The HBox can connect every device in a hospital room to the cloud.

Soon-Shiong’s grand new project promises the closest thing that Earth has ever had to Star Trek’s fabled tricorder. In theory it will work like this: A cancer patient will arrive at the hospital for diagnosis. Everything from her DNA to the proteins in her blood will get instantly analyzed via a proprietary and superfast network, with the data collected automatically in real time–no pens, paper or clipboards. Within minutes computers will recommend which drugs to try. Once the patient is sent home, the same technology will travel with her, allowing doctors to continue to monitor her in real time, as hospital administrators evaluate the efficacy and costs of various procedures and medicines and compare notes with hospitals across the country.

This vision came during the approval process for Abraxane in 2005. Doctors were making bad decisions. One study found that two-thirds of pancreatic cancer patients received the wrong treatment. Computer brainpower wasn’t enough to fix this, Soon-Shiong realized, if it wasn’t paired with a high-tech nervous system. “How could we ever hope to win the war against cancer using our newly gained molecular insights against a disease that has the capacity to constantly change and mutate?” he says.

Like a mechanic rummaging for parts, he started buying companies to build his new machine. He grabbed Eviti, based in Philadelphia, which sold its services to insurers as a way to ensure that cancer doctors weren’t prescribing medicines improperly (and billing for their errors). Thirty oncologists and nurses pore over the latest medical journals to make sure the information is up to date.

Another purchase: iSirona, a firm in Panama City, Fla. that’s attempting to connect hospital machines with electronic health record systems. Soon-Shiong now claims that it can integrate 6,000 different medical devices, including pulse oximeters, blood pressure monitoring devices and bathroom scales, as well as hundreds of different types of clinical and financial software from every major medical vendor.

There were other technologies, too: Qi Imaging, a tool that allows CAT scans and MRIs to be viewed on mobile devices; GlowCap, an $80 pill bottle that lights up when patients at home need to take their medicine and lets doctors know they are opening the cap. He purchased and refurbished the National Lambda Rail, a high-speed government computer network, at a cost of $100 million, so all this data could move quickly from place to place. “In order to have value-based care you need to monitor outcomes in real time,” says Soon-Shiong. “And you need to monitor cost in real time. You’re going to have patient-centered highest-quality care at the lowest cost.”

All of these pieces–and dozens more that he’s bought or built–combine into a corporate structure as byzantine as his overarching product. His 800 employees are splintered across offices in 14 cities, and NantWorks, the parent holding company, houses nine separate units, all with different investor groups and each apparently designed to trade independently as a tracking stock. The first IPO, as early as next year, will likely be NantHealth, his health care information technology play, poised to profit from new payment schemes created by ObamaCare. Investors include Verizon, Celgene, BlackBerry and the Kuwait Investment Authority. FORBES values NantHealth alone at $1.6 billion. All told, FORBES values the entirety of Soon-Shiong’s Nant-related holdings at $7.7 billion.

The potential and pitfalls of Patrick Soon-Shiong’s medical Manhattan Project boil down to one statistic: 47 seconds. That’s the amount of time, the doctor/entrepreneur promises, it now takes for his amalgamated “supercomputer” to complete genomics analysis, all the way to identifying the individual protein in someone’s body that’s amenable to drug treatment. “It normally takes 11 weeks,” Soon-Shiong smiles.

Like so much he says, it’s a stunning statement with infinite promise. And an unverified one of the kind that makes Soon-Shiong polarizing.

When Soon-Shiong dramatically and fantastically described his platform in public for the first time, at the Forbes Healthcare Summit in New York last October, the preeminent doctors, scientists and health care executives in attendance ranked him the top speaker of the event (95% of attendees surveyed rated it good or excellent). Yet many of them were confused (#stilldontgetit, tweeted Halle Tecco of Rock Health, who runs an incubator for health IT companies) or skeptical (“It’s an avant-garde idea–and one that will be delivered in pieces,” said N. Anthony Coles, the former chief executive of Onyx Pharmaceuticals). Johns Hopkins professor (and Forbes.com contributor) Steven Salzberg, pondering the 47-second statement, posited: “What does that even mean?”

For the sake of clarity and credibility, I spent a disproportionate amount of my time over the past year focusing on his oft-repeated 47-second pledge. It turns out to be profoundly misleading because it is an average time, not the time for an individual. It’s like saying McDonald’s can hand you 800 Happy Meals the instant you pull up at a drive-thru window because the company serves 800 meals a second worldwide. The real question is: How fast can an individual patient’s genome be analyzed? Pushed, Soon-Shiong says he is aiming for 24 hours for each patient.

That’s still astoundingly fast. David Feinberg, the president of UCLA Health System, confirms that he got data back on cancer patients within a couple of days. Randy Axelrod, an executive vice president at Providence, where the Nant system will soon roll out, says he sent in DNA sequences from several patients and had them back within hours.

A bake-off by Genomics England, a government project that hopes to sequence 100,000 Britons, found that Nant was one of the few platforms that could consistently sequence cancer genomes quickly.

Even more impressive, Soon-Shiong says–and a number of experts believe–that he can already analyze 500 genomes a day, on par with the world’s most advanced DNA research centers, and will be able to do 4,000 a day by the end of next year. And Nant can move these huge sets of data to any hospital on his network almost instantaneously.

Which raises the question: Why the unnecessary, counterproductive hyperbole? How easy it could have been to instead take a bow for the hardware and the high-speed data connections he has built.

And why compare your time against another (11 weeks) that no longer seems to exist? “Our best shot with software that’s proprietary is 15 minutes, and then there’s still plenty of work to be done,” says Eric Topol, the chief academic officer at Scripps Health. Ultimately, whether you can do it in 47 seconds or an hour or five isn’t really what’s important. Accuracy and cost are.

Soon-Shiong angrily shrugs off the criticisms. “Unfortunately, when you go outside the accepted conventional bounds, some people feel threatened and strike out,” he says. “When you run a public company, short-sellers seize on it and give it even more legs. Fortunately, the strong persevere–and not just me–and we have a better world for it. If they didn’t, a lot of advances in health care, science and technology would never be achieved.”

Soon-Shiong’s chance to silence the doubters will soon begin. “You’ve got these fantastic ideas; you’ve got these fantastic people,” says Jim Davies, the chief technology officer of Genomics England. “Now is the bit where they roll it out.”

At St. John’s, an L.A. hospital to which Soon-Shiong has given $85 million, a prototype of a system is tracking patients’ treatments and what they cost in real time. And a full-scale deployment of Nant’s systems will roll out imminently at Providence Health & Services, which acquired St. John’s. Soon-Shiong met the system’s CEO, Rod Hochman, during the deal. They hatched the idea for using Providence not only as a testing ground for NantHealth’s software but also for its genetic tests, as it aims to offer them to every one of their 25,000 cancer patients each year.

Cancer is a disease of genetics. It happens when a genetic defect or, more likely, a collection of defects causes cells to go haywire and grow out of control. By identifying which genetic defects are present, and picking drugs to target them, doctors may be able to treat otherwise untreatable cancers.

Soon-Shiong has an example, identified using Nant technology. A woman was suffering from cervical cancer and had had her genome sequenced. When it was fed into Nant’s computers, they found that the human papilloma virus, which causes the cancer, had inserted itself into a gene called Her2. This is the target of the breast cancer drug Herceptin; when the woman was given Herceptin, a drug that would normally not be used for treating cervical cancer, her tumors shrank.

It’s a great story. But again, hype blurs the brilliance. Nant’s analysis had a wonderful result for the patient, but it’s hardly a medical breakthrough or even unique: Foundation Medicine, a cancer-genetics startup backed by Bill Gates and Google Ventures, has touted a case where cancer in a woman’s colon shrank because of a lung cancer drug.

As with everything in Big Data, what Nant brings is scale. Where Foundation Medicine tests patients’ tumors for mutations in 343 genes, Soon-Shiong plans to do 260 times more: sequencing the whole genome of the patient, the whole genome of the cancer (which is genetically distinct) and the chemical messages, known as RNA, generated by the cancer genome. Even with the use of DNA sequencers, this will cost $3,000 per patient just for sequencing, and it will take three days, plus another day for analysis. Providence expects to pay for this in part by getting insurers to pay for it.

In the end the most telling statement may have come at the Healthcare Summit from Susan Desmond-Hellmann, who watched Soon-Shiong’s rise when she ran clinical development at Genentech before becoming chancellor at the University of California, San Francisco and then CEO of the Gates Foundation: “Don’t underestimate him.”

“Deep down,” says ASU president Crow, “he knows that being the world’s richest doctor is not the check that he wants by his name. It’s insufficient.” “My quest was and is to improve the quality of life through science,” adds Soon-Shiong. “That is what drove me then, and that is what is driving me now.” The bad blood will mean nothing if he’s successful–and it seems very likely, based on a review of his claims, plans and investments, that he will succeed at something. Even a fraction of his grand vision will mean good news for millions of American patients.

http://www.forbes.com/sites/matthewherper/2014/09/10/medicines-manhattan-project-can-the-worlds-richest-doctor-fix-health-care/

http://www.forbes.com/profile/patrick-soon-shiong/

ANSWERS TO QUESTIONS BELOW

More New Information from September 2014

http://www.healthinnovationcouncil.org/wp-content/uploads/2014/09/BPC_Health-Innovation-Initiative_Building-Better-Health-A-Report-from-the-CEO-Council-Sept-2014.pdf

Building Better Health: Innovative Strategies from America’s Business Leaders: the Bipartisan Policy Center was founded in 2007 by former Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole, and George Mitchell, the Bipartisan Policy Center (BPC) is a nonprofit organization that drives principled solutions through rigorous analysis, reasoned negotiation, and respectful dialogue. With projects in multiple issue areas, BPC combines politically balanced policymaking with strong, proactive advocacy and outreach.

This report outlines the many ways in which our companies are working to improve health and well-being as well as the quality, cost, and patient experience of care.

From page #103 - The Overview and Appendix A and Summary supplies answers to questions of how Dr. Patrick Soon-Shiong will change the face of Healthcare Worldwide.

(following content edited due to space limitations - all can be found under headings in full report at link above)

Overview

With the poorest outcomes and highest cost compared with the industrialized world, the health care system in the United States is failing. According to a 2014 independent Commonwealth Fund report, the United States ranks last among 11 industrialized countries on health care quality and access, despite having the costliest care. The report ranked the United Kingdom first overall, even though its per- capita health spending is less than half that of the United States. The information highway portion is tied in with Keyon Communications Holdings, Inc. thusly:

Grid-computing is a technology model designed to promote the coordinated sharing of resources in dynamic, multi- institutional virtual organizations. Grid-computing focuses on the loose coupling of data and services. This approach allows different institutions to come together to achieve

a particular goal while still maintaining local autonomy in issues ranging from information system architecture to institutional policy to patient privacy. This flexibility and focus on controlled sharing makes grid-computing particularly well suited to address the complexity of the fragmented health care system.

This infrastructure allows for the interoperable, secure sharing of health care data between institutions that likely have different information systems and policies. The IAH infrastructure is open to third-party end-user applications, including NantHealth applications, which will form a seamless ecosystem of functionalities that together create a distributed “virtual” longitudinal health record platform. Rather than trying to consolidate health data into physical databases, this “virtual” electronic health record will allow data to be stored locally and to be assembled and accessible in a dynamic fashion.

Paving a Medical Information Superhighway

IAH was established in 2011 with core funding from Dr. Patrick Soon-Shiong and his wife Michele B. Chan, who have pledged through their family foundation more than $1 billion for health care and health information projects. The Institute currently operates in both California and Arizona and is exploring relationships with other states. In March 2011 it announced the funding of data centers in Phoenix and Scottsdale dedicated to health information storage, and also the funding of a dedicated supercomputer for genomic science in Phoenix.

IAH is working with the National Coalition for Health Integration (NCHI) to design and develop this innovative, groundbreaking infrastructure.

NCHI was formed to build a public private coalition of health care partners and academia dedicated to transforming health care by enhancing the availability and integration of health information across the country. In 2011, NCHI provided funding to maintain the viability of the National LambdaRail (NLR), a fiber infrastructure for numerous large research projects including users such as NASA, the National Science Foundation and US institutions connecting with the Large Hadron Collider in Switzerland. The NLR fiber infrastructure was designed for basic science and the physics scientific community. There is now an urgent national need to replace this aged infrastructure of the NLR with a modern fiber network integrated into clinical practices and hospital facilities across the nation and connected to the NCHI supercomputer in Arizona.

Providence Health, NantHealth and the Chan Soon- Shiong Institute of Molecular Medicine partnered in August 2014 to create the country’s first health network for clinical whole genomic sequencing. This health network spans 5 western states and serves 22,000 new cancer patients and 100,000 cancer cases per year. The partnership is installing an Illumina HiSeq X Ten sequencing system to enable the nation’s first clinical whole genome sequencing paired with RNA--\ sequencing and proteomics.

Increasing Access to Care

Leveraging technologies such as low-cost telehealth will increase access to underserved urban and rural areas, in addition to primary care specialties such as pediatrics, where access to neonatologists and pediatricians is deficient. Technology can reduce disparities in health care for everyone.

Establishing a Next Generation National Secure Infrastructure for Big Data Transport

In March 2011 IAH announced the funding of data centers in Phoenix and Scottsdale dedicated to health information storage, and also the funding of a dedicated supercomputer in Phoenix.

A modernized network under construction, combined with existing data centers and supercomputer connections, will enable massive amounts of genomic and proteomic data to be transmitted, analyzed and used to support clinical decisions, thereby improving health outcomes. This infrastructure will help realize the dream of effective, efficient, and truly “personalized” medicine in America.

In Summary

The discovery of “the God particle” (in the Large Hadron collider project) involved the collaboration of hundreds of physicists across the globe, collaborating in real-time by analyzing millions of bits of data. This achievement occurred through the creation of virtual organizations committed to a common cause, utilizing grid-computing and an information highway (the National LambdaRail) for large science projects. This was the motivation and inspiration for the medical information highway.

*** Take the Patents of Tom Wittenschleager, now at NantTronics, and the Rural Broadband developed by Keyon Communications Holdings and overlay with the NLR that Dr. Soon - Shiong owns. The connections appear to point to the KEYO Shell owned by Dr. Soon - Shiong is of value to him******

BILLIONAIRE DR. PATRICK-SOON-SHIONG

1.

NAMES OF REPORTING PERSONS.

Dr. Patrick Soon-Shiong

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

30,081,734 (See Item 5)

12.

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

Not Applicable

13.

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

79.2% of the outstanding voting power of the Company (See Item 5)

55.9% of the economic interest of the Company (See Item 5)

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8004537

Nantronics, essentially is the National Lambda Rail

*********President at NantTronics, Inc.**********

KeyOn Communications Holdings Inc. (KEYO.OB)

KeyOn Communications Holdings Inc.

11742 Stonegate Circle

Omaha, NE 68164

United States

Phone: 402-998-4000

Website: http://www.keyon.com

| Business Summary |

|---|

Quote:

********ALL OF THE CEO'S PATENTS*********

Patents by Inventor Thomas Wittenschlaeger

Patents by Inventor Thomas Wittenschlaeger

Vector-based anomaly detection

Patent number: 8683591

Abstract: Methods of detecting anomalous behaviors associated with a fabric are presented. A network fabric can comprise many fungible networking nodes, preferably hybrid-fabric apparatus capable of routing general purpose packet data and executing distributed applications. A nominal behavior can be established for the fabric and represented by a baseline vector of behavior metrics. Anomaly detection criteria can be derived as a function of a variation from the baseline vector based on measured vectors of behavior metrics. Nodes in the fabric can provide a status for one or more anomaly criterion, which can be aggregated to determine if an anomalous behavior has occurred, is occurring, or is about to occur.

Type: Grant

Filed: February 9, 2011

Issued: March 25, 2014

Assignee: Nant Holdings IP, LLC Inventor: Thomas Wittenschlaeger

Backhaul Fabric For Wireless Network

Application number: 20130308602

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Application

Filed: July 23, 2013

Issued: November 21, 2013

Assignee: Nant Holdings IP, LLC Inventor: Thomas Wittenschlaeger Backhaul fabric for wireless network

Patent number: 8493889

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Grant

Filed: April 23, 2012

Issued: July 23, 2013

Assignee: Nant Holdings IP, LLC Inventor: Thomas Wittenschlaeger

NON-OVERLAPPING SECURED TOPOLOGIES IN A DISTRIBUTED NETWORK FABRIC

Application number: 20130101291

Abstract: Networks comprising multiple non-overlapping communication topologies are presented. The networks can include a fabric of interconnected network nodes capable of providing multiple communication paths among edge devices. A topology manager constructs communication topologies according to restriction criteria based on required security levels (e.g., top secret, secret, unclassified, etc.). Established topologies do not have overlapping networking infrastructure to within the bounds of the restriction criteria as allowed by the security levels.

Type: Application

Filed: October 16, 2012

Issued: April 25, 2013

Assignee: NANT HOLDINGS IP, LLC Inventor: Thomas Wittenschlaeger DYNAMIC PACKET ROUTING

Application number: 20130094498

Abstract: Dynamic packet routing based on fabric awareness information is presented. Networking nodes in a networking fabric observe environmental properties across the fabric. When differences in environment properties between portions of the fabric are detected, differences in power consumption costs for example, the fabric generates corresponding routing tables. The networking nodes can then route traffic in a manner that is sensitive to the environment properties, power consumption or the cost of power for example.

Type: Application

Filed: September 25, 2012

Issued: April 18, 2013

Assignee: NANT HOLDINGS IP, LLC Inventor: Thomas Wittenschlaeger

Software application striping

Patent number: 8364744

Abstract: A distributed computing system comprising networking infrastructure and methods of executing an application on the distributed computing system is presented. Interconnected networking nodes offering available computing resources form a network fabric. The computing resources can be allocated from the networking nodes, including available processing cores or memory elements located on the networking nodes. A software application can be stored in a system memory comprising memory elements allocated from the nodes. The software application can be disaggregated into a plurality of executable portions that are striped across the allocated processing cores by assigning each core a portion to execute. When the cores are authenticated with respect to their portions, the cores are allowed to execute the portions by accessing the system memory over the fabric. While executing the software application, the networking nodes having the allocated cores concurrently forward packets through the fabric.

Type: Grant

Filed: September 9, 2009

Issued: January 29, 2013

Assignee: Nant Holdings IP, LLC Inventor: Thomas Wittenschlaeger

Distributed computing bus

Patent number: 8296465

Abstract: A distributed computing bus that provides both data transport and ambient computing power is provided. Contemplated buses comprise a network fabric of interconnected networking infrastructure nodes capable of being programmed before or after installation in the field. A fabric manager organizes the fabric into a bus topology communicatively coupling computing elements that exchange payload data using a bus protocol. Nodes within the bus topology operate on the payload data as the data passes through the node on route to its destination.

Type: Grant

Filed: March 7, 2011

Issued: October 23, 2012

Assignee: Nant Holdings, IP, LLC Inventor: Thomas Wittenschlaeger BACKHAUL FABRIC FOR WIRELESS NETWORK

Application number: 20120207016

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Application

Filed: April 23, 2012

Issued: August 16, 2012

Assignee: RAPTOR ACQUISITION, LLC

Inventor: Thomas Wittenschlaeger Distributed Network Interfaces for Application Cloaking and Spoofing

Application number: 20120166601

Abstract: Systems and methods associated with distributing an application's network interface over nodes of a networking fabric are presented. Nodes of the fabric can operate as interface modules, each taking on a role or responsibility for a portion of the application's network address including IP address, port assignments, or other portions of the network address. Interface modules of the networking nodes can then spoof or cloak the application to provide security against internal or external threats.

Type: Application

Filed: February 9, 2011

Issued: June 28, 2012

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Surface-space managed network fabric

Patent number: 8189496

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Grant

Filed: September 1, 2009

Issued: May 29, 2012

Assignee: Raptor Acquisition, LLC

Inventor: Thomas Wittenschlaeger Vector-Based Anomaly Detection

Application number: 20120131674

Abstract: Methods of detecting anomalous behaviors associated with a fabric are presented. A network fabric can comprise many fungible networking nodes, preferably hybrid-fabric apparatus capable of routing general purpose packet data and executing distributed applications. A nominal behavior can be established for the fabric and represented by a baseline vector of behavior metrics. Anomaly detection criteria can be derived as a function of a variation from the baseline vector based on measured vectors of behavior metrics. Nodes in the fabric can provide a status for one or more anomaly criterion, which can be aggregated to determine if an anomalous behavior has occurred, is occurring, or is about to occur.

Type: Application

Filed: February 9, 2011

Issued: May 24, 2012

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Distributed Computing Bus

Application number: 20110161527

Abstract: A distributed computing bus that provides both data transport and ambient computing power is provided. Contemplated buses comprise a network fabric of interconnected networking infrastructure nodes capable of being programmed before or after installation in the field. A fabric manager organizes the fabric into a bus topology communicatively coupling computing elements that exchange payload data using a bus protocol. Nodes within the bus topology operate on the payload data as the data passes through the node on route to its destination.

Type: Application

Filed: March 7, 2011

Issued: June 30, 2011

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Distributed computing bus

Patent number: 7904602

Abstract: A distributed computing bus that provides both data transport and ambient computing power is provided. Contemplated buses comprise a network fabric of interconnected networking infrastructure nodes capable of being programmed before or after installation in the field. A fabric manager organizes the fabric into a bus topology communicatively coupling computing elements that exchange payload data using a bus protocol. Nodes within the bus topology operate on the payload data as the data passes through the node on route to its destination.

Type: Grant

Filed: May 16, 2008

Issued: March 8, 2011

Assignee: Raptor Networks Technology, Inc.

Inventor: Thomas Wittenschlaeger Hybrid Transport - Application Network Fabric Apparatus

Application number: 20100312913

Abstract: A hybrid routing-application network fabric apparatus is presented where a fabric apparatus has multiple apparatus components or resources that can be dedicated to one or more application topologies. The apparatus can receive a topology image definition file describing an application topology and the apparatus can dedicate its local components for use with the application topology. The apparatus can dedicate general purpose processing cores, dedicated routing cores, data channels, networking ports, memory or other local resources to the application topology. Contemplated application topologies include routing topologies, computation topologies, database topologies, storage topologies, or other types of application topologies. Furthermore, application topologies can be optimized by modeling or simulating the topologies on a network fabric.

Type: Application

Filed: August 3, 2010

Issued: December 9, 2010

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Software Application Striping

Application number: 20090327446

Abstract: A distributed computing system comprising networking infrastructure and methods of executing an application on the distributed computing system is presented. Interconnected networking nodes offering available computing resources form a network fabric. The computing resources can be allocated from the networking nodes, including available processing cores or memory elements located on the networking nodes. A software application can be stored in a system memory comprising memory elements allocated from the nodes. The software application can be disaggregated into a plurality of executable portions that are striped across the allocated processing cores by assigning each core a portion to execute. When the cores are authenticated with respect to their portions, the cores are allowed to execute the portions by accessing the system memory over the fabric. While executing the software application, the networking nodes having the allocated cores concurrently forward packets through the fabric.

Type: Application

Filed: September 9, 2009

Issued: December 31, 2009

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Surface-Space Managed Network Fabric

Application number: 20090316619

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Application

Filed: September 1, 2009

Issued: December 24, 2009

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger Software application striping

Patent number: 7603428

Abstract: A distributed computing system comprising networking infrastructure and methods of executing an application on the distributed computing system is presented. Interconnected networking nodes offering available computing resources form a network fabric. The computing resources can be allocated from the networking nodes, including available processing cores or memory elements located on the networking nodes. A software application can be stored in a system memory comprising memory elements allocated from the nodes. The software application can be disaggregated into a plurality of executable portions that are striped across the allocated processing cores by assigning each core a portion to execute. When the cores are authenticated with respect to their portions, the cores are allowed to execute the portions by accessing the system memory over the fabric. While executing the software application, the networking nodes having the allocated cores concurrently forward packets through the fabric.

Type: Grant

Filed: December 18, 2008

Issued: October 13, 2009

Assignee: Raptor Networks Technology, Inc.

Inventor: Thomas Wittenschlaeger Surface-space managed network fabric

Patent number: 7599314

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Grant

Filed: October 13, 2008

Issued: October 6, 2009

Assignee: Raptor Networks Technology, Inc.

Inventor: Thomas Wittenschlaeger

Software Application Striping

Application number: 20090198792

Abstract: A distributed computing system comprising networking infrastructure and methods of executing an application on the distributed computing system is presented. Interconnected networking nodes offering available computing resources form a network fabric. The computing resources can be allocated from the networking nodes, including available processing cores or memory elements located on the networking nodes. A software application can be stored in a system memory comprising memory elements allocated from the nodes. The software application can be disaggregated into a plurality of executable portions that are striped across the allocated processing cores by assigning each core a portion to execute. When the cores are authenticated with respect to their portions, the cores are allowed to execute the portions by accessing the system memory over the fabric. While executing the software application, the networking nodes having the allocated cores concurrently forward packets through the fabric.

Type: Application

Filed: December 18, 2008

Issued: August 6, 2009

Assignee: Raptor Networks Technology, Inc.

Inventor: Thomas Wittenschlaeger Distributed Computing Bus

Application number: 20090198836

Abstract: A distributed computing bus that provides both data transport and ambient computing power is provided. Contemplated buses comprise a network fabric of interconnected networking infrastructure nodes capable of being programmed before or after installation in the field. A fabric manager organizes the fabric into a bus topology communicatively coupling computing elements that exchange payload data using a bus protocol. Nodes within the bus topology operate on the payload data as the data passes through the node on route to its destination.

Type: Application

Filed: May 16, 2008

Issued: August 6, 2009

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger « prev 1 2

Surface-Space Managed Network Fabric

Application number: 20090154391

Abstract: A managed surface-space network fabric is presented. The surface-space network fabric can include a spaced-based network fabric and a surface-based network fabric integrated together to form a single fabric managed by a global fabric manager. The global fabric manager cooperates with other fabric managers local to each fabric to establish a communication topology among all the nodes of the fabric. Preferred topologies include paths from any port on a node to any other port on another node in the fabric. The surface-space fabric, and each individual fabric, can function as a distributed core fabric operating as a single, coherent device.

Type: Application

Filed: October 13, 2008

Issued: June 18, 2009

Assignee: RAPTOR NETWORKS TECHNOLOGY, INC.

Inventor: Thomas Wittenschlaeger

DISAGGREGATED NETWORK MANAGEMENT

Application number: 20090157860