Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

New Southern Arc Video

Here is a new video with Al Korelin and Rhylin Bailie.

Watch it here

anyone still following Southern Arc?

Many things are about to finally happen after a lot of waiting for the new Indonesian Mining Law to come into effect.

They just announced a joint venture with Vale which is the 2nd largest mining company in the world! Very few juniors can say this!

We are still awaiting the IUP (mining permit) for the last property which is their prize property and there is a lot of speculation that more joint ventures might happen as the CEO has be working hard at putting deals together while they were waiting for the IUPs.

The stock chart is looking very bullish!

hopefully, i have no clue why shes dropping ![]()

Thanks. Hopefully it'll improve soon.

Lexi

no idea :/

Hi Gordon,

You know of any reason why this stock is dropping so much? I have other metal stocks that aren't pulling back near as much, so know it's not a sector thing.

Lexi

thx this one is a solid investment. cheers

yes i have possibly in the future, may be a bit of a hold though.

From Stockhouse;

next 3 weeks

-1200 meter drill likely secured

-4 drill hole results

-Yet another COW meeting

-Keep the chins up

I was gonna create a board for this stock but u beat me to it ;) Im hearing big things coming up for this one....have u heard the same? -Gecko

sounds good lexi... yes i was told someitmes the actual canadian stock is more liquid at times but when i called myself they said, it is routed straight to the canadian exchange, so it sounds good to me... thanks for the confirmation !

FYI...I have a TDAmeritrade account and I called in last week to buy shares for I was told the Canadian exchange (SA.V) is the way to go other than SOACF.pk. Anyway, when I talked to the broker he told me this...

When you place a trade for SOACF it is immediately sent to the Canadian exchange and it is the same as SA.V. I bought some shares that I plan to just hold longer term. Sounds like the company has potential and like the article said - some of these junior miners seem to base forever until you want to get out of them, then they take off. CGLD was like that for me. I sold it for a small profit and then it took off like a rocket. So, I'm just going to hold my Southern Arc and give it time to do its thing.

Lexi

An article has came out today mentioning SA.V

http://www.321gold.com/editorials/banister/banister120507.html

HUI index resting before a large breakout

Juniors at fire sale prices

David Banister

Dec 5, 2007

"My favorite Junior is Southern Arc Minerals"

I've seen this movie before a few times in this gold bull market, and I already know the ending. For those contrarian investors like me, this, in my view, is your last chance to buy quality Junior gold exploration stocks at fire sale prices. Bull markets like to buck off as many investors as they can along the ride up. This one has been no different.

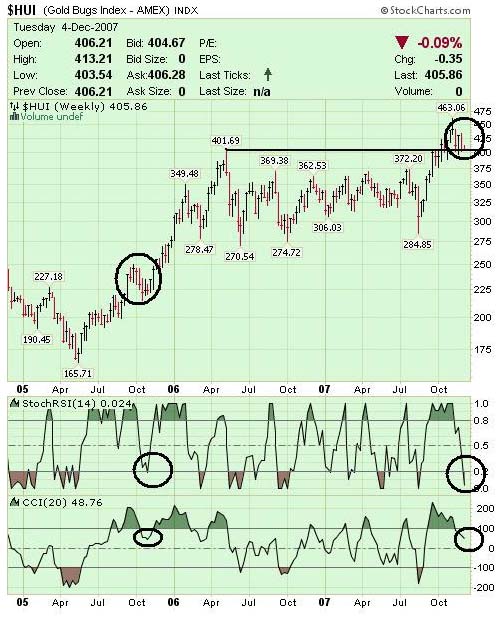

Let's start by examining the HUI index of "unhedged" gold companies. This index has always served me well by using technical analysis and "Elliott wave" theory. One thing I like to do is keep it as simple as I can. The HUI index broke out of its near 18 month base pattern this fall when it finally crept over the May 2006 highs of 401. The index rallied to 463 before recently pulling back in the October-November time window.

This particular pullback looks eerily like the fall of 2005. The HUI index then had begun to run off of extreme bottoms, and formed its first pullback. This is what I call a "wave 2" pullback. Quite simply, the herd has decided to pull their chips off the table assuming the run is over. Once again, the end of this movie will show that herd to be wrong. What we have now is the HUI index coming back to test the May 2006 levels one more time, and whilst doing so, the index has become extremely oversold. If you look at the chart I did here, you will see a strikingly similar pattern to the fall of 2005 pullback. In fact, I expect the HUI to eventually run up towards 600 from 405 today, with the intermediate peak around 525 along the way. The index is going to mimic the April 2005 to May 2006 move, only from much higher levels. Gold will be heading to about $980 per ounce US at its next pivot top.

There is not a lot of time left to enter at these fire sale levels. In a recent interview, John Embry, the Chief Investment Officer of Sprott Asset Management felt that Juniors are at their cheapest valuation levels since 2000-2001. He believes the fund he manages will return 100% or more in the next twelve months for the patient investors. The HUI index back then was at a low of 50, its now 405.

If Embry is right, and the charts that I have used successfully for this entire gold bull market are right, well, it's time to look for some Juniors to invest in at these "fire sale" prices. There are many that come to mind that are trading at 1% to 3% of inferred in situ ore valuations. The key is finding those with low capital costs to build a mine, low labor costs, and economic deposits. Many of the best Juniors are advanced in their exploration projects, are well cashed up, and have multiple drill results to review. The best of them will eventually have the opportunity to be bought out for anywhere between 10% to 40% of their proven and probable resources. Now is the time to invest aggressively in this sector while the inherent discounts to ore value are at extreme lows.

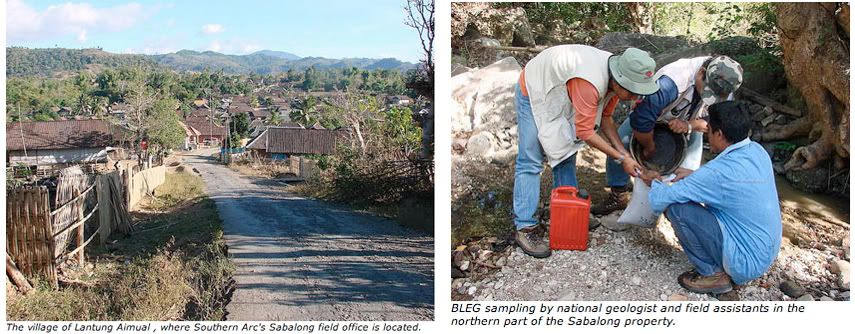

My favorite Junior is Southern Arc Minerals. SA has been written up on 321Gold.com in numerous articles from April through August of this year by Bob Moriarty, Omar Boulden, and Kevin Graham. Southern Arc has continued to drill off 600 meter deep drill holes of gold and copper intercepts all summer long. After six consecutively announced drill holes averaging 430 meters of gold and copper intercept per hole, they recently decided to secure a second drill to expand the work at the Selodong Intrusive Complex in Indonesia. They have identified fifteen - that's right, fifteen - separate porphyry style formations in the same 7km x 3km project area at Selodong. A simple trip to their website will lay it all out for you, including maps and historical drill results from Newmont Mining.

Recently, management decided to take this advanced exploration story on the road to New York, Boston, London, Zurich, Montreal, and Toronto. John Proust, CEO, and Hamish Campbell, chief geologist, conducted over thirty meetings. Following these meetings, Southern Arc announced this week a $12,000,000 brokered private placement at $1.20 per share with warrants. The offering book sold out in 48 hours, and from what I hear, John Proust was trying to find another 2,000,000 shares to help meet demand from one large fund group.

Why the interest? The stock has consolidated heady gains for the past seven months, after having gone from 20 cents in February to $2.48 in June. Southern Arc last did a private placement in March of this year at 30 cents. This offering was 400% higher only eight months later, and six times the value raised. Stocks like to consolidate big gains for many months at a time, until the volume dries up and they become "oversold". The timing for investors in the placement could not have been better, talk about an early holiday present. After completing six deep drill holes back to back all summer long, management felt "it is time to tell the story". Apparently the story was quite well received and I expect the share price to begin climbing into the new year. Once this offering officially closes, Southern Arc will have $11.3 million in the til, [till] plus current cash on hand of near 3 million, or in the neighborhood of $14.3 million. They recently added the second deep drill and now have two turning actively. They are securing a 3rd drill which will be able to drill down as far as 1,200 meters instead of the 700 meter limitations of the current drills. The company is fully cashed up for at least the next twelve to eighteen months of work at Selodong, let alone several other projects with blue sky.

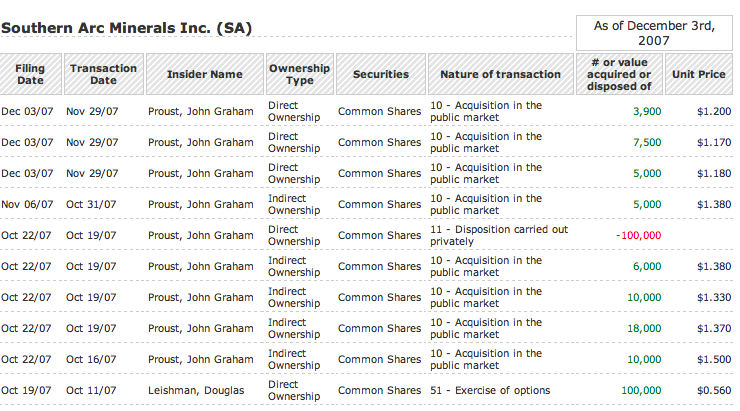

Suffice to say that there will be a lot of news flow coming out of Southern Arc over the next twelve months as they expand the scope of their Selodong work and continue to prove up a potentially huge gold and copper resource deposit. John Proust, the CEO, has been an active buyer of the stock all summer long in the open markets, purchasing more as recently as November 29th. It's rare to find a quality junior with an advanced exploration project with insider buying, thirteen geologists on staff, and fast assay lab results from each drill hole. It's even more rare to find a project with the potential to equal that of the Batu Hijau deposit owned by Newmont Mining, and some are even putting Grasberg in the same sentence. Although there is quite a bit more drilling to do, the company trades at a fully diluted market cap of only about $112,000,000 as of this writing. Bob Moriarty hypothesized this summer after just four deep drill holes, that one could infer 270 million tones of ore already. They had only deep drilled four holes over just two of the fifteen porphyries identified. 270 million tones at about $25 per tonne is about 7 billion dollars of gross ore value. 10% of that figure is 700 million, or $8.50 per fully diluted share.

The stock is selling in the $1.30-$1.50 ranges of late. This calculation assumes there is no further blue sky on the project, and also assumes we are not giving Southern Arc any value for any of their other prospective properties in the prolific Indonesian arena. If we were to put a 5% inferred resource valuation on the figures above, the stock should be trading at $4.30 per fully diluted share today. To wit, Omar Boulden's piece this past June on 321Gold had a fair value of about $3.89 per share at the time, after only three deep drill holes, we now have had seven. Palmajero is good proxy to compare as well. They were acquired this summer for about $1.1 billion, or 40% of proven ore value. Southern Arc is currently trading at about 1.5% of inferred value with a lot of blue sky on this Selodong project to come.

Although this is certainly not a complete representation of all of the facts surrounding Southern Arc, it is but one example of many Juniors that are trading at severe discounts to potential takeover value. Many of the Senior Miners have publicly stated they are concerned about meeting the demand for gold and copper, but also replacing rapidly depleting reserves. I could list another ten juniors here, but Im [I'm] biased about Southern Arc and I am a shareholder. I have invested in some five and 10 baggers several times in the Junior sector, patience is usually difficult when the stock drifts for 6-7 months at a time, but when they start to move, they can really build steam.

With the HUI index ready to resume its advance, along with gold... now may be a good time to build your shopping list, but you probably shouldn't wait for much lower fire sale pricing, it's already here.

Dec 4, 2007

David Banister

email: dbanister@cox.net

David Banister is a Registered Representative with Investor's Capital Corporation and has a personal position in Southern Arc Minerals at the time of this writing. David has written for CBS Marketwatch.com in the past, has been on national radio, and has written articles for local newspapers on the topics of investing and economics. Please perform your own due diligence. All opinions expressed in this article are not the opinions of Investor's Capital, and should not be relied upon for advice.

321gold Ltd

Looks like she is closing yesterdays gap perfectly

alright bud, sounds good... i will keep you posted

Well, I will be radaring this bad boy...GLTY

no hustla i buy this puppy... CEO buys shares on the open market.. and possibly has one of the largest gold / copper depostits... they have drilled tons of holed and have had tons of great results... i expect to hear more from them... definetly not shorting.

U short this puppy?

Congrats onna board there,kiddo! will keep an eye on this one.

thanks bud, i hope she does well... not to many will be interested here i dont think.. since its canadain.. but i dont think they realize u can buy with american accounts.

Nice find Matador, Like the channels in the chart :Thumbsup:

My first canadian pick, CEO buying shares on the open market. and possibly one of the largest gold/copper finds in the world...

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

25

|

|

Created

|

12/04/07

|

Type

|

Free

|

| Moderators | |||

Southern Arc Minerals (SOACF-US; SA-Canada)

IF YOU TRY TO BUY AND CANT TRY SOACF WITH AMERICAN ACCOUNTS

---------------------

CONTACT

www.southernarcminerals.com

Southern Arc Minerals Ltd.

Box 1078, Suite 1500

885 West Georgia Street

Vancouver, BC

Canada V6C 3E8

Telephone: 604-676-5241

Fax: 604-488-0319

---------------------

•52 week high $2.48 52 week low .20 Current Price $1.25

•Estimated Market Cap $98,000,000

•Outstanding Shares 80,500,000 fully diluted as of 12-1-07

•Cash $14,000,000 after closing of $12,000,000 financing http://www.southernarcminerals.com/s/NewsReleases.asp?ReportID=274408&_Type=News-Releases&_Title=Southern-Arc-Announces-12-Million-Equity-Financing

•CEO owns or controls about 10% of stock issued

---------------------

Southern Arc Minerals is a Junior Gold and Copper exploration company with multiple projects in Indonesia, one of the most prolific regions in the world for elephant sized Gold, Copper, and other mineral deposits. Indonesia is home to two of the world’s largest operating Gold and Copper mines, Batu Hijau- Newmont, and Grasberg – Freeport McMoran.

Southern Arc believes they are the leading Junior Exploration company in Indonesia having secured several exploration rights in the year 2005, when the Juniors were not securing exploration projects in the area.

---------------------

About the current drilling project- Selodong

Of immediate interest to investors is the Selodong Intrusive Complex that Southern Arc secured from Newmont Mining in the year 2005. In return for all of the historical drilling results that Newmont had, and a 2% future royalty on any future production, plus the “Right of first refusal”, Southern Arc secured the exploration rights to this area in West Lombok. The Selodong Intrusive Complex encompasses a large gold-copper porphyry deposit that was explored by Newmont and has been further evaluated by Southern Arc to provide a basis for infill and deep drilling, which is currently ongoing. Although classed by Newmont likely to be as significant as the porphyry that ultimately became the world-class Batu Hijau Mine on Sumbawa Island, the company's resources were subsequently concentrated on developing the latter, already more advanced porphyry in west Sumbawa, adjacent to the south to Southern Arc's Taliwang Project. Selodong was therefore put on hold by Newmont and ultimately, in accordance with Indonesian law, the Selodong porphyry had to be relinquished by Newmont, together with the whole of the Block 1. As the reliquishment was being processed Southern Arc acted immediately to acquire Block I as an expansion of its property portfolio.

The excitement began this spring when Southern Arc announced they would begin “deep drilling” this prospect with 600 meter plus holes. Prior to this, Newmont had carried out hundreds of drill holes up to 125 meters in length. Upon the first drill hole being announced in early May, the stock went from 70 cents to about $1.70 in a short period of time. Since then, they have drilled off a further 6 additional deep drill holes as they define and discover the size of the deposit. These holes are showing massive amounts of Gold and Copper intercepts at an average length intercept of 430 meters per hole. The Ore Value is roughly $25 per tonne, and we some have estimates already of 300 million tonnes. The gross in situ value would be $7.5 billion. The market cap is only 100 million fully diluted. This is less than 1% of in situ potential value, with much more upside in tonnage potential to come as they continue drilling.

Juniors usually get bought out for between 10% and 40% of in situ ore value. A good example is a company called Palmajero. They were bought for 1.1 billion in a merger this summer after drilling off about 3 million ounces worth of proven gold equivalents. This was 40% of the insitu valu. As Southern Arc continues to define the resource with more drill holes, they build upon the gross ore value of the site. This is a Porphry Style deposit, very inexpensive to mine and very profitable. Majors love these types of discoveries. To wit, three of the Major miners of the world have signed confidentiality agreements to review all of the metrics of the Selodong deposit since September. We also understand from internal sources at the company that the Chinese have quickly staked out a significant number of prospective areas since Southern Arc first came into Idonesia.

While the stock had an amazing run from 20 cents in February to as high as $2.48 in June of this year, it has consolidated over the past 6 months or so into a bullish pattern. The company announced a $12,000,000 private placement this week at $1.20 a share. It was fully subscribed within 48 hours and will officially close around December 10th. The stock traded down from the $1.40 range to the 1.12-1.22 range on this news, as is expected. Once this placement officially closes out, we expect the stock to regain momentum on news that will be coming all year long on drill results.

---------------------

Insider buying and other coverage

CHECK INSIDER BUYING HERE SHOWS THE CEO BUYING SHARES ON THE OPEN MARKET HIMSELF! http://canadianinsider.com/coReport/allTransactions.php?ticker=sa.v

John Proust is the CEO of Southern Arc. He has been a regular open market buyer of the stock all summer long. John has paid as much as $1.80 per share and as little at $1.10 per share in the open markets. It is extremely rare to find a Junior exploration company with top level executives buying the stock in the open market. In addition, Michael Andrews is a noted Geologist with 30 plus years of world experience, a Director, and he has purchased shares in the open market at 1.49, 1.50, and 1.56 over the past 3 months. John Proust and Michael Andrews have also participated in private placements with their own funds. Mr Proust controls or effectively owns close to 7.5 million shares.

One of the most respected Gold and Mineral analysts-writers is Bob Moriarty, of 321Gold.com. Bob discovered Southern Arc this spring at 35 cents or so a share when he went on a site visit. He believes it may be on of the most exciting Juniors in the market to invest in today. He continues to own a significant number of shares and has written up the company a few times this summer. You can read the articles below by Bob as well as Omar Boulden from his site. In it, Bob speculates that Southern Arc will end up being acquired for between 1 and 2 billion dollars within 12-18 months. At current share levels, that would equate to $12.40 cents full diluted to $24.80 cents fully diluted.

In addition, Bob Bishop retired this summer after more than 30 years writing about precious metals and junior exploration companies. Prior to retiring, Bob’s final newsletters had extremely positive commentary on Southern Arc as well. The coverage this summer helped push the shares to a 52 week high in June of $2.48 per share, up 1200% in only 4 months time from its lows. The company has also been mentioned by Roger Wiegand, Adam Hamilton and others.

Southern Arc stock has drifted back off on low volume as Bishop retired and Moriarty has not written them up in several months. The company has done a poor job of creating market awareness of their Selodong and other prospective exploration projects. With this recent financing now being completed and $12,000,000 soon in the bank, we expect this to change. A second drill was recently mobilized to the site and there are now two drills going full time. A 3rd deeper 1,200 meter drill is being secured now and will help further define how deep the deposit may go. We also are hoping for new institutional support now that Haywood Securities and Cannacord have helped with the financing.

The company and their geologists have identified 15 Porphry targets within the Seldong complex. With some extrapolation, its possible over time they could prove up more copper and gold than Batu Hijau has. Batu Hijau has roughly 1 billion tonnes of copper and gold and is owned by Newmont. Newmont was working on the Selodong deposit and relinquished it to get their Batu Hijau mine up and running by 2001. Southern Arc was in the right place at the right time, and the drilling continues to show it’s possible the 15 Porphry targets connect up and in the future, could prove to be as big or bigger than Batu Hijau, one of the worlds 10 largest gold and copper open pit mines. The grades from drill results so far are remarkably similar. I would suggest you read up on the site for more details, maps, and drill hole results.

---------------------

[b]The following links provide some excellent due diligence reading sources. Once this equity is discovered by the masses, we believe the share price can very rapidly appreciate to fairer value levels. Please read some of the information below and do your own due diligence. You may purchase shares with the symbol SOACF in the US, or SA.V in Canada.

May article from 321 Gold after first deep drill hole

http://www.321gold.com/editorials/moriarty/moriarty051107.html

June article on Southern Arc regarding fair value and due diligence

http://www.321gold.com/editorials/boulden/boulden061907.html

August article by Bob Moriarty on SA

http://www.investdeep.com/investing/114/

Company news releases:

http://www.southernarcminerals.com/s/NewsReleases.asp

Powerpoint presentation on SA.V

http://www.southernarcminerals.com/i/pdf/presentation.pdf

---------------------

Management:

John Proust, C. Dir.

Position: President and CEO

John Proust has successfully managed, directed and advised public and private companies regarding debt and equity financing, mergers and acquisitions and corporate restructuring since 1986. Highly regarded in the industry for his management skills and attention to detail, he has held and is holding senior operating positions and has served on the boards of numerous private and TSX Venture Exchange listed companies including as current president, CEO and a director of Southern Arc Minerals Inc. and as director of Western Uranium Corporation, Superior Mining International Corporation, and Canada Energy Partners Inc.

Mr. Proust was also previously the past President and a Director of Signature Resources Ltd. (UrAsia Energy Ltd.), President and a Director of TelcoPlus Enterprises Inc. (Yamiri Gold and Energy Inc.), President and a Director of Adobe Ventures Inc. (Coalcorp Mining Inc.), and a Director of Atlas Cromwell Ltd. (Terrane Metals Corp.), Canada West Capital Inc. (Canadian Sub-surface Energy Services Corp.), Chap Mercantile Inc. (Silver Wheaton Corp.), Full Riches Investment Ltd. (Bankers Petroleum Ltd.), Cash Minerals Ltd., Navigator Exploration Corp., and Strongbow Exploration Inc. In addition, Mr. Proust was previously the President, a Director and the majority shareholder of Canada Talc Limited, an Ontario miner and processor if industrial minerals.

Mr. Proust has extensive experience in corporate governance, is a graduate of The Directors College, Michael G. De Groote School of Business at McMaster University and holds the designation of Chartered Director (C. Dir.)

Michael Andrews, Ph. D., FAusIMM

Position: Director

Mike Andrews is a geologist with over 26 years of research and mining industry experience in gold, copper, coal and iron exploration. Dr. Andrews is currently a director of Kingsrose Mining Ltd, Advance Concept Holdings Ltd., Paragon Resources (Hong Kong) Ltd., Managing Director of Pacific Goldfields Pty Ltd. and Natarang Offshore Pty Ltd, Australian subsidiaries of Advance Concept Holdings Ltd., and Director of Indonesian PT Natarang Mining and PT Paragon Perdana Mining. Dr. Andrews is a Fellow of the Australasian Institute of Mining and Metallurgy.

Doug Leishman, B.Sc. (Hons. Mining Geology), A.R.S.M., P.Geo.

Position: Director

Mr. Leishman was most recently the Director of Geology and Exploration for Endeavour Financial Ltd., a financial advisory firm focused on the mineral industry. Prior to joining Endeavour he was a Senior Mining Analyst with Yorkton Securities Inc. in Vancouver. He was trained as a geologist and prior to entering the investment industry held positions of responsibility in the exploration sector with various companies in North America, Europe and the Middle East. In the late 1980s, prior to joining Yorkton, he worked as an independent contractor/consulting geologist based in south-central British Columbia. Mr. Leishman is a graduate of the Royal School of Mines (London) and holds a degree in Mining Geology. He is also a registered member of the Association of Professional Engineers and Geoscientists of British Columbia (1994) and a Fellow of the Geological Association of Canada (1985). In addition, Mr. Leishman is a Director of Terrane Metals Corporation, a Vancouver based company developing the Mt. Milligan mineral deposit in northern British Columbia.

Eduard Epshtein, C.A.

Position: Chief Financial Officer

Mr. Epshtein is a Chartered Accountant with experience in mining exploration and oil and gas public companies. He began his career in the mining group of PricewaterhouseCoopers LLP audit and assurance practice in Vancouver. Mr. Epshtein moved to the mining industry as a controller of four public exploration companies, where he managed financial reporting and Sarbanes-Oxley Act compliance. He is also the Chief Financial Officer of Western Uranium Corporation and Canada Energy Partners Inc.

Hamish Campbell, B. Sc. (Geology), MAusIMM

Position: Vice President Exploration

Mr. Campbell is an independent geological consultant who heads Southern Arc's exploration programs in Indonesia. He is well-known and highly regarded within the Indonesian mineral exploration community. Mr. Campbell is a key contributor to our exploration and acquisition strategies. He has over 23 years of international mineral exploration, including 21 years in Indonesia, speaks Indonesian fluently, and has held mineral exploration positions ranging from Field Geologist to Exploration Manager. He has established and maintained both local and foreign owned mining service companies, designed and implemented exploration programs, along with evaluation and assessment of joint venture and acquisition opportunities. Previously Mr. Campbell was a Director of PT. Jasa Prima Raya (Jakarta), Indonesian Exploration Manager of Golden Valley Mines (Australia) and Senior Geologist of Meekathara Minerals (Australia). Mr. Campbell is a graduate of the University of Canterbury, New Zealand, where he completed a Bachelor of Science degree. He subsequently received a MAusIMM designation from the Australasian Institute of Mining & Metallurgy and is a member of the Indonesian Mining Association.

Robert (Bob) Vidoni, P.Eng.

Position: Vice President Project Management

Bob Vidoni is a registered professional civil and structural engineer who is responsible for project and engineering/technical management of Southern Arc's activities in Indonesia, while also holding the office of Secretary of the Corporation. Until mid-June 2005, when he left to join Southern Arc, Mr. Vidoni was senior engineer with Klohn Crippen Berger Ltd, an engineering consulting firm that is a member of the Louis Berger Group and which is internationally recognized for its work in providing engineering and environmental services in the modern global mining industry through the full mine life-cycle of design, construction, operation, audit and closure. Fluent in eight languages, including Indonesian, Mr. Vidoni has more than 20 years of domestic and international civil engineering and international development experience, including providing engineering input to infrastructure projects related to the mining industry, open cast mining and tailings facilities, as well as international water resource management, structural engineering, rural development and foreign assistance, primarily with Klohn Crippen Berger. Mr. Vidoni has completed detailed engineering assignments for Eskay Creek, Yanacocha, Antamina, Highland Valley, Boliden Westmin Mine (Myra Falls), Kemess, Pinchi Lake, Campbell Lake, Marcopper (post-closure review), Ok Tedi, Britannia and Polaris Mines. His professional experience includes completing projects for Klohn Crippen Berger, PCI Asia, SNC-Lavalin, BC Hydro, Hydrosult, the World Bank, the Asian Development Bank, the Government of Indonesia and the Royal Thai Government.

R. Edward Flood, M. Sc.

Position: Senior Corporate Advisor

A key advisor to Southern Arc, Mr. Flood is a director of Ivanhoe Mines. He has been a member of the Board of Directors of Ivanhoe and held executive positions in the company since its inception in 1994. As the founding president of Ivanhoe, Mr. Flood headed the company's inaugural management team for four years, a period that included the company's high-profile initial stock offering on the Toronto Stock Exchange in 1996, and he helped to guide the establishment of the company as a significant presence in Asia's rapidly expanding mineral exploration and mining sectors during the 1990s. During that time, Ivanhoe initiated successful exploration projects in Southeast Asia and saw the start of production in 1998 at the very successful Monywa Copper Project, a Myanmar-based joint venture in which Ivanhoe holds a 50% interest. Mr. Flood is also a director of Jinshan Mines and Asia Gold, two Asia-focused mining and exploration companies that are closely associated with Ivanhoe Mines. Currently, he is also the managing director of investment banking with Haywood Securities (UK) Limited.

Southern Arc Minerals (SOACF-US; SA-Canada)

IF YOU TRY TO BUY AND CANT TRY SOACF WITH AMERICAN ACCOUNTS

---------------------

CONTACT

www.southernarcminerals.com

Southern Arc Minerals Ltd.

Box 1078, Suite 1500

885 West Georgia Street

Vancouver, BC

Canada V6C 3E8

Telephone: 604-676-5241

Fax: 604-488-0319

---------------------

•52 week high $2.48 52 week low .20 Current Price $1.25

•Estimated Market Cap $98,000,000

•Outstanding Shares 80,500,000 fully diluted as of 12-1-07

•Cash $14,000,000 after closing of $12,000,000 financing http://www.southernarcminerals.com/s/NewsReleases.asp?ReportID=274408&_Type=News-Releases&_Title=Southern-Arc-Announces-12-Million-Equity-Financing

•CEO owns or controls about 10% of stock issued

---------------------

Southern Arc Minerals is a Junior Gold and Copper exploration company with multiple projects in Indonesia, one of the most prolific regions in the world for elephant sized Gold, Copper, and other mineral deposits. Indonesia is home to two of the world’s largest operating Gold and Copper mines, Batu Hijau- Newmont, and Grasberg – Freeport McMoran.

Southern Arc believes they are the leading Junior Exploration company in Indonesia having secured several exploration rights in the year 2005, when the Juniors were not securing exploration projects in the area.

---------------------

About the current drilling project- Selodong

Of immediate interest to investors is the Selodong Intrusive Complex that Southern Arc secured from Newmont Mining in the year 2005. In return for all of the historical drilling results that Newmont had, and a 2% future royalty on any future production, plus the “Right of first refusal”, Southern Arc secured the exploration rights to this area in West Lombok. The Selodong Intrusive Complex encompasses a large gold-copper porphyry deposit that was explored by Newmont and has been further evaluated by Southern Arc to provide a basis for infill and deep drilling, which is currently ongoing. Although classed by Newmont likely to be as significant as the porphyry that ultimately became the world-class Batu Hijau Mine on Sumbawa Island, the company's resources were subsequently concentrated on developing the latter, already more advanced porphyry in west Sumbawa, adjacent to the south to Southern Arc's Taliwang Project. Selodong was therefore put on hold by Newmont and ultimately, in accordance with Indonesian law, the Selodong porphyry had to be relinquished by Newmont, together with the whole of the Block 1. As the reliquishment was being processed Southern Arc acted immediately to acquire Block I as an expansion of its property portfolio.

The excitement began this spring when Southern Arc announced they would begin “deep drilling” this prospect with 600 meter plus holes. Prior to this, Newmont had carried out hundreds of drill holes up to 125 meters in length. Upon the first drill hole being announced in early May, the stock went from 70 cents to about $1.70 in a short period of time. Since then, they have drilled off a further 6 additional deep drill holes as they define and discover the size of the deposit. These holes are showing massive amounts of Gold and Copper intercepts at an average length intercept of 430 meters per hole. The Ore Value is roughly $25 per tonne, and we some have estimates already of 300 million tonnes. The gross in situ value would be $7.5 billion. The market cap is only 100 million fully diluted. This is less than 1% of in situ potential value, with much more upside in tonnage potential to come as they continue drilling.

Juniors usually get bought out for between 10% and 40% of in situ ore value. A good example is a company called Palmajero. They were bought for 1.1 billion in a merger this summer after drilling off about 3 million ounces worth of proven gold equivalents. This was 40% of the insitu valu. As Southern Arc continues to define the resource with more drill holes, they build upon the gross ore value of the site. This is a Porphry Style deposit, very inexpensive to mine and very profitable. Majors love these types of discoveries. To wit, three of the Major miners of the world have signed confidentiality agreements to review all of the metrics of the Selodong deposit since September. We also understand from internal sources at the company that the Chinese have quickly staked out a significant number of prospective areas since Southern Arc first came into Idonesia.

While the stock had an amazing run from 20 cents in February to as high as $2.48 in June of this year, it has consolidated over the past 6 months or so into a bullish pattern. The company announced a $12,000,000 private placement this week at $1.20 a share. It was fully subscribed within 48 hours and will officially close around December 10th. The stock traded down from the $1.40 range to the 1.12-1.22 range on this news, as is expected. Once this placement officially closes out, we expect the stock to regain momentum on news that will be coming all year long on drill results.

---------------------

Insider buying and other coverage

CHECK INSIDER BUYING HERE SHOWS THE CEO BUYING SHARES ON THE OPEN MARKET HIMSELF! http://canadianinsider.com/coReport/allTransactions.php?ticker=sa.v

John Proust is the CEO of Southern Arc. He has been a regular open market buyer of the stock all summer long. John has paid as much as $1.80 per share and as little at $1.10 per share in the open markets. It is extremely rare to find a Junior exploration company with top level executives buying the stock in the open market. In addition, Michael Andrews is a noted Geologist with 30 plus years of world experience, a Director, and he has purchased shares in the open market at 1.49, 1.50, and 1.56 over the past 3 months. John Proust and Michael Andrews have also participated in private placements with their own funds. Mr Proust controls or effectively owns close to 7.5 million shares.

One of the most respected Gold and Mineral analysts-writers is Bob Moriarty, of 321Gold.com. Bob discovered Southern Arc this spring at 35 cents or so a share when he went on a site visit. He believes it may be on of the most exciting Juniors in the market to invest in today. He continues to own a significant number of shares and has written up the company a few times this summer. You can read the articles below by Bob as well as Omar Boulden from his site. In it, Bob speculates that Southern Arc will end up being acquired for between 1 and 2 billion dollars within 12-18 months. At current share levels, that would equate to $12.40 cents full diluted to $24.80 cents fully diluted.

In addition, Bob Bishop retired this summer after more than 30 years writing about precious metals and junior exploration companies. Prior to retiring, Bob’s final newsletters had extremely positive commentary on Southern Arc as well. The coverage this summer helped push the shares to a 52 week high in June of $2.48 per share, up 1200% in only 4 months time from its lows. The company has also been mentioned by Roger Wiegand, Adam Hamilton and others.

Southern Arc stock has drifted back off on low volume as Bishop retired and Moriarty has not written them up in several months. The company has done a poor job of creating market awareness of their Selodong and other prospective exploration projects. With this recent financing now being completed and $12,000,000 soon in the bank, we expect this to change. A second drill was recently mobilized to the site and there are now two drills going full time. A 3rd deeper 1,200 meter drill is being secured now and will help further define how deep the deposit may go. We also are hoping for new institutional support now that Haywood Securities and Cannacord have helped with the financing.

The company and their geologists have identified 15 Porphry targets within the Seldong complex. With some extrapolation, its possible over time they could prove up more copper and gold than Batu Hijau has. Batu Hijau has roughly 1 billion tonnes of copper and gold and is owned by Newmont. Newmont was working on the Selodong deposit and relinquished it to get their Batu Hijau mine up and running by 2001. Southern Arc was in the right place at the right time, and the drilling continues to show it’s possible the 15 Porphry targets connect up and in the future, could prove to be as big or bigger than Batu Hijau, one of the worlds 10 largest gold and copper open pit mines. The grades from drill results so far are remarkably similar. I would suggest you read up on the site for more details, maps, and drill hole results.

---------------------

[b]The following links provide some excellent due diligence reading sources. Once this equity is discovered by the masses, we believe the share price can very rapidly appreciate to fairer value levels. Please read some of the information below and do your own due diligence. You may purchase shares with the symbol SOACF in the US, or SA.V in Canada.

May article from 321 Gold after first deep drill hole

http://www.321gold.com/editorials/moriarty/moriarty051107.html

June article on Southern Arc regarding fair value and due diligence

http://www.321gold.com/editorials/boulden/boulden061907.html

August article by Bob Moriarty on SA

http://www.investdeep.com/investing/114/

Company news releases:

http://www.southernarcminerals.com/s/NewsReleases.asp

Powerpoint presentation on SA.V

http://www.southernarcminerals.com/i/pdf/presentation.pdf

---------------------

Management:

John Proust, C. Dir.

Position: President and CEO

John Proust has successfully managed, directed and advised public and private companies regarding debt and equity financing, mergers and acquisitions and corporate restructuring since 1986. Highly regarded in the industry for his management skills and attention to detail, he has held and is holding senior operating positions and has served on the boards of numerous private and TSX Venture Exchange listed companies including as current president, CEO and a director of Southern Arc Minerals Inc. and as director of Western Uranium Corporation, Superior Mining International Corporation, and Canada Energy Partners Inc.

Mr. Proust was also previously the past President and a Director of Signature Resources Ltd. (UrAsia Energy Ltd.), President and a Director of TelcoPlus Enterprises Inc. (Yamiri Gold and Energy Inc.), President and a Director of Adobe Ventures Inc. (Coalcorp Mining Inc.), and a Director of Atlas Cromwell Ltd. (Terrane Metals Corp.), Canada West Capital Inc. (Canadian Sub-surface Energy Services Corp.), Chap Mercantile Inc. (Silver Wheaton Corp.), Full Riches Investment Ltd. (Bankers Petroleum Ltd.), Cash Minerals Ltd., Navigator Exploration Corp., and Strongbow Exploration Inc. In addition, Mr. Proust was previously the President, a Director and the majority shareholder of Canada Talc Limited, an Ontario miner and processor if industrial minerals.

Mr. Proust has extensive experience in corporate governance, is a graduate of The Directors College, Michael G. De Groote School of Business at McMaster University and holds the designation of Chartered Director (C. Dir.)

Michael Andrews, Ph. D., FAusIMM

Position: Director

Mike Andrews is a geologist with over 26 years of research and mining industry experience in gold, copper, coal and iron exploration. Dr. Andrews is currently a director of Kingsrose Mining Ltd, Advance Concept Holdings Ltd., Paragon Resources (Hong Kong) Ltd., Managing Director of Pacific Goldfields Pty Ltd. and Natarang Offshore Pty Ltd, Australian subsidiaries of Advance Concept Holdings Ltd., and Director of Indonesian PT Natarang Mining and PT Paragon Perdana Mining. Dr. Andrews is a Fellow of the Australasian Institute of Mining and Metallurgy.

Doug Leishman, B.Sc. (Hons. Mining Geology), A.R.S.M., P.Geo.

Position: Director

Mr. Leishman was most recently the Director of Geology and Exploration for Endeavour Financial Ltd., a financial advisory firm focused on the mineral industry. Prior to joining Endeavour he was a Senior Mining Analyst with Yorkton Securities Inc. in Vancouver. He was trained as a geologist and prior to entering the investment industry held positions of responsibility in the exploration sector with various companies in North America, Europe and the Middle East. In the late 1980s, prior to joining Yorkton, he worked as an independent contractor/consulting geologist based in south-central British Columbia. Mr. Leishman is a graduate of the Royal School of Mines (London) and holds a degree in Mining Geology. He is also a registered member of the Association of Professional Engineers and Geoscientists of British Columbia (1994) and a Fellow of the Geological Association of Canada (1985). In addition, Mr. Leishman is a Director of Terrane Metals Corporation, a Vancouver based company developing the Mt. Milligan mineral deposit in northern British Columbia.

Eduard Epshtein, C.A.

Position: Chief Financial Officer

Mr. Epshtein is a Chartered Accountant with experience in mining exploration and oil and gas public companies. He began his career in the mining group of PricewaterhouseCoopers LLP audit and assurance practice in Vancouver. Mr. Epshtein moved to the mining industry as a controller of four public exploration companies, where he managed financial reporting and Sarbanes-Oxley Act compliance. He is also the Chief Financial Officer of Western Uranium Corporation and Canada Energy Partners Inc.

Hamish Campbell, B. Sc. (Geology), MAusIMM

Position: Vice President Exploration

Mr. Campbell is an independent geological consultant who heads Southern Arc's exploration programs in Indonesia. He is well-known and highly regarded within the Indonesian mineral exploration community. Mr. Campbell is a key contributor to our exploration and acquisition strategies. He has over 23 years of international mineral exploration, including 21 years in Indonesia, speaks Indonesian fluently, and has held mineral exploration positions ranging from Field Geologist to Exploration Manager. He has established and maintained both local and foreign owned mining service companies, designed and implemented exploration programs, along with evaluation and assessment of joint venture and acquisition opportunities. Previously Mr. Campbell was a Director of PT. Jasa Prima Raya (Jakarta), Indonesian Exploration Manager of Golden Valley Mines (Australia) and Senior Geologist of Meekathara Minerals (Australia). Mr. Campbell is a graduate of the University of Canterbury, New Zealand, where he completed a Bachelor of Science degree. He subsequently received a MAusIMM designation from the Australasian Institute of Mining & Metallurgy and is a member of the Indonesian Mining Association.

Robert (Bob) Vidoni, P.Eng.

Position: Vice President Project Management

Bob Vidoni is a registered professional civil and structural engineer who is responsible for project and engineering/technical management of Southern Arc's activities in Indonesia, while also holding the office of Secretary of the Corporation. Until mid-June 2005, when he left to join Southern Arc, Mr. Vidoni was senior engineer with Klohn Crippen Berger Ltd, an engineering consulting firm that is a member of the Louis Berger Group and which is internationally recognized for its work in providing engineering and environmental services in the modern global mining industry through the full mine life-cycle of design, construction, operation, audit and closure. Fluent in eight languages, including Indonesian, Mr. Vidoni has more than 20 years of domestic and international civil engineering and international development experience, including providing engineering input to infrastructure projects related to the mining industry, open cast mining and tailings facilities, as well as international water resource management, structural engineering, rural development and foreign assistance, primarily with Klohn Crippen Berger. Mr. Vidoni has completed detailed engineering assignments for Eskay Creek, Yanacocha, Antamina, Highland Valley, Boliden Westmin Mine (Myra Falls), Kemess, Pinchi Lake, Campbell Lake, Marcopper (post-closure review), Ok Tedi, Britannia and Polaris Mines. His professional experience includes completing projects for Klohn Crippen Berger, PCI Asia, SNC-Lavalin, BC Hydro, Hydrosult, the World Bank, the Asian Development Bank, the Government of Indonesia and the Royal Thai Government.

R. Edward Flood, M. Sc.

Position: Senior Corporate Advisor

A key advisor to Southern Arc, Mr. Flood is a director of Ivanhoe Mines. He has been a member of the Board of Directors of Ivanhoe and held executive positions in the company since its inception in 1994. As the founding president of Ivanhoe, Mr. Flood headed the company's inaugural management team for four years, a period that included the company's high-profile initial stock offering on the Toronto Stock Exchange in 1996, and he helped to guide the establishment of the company as a significant presence in Asia's rapidly expanding mineral exploration and mining sectors during the 1990s. During that time, Ivanhoe initiated successful exploration projects in Southeast Asia and saw the start of production in 1998 at the very successful Monywa Copper Project, a Myanmar-based joint venture in which Ivanhoe holds a 50% interest. Mr. Flood is also a director of Jinshan Mines and Asia Gold, two Asia-focused mining and exploration companies that are closely associated with Ivanhoe Mines. Currently, he is also the managing director of investment banking with Haywood Securities (UK) Limited.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |