Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

.0000001 is here. This is going to expert soon.

Get out while you can before it goes to expert market.

Kevin is a worthless bum. I have a bad feeling he won’t file.

The stock‘s been switched to Grace Period. They only have a few days left to get their act together, before they’re moved to the Expert Market. We‘ll see if they even have the cash to pay someone to write the financial reports.

https://www.otcmarkets.com/stock/FTXP/overview

Was hoping to hear something soon, timing now would be good.

FTXP

$FTXP dang y’all was kinda joking

We have reason to believe believe we can neither confirm or deny.

https://www.sec.gov/litigation/litreleases/lr-25930

Adar Bays, LLC, located in Florida, and Adar Alef, LLC, doing business in Florida and New York, for failing to register as securities dealers in connection with their convertible note financing business that involved obtaining and selling securities of over 100 microcap companies. The parties have agreed to settle the charges. Among other relief, Goldstein and his entities agreed to pay $1.25 million in monetary relief and to surrender or cancel all remaining shares of public companies allegedly obtained from their unregistered dealer activity.

Could $FTXP????

No idea

I’m patiently waiting on this one… fully loaded and ready for trips season.

Good to see you here,,some trips running. Hopefully FTXP soon…

You and me both!

Only a 23K sell on the trades as a whole. Hope something is forth coming

54 million more bought with virtually zero selling

25M in buys. Hopefully more to come.

Damn, what is with the numerous 149 share trades???

Hopefully the loading continues and we see something soon as there hasn’t been any news in a long time.

117.9M Buys

18.9M Sells

3.4M Unknown

One of the best buy days since April 2023

Yes sir! This will pop eventually!

We meet again… good sign.

Weird buys today. Tons went thru at qty 149.

Need some news

Nice volume today once again.

This oil stock stay at this level too long time, need to post news to push the PPS up.

Nice buy of 10million this morning. Let's get some news

$ftxp got some volume today

19,515,296 shares sold at .0001

19,515,296 shares bought at .0002

Trades occurred at the exact same time

WTF???

Bit of volume here again. Not holding much of this one but all counts….

Good Friday to you, as well.

Sounds like a solid plan to Me. :)

Good Friday to You, Man.

$FTXP

Check the TRADE data every day here, and every ticker you are in and are interested.

People always say BIG buys, when in reality it is HUGE sells. Or huge trades at .000001

However, is it possible that the MMs and VCs are trying to pull the price down to get others to sell while they buy at super low prices?

I don't know. I just buy at .0001 or .0002 and hold for a long time.

Hmm… MDA, You’re right…

Dang CaTrade charts… lol!

Still, great volume.

$FTXP {2024}!!!

53M buy volume

261M sell volume

Were all the sells due to drop in oil price?

Lol! Hey, Man!

Good Wednesday Afternoon to You.

Yeah, a 300,000,000 Share Buy into the Ask Wall at .ooo2$, is Sixty Grand in one shot..:

Which is Great Volume…

$FTXP “Hump Day Volume…” lol

Another high volume OTC with no news, peeps can't get enough OTC!!!

CaTrade alerted a Huge Buy Today!

$FTXP

Hey! Good Tuesday Morning, Man!

Looks like there’s quite a wall on the .ooo2$, so I expect there will be a wait…

With the right info, though… Things could change in a Day… :)

$FTXP {2023}

otcmarkets.com

learn how to play the game.

Yeah… I see the Press Release that explains how the acquired a bunch of Oil and Gas Wells in Oklahoma and Arkansas..:

https://www.nasdaq.com/press-release/foothills-exploration-inc.-otc%3a-ftxp-acquires-545-well-in-kansas-and-oklahoma-2023-03

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

From the Press Release linked above:

It was in January this year that Foothills completed the 100% acquisition of the Oklahoma-based limited liability company Jubilee Exploration LLC. The company owned as many as 545 shut-in oil and gas wells. These wells and leases are situated in Kansas and Oklahoma.

Earlier on in the year on January 31, 2023, the company had managed to complete the acquisition of as many as 21 shallow oil and gas wells. All of those wells are located in Comanche County in the state of Oklahoma and are spread across a total of four leases. The wells are actually stripper wells and have an average depth of 1200 feet. On February 13 Foothills announced that it would start a return-to-production initiative for these wells.

Once these wells are back in production then all the wells combined would produce 20 to 25 barrels of oil daily. At the time, it was also announced that Foothills was going to start the return to production work with immediate effect. Each well was expected to get into production capabilities systematically and it was in the week of February 20 that the wells were expected to get into production.

On January 27 this year, the company provided another key corporate update that investors ought to know about. It had announced that back on November 25 last year, it had reached a settlement agreement with its biggest institutional investors. By way of that agreement, as many as 11 convertible promissory notes were canceled and extinguished. The promissory notes had been issued by the company at different stages between the years 2018 and 2021.

Is it just me, or is it worrisome that it has been this long since they have put out any kind of news or filings? What is going on with this company and why are they being so quiet? Wasn't it like May when we last seen anything form FTXP?

What about LNG, that’s what they are sending to China. They are part of Blue Star in China.

How is it oil keeps going up but this stock goes nowhere??? Even if they sell 10 barrels the stock should go up something!!!! What a joke

Time to get news out, we waiting for long time. Oil stock has good future.

Larger than average Buy at the .ooo2$ alerted.

$FTXP

MMs are playing games with 0.00001

What is going on with the OTCBB market as a whole?

Who is possibly making money with the new barcoding between .000001 and .0001.

Certainly not us.

Ideas?

TDA shows 315M+ at .0003

Yesterday it was 3's. Should have easily hit 4's.

FTXP!!$$??

|

Followers

|

344

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

14197

|

|

Created

|

06/13/16

|

Type

|

Free

|

| Moderators | |||

Regional Focus |  Reserve Growth |  Risk Management | Our strategy creates value for our shareholders and strategic partners by:

|

ManagementFoothills Exploration has assembled a seasoned team of oil and gas industry professionals, with deep experience in the U.S. Rocky Mountain region, providing their expertise in petroleum engineering, geology, geophysics and operations. |  Value CreationThe Company has a carefully developed plan to create and maximize value for shareholders focused on acquiring oil and gas assets at attractive valuations and growth through field optimization and the drill bit. |

Tightly defined geographic focus to leverage basin-specific knowledge, technical & operational expertise |  Sound well economics Stacked pay zones |  Long life assets Very attractive EURs |

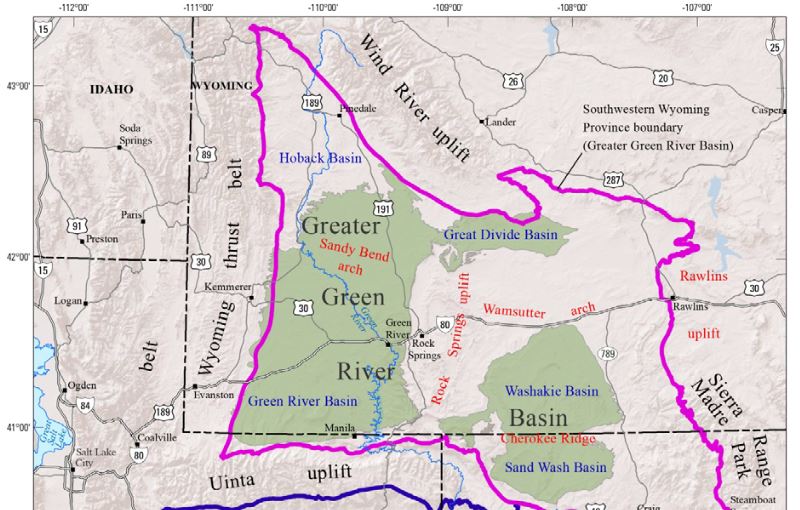

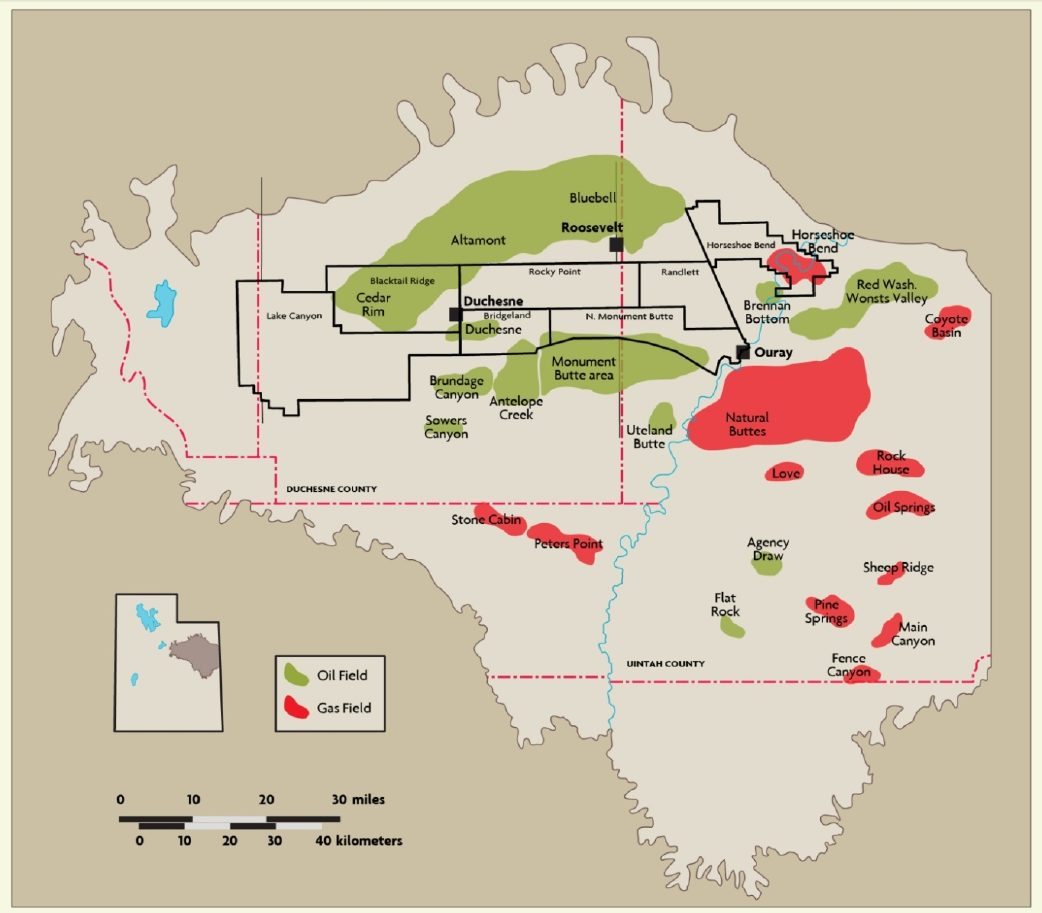

| Foothills Exploration, Inc. (the "Company") currently holds over 34,000 acres in the Greater Green River and Wind River Basins of Wyoming and over 7,800 acres in the Uinta Basin of Utah. The Company is actively seeking to grow its footprint in the Rocky Mountain region by targeting high quality oil and gas assets for acquisition and development. Our management team and advisers have a deep working knowledge and depth and breadth of experience in our geographical area of interest. Our skilled and experienced technical team effectively evaluate the merits of prospective acquisitions, determining each project's geological risk/reward profile and driving informed decisions as to whether we can efficiently optimize and maximize the properties.? |

| FOOTHILLS EXPLORATION, INC. |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |