Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ok to buy here and hold for next 18 months? Should appreciate with the int rate drop right?

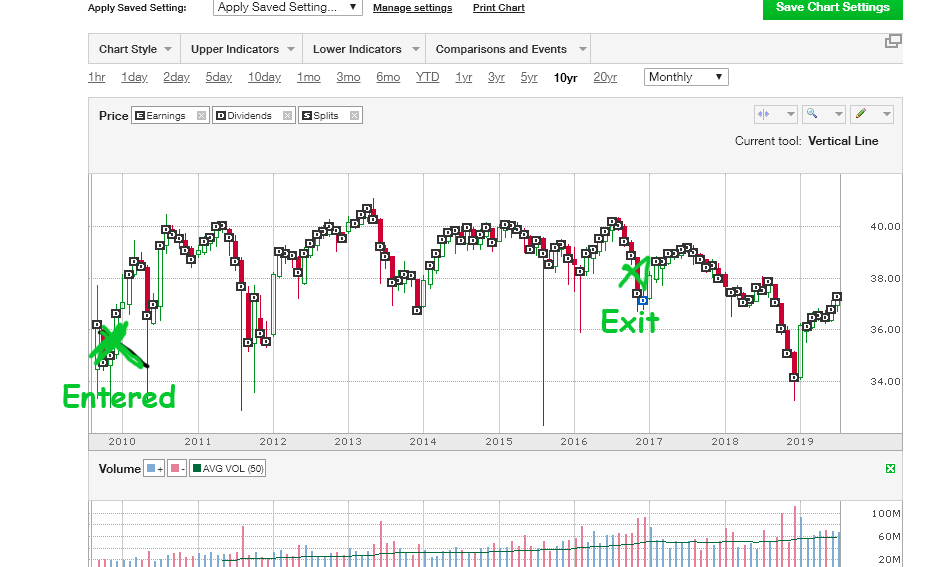

I entered PFF back in 2010 using an account where you could with no cost reinvest the Divvy back into the ETF.

I felt it was safe and did it to diversify. It did not return what could have been had I been in the S&P 500.

The account was with ScottsTrade and was purchased by TD. I lost my history and sorry to say I cannot tell you exactly my gains. It was in an IRA.

EDIT.. I must have exited in 2017.

Have you been pleased with your investment in PFF over the past two years? Considering on doing a long term investment soon.

TIA

Still good

A good solid pick..

Still working this one..

Continues to be strong.. I really like this ETF. About a $.20 divy each month.

Jan divy $.21807

Must own shares on the 1st to get Divy... I think.

Divy

10/1/2010 10/5/2010 10/7/2010 -- -- -- -- 0.22824

9/1/2010 9/3/2010 9/8/2010 -- -- -- -- 0.30683

8/2/2010 8/4/2010 8/6/2010 -- -- -- -- 0.30862

7/1/2010 7/6/2010 7/8/2010 -- -- -- -- 0.24767

6/1/2010 6/3/2010 6/7/2010 -- -- -- -- 0.24363

5/3/2010 5/5/2010 5/7/2010 -- -- -- -- 0.24837

4/1/2010 4/6/2010 4/8/2010 -- -- -- -- 0.20882

3/1/2010 3/3/2010 3/5/2010 -- -- -- -- 0.18955

2/1/2010 2/3/2010 2/5/2010 -- -- -- -- 0.19026

12/29/2009 12/31/2009 1/5/2010 0.23014 0.00000 0.00000 0.00000 0.23014

12/1/2009 12/3/2009 12/7/2009 0.26793 0.00000 0.00000 0.00000 0.26793

11/2/2009 11/4/2009 11/6/2009 0.22536 0.00000 0.00000 0.00000 0.22536

10/1/2009 10/5/2009 10/7/2009 0.20820 0.00000 0.00000 0.00000 0.20820

9/1/2009 9/3/2009 9/8/2009 0.21501 0.00000 0.00000 0.00000 0.21501

8/3/2009 8/5/2009 8/7/2009 0.23323 0.00000 0.00000 0.00000 0.23323

7/1/2009 7/6/2009 7/8/2009 0.31420 0.00000 0.00000 0.00000 0.31420

6/1/2009 6/3/2009 6/5/2009 0.27250 0.00000 0.00000 0.00000 0.27250

5/1/2009 5/5/2009 5/7/2009 0.27500 0.00000 0.00000 0.00000 0.27500

4/1/2009 4/3/2009 4/7/2009 0.25000 0.00000 0.00000 0.00000 0.25000

3/2/2009 3/4/2009 3/6/2009 0.21757 0.00000 0.00000 0.00000 0.21757

2/2/2009 2/4/2009 2/6/2009 0.17900 0.00000 0.00000 0.00000 0.17900

12/29/2008 12/31/2008 1/2/2009 0.42478 0.00000 0.00000 0.00000 0.42478

12/1/2008 12/3/2008 12/5/2008 0.19000 0.00000 0.00000 0.00000 0.19000

11/3/2008 11/5/2008 11/7/2008 0.17500 0.00000 0.00000 0.00000 0.17500

10/1/2008 10/3/2008 10/7/2008 0.22000 0.00000 0.00000 0.00000 0.22000

9/2/2008 9/4/2008 9/8/2008 0.19926 0.00000 0.00000 0.00000 0.19926

8/1/2008 8/5/2008 8/7/2008 0.20834 0.00000 0.00000 0.00000 0.20834

7/1/2008 7/3/2008 7/8/2008 0.21418 0.00000 0.00000 0.00000 0.21418

6/2/2008 6/4/2008 6/6/2008 0.24628 0.00000 0.00000 0.00000 0.24628

5/1/2008 5/5/2008 5/7/2008 0.23508 0.00000 0.00000 0.00000 0.23508

4/1/2008 4/3/2008 4/7/2008 0.25598 0.00000 0.00000 0.00000 0.25598

3/3/2008 3/5/2008 3/7/2008 0.23057 0.00000 0.00000 0.00000 0.23057

2/1/2008 2/5/2008 2/7/2008 0.16109 0.00000 0.00000 0.00000 0.16109

12/27/2007 12/31/2007 1/3/2008 0.74030 0.00000 0.00000 0.00000 0.74030

12/3/2007 12/5/2007 12/7/2007 0.17849 0.00000 0.00000 0.00000 0.17849

11/1/2007 11/5/2007 11/7/2007 0.20743 0.00000 0.00000 0.00000 0.20743

10/1/2007 10/3/2007 10/5/2007 0.19776 0.00000 0.00000 0.00000 0.19776

9/4/2007 9/6/2007 9/10/2007 0.21784 0.00000 0.00000 0.00000 0.21784

8/1/2007 8/3/2007 8/7/2007 0.23189 0.00000 0.00000 0.00000 0.23189

7/2/2007 7/5/2007 7/9/2007 0.19530 0.00000 0.00000 0.00000 0.19530

6/1/2007 6/5/2007 6/7/2007 0.23882 0.00000 0.00000 0.00000 0.23882

5/1/2007 5/3/2007 5/7/2007 0.28536 0.00000 0.00000 0.00000 0.28536

Prospectus

Prospectus

Might be a great fit for an IRA....

The following features are usually associated with preferred stock

Preference in dividends.

Preference in assets in the event of liquidation.

Convertible into common stock.

Callable at the option of the corporation.

Nonvoting.

This has paid a $2.79 Divy this past 12 months...

Sep-09 215

Oct-09 208

Nov-09 225

Dec-09 268

Jan-10 230

Feb-10 190

Mar-10 190

Apr-10 209

May-10 248

Jun-10 244

Jul-10 248

Aug-10 309

2784

I think I like this ETF...

Who does it hold in preferred stock?

BARCLAYS BANK PLC

FORD CAP TRST II

WELLS FARGO & CO

JPMORGAN CHASE CAPITAL XXVI

WELLS FARGO CAP

BANK OF AMERICA CORP

METLIFE INC

MERRILL LYNCH & CO INC

CITIGROUP VIII

NATL CITY CAP TR

ARCHER-DANIELS-MIDLAND CO

COUNTRY WIDE V

BARCLAYS BANK PLC

DB CAP FNDG VIII

MORGAN ST CP III

JPMORGAN CHASE & CO

USB CAPITAL XI

BARCLYAS BANK PLC

FIFTH THIRD CAPITAL TRUST VI

CITIGROUP CAP IX

RBS CAPITAL FUNDING TRUST VII

JP MORGAN CHASE-7% PFD

MOR STAN CAP TR VI 6.6% CAP SE

CITIGROUP CAPITAL XVI

PUBLIC STORAGE

DEUTSCHE BANK CONTINGENT CAPITAL T

WACHOVIA TR IV

PUBLIC STORAGE

REPSOL INTERNATIONAL CAPITAL LTD

SUNTRUST CAPITAL IX

DEUTSCHE BANK CAPITAL FUNDING TRUS

RBS CAPITAL FUNDING TRUST V

GOLDMAN SACHS GP

HSBC FINANCE

KEYCORP CAP IX

FIFTH THIRD CAPITAL TRUST V

METLIFE INC

SANTANDER FIN PFD SA UNI

MORGAN STANLEY

M&T CAPITAL TRUST IV

KEYCORP CAPITAL X

HSBC USA INC

GOLDMAN SACHS GROUP INC

KIMCO REALTY CORP

US BANCORP

PNC CAPITAL TRUST E

SANTANDER FIN PFD SA UNI

USB CAPITAL XII

HOSPITALITY PROP

DUKE REALTY CORP

RENAISSANCERE

ZIONS CAPITAL TRUST B

PUBLIC STORAGE INC 6.625 SERIES M

GOLDMAN SACHS GROUP INC

CAPITAL ONE CAP

BNY CAPITAL V

REGIONS FINANCING TRUST III

FIFTH THIRD CAPITAL TRUST VII

CAPSTEAD MORTGAGE CORP

UBS PREF FDG TR

FPL GROUP CAPITAL TRUST I

AMERICAN ELECTRIC POWER CO INC

HSBC USA INC

COMMONWEALTH REIT

LINCOLN NATL CRP

BANK OF AMERICA CORP SERIES 5

BANK OF AMERICA CORP SERIES H

PRUDENTIAL PLC

BARCLAYS BK PLC

PRUDENTIAL PLC

SANTANDER FIN PFD SA UNI

GENERAL ELECTRIC CAPITAL CORP

WACHOVIA PFD

REALTY INCOME CORP

OMNICARE CAP II

BANK OF AMERICA CORP

NATIONAL CITY CAPITAL TRUST IV

DEVELOPERS DIVERSIFIED REALTY CORP

BLACKROCK FDS III

DEVELOPERS DIVERS

DEVELOPERS DIVERSIFIED REALTY CORP

MORGAN ST CP IV

JPMCHASE CAP XI

KEYCORP CAP VIII

Getting beat but I am looking up on Pref shares...

Starting to like this -- swings nicely...

Neat idea... on watch for signals of early recovery.

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

29

|

|

Created

|

10/17/08

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |