Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Gold, Miners Overboughtness

By: Adam Hamilton | April 12, 2024

Gold’s record-shattering breakout surge during the past six weeks has proven magnificent! Sustained momentum-chasing buying outside of normal channels has fueled these sharp gains, which gold miners’ stocks are increasingly leveraging. But such big-and-fast surges are leaving traders wondering if gold and gold stocks have rallied too far too fast. Resulting excessive overboughtness can force rebalancing selloffs.

Financial markets are forever cyclical, perpetually flowing and ebbing. Rallies are followed by pullbacks, uplegs by corrections, and bulls by bears. The primary force driving these cycles is herd sentiment, how traders feel about sectors. This popular psychology endlessly swings between greed and fear like a giant pendulum. Major toppings happen at the bullish end of its arc, and major bottomings on the bearish side.

Gold’s prevailing sentiment today is surprising. Between mid-February to early April gold has blasted 18.1% higher, with 7/8ths of those gains since March dawned. Those six weeks since have seen fully 16 new nominal record closes, 4/7ths of all trading days! Such a massive record-shattering breakout surge should’ve spawned widespread greed if not euphoria. Yet Western investors are still hardly paying attention.

The combined bullion holdings of the mighty American GLD and IAU gold ETFs are the best daily high-resolution proxy for Western investment demand. Since mid-February when gold’s last mild pullback bottomed at $1,991, those have actually slumped 1.5%. Gold’s full upleg born in early October has powered 29.2% higher at best, yet GLD+IAU holdings somehow suffered a shocking 5.2% draw in that span!

This is unprecedented, something I’ve never seen before in a quarter-century intensely studying and actively trading gold and gold stocks. Western investors remain largely indifferent to gold, enamored by this latest stock-market bubble. Recent months’ powerful gold upleg has apparently been fueled by major buying out of Asia, particularly Chinese investment demand. China has all kinds of economic problems.

Its stock markets have been mauled by a deepening secular bear in recent years. Confidence in Chinese stocks has been seriously damaged, with many government interventions failing to stanch the bleeding. The aftermath of a burst bubble in Chinese housing has also crushed real-estate prices. So investors looking for assets not exposed to China’s troubled economy have been flocking to gold, catapulting it higher.

Ethereal sentiment can’t be measured directly, it must be inferred. Normally how far prices stretch from key baselines reveals excessive herd greed or fear. Big-and-fast surges generate the former, while sharp plunges spawn the latter. Nearly two decades ago I created a trading system called Relativity to quantify this. It simply looks at prices relative to their underlying 200-day moving averages, actually as multiples of them.

Those 200dmas common in many price charts make fantastic baselines. They are dynamic, gradually evolving over time to reflect prevailing price trends and levels. Yet they still change slowly enough that any outsized price moves force big deviations away from them. To the upside and downside those reflect popular greed and fear respectively. Traders grow excited as prices blast higher but depressed as they tumble.

Midweek gold’s latest record close divided by that day’s 200dma yielded a Relative Gold or rGold multiple running 1.176x. In other words, gold was stretched 17.6% above its 200dma. Without context that is meaningless, but when charted over time Relativity multiples often form horizontal trading ranges. These flatten 200dmas to 1.00x, and then render all price fluctuations around them in constant-percentage terms.

This rGold chart superimposes normal gold prices and key technicals including that 200dma over those rGold multiples. To define Relativity trading ranges to help guide the extensive gold-stock trading in our subscription newsletters, I analyze the last five calendar years of data. The current Relative Gold range runs from gold being extremely oversold under 0.90x its 200dma to extremely overbought above 1.15x.

So gold stretched way up to 1.176x its 200dma midweek is well into that extremely-overbought territory! Other traditional overboughtness-oversoldness indicators concur, including the Relative Strength Index and stochastics. Per Relativity, gold hasn’t been this hugely overbought in 3.6 years since mid-August 2020. And paradoxically that comparison is both damning and encouraging, simultaneously bearish and bullish.

Back in mid-2020, a monster gold upleg skyrocketed emerging from March’s pandemic-lockdown stock panic. Gold soared a scorching 40.0% higher in just 4.6 months, shooting to a parabolic climax way up at an extraordinarily-overbought 1.260x its 200dma! And that stretching was even more extreme since that key baseline itself was rising sharply. Gold’s euphoric $2,062 peak then wouldn’t be bested for fully 3.3 years.

That 1.260x rGold extreme was a heck of a lot higher than today’s 1.176x. But back then surging from the latter to the former only took a couple weeks. When popular greed waxes extreme and traders rush to chase vertical gains, buying exhaustion quickly follows. Soon such frenzied parabolic surges attract in all-available near-term capital. Once all traders wanting to chase that big momentum are in, only sellers remain...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | April 13, 2024

This market made a new high today after the past 2 trading days. The market opened higher and closed higher. The immediate trading pattern in this market has exceeded the previous session's high intraday reaching 24488. Therefore, this market has rallied over the past 42 trading sessions. Nevertheless, this market remains well above all seven of our intial support levels. Meanwhile, this market's closing at this time has been the highest during this 42 day rally. This certainly warns that we can still see higher highs ahead from here. It will take a closing below 23506 to signal a decline is unfolding. This market is trading above our normal trading envelope which resides at 23549 suggesting it is strong and still in a breakout position. Moreover, this market is quite strong for now trading above all 8 technical support levels. Additionally, this market is very strong while our projected overhead resistance stands at 24687 and 24813.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Gold Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2015. The Last turning point on the ECM cycle high to line up with this market was 2020 and 2011 and 1996.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Noticeably, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Focusing on our perspective using the indicating ranges on the Daily level in the NY Gold Futures, this market remains moderately bullish currently with underlying support beginning at 23557 and overhead resistance forming above at 23845. The market is trading closer to the resistance level at this time.

On the weekly level, the last important high was established the week of April 8th at 24488, which was up 8 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 24488 to 23217. Nevertheless, the market is still trading downward more toward support than resistance. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 24488 made 0 week ago. This market has made a new historical high this past week reaching 24488. Here the market is trading weak gravitating more toward support than resistance. We have technical support lying at 23792 which we are currently trading below implying the market is very weak. This infers that this level will now be resistance. Our Major Channel Support lies at 21446 and a break of that level would be a bearish indication for this market.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 3 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2020 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2023 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Interestingly, the NY Gold Futures has been in a bullish phase for the past 16 months since the low established back in November 2022.

Critical support still underlies this market at 19860 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Gold Miners $GDX form Golden Cross for the first time since January 2023

By: Barchart | April 12, 2024

• Gold Miners $GDX form Golden Cross for the first time since January 2023.

Read Full Story »»»

DiscoverGold

DiscoverGold

The matrix says gold not going up at all today. Flip those futures.

$GDX #Miners - Heading into the Uppr-Band...

By: Sahara | April 12, 2024

• $GDX #Miners - Heading into the Uppr-Band...

Read Full Story »»»

DiscoverGold

DiscoverGold

DOW is about 38,700 and gold is about 2,350. remember these numbers. Some old fart on another site, who has been rarely correct since 1987, thinks the DOW and gold are going much higher. I think he needs the DOW to go much higher to make money from his advice, but he also knows that gold is going much higher with our without him or his small band of followers money. I guess he figures he can influence enough people to bring in suckers to make markets go up??? his timing days are done. He also said BTC was going to Zero, we see where that is.

What i will tell you is the DOW Gold Ratio will approach 1 again, so will gold and DOW go higher???? and if so, that would mean that Gold would have to go up 25x from where it is if the DOW even came close to doubling in the next few years. good luck with that, what i do know is the ratio will end up close to 1 again during any kind of normal market reset that can make any difference.

Gold mining stocks are perking up after a mostly brutal couple of years

By: SentimenTrader | April 9, 2024

• Gold mining stocks are perking up after a mostly brutal couple of years.

Outside of once-a-decade thrusts, bouts of positive momentum tend to get hammered.

We can see that just in the past couple of years. Whenever fewer than half of the miners were mired in a correction - meaning at least half of them were within 10% of their 52-week highs - the GDX fund soon peaked. The annualized return of GDX is excellent as long as fewer than 50% of miners are in a correction; the problem is when it ticks back above 50%, and that's most of the time.

Read Full Story »»»

DiscoverGold

DiscoverGold

Years ago, before I cared or understood metals there was a few that constantly posted and talked about them. I used to laugh, then I listened, then I cared, then I understood, then I got in, they were right. What is going on now is just a generational cycle that has been delayed for a few years with debt to infinity and other meddling going on while dollar dies. It’s primed for once in a lifetime run like never before and I can go all day with proof.

Dummies everywhere, including left overs from 1987 era, don’t get it. There just self serving vestiges that want to be something they are not. The ones that did get it, are gone, retired, fishing, don’t need to be in it anymore. The crypto craze has done something to metals market that I didn’t understand until recently, which will make this cycle epic, to eclipse them all. I ain’t gonna explain or argue, I’ll let everyone do their thing. I may write a book on it, maybe.

Impressive Kitco guest, who gives 3 historical methods under which the current price https://www.kitco.com/news/video/2024-04-05/silver-supply-crisis-what-s-next-peter-krauthof silver should now be at 300 bucks or actually even higher, per ounce.

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | April 6, 2024

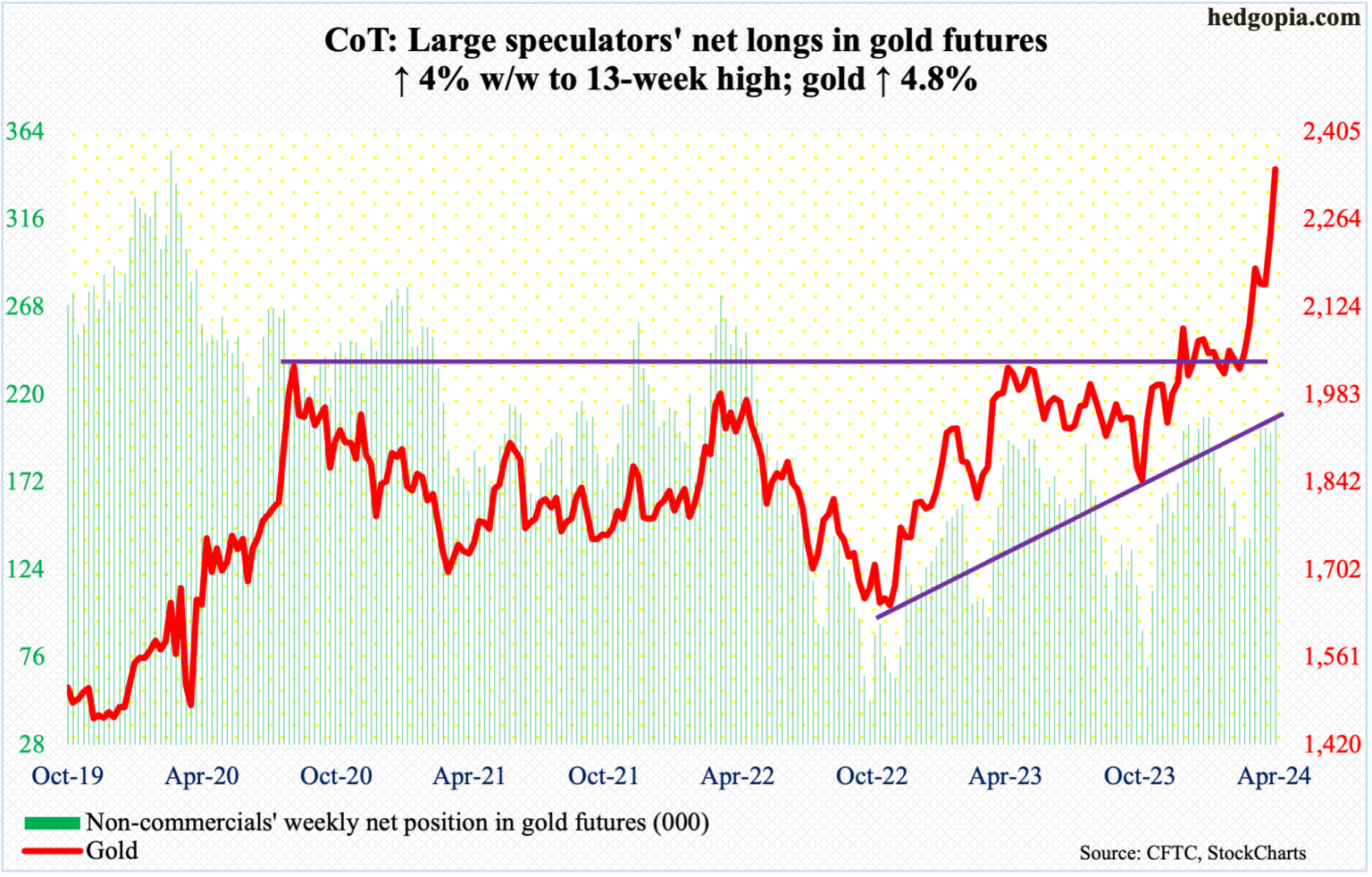

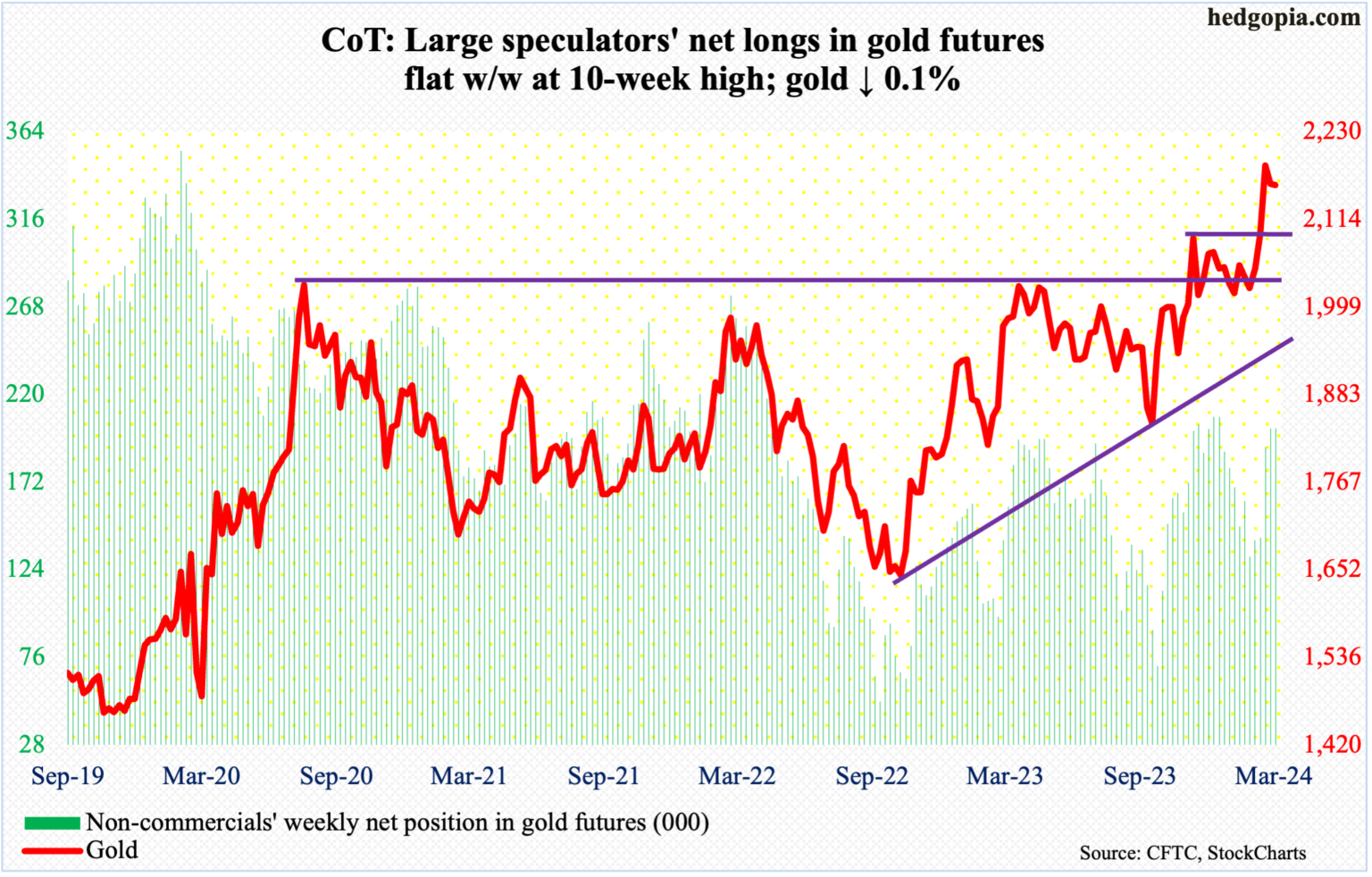

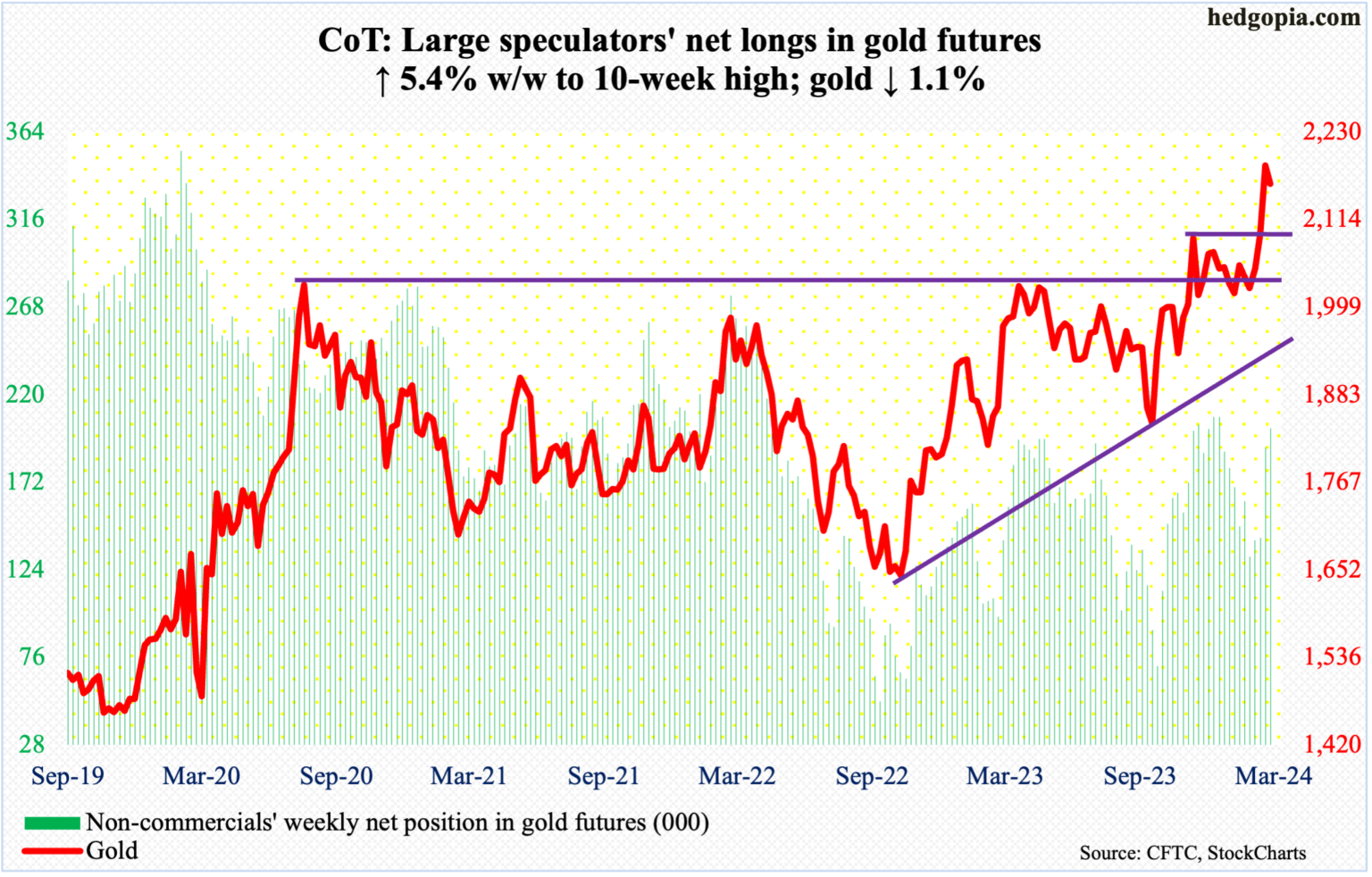

• Following futures positions of non-commercials are as of April 2, 2024.

Gold: Currently net long 207.3k, up 8k.

Gold bottomed at $1,824 last October. Friday, it ticked $2,350 intraday with a close of $2,345/oz – both new highs.

The rally shifted into a higher gear after the metal broke out of $2,080s, which was touched the first time in August 2020, early last month. At some point, breakout retest will occur. But the way the rally has unfolded, there is support before that happens, with the nearest at $2,240s.

Amidst this, non-commercials, who have been adding to net longs the last several weeks, could be tempted to show some aggression. If this scenario pans out, gold bears will be forced to wait before the overbought condition the metal is in gets unwound. The daily RSI closed this week at 82.7 and the weekly at 76.5.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | April 6, 2024

NY Gold Futures closed today at 23454 and is trading up about 13% for the year from last year's settlement of 20718. Up to this moment in time, this market has been rising for 5 months going into April suggesting that this has been a bull market trend on the monthly time level which has been confirmed by electing all of our model's long-term Bullish Reversals from the key low. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 23500 while it has not broken last month's low so far of 20470. Nevertheless, this market is still trading above last month's high of 22569.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Gold Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2015. The Last turning point on the ECM cycle high to line up with this market was 2020 and 2011 and 1996.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Distinctly, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

The perspective using the indicating ranges on the Daily level in the NY Gold Futures, this market remains moderately bullish currently with underlying support beginning at 23019.

On the weekly level, the last important high was established the week of April 1st at 23500, which was up 7 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 23500 to 22491. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 23500 made 0 week ago. This market has made a new historical high this past week reaching 23500. Here the market is trading positive gravitating more toward resistance than support. We have technical support lying at 22800 which we are still currently trading above for now.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 7 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2020 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2023 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Interestingly, the NY Gold Futures has been in a bullish phase for the past 16 months since the low established back in November 2022.

Critical support still underlies this market at 19860 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Gold-Stock Upside Targets 2

By: Adam Hamilton | April 5, 2024

The gold miners’ stocks are building steam, enjoying mounting upside momentum with gold powering to nominal record highs. Speculators and investors alike are taking notice of this high-potential sector that has long been overlooked. Despite their recent surge, gold stocks remain very undervalued relative to the metal that drives their profits. Their technicals and fundamentals argue for much-higher stock prices ahead.

Over the past five weeks or so, gold has blasted higher in a magnificent breakout rally! It was born as March dawned when a top Fed official hinted at more quantitative-easing Treasury monetizations. Gold shot up 2.0% that day to its first nominal record close since late December, and has achieved a dozen more since. Midweek gold was challenging $2,300, and its total upleg since early October had grown to 26.3%!

Who could’ve seen this coming? Me. The very day after gold bottomed under $1,820, I wrote an essay on gold’s violent breakdown. My contrarian conclusion fighting universal bearishness was, “...gold’s latest plunge was driven by massive gold-futures selling, leaving speculators’ positioning exceedingly-bearish. These super-leveraged traders have probably about exhausted their capital firepower available for selling.”

“That guarantees huge mean-reversion short-covering buying is imminent, which will catapult gold sharply higher.” How high? While most other analysts were forecasting gold to keep grinding lower, I wrote “Yet gold can easily surge 20% to 25% out of excessively-bearish spec gold-futures positioning like today on stage-one and stage-two buying alone!” Those are respectively short-covering buying and long buying.

That’s exactly what happened, as I detailed in a late-February essay on gold futures being reloaded. But while gold has been the belle of the ball, gold stocks have acted like ugly stepsisters. At best since early October, the leading GDX gold-stock ETF has merely rallied 27.9%. That’s appalling, not even 1.1x upside leverage to gold! Normally GDX’s major gold miners tend to amplify material gold moves by 2x to 3x.

The gold stocks have languished and lagged their metal for a variety of reasons, which I explored in an early-March essay. The day before I wrote that one, GDX had plunged to $25.79 which was actually a little under its early-October low of $25.91! Major gold stocks had slumped 0.5% during a 4.8-month span where gold had surged 11.7% higher. While bearish market anomalies feel bad, they offer great opportunities.

Extreme disconnects never last long, soon mean reverting to restore normal relationships. Over the last five weeks or so, GDX has rallied a sizable 28.5% leveraging gold’s parallel surge by 2.2x. Naturally that is working wonders for sentiment, rekindling bullishness and attracting in more traders. As they chase these mounting gold-stock gains, this sector’s outperformance relative to its underlying metal will grow.

This chart looks at GDX technicals over the past few years or so. The last time I ran it in early March, this dominant sector benchmark was right at that anomalous pre-gold-upleg low. But gold stocks have started to surge with gold since, achieving some nice gains. Yet GDX is still only about halfway up into its secular uptrend, still having massive room to mean revert higher. Much bigger gold-stock gains are still coming.

Gold stocks remind me of a great Easter sermon my pastor just gave at church focusing on Thomas the Apostle. After Jesus was crucified, Thomas’s world came crashing down. He heard the impossible news of Jesus’s resurrection, but remained skeptical. John’s gospel records Thomas saying “Unless I see the nail marks in his hands and put my finger where the nails were, and put my hand into his side, I will not believe.”

Forever branded Doubting Thomas for that, he was more of a realist. He wanted some real evidence that Jesus had risen, and soon got it as Jesus visited and spoke with him. Right then Thomas believed, and went on to do many great works including spreading the gospel to India. Gold stocks have been out of favor so long they may as well be rising from the dead! So traders want hard evidence before believing this is real.

GDX surging nearly 30% in just over a month is starting to convince skeptics. The hardline bearishness on this sector that has festered for years is softening, with bullish green shoots sprouting up. In markets, buying begets buying. Traders lover chasing winners to ride their upside momentum. The higher and longer anything rallies, the more capital it attracts accelerating its gains. Doubt quickly transforms into belief.

Gold stocks’ violent upside potential has largely been forgotten in recent years. GDX has enjoyed some modest-to-decent uplegs since 2021, clocking in at +28.4%, +41.4%, +52.1%, and +34.4%. Those are alright, but nothing to write home about. Averaging 39.1% gains, they really weren’t compelling enough to overcome the challenges of contrarian trading. But go back just one more year, and everything changes...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

$GDX #Miners - Latest: Popped the 'Coil'...

By: Sahara | April 4, 2024

• $GDX #Miners - Latest

Popped the 'Coil'...

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold doing well because of it for sure. Wow, it took that many tries? Should have paid me a fraction of that cost. I could have done in one days worth of analysis. https://www.foxbusiness.com/economy/million-simulations-show-us-debt-is-on-unsustainable-path

Egon is one of the most solid sources for valid analysis https://www.zerohedge.com/markets/implications-fatal-debt-expect-more-lies

this is becoming common place, and its not coincidence that its happening. they get it, as do central banks, we cannot pay off our debt, Joey has broken the bank and yes liquidity is drying up other than Tbills where they still print money into economy to pretend there is a GDP growth. https://www.zerohedge.com/markets/utah-formally-empowers-state-treasurer-protect-state-funds-gold-and-silver

2 Stocks Surging as Gold Prices Hit Record Highs

By: Schaeffer's Investment Research | April 1, 2024

• Interest rate cut hopes are driving gold stocks higher

• GOLD and RGLD are both eyeing third-straight wins

Gold stocks are on the rise, with the yellow metal surging to a record high earlier today on the heels of February's personal consumption expenditures (PCE) price index, which was in line expectations and fueled hopes of interest rate cuts. In response, Barrick Gold Corp (NYSE:GOLD) and Royal Gold Inc (NASDAQ:RGLD) are on the rise today.

GOLD was last seen up 1.3% to trade at $16.85 -- its highest level since January. The security is on track for a third-straight gain, and has cleared a confluence of moving averages sitting above. The shares have added 18.4% in the last six months.

Call volume is today running at double the intraday average volume, with 43,000 bullish bets exchanged so far, compared to 8,175 puts. The most popular contract is the weekly 6/21 17-strike call.

RGLD is also higher, last seen up 0.8% to trade at $122.82, also heading for its third consecutive win and trading at its highest level since January. The stock toppled its 80-day moving average after spending most of 2024 underneath, and is now swinging above its year-to-date breakeven mark.

At the International Securities Exchange (ISE), Cboe Volatility Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), RGLD's 50-day call/put volume ratio of 4.99 sits higher than 97% of readings from the past year, showing calls being picked up at a much faster-than-usual rate.

