Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Wait how is the link you shared related to this stock? Seems like a different company.

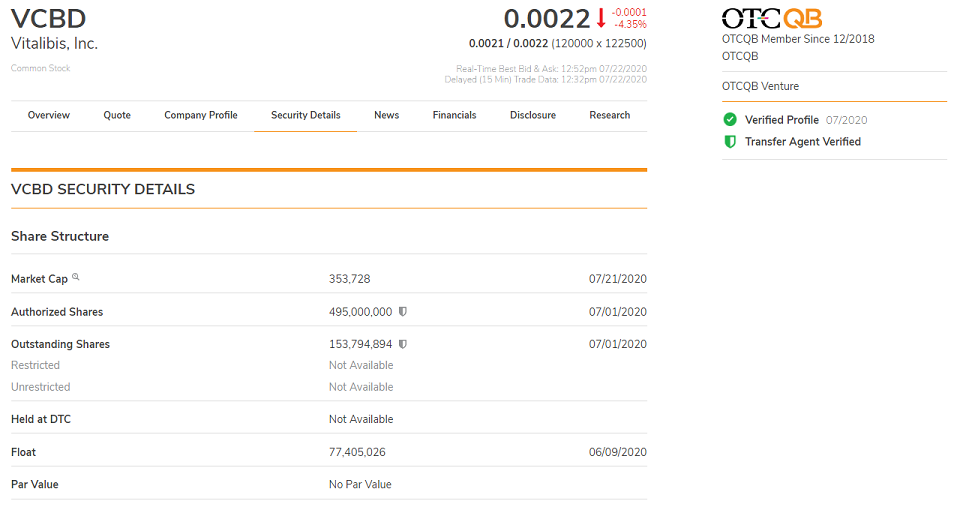

VCBDQ changed to VCBD. BK dismissed.

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Welcome to OTC!! Expect the unexpected.

Mark this post.

No, not your point... My point is they failed in the bankruptcy. Their proposal post-bankruptcy is to dump a bunch of stock, but they haven't even taken the first step to do that. I expect they don't have assets left that are worth anything, if they did the creditors would force a Chapter 7, liquidation, and shut down.

This company couldn't even get financing to finish the bankruptcy and pay their lawyers. It is no sort of investment grade company.

When they filed for BK, if their products or assets any worth, their creditors would have grabbed them and shut the door on their face.

Instead, they negotiated to pull the company out of BK for a reason. Now what? Wait n Watch.

IMO, I am sure there is a plan. After all its 260 million OS and even with 2 billion AS, its peanuts compare to 99.9% of the OTC scams.

Exactly my point. They pulled out of BK for a reason that is to satisfy their creditors.

Don't think they disappear into vacuum. Their assets Vitalibis or whatever products worth peanuts cause there are zillion CBD companies selling products just like them.

IMO, it might be taking time to pump the $hit out of this but its coming.

The reason they pulled out of bankruptcy is because they couldn't put a plan together to continue operations and satisfy their creditors. That's a big deal.

I doubt that happens. There is a reason why they pulled out of BK.

May be things still in works and can't be disclosed to shareholders at this time. I guess we wait n watch.

IMO, worst case, they file BK again. We will then know to give us on this.

In less than 3 months, this will be severely delinquent and subject to SEC revocation, and the books would be tough to sort out given how the bankruptcy went, so I'd say that ain't happening. Pump and dumps are hard to run on the grey sheets.

They all sounds material events to me.

IMO, may be handover shell to debt holders and they can do something with such low SS.

After the bankruptcy closed due to them not being able to put forward a plan to continue operations and pay their debt, I figured they were done. Of course, they'll never say that, they'll just slither off.

That 8K I posted the link to said they were increasing the A/S to 2B shares, but they haven't even taken the time to file that with the state SOS. Very likely they have no money whatsoever to make product since they struggled to even find a DIP lender for the bankruptcy proceedings and lost a lawyer because they weren't paying them.

I'd say you'll never hear from the company again and the stock will sit on the grey sheets with no volume until FINRA kills it off as inactive or the SEC revokes the registration.

All that remains is their creditors looking at the assets to see if it's worth forcing liquidation to get some of their money back. Likely the assets aren't worth a lawyer to even file the new bankruptcy.

do you know what's going on here? It seems they pulled all their products from Vitalibis website and posted on

https://empowerwellnesslifestyle.com/

lights off and ready to disappear poor Vitalibis?

Not sure either.

It seems they pulled all their products from Vitalibis website and posted on https://empowerwellnesslifestyle.com/

change name and direction? Hmmm. what's going on. No PR no news nothing from the company.

They were unable to put a POR together that the creditors would accept, so now they plan to try and sell stock to raise money, lots of it. They vacated the bankruptcy.

The A/S was increased to 2B shares:

https://www.otcmarkets.com/filing/html?id=15220552&guid=QA8wkaoudyg1r3h

The risk is if the two largest creditors decide to force another bankruptcy so they can take over.

Good luck selling stock under the skull and crossbones.

What's going on here, this company have any plans?

Hoodwinked by a trading group on a very thinly traded stock that will be cancelled by the company's bankruptcy plan. Pop the PPS up and then dump on the naive.

Dumping shares that will be cancelled by the bankruptcy plan.

ok, thanks then I sell

Nobody shorts a sub-penny stock, that would be stupid. It goes up because people don’t do their due diligence and think they might a flip out of a cheap stock. The stock will be cancelled after they approve that plan, it says so right in it.

so why does it go up? covered short?

Stock will be cancelled per their bankruptcy plan.

They agreed to a continuance 1 month away. Next hearing is July 7th, expecting to approve the plan of reorganization.

do you know what they said at today's hearing?

this one is setting up for 002 imo trying 0011

Can't believe VCBD still trading..Deletion prob coming Sept...

Pacermonitor has it. Google "pacermonitor vitalibis"

do you have a link?

Next hearing on June 9 to review the bankruptcy plan.

They’re not canceling shares. This is a lie.

where did you find that info?, no they can't unless declared in their filings?

No, the POR cancels the common stock.

It's being pushed on the interwebs as though it was some great investment with no acknowledgement of the bankruptcy nor of the plan of reorganization which cancels the common stock.

Thanks we'll see near the bottom would like to see .01 again

will that ever happen again is the question g/l

That’s awesome!

filled a bunch at .0002 not sure what it will do but hard to beat at that price

Might be a great wholesale buying day. Get those wallets ready!

|

Followers

|

52

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2347

|

|

Created

|

04/25/17

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |