Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This is a wave 2 that has overstayed its welcome. It is rare that they last this long or take a flat pattern. It has retraced wave 1 into the zone of 50% to 61.8% which is hit by twos 73% of the time.

With its end, which may have just happened, we will see a dramatic decline in wave 3 with a target near 3160.

Monday's fifth wave of 1 down doesn't look like it has truncation on its mind.

Futures down 57 at present.

Nice bounce coming when its over.

You can find all targets and direction for the waves to come by joining me in the Trading Pit Forum.

Click the link in the header.

Try it for a month and if it is not for you simply cancel. EWP is not for everyone. What about you?

You will not know till you try.

From: POKERSAM 4/2/2021 2:18:32 PM

986

of 986

I just posted six charts in the Trading Pit Forum covering from 1871 up to today. These Elliott Wave charts range from yearly to one minute. They reveal exactly where we are in the Long, Intermediate, and Short term progression. High odds predictions of future market moves are arrived at using the very latest in the understanding and application of the Elliott Wave Principle. Statistical analysis of all wave ratios are employed to improve the accuracy of predictions as to wave length and duration.

From these charts, it is easy to extrapolate where and when the next small, large, and very large corrections are due to occur with a greater measure of accuracy.

There is no reason for anyone to trade in the dark without a real clue as to what the market will do next.

From short term to long term my charts and projections based on Elliott Wave Principle have proved to be extremely accurate. Only those who cannot time the market say that no one can time the market.

For information go to: http://indexinsight.com/

One of my subs said this past week: "It’s always nice to know what the market is going to do before it does it. When it opened where it did today, the count was much more apparent. Thanks for all of your help!"

From: POKERSAM 4/2/2021 2:18:32 PM

986

of 986

I just posted six charts in the Trading Pit Forum covering from 1871 up to today. These Elliott Wave charts range from yearly to one minute. They reveal exactly where we are in the Long, Intermediate, and Short term progression. High odds predictions of future market moves are arrived at using the very latest in the understanding and application of the Elliott Wave Principle. Statistical analysis of all wave ratios are employed to improve the accuracy of predictions as to wave length and duration.

From these charts, it is easy to extrapolate where and when the next small, large, and very large corrections are due to occur with a greater measure of accuracy.

There is no reason for anyone to trade in the dark without a real clue as to what the market will do next.

From short term to long term my charts and projections based on Elliott Wave Principle have proved to be extremely accurate. Only those who cannot time the market say that no one can time the market.

For information go to: http://indexinsight.com/

One of my subs said this past week: "It’s always nice to know what the market is going to do before it does it. When it opened where it did today, the count was much more apparent. Thanks for all of your help!"

I hope you are enjoying the markets as much as I am. Of course, it is always enjoyable when you are making money. It doesn't matter if the market is going up or down as long as the market moves are large enough in your favorite time frame to make a good profit.

If you have been missing too many opportunities maybe it is time you tried something different. In my forum I post an average of ten charts every trading day. I provide play by play commentary and answer questions during trading hours. For complete information about my service visit:

http://indexinsight.com/

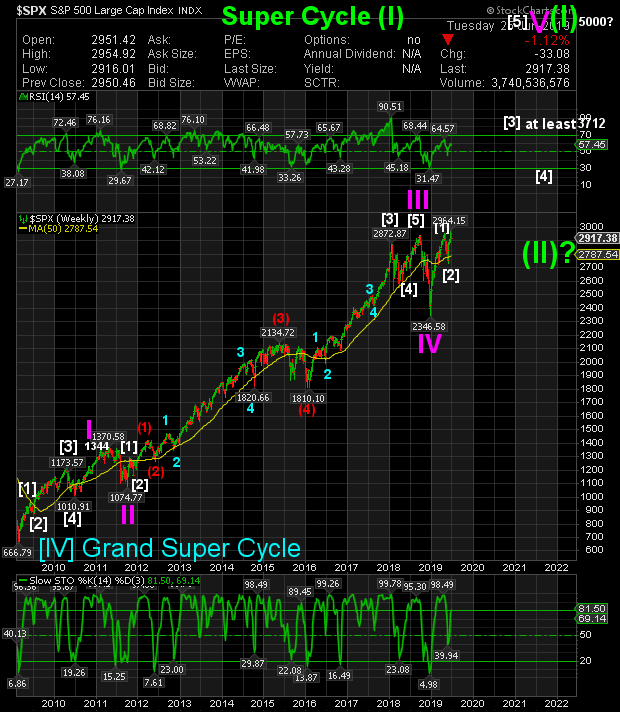

The decline from 3393 to 2191 turned out to be all of Super Cycle (II).

It was shorter than the average two.

We are now going higher in Primary [3] of Super Cycle (III).

The target for (III) is at least 4000.

For all of the dips, blips and up to the minute calls go to http://indexinsight.com/ for information.

Nice C of (4). As expected (4) is an expanded flat. The most common pattern for a four is a flat. The most common flat is an expanded flat.

It is not complete yet. The C wave will be five waves when complete and will go lower than the end of A.

Up to the minute charts and commentary can be found in the Trading Pit Forum. http://www.indexinsight.com/

Can you believe it? An idiot is saying I have been suspended on Ihub for the past 6 months. Of course that is not true. The poster must be suffering from PDS. LOL

We are about to put in the C wave down of an expanded flat wave (4).

Wave (3) began at 2855.94 and ended at 3337.77.

When this correction is complete we go on to new all time highs in (5).

For up to the minute charts and commentary for all time frames

go here for information about the Trading Pit. http://indexinsight.com/

The Weekly Tuesday Night EWP Update. The charts reveal the fact that the Intermediate and Long term trend is still up.

What is not shown on these charts is how we have taken advantage of many short term trading opportunities over the past week.

For up to the minute charts in all time frames, you are invited to join me in my Trading Pit Forum where I post up to ten charts throughout the trading day.

http://www.indexinsight.com/ For information

Good move and good luck with your new posting plan!

Pat S.

On Tues. evening I will post a weekly update with charts. For up to the minute charts in all time frames, you are invited to join me in my Trading Pit Forum where I post up to ten charts throughout the trading day.

http://www.indexinsight.com/

I will post a Weekly Update with charts on Tuesday evening for the fore seeable future.

Sam,

For your bearish count, I am not an Ewaver, but can follow along, and am somewhat confused. Wouldn't a 50% retrace of (l) (2340 to 2940 SPY) be around 2630?

Do you mind clarifying?

Excellent board. You nailed the low in December. Nice work.

I have an important low in May/June in my Hurst cycle work and a current projection to 1900/1800.

Best regards to the board,

~D

We are near a fork in the road. One is bullish and the other bearish. Up till now they have been in sync and both counts viable down from 2940. That will change in the next couple of moves.

Charts can be seen in my forum.

This is the Bearish count for SPX.

2940 was top of (I)

2346.58 up to 2724.99 is A of (2) may be complete?.

Then B of (2) down. Probably 38.2% to 50% retrace of (1) which is 2800,16 down to 2346.58.

Then C of (2) up. From the end of B up to somewhere near 2725+ Not beyond 2800.18

Then down near 735 points in (3) of [3].

In the Bull count for SPX

From (I) top of 2940 down to 2346.58 is an ABC wave (II).

Then we went up in (1) from 2346.58 to 2724.99 and it may be complete?

Now we go down in ABC of (2) retracing 50%-61.8% of (1).

Then we go up in intermediate (3) of Primary [1] of cycle I of super cycle (III). Heights few have thought of.

this bull market will have usual corrections to play the short side but the Long Term Trend will be up.

Sorry for the delay. I do not check in here as often as I should.

You can learn all about my private forum here.

http://indexinsight.com/

If you have questions feel free to email me.

You will see my email at the above link.

So you charge 20 bucks a month for access to your market calls? How often do you put out information?

I couldn't find your trading pit board.

Are you still looking for 3014 somewhere down the line?

the range has opened up to 2340 to 2520. There is the possibility we go to bottom of range to top of range two more times.

Awesome call. Thanks for your commentary.

HH

We are in a 100 point range 2400 to 2500. This is the last throws of 3 of (3) off the top at 2940. We will now go up to 2500 then down to 2400 then up to 2500 then down to about 2325 to end 3.

targets are approx.

Slight change to my count. I dropped the degree one notch on the decline from 2940. We are now in 3 of (3) which began at 2800.

Decline has a long way to go to reach Cycle A of this bear market.

See header for information on one week free trial to my forum.

(2) of [3] complete at 2736. Now we go down in (3) of [3].

It does not get any more bearish than this.

Targets for (3) and [3] are found in the forum.

Again wave [2] gives every indication it is finally over.

Target for [3] is 370 points down from top of two.

Currently that is 2446.46.

[3] will be five waves down.

Join me in the forum to count it down.

see header

[2] continued today with a (C) wave. [2] could be over at today's close or run for another 12+points. That is how far short of the most common wave two range we are. Tomorrow will tell the tale of the two.

[3] down will run 373 points down from the end of [2].

You do not want to be anything but short for that ride. It will happen in five Intermediate waves. It will provide active traders with a picnic.

Bulls will be slaughtered.

It looks like [2] is complete at 2775. It is down from here in [3].

As I mentioned yesterday the bear is in control. 2940 was likely the top for Super Cycle (I) and we are in Super Cycle (II) with a first target for completion at 1810.

There will be swing trades up as we go down of course. To follow the move on all time frames join me in the Trading Pit forum.

See info in the header.

For long term updated chart: http://indexinsight.com

we reached an inflection point today where the bear and the bull waged battle. It looks like the bear won. Down from here. JMHO

Back at the beginning of Feb, you gave a bleak long-range forecast on gold.

We've since seen a triple top in the 1364 to 1369 range. Has been all down hill since April. Has bounced a bit from last month's 1167 low but seems to keep running into resistance in the 1200 to 1210 range.

Just wondering if you have an intermediate-term forecast for gold?

Thanks.

Let's refine that to 3014.

Next target for possible top is now 3000. Longs are safe to there. Top can only occur at the end of a five wave impulse or ending diagonal.

We are at the end of the fifth Cycle wave off the 666 low. Only Intermediate degree wave (5) left to complete. Doubt it can happen till 3000.

No top till wave structure allows it.

Double Top - A top for the 666 bull is only possible at the end of a five wave up. We are near the end of the large degree fifth wave. All that is left is the small degree waves that have to complete to end the bull market with a correction down to 1810. Now a drop of 1100 points. There are targets all along this drop. You should realize this because you have read my posts long enough. The ultimate target for the correction is still 1810 and always has been.

When a top to the bull market is possible I let you know. You do not seem to appreciate it.

Right now there are two scenarios with two different targets for the top. One of them will in all probability play out. Tops occur when all the news is good and sentiment is high. They give no warning and happen when least expected by the herd. Go back and look at the 2872 top of wave(3) of [5]. I warned of that top on the day it

occurred but no one else did. It was sudden and it was a surprise.

It was also possible that it was the end of the 666 2009 bull.

Sometimes there is only one count possible but many times there will be two that are possible. That is the case now but you have no interest.

Please refrain from posting to me if all you have to say is a complaint. Questions I usually answer but complaining about a free post of my opinion is unacceptable.

Take care and best of luck to you.

Are you still waiting for your 350 point DROP, since May?

Your NEW Target is only 2,910?

And yet the Market will continue to move higher than your "so-called" target.

You keep calling for a "TOP", but the market keeps on rising.

Could it be that your E-Wave count is wrong?

You will be changing your Wave 5 Ending Diagonal count, very soon ...

The only addition I would make is that the ending diagonal [5] is moving higher with new target of about 2910.

Well, a lot has happened since my last post.

From 666 We went up in five cycle waves. In the fifth cycle wave we completed Primary [3] at 2872 and [4] at 2553, from there we finished an Ending Diagonal five [5] at 2873. This completed five cycle waves in Super Cycle (I).

We are now going down in Super Cycle (II) with a first target of 1810. SC (II) will consist of an ABC of cycle degree.

I can just repeat my last post. 2848 looks like the top of [2].

Enjoy!

DT - No doubt we are getting down to where the rubber meets the road. The most popular scenario is that we are coming out of a wave four correction and going to new ATH in a wave five.

There are things to commend this view.

There is another view had by a few who see five waves completed from 666 to 2872. IMO that five waves was Super Cycle wave (I).

We are now in Primary wave [3] down of Cycle A of Super Cycle (II).

Wave [3] should go 453 points down.

Actually the charts were BULLISH, not awful.

The SP500 is now over 2800 and rising ...

SP500 is going UP to 2900 next.

More UP is next.

I see false predictions for "down 350 points" - so wrong.

20 Point pull-back

I nailed it again !!!

You are a lot like me, very modest. lol

That was just abut a quadruple top.

OK now we can go down in [3] @2338 min.

S&P500 High of Day = 2795.58

Another excellent call, by me ...

I think you are just looking for a double top, DoubleTop. lol

S&P500 goes to 2800+ BEFORE we have your 453 drop. Currently, it looks like a basing pattern to go higher, by August 1st?

You are right it could happen. I actually hope it does.

Thanks

Jan 26 = 2873 High

Feb 09 = 2533 Low

==================

10 days = 340 Point DROP ( avg 34 point drop per day )

Mar 13 = 2802 High

Apr 02 = 2554 Low

===================

13 Days = 248 Point DROP ( avg 19 point drop per day )

Maybe, by the end of July?

If the DROP starts Monday June 18th,

then the S&P500 could be DOWN 453 points by the end of July?

That is about 30 trading days from today.

453 points / 30 days = 15 points down per day.

DROPS usually happen very quickly ...

No, It will take longer than that. Look for up from here to 2801 to 2816 for the top then it is down 453 points. This will take a good while.

Just in case we do not get these last points up, if we drop below 2760 the big decline is on.

The theme and focus of this board is Technical Analysis in all of its many forms. Foremost here is Elliott Wave Principle. In my opinion the very best system for predicting turning points and market direction in every time frame is Elliott Wave. The proof of the pudding is in the tasting. Nothing compares with it.

Geopolitical and Economic News is of vital interest. We will all attempt to stay on topic. Posts that are not on topic are subject to deletion.

Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. Like weather forecasting, technical analysis does not result in absolute predictions about the future. Instead, technical analysis can help investors anticipate what is "likely" to happen to prices over time. Technical analysis uses a wide variety of charts that show price over time.

Taken from StockCharts Chart School.

Please lead with the name of the person you are addressing or the topic of your post.

Personal attacks will not be tolerated and the post will be deleted.

I have a low tolerance for antagonism and your antagonistic posts will be deleted.

Differing opinions are welcome and will be treated with respect.

If you need assistance posting charts or have other questions just ask.

Please remember that everything that I say or imply on this board is strictly for entertainment purposes and is not meant

to be used in any way for trades with real money. POKERSAM

Join me in The Trading Pit

You will get Targets, support and resistance and turning points for ST, IT and LT.

I am there all day, every trading day, to post charts, answer questions, and provide play by play commentary. That is what is different about my Trading Pit Forum.

For more information go to http://indexinsight.com/

"But forecasters' concerns should be not whether human response is rational or irrational, only that it is observable and systematic." Allen Greenspan

"The bottom line is that certain patterns of price movements have proved through observation over time to be consistently repeated in a systematic fashion." POKERSAM

THE FAIR TAX Please read "About The Fair Tax" before passing judgement. I believe the more you learn about it the more you will appreciate it and become a supporter. https://fairtax.org/about/how-fairtax-works?gclid=COa8kfnH684CFQQGaQodMfINNw

THE LIBERTARIAN PLATFORM http://www.lp.org/platform

Always remember, "It's not done till it's over done."

If you are a "Rigged Market Conspiracist" please talk about it somewhere else. That topic is totally off topic on this board.

US Dept Clock http://www.usdebtclock.org/

The big challenge for every American is to separate the truth from the propaganda.

What is the richest and most powerful criminal organization on the planet?

It is the first duty of every patriot to protect and defend his country from its government.

"government even in its best state is but a necessary evil; in its worst state an intolerable one"

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |