Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Been in and out since 2005.

There no other brand that tops WYNN...IMHO...

ALL THANKS to SW...

Don Rickles one of few who really knew.

WSJ and Demonrats had it in after he tied in with Trump.

All good. God bless SW.

Wynn Resorts $WYNN Rolling out of the 01/19 $95 CALLS & grabbing another week in to the 01/26 $95 Calls

By: FLOWrensics | December 26, 2023

• $WYNN Rolling out of the 01/19 $95 CALLS & grabbing another week in to the 01/26 $95 CALLS.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts (WYNN) Stock Flashing Bear Signal

By: Schaeffer's Investment Research | December 14, 2023

• WYNN just pulled back to a historically bearish signal on the charts

• WYNN's recent bounce could be short-lived

Wynn Resorts Ltd (NASDAQ:WYNN) is on track for its seventh-straight daily gain, up 2.9% at $90.53 despite a price-target cut from J.P. Morgan Securities to $104 from $120. The stock could continue chopping lower, however, as it has since early August, given a bear signal flashing on the charts.

According to Schaeffer's Senior Quantitative Analyst Rocky White, WYNN has come within one standard deviation of its 60-day moving average for the eighth time in the last three years. Following the previous signals, the stock was lower one month later 57% of the time, averaging a 9.2% loss.

When speculating on Wynn Resorts stock, now looks like a good time to weigh in with puts. The security's Schaeffer's Volatility Index (SVI) of 29% ranks in the low 9th percentile of its annual range, meaning options traders are pricing in low volatility expectations at the moment.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN Millions Worth of Short-Expiration Calls (Very unusual for this ticker)

By: Cheddar Flow | November 30, 2023

• $WYNN Millions Worth of Short-Expiration Calls (Very unusual for this ticker)

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN Notable size opening sweeper in to the 12/22 $86 Calls

By: FLOWrensics | November 20, 2023

• $WYNN Notable size opening sweeper in to the 12/22 $86 CALLS.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN they did not like that report at all. Gap to fill if they forgive it., was very extended Friday, 82 some support

By: Options Mike | November 12, 2023

• $WYNN they did not like that report at all. Gap to fill if they forgive it., was very extended Friday, 82 some support.

Read Full Story »»»

DiscoverGold

DiscoverGold

Casino Stock Wynn Resorts (WYNN) Blitzed by Bear Notes After Earnings

By: Schaeffer's Investment Research | November 10, 2023

• No fewer than five analysts slashed their price targets on WYNN

• Wynn Resorts' Macau figures overshadowed a top-line beat for the third quarter

Casino stock Wynn Resorts, Limited (NASDAQ:WYNN) is down 8.6% to trade at $82.83, on track for its worst single-session drop since October 2022. While the company reported third-quarter earnings and revenue that topped expectations, analysts were more concerned about Wynn's Macau properties, which missed revenue estimates amid market headwinds in Asia. WYNN saw no fewer than five price-target cuts in response, with the lowest coming from Jefferies to $91 from $104.

Wynn Resorts stock is trading at its lowest level this year and is on track for its fourth-straight loss, as well as a fourth weekly drop in the last five. To boot, the security breached its year-to-date breakeven level today.

Drilling down to today's options activity, 15,000 calls and 17,000 puts have exchanged hands, volume that is 20 times the intraday average amount. Most popular is the January 2024 75-srike put, where new positions are being bought to open.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), WYNN sports a 50-day put/call volume ratio of 0.67 that ranks higher than 81% of annual readings. This means that while calls still outnumber puts on an absolute basis, the high percentile suggests traders have been more bearish than usual.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts drops 5% despite Q3 beat

By: Investing | November 9, 2023

Wynn Resorts (NASDAQ:WYNN) shares fell more than 5% after-hours despite the company reporting better-than-expected Q3 results.

EPS for the quarter came in at $0.99, compared to the consensus estimate of $0.74. Revenue grew 87.9% year-over-year to $1.67 billion, compared to the consensus estimate of $1.58B.

CEO Craig Billings commented on the results with enthusiasm, noting the exceptional performance at Wynn Las Vegas and Encore Boston Harbor, which set a new third-quarter record for adjusted Property EBITDAR.

“In Macau, the recovery continued to progress during the quarter, with particular strength in our mass gaming, luxury retail and hotel businesses. On the development front, construction on Wynn Al Marjan Island is well underway, and we are confident the resort will be a 'must see' tourism destination in the UAE," added Billings.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts (WYNN) earnings beat by $0.25, revenue topped estimates

By: Investing | November 9, 2023

Wynn Resorts (NASDAQ: WYNN) reported third quarter EPS of $0.99, $0.25 better than the analyst estimate of $0.74. Revenue for the quarter came in at $1.67B versus the consensus estimate of $1.58B.

Wynn Resorts's stock price closed at $90.65. It is down -9.85% in the last 3 months and up 25.90% in the last 12 months.

Wynn Resorts saw 6 positive EPS revisions and 3 negative EPS revisions in the last 90 days. See Wynn Resorts's stock price’s past reactions to earnings here.

According to InvestingPro, Wynn Resorts's Financial Health score is "fair performance".

Check out Wynn Resorts's recent earnings performance, and Wynn Resorts's financials here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts, Limited (WYNN) Shares Sold by Pacer Advisors Inc

By: MarketBeat | September 29, 2023

• Pacer Advisors Inc. cut its position in shares of Wynn Resorts, Limited (NASDAQ:WYNN) by 91.7% during the 2nd quarter, according to the company in its most recent filing with the SEC. The firm owned 8,010 shares of the casino operator's stock after selling 88,629 shares during the quarter. Pacer Advisors Inc.'s holdings in Wynn Resorts were worth $846,000 as of its most recent filing with the SEC...

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd. $WYNN Macau numbers Sunday .. 21 resistance for now support @ 90

By: Options Mike | September 30, 2023

• $WYNN Macau numbers Sunday .. 21 resistance for now support @ 90.

Read Full Story »»»

DiscoverGold

DiscoverGold

Senator Investment Group LP Acquires Shares of 335,000 Wynn Resorts, Limited (WYNN)

By: MarketBeat | September 7, 2023

• Senator Investment Group LP bought a new position in shares of Wynn Resorts, Limited (NASDAQ:WYNN) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 335,000 shares of the casino operator's stock, valued at approximately $37,490,000. Wynn Resorts makes up about 2.0% of Senator Investment Group LP's holdings, making the stock its 23rd biggest holding. Senator Investment Group LP owned about 0.29% of Wynn Resorts as of its most recent SEC filing...

Read Full Story »»»

DiscoverGold

DiscoverGold

WTF WYNN is a $150 stock

$WYNN good Macau numbers and back to the 50D...

By: Options Mike | September 4, 2023

• $WYNN good Macau numbers and back to the 50D...

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN A lot of shorter dated opening positions -- they started with 9/08 $104C but now hitting the weeklies $102 & $103 CALLS

By: FLOWrensics | August 31, 2023

• $WYNN A lot of shorter dated opening positions -- they started with 9/08 $104C but now hitting the weeklies $102 & $103 CALLS.

Read Full Story »»»

DiscoverGold

DiscoverGold

WYNN$ $142.00 TARGET PRICE WOOHOOOOOO

Wynn Resorts Ltd. $WYNN Report was fine, China slowing down is the problem. 88 area on watch now

By: Options Mike | August 20, 2023

• $WYNN Report was fine, China slowing down is the problem.

88 area on watch now.

Read Full Story »»»

DiscoverGold

DiscoverGold

$WYNN Solid report, but concerns China heading into a recession. 200D is a big spot to hold

By: Options Mike | August 13, 2023

• $WYNN Solid report, but concerns China heading into a recession. 200D is a big spot to hold.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN just announced it has decided to close its online sports betting and iGaming platform, WynnBET, in certain jurisdictions

By: Evan | August 11, 2023

• Wynn Resorts $WYNN just announced it has decided to close its online sports betting and iGaming platform, WynnBET, in certain jurisdictions

The Company will seek to cease operations in Arizona, Colorado, Indiana, Louisiana, New Jersey, Tennessee, Virginia, and West Virginia as soon as possible

Operations in Nevada and Massachusetts will continue unaffected and operations in New York and Michigan remain under review

Read Full Story »»»

DiscoverGold

DiscoverGold

Options Traders Dancing to Wynn Resorts (WYNN) Stock's Bullish Beat

By: Schaeffer's Investment Research | August 10, 2023

• Wynn's Las Vegas and Macau properties drove a second-quarter top-line beat

• A short squeeze could help WYNN overcome short-term chart pressure

Wynn Resorts, Limited (NASDAQ:WYNN) is up 3.5% to trade at $105.11 at last check, after the casino giant reported better-than-expected second-quarter earnings and revenue. The company credited the strong results to its Las Vegas and Macau properties, which saw growing hotel bookings, gaming, and dining. In response, Jefferies and Citigroup lifted their price targets on WYNN to $118 and $132.50, respectively.

Despite the positive price action, the equity is yet to overcome recent pressure from the 40-day moving average, which emerged earlier this month. The $112 region also lingers above as a long-term ceiling, but year-to-date Wynn Resorts stock sports a healthy 28.2% lead.

Short sellers are hitting the exits, with short interest down 13.7% over the last two reporting periods. The 5.69 million shares sold short still make up 5.9% of the equity's available float, though, meaning there is still some pessimism left to unwind.

The options pits show a more bullish beat. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 50-day call/put volume ratio of 2.90 sits higher than 99% of readings from the past 12 months. This means long calls have been picked up at a much quicker-than-usual clip.

Drilling down to today's options activity, 10,000 calls and 5,703 puts have been exchanged, which is six times the intraday average volume. Most popular is the weekly 8/11 105-strike call.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts (WYNN) earnings beat by $0.27, revenue topped estimates

By: Investing.com | August 9, 2023

Wynn Resorts (NASDAQ: WYNN) reported second quarter EPS of $0.91, $0.27 better than the analyst estimate of $0.64. Revenue for the quarter came in at $1.6B versus the consensus estimate of $1.54B.

Wynn Resorts's stock price closed at $101.55. It is down -3.64% in the last 3 months and up 55.39% in the last 12 months.

Wynn Resorts saw 6 positive EPS revisions and 1 negative EPS revisions in the last 90 days. See Wynn Resorts's stock price’s past reactions to earnings here.

According to InvestingPro, Wynn Resorts's Financial Health score is "fair performance".

Check out Wynn Resorts's recent earnings performance, and Wynn Resorts's financials here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd $WYNN 110 big spot, may be waiting on Earnings.. they liked $MGM but not so much $LVS

By: Options Mike | July 30, 2023

• $WYNN 110 big spot, may be waiting on Earnings.. they liked $MGM but not so much $LVS.

Read Full Story »»»

DiscoverGold

DiscoverGold

2,915 Shares in Wynn Resorts, Limited (WYNN) Acquired by Morse Asset Management Inc

By: MarketBeat | July 28, 2023

• Morse Asset Management Inc bought a new position in shares of Wynn Resorts, Limited (NASDAQ:WYNN) in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 2,915 shares of the casino operator's stock, valued at approximately $326,000...

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYYN $LVS reports this week, if good, this one can move back up towards 118 area.

By: Options Mike | July 16, 2023

• $WYYN $LVS reports this week, if good, this one can move back up towards 118 area.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd. $WYNN Not sure why it was up on weak Macau numbers on Monday, watching to see how it handles the 200D now

By: Options Mike | July 9, 2023

• $WYNN Not sure why it was up on weak Macau numbers on Monday, watching to see how it handles the 200D now.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd $WYNN Macau numbers due out this weekend, expected to be good, 108 area needs to clear and hold on this one if they are.

By: Options Mike | July 1, 2023

• $WYNN Macau numbers due out this weekend, expected to be good,

108 area needs to clear and hold on this one if they are.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts: Is Now a Good Time to Trade the Stock?

By: Jayanthi Gopalakrishnan | June 22, 2023

When the stock market trends higher, it doesn't necessarily mean all stocks are moving higher. This is why it's necessary to have a method to filter through the day's market action and select stocks or securities to trade that have the potential for a decent return. And since each trader is different and each trading day is different, it's a good idea to develop various scans that identify securities to trade.

Once you've developed your scans, it's good to get in the habit of running a few of them every day. This can be for several reasons—are your scans still working the way they were designed? Are you getting very few results or too many results? Each day you run the scan, it produces different results, some of which may raise eyebrows. For example, on June 21, one of the stocks that came up in the StockCharts Technical Rank (SCTR) scan was Wynn Resorts Ltd. (WYNN).

During the pandemic, casino stocks suffered, and those with exposure to Macau felt the pain for an even longer period. With China reopening, you'd expect casino stocks like WYNN to recover. But the general thought is that the recovery was priced in, and the stock is due for a pullback.

Earlier this month, Wynn was downgraded by a couple of analysts. So when the stock was one that popped up in the SCTR scan results list, it's worth focusing on the stock and analyzing it more closely.

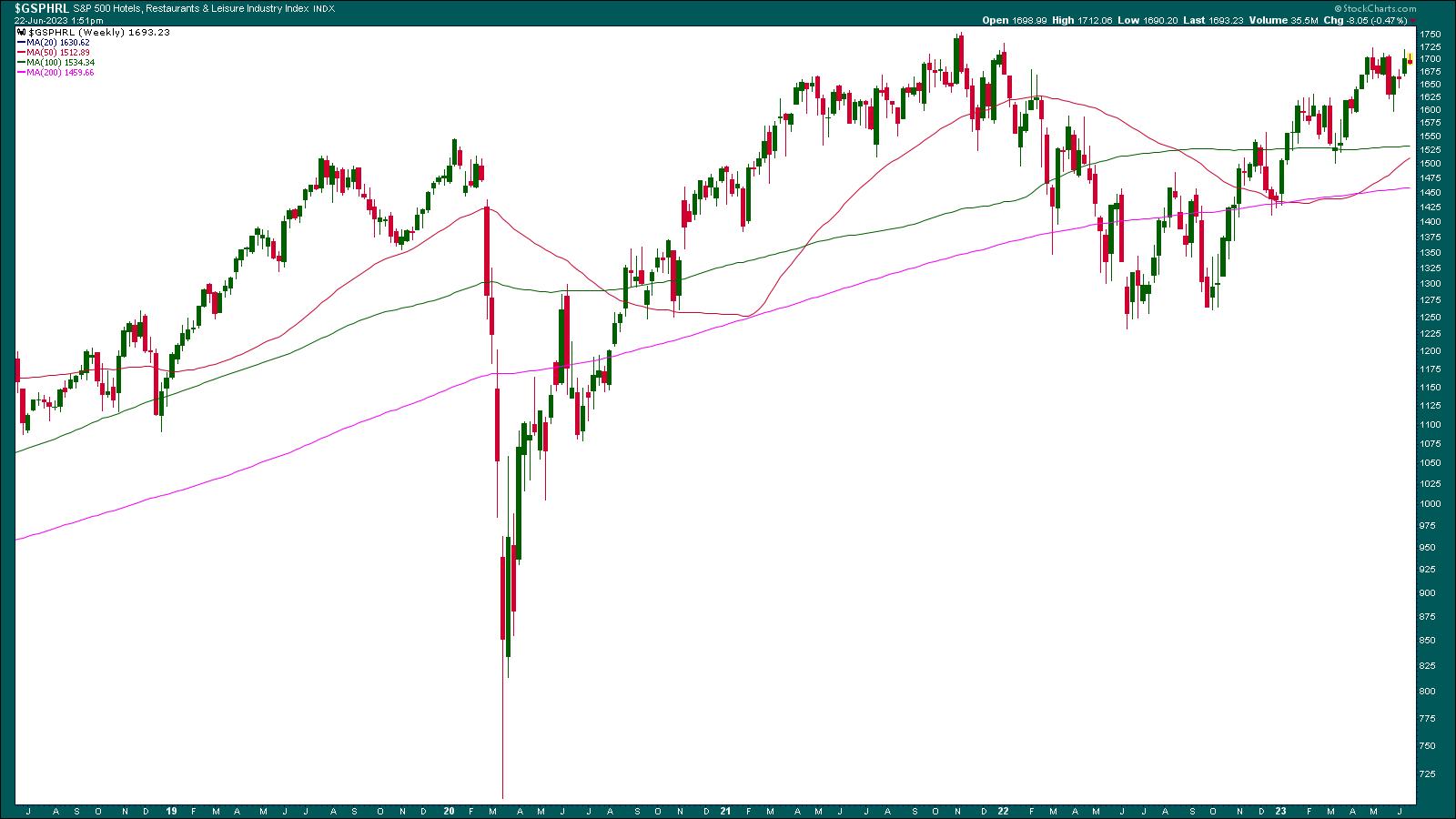

The Big Picture: Analyzing the Leisure Industry

It may be worth doing a top-down analysis for WYNN stock. Let's start by looking at the hotel, restaurant, and leisure industry by analyzing the S&P 500 Hotels, Restaurants & Leisure Industry index ($GSPHRL). The weekly chart (click on the chart below for live version) shows that the index has been trending higher since October 2022. But it looks like it's reaching a high, which could be a resistance level for the industry. The question is whether the index will break to the upside and reach new highs.

CHART 1: STARTING FROM THE TOP. An analysis of the weekly chart of the S&P 500 Hotels, Restaurants & Leisure industry ($GSPHRL) shows that this group of stocks is trending higher. However, it is pretty close to its high. Will it bust through its highs and move higher?

Chart source: StockCharts.com (click on chart for live version). For educational purposes only.

The index is trading above its 50-, 100-, and 200-week simple moving average (SMA). For as long as people are spending more on discretionary items such as travel and leisure, this index could continue to move higher. But inflation is still a huge concern, and if consumers start cutting back on spending, this index could reverse quickly. So if you are considering investing in WYNN, analyzing $GSPHRL would be your starting point.

A Weekly Perspective of WYNN

Looking at the weekly chart of WYNN, you see that the stock has had its share of ups and downs. Although the stock has been trending higher since October 2022, it's had a tough time breaking above $116.90. Plus, there have been a series of lower highs since 2020.

Adding the 50-week and 100-week SMA to the weekly chart shows that the 50-week is crossing above the 100-week SMA. And that's after the stock has pulled back and bounced off its 200-week SMA. The SMA crossover and WYNN's stock bouncing off its 200-week SMA are positive signs.

CHART 2: WEEKLY CHART OF WYNN RESORTS. The stock looks to be trending higher but it has to reverse its lower highs pattern to move higher.

Chart source: StockCharts.com (click on chart for live version). For educational purposes only.

If the stock breaks above its $116.90 resistance, it could go as high as $151, the January 2020 high. That's about a $35 move, or almost a 30% move. If that happened, it would reverse the "lower highs" scenario. What are the chances of that happening? To answer that question, let's turn to the daily chart...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd (WYNN) Retesting where it broke down from here. Over 104 may start to push to the 50D...

By: Options Mike | June 11, 2023

• $WYNN retesting where it broke down from here. Over 104 may start to push to the 50D...

Read Full Story »»»

DiscoverGold

DiscoverGold

Jefferies downgrades Wynn Resorts Limited and Las Vegas Sands as Macau recovery is priced in

By: Investing.com | June 8, 2023

Jefferies analysts downgraded shares of Las Vegas Sands (NYSE:LVS) and Wynn Resorts Limited (NASDAQ:WYNN) to Hold from Buy given that the expected Macau recovery is “relatively well-understood.”

New price targets on these two stocks are $65 and $114, down from the prior $69 and $135, respectively.

Both stocks are down 2.2% in pre-market Thursday after Jefferies made its move.

“We believe the bull case arguments for growth in both cases remain, and while the recovery in Macau remains early stage, we believe these dynamics are relatively well-understood by the market and approximately priced in at present levels,” analysts further said in the client note.

Shares in LVS and WYNN are up 21.7% and 25.2% year-to-date through Wednesday’s close.

Read Full Story »»»

DiscoverGold

DiscoverGold

Don't Gamble on Wynn Resorts (WYNN) Stock This Month

By: Schaeffer's Investment Research | June 7, 2023

• The casino stock has historically struggled in June

• There's plenty of optimism to be unwound

Shares of Wynn Resorts, Limited (NASDAQ:WYNN) are reversing a rally off a pullback to the $95 region, last seen down 0.7% to trade at $102.04. For the quarter, the casino stock is down 8.7%, and history suggests that June may see the stock drop lower still.

In fact, according to data from Schaeffer's Senior Quantitative Analyst Rocky White, Wynn Resorts is the second worst stock on the S&P 500 Index (SPX) to own in June, looking back over the past 10 years. The shares averaged a loss of 4.3% for the month over the last decade, and finished the month lower eight times.

As for the brokerage bunch, there's plenty of optimism to be unwound. Of the nine analysts in coverage, six maintain a "strong buy" rating. Plus, the security is ripe for a round of price adjustments, given the 12-month consensus price target of $129.35 is a 26.5% premium to current levels.

A shift in the options pits could also weigh on WYNN. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Wynn Resorts stock sports a 50-day call/put volume ratio of 2.64, which ranks higher than all readings from the past 12 months.

It's also worth noting that the 7.13 million shares sold short make up 7.4% of the stock's available float. It would take nearly three days for these traders to buy back their bearish bets.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts $WYNN Have seen a recent uptick in casino flow this week -- nice positioning with ~$1.5 mil in premium in to the 07/21 $100 CALLS

By: FLOWrensics | June 1, 2023

• $WYNN Have seen a recent uptick in casino flow this week -- nice positioning with ~$1.5 mil in premium in to the 07/21 $100 CALLS.

Read Full Story »»»

DiscoverGold

DiscoverGold

First Trust Advisors LP Has $7.70 Million Stock Holdings in Wynn Resorts, Limited (WYNN)

By: MarketBeat | May 24, 2023

• First Trust Advisors LP raised its position in Wynn Resorts, Limited (NASDAQ:WYNN) by 487.1% during the 4th quarter, according to its most recent filing with the SEC. The institutional investor owned 93,344 shares of the casino operator's stock after acquiring an additional 77,444 shares during the period. First Trust Advisors LP owned about 0.08% of Wynn Resorts worth $7,698,000 as of its most recent filing with the SEC...

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts, Limited (WYNN) Expected to Earn Q2 2023 Earnings of $0.06 Per Share

By: MarketBeat | May 26, 2023

• Wynn Resorts, Limited (NASDAQ:WYNN) - Equities research analysts at Zacks Research increased their Q2 2023 EPS estimates for Wynn Resorts in a note issued to investors on Tuesday, May 23rd. Zacks Research analyst M. Kaushik now anticipates that the casino operator will post earnings per share of $0.06 for the quarter, up from their previous estimate of ($0.39). The consensus estimate for Wynn Resorts' current full-year earnings is $1.43 per share. Zacks Research also issued estimates for Wynn Resorts' Q3 2023 earnings at ($0.11) EPS, Q4 2023 earnings at $0.50 EPS, FY2023 earnings at $0.74 EPS, Q1 2024 earnings at $0.64 EPS, Q3 2024 earnings at $0.66 EPS, Q4 2024 earnings at $1.87 EPS, FY2024 earnings at $3.88 EPS, Q1 2025 earnings at $1.06 EPS and FY2025 earnings at $4.02 EPS...

Read Full Story »»»

DiscoverGold

DiscoverGold

Intech Investment Management LLC Sells 26,600 Shares of Wynn Resorts, Limited (WYNN)

By: MarketBeat | May 19, 2023

• Intech Investment Management LLC reduced its stake in shares of Wynn Resorts, Limited (NASDAQ:WYNN) by 27.2% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 71,067 shares of the casino operator's stock after selling 26,600 shares during the quarter. Intech Investment Management LLC owned 0.06% of Wynn Resorts worth $5,861,000 at the end of the most recent quarter...

Read Full Story »»»

DiscoverGold

DiscoverGold

Bought 10 WYNN May 19 $110 Calls @ $0.06

Sold 10 WYNN May 19 $110 Calls @ $1.10

ROI 2200%

Ok I take it back

My weekly $110 calls are up 2200%

And June are back to even

Let's go WYNN!

In case one didn't understand

POADS

Piece Of Absolute Dog Shit

All these new investors and this POADS can't rip

Wynn Resorts (WYNN) Earnings beat by $0.34, revenue topped estimates

By: Investing.com | May 9, 2023

Wynn Resorts (NASDAQ: WYNN) reported first quarter EPS of $0.29, $0.34 better than the analyst estimate of $-0.05. Revenue for the quarter came in at $1.42B versus the consensus estimate of $1.37B.

Wynn Resorts's stock price closed at $111.70. It is up 2.82% in the last 3 months and up 81.18% in the last 12 months.

Wynn Resorts saw 6 positive EPS revisions and 0 negative EPS revisions in the last 90 days. See Wynn Resorts's stock price’s past reactions to earnings here.

According to InvestingPro, Wynn Resorts's Financial Health score is "weak performance".

Check out Wynn Resorts's recent earnings performance, and Wynn Resorts's financials here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts, Limited (WYNN) Shares Purchased by Mitsubishi UFJ Kokusai Asset Management Co. Ltd.

By: MarketBeat | May 4, 2023

• Mitsubishi UFJ Kokusai Asset Management Co. Ltd. lifted its position in Wynn Resorts, Limited (NASDAQ:WYNN) by 8.5% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 72,367 shares of the casino operator's stock after purchasing an additional 5,679 shares during the period. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. owned about 0.06% of Wynn Resorts worth $6,195,000 as of its most recent filing with the Securities and Exchange Commission (SEC)...

Read Full Story »»»

DiscoverGold

DiscoverGold

South Dakota Investment Council Boosts Stake in Wynn Resorts, Limited (WYNN)

By: MarketBeat | May 2, 2023

• South Dakota Investment Council lifted its holdings in shares of Wynn Resorts, Limited (NASDAQ:WYNN) by 11.3% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 29,546 shares of the casino operator's stock after buying an additional 3,000 shares during the period. South Dakota Investment Council's holdings in Wynn Resorts were worth $2,437,000 at the end of the most recent reporting period...

Read Full Story »»»

DiscoverGold

DiscoverGold

180 Wealth Advisors LLC Takes $206,000 Position in Wynn Resorts, Limited (WYNN)

By: MarketBeat | April 21, 2023

• 180 Wealth Advisors LLC acquired a new stake in shares of Wynn Resorts, Limited (NASDAQ:WYNN) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 2,006 shares of the casino operator's stock, valued at approximately $206,000...

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd (WYNN) 50D has been support holding so far

By: Options Mike | April 8, 2023

• $WYNN They sold the big gap on great Macau numbers.

50D has been support holding so far.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull of the Day: Wynn Resorts (WYNN)

By: Zacks Investment Research | March 28, 2023

Overview

Based in Las Vegas, NV, Zacks Rank #1 (Strong Buy) stock Wynn Resorts ((WYNN)) was founded in 2002. The company, together with its subsidiaries, is a leading developer, owner and operator of casino resorts. The company currently owns and operates casino hotel resort properties in Las Vegas, and in Macau Special Administrative Region of the People's Republic of China.

Strong Growth Trajectory

Wynn Resorts, one of the leading companies in the gaming and lodging industry, is well poised to grow strategically. Given its strong brand name, Wynn Resorts is better positioned to command a premium rate relative to its peers in the gaming and lodging industry. Moreover, the addition of Encore Boston Harbor in Massachusetts, makes it an initiative placed in the right direction. The company reconfigured its casino and changed the casino loyalty program. Also, it emphasized on adding incremental parking, food and beverage and entertainment amenities. With group business returning back, the initiatives are likely to benefit the company in the upcoming periods. The company stated that it would upgrade Encore Boston Harbor to be the top-performing Casino in the northeast.

Sports Betting to Drive Growth

The company is focusing on sport betting expansion to drive growth. In an effort to focus on online betting, the company announced the merger of Wynn Interactive into Austerlitz Acquisition Corp. To drive growth the company will invest $640 million. Meanwhile, WynnBET sports betting and online casino application were operational in New Jersey for quite some time. During the fourth quarter of 2020, the company launched WynnBET online sports and casino offerings in Colorado and Michigan. It also secured market access in Arizona, New York, Indiana, Iowa and Ohio and received conditional licensing in Tennessee.

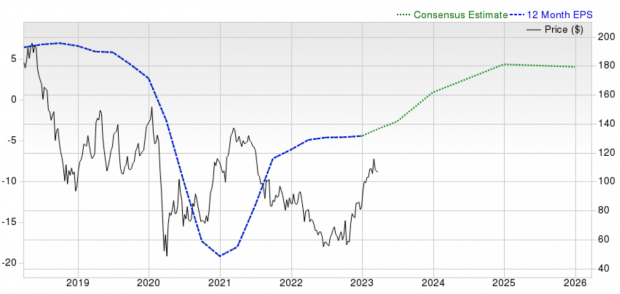

Fundamentals

Zacks Consensus Analyst Estimates suggest that Wynn Resorts is on track to fully recover from the COVID-19-induced earnings slow down by 2025. Prior to the shock of the pandemic, WYNN shares were trading at $200 per share. Should Wynn meet or exceed analyst expectations in the next two years, we expect price to double and regain old, pre-pandemic levels.

Image Source: Zacks Investment Research

Technical View

Shares of Wynn are pulling into the 50-day moving average for the first time since breaking out. The first tag of the 50-day moving average tends to be a favorable area from a reward-to-risk perspective.

Image Source: Zacks Investment Research

Bottom Line

Wynn Resorts is firing on all cylinders and investors are currently being offered an opportunity to take advantage of a temporary market shock (the pandemic). Expect WYNN shares to outperform as the company takes advantage of growth drivers such as sports betting, Macau, and strong brand recognition.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd. (WYNN) Nice way to play China, remains one of the stronger casinos. 102 must hold

By: Options Mike | March 26, 2023

• $WYNN Nice way to play China, remains one of the stronger casinos.

102 must hold.

Read Full Story »»»

DiscoverGold

DiscoverGold

$WYNN Casinos still holding in strong. 106-104 support zone for now then the 50D

By: Options Mike | March 12, 2023

• $WYNN Casinos still holding in strong. 106-104 support zone for now then the 50D

Nice chart.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wynn Resorts Ltd. (WYNN) Macau alive and well and blast off on this one and $LVS

By: Options Mike | March 4, 2023

• $WYNN Macau alive and well and blast off on this one and $LVS. Can't chase here but this thing has been embedded overbought now for 3 months.

Better play on China than China names to me.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

52

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1367

|

|

Created

|

02/07/09

|

Type

|

Free

|

| Moderators | |||

| Remark Holdings Inc | 2 Q | MARK |  -86.17 % -86.17 % |  -85.28 % -85.28 % | - |

| Bravo Multinational Inc | 1 Q | GHDC | - | - |  99556.26 % 99556.26 % |  446579.28 % 446579.28 % |

| International Game Technology Plc | 4 Q | IGT |  792.04 % 792.04 % |  792.04 % 792.04 % |  57.49 % 57.49 % |  57.49 % 57.49 % |

http://www.wynnlasvegas.com/Casino

The elegant casino areas at Wynn and Encore were designed to anticipate your every desire.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |