Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi Praveen -- Any updates on the STR performance in the last few years? Thanks!

Hi Nick

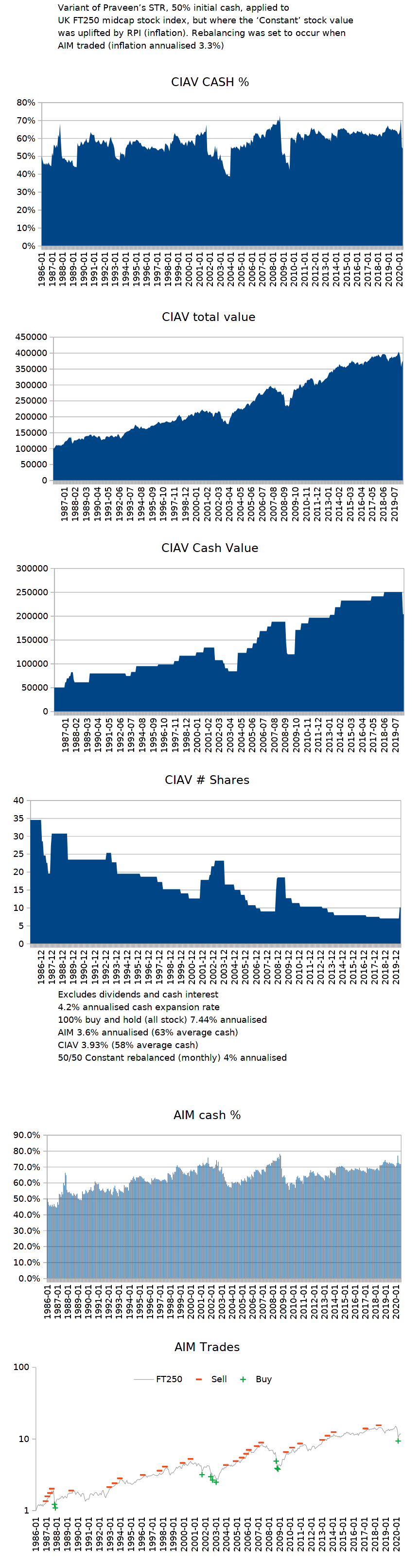

Looking at that backtest data, and its the combined gain + cash expansion growth rate that is the figure that should be compared. Buy and hold all stock 7.44% versus 3.93% constant inflation adjusted value (CIAV) along with a 4.2% cash expansion rate = 8.13%, so around 0.69% more. For the AIM that accumulated more cash (less average stock) the figure is around the same, broadly comparable (less growth, more cash).

Fundamentally income being provided from stock dividends, cash interest and possible real gains on top (ahead of inflation) that might be top-sliced/spent.

A difficulty with top slicing is identifying when and how much to top slice. We might however for instance just run CIAV purely against the stock price (exclude dividends) and cash without interest included, and spend all of the dividends and cash interest. That CIAV will have a dynamic stock/cash weighting over time and if our actual cash to stock ratio has a higher percentage cash level than the CIAV then we can also spend the difference. Thereby providing a automatic means to determine how much 'top-slicing' is appropriate (the 'how much' element). The 'when' element could be as simple as - whenever a fixed rate bond/holding had matured and we had actual cash in hand.

On the assumption/basis that AIM and CIAV can yield comparable rewards/benefits, of the two CIAV/Praveen's STR method is the easier to grasp/manage IMO. Keeps things simpler for heirs that may have little/low interest to pick up and run with.

Fundamentally with buy and hold you compound more gains as that retains more shares. With CIAV and more so with STR and perhaps even more with AIM you see greater levels of cash throw off/spending. Where CIAV/STR/AIM are broadly similar, and that yield a better overall benefit than buy and hold in combined growth + income terms. But perhaps little different to just simple 50/50 yearly rebalancing (that will tend in contrast to accumulate more growth, provide less income). All very broadly speaking.

When you're spending dividends, cash interest and surplus real gains (top-sliced) then your income streams are diversified. It's only natural at times that those individually will rise and fall. With lower cash interest so stock prices might be expected to have relatively risen, such that real gain top slicing might have risen, but where cash interest had fallen. Yes, maximising cash interest is also beneficial. Reasonable choices for 'cash' IMO are the likes of the Permanent Portfolio, or a third each in stock, gold and cash.

https://tinyurl.com/y9qghjjm

I visualise stock/gold 50/50 as being a barbell of two extremes. Stocks tending to more reflect changes in nominal yields, gold tending to reflect changes in real yields, that equally weighted combine to a central 'bullet' type holding, somewhat similar to how 20 year Treasury and 1 year Treasury in equal measures barbell combines to being comparable to a central 10 year bond bullet. But where at times both stock and gold can move in the same direction such that cash helps dilute down the negative cases, and where more often after such high correlation (both stocks and gold down) more often a adjacent year will see one or the other tending to snap sharply upward (compensate for the bad year ... and more).

If you consider stock to be a form of very long (undated) conventional bond, and gold to be a undated inflation bond, then pairing that with long dated conventional bond and TIPS/inflation bond would seem to be reasonable. The Permanent Portfolio however opts to hold cash instead of TIPS. Since 2001 a PP with TIPS has compared to a third each in stock/gold/cash, however the conventional PP with short term treasury has outperformed both of those. Going back further however and a third each stock/gold/cash has been better overall, but with moderately higher volatility. Overall I like that stock/gold/cash choice as for me as a UK investor I can hold domestic Pound cash, US Dollar stocks, and gold is a form of global currency ... so nice currency diversification. Whilst being asset diversified across stocks, commodity (gold) and 'bonds' (cash). Each to their own.

Regards.

Clive (a.k.a Clean Bee :)).

First line...”Clean be”. Don’t know where that came from. Please ignore

Great analysis again Clean be, thanks for posting.

Your CIAV is where my head was at a couple of years ago when I first posted over on the AIM board.

It is essentially the model I am following. All World equities 50ish percent and ‘cash’ comprising of long bonds (some inflation linked) short bonds, best rate deposits and gold. 3% withdrawal rate with a bit of flexibility and the expectation of an occasional cash ‘bonus’ to splurge or reinvest.

I still think improving the cash return is key and I probably see this as the greatest risk to my future net worth until real rates turn positive again (which may or may not happen in my investing lifetime)

Thank again

Nick

Hi Praveen

Applying a variant of STR that instead revises the Constant Value upwards by inflation, so that the stock value is biased towards having offset inflation, with no dividends or cash interest included, did a reasonable job overall. All Constant Value methods tend to throw off copious amounts of cash over time, which is nice for those in drawdown/retirement when supplemented with dividends and cash interest.

I started that - what I'm calling Constant Inflation Adjusted Value (CIAV) with 50/50 stock/cash (applied to the UK's midcap FT250 index) as earlier years sequence of returns risk is the most dangerous time to endure a big drop.

Instead of yearly reviews/rebalancing I opted to use the same months that AIM traded, more just for comparison purposes. In practice rebalancing as and when bonds (cash) mature is more ideal (liquidity).

Fundamentally some/many investors invest in stocks in anticipation of a share price that offsets inflation, along with providing dividends on top. And if the share price does rise broadly with inflation so the dividend value also increases broadly with inflation. Invest just in cash, and perhaps the interest might offset inflation, but leave no surplus income (broadly/generally).

With 50/50 CIAV the trading saw cash-throw-off expand at a rate greater/faster than inflation, whilst having the constant value set to rise with inflation would also tend to ensure that the stock value rose with inflation over time. Leaving dividends and cash interest earned free to be spent.

The following image outlines the results, along with the results from a standard AIM (again just price only, no interest or dividends included).

Overall I like your STR as it better caters for matching bonds maturing with trade/rebalance time points. It's also easier to manage IMO, teaching others AIM and that has more quirks/stumbling points whereas STR is a much easier concept that seems to generate comparable rewards.

With age, I've become more indolent, a greater tendency towards keeping actual holdings/investments as simple as possible, as such I'm more in the simple once/year rebalancing a portfolio back to target weightings and with a asset allocation that has capital preservation more utmost in mind over that of maximising potential rewards. So I'm largely indifferent as to which may or may not be the better overall portfolio management choice and looking at the above results the differences are negligible. AIM tends to accumulate more cash which the likes of Vealies can negate; Standard STR will also have a tendency to accumulate cash if just being applied to a single holding - that multiple holdings and deploying spare cash (>30%) negates; So also however does yearly rebalancing to target weightings; So more a question of whichever portfolio management method/tools one feels most comfortable using. So this posting is intended more as a general observation, isn't intended as any form of critique of any of the individual choices/methods.

I do hope you are keeping well. I lost my father 12 years ago and still miss him dearly every day. As a only child I can't even begin to imagine the loss of both a father and brother at near the same time.

Kind regards.

Clive.

Hi AIMster,

Thanks for your condolences. Sorry I haven't been on much.

As far as passive income:

1. If you have an investment account (managed by my system, AIM, buy/hold, etc), then you can afford to take 4% out a year without worrying about it running out of money. In fact, at 4%, it should grow enough to keep up with inflation. If you are older, and don't mind exhausting the fund in, say, 20 years, you can take out a more aggressive % each year.

2. Trying to sell products over the internet, multi-level-marketing, etc. don't really work and are hard. There are so many people trying to get rich quick.

3. The best way to get passive income is to expand your definition of "passive" to include working from home. Then, you can get free-lance work like writing or programming or consulting/coaching.

Mr. Puri,

A bit late in the time of this plane, but in the Cosmic sense, not even the blink of an eye. However you want to view it, please accept my condolences at your loss. Never easy. But part of the duality.

In a more on-topic related sense, your system (and AIM and similar) are working as volatility capture mechanisms. Which may well be fine for someone fairly young, with a long enough window to make such systems work. However for those of us now closer to retirement age, (how we got here so quickly is another thought), with the shift in emphasis to become more one of developing a passive income stream, in anticipation of leaving one's employment and wanting to still have money coming in, do you have any thoughts as to how this concern may be addressed?

Thank you kindly in advance.

Hi Crumbcatcher,

My system hasn't changed—I still use it and I'm still beating the market.

Since my system is working, I stopped tinkering with it, and have been concentrating on building my management consulting business.

Also, I've been dealing with a lot of personal tragedy. My brother, who was caring for my elderly parents, got cancer last spring and I had to step in to take care of all of them. My brother ended up dying in January, and then my father died a couple of weeks ago.

So losing 2 family members less than 2 months apart has been rough.

Check out the

Aim users bulitin board

It is much more active.

Toofuzzy

Check out the

Aim users bulitin board

It is much more active.

Toofuzzy

Mr. Puri,

Was curious about the lack of activity on your message board, did something change in your STR approach or has the last few years of "unexpected market fiasco" dampened peoples interest in the Market? Would love to get your opinion.

Just decided to try the stock market again after about 5-6 years of dismal failure in other endeavors.Loved your approach, but it left me too much idle time, so as per usual, I started tinkering, and the rest is "unsuccessful" history.

13 Year Return on my portfolio vs. Total Return on S&P 500 (including dividends)

In 2017, My "Stock Trading Riches" account beat the S&P 500 again (26% vs. 21.83%).

Here is the cumulative 13-year return:

(Source for S&P500 returns = http://www.spindices.com/idsenhancedfactsheet/file.pdf?calcFrequency=M&force_download=true&hostIdentifier=48190c8c-42c4-46af-8d1a-0cd5db894797&indexId=340 )

Year, Me, S&P 500

2005, 13%, 4.91%

2006, 14%, 15.79%

2007, 22%, 5.49%

2008, (40%), (37%)

2009, 44%, 26.46%

2010, 22%, 15.06%

2011, (5%), 2.11%

2012, 13.3%, 16%

2013, 23%, 32.39%

2014, 13%, 13.69%

2015, 1.49%, 1.38%

2016, 20.88%, 11.96%

2017, 26%, 21.83%

My portfolio had a cumulative 13 year return of +281% vs. +187% for the S&P 500.

That translates into a 13 year average annual return of 10.84% vs. 8.45%

12 Year Return on my portfolio vs. Total Return on S&P 500 (including dividends)

In 2016, My "Stock Trading Riches" account beat the S&P 500 again (20.88% vs. 11.96%).

Here is the cumulative 12-year return:

(Source for S&P500 returns = http://www.spindices.com/idsenhancedfactsheet/file.pdf?calcFrequency=M&force_download=true&hostIdentifier=48190c8c-42c4-46af-8d1a-0cd5db894797&indexId=340 )

Year, Me, S&P 500

2005, 13%, 4.91%

2006, 14%, 15.79%

2007, 22%, 5.49%

2008, (40%), (37%)

2009, 44%, 26.46%

2010, 22%, 15.06%

2011, (5%), 2.11%

2012, 13.3%, 16%

2013, 23%, 32.39%

2014, 13%, 13.69%

2015, 1.49%, 1.38%

2016, 20.88%, 11.96%

My portfolio had a cumulative 12 year return of +202.4% vs. +135.7% for the S&P 500.

That translates into a 12 year average annual return of 9.66% vs. 7.41%

The 3% signnal by the way uses just one small cap stock fund and one bond fund.

Toofuzzy

Hi Praveen

I tried out udpix 2x fund with constant value. I took the percent change per listing at yahoo.com and worked it from beginning of its existence to now. I applied it onlyto his once per year. If i did it right it increased 90 percent . I started with a 50 50 mix of cash and stocks. i did it that way because it is a 2x fund of the dow.

I used yahoo finance performance table to do it.

Thank you for your answer

Neko

ps this was straight constant value. It was not value averaging.

Mr. Kelly mentioned it as a way to enhance dow performance.

I also tried it in aim and the results were even better. I am referring to his previous book . i forgot the title.

Hi Neko,

I checked out the 3% signal at the author's website:

http://jasonkelly.com/books/3sig/

It looks like the essence of the system is that, each quarter, you check the stock. If it went up 3%, you leave it alone. If it goes up more than 3%, you take out the excess. If it grows less than 3% or goes down, you increase it to the 3%.

With the basic stock trading riches system, we are looking to buy or sell back to the constant value at the end of the year if it goes up or down 10%.

To make it simulate the 3% solution, we would recalculate the constant value by raising it 10% (or 12% if you want to keep the 1% per month / 3% per quarter).

So, let's look at 12%. If the constant value is $2000 at the start of the year then, after 1 year, the new constant value would be 2000 x 1.12 = $2,240. So we would rebalance the stock or fund to $2,240.

This would be more aggressive than rebalancing back to a constant value, so you would want to try this either with a fund or with stocks if you are diversified (have at least 10-12 stocks).

Hi praveen

I made a mistake on the title . It is the 3% signal.

My apologies . I guess it was a senior moment

Neko

Hi praveen

I made a mistake on the title . It is the 3% signal.

My apologies . I guess it was a senior moment

Neko

Hi Praveen

I just read a book called 3% solution. It is value averaging using a bond fund and a stock fund specificly small caps. can your constant value metod be modified to a value average . where the amount would grow 1% a month as recommended in this book . You would let the methodology of constant value and the prescribed growth determine the next buy and sell point

I believe the authors last name was Kelly.

Neko

Thanks Chris,

I'm glad you liked the book and my method.

Too many sources of information tend to over-complicate trading/investing and, consequently, not enough people take advantage of letting their money work hard for them.

I like it when people realize that investing can be simple.

Hi everyone,

I just bought Praveen's book the other day, and I am really impressed!

After 15 years of studying trading systems, I have finally found one that is so simple, so "zen-like"...and most importantly...profitable.

I also encouraged my parents to buy the book, as well, to help them with rebuilding their retirement accounts, and they purchased the book the other day.

Thank you, Praveen, for sharing your trading technique with the world!

-Chris in Chicago

11 Year Return on my portfolio vs. Total Return on S&P 500 (including dividends)

(Source for S&P500 returns = https://en.wikipedia.org/wiki/S%26P_500_Index )

Year, Me, S&P 500

2005, 13%, 4.91%

2006, 14%, 15.79%

2007, 22%, 5.49%

2008, (40%), (37%)

2009, 44%, 26.46%

2010, 22%, 15.06%

2011, (5%), 2.11%

2012, 13.3%, 16%

2013, 23%, 32.39%

2014, 13%, 13.69%

2015, 1.49%, 1.38%

My portfolio had a cumulative 11 year return of +150.2% vs. +110.5% for the S&P 500.

That translates into a 11 year average annual return of 8.70% vs. 7.00%

Excellent article regarding Trump. I realize it was posted a few months ago, but it is very revealing. Big ego and a lot of bluster.

Hi Praveen

Thank You

Respectfully

Neko

I had to modify the script again, so that on the first price (when ovshares is 0) we calculate shares based on control (not vcontrol).

So here is the correct script:

BEGIN {

control = 2000

vcontrol = 2 * control

cash = control

orig = control

}

{

price = $1

value = shares * price + cash

ovshares = vshares

oshares = shares

vshares = int(vcontrol / price)

if (ovshares == 0)

shares = int(control / price)

else

if (vshares > ovshares)

shares = oshares + (vshares - ovshares)

else

shares = oshares - (ovshares - vshares)

if (shares < 0)

shares = 0

cash = value - shares * price

if (cash < 0)

{

value += -1*cash

orig += -1*cash

cash = 0

}

print price" "shares" "cash" "value" "orig

}

Hi Neko,

Below is the modified awk script.

Notice I added a "vcontrol" and "vshares" to track virtual shares. I defaulted to twice the control, but you can change it to any amount ( a multiple of control or an absolute number like "vcontrol = 1300").

It calculates the new virtual shares and then adds or subtracts actual shares based on the change to virtual shares. (it uses oshares and ovshares to store the old value).

So if virtual shares go up by 300, then you would buy 300 shares.

BEGIN {

control = 2000

vcontrol = 2 * control

cash = control

orig = control

}

{

price = $1

value = shares * price + cash

ovshares = vshares

oshares = shares

vshares = int(vcontrol / price)

if (vshares > ovshares)

shares = oshares + (vshares - ovshares)

else

shares = oshares - (ovshares - vshares)

if (shares < 0)

shares = 0

cash = value - shares * price

if (cash < 0)

{

value += -1*cash

orig += -1*cash

cash = 0

}

print price" "shares" "cash" "value" "orig

}

Hi Toofuzzy

Thank you for your reply

Neko

Just pretend you yave more shares

Toofuzzy

Hi praveen

How would you modify your awk or perl script to use or include virtual shares . To make your system more aggressive. I am interested in your system . I know aim has ld aim. I understand your system the best as it is straight forward. But I want to get more out of it within reason. Virtual shares in a small propportion might be the answer. I want to experiment first before committing.

Thank you.

Neko

Donald Trump would have been twice as rich if he switched from real estate to stocks.

An interesting article ( http://www.moneytalksnews.com/why-youre-probably-better-investing-than-donald-trump/ ) shows that Trump would have had $10 billion more if he had switched to a simple S&P 500 fund about 30 years ago.

For his value today, Trump estimates it at $10 billion, while Forbes has him at $4.1 billion. They give him the benefit of the doubt and used $10 billion.

For the value in 1982, Forbes had him at over $200 million but said that Trump claimed $500 million. Again, they used Trump's claim.

So, starting with $500 million in 1982, if he had put it in an S&P 500 fund, he would have made (from 1982 to 12/14) an annualized 11.86%, and his $500 million would have become $20 billion.

This shows that simple investments like stocks, which are available to anyone, are powerful.

It also shows that he isn't that great of a business man.

Hi L, Re: your history example................

I like seeing the price/share at $16+ sixteen years later when you start consistently making money - when the account started with a price/share of $38+. In fact the system created a profitable return through downward averaging even though Mr. Buy and Hold would have suffered over a 50% loss on share price.

Buying into weakness can be agonizing with individual company stocks, but ETFs are far less likely to fail completely. Selling into strength may seem less logical, but to prepare for subsequent cycles, one needs to fund the cash reserve position with profitable selling.

Thanks,

Hi Praveen !!

First of all,excuse my english...not my mother language ![]()

Take my hat off Sir for sharing with everyone such a simple but powerfull investment system.

Great book,simplicity always works better...some people have a formula to build wealth in front of them and still cant see it !

In my experience over 10 years fighting the markets,if someone wants to succeed in this bussiness best thing can do,is to move against the herd.That´s why this system is so special: because you buy when nobody does.

If you buy and sell like everyone does,you are in trouble.

Over the years I have learnt that most of the time works better to do something that is the opposite of what is usually done.

No system is perfect and STR and Core Postiong trading has potential drawbacks as well.

You can let the magic formula do the dirty math,but if your timing is not right,you will pay for that mistake in terms of keeping dead money for a long period of time and opportunity cost of investing that money in another business.

I enclose Praveen´s STR Excel with Nikkei data assuming a rebalance the first of each year: starting 1990 and ending jan 2015.

I know it is a worst case scenario but its the kind of situation you want to face when you start testing a trading or investment system.

I really dont wanna mess with stocks,_I only trade ETFs,and as you can see,Nikkei was severy beaten down to the point that it takes 16 years to retrieve your money.

Having said that,I think its a good thing to invest in beaten down ETF sectors with 20-40% fall from the top.This way you limit the possibility of buying right at the peak and you limit the downward trend length in terms of getting trapped in the "dead money" cycle until market bounces.

Another interesting point I dont agree is related to cut the amount invested when the chart starts a new upward trend.

IMHO it might result much more effective to use a simple trailing ATR stop loss and follow the trend until is broken.Really dont see the necessity to diminuish market position when Mr Market paddles on the same side.

Hope we all can share experiences with this great system.

Y´all take care !!

Hi Bob,

I presently own 38 shares of Face Book. Last year, I raised the constant value for all my positions to $3,000, instead of adding more positions.

This part of my system is more discretionary than automatic.

Normally, after I rebalance my positions in Dec, I look at the amount of cash I have. If it is over 30%, then I will buy more positions, otherwise, I will leave it in cash. I want to cap cash to a maximum of 30%.

However, in the case of last year, I saw that a lot of my positions were up, and I seemed to have a lot of stocks, so I decided to raise all the positions to $3000 from $2000.

Praveen,

Another follow-up on my original inquiry about your position in FaceBook (FB). It has now been 3 years since you first purchased it, and they have been really good years. An earlier reply to my questions stated that you had purchased a total of 74 shares as of December 2012, just out of curiosity, how many shares do you presently own? My guess would be around 25 or 26 shares. Do you use the money generated each December to accumulate new stocks? Is there a "limit" on how many stocks you are willing to own, and you simply start raising the level from $2,000 to $3,000 per stock?

Thanks for putting this style of investing out in the Public view and congratulations on the success of this issue.

Bob

The WSJ had an article about human stock pickers making a come back.

So far this year, through the end of April, actively managed funds have gained 2.25% (including dividends and expenses), while indexed funds (all indexes) rose 2.2%. The S%P 500 gained 1.9%.

During this same time, my account has risen 3.89%, further proof that rebalancing systems like STR and AIM work well.

Thank you for your response....

Hi,

One of the earliest books that mention it is:

Practical Formulas for Successful Investing, by Lucile (Tomlinson) Wessmann, W. Funk (1953)

Sir,

In your book you mentioned that your trading system was based on an "old wall street" concept. Could you share with me where I could find more on that old wall street concept. I would like to compile as much research as possible on the system (your system) that I am currently using. I actually think it's quite fascinating. Thank you in advance.

Water and hydrogen should be transported with trucks. Various places on earth are hotter than others and even these places vary on temperature. Trucks can transport water to hydrogen plants which are connected to gas stations. Plants who produce a lot of hydrogen can transport it with trucks to other plants which cannot produce enough for the period. These trucks can also transport water on a regularly basis.

How can these stations be?

The water can be contained in pools, with solar panels on top. Sunlight converts water into hydrogen.

Is this costly?, no.

Gas companies can pay a fee or tax so that these pools can be created. This can create a new industry where gas companies can cooperate with trucks and personnel between each other and make money selling the hydrogen.

Petrol/Diesel can be used in areas where solar panels doesn't work.

10 Year Return on my portfolio vs. Total Return on S&P 500 (including dividends)

(Source for S&P500 returns = en.wikipedia.org/wiki/S%26P_500 )

Year, Me, S&P 500

2005, 13%, 4.91%

2006, 14%, 15.79%

2007, 22%, 5.49%

2008, (40%), (37%)

2009, 44%, 26.46%

2010, 22%, 15.06%

2011, (5%), 2.11%

2012, 13.3%, 16%

2013, 23%, 32.39%

2014, 13%, 13.69%

My portfolio had a cumulative ten year return of +148% vs. +109% for the S&P 500.

That translates into a 10 year average annual return of 9.51% vs. 7.65%

Hi Allen,

They are all "Stock Trading Riches" with different covers and titles. There is no new information in them.

I had been thinking of refreshing the book and there was a publishing mixup, and all the title / cover possibilities ended up live on Amazon.

Once on Amazon, titles stay on Amazon forever. Rather than setting them all to "out of print", we put a note in each of the descriptions saying that readers who have already read "Stock Trading Riches" should not buy them.

Perhaps it would be better if I got them taken out of print.

I'm sorry for any confusion you experienced.

Praveen

Hi PraveenP,

Which of the ~dozen books you put out in ~2012 about "Zen and..." investing, Wall Street, etc., is the best to get, covers the most ground as an advancement on "Stock Trading Riches"?

Thanks,

Allen

a 79 yo man who has 450k that he has to live on and invest with. He'll need to get income from the money, but also he'll want it to grow

Hi glog

Only use ETFs or mutual funds. They cant go to zero.

Toofuzzy

Hi Greg,

I can stand the drawdowns because I know it's part of the process. I know that, as long as I have many stocks (or funds) then eventually stocks will bounce up.

I also remember that drops set up big gains. I like to think of it as a wind farm or pump. So, I welcome when the market goes up or down, because it is like wind and it generates energy (profits to be harvested).

Also, I had a big drawdown in 2008 (when everything melted) because I didn't have a big cash cushion. At that time, I think I had put in less than 30% cash. I recommend 30% cash in most cases, and probably 35-40% cash if you are retired, up to 50% to be conservative.

A big cash cushion will keep the drawdowns from becoming too severe.

Praveen

Hi Praveen,

I wanted to thank you again for your advice on implementing STR for retirees. Very helpful. I have a simple (blunt) question...what helps you tolerate the drawdowns in your system? I think the DD's are the one thing that prevents me from implementing this system for myself. How do you do it?

Thanks for any insight you might provide.

Greg

Hi Greg,

If I was retired, I would have at least a year of expenses in a bank account (2 would be safer).

I would use this cash account to pay for expenses, and deposit any incoming money (i.e. social security, pensions, part-time job, etc) into it.

So I would leave the investment account alone during the year. Then, at the end of the year, I would pull out money from the investment account to top back the cash account to 1 (or 2) years of expenses.

Also, to cushion the volatility in the investment account, you can increase the amount in the cash/STB portion - maybe allow a maximum of 40 or 50% cash instead of a maximum of 30%.

Hi Praveen,

I backtested your system back to 2006 in a papertrading account. It has performed well, though in 2008 there was a 50+ % drop. Here's a link to the portfolio and its perfomance:

https://www.flickr.com/photos/96890848@N08/

For someone in retirement, might it be better to keep and additional amount, says 2 years of expenses, in cash in order to cushion against downturns? Interested in your thoughts.

Thanks so much.

Greg

Hi Greg,

I was closing out part of my Google account, and it also closed my blog (since Blogger is owned by Google). That's one of the downsides to the way they keep merging stuff into one account ![]() .

.

I am going to start a new blog.

The Stock Trading Riches system should work nicely - I would try and maintain a minimum of 30%-40% in the cash/ST bond portion and, in the stock portion, maybe 10% in a long term bond ETF (that is rebalanced as a stock). For the rest, you can do stock ETFs, mutual funds, and/or individual stocks.

The main thing about stock ETFs and mutual funds is not to hold broad-based index ones (such as the s%P 500), because the diversification within the fund will make it fluctuate less, so they are not good for rebalancing.

It would be better to buy individual stocks and/or sector or industry based ETFS and funds.

For example: communications, financial, banking, small cap, value, growth, etc.

Praveen

Hi Praveen, I was wondering where your Stock Trading Riches blog is? It looks like its been taken down. Do you have another blog? Thanks!

Also, do you feel that its appropriate to implement Stock Trading Riches for a 79 yo man who has 450k that he has to live on and invest with. He'll need to get income from the money, but also he'll want it to grow. I thought the STR program might be quite nice, though I might want to add a larger cash/ST bond portion?

Thanks for your consideration

Greg

I'm Praveen Puri, the author of "Stock Trading Riches". It describes my Stock Trading Riches (STR) trading system which, like Robert Lichello's AIM system, is based on constant value rebalancing. (My book is available in paperback and Kindle formats).

I have been involved with investing for over 30 years. I have been a full-time trader, financial software developer, consultant at the Chicago Board of Trade, and a vice-president at a major bank. I'm currently an independent business consultant who use Strategic Simplicity to help clients achieve faster change and innovation.

I'm passionate about simplicity, and so I always gravitated towards designing simple systems. I was originally a big advocate of trend-following, but years of experience and testing convinced me that counter-trend rebalancing systems (such as STR or AIM) are better for achieving a repeatable and dependable economic-based edge in the market.

I read Robert Lichello's book on the AIM system in the early 1990's, but I ended up developing my own system because I felt that AIM had several drawbacks:

1. Lichello originally intended for AIM to be applied at the portfolio level. Thus, there would be one portfolio control and one cash. The problem with this is that individual stock movements cancel each other out, thus dampening volatility.

2. While AIM can be applied individually to each stock, I felt, as an evangelist for simplicity and elegance, that this was a bit too clunky and complex - having to track separate controls, safes, cash, etc.

3. I also didn't agree (when trading individual positions) of portfolio control increasing during down cycles, and not increasing during prolonged bull moves.

Note that these views don't mean that I think AIM doesn't work. AIM and the STR systems are cousins and any re-balancing system is a good approach to the market.

The basic Stock Trading Riches system is to build a portfolio of many positions. Each individual position is assigned a constant value (which never changes) and is rebalanced once a year. Growth happens at the portfolio level. The portfolio consists of the individual positions and a cash balance. At this level, the system uses constant ratio balancing to have a maximum cap on the cash level. For example, the default value is 30% cash.

If cash builds up over 30%, then the cash is used to add new positions. Besides the basic system, my book also discusses optional rules, trading psychology, and (in the 2009 updated section) ideas for stock picking, IPOs, portfolio design, etc. Readers of my book also get a link to download an Excel spreadsheet of the basic rebalancing system.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |