Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Silver Bull Announces Filing of Request for Arbitration with International Centre for Settlement of Investment Disputes

Silver Bull Resources, Inc.

Thu, June 29, 2023 at 4:30 PM EDT

In this article:

SVBL

0.00%

Watchlist

Watchlist

Silver Bull Resources, Inc.

Silver Bull Resources, Inc.

VANCOUVER, British Columbia, June 29, 2023 (GLOBE NEWSWIRE) -- Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) announces that it has commenced international arbitration proceedings against the United Mexican States (“Mexico”) under the Agreement between the United States of America, Mexico, and Canada (the “USMCA”) and the North American Free Trade Agreement (the “NAFTA”). The Arbitration arises from Mexico’s unlawful expropriation and other unlawful treatment of Silver Bull and its investments resulting from the illegal blockade of Silver Bull’s Sierra Mojada project.

The arbitration has been initiated under the Convention on the Settlement of Investment Disputes between States and Nationals of Other States process, which falls under the auspices of the World Bank’s International Centre for Settlement of Investment Disputes (ICSID), to which Mexico is a signatory.

Silver Bull officially notified Mexico on March 2, 2023 of its intention to initiate an arbitration owing to Mexico’s breaches of NAFTA by unlawfully expropriating Silver Bull’s investments without compensation, failing to provide Silver Bull and its investments with fair and equitable treatment or full protection and security, and not upholding NAFTA’s national treatment standard. Silver Bull held a meeting with Mexican government officials in Mexico City on May 30, 2023, in an attempt to explore amicable settlement options and avoid arbitration. However, the 90-day period for amicable settlement under NAFTA expired on June 2, 2023, without a resolution.

Despite repeated demands and requests for action by the Company, Mexico’s governmental agencies have allowed the unlawful blockade to continue, thereby failing to protect Silver Bull’s investments. Consequently, Silver Bull will seek to recover an amount of approximately US$178 million in damages that it has suffered due to Mexico’s breach of its obligations under NAFTA, which includes sunk costs of approximately US$82.5 million, usually considered minimum damages in such cases.

The Company has engaged Boies Schiller Flexner (UK) LLP (“BSF”), an international law firm with extensive experience in international investment arbitration concerning mining and other natural resources, to act on its behalf. The BSF Team will be led by Timothy L. Foden, a noted practitioner in the mining arbitration space.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer and Director

INVESTOR RELATIONS:

1 604 687 5800 info@silverbullresources.com

Via email: Silver Bull Announces Termination Of Option Agreement With South32 At Sierra Mojada

Shaking my head….

Vancouver, British Columbia – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) announces the termination of the option agreement with a wholly-owned subsidiary of South32 Limited (“South32”) at the Sierra Mojada project located in Coahuila, Mexico. The Sierra Mojada project has been illegally blockaded (see news release from September 30, 2019) and thus there has been an inability to progress investment in exploration activities.

Tim Barry, CEO commented, “While we are disappointed that South32 has decided to terminate the option agreement for Sierra Mojada, we understand their reasoning given the inability to access the project site since September 2019. We appreciate South32’s professionalism throughout this partnership.”

Mr. Barry went on to say, “The ongoing illegal blockade of the Sierra Mojada project by the local mining cooperative, Sociedad Cooperativa de Exploración Minera Minero Norteños S.C.L., has been in place since September 2019. There has been no intervention by the appropriate authorities to bring this to an end and despite the Company’s many attempts to reach a reasonable path towards an amicable settlement, we have been unable to gain permanent access to the project site. We hope that this unfortunate recent outcome will encourage the appropriate government agencies to take immediate action to remove the illegal blockade for the betterment of the project and the broader local community and businesses.”

Silver Bull will continue to assess the current situation at Sierra Mojada and other opportunities outside of Mexico as they present.

Arras Minerals acquires five new mineral exploration licences increasing its total land package in northeastern Kazakhstan by 70%

TSX-V: ARK

Vancouver, British Columbia – Arras Minerals Corp. (TSX-V: ARK) (“Arras” or “the Company”) is pleased to announce the acquisition of five mineral exploration licences. The new licences held by the Company’s 100 % owned Kazakh Subsidiary, Ekidos Minerals LLP, cover a total of 2,122 square kilometers (“sq km”) in northeastern Kazakhstan focussed on the Bozshakol-Chingiz and Baidaulet-Akbastau metallogenic belts.

Highlights:

• A total of five new mineral exploration licenses (namely, “Maisor”, “Aktasty”, “Elemes”, “Norgubek”, and “Akkuduk”) totaling 2,122 sq km have been granted by the Ministry of Industry and Innovational Development, Government of Kazakhstan, increasing the Company’s total land package in northeastern Kazakhstan by 70% to 3,028 sq km. All licenses are located within a 120 km radius of Arras' operational base in the city of Ekibastuz, Pavlodar facilitating cost-effective exploration.

• Arras is now the largest license holder in the highly prospective Bozshakol-Chingiz metallogenic belt, and the third largest in the Republic of Kazakhstan, after Fortescue Metals Group and Rio Tinto.

• The Bozshakol-Chingiz and Baidaulet-Akbastau metallogenic belts host the producing Bozshakol porphyry copper-gold mine and Maikain volcanic-hosted massive sulfide (“VHMS”) mine, respectively, as well as Arras’ Beskauga porphyry-epithermal copper-gold project where an initial 10,000-meter drill program (permitted for 30,000m) is currently underway.

• Compilation, digitization, and interpretation of Soviet-era geological and geophysical datasets for the new licenses has identified multiple targets for porphyry, epithermal, VHMS, and orogenic gold mineralization.

More at:

https://www.arrasminerals.com/

Seems that ARK.cn is not freely trading around .35

ARRAS MINERALS INTERCEPTS 1120.4M @ 0.59 % CuEq, INCLUDING

465.1 M @ 0.81 % CuEq STARTING FROM 43.9M BELOW SURFACE ON

THE BESKAUGA PROJECT IN NORTHEASTERN KAZAKHSTAN

June 22, 2022

https://irp.cdn-website.com/8c0a7d35/files/uploaded/2022-06-22_Arras%20Minerals%20Drill%20Results_FINAL.pdf

Arras Minerals Files NI 43-101 Resource of 1.75 Million Ounces of Gold & 333.6 Thousand Tonnes of Copper in “Indicated” Category, and 1.49 Million Ounces of Gold & 222.2 Thousand Tonnes of Copper in “Inferred” Category on the Beskauga Copper-Gold Project

Mr. Tim Barry reports:

VANCOUVER, British Columbia, June 20, 2022 (GLOBE NEWSWIRE) -- Arras Minerals Corp. (TSX-V: ARK) (“Arras”, or the “Company”) is pleased to announce it has filed an updated Mineral Resource estimate report on the Beskauga copper-gold project onto the SEDAR website.

Continued below:

https://www.juniorminingnetwork.com/junior-miner-news/press-releases/3157-tsx-venture/ark/123382-arras-minerals-files-ni43-101-resource-of-1-75-million-ounces-of-gold-333-6-thousand-tonnes-of-copper-in-the-indicated-category-and-1-49-million-ounces-of-gold-222-2-thousand-tonnes-of-copper-in-the-inferred-category-on-the-beskauga-copper-gold-project-in-north-eastern-kazakhstan.html

$SVBL Bottom channel. Increasing technicals. Price test above 50sma with increasing OBV. RSI 55. 10sma over 20sma

big chart events started,sma50 crossing sma200

insider buying>>SEC Transactions Last 6 Months

Buy / Sell

BUYS

3

SELLS

0

TOTAL

3

Shares

BOUGHT

437,501

SOLD

0

GROSS

437,501

NET

437,501

wow,nice reversal chart,lots of buying,something big coming?

8.9 m market cap. Super lean. Seems like a good price for the potential here. Watching to see if it breaks lower. Going to buy small position here at .25 . If it stays in this range will buy more.

Silver demand to surpass 1 billion ounces this year, hitting a 6-year high – Silver Institute

By Neils Christensen

Wednesday November 17, 2021 11:25

The global silver market will see demand reach 1.29 billion ounces this year, the first time it has breached 1 billion since 2015, according to the latest report from the Silver Institute.

Wednesday, in its interim market report, the Silver Institute said that silver demand had seen broad-based growth through 2021, with industrial demand leading the way.

"The recovery in silver industrial demand from the pandemic will see this segment achieve a new high of 524 million ounces (Moz). In terms of some of the key segments, we estimate that photovoltaic demand will rise by 13% to over 110 Moz, a new high and highlighting silver's key role in the green economy," said analysts at Metals Focus, who conducted the latest research on behalf of the Silver Institute.

The report also noted robust investment demand with interest in physical bullion expected to increase 34% or by 64 million ounces to 263 million ounces, representing a six-year high.

"Growth began with the social media buying frenzy before spreading to more traditional silver investors. Indian demand reflects improved sentiment towards the silver price and a recovering economy. Overall, physical investment in India is forecast to surge almost three-fold this year, having collapsed in 2020," the analysts said.

Paper demand for silver is also expected to increase in 2021. Holdings in silver-backed exchange-traded funds are projected to rise by 150 million ounces.

"During 2021 and through to November 10, holdings rose by 83 Moz, taking the global total to 1.15 billion ounces, close to its record high of 1.21 billion ounces which occurred on February 2, at the height of the social media storm," the analysts said.

The report said that silver jewelry and silverware fabrication is expected to see partial recoveries from the 2020 depressed levels, growing by 18% and 25%, respectively.

"Both markets will benefit from a marked upturn in all key countries, especially in India as the economy and consumer sentiment have bounced back more quickly than expected, and as restrictions ended in time for the all-important wedding and festive season," the analysts said.

Looking at the supply side, Metals Focus said that mine production is forecasted to increase by 6% to 829 million ounces.

"This recovery is largely the result of most mines being able to operate at full production rates throughout the year following enforced stoppages in 2020 due to the pandemic. Those countries where output was most heavily impacted last year, such as Peru, Mexico and Bolivia, will have the biggest increases," the analysts said.

Looking at the market's supply/demand fundamentals, Metals Focus looks for silver to see a modest supply deficit of 7 million ounces. "This will mark the first deficit since 2015," the report said.

The optimistic demand outlook comes as silver prices see a renewed uptrend. December silver prices last traded at $25.215 an ounce, up 1% on the day. Economists have noted that precious metals have seen new bullish momentum after consumer inflation rose to its highest level in 31 years.

One billion ounces is just the start - Hecla CEO

Phillip Baker, CEO of Hecla Mining, said in a telephone interview with Kitco News that he expects silver prices to remain in a strong uptrend as investors look for inflation hedges.

"Right now, we are seeing the consequences of trying to smooth out our economic system and avoid crisis," he said. "The result is higher inflation and it is doesn't seem to be very transitory."

Tuesday, Hecla, which represents 40% of all silver mined in the U.S., rang the closing bell on the New York Stock Exchange. This year the company is also celebrating its 130th anniversary.

Baker added that he expects silver demand to continue to grow and sees the potential of a 2-billion ounce market in the next 30 years.

"There's no doubt that with the desire to have clean energy, the demand for silver is going to continue to increase and increase probably at a much faster rate than what we've seen in the past," he said. "With all that demand, silver is more expensive."

To put the demand growth into perspective, Baker said that the world would need to see seven to ten new mines the equivalent size of its Green Creek in Southeast Alaska. The mine is forecasted to produce about 10 million ounces of silver this year. It is one of the largest primary silver producers in the world.

https://www.kitco.com/news/2021-11-17/Silver-demand-to-surpass-1-billion-ounces-this-year-hitting-a-6-year-high-Silver-Institute.html

Daybreak in the Land of Precious Metals

Michael J. Ballanger

Friday, November 12, 2021

There have been many times in my sexagenarian journey through four and a half decades of inflationary, disinflationary, and deflationary cycles when the spinning plates above my head suspended upon poles of flawed data and errant central bank policy appear on the verge of a massive chaotic accident. There are, however, other times when all is right with the world in which the precious metals investor resides and this past week was just one of those.

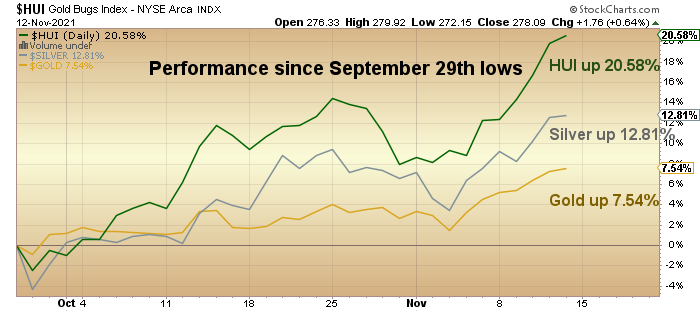

From a technical perspective, I could not ask for a more enviable confluence of conditions and events. Firstly, the precious metals bucked the trend of yielding to U.S. dollar strength so to the degree that this decoupling marks a new paradigm of gold and silver drivers, it was a watershed week. Secondly, as you all have been reading for as long as I have been allowed to perch upon the soapbox of blogosphere scrutiny, that repetitive drone resembling the bespectacled high school English teacher blathering on about conjugations with fifteen minutes left in an early summer school day, it was that silver outperformed gold and that the HUI outperformed both metals while the mightily-gilded TSX Venture Exchange surpassed 1,000, symbolizing the return of “animal spirits” to the world of precious metals.

To coin the Longfellowian phrase, it was as if the world of the hard asset disciple rolled into light; it was daybreak everywhere; and it was long overdue.

I have been arguing the bullish case for gold and silver since the middle of August, having stepped away from the senior and junior miner ETF’s back in August of 2020, when suddenly every blogger on the planet were reciting quotes from the “Gold Bug’s Almanac” while quoting Von Mises and Keynes and Peter Schiff chapter and verse in their rebirth into gold and silver idolatry. Flash forward to late September 2021 when I seized upon silver’s phony false breakdown below $22/ounce (so obviously orchestrated by the bullion bank silver shorts) and designed to spook speculative longs into a final cathartic capitulation. I contend that the late September reversal was the precise moment that the precious metals gods finally held up both hands and pronounced “Enough!” putting an end to the ever-ignored shenanigans that have plagued the paper markets for what seems like an eternity.

The star performer was gold for much the early move but now it appears that the freckle-faced, red-haired hellion – silver – has put a clamp on the leadership torch wrenching it away from gold and about to pass it over happily to the mining shares, where the GDX and GDXJ have been absolute beasts since the late September reversal.

Outside of the RSI levels for the HUI, GDX, and GDXJ all closing out the week solidly above 70 (overbought), history has proven that they can stay overbought for weeks and especially when gold has moved away from “correction” mode and into “resumed uptrend” mode in which I believe we are now immersed and in a highly-convincing manner.

This chart marks the performance of the three precious metal classes and it is textbook. Shares are outperforming metal and silver is outperforming gold; this is a classic trademark of a confirmed bull market and while it will most certainly not be a straight line to all-time highs, my only conundrum is whether gold gets there by New Year’s Day.

We all read the same commentators and listen to all the same podcasts but to whom I pay particular attention are those highly-successful investors that have rarely, if ever, owned precious metals that are now on the record as owning gold and looking for significantly higher prices. A few weeks ago, I listened to an interview with Sam Zell, one of the greatest horse-traders in the history of modern finance, in which he basically called out the policymakers for trashing the American balance sheet while citing gold as an appropriate place to park one’s wealth. It is those massive pools of capital that are now sloshing around the bond and equity arenas that are going to be eventually forced to assets that have no counterparty risk and when that occurs, it will be elephantine demand meeting rodent-ine supply resulting in an unfathomable price reaction in everything vaguely even associated with gold or silver.

I have told this story before but it bears repeating. In the late 1970’s while working as a clueless trainee for a large Canadian brokerage firm, one of the senior salesmen (not “wealth advisor”) told me about a junior gold explorer called “Mattachewan Consolidated Mines” at about CAD $.08 per shares so, having never bought a stock before in my life, I took my life savings at the time and bought 20,000 shares worth CAD $1,600 and then promptly forgot about it. A few months later, I was handing out the bond quote sheets (there were no quote terminals for bonds back then) when I ran into the senior salesman who asked while sporting a broad smile how I liked the move in Mattachewan. I asked him what it was doing, sluffing off my ignorance due to being “too busy” counting Canada Savings Bonds and licking stamps. “Why,” he said “it just traded at $1.80 and it’s going to $3!” Having earlier learned my “times tables”, I quickly did the math and realized (while hyperventilating madly) that I had just won a lottery with my $1,600 now worth $36k and possibly on its way to $60k! “Well,” I said puffing out my chest and trying to look scholarly, “I need to do some research on this. Can you tell me where they have their gold and how much of it they own?” The senior salesman began laughing hysterically after which he responded while wiping tears from his ruddy cheeks, “son, this is a gold bull market and there is no bull market like a gold bull market. The only gold Mattachewan has is the letters G-O-L-D in their name.” He then embarked on another howling round of laughter and I skulked off to the cloakroom.”

The point I make is that the vast majority of Millennials and Genexers have never seen a) a bear market or b) a bull market in precious metals miners. They know crypto and they know technology but their eyes glaze over when you describe the move in Consolidated Stikine in 1989 or Diamondfields in 1996. Just as fortunes have been made in this cycle in worthless EV companies or counterfeiting schemes like certain crypto deal, fortunes are about to made in the junior developers and explorers. The TSX Venture Exchange is the Canadian version of the junior NASDAQ so like its U.S. counterpart, it is a great barometer for speculative sentiment. While the tech-laden COMPQ hit record highs last week, it is important to remember that the high for the TSXV was in May 2007 when it traded over 3,350; it has been that long since the junior mining markets have received anything resembling “love” on a par with technology or crypto. The bottom line is that like silver, which has yet to see record highs, the junior resource sector has a great deal of upside if we are to believe that the Great Currency Debasement exercise around the world is going to reprice all assets to new highs. We have seen it everywhere in the industrial and soft commodities and should expect to see it in uranium, silver, and the TSXV before the cycle gets terminated by either policy errors or global war, both of which are possible but impossible to either time or predict.

I went long December Silver in late September the day the bullion bank monkeys tried to smash it below $22 but just as the Twitterverse had concluded that it was $18 bound, the mysterious forces of short-covering evil stepped into the panic and before you could say “JP Morgan”, silver went on an eleven-day recovery to $23 and has not looked back. I see some resistance around $27-28 after which 2021 highs are likely above the $30 “#silversqueeze” spike level that created the underperformance that has persisted since February. This week it appears to have broken the shackles of its lead-filled sneakers once and for all, so since we own the SLV:US from $22.10 (now $23.42) and the January $20 calls from $2.10 (now $3.56), I see no reason to rush to ring the register unless RSI spikes into the high 70’s (or until I see all of the usual silver bugs taking victory laps around the Twitter Track).

Gold and silver investors have had to endure a very long and very cold night since the sun went down in August 2020. As I pointed out last week, the gold and silver mining shares represented by the GDM are absurdly undervalued despite a superb advance this past week but what are even more undervalued are those junior developers with large and rapidly-growing resources (like Getchell Gold Corp. GTCH:CSE / GGLDF:US OTC QB) whose share prices are wallowing in sentiment purgatory despite impressive 2021 results. As I constantly harp on every time an unattended pair of ears or eyes can be found, it is the junior developers that will have the biggest lift in 2022 along with selected exploration issues (available to all subscribers).

Enjoy the warmth of the daylight sun and remember the lesson behind Mattachewan Consolidated Mines because that is where we are headed…

MJB

https://lemetropolecafe.com/toulouse-lautrec_table.cfm?pid=17269

(Sub required ~ painless 2 week trial available)

It's really very simple, Pro-Life:

"Bumbles" Barry couldn't manage a lemonade stand.

And unless and until he is removed from any and all management / director positions he holds, and someone with real mining management experience is put in charge, both Silver Bull and Arras are going nowhere!.

And that said, I feel really bad for basserdan who's somehow been stuck with the unenviable job of defending this indefencible Clown Show.

Some lucky company will pick this abomination up out of Receivership, because that's what's coming, like a freight train.

Period. Full stop.

Another new low for the move. Wow.

Does anyone have the new stock? If so what is the symbol?

<<<But more than a 69% drop is incredibly unjustified. From $1.25 in June to 44¢ is just crazy. The Arras deal did not cost the company greater than 2/3 of it's value.

Yes, silver has dropped but not for long and not for 2/3 like SVBL.

This may be quite a buying opportunity.>>>

I agree and fwiw, have been a buyer on this seemingly overdone break in value.

But more than a 69% drop is incredibly unjustified. From $1.25 in June to 44¢ is just crazy. The Arras deal did not cost the company greater than 2/3 of it's value.

Yes, silver has dropped but not for long and not for 2/3 like SVBL.

This may be quite a buying opportunity.

Thanks, Dan!!! Always a pleasure!

<<<I am still bewildered why this stock price dumped... am I blind? What am I missing?>>>

G'morning, Pro-Life...

It is primarily because their Kazak resource (Arras Minerals) was converted into a separate company and I don't doubt the weakness in Ag has been an accomplice as well.

If you're a Silver Bull shareholder, you should have the Arras shares (one for each SVBL share you own) in your account.

I am still bewildered why this stock price dumped... am I blind? What am I missing?

"Bumbles" Barry has dug a hole so deep here they'll be years, if not decades, getting out of it on their own.

Nothing left here but to hope some vulture that knows what they're doing will pick up the carcass for cents on the dollar and we can ride their wagon.

Arras Minerals Announces the Start of 30,000 Meter Drill Program on the Beskauga Deposit, Northeastern Kazakhstan

October 01, 2021 19:06 ET

Source: Arras Minerals Corp.

VANCOUVER, British Columbia, Oct. 01, 2021 (GLOBE NEWSWIRE) -- Arras Minerals Corp. (“Arras”) is pleased announce it has commenced an initial 30,000 metre surface drill program targeting the extensions of the Beskauga deposit both laterally and at depth, as well as a series of never before tested targets within the wider area.

For the drilling, Arras is using the local company “Tsentrgeolsemka LLP”. The drill program is conducted under the Option to Purchase agreement (“Option Agreement”) executed on January 26, 2021, with Copperbelt AG (“Copperbelt”), a mineral exploration company registered in Zug, Switzerland. Pursuant to the Option Agreement, Arras has the right to acquire Copper Belt’s right, title and 100% interest in the Beskauga property located in Kazakhstan by incurring US$15,000,000 in cumulative exploration expenditures on the Beskauga Project by January 26, 2025.

About the Beskauga Deposit: The Beskauga deposit is a gold-copper-silver deposit with a NI 43-101 compliant “Indicated” Mineral Resource of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million ounces of contained gold, 476.1 thousand tonnes of contained copper, and 7.25 million ounces of contained silver and an “Inferred” Mineral Resource of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million ounces of contained gold, 220.5 thousand tonnes of contained copper, and 4.82 million ounces of contained silver.

The constraining pit was optimised and calculated using a NSR cut-off based on a price of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project

CATEGORY TONNAGE (MT) CU % AU G/T AG G/T AU (MOZ) CU (KT) AG (MOZ)

Indicated 207 0.23 0.35 1.09 2.33 476.1 7.25

Inferred 147 0.15 0.33 1.02 1.56 220.5 4.82

Silver Bull and Arras Minerals Appoint Darren Klinck as President

Vancouver, British Columbia September 29, 2021 - Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) and Arras Minerals Corp. (“Arras”) are pleased to announce the appointment of Darren Klinck to both companies as President, effective October 1, 2021. Mr. Klinck will also be joining the Board of Directors of Arras.

Mr. Klinck is an accomplished mining executive with considerable management experience throughout Australasia & The Americas. He was most recently President & CEO of Bluestone Resources, following the acquisition of the Cerro Blanco gold project in Guatemala in 2017, where he led the team that financed and advanced the project through resource expansion, feasibility and engineering phases of project development.

He also spent more than ten years with OceanaGold as a member of the Executive Committee that achieved significant growth and business expansion to become a multi-mine, international gold mining company, growing from a market capitalization of less than C$100M to one greater than C$3B.

Over the past 20 years, Darren has been instrumental in negotiating both equity and debt financing packages totaling more than $800m and has significant experience leading teams in emerging markets with a strong focus on Corporate Social Responsibility (CSR) and community engagement programs, as well as extensive government relations activities.

Mr. Klinck has a Bachelor of Commerce degree from the Haskayne School of Business at The University of Calgary. He is a Director of ValOre Metals Corp and Gold Basin Resources Corp.

Mr. Klinck commented, “I look forward to working closely with Tim and the team as we advance from a solid base already in place in Mexico at Silver Bull but also as we begin to emerge with Arras in Kazakhstan. The team has done a terrific job through this challenging global pandemic to evaluate opportunities focusing on high-quality geological potential in jurisdictions that welcome mineral development. The significant opportunity established in Kazakhstan by Arras over the past year has positioned the company to be an early mover in one of the few copper-gold belts remaining globally that has not benefitted from significant modern exploration and focus. Pleasingly, Beskauga is already a significant deposit in its own right and provides a solid base from which to build on in the future within a country that is the most advanced economy in Central Asia; has recently modernized their mining regulations based on Western Australian code; and is now seeing new entrants comprising of the largest players in our industry.”

Brian Edgar, Chairman of Silver Bull stated “This is an important step forward for Silver Bull and Arras. Darren’s appointment significantly strengthens and diversifies our existing management team. He has a track record of creating shareholder value and a broad range of experience in management, corporate finance and investor relations. Silver Bull and Arras have two exceptional projects which provide exposure to silver and zinc, and gold and copper, respectively, and Darren’s capital markets expertise, coupled with management’s technical expertise, positions the Companies for significant success.”

Silver Bull and Arras Moving Forward: On September 24, 2021, Silver Bull completed the distribution of shares of Arras to its shareholders. Silver Bull continues to own approximately 4% of Arras, on a non-diluted basis.

Silver Bull will continue to focus on the Sierra Mojada project and surrounding area in Mexico and managing the joint venture option with South32. It will continue to trade under the symbol “SVB” on the TSX, and “SVBL” on the OTCQB.

Arras as a standalone entity will focus on the Beskauga deposit in Northeastern Kazakhstan.

The exploration activities of both companies will continue to be managed by current management and will be headquartered in Vancouver.

A summary of Arras’s Beskauga project in Kazakhstan, and the Sierra Mojada Project in Mexico is provided below.

Beskauga Deposit, Kazakhstan: The Beskauga deposit is an open pittable gold-copper-silver deposit with a NI 43-101 compliant “Indicated” Mineral Resource of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million ounces of contained gold, 476.1 thousand tonnes of contained copper, and 7.25 million ounces of contained silver and an “Inferred” Mineral Resource of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million ounces of contained gold, 220.5 thousand tonnes of contained copper, and 4.82 million ounces of contained silver.

The constraining pit was optimized and calculated using a NSR cut-off based on a price of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver. Mineralization remains open in all directions as well as at depth.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project

(Click on link below to view Table 1)

For a full summary of the Beskauga resource please refer to Silver Bull’s press release dated January 28, 2021 and filed on its profile at www.SEDAR.com, or by visiting the following link:

https://www.silverbullresources.com/news/silver-bull-announces-maiden-ni-43-101-resource-of-2.33-million-ounces-of-gold-476-thousand-tonnes-of-copper-in-the-indicated/

Sierra Mojada deposit, Mexico: Sierra Mojada is an open pittable oxide deposit with a NI 43-101 compliant Measured and Indicated “global” Mineral Resource of 70.4 million tonnes grading 3.4% zinc and 38.6 g/t silver for 5.35 billion pounds of contained zinc and 87.4 million ounces of contained silver. Included within the “global” Mineral Resource is a Measured and Indicated “high grade zinc zone” of 13.5 million tonnes with an average grade of 11.2% zinc at a 6% cutoff, for 3.336 billion pounds of contained zinc, and a Measured and Indicated “high grade silver zone” of 15.2 million tonnes with an average grade of 114.9 g/t silver at a 50 g/t cutoff for 56.3 million contained ounces of silver. Mineralization remains open in the east, west, and northerly directions.

The constraining pit was optimized and calculated using a NSR cut-off based on a silver price of US$15/oz, and a zinc price of US$1.20/lb and assumed a recovery for silver of 75% and a recovery for zinc of 41%. Approximately 60% of the current 3.2 kilometer mineralized body is at or near surface before dipping at around 6 degrees to the east.

For a full summary of the Sierra Mojada resource, please refer to Silver Bull’s press release dated October 31, 2018 and filed on its profile at www.SEDAR.com, or by visiting the following link:

https://www.silverbullresources.com/news/silver-bull-resources-announces-5.35-billion-pounds-zinc-87.4-million-ounces-silver-in-updated-sierra-mojada-measured-and/

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer and Director

INVESTOR RELATIONS:

+1 604 687 5800 info@silverbullresources.com

https://silverbullresources.com/news/silver-bull-and-arras-minerals-appoint-darren-klinck-as-president/

Not yet, but it will go something like this:

Transfer Agent gets the Eligible Shareholder List, cuts Shares of SpinCo to DTC, DTC distributes them to the Brokers, Brokers put them in your Account.

You will probably see them show up with nothing but their CUSIP number, so look for them on that basis. Your Transaction Log for your Account will identify them, also.

Silver Bull Announces Completion Of Distribution Of Arras Minerals Shares To Silver Bull Shareholders

Vancouver, British Columbia – September 27, 2021 - Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull” or the “Company”) is pleased to announce the completion of the previously announced distribution of shares of Arras Minerals Corp. (“Arras”) to Silver Bull shareholders (the “Distribution”).

The Distribution was effective as of September 24, 2021. Pursuant to the Distribution, shareholders of Silver Bull common stock as of September 10, 2021 were entitled to receive one common share of Arras for each share of Silver Bull common stock held as of that date.

In connection with the Distribution, Silver Bull’s shareholders were issued a total of 34,547,838 common shares of Arras, collectively representing approximately 84% of Arras, on a non-diluted basis. Silver Bull continues to own approximately 4% of Arras, on a non-diluted basis. The remaining approximately 12% of Arras is held by those who participated in Arras’ private placement in April 2021.

Registered Silver Bull shareholders holding physical share certificates or shares in book-entry form with the Company’s transfer agent (Olympia Trust Company) were issued Arras shares in book-entry form. Silver Bull shareholders who hold their shares of Silver Bull stock through a bank, broker or other nominee had or will have their Arras shares credited to their accounts by their bank, broker or other nominee. For questions relating to the transfer or mechanics of the Distribution, please contact Olympia Trust Company by telephone at 1-833-684-1546 (toll free in North America) or by online inquiry at cssinquiries@olympiatrust.com.

Arras is not currently listed on a public stock exchange but will report under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer status. The Arras shares distributed to Silver Bull shareholders, though freely transferable in the United States, may be illiquid until such time as the shares are listed or a trading market develops, if at all. The Distribution of Arras shares by Silver Bull constitutes a distribution of securities that is exempt from the prospectus requirements of Canadian securities legislation. As such, the first trade in Arras shares in Canada will be a distribution for the purposes of Canadian securities laws and subject to prospectus requirements unless certain conditions are satisfied. Until such conditions are satisfied, Arras shares may only be resold in Canada pursuant to an exemption from prospectus requirements. Silver Bull warrants and options will also be adjusted pursuant to the Distribution. For further details regarding the Canadian resale restrictions on the Arras shares distributed by Silver Bull and the adjustments being made to Silver Bull warrants and options in connection with the Distribution, please refer to the Registration Statement on Form 20-F of Arras filed on September 1, 2021 with the U.S. Securities and Exchange Commission (the “SEC”) on EDGAR at www.sec.gov/edgar (the “20-F”).

Tax Implications

The following discussion is qualified in its entirety by the discussion of tax matters set forth in the 20-F. Silver Bull shareholders who were entitled to receive the Distribution of Arras shares should make reference to that discussion for further details regarding the tax consequences of the Distribution.

For U.S. federal income tax purposes, the receipt of Arras common shares by Silver Bull shareholders should be treated as a distribution of property in an amount equal to the fair market value of the common shares received. The Distribution of Arras common shares should be treated as dividend income to the extent considered paid out of Silver Bull’s current and accumulated earnings and profits. Distributions in excess of Silver Bull’s current and accumulated earnings and profits will be treated as a non-taxable return of capital to the extent of the holder’s basis in its Silver Bull shares and thereafter as capital gain. Silver Bull will not be able to determine the amount of the Distribution that will be treated as a dividend until after the close of the taxable year of the Distribution because its current year earnings and profits will be calculated based on its income for the entire taxable year in which the Distribution occurs. However, based on current projections, it is reasonably expected that a portion of the Distribution of Arras common shares should be treated as a return of capital rather than a dividend. Silver Bull’s tax year-end is October 31, and as such, the Company expects to advise shareholders of these determinations by no later than January 31, 2022.

For Canadian tax purposes, the Distribution of Arras shares is considered a dividend in kind on the Silver Bull shares to shareholders resident in Canada. Such shareholders will be required to include in computing their income for a taxation year the amount of such dividend (equal to the fair market value of the Arras shares received). A dividend in kind of the Arras shares paid in respect of the Silver Bull shares to a shareholder who is not a resident of Canada will not be subject to Canadian withholding tax or other income tax under the Income Tax Act (Canada).

Management Focus

Silver Bull is continuing to focus on the Sierra Mojada asset and surrounding area in Mexico and managing the joint venture option with South32. It continues to trade under the symbol “SVB” on the TSX and “SVBL” on the OTCQB. The current management and board are remaining in place to continue to run the Company.

Arras is focused on the Beskauga deposit located in Kazakhstan along with additional exploration licenses held or under application in the country. In addition, current Silver Bull management and directors have been appointed as management and directors of Arras, along with G. Wesley Carson as an additional independent director.

Both companies remain headquartered in Vancouver.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800 info@silverbullresources.com

https://silverbullresources.com/news/silver-bull-announces-completion-of-distribution-of-arras-minerals-shares-to-silver-bull-shareholders/

The Distribution appears to have taken place on schedule, SVBL price has been adjusted by roughly the notional value of the SpinCo, we should see SpinCo Shares in our Accounts soon.

And then we'll wait for Tim "Mr.Bumbles" Barry's next Stupid Pet Trick.

Gad!

and what's that mean, may not even be able to trade the spin off???

Acting as though something big is about to happen. Large blocks, all at the Ask, as though "Somebody" said "I want IN, NOW!"

This might be the Payday for which all us long-sufferers have been waiting.

SVBL!

Posted at Stockwatch 6/11/21

Drill Results to Remember for Sierra Mojada

Here are some of the drill results from Sierra Mojada. Ask yourself if this was any other silver exploration company today releasing these results would it still be only $40m US market cap?

These are also JUST the Shallow Depth results, there is the intrusion close by and that is what South32 is looking for. It will be hundreds of meters thick. The Shallow deposit is just the overflow from the main ore body.

--------------------Past Drill Results-------------------

At a 25 g/t cutoff grade for the silver, the updated resource represents a 99% increase in the open pit resource of the Shallow Silver Zone previously reported by Silver Bull's July 2012 NI43-101 Technical Report. Additional data added in this report includes 10,056 meters of surface diamond drilling; 6,647.5 meters of underground diamond drilling completed for the "twinning" program of the historical long hole data set; and approximately 400 new channel samples. With the success of the twinning program in showing an exceptional correlation with the long hole data set, a significant increase in the range of influence of 40,240 meters of long hole data has also been included in the resource estimation. Recent highlight intercepts from the twinning program include:

* 912g/t Silver over 17.6 Meters including 1,927g/t Silver over 3.66 Meters

* 463.55g/t Silver over 15.05 Meters including 1654.92g/t over 3.1 Meters

* 202.7g/t Silver over 42.65 Meters including 878g/t over 3.9 Meters

* 193.38g/t Silver over 43.65 Meters including 440.66g/t over 15 Meters

* 158.9g/t Silver over 30.75 Meters including 2,250g/t over 1 Meter

* 151.6g/t Silver over 57.30 Meters including 600.6g/t over 5.95 Meters

* 19.52% Zinc over 22.85 Meters including 47.59% over 4.4 Meters

* 15.65% Zinc over 43.55 Meters including 20.26% over 14.5 Meters

https://stockhouse.com/companies/bullboard/svbl/silver-bull-resources,-inc?postid=33370677

Posted earlier today at Stockhouse:

NPV of Sierra Mojada is $1.2 Billion pre-tax

By LondonInvest

June 11, 2021 - 01:19 AM

If you recall the Preliminary Economic Assessment for Sierra Mojada, see link:

https://silverbullresources.com/news/silver-bull-completes-positive-preliminary-economic-assessment-for-the-sierra-mojada-project-coahuila-mexico/

At Silver $28/oz, Zinc $1.35/lb the PEA would show NPV = $1.2 Billion

Current Market Cap of Silver Bull = $40 Million

A 10-15% valuation to NPV would mean it goes to $3.50-$5.00.

I think just a long-deserved revaluation is taking place and an appreciation of resource.

Note all of this is only what has been discovered. South32 is around because the geology is the same as Wildcat Silver/Arizona Mining and they have confidence they will find the main ore body. In that case SVBL would be worth 10x current found resource. This is an option on silver with no expiration date and a major player who wants to be in their sandbox.

https://stockhouse.com/companies/bullboard/svbl/silver-bull-resources,-inc?postid=33370582

"Someone" has been "stealth buying" for the past two weeks, and now they've had to come out in the open today. Yikes.

Not sure what's behind this, but for all the long-suffering Shareholders who've endured Brain-Dead Barry's BungleRama Show for all these years the suffering may finally be over.

Maybe they've finally made him Broom Boy of the Circus Parade.

from the SI board

Here is an e-mail I just sent to the company. I will let you know if I get any response. And I would encourage to also contact management for their explanation of what seems to be a betrayal of shareholders.

Hello

As a Silver Bull shareholder of long duration, right back to the MMGG.OB days, I read today's PR with disgust and dismay.

Here's how I interpret it.

"We spent a bunch of money on an asset in Kazakhstan. Now we are distributing much of that value to shareholders in a form that makes what shareholders get worthless. We do not plan to do anything which will make what we have given you worth anything, especially if you are Canadian."

Am I wrong? If so, how?

Our only hope is that this was a poorly written NR which requires further explanation.

LC

Silver Bull Announces Intent to Distribute Shares of Arras Minerals to Silver Bull Shareholders

Vancouver, British Columbia - May 25, 2021 – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) ("Silver Bull") a mineral exploration company with assets in Kazakhstan and Mexico, is pleased to announce its intent to distribute shares of Arras Minerals Corp. ("Arras Minerals") to Silver Bull shareholders.

As announced on April 1, 2021, Silver Bull transferred its Kazakh interests, including the Beskauga Option Agreement and the Ekidos and Stepnoe mineral licences, to Arras Minerals, a newly formed British Columbia incorporated company and currently an approximately 88%-owned subsidiary of Silver Bull. In return, Silver Bull received 36 million shares of Arras Minerals.

Silver Bull intends to distribute approximately 34.2 million shares of Arras Minerals to Silver Bull shareholders, which will result in one Arras Minerals share to be distributed to Silver Bull shareholders for each share of Silver Bull held. Upon completion of the distribution, Silver Bull anticipates retaining approximately 1.8 million Arras Minerals shares as a strategic investment, expected to represent approximately 4% of the outstanding Arras Minerals shares at the time of distribution. The Arras Minerals shares are not expected to be listed or posted for trading on any stock exchange immediately following the distribution. Accordingly, the Arras Minerals shares distributed to Silver Bull shareholders, though freely transferable in the United States, may be illiquid until such time as the shares are listed or a trading market develops, if at all. In Canada, shareholders of Arras Minerals will be able to trade their shares only pursuant to an exemption from prospectus requirements.

The proposed distribution of Arras Minerals shares to Silver Bull shareholders does not require shareholder approval, but is subject to certain conditions, including the registration of the Arras Minerals shares under the U.S. Securities Exchange Act of 1934 and final approval by the Board of Directors of Silver Bull. Silver Bull intends to complete the proposed distribution of the shares before the end of the third quarter of 2021, however the actual timing is subject to receipt of regulatory approvals and the final approval by the Board of Directors of Silver Bull.

Silver Bull will provide an update on record and distribution dates for the proposed distribution of Arras Minerals shares if and when it receives requisite approvals, including regulatory and board approvals.

Summary of Arras Minerals' Assets

The Beskauga deposit is Arras Minerals' material property and is an open pittable gold-copper-silver deposit with a NI 43-101 compliant "Indicated" Mineral Resource of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million ounces of gold, 476.1 thousand tonnes of copper, and 7.25 million ounces of silver and an "Inferred" Mineral Resource of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million ounces of gold, 220.5 thousand tonnes of copper, and 4.82 million ounces of silver.

The constraining pit was optimised and calculated using a net smelter return cut-off based on a price of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver. Mineralization remains open in all directions as well as at depth.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project

(Click on link below to view table 1)

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800 info@silverbullresources.com

https://silverbullresources.com/news/silver-bull-announces-intent-to-distribute-shares-of-arras-minerals-to-silver-bull-shareholders/

Shareholder dividend ?

Why are they doing this ??

https://finance.yahoo.com/news/silver-bull-announces-intent-distribute-113000824.html

is it taxable ?

what can you so with it?

Maintaining +80¢/share... looking real solid.

Silver Bull Announces Voting Results of Annual Meeting of Shareholders

VANCOUVER, BC – (April 20, 2021) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) announces the detailed voting results of the proposals considered at its annual meeting of shareholders held on April 19, 2021 (the “Meeting”). A total of 18,265,547 or 54.17% of the Company’s issued and outstanding shares were represented at the Meeting.

Most critically, the Meeting included a proposal for shareholders to approve and adopt amended and restated articles of incorporation of the Company to increase the number of authorized shares of Silver Bull common stock from 37.5 million to 150.0 million and to make certain non-substantive amendments, which required the approval from a majority of the outstanding shares of Silver Bull common stock. The voting results were as follows: (Click on link below to view results)

As a majority of the outstanding shares of Silver Bull common stock was received in favour of the proposal, it was approved.

President and CEO, Tim Barry stated: “We would like to thank those shareholders who took the time to vote on this matter, which is vital to the future growth and advancement of the Company. We see great potential for the Company’s Sierra Mojada project, and with the ability to seek equity financing at Silver Bull, we will be focused on continuing its advancement.

Additionally, we look forward to advancing the Beskauga project in Kazakhstan in our new subsidiary, Arras Minerals Corp., for which we recently completed a private placement financing, and are commencing a drill program in the coming months.”

In addition to the above-noted proposal, the following nominees, as listed in Silver Bull’s proxy statement, were re-elected as directors of the Company: (Click on link below to view results)

Silver Bull is also pleased to announce that the Company’s shareholders have ratified and approved the appointment of Smythe LLP, as the Company’s independent registered public accounting firm, for the fiscal year ending October 31, 2021 (18,080,515 or 98.98% voted “For”, 66,260 or 0.36% voted “Against” and 118,772 or 0.65% abstained from voting).

Finally, the Company’s shareholders voted to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (12,538,304 or 92.65% voted “For”, 740,928 or 5.47% voted “Against”, and 253,020 or 1.86% abstained from voting).

Full details of the proposals are fully described in the Company’s definitive proxy statement filed on February 23, 2021 available on SEDAR at www.sedar.com, and on EDGAR at www.sec.gov.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Lth. In addition, Silver Bull’s subsidiary, Arras Minerals Corp., holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-voting-results-of-annual-meeting-of-shareholders/

Silver Bull Announces Postponement Of Annual Meeting Of Shareholders

VANCOUVER, BC – (April 12, 2021) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) today announced that it is postponing its 2021 annual meeting of shareholders (the “Meeting”) to April 19, 2021 to provide its shareholders with additional time to vote on the proposals submitted for shareholder approval at the Meeting. Shareholders are advised that because one of the proposals involves proposed amendments to the Company’s articles of incorporation, the holders of a majority of the outstanding shares of Silver Bull common stock must approve such proposal.

The record date for determining the shareholders eligible to vote at the Meeting will remain the close of business on February 18, 2021. Shareholders who have already submitted a proxy do not need to vote again for the postponed Meeting rescheduled for Monday, April 19, 2021 at 10:00 a.m. Pacific time at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, as the proxies submitted will remain valid.

Of particular importance, the Company’s board of directors strongly recommends that all shareholders to vote “FOR” the proposal to increase the number of authorized shares. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have virtually no shares available for issuance to raise funds to fund general corporate overhead or cover the costs associated with maintaining its mining interests, including in the Sierra Mojada project in Mexico.

Silver Bull shareholders as of close of business on February 18, 2021 who have not voted are encouraged to vote online at www.proxyvote.com or by telephone at 1-800-690-6903. The proxy voting deadline to vote by Internet or telephone is April 18, 2021 at 11:59 p.m. Eastern time. Silver Bull shareholders who require assistance with voting their shares or have questions may contact the Company by email at info@silverbullresources.com.

Shareholders who have already submitted proxies and want to change their proxy can update their vote at any time before the votes are cast at the Meeting. Your vote will be recorded at the Meeting in accordance with your most recently submitted proxy.

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Meeting. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on February 23, 2021. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Meeting. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2020 filed with the SEC on January 28, 2021, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the Meeting filed with the SEC on February 23, 2021.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd. In addition, Silver Bull’s subsidiary, Arras Minerals Corp. holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-postponement-of-annual-meeting-of-shareholders/

My personal plea to ALL fellow Silver Bull shareholders (TSX:SVB, OTCQB:SVBL):

Please vote "YES" on the provision to increase the number of shares from 37.5 million to 150 million!

All bets are off if shareholders choose not to increase the share capital of Silver Bull. No company can run itself without access to the capital markets - Silver Bull will be no different

Silver Bull Reminds Shareholders Of The Annual Meeting Of Shareholders On April 12, 2021

VANCOUVER, BC – (April 6, 2021) – Silver Bull Resources, Inc. (TSX:SVB, OTCQB:SVBL) (“Silver Bull” or the “Company”) reminds all shareholders to vote in advance of the annual meeting of shareholders (the “Meeting”) on Monday, April 12, 2021 at 10:00 a.m. PT.

The Company’s board of directors STRONGLY RECOMMENDS that all shareholders vote “FOR” all proposals, particularly the proposal to increase the number of authorized shares.

YOUR VOTE IS IMPORTANT – PLEASE VOTE TODAY

The proxy voting deadline is 11:59 p.m. ET on April 11, 2021.

We encourage you to vote well in advance of the deadline.

For any questions or assistance with voting, please contact management by email at info@silverbullresources.com.

President and CEO Tim Barry states,

We have recently announced the private placement into our British Columbia incorporated subsidiary “Arras Minerals Corp.” which holds the option agreement for the Beskauga Project, and the Stepnoe and Ekidos mineral licenses in Kazakhstan. This structure allows us to move forward and finance the Kazakhstan projects. We still need to be able to fund the costs of the Sierra Mojada Project. To do this we need to increase the Company’s authorized share capital. To ensure the Company can continue the development of the Sierra Mojada project, and ensure shareholders continue to have exposure to silver and zinc, it is vital that the Company has access to capital.

Without shareholder approval, the Company will have virtually no shares available for issuance to cover the costs of maintaining its interest in the Sierra Mojada project or cover the costs of its general corporate overhead. bd's bolding for emphasis Management would need to immediately investigate all available options, including, but not limited to, seeking to dispose of the Company’s assets or engage in a business combination. Any such transaction may not be on terms that are favorable to the Company. Continuing in business with virtually no shares available for issuance is not a sustainable path for the Company.

On behalf of Silver Bull’s management and board, we thank you for your support on this very important matter.”

Authorized Share Increase Proposal

By increasing the number of authorized shares of Silver Bull common stock now, the Company will be able to act in a timely manner when the need to raise equity capital arises or when the Company’s board of directors believes it is in the best interests of the Company and shareholders to take action, without the delay and expense that would be required at that time to obtain shareholder approval to increase the authorized shares. Business purposes for which the Company could seek to raise additional capital include furthering the development of the Sierra Mojada project in Mexico. Virtually all junior exploration companies like the Company remain as viable companies and conduct their mineral exploration activities by raising funds by issuing shares from time to time. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have an insufficient number of authorized shares to raise funds to fund general corporate overhead or cover the costs associated with maintaining its interests in the Sierra Mojada project in Mexico.

Silver Bull Annual Meeting of Shareholders

The Meeting is scheduled for 10:00 a.m. PT on Monday, April 12, 2021, at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia.

The board of directors of Silver Bull unanimously recommends that Silver Bull shareholders vote FOR all proposals.

Additional information concerning the proposals can be found in the definitive proxy statement dated February 23, 2021. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

How to Vote Your Shares

* By Internet: If you received a Notice of Internet Availability of Proxy Materials (the “Notice”), you can access the Company’s proxy materials and vote online at www.proxyvote.com. Further instructions to vote online are provided in the Notice.

* By Telephone: You may vote your shares by calling 1-800-690-6903. You will need to follow the instructions on your proxy card and the voice prompts.

Due to the essence of time, shareholders are encouraged to vote by Internet or telephone as set out above.

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Meeting. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on February 23, 2021. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Meeting. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2020 filed with the SEC on January 28, 2021, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the Meeting filed with the SEC on February 23, 2021.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd. In addition, Silver Bull’s subsidiary, Arras Minerals Corp. holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-reminds-shareholders-of-the-annual-meeting-of-shareholders-on-april-12-2021/

For anyone who might be interested, here is a link to the AGM.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MONDAY, APRIL 12, 2021

https://www.silverbullresources.com/site/assets/files/5778/letter_to_shareholders_and_proxy_statement.pdf

Silver Bull Announces Private Placement of C$2,517,500 in Newly Incorporated Subsidiary Arras Minerals Corp. And Transfer of Kazakh Exploration Projects

VANCOUVER, British Columbia, April 01, 2021 -- Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull” or the “Company”), a mineral exploration company with assets in Kazakhstan and Mexico, is pleased to announce the completion of a C$2,517,500 private placement (the “Private Placement”) into its newly incorporated British Columbia subsidiary, Arras Minerals Corp. (“Arras Minerals”).

Pursuant to the Private Placement, investors purchased 5.035 million shares of Arras Minerals at a price of C$0.50 each for gross proceeds of C$2,517,500, with management and directors (and their affiliates) taking approximately C$200,000 of the offering. No placement agent or finder’s fees were paid in connection with the Private Placement.

Silver Bull’s assets in Kazakhstan, including the Beskauga Option Agreement and the Ekidos and Stepnoe mineral licences, have been transferred to Arras Minerals. In return, Silver Bull has received 36 million shares of Arras Minerals and owns approximately 88% of the company, with the remaining 12% owned by the individuals who participated in the Private Placement.

The net proceeds from the Private Placement will be used to fund exploration activities, technical studies and permitting on the Company’s projects in Kazakhstan and for general and working capital purposes in managing the Kazakhstan projects.

Beskauga Deposit, Kazakhstan: The Beskauga deposit is an open pittable gold-copper-silver deposit with a NI 43-101 compliant “Indicated Mineral Resource” of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million contained ounces of gold, 476.1 thousand contained tonnes of copper and 7.25 million contained ounces of silver and an “Inferred Mineral Resource” of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million contained ounces of gold, 220.5 thousand contained tonnes of copper and 4.82 million contained ounces of silver.

The constraining pit was optimised and calculated using a net smelter return (“NSR”) cut-off based on prices of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver. Mineralization remains open in all directions as well as at depth.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project:

Click on link below to view Table 1.

Notes:

* An NSR $/t cut-off of $5.70/t was used, and the NSR formula is: NSR $/t = (38.137+11.612 x Cu%) x Cu% + (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x Ag g/t

* The NSR formula incorporates variable recovery formulae. Average copper recovery was 81.7% copper and 51.8% for both gold and silver.

* Metal prices considered were $2.80/lb copper, $1,500/oz gold and $17.25/oz silver.

* The Resource is stated within a pit shell that considers a 1.25 factor above the metal prices.

* Mineral Resources are estimated and reported in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves adopted 10 May 2014.

* The Mineral Resource is not believed to be materially affected by any known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant factors

* These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

* The quantity and grade of reported Inferred Resources in this mineral resource estimate (MRE) are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

For additional details, please refer to the Beskauga Copper-Gold Project NI 43-101 Technical Report prepared by CSA Global Mining Industry Consultants dated February 8, 2021, which is available on SEDAR at www.sedar.com.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-private-placement-of-c-2-517-500-in-newly-incorporated-subsidiary-arras-minerals-corp-and-transfer-of/

Despite the blockade, the joint venture option with South32 remains in good standing but under a force majeure pause.

Silver Bull Resources Wins Lawsuit in Mexico

Vancouver, British Columbia March 31, 2021 – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) ("Silver Bull" or the "Company") is pleased to announce it has won a definitive and conclusive decision in its favor in a lawsuit filed by a local mining co-operative called Minera Norteños. The decision was made by the unanimous vote of three Judges in the third Federal Circuit Court of Chihuahua.

Tim Barry, President, CEO and director of Silver Bull states, "This ruling is welcome, but not unanticipated. This is the fourth time that the courts have ruled in our favor on this issue. Unfortunately, we believe the plaintiff, Minera Norteños was manipulated and ill advised by legal and other advisers. Our legal team in Mexico is to be commended for patiently making progress in the face of numerous tactics to delay a judgement on the merits of the case.

Despite the fact that the Company has at all times proceeded in accordance with the law, the project remains under an illegal blockade manned by a small group of radical members from within Minera Norteños. We believe their actions do not represent the view of the vast majority of the Minera Norteños members and wider local community, and we are working with authorities to resolve the situation in a safe, fair, and timely manner. We remain committed to good faith dialogue with reasonable members from Minera Norteños, many of whom have worked for Silver Bull, to find a solution that facilitates the resumption of the drilling program halted by the blockade more than one year ago.

It is unfortunate shareholders have had to put up with this type of action over the recent years, however we are optimistic we will find a solution to the blockade and look forward to continuing our exploration program with our joint venture partner, South32. Sierra Mojada remains one of the largest undeveloped silver-zinc projects in Mexico. The silver-zinc mineralization sits largely at surface and is open pittable and has excellent infrastructure close by. These types of deposits are rare."

South32 Joint Venture Option: In June 2018 Silver Bull signed an agreement with a wholly owned subsidiary of South32 whereby Silver Bull has granted South32 an option to form a 70/30 joint venture with respect to the Sierra Mojada Project. To maintain the option in good standing, South32 must contribute minimum exploration funding of US$10 million ("Initial Funding") during a 4-year option period with minimum aggregate exploration funding of US$3 million, US$6 million and US$8 million to be made by the end of years 1, 2 and 3 of the option period respectively. South32 may exercise its option to subscribe for 70% of the shares of Minera Metalin S.A. De C.V. ("Metalin"), the wholly owned subsidiary of Silver Bull which holds the claims in respect of the Sierra Mojada Project, by contributing US$100 million to Metalin for Project funding, less the amount of the Initial Funding contributed by South32 during the option period.

Despite the blockade, the joint venture option with South32 remains in good standing but under a force majeure pause.

About Silver Bull: Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. In addition to the Sierra Mojada project, Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. The Beskauga deposit is an open pittable gold-copper-silver deposit with a NI 43-101 compliant "Indicated Mineral Resource" of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million contained ounces of gold, 476.1 thousand contained tonnes of copper & 7.25 million contained ounces of silver and an "Inferred Mineral Resource" of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million contained ounces of gold, 220.5 thousand contained tonnes of copper & 4.82 million contained ounces of silver.

For additional details, please refer to the Beskauga Copper-Gold Project NI 43-101 Technical Report prepared by CSA Global Mining Industry Consultants dated February 8, 2021, which is available on SEDAR at www.sedar.com and on the Company's website at www.silverbullresources.com.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

One day this will be nicknamed 'Raging' Bull.

Silver Bull Files Maiden NI 43-101 Resource of 2.33 Million Ounces of Gold & 476 Thousand Tonnes of Copper in the “Indicated” Category, and 1.56 Million Ounces of Gold & 220 Thousand Tonnes of Copper in the “Inferred” Category on the Beskauga Copper-Gold Project in Northeastern Kazakhstan

February 16, 2021

An excerpt:

Tim Barry, President, CEO and director of Silver Bull states, "This is a great first step in development of the Beskauga project and wider regional potential. Kazakhstan is fast emerging as one of the premium mining jurisdictions on the planet. The prospectivity of the geology, coupled with the recently revised mining law and strong government support for the mining sector makes it a standout in the mining world. Furthermore, the outstanding infrastructure and access to the project adds significantly to Beskauga's potential viability"

Entire updated report at:

https://www.silverbullresources.com/news/silver-bull-files-maiden-ni-43-101-resource-of-2.33-million-ounces-of-gold-476-thousand-tonnes-of-copper-in-the-indicated/

|

Followers

|

93

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1395

|

|

Created

|

05/29/06

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |