Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

EIA reports a draw of 44 Bcf versus expectations for a draw of 53 Bcf and the 5 year average of 175 Bcf.

NG drops from $2.12 to $2.11/mcf when the news hits.

Current storage is 3,148 Bcf which is 74 Bcf above the five-year average of 3,074 Bcf.

EIA reports a draw of 58 Bcf versus expectations for a draw of 57 Bcf and the 5 year average of 89 Bcf.

NG drops from $2.13 to $2.12/mcf when the news hits.

Current storage is 3,192 Bcf which is 38 Bcf below the five-year average of 3,230 Bcf.

EIA reports a draw of 161 Bcf versus expectations for a draw of 148 Bcf and the 5 year average of 101 Bcf.

NG rises from $2.22 to $2.24/mcf when the news hits.

Current storage is 3,250 Bcf which is 69 Bcf below the five-year average of 3,319 Bcf.

EIA reports a draw of 107 Bcf versus expectations for a draw of 94 Bcf and the 5 year average of 112 Bcf.

NG rises from $2.25 to $2.28/mcf when the news hits.

Current storage is 3,411 Bcf which is 9 Bcf below the five-year average of 3,420 Bcf.

EIA reports a draw of 73 Bcf versus expectations for a draw of 76 Bcf and the 5 year average of 68 Bcf.

NG drops from $2.29 to $2.28/mcf when the news hits.

Current storage is 3,518 Bcf which is 14 Bcf below the five-year average of 3,532 Bcf.

EIA reports a draw of 19 Bcf versus expectations for a draw of 22 Bcf and the 5 year average of 41 Bcf.

NG rises from $2.41 to $2.42/mcf when the news hits.

Current storage is 3,591 Bcf which is 9 Bcf below the five-year average of 3,600 Bcf.

EIA reports a draw of 28 Bcf versus expectations for a draw of 32 Bcf and the 5 year average of 57 Bcf.

NG drops from $2.52 to $2.51/mcf when the news hits.

Current storage is 3,610 Bcf which is 31 Bcf below the five-year average of 3,641 Bcf.

EIA reports a draw of 94 Bcf versus expectations for a draw of 89 Bcf and the 5 year average of 32 Bcf.

NG rises from $2.55 to $2.58/mcf when the news hits.

Current storage is 3,638 Bcf which is 60 Bcf below the five-year average of 3,698 Bcf.

EIA reports a build of 3 Bcf versus expectations for a draw of 2 Bcf and the 5 year average build of 30 Bcf.

NG drops from $2.67 to $2.65/mcf when the news hits.

Current storage is 3,732 Bcf which is 2 Bcf above the five-year average of 3,730 Bcf.

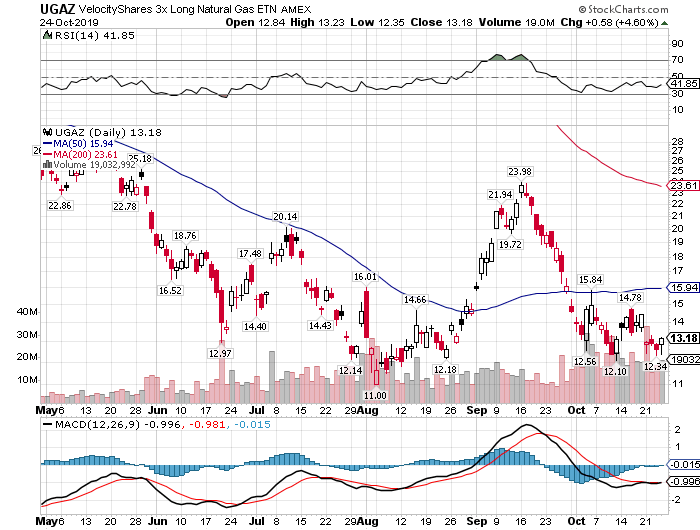

I bought some UGAZ $15.3s Monday when NG dropped down to $2.62 touching the dec 50ma. If it holds above the 50ma, bases it could get a trading range bounce. A revised colder forecast could break it out. If it drops below the 50ma with any authority my stop limit will trigger.

Things ng has going for it.

Its relatively cheap for this time of year

A large short position

Lots of eager beaver newbie NG traders wanting to relive 2018

Thank you, your commentary has been helpful. Agree on Roth trading of aggressive assets, too many savings to be had not to.

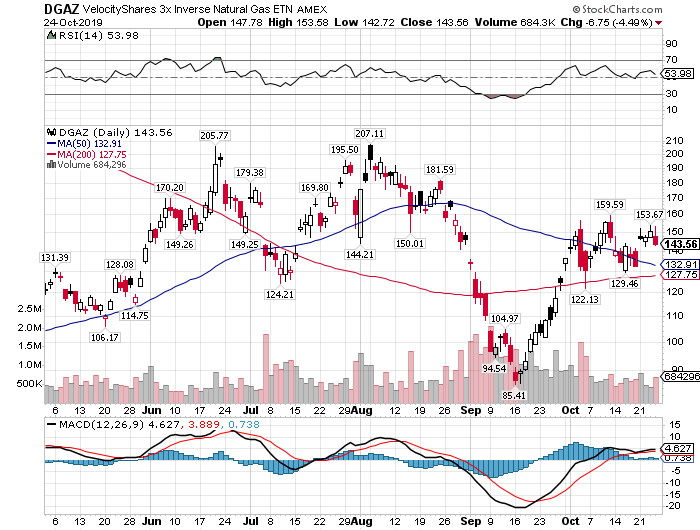

Interesting to note, I’ve been following random large buy/sell bars towards end of day, it has been 9/9 so far. UGAZ just had a monster sell bar hit. Let’s see if DGAZ gets another move up tomorrow to make the indicator 10/10

Nice play I thought about buying dgaz last week but I was in ira 3 day settlement period. I got burnt buying with unsettled cash, never again. It makes flipping both sides difficult. I only trade in Roth IRAs. Never pay a dime in capital gains tax.

Cashed out $108 this morning but think this could easily return to $130+

$DGAZ

Might better check this out

https://www.fxempire.com/forecasts/article/where-is-the-top-for-natural-gas-611376

Still holding hoping for $100+

EIA reports a build of 34 Bcf versus expectations for a build of 45 Bcf and the 5 year average of 57 Bcf.

NG spikes from $2.81 to $2.86/mcf when the news hits.

Current storage is 3,729 Bcf which is 29 Bcf above the five-year average of 3,700 Bcf.

Grabbed $88s yesterday myself. Sell bars end of day on ugaz look like another Green Day here tomorrow.

$DGAZ

What matters most this time of a yr is the anticipation that Its Gonnna Be A Long Cold Hard Winter. For a few weeks at least

About that time to start scaling in again slowly.

I dipped my toe in Dgaz today.

Looks like a Green Day here tomorrow

$DGAZ

The tug of war between record production and winter weather is currently being won by winter.

HFIR reported a new record for weekly US production at 95.7bcf

On the other hand winter temps are early in eastern US.

The best free winter info comes from Dr Judah Cohen of MIT. He posts a blog every 8- 10 days where he discusses factors driving winter weather for the short and long term. Its pretty dense reading. Here's a link so his most recent blog:

https://www.aer.com/science-research/climate-weather/arctic-oscillation/

The short version of his blog says there's a chance that cold weather could persist longer.

That ride can get pretty hairy. During spasmodic episodes of extreme volatility I have witnessed DGAZ not performing as advertised. The automatic buying and selling of underlying securities could not keep up with NG price action.

The (nearly) annual fall-into-winter UGAZ/DGAZ rodeo is upon us. For the adventurous, ride the UGAZ wave up OCT/NOV, and the DGAZ wave back down JAN/FEB.

The adrenalin junkies will stay on the ride in December.

Dec NG gaps to 2.79 at start of comex trading Sunday night. January contract to 2.87. DGAZ starts roll into Jan contract on Friday. Last chance for contango trade. Weather forecast is saying cold in eastern US is gonna stay a while.

The widow maker is causing heart palpitations for bears.

EIA reports a build of 89 Bcf versus expectations for a build of 86 Bcf and the 5 year average of 65 Bcf.

NG drops from $2.67 to $2.66/mcf when the news hits.

Current storage is 3,695 Bcf which is 52 Bcf above the five-year average of 3,643 Bcf.

Whatever you want to tell yourself. Shoot I agree with you too but your gonna have a hard time convincing my cash account. :) :)

It’s still wildly incorrect. The gap up in natural gas was caused by a change in weather pattern forecasts

I swapped over to ugaz and am doing well. I’ll hold there for the next couple months. Then I’ll be back to DGAZ. Futures are increasing week by week.

What do you think about that article now?????

????????

This person misunderstood the contract roll for a breakout. Very poorly written article

Cantango is DGAZs best buddy. No brainer contango gap closer underway. Sell dgaz when ng drops down near or closes the gap

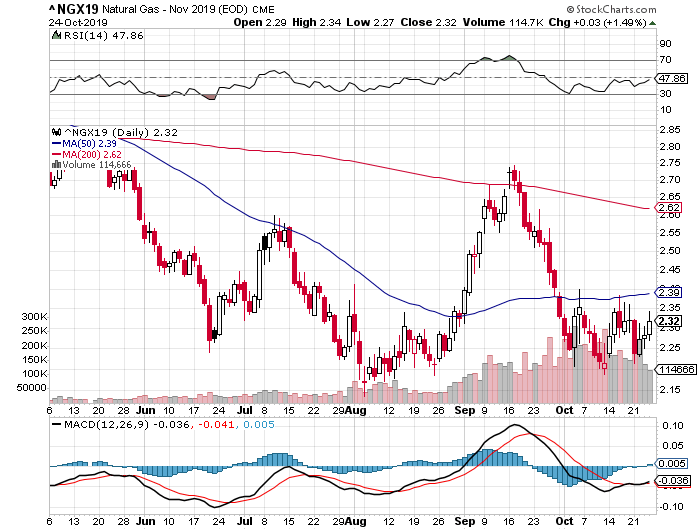

Nov NG vol 114.7k

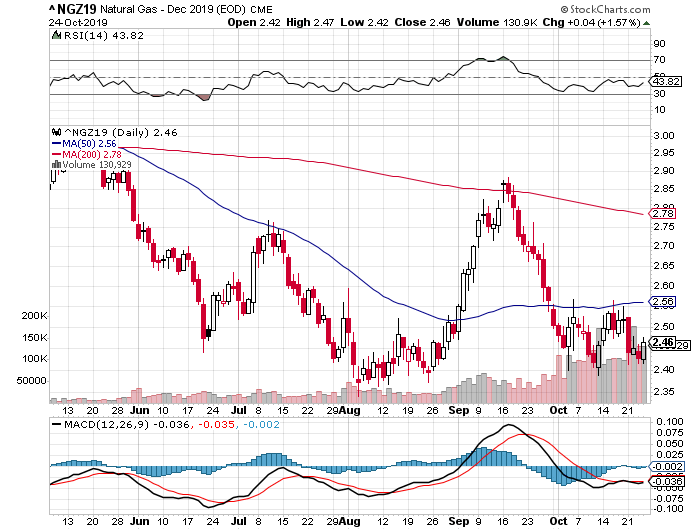

Dec NG vol 130.9k

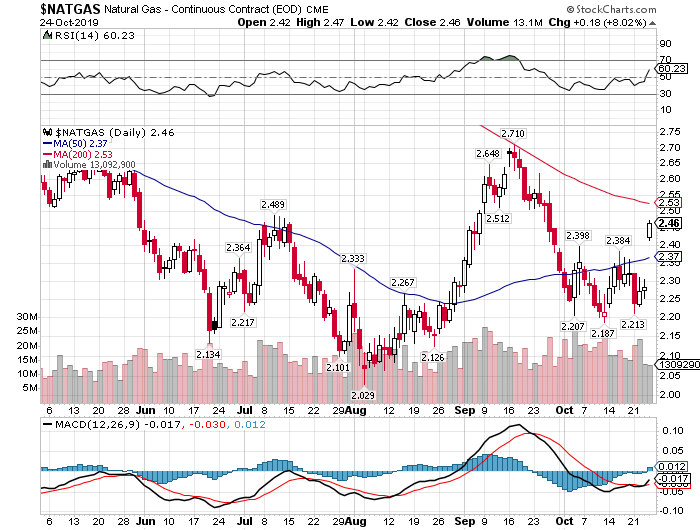

Stockchart rolls the NG chart at the EOD when the frt month vol decreases below the fwd month that happened today.

NG chart shows a 8% gain .12 gap up. At first glance this looks like a huge breakout above the 50ma for NG. FX empire even wrote did an article to that affect today complete with video review. Yet Nov and Dec both have been struggling/basing below the 50ma for weeks. Today nov/dec were up about 1.5%

https://www.fxempire.com/forecasts/article/natural-gas-price-forecast-natural-gas-markets-finally-break-out-608163

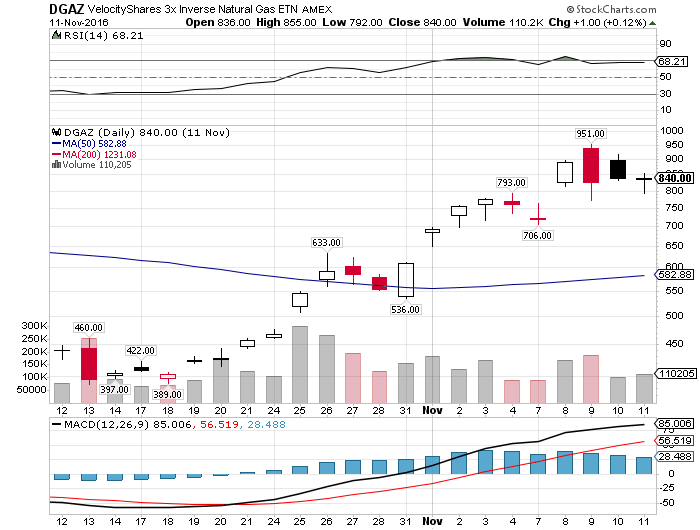

To see how this might play out we go look at similar situations when there was Contango during the chart/contract roll 2016 oct/nov is a good example

Initially there was a slight bump Thursday Friday then Monday gap n trap selloff then that week the gap up was fully closed. Any move down into the Contango gap results in a decrease in the value of UGAZ and increase in DGAZ. NG goes back to where it was before the roll. Ask yourself will NG go back and at least test the 50ma for support. The same 50ma it has been struggling to get up above.

Contango & DGAZ good buddies.

87/88 and still .14ish Contango to unwind wx is mixed not the most bullish senario. Im holding DGAZ for now trust the Contango process. Contango is DGAZ friend

EIA report came in as expected so essentially no reaction in NG prices immediately following the report.

EIA reports a build of 87 Bcf versus expectations for a build of 88 Bcf and the 5 year average of 73 Bcf.

NG rises from $2.29 to $2.30/mcf when the news hits.

Current storage is 3,606 Bcf which is 28 Bcf above the five-year average of 3,578 Bcf.

Everybody scared

What shall we do 59?

Goodluck

Nice gap up. Very thankful to have gotten some $131s in AH Friday

$DGAZ

I sold the remainder of my D when it popped over 150 this morning. I'm still kinda bearish.

report was oh well moment NG roll/slowly shrinking contango (.175) unwinding thru next week not the most bullish senario barring a scary cold wx forecast. bought DGAZ $135 using tight stop. Dec NG could sit and Nov come up and UGAZ/DGAZ stay flat minus bleed. Sitting on the sidelines with most of my NG cash during this cycle.

EIA reports a build of 104 Bcf versus expectations for a build of 106 Bcf and the 5 year average of 81 Bcf.

NG rises from $2.33 to $2.35/mcf when the news hits.

Current storage is 3,519 Bcf which is 14 Bcf above the five-year average of 3,505 Bcf.

Also, the ETNs aren't tracking the prompt month...they are presently tracking Dec

I sold another 100 shares of D when it popped over 146. Im still holding 30% of my original position. Im still modestly bearish on ng. I hope the threat of early November cold snap gains traction so i can get a lower reentry in D. I dont think real cold weather is in the forecasts... yet.

$2 level for NG is a huge psychological barrier/support.

If NG does reach this level, or below, I believe it will be for a very short period of time.

Also DGAZ does not move with NG in a direct correlation. Contango and decay impact UGAZ and DGAZ.

Do you think the panic can drop NG below 2?

NOAA posted their regular Friday experimental 3-4 week outlook. https://www.cpc.ncep.noaa.gov/products/predictions/WK34/gifs/WK34temp.gif

Dr Judah Cohen of MIT and AER updated his winter weather blog on Monday. He said Winter is still yet to be defined but early November cold shot looks to be a head fake. However several factors seem to point weakly to a winter with multiple cold shots in the east, where it matters most.

I am still bearish but just barely. All it takes is one cold forecast to turn NG around. I sold about 60% of my D at 151.

Agreed. Next week’s injection is gonna be a beast.

There isn’t any meaningful cold weather in sight.

In light of chronic loose supply, big money already knows the odds of shortage this winter are real slim.

COT is still bearish.

It could get real ugly. NGF20 at 2.00 ugly.

Bulls are fighting to save 2.20 support but the fundamentals aren’t there.

Im still bearish.

|

Followers

|

133

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

18980

|

|

Created

|

08/02/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |