Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

"block 4 has "source oil" from which flows the oil into the other blocks."

I don't know ALL that that means ..but I think is BIGGER than anyone realizes

Block 4 may be able to control the Flow of oil or maybe more important the NON FLOWING OF OIL to the other blocks.The silence of information is Deafening.

As Kosmos alluded to Block 4 is the crown jewel of the EEZ

OFFOR is not going to let this slide by...He has more than enough money to tie this up indefinitely and as Kingpin alluded to "Gum up the works"

The worst nightmare of SAO TOME and the other Companies involved

a deal is either in the works or already done You all can count on it

I think selling and swapping assets and buying are all going on. To have one Company make an .announcement could lead to insider trading.It IMO going to be a statement by the Sao Tomeans Oil/Mineral Ministry

Its all a wish list again not based on actual facts. IOW nothing more than bullshit.

: Every penny is $25 million dollars that ERHC has to show as profit or anticipated profit..

:

You seriously discount the exuberance of the ,market !!!!

Hmmmmm. Let's see, doesn't seem to take a rocket scientist or a psychiatrist - the definition of a delusional person:

A delusional person believes things that couldn't possibly be true. If you're convinced that the microwave is attempting to control your thoughts, you are, sadly, delusional. Delusional comes from a Latin word meaning "deceiving." So delusional thinking is kind of like deceiving yourself by believing outrageous things.

According to xrimlinger.com, the adjacent block 3 is equivalent to 20 cents a share of ERHC. According to Kosmos litigation block 4 it's worth 17 cents a share.

That's before oil prices rose and before we discovered that block 4 has "source oil" from which flows the oil into the other blocks.

You're probably looking at north of 20 cents just for that block from Shell. They can EASILY do a dividend of a penny or two from 20 cents and that alone could result in a short squeeze into the dollars.

But the real money is the JDZ, which Oranto equivalently values at 80 cents a share for its 100% block in the JDZ which is equivalent to five 20% blocks that ERHC has.

I think Shell will buy block 4 and Total will buy the JDZ properties. That's why I prefer there to be one announcement for both Shell and Total simultaneously to achieve maximum damage to the short sellers.

Nothing delusional in the above assumptions and facts.

Krombacher

I have a degree in psychology but I don't really care if you are delusional or not. You are entitled to think whatever you want...even if you can't back it up. I remember once when you called me out for using the word 'I' to many times in my post. LOL. I thought that was odd but it didn't really matter. I'm confident in what I believe.

Again, I will wait for my big payday but I am not holding my breath. If ERHC gets some kind of deal I figure I'll be lucky to get .01 or .02 / share. I mean there are a lot of shares outstanding. Every penny is $25 million dollars that ERHC has to show as profit or anticipated profit....not based on zillions of barrels of oil like people thought with the JDZ blocks. And it can't be pie in the sky accounting. Hell...most

of any revenues could be disposed of by management for things that don't benefit shareholders. They do what they want and disregard your desires.

If there were ever a payday I will not wait for your OK to cash in...as I would guess that others will not either. But IMHO It's still highly doubtful that there will be any cashing in. ERHC does not seem in a good position. They could end up with nothing. And still no one can show any proof of any shorts. That's what seems delusional to me. Short squeeze???? Not if there are no shorts.

Badog

How many shorts are there? Not your assumption....show me actual facts that back you up?

Badog

Neither you nor ssc have a psychiatric background to diagnose whether I have delusions or diagnose pathological lying.

Hence it's defamation.

If shorts still have any money after this, I will pursue them in court for defamation.

Krombacher

Hey bear dung - ding The shorts can hardly cover when there are no sellers. Duh

Still living in delusion I see.

I think short sellers are living in the past and gaining false comfort from the share price.

That's normal behavior though due to the loss aversion they're experiencing.

But they will lose everything.

Krombacher

Just out of curiosity....did anyone ever know Oilphant...or whether he is still around?

His posts kept a lot of people guessing

Badog

More bullshit.

How is your next new narrative coming along? I mean the one you will deceitfully spew out after the September 2024 deadline comes and goes? Will you attempt to recycle the African Queen nonsense? Or maybe back to the Total dollars/share buyout "done deal"? When there is no Shell bidding war, no erhe dividends, nothing to move the share price away from near zero, what next? Maybe sketched heads of you and the "other dickran" assuring each other that share price just doesn't matter? lmao at dickran's pathetic and embarrassing greed and hubris driven delusions.

There aren't any shorts on a .0001 pps grey market stock. No matter how you put it or how you try to tell anyone who will listen to your bullshit, there isn't any shorters on a scam pump and dump penny ticker.

BTW, STILL .0001 pps.

Don't be mad bro. Just be happy that nobody is buying your stinkweed.

Dude, look at the volume!

No one is selling so the shorts aren't covering.

Shorts need to work way harder at trying to bullshit about tax loss selling (in May!?!?) because even in the last week of December at a price of $.000001 when tax loss selling would've produced the greatest tax loss, volume was still ZERO.

WHAT ARE THE SHORTS GOING TO DO?!?!?!

I guess you should go hard at work at placing clown emojis on posts... maybe that will work?

Or... wait for the short sellers' financial demise.

Muhahahahaha

Krombacher

Dude. Look at the price. Just saying.

I see that the Shorties have gotten out of their cages again ! It is going to be soooo entertaining

when the smoke begins streaming out of their butt holes .

Again you are on point.

Delusional liar guerguerian dickran just can't restrain his/her desperate, demented bullshit. Now we see dickran's latest new narrative -

But I think we will likely have at least the Shell deal announced before then... followed by a Total deal.

Everything in your post is a wish list. Not based on fact.

The word it Moot.

If there's been an extension granted as I believe is the case...

Then there's no point to a count down, except, I guess if ERHC still exists on the deadline, then it means that there's been an extension. But I think we will likely have at least the Shell deal announced before then... followed by a Total deal. And if management does this intelligently, they'll announce both simultaneously.

Krombacher

How do you know that the assignment agreement does not officially bind Total to ever perform work on a block to prove that block is "in production" better than a PSC when over half the agreement is redacted?

Do you even have a working definition of "in production" to qualify either the PSC or the assignment agreement as meeting the criteria for "in production"?

The only one I would like to hear from now is our CEO. We should have complete silence until then. These arguments are now mute. The only post that will matter on this board is one from the company.

It is the only explanation for the events that unfolded in the last two years...Lots of OIL Lots of money...Lots of gamesmanship being worked around the JDZ and EEZ from Govts to Companies

How do you know that the assignment agreement does not officially bind Total to ever perform work on a block to prove that block is "in production" better than a PSC when over half the agreement is redacted?

Do you even have a working definition of "in production" to qualify either the PSC or the assignment agreement as meeting the criteria for "in production"?

What makes no sense is that STP didn't wait until Sept to pick up the block without the fuss of an international caveat emptor if there were no extension. Hence, it's logical that there is an extension. Whether ERHC got it with the assignment agreement, a stealth PSC, or some other means, logic dictates they got it.

Krombacher

You could off set other capital gains. But I would talk to a broker and tax man on what you do with shares that you have taken a loss and is considered worthless.

Also its my understanding that you can sell them but you cant buy them. How that happens is a question.

I was assuming that come the end of the year one may have gains that you want to offset with losses. Can't imagine anyone could sell this for the gain part.......unless, of course, they were part of the debt squad that got quite a deal. Even then, this is difficult to sell, period

Actually according to the IRS you can claim the loss as soon as you deem the issue worthless which is usually sub penny. So I am sure over the last 5 years this has occurred alot. Of course you can only claim as much as you have gains. But can carry forward the rest.

What a scammer. Holy buckets just when I think you cant get any lower you do it. Wow huge bullshit.

The discussion was about completion (or lack thereof), not termination. I never said that I assumed the agreement was terminated.

And how can an assignment agreement with another company, no matter how qualified, that does not officially bind said company to ever perform any work on a block prove that block is “in production” better than a Production Sharing Contract? That just does not make sense.

Fun scenario, and I do agree with your last statement.

.

ERHC never got an extension on Block 11 because they never requested one. They sold out to Kosmos long before any extension would have been needed.

When Oranto was designated as Operator for Block 3 in a PSC did they get an extension? Apparently, yes, since they completed Phase I in 2015 and only had two years under the PSC to complete Phase II. To get from 2017 to November of 2023 they had to have been granted at least one extension. And since it is doubtful they were given one six year extension, they were likely granted more than one.

So the assumption that Oranto needs to have a “qualified operator” signed on to participate in Block 3 in order to get an extension is not supported by the evidence.

.

And bingo, there you have it. A classic delusional, desperate dickran temper tantrum complete with 13 steps of nonsense followed by more gag order and erhe short seller bullshit. But still erhe sits near zero with no buyout, no bidding war, no short squeeze, no dividend. Apparently all designed to support the newest twisted narrative with dickran now saying the September 2024 deadline doesn't matter and stuck longs should hold on for a few more short years lmao. dickran's greed and hubris driven deceit truly knows no bounds.

Well you're going to be waiting for another 100 years since this piece of shit scam isn't going anywhere. It's a scam and anyone who still is in it, is operating on false hope or is blind to what the facts are about this ticker.

Well, you have this going for you to encourage people to not sell. It's pretty much impossible and not worth doing. Why not hold at this point? LOL The next time it will be potentially worth selling will be going into tax loss selling time, or if someone life ends and those who inherit are cleaning up the books.

On the other hand, if for some reason someone is willing to pay anywhere close to a tenth of a penny per share, I would imagine sellers would come out of the woodwork.....most likely yourself, included. I, on the other hand, will not a seller nor a buyer be. The management has taught me well over the years

I've been waiting 18 years.

It takes that long to become a billionaire.

But, you won't become one if you throw in the towel because you broke down in the home stretch.

Yes, ERHC has been quiet... but for good reason, a gag order.

And thank goodness for that gag order... thanks to it, shorts assumed the worst and sold us all very cheap shares.

Krombacher

In your own quote it says that if any condition is not met then any party may terminate but it doesn't say that the agreement is terminated automatically.

In other words, any party to the agreement has the option to terminate if a condition is not met, but that doesn't mean they necessarily will terminate it.

So, I would not conclude that the agreement is "incomplete" if a condition isn't met. I would only conclude that the possibility exists that the contract can be terminated if one of the parties wants to terminate it, if a condition is not met.

But let's say your assumption is correct and the contract was terminated after ERHC presented the assignment agreement to STP and got its extension because it proved it signed on a credible operator with this contract and that was enough to prove they're "in production" better than a PSC of self declared / self designated operators can.

So the sequence of events in this hypothetical scenario would go like this:

Step 1 - assignment agreement is signed with Total and presented to STP for extension

Step 2 - extension is granted

Step 3 - some conditions in the agreement are not met

Step 4 - Total elects to terminate the contract even though it doesn't have to

Step 5 - ERHC has no operator so STP is upset and ERHC doesn't pay taxes on Block 11, further annoying STP.

Step 6 - STP can't wait until end of Sept when the block would otherwise expire because it already granted ERHC its extension.

Step 7 - so STP starts a bidding process on block 4

Step 8 - ERHC issues an international caveat emptor causing the bidding process to fail

Step 9 - STP gets smart and decides instead to invite Shell into a PSC

Step 10 - Shell and ERHC cut a deal brokered by STP as the middle man

Step 11 - Total still wants the JDZ assets

Step 12 - With the block 4 issue resolved, Total moves forward on the JDZ assets

Step 13 - ERHC shorts are screwed.

The above is hypothetical.

Krombacher

Oranto was "designated" by whom? By Oranto. So that's the same as declaring themselves operator... so you're splitting hairs.

When ERHC was "designated" as operator for block 11 in a PSC did they get a license extension? Nope.

When Oranto was "designated" as operator for block 3 in a PSC did they get an extension? Nope... not until last November.

So your assumption that you need to be designated as an operator on a block to get an extension is false and maybe that's the reason ERHC didn't do it for block 4.

Krombacher

The problem is that we get zero information from erhc’s mgmt.. so you want us to wait to sell? I’ve been waiting ~ 20 yrs.

Nd9

Nice work reporting the facts and exposing yet another delusional dickran narrative. Now get ready for a full-fledged dickran temper tantrum as we all know how much he/she hates to be proven wrong (although dickran should be used to it by now as it happens on an almost weekly basis). Regardless of how many versions of his/her desperate, deceitful claims of dollars/share buyout, bidding wars, short squeeze or erhe dividends dickran spews out, at the end of each day the erhe share price near zero is the indisputable fact that just doesn't go away.

And I always thought that to be the operator one had to have the technical expertise and equipment to do so.

Wow HUGE bullshit. How do you do this day in and day out? Again WOW

Section 4.1 of the ERHC/Total Assignment Agreement reads...

4.1 Condition Precedent

Completion is subject to the fulfilment (or, where permitted, waiver) of the following conditions (“Conditions”):

(a) receipt of all requisite written approvals and consents from the Competent Authority of the Deed of Assignment;

(b) notification by Assignee that it has obtained the authorisation of Total SA (I) on the transfer of the Transferred Interests under the terms and conditions of this Agreement, and (ii) to become a party to the PSC for Block 4; and

(c) execution and entry into full force and effect of a PSC in respect of Block 4 either:

(i) between (i) Assignor (or Assignee in cased Assignor has assigned and transferred remaining rights and interests in Block 4 to Assignee pursuant to Clause 4.7), (ii) Assignee and (iii) DRSTP represented by ANP-STP; or

(ii) in the case of the Farm-In Alternative between (I) Assignor and (ii) DRSPT represented by ANP-STP.

In the event that a Condition precedent is not satisfied or waived by the Longstop Date, any Party shall have the right to terminate this Agreement in accordance with Clause 4.8 at any time by written notice to the other Party. By mutual agreement of the Parties in writing the Longstop Date may be extended for another period to be agreed by the Parties.

Discussion:

Condition (a): something confirming that this condition was met would likely only be included as part of a SEC filing, as Kosmos did with Block 11 (see below). As we know, ERHC is not filing and Total has filed nothing related to EEZ Block 4. Additionally, there is no evidence that any interest in Block 4 has ever been transferred to Total. Conclusion: condition (a) has not been met.

https://www.sec.gov/Archives/edgar/data/1509991/000155837016005628/kos-20160331ex101065573.htm

Condition (b): a document of this nature would likely not be made available for public viewing. Conclusion: neutral.

Condition (c): the only official mention of a PSC for Block 4 is the ANP-STP invitation to Shell to negotiate such a PSC. If ERHC/Total/STP had executed a full force and effect PSC for Block 4 then STP would have had no reason to run their bid process on Block 4. Conclusion: condition (c) has not been met.

So, with two out of three conditions being unmet (although it would only take one), it is my conclusion that the Assignment Agreement has not been completed.

I welcome any evidence to the contrary.

.

Nigerian, Malaysian, Indian, South African, etc....

Doesn't matter where, nobody believes that a ticker that has been delisted to the "grey" markets from a company set up in Nigeria where they can't even verify information, that this is at any point legitimate.

They don't believe YOU most of all because you're just a blowing wind up everyone's butts. The price is still .0001 and it's not going anywhere. The scam is burnt.

Oranto did not declare themselves the operator on the block, they were designated as the Operator in a contractual agreement between themselves and STP. And they were a perfectly capable operator in getting Phase I accomplished. And I could be wrong about their reasons for going to xrimlinger. Maybe they feel they could be the technical operator but they just want to share the financial risk of drilling a deep water well.

Why didn't ERHC think of that? Maybe they did. After all, they were designated as the Operator on the Block 11 PSC (see below). Maybe ERHC wanted to enter into a PSC for Block 4 but STP refused until they paid their taxes due on Block 11.

28.1

ERHC ENERGY EEZ, LDA is hereby designated as the Operator under this Contract to execute, for and on behalf of the Contractor, all Petroleum Operations in the Contract Area pursuant to and in accordance with this Contract and the Petroleum Law.

https://www.resourcecontracts.org/contract/ocds-591adf-3122094392/view#/search/operator

As to the conditions to completion of the ERHC/Total Assignment Agreement. I will try to address them if I get time later today.

.

I read what you wrote but I discounted that anyone could convince ERHC to do anything.

What have you convinced ERHC to do in all the years you have been here?

Did someone convince ERHC to dilute this into a nothing sp?

Did someone convince ERHC to balloon this to 2.5 billion shares?

Did someone convince ERHC into the reverse split?

Did someone convince ERHC to quit having communications with investors? Or to quit publishing financials?

Does anyone even answer the phone at ERHC?

Badog

ERHC's common stock is traded on the OTC Grey Sheets (No Bid/Ask) under the symbol "ERHE."

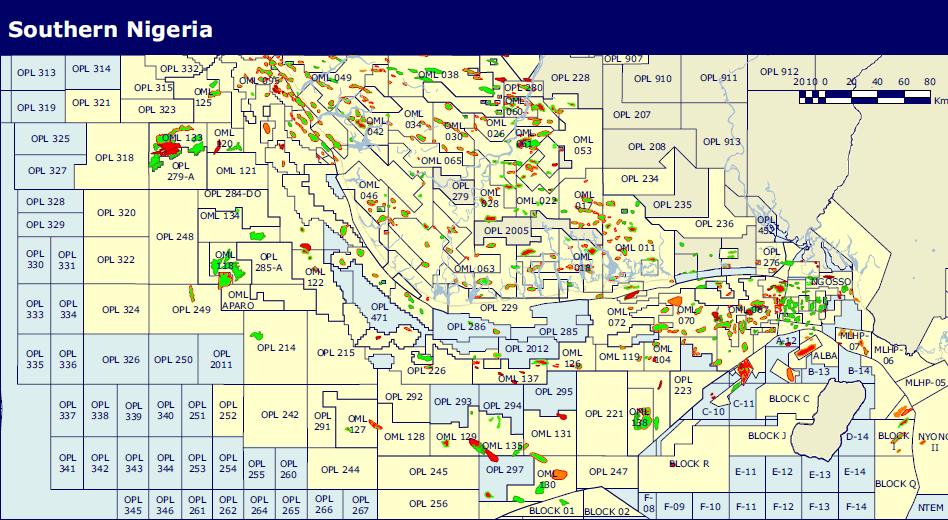

ERHC Energy Inc. is a Houston-based independent oil and gas company focused on exploration of its working interests in the Gulf of Guinea, off the coast of central West Africa. We are proud of our heritage of visionary leadership that was responsible for ERHC being among the first to identify the possibility of significant oil reserves in what was once an undeveloped oil region of the world. We continue to build upon that heritage by continuing to be willing to take chances and having the commitment to do the hard work necessary to realize the value of our assets.

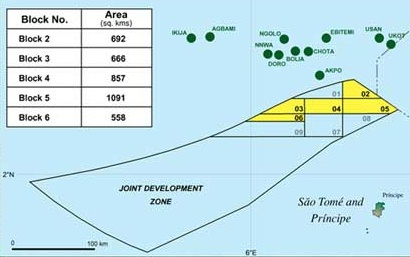

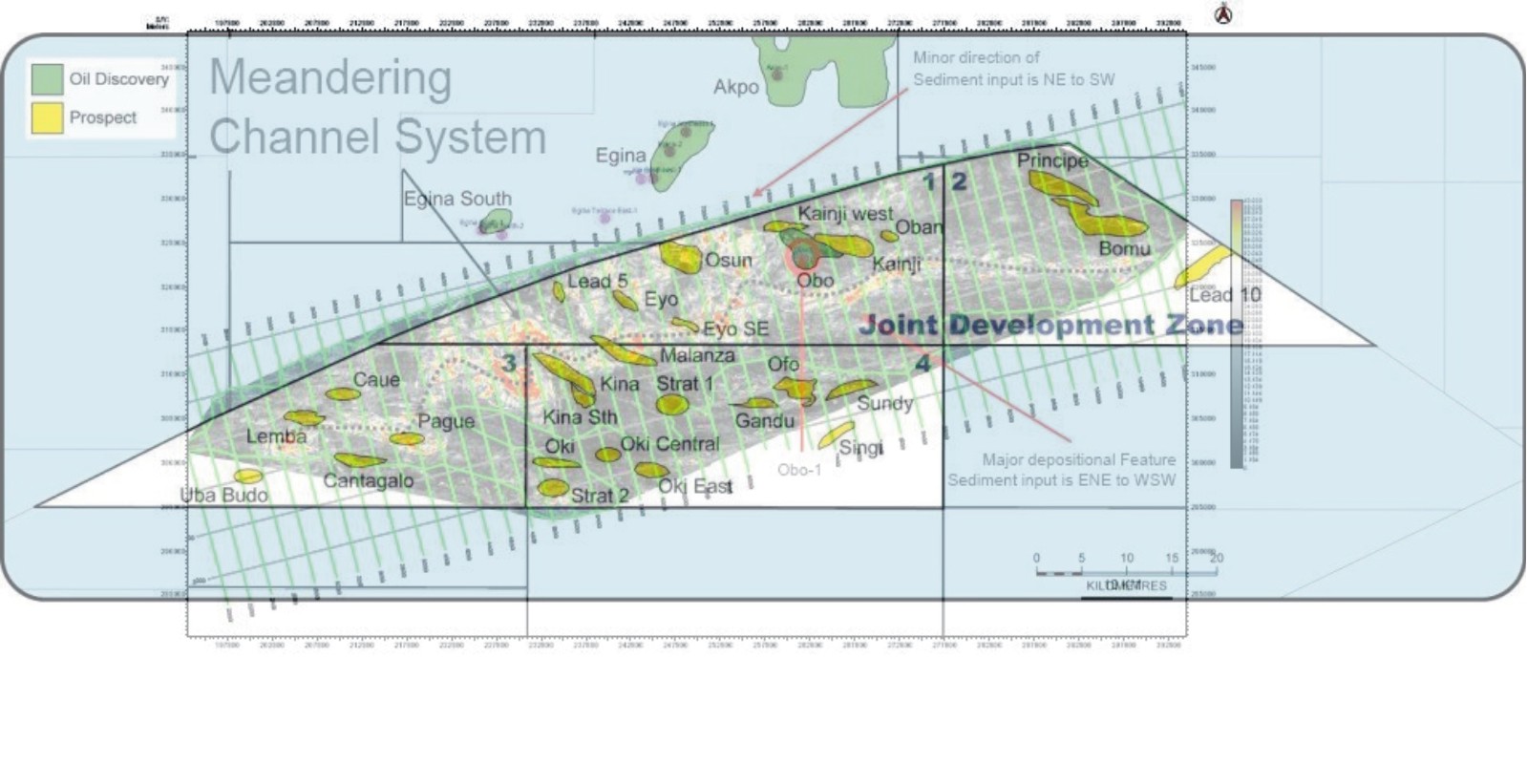

Today, ERHC has interests in Blocks 2, 3, 4, 5, 6, and 9 in the offshore Joint Development Zone (JDZ) of Nigeria and the island nation of Sao Tome and Principe. The National Petroleum Agency of São Tomé & Príncipe (ANP-STP) on behalf of the Government of São Tomé and Principe has awarded ERHC Energy 100 percent working interests in Blocks 4 and 11 of the São Tomé & Príncipe Exclusive Economic Zone (EEZ). In addition to the two Blocks already awarded, ERHC has rights to acquire up to a 15 percent paid working interest in two additional blocks of its choice in the EEZ.

The Company has signed participation agreements with subsidiaries of Addax Petroleum Inc. and Sinopec Corp. The operators of JDZ Blocks 2 (Sinopec), 3 (Anadarko) and 4 (Addax) have secured approval from the Joint Development Authority for drilling locations. Additionally, ERHC continues to pursue other potential oil and gas acquisitions, where feasible.

JDZ Block 2: 22.0%

JDZ Block 3: 10.0%

JDZ Block 4: 19.5%

JDZ Block 5: 15.0%

JDZ Block 6: 15.0%

JDZ Block 9: 20.0%

ERHC will be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The São Tomé & Príncipe EEZ encompasses an area of approximately 160,000 square kilometers south and east of the Nigeria/São Tomé & Príncipe Joint Development Zone and surrounding the volcanic islands of Príncipe and São Tomé. Block 4 is situated directly east of the island of Principe. Block 11 is directly east of the island of Sao Tome.

Ocean water depths around the two islands exceed 5,000 feet, depths that have only become feasible for oil production over the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo.

The African coast is less than 400 nautical miles offshore, which means the exclusive economic zones of the concerned countries overlap.

Operations in JDZ Block 2

ERHC's consortium partner Sinopec Corp. is the operator in JDZ Block 2. In August 2009, Sinopec commenced exploratory drilling of the Bomu-1 well, which was completed in early October 2009. The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 2 totaled 77 million barrels of oil and 93.9 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 2 totaled 38.3 million barrels of oil and 47.9 billion cubic feet of natural gas (P50).

Operations in JDZ Block 3

The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 3 totaled 27.3 million barrels of oil and 32.9 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 3 totaled 8.7 million barrels of oil and 10.5 billion cubic feet of natural gas (P50). The operator, Addax Petroleum, began drilling the Lemba-1 well in October 2009 and completed drilling in November 2009.

Operations in JDZ Block 4

ERHC's consortium partner Addax Petroleum is the operator of JDZ Block 4. In August 2009, Addax took possession of the Deepwater Pathfinder deepwater drill ship and started drilling the Kina prospect. The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 4 totaled 231.6 million barrels of oil and 245 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 4 totaled 88.4 million barrels of oil and 86.2 billion cubic feet of natural gas (P50). In 2009, Addax Petroleum drilled the Kina, Malanza-1 and Oki East wells.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2012 (from 10Q)

| Weighted average number of shares of common shares outstanding | 738,933,854 |

Authorized shares: 950,000,000

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ERHC Energy Milestones

In May 1997, ERHC entered into an exclusive joint venture with São Tomé & Príncipe. ERHC sought that agreement because it identified the possibility of significant reserves offshore of Sao Tome & Principe years before anyone else did and was willing to undertake the hard work necessary to realize the value of these assets.

All of the proceeds from these sales were received by the Company during the quarter ending March 31, 2006.

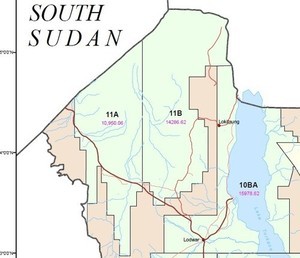

Block 11A encompasses 11,950.06 square kilometers or 2.95 million acres (click on map to enlarge). The Block is situated on Kenya's border with South Sudan to the north, Block 11B and Lake Turkana to the east and near Kenya's border with Uganda to the west.

-Link to the June 2009 Sao Tome and Principe AAPG (American Association of Petroleum Geologists) Conference slide presentation in Denver. It shows EEZ Block delineations and much more: http://www.internationalpavilion.com/ip_2005/Denver09_Talks/Presentation%20Sao%20Tome%20&%20Principe%20AAPGv3%20(2)_files/frame.htm

-The National Petroleum Agency of São Tomé & Príncipe (ANP-STP) on behalf of the Government of São Tomé and Principe has awarded ERHC Energy 100 percent working interests in Blocks 4 and 11 of the São Tomé & Príncipe Exclusive Economic Zone (EEZ). The ANP-STP has indicated that it expects to invite ERHC to negotiate Production Sharing Contracts (PSCs) on the two Blocks in due course. In addition to the two Blocks already awarded, ERHC has rights to acquire up to a 15 percent paid working interest in two additional blocks of its choice in the EEZ. The ANP-STP has informed the Company that selection of these other blocks will take place at a later date to be determined.

-Another great post on the EEZ can be found here: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36450859

-Possible pre-salt oil deposits in the EEZ: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36565661 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36570193 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36596746 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36450859 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43260765

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Operators/ partners for Blocks 2,3 and 4

http://www.addaxpetroleum.com/home (Block 4)

http://www.addaxpetroleum.com/home(Block 3)

http://english.sinopec.com/ (Block 2)

Deepwater rigs

http://www.pacificdrilling.com/

http://www.fredolsen-energy.no/?aid=9048927

http://www.seadrill.com/

http://www.deepwater.com/fw/main/default.asp

http://www.saipem.eni.it/index.asp

http://www.deepwater.com/fw/main/Sedco-702-92C77.html?LayoutID=17

http://www.marinetraffic.com/ais/nl/shipdetails.aspx?MMSI=636014746

Deepwater rigs video's and animations

http://www.youtube.com/watch?v=Ii2zOZh41eA

http://www.deepwater.com/fw/main/Discoverer-Clear-Leader-Begins-Operations-410C1.html?LayoutID=6

Presentations

Growth Company Investor Show 2008 in London

http://www.youtube.com/watch?v=sgXCHO-Ot4E part 1

http://www.youtube.com/watch?v=OQm6SwY5ceo part 2

http://www.youtube.com/watch?v=aaam9Tyh4DE Q&A part

ERHC Web TV presentation to RedChip Conference

http://www.modavox.com/events/redchip/0608/room1.html

CEO Peter Ntephe Interview - on RedChip TV

http://www.modavox.com/events/redchip/0608/ceo_interviews.html

DD web sites

Facts about ERHC/ERHE: http://www.erhc.com/en/cms/?60

FAQ about ERHC/ERHE: http://www.erhc.com/en/cms/?56

http://www.anp-stp.gov.st/eng/

http://www.enercominc.com/

Track drillships marinetraffic.com/ais/default.aspx

http://www.erhc.com

http://finance.yahoo.com/q?s=erhe.ob

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000799235

http://www.otcbb.com/asp/Info_Center.asp

http://www.nigeriasaotomejda.com/

http://www.investorshub.com/boards/read_msg.asp?message_id=5721853

http://www.equatorialoil.com/pages/TechReview.html

http://www.nigeria-oil-gas.com/

http://www.sao-tome.com/englisch/index.htm

http://www.eia.doe.gov/emeu/cabs/nigeria.html

www.ods-petrodata.com/odsp/day_rate_index.php

Industry News

http://www.rigzone.com/news/

http://www.oil.com/

http://www.platts.com/

Articles

The New Yorker, 10/07/2002, OUR NEW BEST FRIEND, by JON LEE ANDERSON,post #3510

http://investorshub.advfn.com/boards/read_msg.asp?message_id=6512250

DAILY INDEPENDANT, Tuesday May 24th, 2005, The long wait for JDZ deal POST #3035

http://investorshub.advfn.com/boards/read_msg.asp?message_id=6479732

Area News & Newspapers

http://www.allAfrica.com

http://www.nigeriamasterweb.com/paperfrmes.html

http://www.nigeriamasterweb.com/newsfrmes.html

http://www.independentng.com

http://www.ngrguardiannews.com/

http://www.newswatchngr.com/

http://www.punchng.com

http://www.thisdayonline.com/

http://www.vanguardngr.com/

http://www.jornal.st/index.php

http://www.tekoilandgas.com/technology/glossary-of-terms

AKPO information

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=48439213

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=48446472

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ERHE 8K 4-24-2017

http://archive.fast-edgar.com//20170424/AI22B22CZC228JGU22222Z32GOMFIC22Z292/

https://www.otcmarkets.com/stock/ETBI/overview

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |