Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This is the stock UOIP Sorry I don't have PM to reply- can only receive. I haven't checked it out.

ASCK!! Watch...

GLRI ~~ If possible that they can weather the low oil prices and if they avoid R/S...on watch as bounce play...will get delisted from NAS...lets see if they keep OS intact... Longer term watch....

AVSC ~~ on watch SOS name change ~~ small OS ...JNV (justneedsvolume)

SGBY on watch ~~

Item 3.02. Unregistered Sales of Equity Securities.

(1)

On April 26, 2016, St. George Investments, LLC converted a $12,855.57 portion of the St. George Convertible note into 23,373,764 shares of common stock. The balance remaining on the St. George Convertible Note after this conversion is $0.00.

Item 7.01. Regulation FD Disclosure.

The Company has received questions about the spin out of EVIO Labs. The Company felt it was better to answer the questions through an 8-K instead emailing the individuals directly. As announced in the press release dated April 20, 2016, the Company formed EVIO Inc. d/b/a EVIO Labs to be the dedicated operating company for all analytical testing services. EVIO Labs will initially consist of the assets of CR Labs which was acquired by the Company last September, all pending Oregon acquisitions and future nationwide expansion opportunities. The company will report all activities of EVIO Labs in its consolidated financial statements. In addition, if EVIO Labs is to issue dividends in the future the Company will look to implement a dividend policy to forward at a minimum a portion of those dividends directly to the Company's shareholders.

Item 8.01. Other Events.

(1)

On April 20, 2016 the company acquired a vanity toll-free number for EVIO Labs. The toll-free number for our customers to reach us is 1-888-544-EVIO (3846).

(2)

In anticipation of the successful closure of EVIO Labs acquisitions of both Oregon Analytical Services and Kenevir Research, the companies have been working together in a collaboration to expand the services offered by each in addition to improving our customer turn-around times.

(3)

On April 19, 2016, the company began offering expanded cannabinoid potency profiling. In accordance with the Oregon Health Authority, under OAR 333-008-1190, the Company provides compliance testing services which includes potency measurements for THC, THCA, CBD and CBDA. In response to requests from our clients we are now also reporting CBC, CBG and CBN measurements. We are also working on measuring and reporting on THCV, Tetrahydrocannabivarin.

GEQU....

Check DD....http://investorshub.advfn.com/boards/read_msg.aspx?message_id=117726150

And recent charts....been consolidating heavily the last weeks.

IGEX..DD..

IGEX.... Due Diligence....The Next E*Trade of Asia… IGEX working in Indonesia, Papua New Guinea , Philippines and about to launch into Brazil, Russia, India, China, South Korea, Mexico, Turkey, and Saudi Arabia... There is NO major International competitor of IGEX that has a physical presence in these countries...Namely the Pacific Rim Market Place…. Companies like Saxo Bank, E*Trade, IG Markets, Global FX trading or the major banks don’t have a presence in all these countries...

IGEX offers its clients, the first locally supported market access to..

This is the IGEX Office in Indonesia..

Menara Standard Chartered

30th Floor

JI. Prof. Dr. Satrio

Jakarta, KAV146

Indonesia

Phone: 62 21 255 55600

http://www.regus.com/locations/office-space/jakarta-menara-standard-chartered

IGEX HAS AGREEMENTS WITH ..

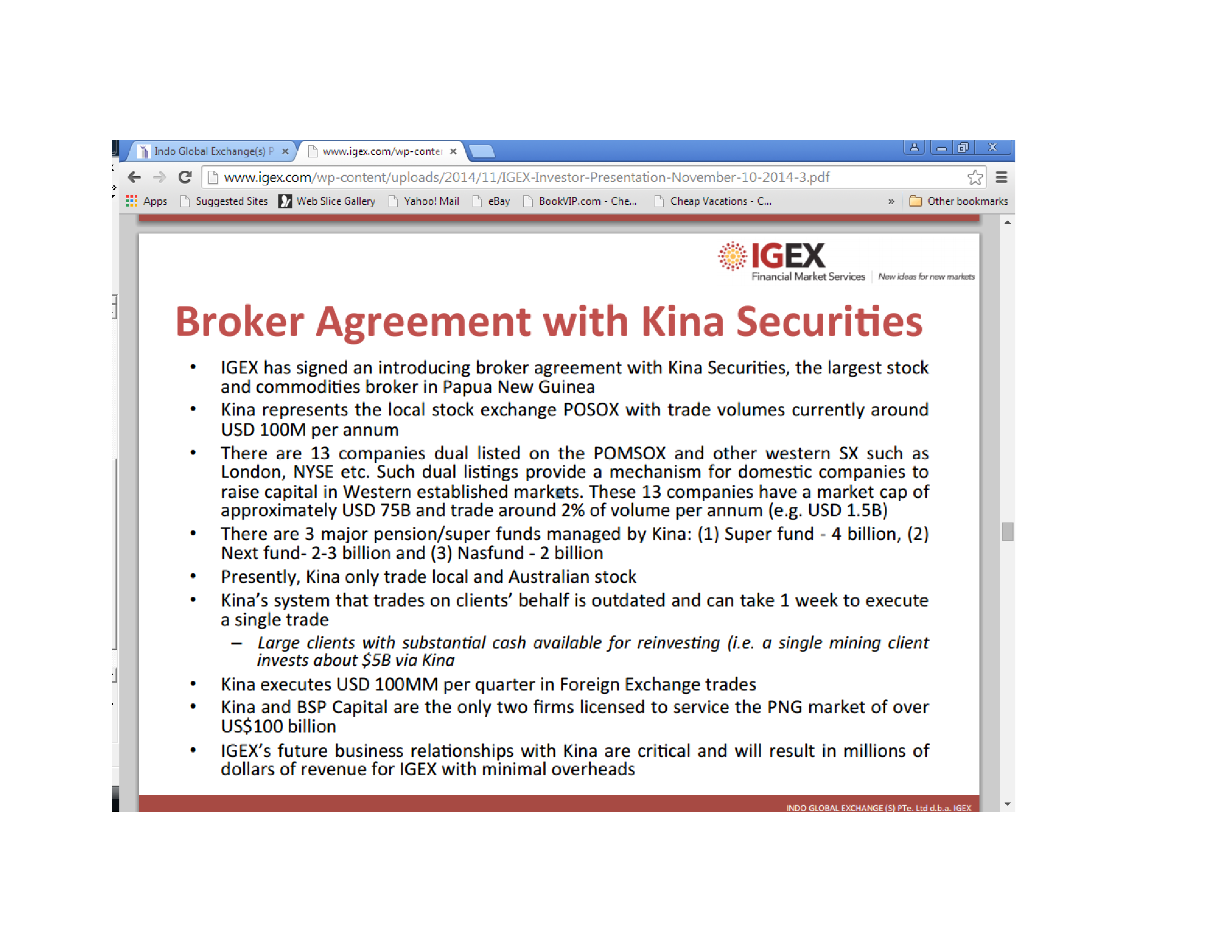

KINA SECURITIES LTD.. KINA Chose IGEX over E*Trade !!!...Kina Securities HAD its initial public offering @ $1.00 per share which was jointly floated on the Australian Securities Exchange and the Port Moresby Stock Exchange, and Raised $97 million.. with a market capitalisation of about $164 million… chaired by former PNG prime minister Sir Rabbie Namaliu….$2.5 billion of funds under management…KINA had Entered into ten year services agreement with IGEX… to provide all KINA Securities clients with access to over 21 global exchanges that have direct access to international markets of equities, currencies, futures, CFDs, options, and commodities.

KINA Securities represents 70% of all security transactions in PNG, and currently use E*Trade Securities as their main execution and clearing partner. KINA will be migrating all existing clients to IGEX but recognizes the huge value in offering a more sophisticated trading platform currently not available in PNG. This will position KINA to increase their market share and be able to grow business in alternative markets that currently also do not have direct access to international financial markets.

The potential revenue from such an agreement with KINA is substantial due to KINA having already an established brand and client base within PNG. IGEX will book 100% of all revenue and retain 30% of all commissions and trading revenue executed on KINA's clients.

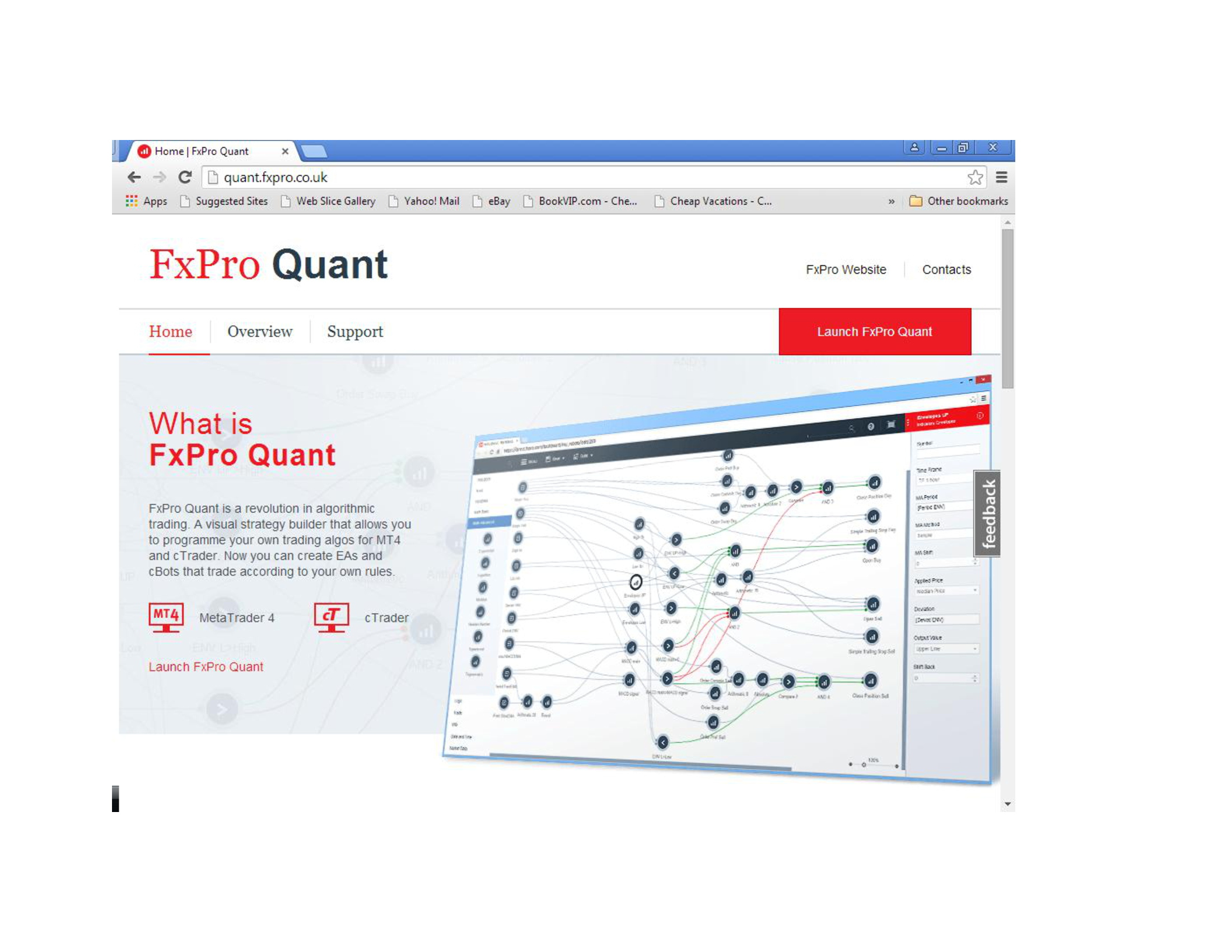

IGEX Appointed Investment Manager for FxPro White Label Partners Millions of New Funds Expected from Retail Clients.. secured Star Signals, FX professional Academy and Investor Limited as new clients of IGEX SuperTrader. All these new clients for IGEX are White Label partners of FxPro and after FxPro funds management division invested $500,000 in IGEX trading Strategy’s there partners are following with retail clients using IGEX as services provider...FxPro manage more than $60 billion trading volume per month in the foreign exchange market and have over $300mn Funds Under Management..

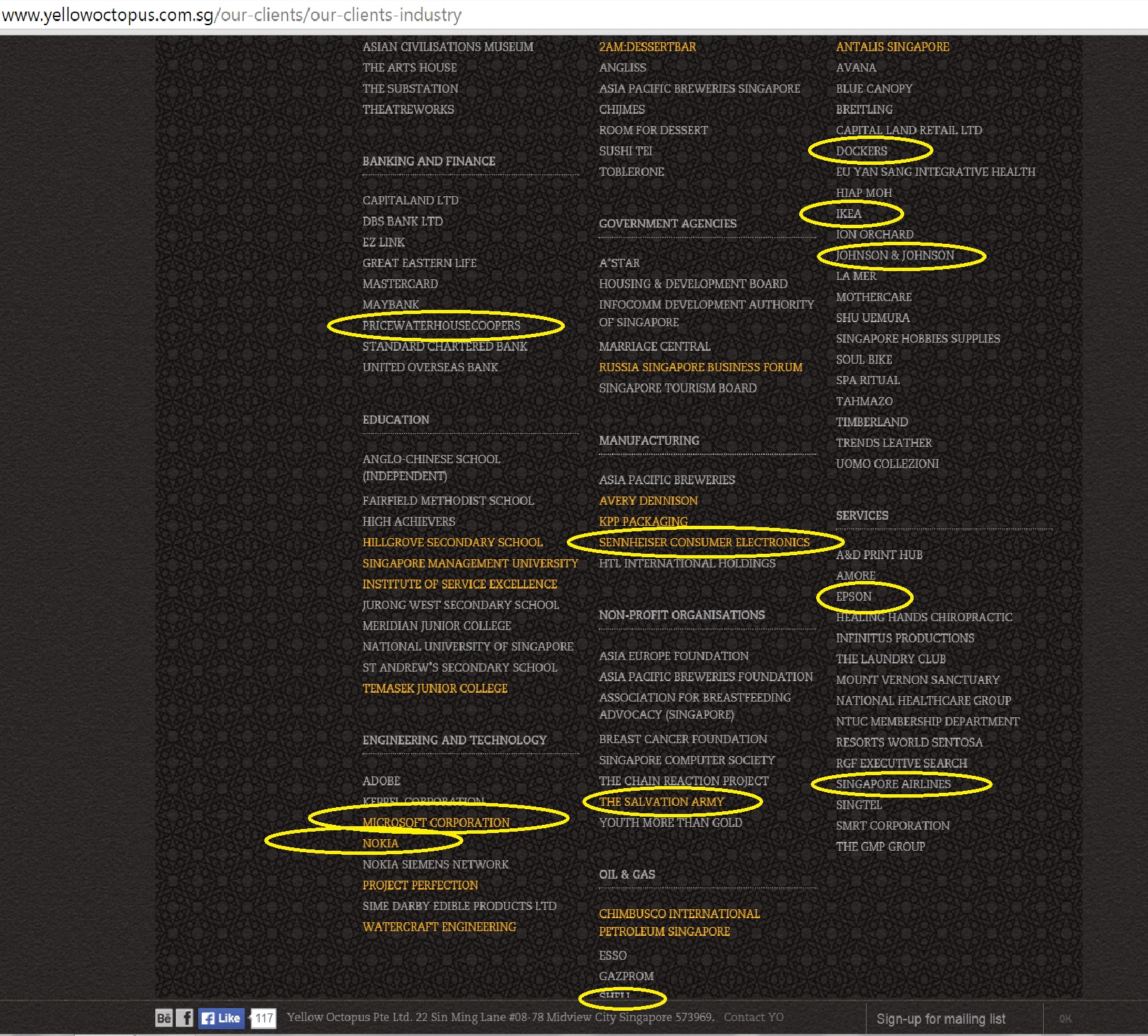

With Yellow Octopus…As part of the agreement Yellow Octopus performance is linked to IGEX shares. For every $500,000 of funds under management IGEX will issue 500,000 IGEX shares up to 26,000,000 shares. Once the targets are reached this would represent over $520,000 per month in recurring revenue to IGEX. Also added to the agreement is a list of large and established broker companies that Yellow Octopus has highlights as strategic partners and will be introduced to IGEX SuperTrader.

- CLSA Asia-Pacific Markets

- Shenyin & Wanguo Securities Co., Ltd.

- Haitong International Securities Group Limited

- CITIC Securities Brokerage (HK) Limited

- CLSA Asia-Pacific Markets

- Shenyin & Wanguo Securities Co., Ltd.

- Haitong International Securities Group Limited

- CITIC Securities Brokerage (HK) Limited

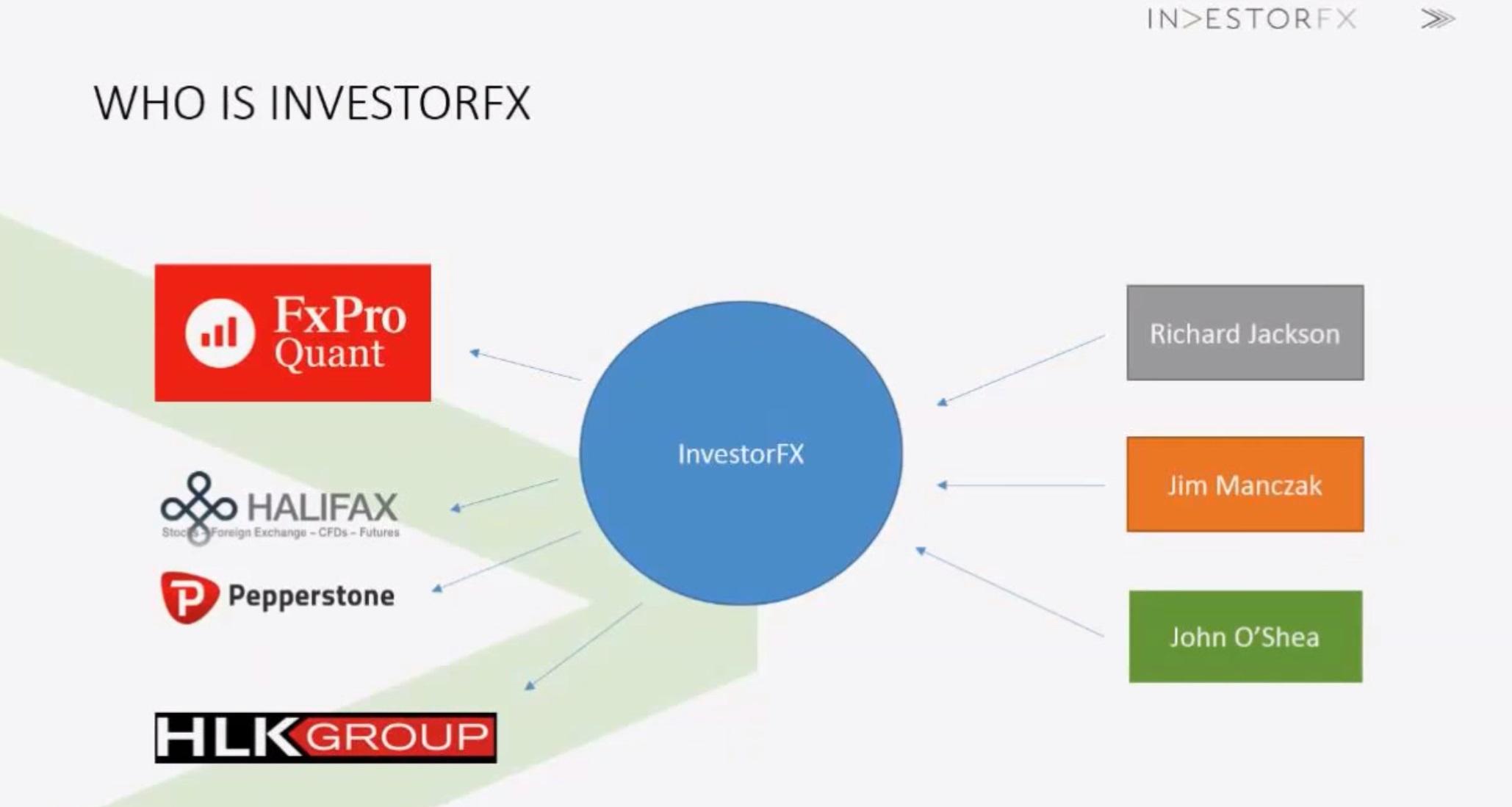

InvestorsFX..Big Coglomerates along with IGEX joining hands for a greater plan..

http://www.investorfx.com.au/

Partnership with Halifax ..and Axis Traders..

Halifax Investment Services

https://halifax.com.au/

Halifax Investment Services Ltd is a boutique financial services provider offering advice and trading in financial markets including stocks, options, futures, foreign exchange and contact's for difference. Halifax has professional advisors and dealers in Sydney, Southport, Melbourne that offer exceptional service to both retail and institutional clients.

Headquarters 2000 Australia Company Size 51-200 employees

Founded 1998 Halifax Investment Services Online Share Trading allows you to trade in both Australian and US markets from one personalized account.

https://en.wikipedia.org/wiki/HBOS

International Global Exchange (otc pink:IGEX) announced it is in final stages of reaching an agreement to acquire 32% of an Australian-based Managed Investment Scheme. The undisclosed deal will see an IGEX appointment become a member of the investment committee and responsible for managing the Fund's Derivatives and Forex portfolio. IGEX will also be appointed to the board of the company once the transaction is completed. The ownership is split between managers and financial planners that are referring clients to the managed investment pool. The financial planners receive bonus equity on achieving new Funds Under management targets. This will ensure a continued flow of new funds and keep established funds within the system. IGEX will be responsible for managing 4% of the fund and 4% of new funds monthly. This will represent millions of funds under management and substantial revenue to IGEX

International Global Exchange (otc pink:IGEX) announced it is in final stages of reaching an agreement to acquire 32% of an Australian-based Managed Investment Scheme. The undisclosed deal will see an IGEX appointment become a member of the investment committee and responsible for managing the Fund's Derivatives and Forex portfolio. IGEX will also be appointed to the board of the company once the transaction is completed. The ownership is split between managers and financial planners that are referring clients to the managed investment pool. The financial planners receive bonus equity on achieving new Funds Under management targets. This will ensure a continued flow of new funds and keep established funds within the system. IGEX will be responsible for managing 4% of the fund and 4% of new funds monthly. This will represent millions of funds under management and substantial revenue to IGEX

International Global Exchange (otc pink:IGEX) today announced it is in final stages of reaching an agreement to acquire 32% of an Australian-based Managed Investment Scheme. The undisclosed deal will see an IGEX appointment become a member of the investment committee and responsible for managing the Fund's Derivatives and Forex portfolio. IGEX will also be appointed to the board of the company once the transaction is completed. The ownership is split between managers and financial planners that are referring clients to the managed investment pool. The financial planners receive bonus equity on achieving new Funds Under management targets. This will ensure a continued flow of new funds and keep established funds within the system. IGEX will be responsible for managing 4% of the fund and 4% of new funds monthly. This will represent millions of funds under management and substantial revenue to IGEX

TSOI awesome 8K filed afterhours. Today the chase above begins.

IGRW - UNDISCOVERED GEM .0025

HERE'S THE DD

UNDERVALUED MMJ COMPANY

Our success will be built on designing and creating cannabinoid products in the interim that are legal at the Federal level for clinical, cosmetic, health, alternative healing, herbal and other health needs.

Our business model, products and services will all be based around adding value to our business activities and value for our shareholders.

The earlier term of divesture didn't fully describe the intent of the Company's actions currently and in the near future. We are still fully committed to stay in the legal sector of this market and we expect to fully utilize the assets we have to add value to the company. We have and are acquiring key relationships currently to obtain these goals to have products and services ready to go to market by the spring of 2015.

AVLS very low float becoming current again!

This company has recently become current with it's filings again and has a nice low float company structure. Could be a great opportunity to get in, they will probably release some news in the near future.

$MINE In one month 7 major events.

Chairman/CEO Scott Vanis has never shied from the fact, the SHAREHOLDERS come first, EXCEPT where the company is concerned.

Nov. 6, 2014 (GLOBE NEWSWIRE) Avanzar Shows Significant Growth in October

Southern California Beverage Distributor Increases Its Sales and Footprint Within the Los Angeles and Southern California Markets

www.quotemedia.com

Nov. 5, 2014 VitaminFIZZ(R) to Cross the Pond to the United Kingdom.

Minerco's Level 5 Finalizes Distribution Deal With London Based JD's Food Group.

http://finance.yahoo.com/news/vitaminfizz-r-cross-pond-united-181249730.html

Nov. 4, 2014 Minerco's Level 5 Confirms Formulations of Vitamin Creamer(R)

http://finance.yahoo.com/news/minercos-level-5-confirms-formulations-190000960.html

Nov. 3, 2014 MINERCO RESOURCES, INC. Files SEC form 8-K, Entry into a Material Definitive Agreement with JD's Food Group

http://biz.yahoo.com/e/141105/mine8-k.html

Oct. 27, 2014 Minerco's Level 5 Acquires Specialty Beverage Distributor, Avanzar

http://finance.yahoo.com/news/minercos-level-5-acquires-specialty-131500932.html

October 24, 2014 Material Agreement_Avanzar Sales and Distribution, LLC

http://biz.yahoo.com/e/141027/mine8-k.html

Oct. 6, 2014 Minerco/Level 5 Schedule Rush Production Run to Meet Consumer Demand

Amazon Sells Out of Most Popular VitaminFIZZ Flavor

http://finance.yahoo.com/news/amazon-sells-most-popular-vitaminfizz-133000915.htm

$MINE Heavy hits at .0042 for DOUBLE UP tomorrow.

Minerco's Level 5 Acquires Specialty Beverage Distributor, Avanzar

http://app.quotemedia.com/quotetools/newsStoryPopup.go?storyId=71141605&topic=MINE&symbology=null&cp=null&webmasterId=500

$TEMN Check DD. FINRA should allow announcement to be made in the next few days as NEW ticker is brought forward and FULL DISCLOSURE is reestablished.

Please forgive me for that.

Well that is good to hear - I bought $AQUM at .001 and it promptly dropped to .0001. Maybe I can break even on the resurrection.

A new site coming - https://www.investfeed.com/?rec=0528e42

DHCC site approval catalyst July

Get CMGO if you don't already have it...

Ok..was wondering if someone out sluethed me...lol I triple checked with all my guys...some bids in ....no selling at all.

Just breaking his balls I have no clue at all. It would not surprise me is it was PM I dont post to him at all I will have some funds clear on Wed not much

Yes you are bud ~~~ Feel free to post your DD on hidden gems here.....mid to long holds...we want to find them first, before any awareness....:) Just like CMGO..and the others I posted...that one XPOI..found it at .07, they sold assets and distributed 1.00 to all stock holders....:)

Hit good on ALVR, PEII, BCCI and others as well....we will ramp it back up soon....

I am sure an happy investor with CMGO

I have been away for a while...working other projects...the GEM discovery will continue...had a few sleepers really go..and couldn't even post it last several months...

All CMGO longs should be a little happy now....

Feel free to post some gems boys.

BMSN = Non-Stop DILUTIONS ! ![]()

Filed = 2014-01-07

http://www.sec.gov/Archives/edgar/data/1079282/000155479514000005/bmsn10291310k.htm

….and this is just SOME Dilution shown! ![]() There is a LOT MORE listed in this Filing!!

There is a LOT MORE listed in this Filing!! ![]()

On January 8, 2013 the Company issued 90,000,000 Common Shares in (“Shares”) satisfaction of $9,900 of outstanding convertible indebtedness

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On February 27, 2013 the Company issued 21,450,717 Common Shares (“Shares”) in satisfaction of $24,775 of outstanding convertible indebtedness

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On March 21 , 2013 the Company issued 5,158,730 Common Shares (“Shares”) in satisfaction of $30,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On March 21 , 2013 the Company issued 2,777,778 Common Shares (“Shares”) in satisfaction of $15,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On March 22 2013 the Company issued 100,000,000 Common Shares (“Shares”)in satisfaction of $100,000 of outstanding convertible indebtedness and accrued interest.

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On March 25 2013 the Company issued 7,721,740 Common Shares (“Shares”)in satisfaction of $35,520 of outstanding convertible indebtedness and accrued interest.

The Shares were issued pursuant to Section 4(a) (2) of the Securities Act of 1933, as amended. The Shares were issued pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On April 2 2013 the Company issued 100,000,000 Common Shares (“Shares”)in satisfaction of $50,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On April 12 2013 the Company issued 100,000,000 Common Shares (“Shares”)in satisfaction of $50,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On April 17, 2013 the Company issued 7,162,534 Common Shares (“Shares”) in satisfaction of $13,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On April 23 2013 the Company issued 100,000,000 Common Shares (“Shares”)in satisfaction of $50,000 of outstanding indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On April 25, 2013 the Company issued 84,848,085 Common Shares (“Shares”)in satisfaction of $140,000 of outstanding convertible indebtedness.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On May 16 2013 the Company issued 100,000,000 Common Shares (“Shares”)in satisfaction of $50,000 of outstanding convertible indebtedness.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On June 10 2013 the Company issued 20,000,000 Common Shares (“Shares”)in satisfaction of $10,000 of outstanding convertible indebtedness.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On June 13 2013 the Company issued 100,000,000 Common Shares (“Shares”) in satisfaction of $50,000 of outstanding convertible indebtedness.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On August 26 2013 the Company issued 100,000,000 Common Shares (“Shares”) in satisfaction of $35,000 of outstanding convertible indebtedness.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On August 30 2013 the Company issued 66,287,898 Common Shares (“Shares”) in satisfaction of $70,197 of outstanding indebtedness and accrued interest.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On September 11 2013 the Company issued 60000000 Common Shares (“Shares”) in satisfaction of $120,000 of outstanding indebtedness and accrued interest.

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On October 14, 2013 the Company Issued 120,000,000 Common Shares (“Shares”) in satisfaction of $ 44,500 of indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On November 13, 2013 the Company Issued 120,000,000 Common Shares (“Shares”) in satisfaction of $ 12,000 of indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

On December 5, 2013 the Company Issued 120,000,000 Common Shares (“Shares”) in satisfaction of $ 15,000 of indebtedness

The Shares were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Shares were offered directly through the management. No underwriters were retained to serve as placement agents. No commission or other consideration was paid in connection with the sale of the Shares. There was no advertisement or general solicitation made in connection with this Offer and Sale of Shares.

BMSN will be a good investment in the next months or year.

The company is working with fda to start a trial on a new stem cells drug to treat bone marrow cancer.

The company looks promising in the next months for the CV record of people involved and the important links BMSN has with companies in the sector.

It is worth to have it in a mid-long term oriented portfolio.

ELTP has been making a significant run. Pharmaceutical company with a growing pipeline and increasing revenues every quarter. Lots of potential in this one

WMHI news out ........

Good bounce play, low float

Jan. 8, 2014, 7:58 p.m. EST

World Mobile Holdings, Inc. Completes Order for Signage Media Player System and Announces the Merger Plan

NEW YORK, NY, Jan 08, 2014 (Marketwired via COMTEX) -- World Mobile Holdings, Inc. (otc pink:WMHI), a global leader in developing Image Transmission Devices (ITD), Lithium-Iron (LiFePO4) Battery Modules, and Solutions Integration for major wireless carriers around the world, is pleased to announce a new order to build a Multimedia Signage System for China Mobile, Shanghai. All hardware was delivered to the client at the end of 2013 and the entire system is expected to be completed by the end of January 2014.

World Mobile Holdings Inc. is also announcing plans to acquire a factory in China which owns a Nanotechnology for lithium iron phosphate powder which is the upstream core material used in the manufacturing of advanced LiFePO4 batteries. This Nanotechnology has been patented in China and World mobile Holdings Inc. will apply for new global patents upon the completion of the merger. The merger is expected to close by the end of Q2, 2014.

"We are proud to announce this news to our shareholders and potential investors. This Nanotechnology makes our lithium iron phosphate powder more quality stable and more price competitive than the existing three other powders with global patent, so it will make our LiFePO4 batteries in higher quality & more price competitive than all others in the market.

"The establishment of the assembly plant is scheduled to be completed in 2014 Q3 so the sales revenue of LiFePO4 batteries in U.S. is expected to be increased vastly & rapidly," commented Jason Hu, Board Chairman and CEO of World Mobile.

About World Mobile Holdings Inc: World Mobile Holdings, Inc. provides effective processed system, and customized systems integration, such as, integration of Surveillance Systems & Multimedia Signage, integration of Lithium-Iron Battery (LiFePO4) Modules, and systems for nursing & medical centers. Cooperating with the world's leading wireless operators, World Mobile's B to B business model has valuable assets to assist the major wireless operators around the world in fulfilling their needs of 3.5G and 4G / 5G wireless information services in order to satisfy their customers.

MVTG is a perfect stock for this group.

AS 100M

OS 57 M

3 issued patents.

1 for an entire new generation of fuel cell, that is smaller, lighter and a fraction of the cost of next best fuel cell on the market. It can run on liquid formic acid.

#2 and #3 patents, issued also, cover a reactor that converts CO2 into formic acid using renewable power, electricity, at a profit. 20% ROI with out any carbon capture credit value included.

The french version of GE, Alstom, 93,000 employees in 70 countries that designs and builds power plants, including nuclear, and transportation systems, high speed trains, just turned on the largest offshore wind turbine (they built) in the world, and is now paying MVTG (Real revenue for MVTG now) to do R&D on improving the ERC efficiency and expanding the product family for converting CO2 into organic chemicals.

MVTG is a massive sleeper.

$MINE Growing LEVEL 5 Beverage subsidiary. Products can be found now on Amazon.com. Completed test market of product in S. California with rave reviews, SOLD OUT. LEVEL 5 is now a feature on Facebook.

Powered by POWER BRANDS LLC.

http://www.powerbrands.us/portfolio.htm

Stock has been accumulating for over a month in the .0030 range.

Expecting HUGE ANNOUNCEMENT THIS AFTERNOON, allowing for California time.

Perfect MID-LONG Accumulate and HOLD.

It did indeed bounce...:) CABN

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=91869067

Lots of IFUS news this weekend, and IFUS closed up 3 days in a row now!!!!

IFUS charts scream buy

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92485413

Check out the new ad for IFUS live stock feed!!!!! On Alibaba!!!!

http://www.alibaba.com/product-free/148703167/Supreme_Gold_Plus.html

More IFUS news on the facebook web site for IFUS

https://www.facebook.com/pages/Impact-Fusion-International/372113976153315

IFUS needs to more likes to hit 200!!!! It was just 100 not long ago.

"We have had over 100,000 hits on our sight in the last 24 hours of people viewing the video on "CDC Reveals Disturbing Truth about Factory Farms and Superbugs". If you are having trouble with H.Plori in these transitioning months, try our Natural H.Pylori Value Pack. It works in 24 hours with no drugs or drug interaction. All of our products are in stock and ready to ship!! 888-443-3335"

MHTX NEWS OUT

http://finance.yahoo.com/news/manhattan-scientifics-announces-initiation-coverage-133000518.html

NEW YORK--(BUSINESS WIRE)--

Manhattan Scientifics Inc. (MHTX) announced today that SeeThruEquity, LLC has initiated coverage on the Company. The report is now available for viewing at the following link.

“We initiate coverage on Manhattan Scientifics, Inc. (“MSI”) with a price target of $0.14 per share. MSI is focused on technology transfer and the commercialization of transformative technologies in the nanotechnology space. MSI is currently focused on two opportunities, one in nanostructured metals technology through wholly-owned subsidiary Metallicum Inc., and the other in nanoparticle based cancer detection through wholly owned subsidiary Senior Scientific LLC. With one licensing deal already in place, others in negotiation on the metals technology side of the business and commencement of product trials on their cancer detection product slated for 2014, MSI has numerous revenue drivers and catalysts through the 2014-2015 timeframe,” remarked Ajay Tandon, Director of Research at SeeThruEquity, LLC.

A very nice posting on all the prospects that lie ahead for MHTX here. The only part which is not entirely made clear to others is...

MHTX is contracted to receive a minimum of $9.5 million in royalties from Carpenter during the period 2015-2017 of which there is no guaranty. After chatting with big wigs at MHTX they told me that the 9.5 million is theirs already, but no guarantee production will actually take hold. But as I discovered already MithralMRX already on the CRS European line of Titanium alloys for sale we know it is just around the corner now.

The other thing not entirely clear is when Legg Mason and his 2 buddies bought the $300,000 in stock they also had the insight of purchasing last year, optionally if desired, the remaining 10% of MHTX stock which was the 50 million still left at that time. He did not become among the top 5 riches stock investors in history for making bad deals. Why else would he loan them the 2.5 million for them too a few months back for the production of the first two NanoMRX Cancer machines.

I'd like to request the honor of posting your sight I just found here on the MHTX boards. I am a very heavy investor with them at 2 million shares now, with another 1.81 million Private Placements in a matter of days now too... :)

I was a whole lot more impressed with the results I got taking the IFUS intact digest.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=91843088

http://investorshub.advfn.com/Ecomikes-Favorite-stock-picks-and-Stock-DD-topics-26971/

Be warned I am still looking for an IFUS-Basher Vaccine for IHUB ticker boards like IFUS, IFUS is infested with the worst of them LOL.

I just listened to that whole interview and I gotta say I was very impressed. I will be checking out these products.

Warning, before you buy IFUS shares,

listen to this message!!!! ![]()

|

Followers

|

51

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

974

|

|

Created

|

06/03/11

|

Type

|

Free

|

| Moderator FergusVI | |||

| Assistants WakingBake | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |