Thursday, March 06, 2014 6:56:05 AM

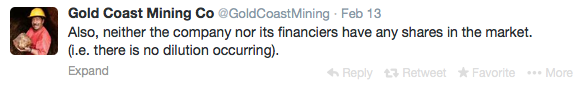

First thing NO DILUTION!!! Period.

Tweet From 3/5/14:

Another recent Tweet:

More from recent PR:

“Finally, the Company wishes to address its share structure. The current common stock outstanding is approximately 3.2 billion shares and has not changed in the last 90-100 days.”

COMPANY UPDATE 3/5/14 NEWS CLARIFICATION:

MMJ SUBSIDIARY -- All the DD is found in MGF's posts but it is not certain which one yet. It might be Artisanal Medicinals (or it could be a combination of several). Artisanal Medicinals has close links to Chris Chiari of Gelpid and fits but it could be one of his other connections as well, or a combination of several being brought together. Chris is very well connected in that arena -- i.e., Edipure, Medfresh, etc.

MGF's DD Post from 3/4/14 IS EXCELLENT!!!!! See here:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98261213

More GREAT DD FROM MGF from 3/5/14!!! See here:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98265376

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98307580

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98311193

READ THIS PLEASE!!!! The CO dispensary tweet has nothing to do with the MMJ accessories business that is being acquired via Gelpid.

That was an additional venture being pursued along with purchasing land and cultivating crops for wholesale distribution and supply. The land acquisition for GDSM is still being pursued but the dispensary that it would have supplied is off the table, for now. The company was trying to vertically integrate the entire business model.

Conclusion (distilled down for easy reading and comprehension)

1. MMJ accessory business still finalizing and progressing very well. The closest the deal has been to completion to date.(THIS IS STILL A GO!!!)

2. Land acquisition for MMJ growing & wholesale being pursued. (THIS IS STILL A GO & NEW!!!)

3. The Dispensary idea (first announced today) is off the table due to CO law. (NEW IDEA 3/4/14 OFF THE TABLE FOR NOW - Might be another way to capture value here.)

4. AGAIN -- NO DILUTION BY THE COMPANY OR ANY STAKEHOLDER AFFILIATED WITH THE COMPANY (VERIFIED BY TWEET 3/5/14!!!)

Shareholders received 3/4/14 Info -- Confirmation of the MMJ with an established company in accessories and looking for a turn key or bolt on acquisition for wholesale supply and distribution. THERE IS NOW MORE TO OFFER IN THE END ONCE THEY WORK IT ALL OUT.

Read the tweets below it. The deal is still the same for MMJ subsidiary -- the accessory business!

IT SAYS "NOTHING HAS CHANGED AND PROGRESS IS BEING MADE. THE R/E IS JUST ANOTHER WAY TO PARTICIPATE IN MJ" -- MEANING THE GELPID MMJ ACCESSORIES DEAL STILL ON, LEASED GROWER DISTRIBUTION STILL ON, DISPENSARIES ARE OFF THE TABLE. TWO OUT OF THREE AND BEFORE TODAY IT WAS ONLY 1 - GELPID MMJ ACCESSORIES.

Here is a ton of DD:

Accessories:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98196721

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98196795

Big DD Packet!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=97939454

1. They will use a shelf offering for the MMJ sub. -- to pay everything back. Since Gelpid (the MMJ business) issued roughly $5MM in debt to GDSM and they are going to do it all internally to then spin the company out with a shelf offering that will raise capital to play Gelpid back and to give Gelpid initial cash flow. Effectively there is not debt burden assumed by GDSM in this scenario. This is the only way for Gelpid to really get their $5MM back.

From PR February 18:

"legal discussions are occurring to determine the best strategy for establishing a subsidiary, spinning it off and arranging a registered shelf offering;"

2. The PR states from today that the land lease purchases (for wholesale supply and distribution) will be financed via private investor capital:

"Given the capital required to pursue this strategy, the Company, via its subsidiary, would propose to be the general partner and raise capital from private investors. Obviously, the Company would retain an interest and control t

Recent GRLF News

- Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • InvestorsHub NewsWire • 06/24/2024 12:30:00 PM

- Green Leaf Innovations, Inc. Engages Olayinka Oyebola & Co for Two-Year Audit • InvestorsHub NewsWire • 05/28/2024 12:30:00 PM

- Form 253G2 - • Edgar (US Regulatory) • 01/29/2024 06:37:20 PM

- Form QUALIF - Notice of Qualification [Regulation A] • Edgar (US Regulatory) • 11/07/2023 05:15:09 AM

- Form 1-A POS - • Edgar (US Regulatory) • 11/01/2023 08:02:30 PM

ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • HALO • Oct 10, 2024 8:09 AM

CBD Life Sciences Inc. (CBDL) Targets Alibaba as the Next Retail Giant for Wholesale Expansion of Top-Selling CBD Products • CBDL • Oct 10, 2024 8:00 AM

Foremost Lithium Announces Option Agreement with Denison on 10 Uranium Projects Spanning over 330,000 Acres in the Athabasca Basin, Saskatchewan • FAT • Oct 10, 2024 5:51 AM

Element79 Gold Corp. Reports Significant Progress in Community Relations and Development Efforts in Chachas, Peru • ELEM • Oct 9, 2024 10:30 AM

Unitronix Corp Launches Share Buyback Initiative • UTRX • Oct 9, 2024 9:10 AM

BASANITE INDUSTRIES, LLC RECEIVES U.S. PATENT FOR ITS BASAFLEX™ BASALT FIBER COMPOSITE REBAR AND METHOD OF MANUFACTURING • BASA • Oct 9, 2024 7:30 AM