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

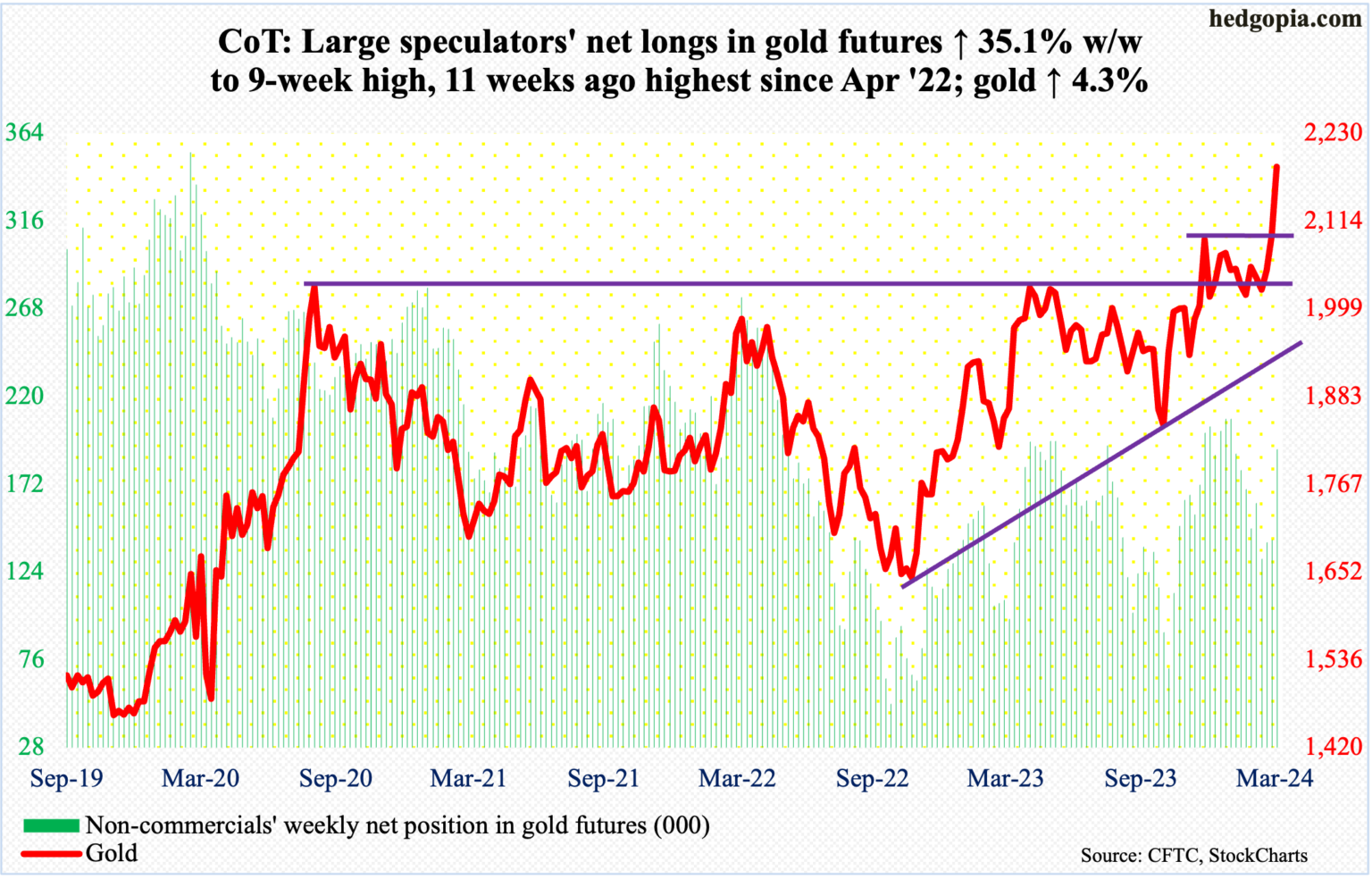

By: Hedgopia | March 30, 2024

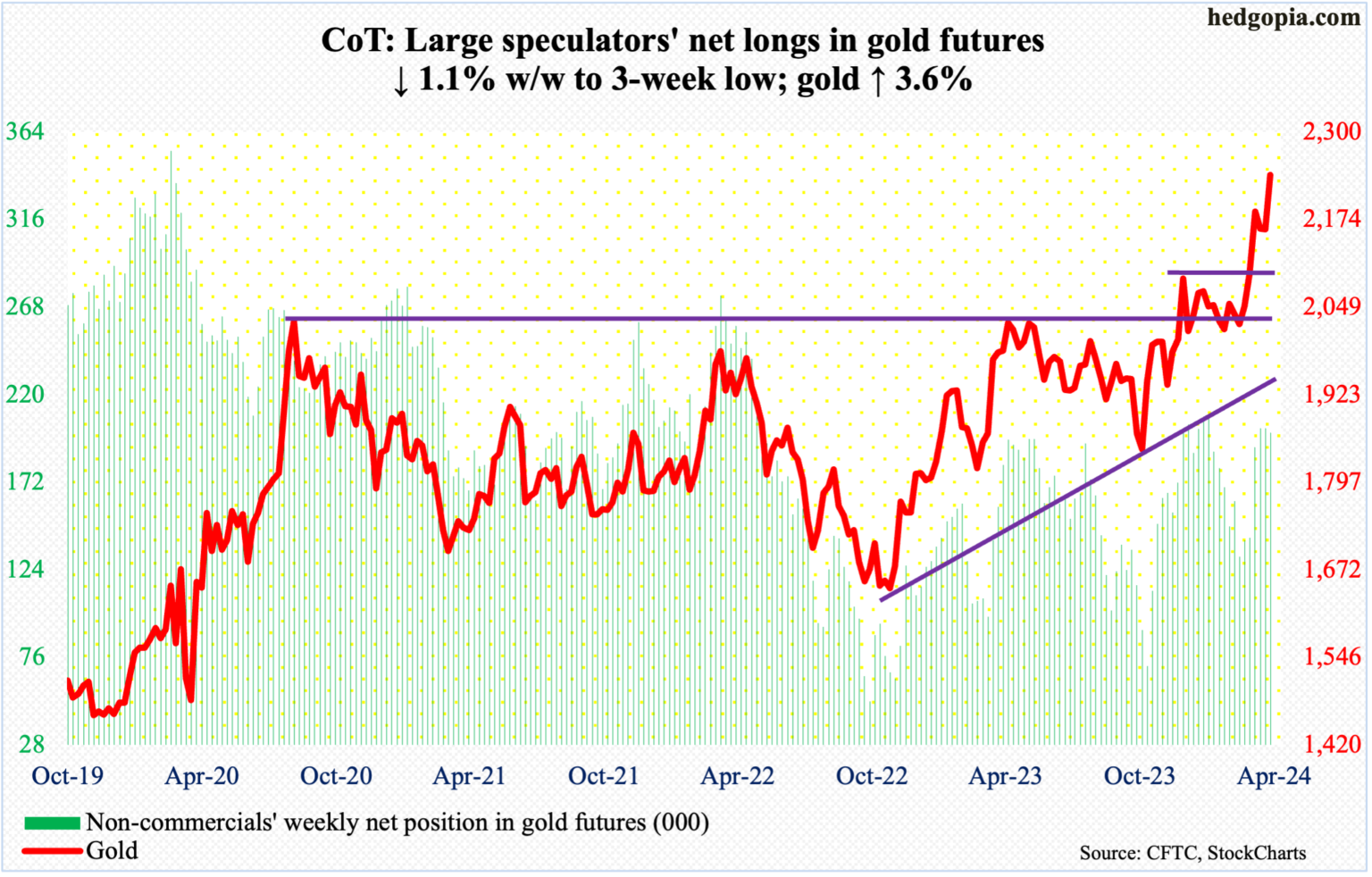

• Following futures positions of non-commercials are as of March 26, 2024.

Gold: Currently net long 199.3k, down 2.3k.

In a holiday-shortened week, gold rallied in all four sessions. By Friday, it surpassed the March 25th high of $2,225 to rally 3.6 percent for the week to $2,238, with the metal ticking $2,247/ounce. Last week’s potentially bearish gravestone doji has been negated.

Monday’s intraday low of $2,164 came just above horizontal support at $2,150s, which was the high from early December. The yellow metal has come a long way from last October when it bottomed at $1,824.

At some point, successful breakout retest at $2,080s is the path of least resistance – and probably healthy for gold bugs. Since August 2020, when $2,080s was hit the first time, rally attempts stopped at that price point several more times, including in March 2022 ($2,079), May last year ($2,085) and a few more times this year. The 50-day has now risen to $2,089.

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold Stocks’ Spring Rally ‘24

By: Adam Hamilton | March 29, 2024

With gold forging deeper into record territory, interest in gold stocks is mounting. They’ve started to mean revert higher, on the way to catch up with and surpass the surging metal their profits leverage. The timing of this gold-stock upleg is fortuitous, coinciding with spring-rally seasonals. They’ll generate a strong tailwind on top of this sector’s primary drivers of battered sentiment, oversold technicals, and fantastic fundamentals.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behaviors driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold stocks display strong seasonality because their price action amplifies that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities see, as its mined supply remains relatively steady year-round. Instead gold’s major seasonality is demand-driven, with global investment demand varying considerably depending on the time in the calendar year.

This gold seasonality is fueled by well-known income-cycle and cultural drivers of outsized gold demand from around the world. Like clockwork these power major autumn, winter, and spring seasonal rallies in gold and thus its miners’ stocks. Interestingly market forces behind the latter are the least-understood out of all gold’s seasonal surges. Maybe that’s why this imminent spring rally has also proven gold’s weakest.

Yet surprisingly gold stocks still enjoy their best seasonal outperformance relative to their metal during these same coming months! So gold stocks’ spring rally has proven their strongest seasonal one during gold’s modern bull-market years. This contradictory mismatch between gold’s worst seasonal rally and its miners’ best one offers an important clue on the spring rally’s motivating impetus, sentiment is likely the key.

Traders’ psychology exceedingly influences their capital-allocation decisions. They won’t buy gold or gold stocks or anything unless they are optimistic prices will climb on balance. After dark cold winters in the northern hemisphere where the vast majority of the world’s traders live, spring naturally breeds optimism. Its glorious swelling sunshine and warming temperatures universally buoy the spirits of nearly everyone.

The lengthening daylight hours and improving weather from March to May bring joyful anticipation of the summer vacation season. That’s such a wonderful contrast to January and February, which often seem like nose-to-the-grindstone months of relentless busyness. With things looking up and traders generally feeling happier during springs, their optimism makes them more bullish on much including gold and gold stocks.

This glass-half-full sentiment leaves traders more willing to deploy capital to chase expected gains. And their optimistic buying feeds on itself, fueling virtuous circles of strength. The more traders buy gold and its miners’ stocks, the more they rally. Those resulting gains attract in still-more traders, accelerating the upside. Spring is exceptionally favorable for nurturing this positive psychological feedback loop in markets.

Since it is gold’s own demand-driven seasonality that fuels gold stocks’ seasonality, that’s logically the best place to start to understand what’s likely coming. This old research thread focuses on modern bull-market seasonality, as bull and bear price action are quite different. Gold enjoyed a mighty 638.2% bull run from April 2001 to August 2011, fueling gold stocks skyrocketing 1,664.4% per their leading HUI index then!

Following that secular juggernaut, gold consolidated high then started correcting into 2012. But the yellow metal didn’t enter formal bear territory down 20%+ until April 2013. That beast mauled gold on and off over several years, so 2013 to 2015 are excluded from these seasonal averages. Gold finally regained bull status powering 20%+ higher in March 2016, then its modest gains grew to 96.2% by August 2020.

Another high consolidation emerged after that, where gold avoided relapsing into a new bear despite a serious correction. Later the yellow metal started powering higher again, coming within 0.5% of a new nominal record in early March 2022 after Russia invaded Ukraine. So 2016 to 2021 definitely proved bull years too, with 2022 really looking like one early on. Then Fed officials panicked, unleashing market chaos.

Inflation was raging out of control thanks to their extreme money printing. In just 25.5 months following the March 2020 pandemic-lockdown stock panic, the Fed ballooned its balance sheet an absurd 115.6%! That effectively more than doubled the US monetary base in just a couple years, injecting $4,807b of new dollars to start chasing and bidding up the prices on goods and services. That fueled an inflation super-spike.

With big inflation running rampant, Fed officials frantically executed the most-extreme tightening cycle in this central bank’s history. They hiked their federal-funds rate an astounding 450 basis points in just 10.6 months, while also selling monetized bonds through quantitative tightening! That ignited a huge parabolic spike in the US dollar, unleashing massive gold-futures selling slamming gold 20.9% lower into early September.

That was technically a new bear market, albeit barely and driven by an extraordinary anomaly that was unsustainable. Indeed gold soon rebounded sharply, exiting 2022 with a trivial 0.3% full-year loss. Gold kept on powering higher, reentering bull territory up 20.2% in early February 2023! So I’m also classifying 2022 as a bull year for seasonality research. Gold’s modern bull years include 2001 to 2012 and 2016 to 2023.

Prevailing gold prices varied radically across these secular spans, running just $257 when gold’s mighty 2000s bull was born to March 2024’s latest record high of $2,194. That vast range of gold levels spread over all those long years has to first be rendered in like-percentage terms in order to make them perfectly comparable with each other. Then they can be averaged together to distill out gold’s bull-market seasonality.

That’s accomplished by individually indexing each calendar year’s gold price action to its final close of the preceding year, which is recast at 100. Then all gold price action of the following year is calculated off that common indexed baseline, normalizing all years. So gold trading at 110 simply means it has rallied 10% off the prior year’s close. Gold’s previous seasonality before 2023 was added is shown in light blue.

If investors understood gold’s phenomenal performance in recent decades, it would be far more popular with allocations included in every portfolio. Through 20 of these last 23 years, gold has enjoyed fantastic average calendar-year gains of 13.7%! And the great majority of that was before the Fed recklessly more than doubled the US money supply. With inflation raging since, everyone should have 5% to 10% in gold.

Seasonally gold enjoys three distinct rallies occurring in autumn, winter, and spring. Their average gains from 2001 to 2012 and 2016 to 2023 clocked in at 4.8%, 8.4%, and 3.5%. Gold’s spring rallies tend to start in mid-March near its seasonal uptrend’s lower support. But gold got an early start this year after a mild pullback into mid-February. At worst gold merely slumped 4.2% on a parallel 3.9% US Dollar Index surge...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 29, 2024

NY Gold Futures closed today at 22384 and is trading up about 8.04% for the year from last year's settlement of 20718. Up to now, this market has been rising for 2 years going into 2024 reflecting that this has been only still a bullish reactionary trend. As we stand right now, this market has made a new high exceeding the previous year's high reaching thus far 22569 while it is still trading above last year's high of 21523.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Clearly, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Solely focusing on only the indicating ranges on the Daily level in the NY Gold Futures, this market remains in a bullish position at this time with the underlying support beginning at 22253.

On the weekly level, the last important high was established the week of March 18th at 22253, which was up 5 weeks from the low made back during the week of February 12th. So far, this week is has moved to the upside exceeding last week's high of 22253 reaching 22569. A closing above last week's high would be a technical signal that the advance is still in motion just yet. This makes the current rally 1 weeks to date. .

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 22253 made 0 week ago. Still, this market is within our trading envelope which spans between 19857 and 21663. This market has made a new historical high this past week reaching 22253. We have exceeded that high suggesting the market is still pushing upwards.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 5 weeks overall.

INTERMEDIATE-TERM OUTLOOK

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 21523. After a thirteen month rally from the previous low of 19879, it made last high in December. Since this last high, the market has corrected for thirteen months. However, this market has held important support last month. So far here in March, this market has held above last month's low of 19964 reaching 20470.

Critical support still underlies this market at 19070 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Miners should be blowing the top off the popper any day now...But that was supposed to happen months ago and didnt....soooo!

maybe they are waiting for the actual move in silver to occur, why, because that is what silver does.

$GDX #Miners - Update: Striving to push thru the Wkly 150/EMA (Cyan), & negating those two 'Spinning Top' Candles. Powered by the Mthly 'Morning star' Tri-Star Candle Set-Up I showed prior...

By: Sahara | March 27, 2024

• $GDX #Miners - Update.

Striving to push thru the Wkly 150/EMA (Cyan), & negating those two 'Spinning Top' Candles. Powered by the Mthly 'Morning star' Tri-Star Candle Set-Up I showed prior...

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold still looking weak. Lost all its gains today, after getting stopped short of 2200.

Gold up today on bridge hit. Ships will have to rack and stack in Chesapeake bay. It will disrupt things but don’t see black swan yet. Although Baltimore is major port. From what I saw, ship lost power, lights went out and lost steering. After ATSs switched power over to emergency power, lights came back on. Lights went out again, main engines started up, black smoke under heavy load can be seen. once main engines up, ATS switch complete, lights came back on. Ship appeared to try and steer away from bridge at last second. Root cause for Why engines went out has yet to be determined. Terrorism, maybe, struggle to get ship under control obvious, power loss and restart a given from what I see. Big deal for markets is cost inflation and delays. If it was terror, black swan possible. I have seen a thing or 2 so I know a thing or 2.

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | March 23, 2024

• Following futures positions of non-commercials are as of March 19, 2024.

Gold: Currently net long 201.6k, unchanged.

Gold was down 0.1 percent to $2,160/ounce, but that belies the intra-week volatility. Intraday Thursday, the metal rallied as high as $2,225 to surpass the March 8th high of $2,203, but only to reverse to close at $2,185, forming a spinning top. For the week, a gravestone doji developed.

Thus far, gold bugs have defended $2,150s, which was the high from early December. Odds favor this support gives way in the sessions ahead. In an ideal scenario for the bulls, gold then heads toward $2,080s for a successful breakout retest, laying the foundation for the next leg higher.

Since August 2020, when $2,080s was hit the first time, rally attempts stopped at that price point several more times, including in March 2022 ($2,079), May last year ($2,085) and a few more times this year. The 50-day at $2,075 is rising toward that level.

The yellow metal has come a long way from last October when it bottomed at $1,824 and is itching to unwind the overbought condition it is in.

Read Full Story »»»

DiscoverGold

DiscoverGold

Call buyers are wildly bullish of $GDX here, as skew gets quite lopsided again

By: Markets & Mayhem | March 22, 2024

• Call buyers are wildly bullish of $GDX here, as skew gets quite lopsided again.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 23, 2024

NY Gold Futures closed today at 21600 and is trading up about 4.25% for the year from last year's settlement of 20718. This price action here in March is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 22253 intraday and is still trading above that high of 20832.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Gold Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2015. The Last turning point on the ECM cycle high to line up with this market was 2020 and 2011 and 1996.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Prominently, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Solely focusing on only the indicating ranges on the Daily level in the NY Gold Futures, this market remains moderately bullish currently with underlying support beginning at 21587 and overhead resistance forming above at 21663. The market is trading closer to the support level at this time. An opening below this level in the next session will imply a decline is unfolding.

On the weekly level, the last important high was established the week of March 18th at 22253, which was up 5 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 22253 to 21492. Nevertheless, the market is still trading downward more toward support than resistance. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 22253 made 0 week ago. Still, this market is within our trading envelope which spans between 19857 and 21663. This market has made a new historical high this past week reaching 22253. Here the market is trading weak gravitating more toward support than resistance. We have technical support lying at 21878 which we are currently trading below implying the market is very weak. This infers that this level will now be resistance. Our Major Channel Support lies at 20256 and a break of that level would be a bearish indication for this market.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 5 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2020 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2023 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 21523. After a thirteen month rally from the previous low of 19879, it made last high in December. Since this last high, the market has corrected for thirteen months. However, this market has held important support last month. So far here in March, this market has held above last month's low of 19964 reaching 20470.

Critical support still underlies this market at 19070 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Gold Mid-Tiers’ Q4’23 Fundamentals

By: Adam Hamilton | March 22, 2024

The mid-tier and junior gold miners in this sector’s sweet spot for upside potential are finishing reporting their latest quarterly results. Those have proven spectacular, with these fundamentally-superior smaller gold producers delivering big on all fronts. The potent combination of growing production, lower mining costs, and near-record gold prices fueled huge windfall profits. So mid-tiers shouldn’t stay undervalued for long.

The leading mid-tier-gold-stock benchmark is the GDXJ VanEck Junior Gold Miners ETF. With $4.3b in net assets mid-week, it remains the second-largest gold-stock ETF after its big brother GDX. That is dominated by far-larger major gold miners, though there is much overlap between these ETFs’ holdings. Still misleadingly named, GDXJ is overwhelmingly a mid-tier gold-stock ETF with little weighting allocated to juniors.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, these thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. Today only two of GDXJ’s 25 biggest holdings are true juniors!

Their Q4 production is highlighted in blue in the table below. Juniors not only mine less than 75k ounces per quarter, but their gold output generates over half their quarterly revenues. That excludes both primary silver miners producing byproduct gold, and royalty and streaming companies that purchase future gold output for big upfront payments used to finance mine builds. But mid-tiers often make better investments.

These gold miners dominating GDXJ offer a unique mix of sizable diversified production, excellent output-growth potential, and smaller market capitalizations ideal for outsized gains. Mid-tiers are less risky than juniors, while amplifying gold uplegs much more than majors. Our newsletter trading books are now filled with fundamentally-superior mid-tiers and juniors, smaller gold miners which we’ve long specialized in at Zeal.

While the mid-tiers’ fundamentals are stellar as you’ll soon see, GDXJ’s recent performance has been wanting. Ultimately gold stocks are leveraged plays on gold, and its latest upleg was born back in early October. By early December, gold had surged 13.8% to its first new nominal record close in 3.3 years on gold-futures short-covering buying. GDXJ only rallied 27.9% in that early-upleg span, mere 2.0x upside leverage.

After that gold consolidated high before slipping into a mild pullback into mid-February. Gold just gave back 3.9%, yet GDXJ plunged 21.1% as gold stocks fell out of favor again! The extreme euphoria and greed spewing out of the general-stock-market bubble were overshadowing alternative investments. Gold bounced back strong, surging 9.6% over the subsequent few weeks into mid-March. But mid-tiers kept lagging.

GDXJ merely rebounded 18.5%, amplifying gold an even-worse 1.9x. At best in mid-March, gold’s upleg had powered 19.9% higher achieving nine new nominal record closes! Yet GDXJ was only up 19.6%, just pacing gold. Much riskier than their metal, gold stocks need to way outperform to compensate traders for their big additional operational, geological, and geopolitical risks that are heaped on top of gold price trends.

For 31 quarters in a row now, I’ve painstakingly analyzed the latest operational and financial results from GDXJ’s 25-largest component stocks. Mostly mid-tiers, they now account for 64.7% of this ETF’s total weighting. While digging through quarterlies is a ton of work, understanding smaller gold miners’ latest fundamentals really cuts through the obscuring sentiment fogs shrouding this sector. This research is essential.

This table summarizes the GDXJ top 25’s operational and financial highlights during Q4’23. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDXJ over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q4’22. Those symbols are followed by their recent GDXJ weightings.

Next comes these gold miners’ Q4’23 production in ounces, along with their year-over-year changes from the comparable Q4’22. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

The mid-tier gold miners’ overall Q4’23 performance again proved spectacular! These sweet-spot-for-upside smaller gold stocks grew their production while slashing mining costs. That along with surging prevailing gold prices fueled massive earnings jumps, both per-ounce and bottom-line. Last quarter was undoubtedly one of the best the mid-tier and junior gold stocks ever reported, which should attract back investors.

Production growth trumps everything else as the primary mission for gold miners. Higher outputs boost operating cash flows which help fund mine expansions, builds, and purchases, fueling virtuous circles of growth. Mining more gold also raises profitability, lowering unit costs by spreading big fixed operational expenses across more ounces. The GDXJ-top-25 gold miners delivered again for the seventh quarter in a row!

Their collective production grew 2.8% YoY to 3,543k ounces last quarter. That trounced the larger super-majors and majors dominating GDX, which I analyzed in another essay last week. In Q4’23 the GDX-top-25 gold miners suffered a big 4.6%-YoY output drop to 8,845k ounces. The World Gold Council reported overall global gold-mining output in Q4 slipped 1.7% YoY to 29,925k. So the mid-tiers are outperforming.

But not as much as their aggregate production implies, as fully 14 of these GDXJ-top-25 stocks reported lower Q4 production. The biggest output growth came from GDXJ’s largest component, Pan American Silver which just grew into a major gold miner over this past year. Its Q4’23 gold production soared up 63.0% YoY, mostly because it acquired Yamana Gold at the end of Q1’23. PAAS’s output shot up 104k ounces.

That exceeded the GDXJ top 25’s total growth of 96k, so without that buyout aggregate production would have shrunk. But it still would’ve been much better than the GDX-top-25 majors. Some of the GDXJ mid-tiers reported great growth, including Centamin’s and Eldorado Gold’s surging 21.8% and 11.4% YoY. A sizable fraction of these elite mid-tiers and juniors have expansions going live this year that will boost output...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

$GDX - Update: Still within the fractal 'Coil' within a 'Coil'. Striving to recover the MA's...

By: Sahara | March 21, 2024

• $GDX - Update

Still within the fractal 'Coil' within a 'Coil'. Striving to recover the MA's...

Read Full Story »»»

DiscoverGold

DiscoverGold

Barron's Gold Mining Index to Gold ratio is at its lowest point since 1940

By: Brandon Beylo | March 18, 2024

• Barron's Gold Mining Index to Gold ratio is at its lowest point since 1940.

Something has to give.

Either gold prices pull back sharply.

Or gold miners start ripping higher.

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold Stocks Strongly Outperform After Gold Breakouts

By: Jordan Roy-Byrne | March 17, 2024

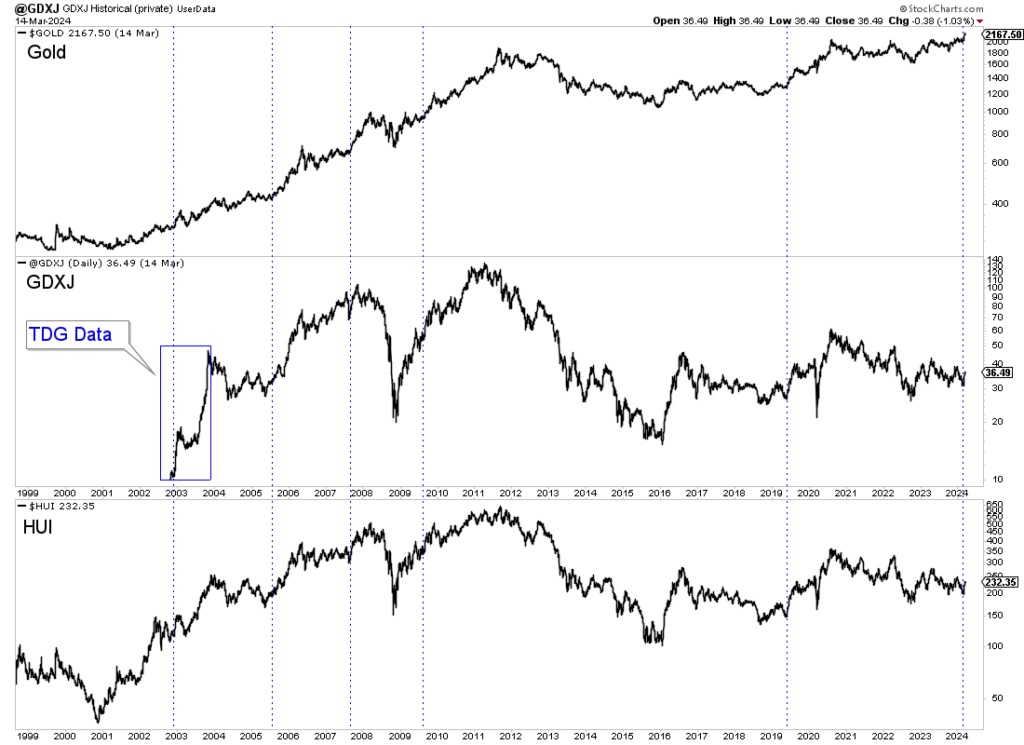

The gold stocks have underperformed Gold for almost 20 years so it is extremely difficult to imagine they could outperform Gold.

There are three reasons for the underperformance, but with Gold’s major breakout, two will evaporate.

One reason for the underperformance is the introduction of Gold ETFs (like GLD) in the mid-2000s. Before Gold ETFs, the majority of investors could only gain exposure to Gold through individual gold stocks. This reason remains in effect.

A second reason is that Gold and Silver have been in a secular bear market since 2011. The Gold price has remained essentially unchanged for over a decade, while the silver price remains well below its 2011 peak.

Finally, cost inflation over the past four years has taken a big bite of margins.

However, gold stocks are in a much better position now that Gold has broken out of its 13-year cup and handle pattern and likely started a new secular bull market.

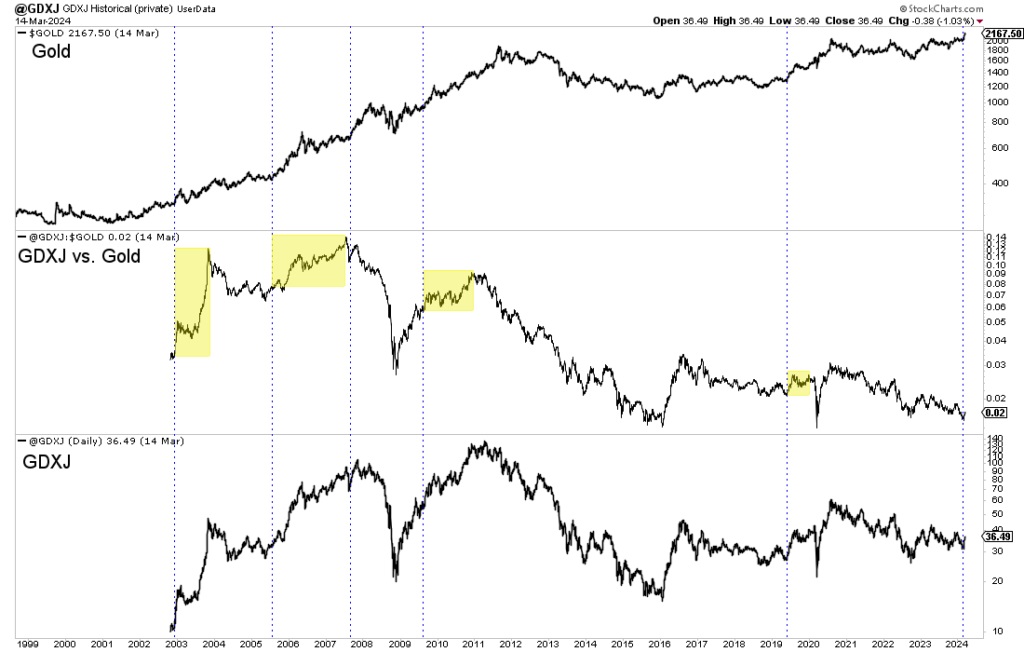

We plot Gold, GDXJ, and the HUI in the chart below.

GDXJ is constructed from the MVIS Junior Gold Miners Index, which has data from 2004. I extended the index back to late 2002 with data from an old index of 15 companies.

The blue lines mark the start of breakout moves in Gold.

In the next chart, we plot Gold and GDXJ against Gold and GDXJ. The yellow marks the outperformance of GDXJ against Gold following Gold breakouts.

Most gold stock indices (HUI, GDM, etc) peaked against Gold in 2004, but GDXJ did not peak against Gold until 2007.

Think of gold stocks and junior gold miners as an option on Gold.

They outperform Gold after major breakouts in Gold and after significant rebounds from extreme oversold conditions ala 2008, 2016 and 2020.

As Gold’s upside potential slows or reverses, gold stocks and junior gold miners will underperform Gold.

Gold is only days past potentially its most significant breakout in 50 years. Should the breakout hold, we should expect gold stocks, especially junior gold stocks, to dramatically outperform Gold over the next year or two.

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

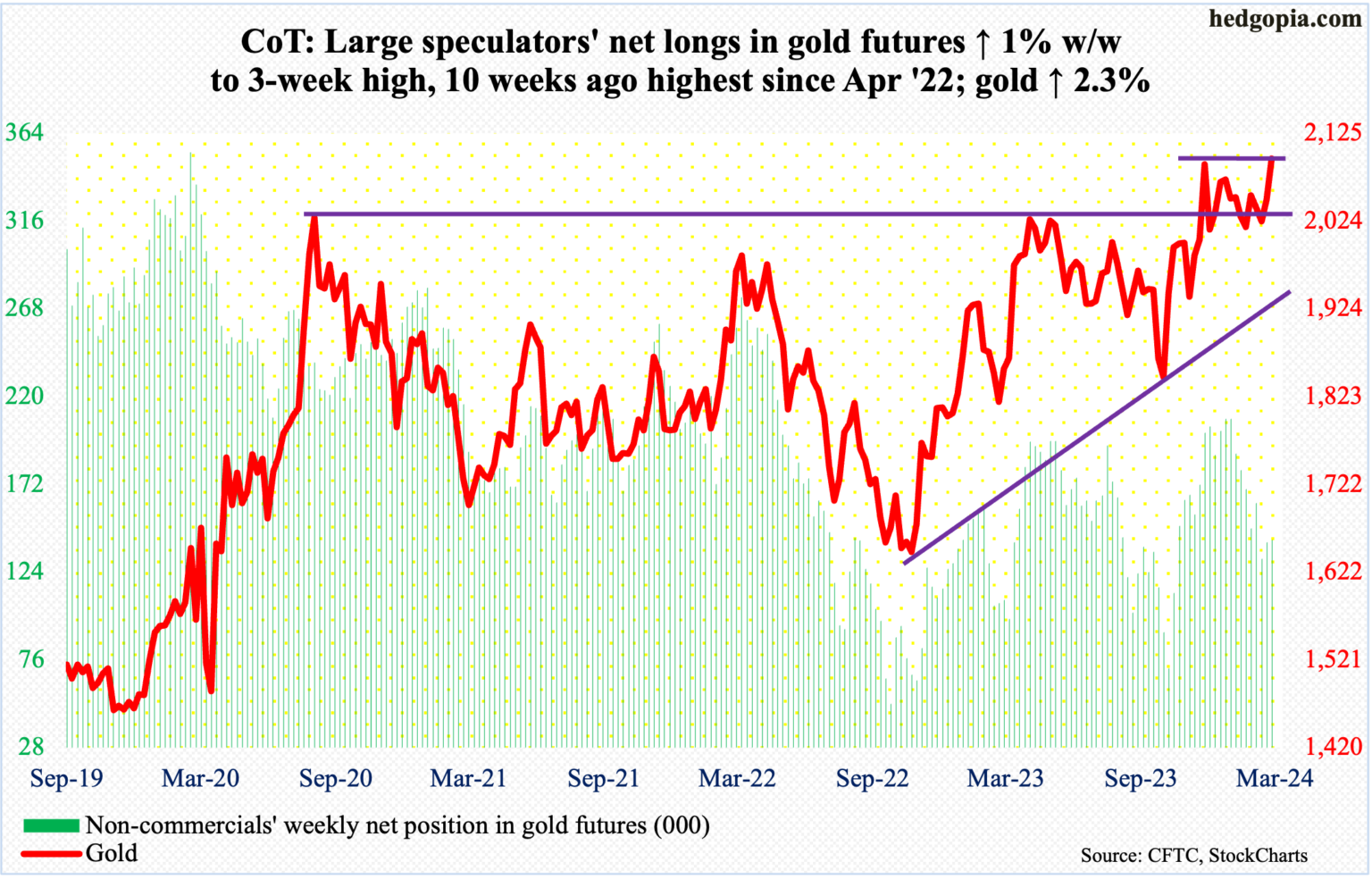

By: Hedgopia | March 16, 2024

• Following futures positions of non-commercials are as of March 12, 2024.

Gold: Currently net long 201.6k, up 10.3k.

Since it hit $2,203/ounce – a record – last Friday, gold has come under slight pressure, closing this week down 1.1 percent to $2,162 – first down week in four. Gold bugs, however, showed up for most of this week at/near $2,150s. Last December, the metal ticked $2,152, which was a new high back then, and reversed lower. Before that in October, it bottomed at $1,824. It has come a long way from that low.

In the sessions ahead, gold is likely to breach the $2,150s support. In an ideal scenario for the bulls, it then heads toward $2,080s for a successful breakout retest, laying the foundation for the next leg higher.

Since August 2020, when $2,080s was hit the first time, rally attempts stopped at that level several more times, including March 2022 ($2,079), May last year ($2,085) and a few more times this year.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 16, 2024

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Gold Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2015. The Last turning point on the ECM cycle high to line up with this market was 2020 and 2011 and 1996.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Noticeably, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

The perspective using the indicating ranges on the Daily level in the NY Gold Futures, this market remains moderately bullish currently with underlying support beginning at 21612 and overhead resistance forming above at 21908. The market is trading closer to the support level at this time. An opening below this level in the next session will imply a decline is unfolding.

On the weekly level, the last important high was established the week of March 4th at 22030, which was up 3 weeks from the low made back during the week of February 12th. Afterwards, the market bounced for 3 weeks reaching a high during the week of March 4th at 20881. Since that high, we have been generally trading down to sideways for the past week, which has been a reasonable move of 2.124% in a reactionary type decline. Nonetheless, the market still has not penetrated that previous low of 19964 as it has fallen back reaching only 4523 which still remains -77.3% above the former low.

When we look deeply into the underlying tone of this immediate market, we see it is cautiously starting to strengthen since the previous low at 19964 made 4 weeks. The broader perspective, this current rally into the week of March 4th has exceeded the previous high of 20832 made back during the week of January 29th. This immediate decline has thus far held the previous low formed at 19964 made the week of February 12th. Only a break of that low would signal a technical reversal of fortune and of course we must watch the Bearish Reversals.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. From a pointed viewpoint, this market has been trading down for the past week.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2020 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2023 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 21523. After a thirteen month rally from the previous low of 19879, it made last high in December. Since this last high, the market has corrected for thirteen months. However, this market has held important support last month. So far here in March, this market has held above last month's low of 19964 reaching 20470.

Critical support still underlies this market at 19070 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Gold Miners’ Q4’23 Fundamentals

By: Adam Hamilton | March 15, 2024

The major gold miners are finishing reporting their latest quarterly results, which proved mixed. Their collective production generally declined, forcing mining costs modestly higher. Yet outliers were mostly responsible. Unit profitability still surged dramatically due to near-record prevailing gold prices, but huge impairment charges gutted accounting earnings. Traders need to handpick outperformers to leverage gold.

Out of each year’s four quarterly earnings seasons, Q4’s are the most challenging to analyze. While the annual reports are more comprehensive than quarterlies, some companies report less Q4 detail focusing on full-year results. And annual reporting deadlines are looser and more spread out than quarterly ones, running 60 days after year-ends in the US and a bewildering 90 days for gold stocks trading in Canada!

So plenty of gold miners in the Great White North wait until late March to publish Q4 results, when Q1 is almost over. That’s way too late, leaving shareholders with stale fundamental data. Thus I try to split the difference between US and Canadian reporting, gathering and analyzing all available Q4 reports in mid-March. While not fully complete then, the resulting picture of major gold stocks’ fundamentals is more timely.

The GDX VanEck Gold Miners ETF remains this sector’s dominant benchmark. Birthed way back in May 2006, GDX has parlayed its first-mover advantage into an insurmountable lead. Its $12.9b of net assets mid-week dwarfed the next-largest 1x-long major-gold-miners ETF by nearly 31x! GDX is undisputedly the trading vehicle of choice in this sector, with the world’s biggest gold miners commanding most of its weighting.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, these thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. Those two largest categories account for over 58% of GDX.

Unfortunately gold stocks are languishing well out of favor today because of recent dreadful underperformance relative to the metal they mine. Gold is enjoying a strong upleg, powering 19.9% higher at best since early October achieving nine new nominal record closes! Yet in that parallel span GDX only rallied 16.9%, making for terrible 0.9x upside leverage. Much riskier than their metal, gold stocks need to outperform.

Normally they do, with GDX’s major gold stocks tending to amplify material gold moves by 2x to 3x. That compensates traders for miners’ big additional operational, geological, and geopolitical risks heaped on top of gold price trends. This vexing lagging has really damaged confidence in this high-potential sector. The battered gold stocks need to stage a massive mean-reversion catch-up rally to restore bullish sentiment.

For 31 quarters in a row now, I’ve painstakingly analyzed the latest operational and financial results from GDX’s 25-largest component stocks. Mostly super-majors, majors, and larger mid-tiers, they dominate this ETF at 87.3% of its total weighting! While digging through quarterlies is a ton of work, understanding the gold miners’ latest fundamentals really cuts through the obscuring sentiment fogs shrouding this sector.

This table summarizes the operational and financial highlights from the GDX top 25 during Q4’23. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDX over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q4’22. Those symbols are followed by their current GDX weightings.

Next comes these gold miners’ Q4’23 production in ounces, along with their year-over-year changes from the comparable Q4’22. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

Five weeks ago before this latest earnings season got underway, I wrote a Q4’23 earnings preview essay. Based on major gold miners’ latest cost guidance and Q4’s lofty prevailing gold prices, it looked like they would be reporting blockbuster results. While the actuals have been coming in quite good on some key fronts, they aren’t fantastic. Unfortunately there’s still too much deadweight among major gold miners.

Production growth trumps everything else as the primary mission for gold miners. Higher outputs boost operating cash flows which help fund mine expansions, builds, and purchases, fueling virtuous circles of growth. Mining more gold also boosts profitability, lowering unit costs by spreading big fixed operational expenses across more ounces. Yet the GDX top 25’s collective output in Q4 fell 4.6% YoY to 8,845k ounces.

That was worse than overall global-gold-mining output according to the World Gold Council, which only slipped 1.7% YoY to 29,925k in Q4. Fully 14 of these GDX-top-25 miners suffered declining production last quarter. And disappointingly plenty of them didn’t expound on the reasons, focusing their analyses on full-year-2023 results with Q4 just lumped in. That’s likely done intentionally to obscure any Q4 challenges...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | March 9, 2024

• Following futures positions of non-commercials are as of March 5, 2024.

Gold: Currently net long 191.3k, up 49.7k.

Gold bugs were able to build on last week’s action, when the metal closed at $2,096 – just above major resistance at $2,080s. This level has acted as a ceiling ever since August 2020 when gold reached $2,089 and retreated. After that, rally attempts stopped in March 2022 ($2,079), May last year ($2,085) and several times this year, not to mention last December when the metal hit a new high of $2,152.

This week, the December high was surpassed, with the yellow metal reaching $2,203 on Friday, closing at $2,186/ounce.

Gold has broken out of a long base. This is occurring at a time when equities, after massive rallies since last October’s lows, are showing signs of exhaustion.

The only thing is that gold has rallied for seven sessions in a row, with a somewhat parabolic look to it. A little backing and filling will be healthy.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Gold Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 9, 2024

NY Gold Futures closed today at 21855 and is trading up about 5.48% for the year from last year's settlement of 20718. This price action here in March is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 22030 intraday and is still trading above that high of 20832.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Gold Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2022 and 2015. The Last turning point on the ECM cycle high to line up with this market was 2020 and 2011 and 1996.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The NY Gold Futures has continued to make new historical highs over the course of the rally from 2015 moving into 2024. However, this last portion of the rally has taken place over 9 years from the last important low formed during 2015. Prominently, we have elected four Bullish Reversals to date.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NY Gold Futures, this market remains in a bullish position at this time with the underlying support beginning at 21505.

On the weekly level, the last important high was established the week of March 4th at 22030, which was up 3 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 22030 to 20881. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a weak posture. This market has made a new historical high this past week reaching 22030. Here the market is trading positive gravitating more toward resistance than support. We have technical support lying at 21186 which we are still currently trading above for now.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 3 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2020 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2023 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 21523. After a thirteen month rally from the previous low of 19879, it made last high in December. Since this last high, the market has corrected for thirteen months. However, this market has held important support last month. So far here in March, this market has held above last month's low of 19964 reaching 20470.

Critical support still underlies this market at 19070 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Positive Indications For the Gold Mining Sector

By: Gary Tanashian | March 8, 2024

The gold mining sector rallied as if on cue after our update highlighted some positives.

While noting that nothing other than an oversold condition was technically actionable (a strong argument for my assertion that TA should not be viewed as whole analysis; it’s only one tool and anyone stating otherwise is a carnival barker in my less than humble opinion), an NFTRH+ update (now public) posted in pre-market last Friday did show some positives in play.

While the larger macro has not yet flipped positive for the gold mining sector, a) that flip is not needed for a strong rally and b) the macro may well be in a slow process of changing now. Anyway, here’s the chart that bugged my eyes out when I looked at it and I wanted to be sure that subscribers were well apprised of it as well, ahead of time.

From the update:

Referring back to the first paragraph, the miners are under the pressure of the Gold/SPX ratio and indicators similar to it. However, check out this positive divergence by the Gold/RINF ratio to HUI. Gold/RINF and HUI had been a reliable correlation since mid/late 2022. In essence, it’s a view of gold vs. a gauge of inflation expectations.

Far be it from me to cherry pick and cheer lead positive indicators. But also it be me to look for positive indications amid utter ignominious and bearish market activity (i.e. contrarian opportunity).

Here is the chart as it exists this afternoon. HUI is making its move per the divergence implications.

Consider this divergence in Gold/RINF to gold stocks to be playing out perfectly as a positive indicator against a backdrop that had become over-bearish for the sector sentiment-wise, and oversold, technically (Ref. BPGDM chart in the linked update).

Read Full Story »»»

DiscoverGold

DiscoverGold

strange days lately for miners, Gold taking off, at all time highs, and miners going sideways or down. Gotta do some research from 1999.

Gold is flying but miners are left in the dirt

By: Financial Times | March 6, 2024

• Cheap targets abound, with some juniors reaching point where investment needs of projects look overwhelming

When the world’s largest gold miners by market value prefer to discuss copper projects, the shiny metal might have an image problem.

The gold price this week hit another record high, above $2,100 per ounce. Expectations of lower US interest rates and persistent demand from Chinese households are two reasons for this.

But the biggest miners, such as Newmont and Barrick, haven’t enjoyed the same success. Shares of Denver-based Newmont Mining have fallen into a pit, down 25 per cent over one year. This follows Newmont’s deal to buy Australia’s Newcrest last February for an increased price of $19.5bn, too rich for shareholders. Barrick shares have also struggled. It has plans to build a copper-gold mine in geopolitically risky Pakistan.

Unlike goldbugs, equity investors demand free cash flow for share buybacks and dividends from gold miners. Investors have little faith in mining executives as stewards of their capital. Ironically, this disconnect between metal and miners may prompt more dealmaking.

Investors haven’t shunned all gold miners. Canada’s Kinross Gold, under pressure from activist investor Elliott Management, has used surplus cash to buy back its shares. Its stock has climbed 42 per cent over the same period. Number three largest, Agnico Eagle, has benefited from fiscally conservative management and mine assets sitting in politically stable Canada.

Deals for small- to medium-sized miners are most likely to find favour with investors. China’s Yintai Gold last month stepped in to buy Osino Resources for C$368mn in cash ($272.53mn). This topped that of Osino’s local rival Dundee Resources. These smaller acquisitions have gilt-lined shareholder pockets in recent years.

The best returns on investment — averaging 100 per cent — occurred on purchases under $2bn, according to an analysis of 22 deals since 2018 by BMO Capital Markets. These were usually mid-sized miners buying small fry with greenfield projects. On the other hand, Newcrest’s merger destroyed some $1.4bn of value.

Cheap targets abound, thinks John Hathaway at Sprott Asset Management. Some juniors are reaching the point where the investment needs of projects look overwhelming, forcing a sale.

Smaller miners fall into two camps. Some in production, such as Toronto-listed OceanaGold, should soon turn free cash flow positive, notes BMO. Others need new sources of capital: Reunion Gold needs money to develop its Oko West mine in the new petrostate of Guyana. That might appeal to risk-taking investors, or miners with capital.

Should the gold price continue its ascent, talk of deal activity will only grow. Shareholders, wary of overpaying for growth, would prefer companies to mine the market for cheap assets first.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GDX - Update. Moved up from that Lwr-Line of 'Coil' & Bull 'Wedge' Green

By: Sahara | March 4, 2024

• $GDX - Update.

Moved up from that Lwr-Line of 'Coil' & Bull 'Wedge' Green.

Now tackling its Daily Dotted-Grey 150/SMA...

Read Full Story »»»

DiscoverGold

DiscoverGold

Gold CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | March 2, 2024

• Following futures positions of non-commercials are as of February 27, 2024.

Gold: Currently net long 141.6k, up 1.4k.

Gold bugs are back at it again. In fact, with a close of $2,096/ounce this week, it has managed to reclaim $2,080s, which has acted as a ceiling ever since August 2020 when it reached $2,089 and retreated. After that, rally attempts stopped at that price point in March 2022 ($2,079), May last year ($2,085) and several times this year, not to mention last December when the metal hit a new high of $2,152.

This is as good an opportunity as it gets to build on this week’s action. Needless to say, a breakout would be massive. Encouragingly for the bulls, the metal has been making higher lows since November 2022 when it bottomed at $1,618.

Read Full Story »»»

DiscoverGold

DiscoverGold

May get a big rally before it happens or may not who knows