Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

GEEK: effective Nov. 2,2015 liquidation and final distribution of .04 and FINRA deleted symbol.

http://otce.finra.org/DLDeletions

Those who understand the intricacies of elimination? Now what to expect from the stock? Will there be some other payments?

The price dropped because the company sold off assets and is distributing the proceeds. So in my mind, the shares are worth 2 cents or less. Previously they said the distributions will be between $0.68-$0.70.

News out at 1:36. Price dropped way before that.

Shareholders will receive $ 0.68? But why the price dropped? Who can explain this?

Item 8.01 Other Events.

On June 25, 2015, pursuant to the Company’s plan of liquidation, the Company completed the first distribution by the Company to its shareholders of substantially all proceeds from the previously reported and completed sale of substantially all of its operating assets (other than those amounts currently held in escrow which shall be distributed when those funds are released) and from cash in the bank in an amount equal to $0.68 per share of the Company’s common stock (the “First Asset Sale Distribution”). The company will continue with it’s plan of liquidation and other possible distributions, and a copy of the Plan of Liquidation filed as Exhibit 2.2 to, the Company’s Current Report on Form 8-K, filed with SEC on June 16, 2015, and as incorporated herein by reference.

http://www.sec.gov/Archives/edgar/data/1001279/000114420415039295/v414144_8k.htm

No news, no statements. The company generates revenue on a quarterly basis. The carrying value of $ 0.89. Probably it had margin call. After lunch, will return to $ 0.68

Reversal shaping up...

MM playing the naked short game. Easy double.

Great seller and margin calls. Beech cost $ 0.89. Will return rates up throughout the day today or tomorrow.

bought some @ .16

There were 6 x 30k buys at 68 cents this morning. Buying some down low.

what the?

anybody understand how the recent fcc ruling will impact this company?

Director bought 2 million shares @ .40c someone is confident

still on my watchlist. though i havent been following the market as much lately as in the past. i think she breaks out eventually but needs volume

anyone still watching this stock?

anyone still watching this stock?

something brewing here. called this as a play to watch on my new board. check it out and follow me for plays like this and more..

The Watchlist

aim high profits posted this about geek...sounds like owner has a hx of selling his companies....

http://www.aimhighprofits.com/volume-alert-internet-america-inc-s-geek-stock

hmmmm

what could it possibly mean?

Yes, there were huge insider buys five months back. Almost 2 million shares purchased by 3 different company directors:

http://www.thestreet.com/story/10963171/1/insiders-trading-vmw-amtd-geek-azo.html

I just don't like it's chart though.....

I'm going to wait a bit to see about gap fills, and maybe

DD to find out what is coming in their pipeline.

GLTA who trade GEEK

P.S. and speaking of HUGE, what about your profile pic, now that is nice.

huge insider buy,,..

Well...

lets hope something happens here soon.

on watch.

I'm seeing that

Lol

LMAO! That's an understatement . This is the most posts its gotten in 5 years.

Hasn't been much activity here recently

looks interesting here...hmmmm might grab a few tommorow

just noticed 3 directors bought around 1.8 million shares between them, for what its worth i bought a few myself.

Internet America Reports Fiscal Third Quarter Results

May 8, 2009 6:31:00 PM

Copyright Business Wire 2009

Email Story Discuss on ZenoBank

View Additional ProfilesHOUSTON--(BUSINESS WIRE)-- Internet America, Inc. (OTCBB: GEEK) today announced results for the fiscal third quarter ended March 31, 2009. Total revenues for the third quarter decreased by 15.5% to approximately $1.9 million compared to total revenues of approximately $2.3 million in the third quarter of 2008, and the total subscriber count decreased to 27,500 on March 31, 2009 compared to 31,800 subscribers at the end of the same period last year. These decreases were due to the anticipated decline of dial-up Internet service customers from Internet America's legacy dial-up Internet operations. The Company's wireless broadband Internet subscriber count of 8,000 as of March 31, 2009, was virtually unchanged from the subscriber count of 8,100 as of March 31, 2008.

Net loss for the third quarter of 2009 was approximately $492,000, or a loss of $0.03 per share, compared to net loss of approximately $485,000, or $0.03 per share, in the same period last year. EBITDA loss (earnings before interest, taxes, depreciation and amortization) was approximately $215,000 in the third quarter compared to EBITDA loss of approximately $183,000 in the third quarter a year ago. Net loss and EBITDA (loss) were positively impacted in the third quarter of 2009 by reductions in all costs associated with connectivity and operations, sales and marketing and general and administrative expenses totaling $555,000 or 20.1%. This was offset by a write-off of direct merger costs of $194,000, recorded on February 19, 2009, when the Company announced its termination of the definitive agreement to merge with KeyOn Communications Holdings, Inc. due to their inability to comply in a material respect with certain of the covenants and conditions to closing. Additional indirect costs of management's time negotiating and preparing to close the merger and the related travel costs also impacted reported losses.

Internet America is a leading Internet service provider serving the Texas market. Based in Houston, Internet America offers businesses and individuals a wide array of Internet services including broadband Internet delivered wirelessly and over DSL, dedicated high-speed access, web hosting, and dial-up Internet access. Internet America provides customers a wide range of related value-added services, including Fax-2-Email, online backup and storage solutions, parental control software, and global roaming solutions. Internet America focuses on the speed and quality of its Internet services and its commitment to providing excellent customer care. Additional information on Internet America is available on the Company's web site at http://www.internetamerica.com.

In this press release, the Company refers to a non-GAAP financial measure called EBITDA because of management's belief that this measure is a financial indicator of the Company's ability to internally generate operating funds. Management also believes that this non-GAAP financial measure is useful information to investors because it is widely used by professional research analysts in the valuation and investment recommendations of companies in the Company's peer group. EBITDA should not be considered an alternative to net income, as defined by GAAP.

This press release may contain forward-looking statements relating to future business expectations. These statements, specifically including management's beliefs, expectations and goals, are subject to many uncertainties that exist in Internet America's operations and business environment. Business plans may change, and actual results may differ materially as a result of a number of risk factors. These risks include, without limitation, that (1) we will not be able to increase our rural customer base at the expected rate, (2) we will not improve EBITDA, profitability or product margins, (3) we will not form additional partnerships with public entities seeking to participate in grant programs or those partnerships may not be successful, (4) we will not expand our coverage in public-private partnerships with state or local governments, utility providers, or other entities, (5) Internet revenue in high-speed broadband will continue to increase at a slower pace than the decrease in other Internet services resulting in greater operating losses in future periods, (6) financing will not be available to us if and as needed, (7) we will not be competitive with existing or new competitors, (8) we will not keep up with industry pricing or technological developments impacting the Internet, (9) we will be adversely affected by dependence on network infrastructure, telecommunications providers and other vendors or by regulatory changes, (10) service interruptions or impediments could harm our business, (11) we may be accused of infringing upon the intellectual property rights of third parties, which is costly to defend and could limit our ability to use certain technologies in the future, (12) government regulations could force us to change our business practices, (13) we may be unable to hire and retain qualified personnel, including our key executive officers, (14) future acquisitions of wireless broadband Internet customers and infrastructure may not be available on attractive terms and if available we may not successfully integrate those acquisitions into our operations, (15) provisions in our certificate of incorporation, bylaws and shareholder rights plan could limit our share price and delay a change of management, and (16) our stock price has been volatile historically and may continue to be volatile. These factors are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements included in our other publicly filed reports and documents.

Internet America, Inc.

Unaudited Financial Summary

(in thousands, except per share data and subscriber count)

Statement of Operations Data:

Quarters Ended

3/31/2009 3/31/2008

Wireless Broadband Internet Subscribers 8,000 8,100

Total Subscribers 27,500 31,800

Revenue:

Internet Services $ 1,879 $ 2,174

Other 44 102

Total Revenue 1,923 2,276

Operating Costs & Expenses:

Connectivity & Operations 1,272 1,514

Sales & Marketing 70 117

General & Administrative 793 829

Provision for (Recoveries of) Bad Debt 3 (1 )

Depreciation & Amortization 257 297

Operating Loss (472 ) (480 )

EBITDA (Loss) (215 ) (183 )

Interest Expense, Net (20 ) (5 )

Minority Interest in Loss of Consolidated Subsidiary - -

Net Loss $ (492 ) $ (485 )

Basic & Diluted Loss Per Share $ (0.03 ) $ (0.03 )

Weighted Average Basic & Diluted Shares 16,857 16,857

Reconciliation of Net Loss (a GAAP Measure) to EBITDA (Loss) (a Non-GAAP

Measure)

Quarters Ended

3/31/2009 3/31/2008

Net Loss $ (492 ) $ (485 )

Add:

Depreciation & Amortization 257 297

Interest Expense, net 20 5

Minority Interest in Loss of Consolidated Subsidiary - -

EBITDA (Loss) $ (215 ) $ (183 )

Balance Sheet Data:

Periods Ending

3/31/2009 3/31/2008

Current Assets $ 3,796 $ 5,636

Property & Equipment, Net 2,188 2,380

Other Assets, Net 4,399 5,790

Total Assets $ 10,383 $ 13,806

Current Liabilities $ 2,475 $ 2,909

Long-Term Liabilities 861 1,478

Total Stockholders' Equity 7,047 9,419

Total Liabilities & Stockholders' Equity $ 10,383 $ 13,806

Source: Internet America, Inc.

----------------------------------------------

Internet America

Inc.

Jennifer S. LeBlanc

713-968-2500

investor.relations@airmail.net

I understand that and I agree with it. This is a great small cap.

your right Internet America has found an interesting niche in the market and they most certainly are catering to it

I think thats just a nationwide problem. There are certain areas of the country that aren't privileged enough to have access to high speed cable/dsl and there are parts that have access to both. I live in the Tri-State area, and the city is only an arms length away. However I was back and forth with my provider (verizon) for over a month. One person told me yes you can get our service, another person said I'm too far from the central server (which was located 200 ft away on the main road in my town) It was very frustrating to say the least. They had numerous service employees come to my house and try to configure the system and finally it worked. The point is I can see how some people would get upset enough to file a complaint to the BBB. The fact that verizon sent me all the utilities and software to begin using their service a month before it was scheduled to begin and 2 days before the schedule day they call and cancel my service was enough for me to be upset. Hell, I was a phone call away from calling the BBB myself and I used that as leverage against my provider. I don't take the BBB complaints serious, I was just putting out some information I came across.

Now if Internet America could capitalize on the areas in which these bigger companies don't serve, they would see some nice revenue coming in IMO. Little companies become big companies by catering to those who are interested and need help, not the people who already have what they want and offering them the same service just with a different provider name. This is almost common sense, and so far GEEK has realized that

Not many at all.

I concur with you. I live in a rural area and know what it is like to try and get some services out here. Very good point.

THat is a valid point. Fraud and scam complaints are filed w/ State's Attorney General offices in my experiences.

that's good stuff Manny but remember that the BBB is a kind of "complain for every little thing site." It is my experience, and if you read through the report you will see that some of the complaints that were issued were resolved, and those must have been the ones that dealt with an implication, where the ones that weren't were complaints dealing with "failure to provide promised service." Let us remember that Internet America caters to providing broadband connection to the suburban areas in Texas, so at times this can be difficult and other times impossible. I can imagine that those customers who initially thought they could get broadband and ran a preliminary search online for qualification and saw they were within range of service, only to find out they just missed it, would be pretty mad. I had this happen to many people I know.

sorry guys I felt like being a cyber detective tonight and wanted to take an in depth look at this companies history. I did some searching on the BBB site and came across the the information I listed below. It may appear on the surface as this is all bad information, but what I gather from it really is that this is all positive. My outlook is that the BBB may have all these complaints and they appear to be serious matter, however when you look further into detail they are simply minor issues and should be the least of worries to an investor. This company seems to have a great plan and their focus seems to be targeted more on the future rather than now.

Note: please be careful to pay attention when doing DD, I have found that there are numerous other companies with the same Internet America name. Some are located in two companies for example are Internet America, Inc., Statesville, NC and Internet America, Demopolis, AL

Internet America

PO Box 690753

Houston, TX 77269-0753

Telephone: (214) 861-2500

Fax: (214) 861-2663

www.airmail.net

www.internetamerica.com

The BBB reports on members and non-members. If a company is a member of the BBB, it is stated in this report

BBB Definition:

report - A summary of activity reflected in a company's BBB file. Includes basic business background, BBB membership information, and BBB complaint activity over the previous three years. Also reports may include any known government actions, advertising issues or other information that results from activity conducted by the BBB.

.

Principal: Mr. Peter Tremblay, Vice President Customer Care

Customer Contact: Mr. Peter Tremblay, Vice President Customer Care

File Open Date: June 1995

TOB Classification: Internet Services

BBB Membership: This company is not a member.

Additional DBA Names

PDQ Net

Customer Experience

Based on BBB files, this company has an unsatisfactory record

BBB Definition:

unsatisfactory record - A company has an "unsatisfactory business performance record" with the BBB is based on the experiences reflected in BBB files. This file condition results when the company has failed to resolve or respond to complaints, repeatedly failed to respond or resolve issues in a timely manner, failed to resolve the underlying issues for a pattern

BBB Definition:

pattern - More than 2 complaints involving the same allegations usually within 12 months that are significant in relation to the company's size and volume of business.

of complaints, failed to honor their commitment to mediate or arbitrate disputes or honor mediated agreements or arbitrated decisions, failed to substantiate, modify or discontinue false advertising claims that are challenged by the BBB, or failed to discontinue unauthorized use of the BBB name and logo, a Federally protected trademark.

with the BBB due to failure to respond to a complaint. However the business has resolved

BBB Definition:

resolved - The company resolved the complaint issues.

most complaints presented to the bureau.

When considering complaint information, please take into account the company's size and volume of transactions, and understand that the nature of complaints and a firm's responses to them are often more important than the number of complaints.

The BBB processed a total of 12 complaints about this company in the last 36 months, our standard reporting period.Of the total of 12 complaints closed in 36 months, 4 were closed in the last year.

Billing or Collection Issues

BBB Definition:

Billing or Collection Issues - Claim alleging billing errors, unauthorized charges, or questionable collection practices.

Resolved

BBB Definition:

Resolved - The company resolved the complaint issues.

1 - Company resolved

BBB Definition:

resolved - The company resolved the complaint issues.

the complaint issues. The consumer acknowledged acceptance to the BBB.

2 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Unresolved

BBB Definition:

Unresolved - The company failed to resolve the complaint issues.

1 - Company failed to resolve the complaint issues through the BBB voluntary and self-regulatory process.

Administratively Closed

BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

1 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

Customer Service Issues

BBB Definition:

Service Issues - Claims of alleged delay in completing service, failure to provide promised service, inferior quality of provided service, or damaged merchandise as a result of delivery service.

BBB Definition:

Customer Service Issues - Claims alleging unsatisfactory customer service, including personnel's failure to provide assistance in a timely manner, failure to address or respond to customer dissatisfaction, unavailability for customer support, and/or inappropriate behavior or attitude exhibited by company staff.

Resolved

BBB Definition:

Resolved - The company resolved the complaint issues.

6 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Refund or Exchange Issues

BBB Definition:

Refund or Exchange Issues - Claim of alleged failure to honor company policy or verbal commitment to provide refunds, exchanges, or credit for products or services.

No Response

BBB Definition:

No Response - The company failed to respond to the complaint.

1 - Company failed to respond to the BBB to resolve or address the complaint issues.

Company Management

Additional company management personnel include:

Mr. Aaron Alwell - Director QC & Correspondence

Additional Addresses, and Telephone Numbers

Additional Addresses

350 N. St. Paul

Suite 3000

Dallas, TX 75201

Additional Phone Numbers

Tel: (214) 861-2730

Tel: (800) 232-4335

Tel: (214) 961-2748

Tel: (214) 961-2939

Report as of September 16, 2007

Copyright© 2007 BBB®, Inc.

nice find benfikaman!

I did a quick search using Internet America's cusip number (46058Y-10-9) and game up with a lot of stuff here. Haven't had a chance to look through some of the older stuff however theres loads and loads of information dating back from 10/7/99 merger acquisition schedule to the recent 8-k report released 9/14/07

http://www.secinfo.com/$/SEC/Registrant.asp?CIK=1001279

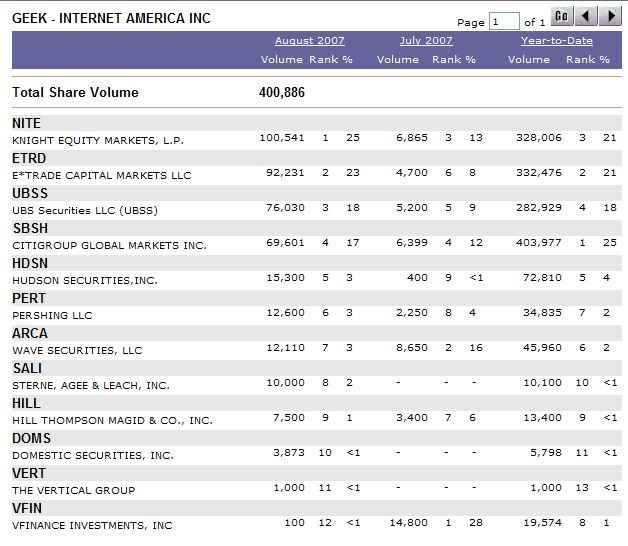

Monthly Share Volume report from the otcbb:

interesting to note that from july to august we picked up three new market makers (SALI, DOMS, and VERT) while all the other MM's accumulated 16- 38 times more GEEK shares then in the previous month. 440,886 shares for the month.

Some DD on GEEK:

All information I present is factual and comes primarily from government or verified sources, this information comes from the Texas Comptroller of Public Accounts, state department.

CERTIFICATE OF ACCOUNT STATUS:

http://ecpa.cpa.state.tx.us/coa/servlet/cpa.app.coa.CoaLetter

CERTIFICATE OF ACCOUNT STATUS

THE STATE OF TEXAS

COUNTY OF TRAVIS

I, Susan Combs, Comptroller of Public Accounts of the State of Texas, DO HEREBY CERTIFY that according to the records of this office

INTERNET AMERICA INC

is, as of this date, in good standing with this office having no franchise tax reports or payments due at this time. This certificate is valid through the date that the next franchise tax report will be due May 15, 2008.

This certificate does not make a representation as to the status of the corporation's Certificate of Authority, if any, with the Texas Secretary of State.

This certificate is valid for the purpose of conversion when the converted entity is subject to franchise tax as required by law. This certificate is not valid for the purpose of dissolution, merger, or withdrawal.

GIVEN UNDER MY HAND AND

SEAL OF OFFICE in the City of

Austin, this 15th day of

September 2007 A.D.

Susan Combs

Texas Comptroller

Taxpayer number: 30117911666

File number: 0136366700

Form 05-304 (Rev. 02-03/14)

----------------------------------------------------------------

Company Information:

INTERNET AMERICA INC

10930 W SAM HOUSTON PKWY N STE 200

HOUSTON, TX 77064-6331

Status:

IN GOOD STANDING NOT FOR DISSOLUTION OR WITHDRAWAL through May 15, 2008

Registered Agent:

WILLIAM E LADIN JR

350 NORTH ST. PAUL STREET, SUITE 3000

DALLAS, TX 75201

Registered Agent Resignation Date:

State of Incorporation: TX

File Number: 0136366700

Charter/COA Date: July 21, 1995

Charter/COA Type: Charter

Taxpayer Number: 30117911666

----------------------------------------------------------------

Officers and Directors

INTERNET AMERICA INC

CAO JENNIFER LEBLANC

10930 W SAM HOUSTON PARKWAY

HOUSTON , TX 77064

DIRECTOR WILLIAM E LADIN JR

10930 W SAM HOUSTON PARKWAY

HOUSTON , TX 77064

CEO WILLIAM E LADIN JR

10930 W SAM HOUSTON PARKWAY

HOUSTON , TX 77064

PRESIDENT WILLIAM E LADIN JR

10930 W SAM HOUSTON PARKWAY

HOUSTON , TX 77064

http://ecpa.cpa.state.tx.us/coa/servlet/cpa.app.coa.CoaGetTp?Pg=tpid&Search_Nm=Internet%20americ...

|

Followers

|

5

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

105

|

|

Created

|

09/08/07

|

Type

|

Free

|

| Moderators | |||

Company Information

Internet America, Inc. is a leading regional Internet Service Provider in the southwestern United States, with operations based in Houston, Texas. We provide our subscribers with a high quality Internet experience with fast, reliable service and responsive customer care. Our common stock trades on the over-the-counter bulletin board under the symbol "GEEK".

Internet America offers a wide array of Internet services tailored to meet the needs of both individual and business subscribers. Our primary service offerings include broadband Internet delivered wirelessly and over DSL, and dial-up Internet access. Additionally we provide related value-added services such as Fax2email, online backup and storage solutions, parental control software, and more.

Our consumer products include high-speed Wireless Internet access, DSL access, dial-up Internet access, e-mail addresses, web site hosting and other services. For our business subscribers we offer dedicated high-speed Internet access, managed web site hosting, server colocation, domain name registration and other services.

Internet America signed its first subscriber in January 1995, and by mid April, only three months later, the Company had grown to over 3,500 subscribers. Since then, Internet America has evolved into one of the most technologically sophisticated ISPs in the U.S. As of June 30, 2006, we served approximately 37,000 active subscribers. Our popular services and our seven-days-a-week customer care staff provide our customers with an easy and enjoyable Internet experience.

Recent Acquisitions

TeleShare Communications July, 2007 Houston, Texas

NoDial.net, Inc. June, 2007 Victoria, Texas

Shadownet, Inc. June, 2007 Victoria, Texas

Blue wireless(Residential Customers Only) June, 2007 Dallas, Texas

Powerweb Feb, 2006 Houston, Texas

2Fast Communications Jan., 2006 San Antonio, Texas

TopGun Telecom, Inc. July, 2005 San Antonio, Texas

Company Information

Internet America, Inc. is a leading regional Internet Service Provider in the southwestern United States, with operations based in Houston, Texas. We provide our subscribers with a high quality Internet experience with fast, reliable service and responsive customer care. Our common stock trades on the over-the-counter bulletin board under the symbol "GEEK".

Internet America offers a wide array of Internet services tailored to meet the needs of both individual and business subscribers. Our primary service offerings include broadband Internet delivered wirelessly and over DSL, and dial-up Internet access. Additionally we provide related value-added services such as Fax2email, online backup and storage solutions, parental control software, and more.

Our consumer products include high-speed Wireless Internet access, DSL access, dial-up Internet access, e-mail addresses, web site hosting and other services. For our business subscribers we offer dedicated high-speed Internet access, managed web site hosting, server colocation, domain name registration and other services.

Internet America signed its first subscriber in January 1995, and by mid April, only three months later, the Company had grown to over 3,500 subscribers. Since then, Internet America has evolved into one of the most technologically sophisticated ISPs in the U.S. As of June 30, 2006, we served approximately 37,000 active subscribers. Our popular services and our seven-days-a-week customer care staff provide our customers with an easy and enjoyable Internet experience.

Recent Acquisitions

TeleShare Communications July, 2007 Houston, Texas

NoDial.net, Inc. June, 2007 Victoria, Texas

Shadownet, Inc. June, 2007 Victoria, Texas

Blue wireless(Residential Customers Only) June, 2007 Dallas, Texas

Powerweb Feb, 2006 Houston, Texas

2Fast Communications Jan., 2006 San Antonio, Texas

TopGun Telecom, Inc. July, 2005 San Antonio, Texas

Share Statistics

Authorized Shares: 40M

Shares Outstanding: 12.51M

Float: 9.95M

Daily Chart

Share Statistics

Authorized Shares: 40M

Shares Outstanding: 12.51M

Float: 9.95M

Daily Chart

link to recent Press Releases:

http://finance.yahoo.com/q/h?s=GEEK.OB

Internet America Reports Fiscal Year End Results

Friday September 14

- Company Reports Annual Broadband Wireless Internet Subscriber Growth of 80%

- EBITDA Increased by 77% from Previous Year

- Net Loss Reduced by Almost 50%

- Company Positioned for Continued Growth in 2008

"Internet America Publishes Company Profile

HOUSTON, Sept. 11 /PRNewswire-FirstCall/ -- Internet America, Inc. (OTC Bulletin Board: GEEK), a Houston-based provider of Internet access services, today announced that it has published its "Company Profile", which can be found on Internet America's website at http://www.InternetAmerica.com in the Investor Relations section."

Internet America Announces Closing of TeleShare Acquisition

Wednesday August 1, 6:00 am ET

Latest SEC Filings

http://finance.yahoo.com/q/sec?s=GEEK.OB

Audio interview with Internet America's CEO

http://www.thebusinessmakers.com/2007/08/18/episode-115-featured-guest-william-e-ladin-jr/

Internet America Inc.

350 N. St. Paul

Suite 3000

Dallas, TX 75201

United States

Phone: 214-861-2500

Fax: 214-861-2663

Website

http://www.internetamerica.com/

link to recent Press Releases:

http://finance.yahoo.com/q/h?s=GEEK.OB

Internet America Reports Fiscal Year End Results

Friday September 14

- Company Reports Annual Broadband Wireless Internet Subscriber Growth of 80%

- EBITDA Increased by 77% from Previous Year

- Net Loss Reduced by Almost 50%

- Company Positioned for Continued Growth in 2008

"Internet America Publishes Company Profile

HOUSTON, Sept. 11 /PRNewswire-FirstCall/ -- Internet America, Inc. (OTC Bulletin Board: GEEK), a Houston-based provider of Internet access services, today announced that it has published its "Company Profile", which can be found on Internet America's website at http://www.InternetAmerica.com in the Investor Relations section."

Internet America Announces Closing of TeleShare Acquisition

Wednesday August 1, 6:00 am ET

Latest SEC Filings

http://finance.yahoo.com/q/sec?s=GEEK.OB

Audio interview with Internet America's CEO

http://www.thebusinessmakers.com/2007/08/18/episode-115-featured-guest-william-e-ladin-jr/

Internet America Inc.

350 N. St. Paul

Suite 3000

Dallas, TX 75201

United States

Phone: 214-861-2500

Fax: 214-861-2663

Website

http://www.internetamerica.com/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |