| Followers | 679 |

| Posts | 141057 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Sunday, March 24, 2024 10:27:14 AM

By: Hedgopia | March 23, 2024

• Following futures positions of non-commercials are as of March 19, 2024.

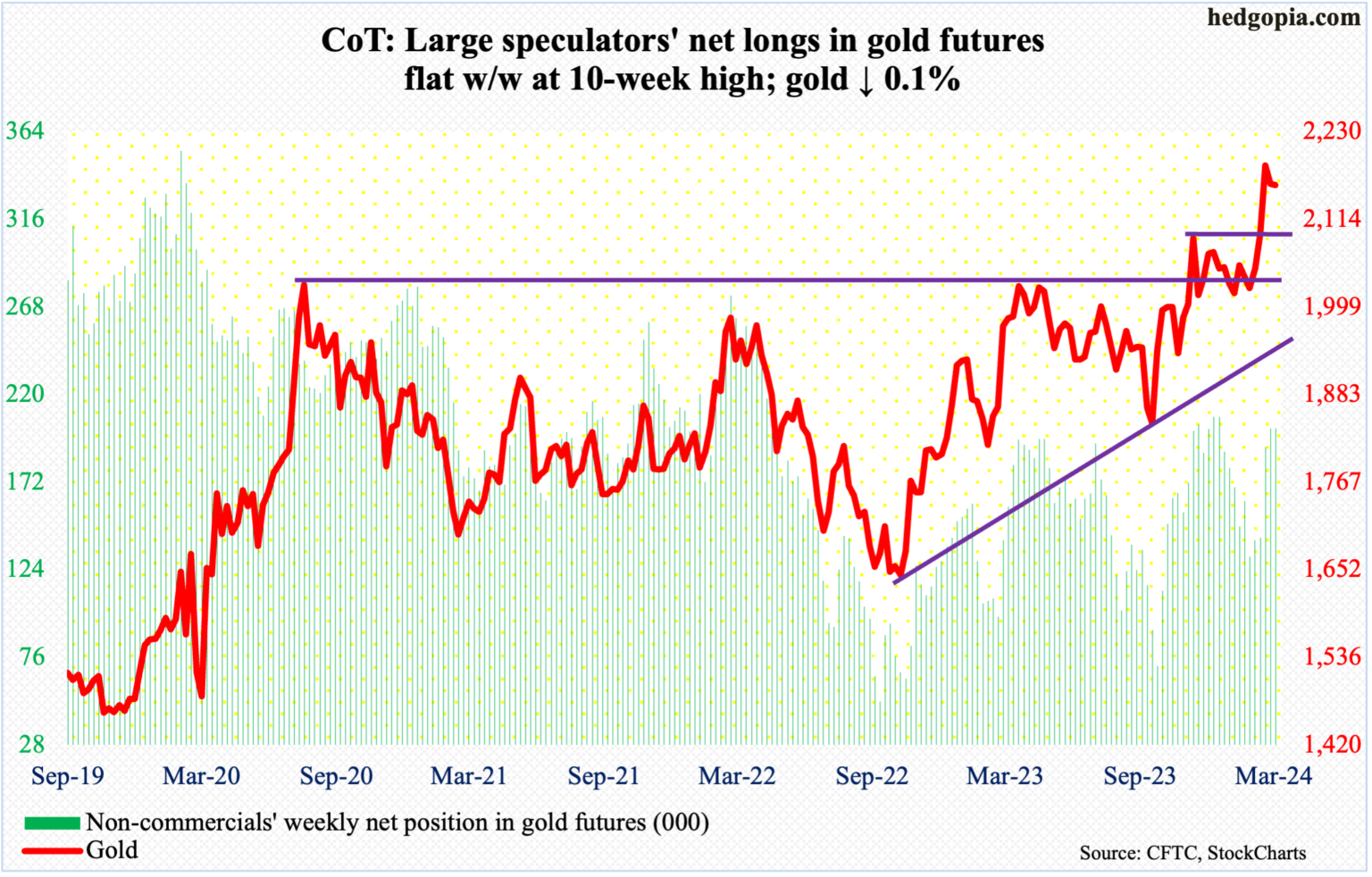

Gold: Currently net long 201.6k, unchanged.

Gold was down 0.1 percent to $2,160/ounce, but that belies the intra-week volatility. Intraday Thursday, the metal rallied as high as $2,225 to surpass the March 8th high of $2,203, but only to reverse to close at $2,185, forming a spinning top. For the week, a gravestone doji developed.

Thus far, gold bugs have defended $2,150s, which was the high from early December. Odds favor this support gives way in the sessions ahead. In an ideal scenario for the bulls, gold then heads toward $2,080s for a successful breakout retest, laying the foundation for the next leg higher.

Since August 2020, when $2,080s was hit the first time, rally attempts stopped at that price point several more times, including in March 2022 ($2,079), May last year ($2,085) and a few more times this year. The 50-day at $2,075 is rising toward that level.

The yellow metal has come a long way from last October when it bottomed at $1,824 and is itching to unwind the overbought condition it is in.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

- Surging S&P 500 Breadth • ValueWalk • 07/19/2023 03:16:37 PM

- S&P 500 Corrects In Breadth • ValueWalk • 07/18/2023 03:08:49 PM

- If The USDX Fell So Much, Why Didn’t Gold Truly Soar? • ValueWalk • 07/17/2023 05:16:20 PM

- USD’s Decline That’s… Bearish For Gold?! • ValueWalk • 07/12/2023 02:38:08 PM

- S&P 500 Late Day Reversal Worry • ValueWalk • 07/10/2023 03:17:34 PM

- Massive Gaming Celebrates Global Launch of House of Blackjack with USDC Earning Race • ValueWalk • 07/10/2023 02:44:17 PM

- Breathers In Mining Stocks Are Not Real Rallies • ValueWalk • 07/06/2023 05:20:55 PM

- S&P 500 Character Changes • ValueWalk • 07/06/2023 03:10:06 PM

- S&P 500 – As Bullish As It Gets • ValueWalk • 07/03/2023 04:01:21 PM

- The Great Gold Migration: How Asia Is Dominating The Global Gold Landscape • ValueWalk • 06/30/2023 05:07:35 PM

- S&P 500 Dip Buying And Tame PCE • ValueWalk • 06/30/2023 03:34:13 PM

- The Bullish Reversal In Gold Is Coming • ValueWalk • 06/29/2023 04:00:44 PM

- Insufficient S&P 500 Rotations • ValueWalk • 06/27/2023 02:41:42 PM

- Failing S&P 500 Rotations • ValueWalk • 06/23/2023 03:09:19 PM

- Countdown to S&P 500 Downleg • ValueWalk • 06/19/2023 01:49:20 PM

- Now THAT Was The Game-Changer For The Price Of Gold! • ValueWalk • 06/15/2023 04:40:35 PM

- S&P 500 Manages To Recover Initial Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Manages To Recover From Tech-Driven Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Withstands The Initial Selling – No Hike Tomorrow • ValueWalk • 06/13/2023 03:15:19 PM

- Roadmap For Mining Stocks – Courtesy Of The Stock Market • ValueWalk • 06/06/2023 03:17:49 PM

- Stocks To Still Extend S&P 500 Upswing • ValueWalk • 06/05/2023 03:31:02 PM

- AI, Stocks, And Gold Stocks – Connected After All • ValueWalk • 05/31/2023 03:29:15 PM

- Could Gold Miners Finally Stop Sliding?! • ValueWalk • 05/26/2023 08:42:37 PM

- S&P 500 Fine Selling Initiative • ValueWalk • 05/24/2023 03:06:00 PM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM