Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi. JP i hope you didnt give up. I have been getting emails from GC selling poop meds for 350 bucks under tollo health in tampa bay. Sick em tiger. I know you will. And thank you

For the few here that understand PASC and viral persistence--remember when Drs were seeing EBV reactivate in PASC patients.

And me (for example) stated there would be more chronic conditions that would be "illuminated" and the whole covid nightmare--the 1 possible benefit might be other conditions being looked at as a result of viral persistence and bad gut microbiome--instead of Drs and scientists just trying random Rx that only masks symptoms

And what shakes out--only this--https://answers.childrenshospital.org/crohns-epstein-barr/

GEEZ the wheels turn slow

Did we add another zero to the price yesterday??????

All the zeroes walked out the door.

Did this ticker add a couple of zeros in front of it while I was gone?????

TOMDF up an infinitesimal fraction today, so we got that going for us.

LONG COVID...... hmmmmmm NEVER HEARD OF IT

Thanks for signing up to reply to that post.

IF you took time to read the link--it is about long covid. If you understand PASC??

Not covid mortality or flu death.

FLU KILLING MORE PEOPLE THAN COVID reported today

https://www.latimes.com/opinion/story/2025-02-16/long-covid-research-funding

YEARS later--still waiting on trials

still waiting on Rx

Gerald Commissiong appeared on the Liz Claman Countdown, Jan. 11, 2022, so we got that going for us.

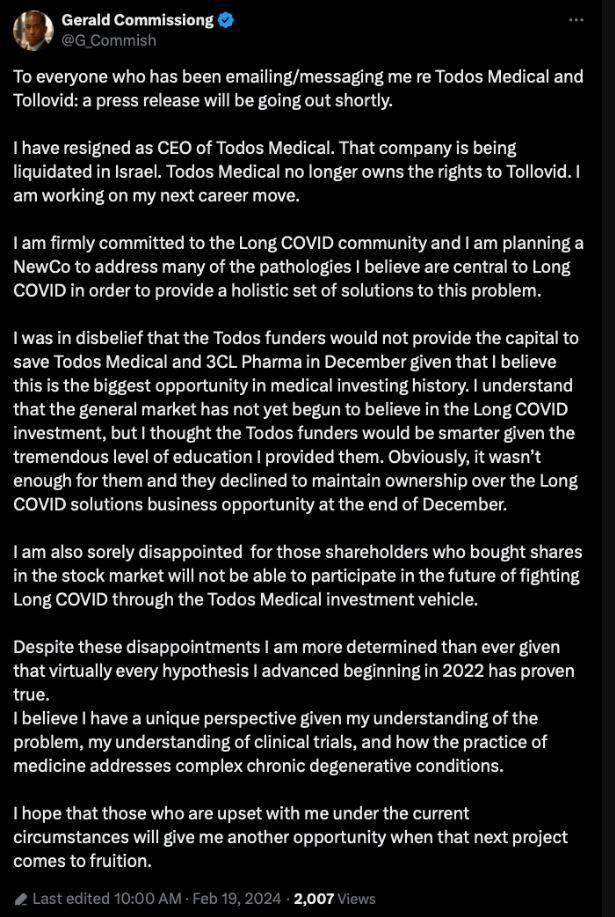

Gerald Commissiong most definitely used the Gaza war …

as an excuse for his failed Tollovid/vir scam and royal fleecing of his faithful and gullible shareholders and investors

all in an effort to fund TOMDF’s back office management under the tutelage of JF and the Astoria, Queens financial mafia

not once but twice - which was the same scam also orchestrated under his AMBS playbook

when the last TOMDF scam ran its course, JF and the boys threw Gerald under the bus as their personal scapegoat, douche bag and useful idiot hangman

but Gerald didn’t give a flying fork, as they had him greased-up like a well oiled mechanical ball bearing and tool-set flunky

Gerald is nothing more than a hack, liar, thief, and a conman - plain & simple

he and his ilk should be behind bars

must say thought that his pumpers were relentless in their efforts all on his benefit…!

AJMHO

Now that the "war" is in ceasefire, GC can renew confidence in some gullible investor(s).

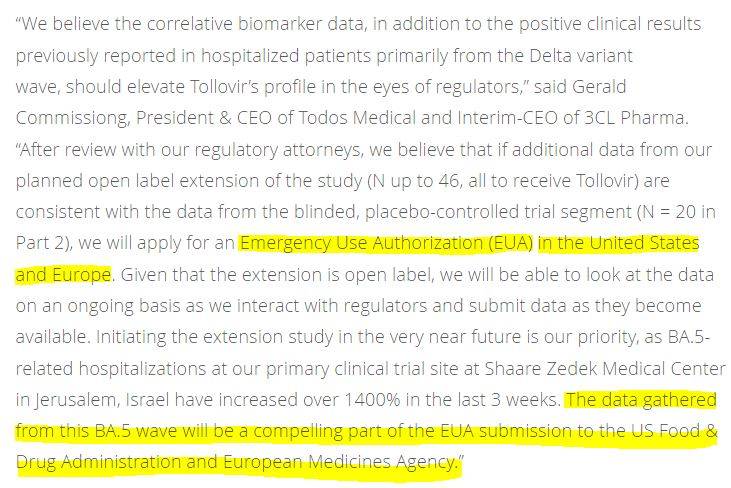

He reported the main investor funding the NLC Pharma spinoff backed away when the war broke out. I'm not sure if this means the investor was from Israel, or simply didn't feel comfortable investing in the spinoff of an Israeli company during a time of war. Understandable in either case... too many uncertainties. It would be great if that investor moved forward on that front after the war is over. Tollovid and Tollovir would benefit a lot of people in the world. I hope they can figure out a way to make it happen.

I don't think he used the war as the excuse, only as a factor in the outcome. The Twitter post is copied on this board if you want to look it up. I think I'm the one who posted it. The former CEO taking the company into insolvency court over unpaid backpay he claimed was owed him is what ended this. Had the spinoff gone through, the insolvency hearing would likely have had a different outcome and the company would have survived.

The company's cash cow with Covid testing dried up as the government and hospitals moved away from testing when the government announced the pandemic was over. Covid testing of wastewater streams around the world tell a much different story, however. And Tollovid sales helped in revenues, they weren't substantial enough to make a difference. The price started at $379 per bottle and slowly worked down to $99 per bottle, probably due to both lower demand at the higher price and scaling for larger production runs to reduce cost per bottle. It was a great product and I wish I still had access to it.

I have to believe had the spinoff been successful, Todos investors would at least have had the option to exit their position little or no loss regardless of whether the company succeeded or failed afterwards.

I took a big loss here. My decision, my ownership. But I did get a nugget from GC about Novavax, and I took a large position there. I've swing traded the stock over the last 5 weeks and picked up over $40,000 in free NVAX shares. I converted the NVAX shares to my Roth account on Friday at the lowest share price since the Sanofi partnership deal was announced. No state taxes on the conversion for me, only federal. I think it will do extremely well and I expect to fully recover my Todos loss with Novavax.

I'm already testing my investment strategy beyond Novavax using leveraged ETFs and an algorithm I've studied for a long time, which in testing historical price data with a number of ETFs has shown average annual returns ranging from 35% to 68% over the most recent 5-year periods. So I'll likely be heavy into that model next. Best part is I don't have to sit in front of my computer, as I've designed it so it requires only about 15 minutes/month on average per investment. 😎

Did Gerald Commissiong use "war" as an escape hatch?

Not so sure a spinoff would have made any difference -- when expenses continuously exceed income then bankruptcy is the only option other than GC's excuse that creditors lost faith.

100%. I still have 1 unopened bottle and about half of another

The issues in Israel ruined the potential of the product alongside the thousands of lives ruined from politics/hate that seems never ending

I too hope Dr Arad finds a path to her project and gets success helping people that need a sustainable 3CL Protease Inhibitor for treatment

No argument there. I really thought this would succeed, especially with the science of Dr. Arad behind the products. Still, I wonder how this might have turned out had there been no breakout of war with Israel just prior to the planned spinoff. The NLC Pharma spinoff probably would have prevented the insolvency altogether.

Shit happens. Live and learn. I wish I still had access to Tollovid.

Agree, but Gerald Commissiong was not up to the task.

Stuart Varney gave him an excellent opportunity. TODMF shot up to 8 cents and then Long Agony took precedence over Long Covid.

It's too bad the Tollovid product didn't survive the Todos Medical insolvency. It was a product that helped a lot of Long Covid patients. It didn't work for everyone, but impacts reportedly ranged from little/no improvement to total recovery. I suspect those with little to no improvement probably took it for a short time, saw no improvement, and stopped taking it. Hindsight has shown it typically required several weeks or months of continued treatment to start to see improvements.

Tollovid was one of the approved Long Covid treatments administered by RTHM Direct, a team of degreed and licensed medical professionals whose focus is on providing a comprehensive set of treatments, labs, and guidance for complex illnesses like Long Covid, ME/CFS, MCAS and POTS. Sadly it is no longer listed as one of their treatments because when their supply was exhausted it was no longer being manufactured.

Author Alisa Valdez was the poster girl for Tollovid for a time, posting details of her serious Long Covid issues and her full recovery while taking Tollovid as a participant in a Long Covid study sponsored by Todos Medical in which she was provided free Tollovid in exchange for documenting the impact on her condition. She reported an amazing full recovery and return to a normal life, but then wound up in the hospital, and publicly blamed Tollovid. An investigation revealed she had given part of her free Tollovid supply to friends. She ran out of Tollovid and then purchased Gromwell root powder from Amazon and ingested it believing it would work the same as Tollovid. This caused liver damage that resulted in her hospitalization. Unfortunately, she blamed Tollovid for her condition after the company refused to replenish her supply of Tollovid for free. Todos revealed her actions that violated her agreement with the company and invalidated their study. She soon went silent on her claims after her actions were revealed by the Todos CEO on Twitter.

I took Tollovid on a daily basis for almost 2 years, and not only did I remain protected against Covid infections when everyone around me at work was getting infected, but also eliminated a long-standing issue with a chronic cough.

I hope Dr. Arad can find a way to get Tollovid back on the market to help Long Covid patients, and get Tollovir into a clinical trial for hospitalized Covid patients. People are still dying from Covid, so there is still a need for Tollovir over what's currently being used for treatment.

Not to worry, with that information Gerald Commissiong will make stockholders a fortune.

TOMDF stock is a steal right now.

BNO News @BNOFeed OCT 06

Weekly U.S. COVID update:

- New cases: 91,800 est.

- Average: 122,641 (-18,476)

- In hospital: 4,187 (-470)

- In ICU: 509 (-42)

- New deaths: 1,209

- Average: 1,254 (-86)

ANALYSIS: So far this year, more than 5.6 million COVID cases have been reported in the U.S., causing at least 381,888 hospitalizations (partial data) and 45,132 deaths.

Only 32.8% of hospitals in the U.S. submitted COVID data this week, which is similar to last week but down from 91% in early May. This means actual case numbers and hospitalizations are substantially higher than reported.

Thank goodness covid is over and covid is just like the flu--some levels of stupidity are amazing

Worthless??? NFL Hall of Famer Michael Irvin is an Ambassador for Tollovid

https://www.globenewswire.com/en/news-release/2022/09/16/2517590/0/en/Todos-Medical-Announces-NFL-Hall-of-Famer-Michael-Irvin-as-Tollovid-Sports-Ambassador-for-TolloUp-Campaign.html

WoW where can I buy more of those worthless TOMDF shares...?

what hooie...!

Jon Najarian interviews Gerald Commissiong (CEO Todos Medical). Looks promising for Long Covid.

What fantasy world do you live in? Good luck suing me for anything I posted. I was invested in MONI at one point for a brief period but then sold at 0.053 for a small loss. Glad I exited that pile of 💩. Even after your 500% run-up in price, it's still at 0.03. I hope this time the new merger is real and shareholders benefit, but again I ask why any entity would want to associate themselves with a company like MONI and retain their shadowy legal counsel. If I'm wrong, I'll admit it, but you're all ready to call it a glowing success with the share price only at 3 cents. Perhaps you should look at the MONI chart and see if it matches the pump-and-dump pattern you claim here. We both know the answer, don't we?

I don't recall explicitly recommending anyone sell MONI but I did post my opinion that it was a scam and has been for it's entire existence through various company name changes. Then I posted links to their corporate counsel, who has a long history of involvement with pump-and-dump companies. Can you honestly tell me you read his history and didn't have concerns? Or was your head stuck in the sand like everyone else there?

So show me the post you claim. And tell me again how anyone taking investment advice from a complete stranger on a message board is not a complete moron. I'll go one further and state that anyone who believes anyone else is responsible for their own investment choices is also a moron, and a very naive investor. I think we have a few on this board. How exactly does that work? Is it...

1. I'm a novice investor and will blindly follow advice from a stranger on a message board.

2. I'm a lazy investor and will do no DD of my own, but will accept what is posted on a message board, without question, and make my investment decisions accordingly.

3. I'm an immature person and never learned to accept responsibility for my own decisions. I find there are plenty of individuals to blame if I lose money in ANY situation in life.

You've also called Novavax a pump-and-dump. I guess that's why Sanofi invested $1.3 Billion dollars with them to license their Covid vaccine and adjuvant technology. Too bad the Sanofi team isn't as keen as you. I wonder if they looked at the stock chart. LMFAO

Here's the latest update on my Todos Medical Investment Loss Recovery Plan. I expect the overall return to change dramatically for the better by end of year as planned announcements are made. I've stopped investing my own money here but have increased my share position over the last few weeks by 13.2% by swing trading a portion of my shares. The current value of these "free" shares is $37,800. I will continue this process of accumulating free shares until the short-sellers exit the stock. And my very positive outlook and posts on the stock haven't changed one iota during the time I have been invested.

Again, thanks to GC for turning me onto the excellent Novavax Covid vaccine. Two years of protection lasting far longer than mRNA options, with zero side effects. Looking forward to the upcoming Combined Influenza-Covid vaccine and will be adding that to my annual regime.

Still waiting for the geniuses still posting here (extreme sarcasm) to explain how I'm a P&D'er. Clearly ignorance is running amuck here. Let me educate you a little.

Investopedia: How Does a Pump-and-Dump Scam Work?

A pump-and-dump scam is the illegal act of an investor or group of investors promoting a stock they hold and selling once the stock price has risen following the surge in interest as a result of their endorsement.

KEY TAKEAWAYS

• Pump-and-dump is a scheme that attempts to boost the price of a stock through recommendations based on false, misleading, or greatly exaggerated statements.

• The favored medium of communication for traders involved in pump-and-dump is social media platforms or anonymized messaging apps like Telegram and Discord.

• Promoters of the scheme will then begin to coordinate rumors, misinformation, or hype in order to artificially increase interest in the security, driving up its price.

• Then, once the price of the stock has been increased sufficiently by unsuspecting marks, the promoters then sell the stock at high prices.

It is clear the intent of a pump-and-dump scheme is to MAKE MONEY, correct? So if a person loses almost all of their investment, how are they a pump-and-dumper? I'm still waiting for the intellects here to explain that, while at the same time claiming this was a pump-and-dump stock. Seriously, answer the question. Or continue to post false claims based on ignorance and personal bias. Some here are blaming others for their losses. Some here lost in GC's previous company, Amarantus, and yet invested again. How is that anyone's fault besides your own?

I posted the news of Todos Medical's insolvency hearing in Israel. I held my shares for a few months to see how that worked out. I sold my shares over 4 days in February 2024 and posted here that I have exited my entire position. I've posted my losses and how I intend to recover those via an investment in Novavax, where I rolled the approximately $8K I recovered from my Todos shares. So once again I ask, how was this a pump-and-dump scheme and where did I profit?

Summary of my closed TOMDF positions with Fidelity, printed today. See any profits in my TOMDF sales? Time for the geniuses to step up and enlighten the board on how this was a pump-and-dump. Enlighten us.

Love it. Nice to see other people exposing them

Just pulling the chain of the P+D'ers.

Maybe the creditors will feel bad that Gerald Commissiong criticized them for not having enough confidence in his ability to prolong the inevitable.

Just remembered Carlos Santana and his wife Cindy are using Tollovid.

SUN UPDATE

BNO News @BNOFeed

Weekly U.S. COVID update:

- New cases: 117,284 est.

- Average: 141,118 (-15,072)

- In hospital: 4,657 (-317)

- In ICU: 551 (-38)

- New deaths: 1,213

- Average: 1,340 (-12)

BNO ANALYSIS: So far this year, more than 5.5 million COVID cases have been reported in the U.S., causing at least 375,971 hospitalizations (partial data) and 43,923 deaths.

U.S. reports more than 1,000 new COVID deaths for the 7th week in a row

Interesting the Pump and Dumpers haven't come back to this page much, but are doing another P&D on another Covid Stock. Hmmm, makes you wonder. #0.000001 WOOOOOOOOOWWWWWWWW. How many zeros is that???

WHAT IS GOING ON WITH THIS 2022-2023 PUMP AND DUMP. Funny, the P&D'sters were on other pages warning people before the stock ran 400%. Maybe they should be on here warning people so this stock can run 400%. #YOUCANTMAKETHISSTUFFUP

MON NITE

BNO News @BNOFeed

Sep 22

Weekly U.S. COVID update:

- New cases: 131,271 est.

- Average: 156,190 (-10,796)

- In hospital: 4,974 (-325)

- In ICU: 589 (-36)

- New deaths: 1,360

- Average: 1,352 (+71)

BNO ANALYSIS: So far this year, more than 5.4 million COVID cases have been reported in the U.S., causing at least 369,739 hospitalizations (partial data) and 42,710 deaths.

I see what you're doing and....

I'm not going to take your bait and spar with you...!

but here is the "end result" of all your serial pumping, along with that of the TOMDF Back Office Boiler Room Pump Boys:

SMH - who knows, maybe a few pictures will help you to finally get the message...!

and if pictures don't help, here's some words that may...!

TOMDF Sham Exposed in 200 Chronological Order PR’s:

Todos Medical Announces Insolvency Proceedings in Israel

Dec 22, 2023 5:28pm EST

Todos Medical Provides Corporate Update: Retooling to Focus on Long COVID Epidemic

Sep 26, 2023 11:01am EDT

Todos Announces Notice of Allowance From USPTO for Patent Application Covering Use of Compositions In Tollovid™ and Tollovir™ Ingredients

Aug 30, 2023 8:19am EDT

Todos Medical Enters Into Letter of Intent for Provista Diagnostics to License PCR-based Sepsis Diagnostic Test AcuSept LDT Rights From Acumen Diagnostics

Mar. 28, 2023

Todos Medical Begins Trading on the OTC Pink Marketplace

Mar. 27, 2023

Todos Medical Supports Long COVID Awareness Day

Mar. 15, 2023

Todos Medical Enters Into Moratorium on Conversions Agreement With Convertible Note Holders

Mar. 13, 2023

Todos Medical Initiates Validation Plan for PCR-based Avian Influenza A (H5N1, Bird Flu) Test at CLIA/CAP Testing Lab Provista Diagnostics

Feb. 14, 2023

Todos Medical to Present at the RHK 2022 Disruptive Growth Conference

Dec. 06, 2022

Todos Medical’s 3CL Pharma Awarded Oral and Poster Presentations at World Antiviral Congress 2022

Nov. 29, 2022

Todos Medical to Attend World Antiviral Congress

Nov. 22, 2022

Todos Medical Enters Into Exclusive Worldwide Automated Retail Supply Agreement With Smart Automated Retail Network

Nov. 16, 2022

Todos Medical Terminates Tollovid™ Products License & Distribution Agreement with T-Cell Protect Hellas S.A.

Nov. 10, 2022

Todos Medical CLIA/CAP Lab Provista Submits Emergency Use Authorization Application for MonkeyPox PCR Test to US FDA

Oct. 14, 2022

Todos Medical Announces Successful Pilot Launch of Suite of PCR Testing Services by CLIA/CAP Lab Provista Diagnostics

Oct. 06, 2022

Todos Medical Receives Two Notices of Allowance from USPTO for AI-Based TBIA Pan-Cancer Blood Diagnostics Platform

Sep. 30, 2022

Todos Medical Announces USPTO Trademark Notice of Allowance for 3CL Protease Biomarker Diagnostics TolloTest™

Sep. 27, 2022

Todos Medical Enters Into $50M Contract to Supply Tollovid™ and CBD Products to Retail Distributor Company Nerd Hemp

Sep. 22, 2022

Todos Medical Announces NFL Hall of Famer Michael Irvin as Tollovid™ Sports Ambassador for #TolloUp Campaign

Sep. 16, 2022

Todos Medical Announces Preprint of Long COVID Case Study Participant with Confirmed Microclot and Hyperactivated Platelets who Benefitted from Tollovid

Sep. 15, 2022

Todos Medical & The Alchemist’s Kitchen to Host “Long COVID: An Integrated Approach” Event Benefitting Survivor Corps

Sep. 13, 2022

Todos Medical’s 3CL Protease Inhibitor Supplement Tollovid™ Featured in Wellness Magazine

Sep. 13, 2022

Todos Medical Partner NLC Pharma Assigns IP for Tollovir™, Tollovid™, and TolloTest™ into JV 3CL Pharma

Sep. 12, 2022

Todos Medical CEO Discusses Long COVID Economic Impact with Moneta Advisory Managing Partner Marc LoPresti

Sep. 09, 2022

Todos Medical Announce Kingcarlx as Brand Ambassador for the Tollovid #TolloUp Lifestyle Campaign

Sep. 02, 2022

Todos Medical Establishes Botanical Supplement Manufacturing Capabilities to Support Tollovid Global Expansion and Initiates CBD-A Production

Aug. 31, 2022

Todos Medical Expands COVID Onsite School Sample Collection to Include MonkeyPox Testing

Aug. 29, 2022

Todos Medical Announces Saliva-Only MonkeyPox Testing at CLIA/CAP Clinical Lab Provista Diagnostics

Aug. 26, 2022

Todos Medical Enrolls Female Long COVID Patient Unable to Secure Testing While Symptomatic for MonkeyPox into Provista Diagnostics Case Study Series

Aug. 25, 2022

Todos Medical Initiates MonkeyPox Diagnostic Case Studies After Being Approached by 4 Patients, Including 3 Women

Aug. 23, 2022

Todos Medical Announces Commercialization of Lesion and Saliva-Based MonkeyPox PCR Testing

Aug. 22, 2022

Todos Medical Announces Preprint of Data from First 100 Participants in IRB-waived Market Research Study of Supplementation with Tollovid in Long COVID

Aug. 19, 2022

Todos Medical Reports Pre-Print of Publication Detailing Tollovid Supplementation Following COVID-19 mRNA Vaccination in Long COVID

Aug. 15, 2022

Todos Medical Completes Trial Design for Tollovid™ Long COVID Clinical Study in Adults

Aug. 11, 2022

Todos Medical Announces PCR Validation of Wound and Respiratory Pathogen Panels at CLIA/CAP Lab Provista Diagnostics

Aug. 10, 2022

Todos Medical Announces First Two Contracts for PCR-based MonkeyPox Testing at CLIA/CAP Clinical Testing Laboratory Provista Diagnostics

Aug. 08, 2022

Todos Medical Announces First Long COVID Clinic Laboratory Services Agreement for Long COVID Panel Biomarker Partnership with Amerimmune Diagnostics

Aug. 05, 2022

Todos Medical Initiates Validation Plan for PCR-based MonkeyPox Test at CLIA/CAP Clinical Testing Laboratory Provista Diagnostics

Aug. 03, 2022

Todos Medical Announces Preprint of Acute COVID-19 Paxlovid Rebound Rescued by Tollovid

Aug. 01, 2022

Todos Medical Partners with Amerimmune Diagnostics on Long COVID Biomarker Panel

Jul. 28, 2022

Todos Medical Announces Preprint of Chronic Long COVID Case Study #8 of Paxlovid® Treatment Followed by Tollovid™ Dietary Supplementation

Jul. 22, 2022

Todos Medical Reports Case Study #7 in Acute and Long COVID

Jul. 12, 2022

Todos Medical Announces Positive Biomarker Data from Phase 2 Trial of Tollovir in Hospitalized COVID-19 Patients

Jun. 30, 2022

Todos Medical Releases Preliminary Data From IRB-Waived Tollovid® Market Research Study in Acute and Long COVID

Jun. 23, 2022

Todos Medical Retains Moneta Advisory Partners as Strategic Advisors for National Exchange Listing and 3CL Pharma Spinoff

Jun. 21, 2022

Todos Medical Completes Validation of 27 Pathogen UTI PCR Panel at Its CLIA/CAP Laboratory Provista Diagnostics

Jun. 13, 2022

Todos Medical Reports Day 45 Update for Case Study #6

Jun. 10, 2022

Todos Medical Reports Day 28 Update for Case Study #5 with Erectile Dysfunction

Jun. 07, 2022

Todos Medical Announces Enrollment Complete for Confirmatory Cohort of LymPro Alzheimer’s Blood Test Clinical Validation Trial vs. Amyloid PET

Jun. 03, 2022

Todos Medical Reports Day 26 Update For Case Study #4

Jun. 01, 2022

Todos Medical to Present Final Data from the Tollovir Phase 2 Clinical Trial in Hospitalized COVID-19 Patients at the Personalized Medicine World Conference

May 27, 2022

Todos Medical Reports Day 14 Update from Ongoing 30-Day Case Study of Paxlovid Rebound Patient

May 06, 2022

Todos Medical Receives New FDA Certificate of Free Sale for Tollovid® Max Strength Including 5 Day Dosing, 30 Day Dosing and 3CL Protease (3CLpro, Mpro, Nsp5) Inhibitor Claim

May 02, 2022

Todos Medical Initiates IRB-Waived Tollovid Market Research Study and Announces 50% Price Reduction Until May 30th, 2022

Apr. 27, 2022

Todos Medical Appoints Philippe Goix as Chief Commercial Officer for Provista Diagnostics

Apr. 21, 2022

Todos Medical Reports 2nd Long COVID Case Study and Launches Website for Physicians and Pediatricians to Indicate Interest in Participating in Tollovid Long COVID Clinical Study

Apr. 20, 2022

Todos Medical Targets Athlete Support with Informed Sport Certification for Tollovid by LGC Group

Apr. 19, 2022

Todos Medical Applauds White House Initiative on Long COVID and Announces New Tollovid® US FDA Certificate of Free Sale with Daily and Acute Dosing on the Label

Apr. 06, 2022

Todos Medical Announces Positive 3CL Protease Inhibition In Vitro Data Against BA.1 and BA.2 Omicron SARS-CoV-2 Variants

Apr. 04, 2022

Todos Medical Reports Case Study of Patient with Long COVID

Mar. 31, 2022

Billy Blanks® Endorses Todos Medical’s Line of Tollovid® Products

Mar. 28, 2022

Todos Medical Completes Acquisition of Key Assets and Intellectual Property from NLC Pharma

Mar. 16, 2022

Todos Medical Appoints Greg Meiselbach as Vice President of Government Affairs

Mar. 08, 2022

Todos Medical and NLC Pharma Announce Primary and Secondary Endpoints Met in NLC-V-01 Phase 2 Clinical Trial of Oral Antiviral 3CL Protease Inhibitor Tollovir™ in the Treatment of Hospitalized COVID-19 Patients

Jan. 27, 2022

Todos Medical Announces Data Lock in Tollovir Phase 2 Clinical Trial for the Treatment of Hospitalized COVID-19 Patients

Jan. 24, 2022

Pepperdine University Hosts the 22nd Annual Celebrity Flag Football Challenge®, Presented by Todos Medical’s Tollovid®

Jan. 19, 2022

Todos Medical Releases Videos of Recent CEO Interviews with Fox Business, NewsMax and Black News Channel on COVID Testing & Treatment Strategies

Jan. 18, 2022

Todos Medical to Announce Topline Results from Tollovir™ Phase 2 Clinical Trial from the Treatment of Hospitalized COVID-19 Patients on January 27th, 2022

Jan. 12, 2022

Todos Medical CEO to Appear on Fox Business to Talk COVID Testing & Tollovir on Tuesday, January 11, 2022 and is Presenting at Biotech Showcase 2022

Jan. 10, 2022

Todos Medical Records Record Weekly COVID PCR Testing Volumes at Provista

Dec. 27, 2021

Todos Medical CEO to Appear on Yahoo Finance Live! at 12:10PM EST with Akiko Fujita to Talk Pfizer’s Paxlovid Approval, Tollovir™ Phase 2 & COVID Testing

Dec. 23, 2021

Todos Medical Announces New cPass Neutralizing Antibody Testing Reference Lab Agreement for CLIA/CAP Lab Provista with Physician Group in 40 States

Dec. 22, 2021

Todos Medical Appoints Valentino Smith, MBA as Vice President of Marketing

Dec. 20, 2021

Todos Medical Announces “Test & Tollovid®” Holiday Package for Atlanta Area at Provista Diagnostics

Dec. 17, 2021

Todos Medical to Host Key Opinion Leader Webinar Entitled Tollovir™: a Potential Treatment for Covid-19

Dec. 16, 2021

Todos Medical Enters 90-Day Extension of Agreement with Convertible Note Holders on Moratorium on Conversions of Convertible Notes

Dec. 13, 2021

Todos Medical Interview and Presentation on Benzinga's All Access Conference Live December 14th at 10:20 AM EST

Dec. 10, 2021

Todos Medical Announces 2 New COVID-19 PCR Testing Reference Lab Agreements for CLIA/CAP Lab Provista Diagnostics

Dec. 07, 2021

CEOs Presenting at the Emerging Growth Conference on December 8; Register Now

Dec. 07, 2021

Todos Medical to Present at Upcoming Emerging Growth Conference

Dec. 06, 2021

Todos Medical Announces All 31 Patients Enrolled to Date in Tollovir® Phase 2 Clinical Trial in Hospitalized COVID-19 Patients Have Completed Study Participation

Dec. 02, 2021

Todos Medical Confirms SARS-CoV-2 PCR Test Kits Used at CLIA/CAP Lab Provista Diagnostics Detect Omicron Variant

Nov. 30, 2021

Todos Medical Enters into Binding Agreement to Acquire All 3CL Protease Biology-Related Assets and Intellectual Property from NLC Pharma

Nov. 29, 2021

Todos Medical Receives Purchase Order for 50,000 Bottles of Tollovid Daily from Its European Distribution Partner T-Cell Protect Hellas S.A for Initial Market Launch in Greece

Nov. 22, 2021

Todos Medical Announces Completion of Enrollment for COVID-19 Oral Antiviral 3CLPro (Mpro) Inhibitor Tollovir Phase 2 Clinical Trial Interim Analysis in Severe and Critical Hospitalized Patients

Nov. 19, 2021

Todos Medical Announces Tollovid® Products Exclusive License & Distribution Agreement with T-Cell Protect Hellas S.A. Covering 30 Countries in Europe

Nov. 18, 2021

Todos Medical Announces Addition of Semi-Quantitative Titer Claims to the Emergency Use Authorization for the cPass Neutralizing Antibody Test

Nov. 17, 2021

Todos Medical’s Provista Laboratory to Boost Top Line Through New Atlanta-based Reference Lab Agreement for COVID PCR, cPass Neutralizing Antibody & Respiratory Pathogen Panel Tests

Nov. 16, 2021

Todos Medical Reports Third Quarter 2021 Business and Financial Results

Nov. 15, 2021

Todos Medical Sees Significant Ramp Up in COVID PCR Testing Volume at Its Provista CLIA/CAP Lab with New Automation in Place

Nov. 02, 2021

Todos Medical Announces 2nd Clinical Trial Site for Tollovir Phase 2 Clinical Trial for the Treatment of Hospitalized COVID-19 Patients

Nov. 01, 2021

Todos Medical Announces Publication in Nature Neuroscience That Describes the Main Protease (3CL Protease) Causes Microvascular Brain Pathology

Oct. 25, 2021

Todos Medical Announces Publication in Journal of Clinical Virology Highlighting Clinical Utility of cPass Semi-Quantitative Neutralizing Antibody Test in SARS-CoV-2 Risk Assessment Post-Vaccination or Recovery from Infection

Oct. 21, 2021

Todos Medical to Conduct Webinar Highlighting the cPass SARS-COV-2 Neutralizing Antibody Test for AMDA, The Society for Post-Acute and Long-Term Care Medicine, on October 22, 2021 at 12:00 PM EDT

Oct. 14, 2021

Todos Medical Announces Positive Data in Hospitalized and Outpatient Setting for TolloTest™, a Novel SARS-CoV-2 3CL Protease Biomarker Assay

Oct. 06, 2021

Todos Medical Provides Update on COVID-19 Oral Antiviral 3CL Protease (Main Protease) Inhibitor Tollovir Clinical Development Program in Light of Molnupiravir Clinical Trial Data from Merck

Oct. 04, 2021

Todos Medical Announces Positive Observational Trial Results for Oral Antiviral 3CL Protease (MPro) Inhibitor Tollovir®

Sep. 30, 2021

Todos Medical Receives Approval by Amazon to Sell Immune Supplements Tollovid® & Tollovid Daily™

Sep. 27, 2021

Todos Medical Reports Second Quarter 2021 Financial Results

Fri, Sep. 24, 2021

UPDATE: Todos Medical Announces 90-Day Moratorium on Conversions of Convertible Notes and Lockup of Common Stock Sales with Convertible Note Holders

Sep. 24, 2021

Todos Medical Launches Tollovid Daily™ via Subscription at MyTollovid.com

Sep. 23, 2021

Todos Medical Receives Trademark Notice of Allowance from USPTO for Its 3CL Protease Inhibitor Oral Antiviral Drug Candidate Tollovir™

Sep. 20, 2021

Todos Medical Now Accepting Cryptocurrency for the Purchase of Tollovid® and Tollovid Daily™ Through Coinbase Commerce

Sep. 17, 2021

Todos Medical Announces 90-Day Moratorium on Conversions of Convertible Notes and Lockup of Common Stock Sales with Convertible Note Holders

Sep. 15, 2021

Todos Medical’s CLIA/CAP Lab Provista Completes Validation of Combination COVID, Influenza A & B, RSV & hMPV Respiratory Panel Test

Sep. 01, 2021

Todos Medical’s CLIA/CAP Lab Provista Completes Validation of High-Capacity SARS-CoV-2 Variant Testing Service Capable of Identifying Known Variants

Aug. 26, 2021

Todos Medical’s CLIA/CAP Lab Provista Enters Into Reference Lab Agreement with Meadowlands Diagnostics to Provide cPass Neutralizing Antibody Blood Testing for Quantifying and Monitoring Key COVID-19 Immunity Biomarkers

Aug. 24, 2021

Todos Medical Completes Validation of cPass Neutralizing Antibody Blood Test at Provista Diagnostics to Quantify and Monitor Key Biomarkers of COVID-19 Immunity

Aug. 23, 2021

Todos Medical CEO to Appear on Fox Business Network Varney & Company Today at 11:40am to Discuss the Company’s Launch of cPass Neutralizing Antibody Testing for Monitoring COVID-19 Immunity

Aug. 23, 2021

Update: Todos Medical Receives Trademark Notice of Allowance from USPTO for Its 3CL Protease Inhibitor Dietary Supplement Tollovid™

Aug. 05, 2021

Todos Medical Receipt Notice of Allowance from USPTO for 3CL Protease Inhibitor Dietary Supplement Tollovid™

Aug. 05, 2021

Todos Medical Makes Final Payment to Close Provista Diagnostics Acquisition

Aug. 02, 2021

Todos Medical Retains CRO for COVID-19 Outpatient and Inpatient Phase 2/3 Clinical Trials for Oral Antiviral 3CL Protease Inhibitor Tollovir

Jul. 28, 2021

Todos Medical Receives New FDA Certificate of Free Sale for Tollovid Daily™ Including 3CL Protease Inhibitor Claim

Jul. 22, 2021

Todos Medical to Launch EUA Authorized cPass SARS-CoV-2 Neutralizing Antibody Kit Through Agreement with Fosun Pharma

Jul. 19, 2021

Todos Medical Appoints Ilanit Halperin, CPA as Corporate Controller

Jul. 07, 2021

Todos Medical Receives FDA Certificate of Free Sale for New 5-Day Tollovid Dosing Regimen

May 04, 2021

Todos Medical Launches Phase 2 Clinical Trial of Its Antiviral 3CL Protease Inhibitor NLC-V-01 (Tollovir) in Hospitalized COVID-19 Patients

Apr. 19, 2021

Todos Medical Receives Notice of Allowance from European Patent Office for Patent Application Covering Diagnosis of Cancer Using Proprietary Artificial Intelligence TBIA Immune Profiling Platform

Apr. 08, 2021

Todos Medical Completes Automation Equipment Installation and Training for Meadowlands Diagnostics

Apr. 01, 2021

Todos Medical Enters Into Distribution Partnership with Osang Healthcare for the GeneFinder Plus™ COVID-19 Plus RealAMP Kit in the United States

Mar. 30, 2021

Todos Medical Completes Automation Equipment Installation and Training for a Laboratory Client in Brooklyn, NY

Mar. 29, 2021

Todos Medical Enters Into Automation and Reagent Supply Agreement with MAJL Diagnostics

Mar. 23, 2021

Todos Medical Announces $7.2M in Sales for February 2021, a 38% Month Over Month Increase From Sales of $5.2M in January 2021

Mar. 12, 2021

Todos Medical Applauds Senate and House Passage of the American Recovery Act

Mar. 11, 2021

Todos Medical Announces Strategic Investment by Yozma Group Korea

Jan. 25, 2021

Todos Medical Announces $4.8 Million in Sales for December 2020, a 50% Month Over Month Increase in Sales from November 2020

Jan. 11, 2021

Todos Medical Announces Agreement to Supply Natural Wellness Clinics with COVID-19 Testing Products to Support Initiatives in the Commonwealth of Kentucky

Dec. 23, 2020

Aditxt Signs Distribution Agreement with Todos Medical Ltd. For AditxtScore™ for COVID-19 Immune Monitoring Service

Dec. 14, 2020

Todos Medical Announces Commercial Launch of Proprietary 3CL Protease Inhibitor Dietary Supplement Tollovid™ at The Alchemist’s Kitchen

Dec. 07, 2020

Todos Medical Announces $3.2 Million in Sales for November 2020, a 269% Increase Sequential Month over Month Sales Growth from October 2020

Dec. 02, 2020

Todos Medical Provides Strategic Outlook

Dec. 01, 2020

Todos Medical Completes Installation of Lab Automation Equipment at Wisconsin Lab Client to Support COVID-19 PCR Testing

Nov. 24, 2020

Todos Medical Announces Positive In Vitro Data for Tollovid™ Confirming 3CL Protease Inhibition Mechanism of Action

Nov. 20, 2020

Todos Medical Announces Positive Initial Clinical Proof-of-Concept Data for a Rapid SARS-CoV-2 3CL Protease Detection Assay

Nov. 18, 2020

Todos Medical Announces Clinical Validation and National CLIA Certification for MOTO+PARA Mobile High Complexity Labs

Nov. 17, 2020

Todos Medical Announces $867,000 in Sales for October 2020

Nov. 12, 2020

Todos Medical Trademarks Tollovid for Dietary Supplement NLC-001 and Enters Into Private Label & Distribution Agreement With The Alchemists Kitchen

Oct. 29, 2020

Todos Medical Announces Instrument Validation Complete at MOTO+PARA Mobile Lab

Oct. 26, 2020

Todos Medical Announces Distribution Agreement with Adial Pharmaceuticals to Market the FDA, EUA Authorized, Assure/FaStep Point-of-Care Covid-19 Antibody Tests

Oct. 22, 2020

Todos Medical Receives Notices of Allowance From the European Patent Office Covering Use of TBIA Cancer Platform to Detect Benign Colon Cancer

Oct. 20, 2020

Todos Medical Reports $2.0 Million in Revenue for the Third Quarter of 2020

Oct. 13, 2020

Todos Medical Enters into Exclusive COVID-19 Testing Supply Agreement with MOTO+PARA’s National Mobile CLIA Lab Partner Integrated Health

Oct. 07, 2020

Todos Medical Enters into Exclusive Branding and Distribution Agreement with Melbourne Biotech for 96 and 384 Well RT-PCR Machines in the United States

Sep. 30, 2020

Todos Medical Enters Into COVID-19 PCR Testing Implementation and Equipment Financing Partnership with AID Genomics

Sep. 25, 2020

Todos Medical Expands Existing Contract for COVID-19 PCR Testing Equipment & Supplies with Wisconsin-based Laboratory to $47.5 Million

Sep. 22, 2020

Todos Medical CEO Releases Letter to Shareholders

Sep. 18, 2020

3CL Protease Inhibitor NLC-001 Added to COVID-19-focused Joint Venture Between Todos Medical and NLC Pharma

Sep. 17, 2020

Todos Medical Expands Partnership with Care G.B. Plus for Proprietary TBIA Cancer Tests to Include Europe, Israel and Africa

Sep. 16, 2020

Todos Medical Announces Commercial Launch of Todos Branded COVID-19 qPCR Test Kits in the United States

Sep. 11, 2020

Todos Medical Announces August Sales of $1,190,000, Up 100% Compared with July

Sep. 03, 2020

Todos Medical Enters Into Partnership With Pangea for COVID-19 Testing and Contact Tracing

Sep. 02, 2020

Todos Medical Announces $23,760,000 Contract for COVID-19 PCR Testing Equipment & Supplies With Wisconsin-based Laboratory

Aug. 31, 2020

Todos Medical to Present at The LD 500 Virtual Conference

Aug. 31, 2020

Todos Medical Announces $4,500,000 Contract for COVID-19 PCR Testing Equipment & Supplies with New York-based Laboratory

Aug. 27, 2020

Todos Medical Appoints Marsha Fontanive as VP of Sales and Chris Gross as VP of Sales Operations

Aug. 25, 2020

Todos Medical Announces $1.2 Million Contract for COVID-19 PCR Testing Equipment & Supplies with Texas-based Laboratory

Aug. 24, 2020

Todos Medical Announces $6,000,000 Contract for COVID-19 PCR Testing Equipment & Supplies with New York-based Laboratory

Aug. 21, 2020

Todos Medical Announces Positive Proof-of-Concept Data for Novel 10-Minute Point-of-Care Saliva-based Test Detecting Active SARS-CoV-2 Infection

Aug. 17, 2020

Todos Medical Acquires Distribution Rights to SARS-CoV-2 Rapid Point-of-Care Antigen Test and Rapid Point-of-Care PCR Test

Aug. 14, 2020

Todos Medical Announces July Sales of COVID-19 Tests

Aug. 07, 2020

Todos Medical Announces Common Stock Purchase Agreement with Lincoln Park Capital Fund, LLC

Aug. 06, 2020

Todos Medical Appoints Dr. Jorge Leon as Consulting Chief Medical and Scientific Officer of Infectious Disease and Oncology

Aug. 04, 2020

Pathnova Laboratories (PATHNOVA) Enters into Partnership to Commercialize Todos Medicals COVID-19 and Breast Cancer Tests in Singapore

Aug. 03, 2020

Todos Medical Completes Acquisition of Breakthrough Diagnostics, Gains Full Rights to the Alzheimer’s Blood Diagnostic LymPro™ Test from Amarantus

Jul. 28, 2020

Todos Medical Announces SARS-nCoV-19 Testing Kit Contract with NJ-Based Best Supply Clinical Laboratory

Jul. 27, 2020

Todos Medical Expands Management Team and Advisory Board

Jul. 20, 2020

Todos Medical Announces ANVISA Authorization in Brazil for 3D Med qPCR Kits and ANDis Extraction S

Jul. 16, 2020

Todos Medical Releases Letter to Shareholders

Feb 07, 2020 9:15am EST

Todos Medical Enters into Exclusive Option Agreement to Acquire Provista Diagnostics and Announces Management Changes

Jan 09, 2020 8:00am EST

Todos To Present At Upcoming 12th Annual LD Micro Main Event

Dec 06, 2019 7:29am EST

Todos and Amarantus JV Announces Full Enrollment for Clinical Trial of LymPro Alzheimer’s Blood Test Relationship with Amyloid PET

Nov 14, 2019 11:02am EST

Todos Medical to Present at Dawson James Small Cap Growth Conference

Oct 24, 2019 9:25am EDT

Todos Medical and Orot+ Announce First Patient Enrolled in Pre-Commercial Launch Preparations of TM-B1 and TM-B2 Breast Cancer Blood Screening Tests in Europe

Sep 24, 2019 9:14am EDT

Todos Medical Signs Binding Term Sheet with HWH World for Network Marketing of Blood Tests for the Early Detection of Breast Cancer

Sep 13, 2019 7:30am EDT

Todos Medical Enters into MOU to Expand Existing Early Detection Breast Cancer Blood Test Distribution Partnership with Orot+ into Japan

Sep 03, 2019 1:29pm EDT

Todos Medical Appoints Dr. Jorge Leon as Medical Advisor

Aug 06, 2019 7:00am EDT

Todos Medical Announces Positive Alzheimer's Biomarker Clinical Data from LymPro vs. Amyloid PET Interim Analysis

Jul 15, 2019 7:00am EDT

Todos Medical CEO Presented Corporate Update And Roadmap at The LD Micro Conference

Jun 17, 2019 8:30am EDT

Todos Medical Announces Positive Clinical Trial Data for Breast Cancer Blood Test TM-B1 in Dense Breasts

Jun 03, 2019 8:00am EDT

Todos Medical Exercises Option to Acquire Remaining 80.01% of Breakthrough Diagnostics from Amarantus After Review of Alzheimer's Blood Test Data

May 28, 2019 8:57am EDT

Todos Medical Receives Approval from Israeli Ministry of Health (AMAR) to Market and Sell its Breast Cancer Screens in Israel

May 23, 2019 8:00am EDT

Todos Medical Enters Exclusive Distribution Agreement with Care G.B. Plus, Ltd. for its Breast Cancer Screening Tests in Israel

May 21, 2019 8:00am EDT

Todos Medical Announces Voting Results from 2019 Annual Shareholder Meeting

May 03, 2019 8:52am EDT

Todos Medical Receives Notice of Allowance from the USPTO Covering the Early Diagnosis of Lung Cancer Using the Todos Biochemical Infrared Analysis (TBIA)

May 01, 2019 8:00am EDT

Todos Medical Enters Into Definitive Agreement With Orot+ for Exclusive Distribution Rights of its Breast Cancer Screening Tests in 2 European Countries

Apr 15, 2019 8:00am EDT

Todos and Amarantus Announce Completion of LymPro PET 1 Study by Leipzig University for Alzheimer’s Blood Diagnostic LymPro Test 2.0

Apr 08, 2019 7:30am EDT

Todos Medical to Present at Two Upcoming Investor Conferences

Mar 28, 2019 8:00am EDT

Todos Medical Appoints Dr. Colin Bier to Its Board of Directors

Mar 27, 2019 8:00am EDT

Todos Medical Raises $1,350,500 In Funding and Finalizes Joint Venture Agreement with Amarantus Bioscience

Feb 28, 2019 9:30am EST

Todos Medical Presents Encouraging Scientific Abstract at the San Antonio Breast Cancer Symposium (SABCS)

Dec 06, 2018 4:00pm EST

Todos Medical Enters into Joint Venture Agreement with Amarantus to develop Alzheimer’s Blood Diagnostic LymPro Test 2.0

Dec 03, 2018 8:30am EST

Todos Medical to Present Scientific Abstract at the Upcoming San Antonio Breast Cancer Symposium (SABCS)

Nov 29, 2018 8:30am EST

Todos Medical, Ltd. Announces Additional Patent Issuance Covering the Use of IR Spectrum of Blood Plasma For Indicating the Presence of Breast Cancer

Oct 17, 2018 8:30am EDT

Todos Medical, Ltd. Signs Non-Binding Memorandum of Understanding with Orot+ for Distribution Rights of its Breast Cancer Screening Tests in Romania and Austria

Sep 13, 2018 8:30am EDT

Todos Medical, Ltd. Appoints Herman Weiss, MD MBA as New Chief Executive Officer

Jul 31, 2018 4:03pm EDT

Todos Medical reports on results of clinical trials for its blood test for breast cancer screening (TM - B1) conducted at Kaplan Hospital in Rehovot, Israel

Mar 22, 2018 8:00am EDT

Todos Medical initiates clinical trial of its blood test for breast cancer in Kaplan Hospital, Rehovot, Israel for subjects undergoing breast cancer screening

Mar 05, 2018 8:00am EST

U.S. Patent and Trademark Office has granted to Todos Medical two additional patents

Feb 12, 2018 8:00am EST

Mr. David Ben Naim, CPA, MBA Joins Todos Medical as Chief Financial Officer

Feb 06, 2018 8:00am EST

Todos Medical Appoints Dr. Meir Silver as Vice President of Clinical Research and Regulatory Affairs

Aug 29, 2017 8:30am EDT

MOO dung

if you do not have the mental acuity to "cop-a-clue" after all this time, and "comprehend" what exactly happened

Guy that has ZERO to do with collecting photos of some person you are obsessed with. Knowing how old each photo is. Knowing who that person associates with/does business with. I can see why they placed a restraining order on--that you never deny. Only duck/dodge/deflect about having the records washed --EXPUNGE away guy. But you need serious prof help . GLTU

correct...

who has not unequivocally destroyed 1 - but now 2 public securities

who has unequivocally destroyed 'just not' 1 - but now 2 public securities

sorry thewordsman - but how you think and how you feel is exactly that

those are your thoughts, your feelings, your reactive actions, and responsibilities

unfortunately you do not know or understand what I do - having been involved since 2012 - and you never will - so be thankful you never have to go thru what I did with this individual

hopefully the end result of my 'freedom of speech' has resulted in at least some TOMDF and AMBS shareholders not loosing some or all of their money...!

to what I consider to be a serial public security scammer, liar, manipulator, and user - who has not unequivocally destroyed 1 - but now 2 public securities

this sites' public security (TOMDF) was declared insolvent and dissolved long ago - having gone thru $138-Mil. and 200 completely worthless PR's, all of which amounted to absolutely nothing in less than 5 years time - excpet for t lining the pockets of these unscrupulous and nefarious culpable scam artists

the salaries these corp. officers were taking down were some the largest in the history of the OTC

if you do not have the mental acuity to "cop-a-clue" after all this time, and "comprehend" what exactly happened - to not only TOMDF but AMBS shareholders as well, then that is on you and you alone sir...!

but here is and will continue remaining my mission - to protect the innocent, naïve, speculative, under-informed, and prospective shareholders from repeating what I did, by trusting a scam artist, and a serial one at that...!

WARNING: to all prospective OSTX shareholders, this guy is on his 3 public security - just like he said he would do...!

SMH - you simply can't make this stuff up folks...!

MOO stunad

At 1 time I sorta gave you the benefit of the doubt that there was not a restraining order placed on you at 1 time by Gerald. Regardless of the number of photos you had of him. You said often you were not a stalker , that you felt Gerald cost you money.

But now--as anyone can see--you are following him and his career around. You even know the age of photographs of him. You do collect these as some type of treasure or affection. You have posted many thru months--you need help.

ANYONE that sees you and your hours/days spent collecting--following some former "partner" around is a stalker. Hopefully you can step back and realize your sickness/weakness and get professional treatment. So sad

As previously posted, this week:

1. I got the updated 2024-25 Novavax Covid vaccine

2. I got the updated quadrivalent flu vaccine

3. I purchased more Novavax shares.

WOW. The P&D of this stock are still posting on other boards. Funny they say don’t buy that stock and as of today it’s run 500%. Can’t make this up. Maybe they should warn us on this stock so it will run 500%.

he'll bring his Astoria, Queens financial mafia into OSTX

and destroy this new public security with toxic death spiral financing...

https://ir.ostherapies.com/

Common Stock par value $0.001, 50,000,000 shares authorized, 5,991,041 and 5,340,000 issued and outstanding, respectivel

Preferred Stock, par value $0.001, 5,000,000 shares authorized, 0 and 1,302,082 shares Preferred Stock A issued and outstanding

Accumulated deficit: (32,565,900)

Total Stockholders’ Deficit: (27,063,937)

love the 20 year old photo

SMH - wash rinse repeat...!

MOO dolt

Uh oh, the CEO of two failed companies has hopped aboard a new company as Chief Business Officer.

https://ostherapies.com/leadership/

I have travel (airplane/ports--hotels--restaurants ) OCT NOV DEC so been wanting to wait a while longer. Need to check my CVS

Last year the pharmacist that gave shot (I hate shots)--told him that was best shot ever had . Dunno if he was that smooth or just a small needle/vol of Rx. I glanced at syringe --then I cringed--then I couldn't believe it was over. Really wasn't sure --as I never felt needle

Haven't gotten a flu shot since 1977?? (the swine flu)--but that is another story (not good memories) but adds to the hate shots feeling

Getting my Novavax Covid (non-mRNA) vaccine this week, along with my annual flu vaccine. Also buying more NVAX shares.

SUN NITE

BNO News @BNOFeed

Weekly U.S. COVID update:

- New cases: 150,210 est.

- Average: 166,986 (-4,752)

- In hospital: 5,299 (+3)

- In ICU: 625 (+5)

- New deaths: 1,232

- Average: 1,281 (+24)

BNO Analysis: U.S. reports more than 1,000 new COVID deaths for the 5th week in a row

So far this year, nearly 5.3 million COVID cases have been reported in the U.S., causing at least 362,954 hospitalizations (partial data) and 41,350 deaths.

But yea the smart 1s here KNOW its just like the flu

It’s going to disappear. One day, it’s like a miracle, it will disappear--genius

WHAT IS GOING ON WITH THIS 2022-2023 PUMP AND DUMP. Funny, the P&D'sters were on other pages warning people before the stock ran 400%. Maybe they should be on here warning people so this stock can run 400%. #YOUCANTMAKETHISSTUFFUP

SUN NITE

BNO News @BNOFeed

Weekly U.S. COVID update:

- New cases: 165,705 est.

- Average: 171,738 (-635)

- In hospital: 5,296 (-61)

- In ICU: 620 (-7)

- New deaths: 1,555

- Average: 1257 (+199)

BNO ANALYSIS : U.S. reports more than 1,500 new COVID deaths, the highest since early March, according to BNO's COVID tracker

Remember just a few weeks ago when the "1st week of over 1,000 deaths in this summer surge??

Any product or investment recommended by Gerald Commissiong is a non-starter.

|

Followers

|

132

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

20583

|

|

Created

|

04/25/18

|

Type

|

Free

|

| Moderators | |||

| Volume: | 280,000 |

| Day Range: | 0.000001 - 0.000001 |

| Last Trade Time: | 10:20:19 AM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |