Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I hope that nutcase, CIAEYESANDEARS, who was posting that negative malarky backed his play and shorted SVBL... <g>

SVBL!

The CrimNakes and their Connected Cronies will be pulling every Dirty Trick they've got in their bag(s) to short-circuit this movement before it really gets out of hand.

This is the 2021 version of 1789. Louis XVI and Marie Antoinette thought they ".. had it under control" too, but then the Crowd stormed the Bastille.

That Crowd had torches and pitchforks; this Crowd has smartphones and Reddit.

Just as then..... heads will roll.

Hi-ho, Silver! Away!

The market moving power of amateur traders is continuing into the new week as the WSB/Reddit crowd turns their on sights silver after pumping up shares of GameStop (GME) and other heavily shorted stocks. COMEX silver prices are up 11.2% to $29.92/oz., the highest level since mid-August, following a 6% jump last week that boosted silver mining firms. On Friday, almost $1B already flowed into iShares Silver Trust (NYSEARCA:SLV), the world's largest ETF backed by silver, according to fund sponsor BlackRock (NYSE:BLK).

U.S. bullion broker Apmex has also disclosed a 1-3 day delay in processing silver transactions, while Money Metals and SD Bullion warned of unprecedented demand. Some on Wall Street were already positive on silver's outlook as part of a broad upswing in raw materials, with Goldman Sachs calling last week for a $30/oz. price target. Others, like analysts at Commerzbank, see the latest retail frenzy "not lasting all that long."

Premarket: First Majestic Silver (NYSE:AG) +40%, Pan American Silver (NASDAQ:PAAS) +17%, Coeur Mining (NYSE:CDE) +23%. Elsewhere, COMEX gold is up 1% to $1868.20/ounce, while palladium is 3.7% higher.

Bigger picture: This squeeze here is aimed at banks by forcing physical delivery of silver into vaults. The Silver Trust ETF is backed by physical silver, meaning the precious metal needs to be purchased when new investments are received. However, retail traders may find it harder to influence silver prices, compared to a single stock, given the large off-exchange market for the precious metal in which banks trade on behalf of clients.

Flashback: In 1979-80, the Hunt brothers attempted to corner the silver market by buying up one-third of the entire world supply (other than that held by governments). Within a year, the price for silver jumped 713% to a record high of $49.45 per troy ounce, but later collapsed in an event called "Silver Thursday." COMEX adopted "Silver Rule 7," which placed leverage restrictions on the purchase of commodities on margin, and the Hunt brothers had borrowed heavily to finance their purchases. (70 comments)

https://seekingalpha.com/article/4402389-wall-street-breakfast-hi-ho-silver-away

This could be it.... one of the Reddit'ers has discovered SVBL

This just in from Stockhouse:

https://stockhouse.com/companies/bullboard?symbol=t.svb&postid=32430629

salient paragraph :

One of them is Silver Bull Resources, the stock has been in a negative trend channel since 2007 (https://www.tradingview.com/x/4Fhvt3Ej/).

If such large formation breaks to the upside, anything could happen as we saw in gamestop that had a similair pre breakout technical setup to SVB.

SVB has a very large Silver deposit in Mexico with a yearly production profile of 7 moz/year (see PFS released 2013) and a NPV close to $1 billion. At 0,2 cut of that deposit has over 500 million oz silver eq

Bullish engulfing candle on the weekly chart :

https://schrts.co/kyYppHdt

T-minus just a few more hours now, and counting.

SVBL!

The Reddit crowd is eager to see a silver short squeeze; when one of them spots this stock with its self-defining name .... it'll be GME on steroids.

SVBL!

Silver Bull Announces Maiden NI 43-101 Resource of 2.33 Million Ounces of Gold & 476 Thousand Tonnes of Copper in the “Indicated” Category, and 1.56 Million Ounces of Gold & 220 Thousand Tonnes of Copper in the “Inferred” Category at the Beskauga Copper-Gold Project in Northeastern Kazakhstan

Vancouver, British Columbia Jan. 28, 2021 – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) is pleased to announce its maiden Mineral Resource estimate on the Beskauga copper-gold project completed by CSA Global Consultants Canada Ltd (“CSA Global”). Highlights of the Mineral Resource report include:

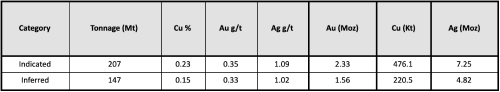

* An open pit-constrained Indicated Mineral Resource of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million ounces of gold, 476.1 thousand tonnes of copper, & 7.25 million ounces of silver.

* An open pit-constrained Inferred Mineral Resource of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million ounces of gold, 220.5 thousand tonnes of copper, & 4.82 million ounces of silver.

* The constraining pit was optimised and calculated using a NSR cut-off based on a price of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver.

Beskauga Resource: The Beskauga resource was estimated from 118 diamond drill holes, totalling 45,605.8 meters drilled between 2007 and 2017 by the private Swiss company, Copperbelt AG. Holes were drilled from surface using an HQ or NQ sized core diameter and varied in depth between 150m to 815m. The estimated Mineral Resource is shown in the table below.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project

Notes:

* An NSR $/t cut-off of $5.70/t was used, and the NSR formula is: NSR $/t = (38.137+11.612 x Cu%) x Cu% + (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x Ag g/t

* The NSR formula incorporates variable recovery formulae. Average copper recovery was 81.7% copper and 51.8% for both gold and silver.

* Metal prices considered were $2.80/lb copper, $1,500/oz gold and $17.25/oz silver.

* The Resource is stated within a pit shell that considers a 1.25 factor above the metal prices.

* Mineral Resources are estimated and reported in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves adopted 10 May 2014.

* The Mineral Resource is not believed to be materially affected by any known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant factors

* These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

* The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

In order to address the potential for eventual economic extraction in an open pit context, the reported Mineral Resources fall within an optimized Lerch-Grossman pit shell that uses a gold price of US$1,500/oz, a copper price of US$2.80, and a silver price of US$17.25 with an average recovery of copper at 81.7% and gold and silver of 51.8%.

Pit walls are set at 42 degrees in the overburden and 45 degrees in the hard rock. Mining costs were assumed to be US$1.00 in overburden and US$1.50/tonne in the hard rock and processing costs were assumed to be US$5.70/tonne. To determine the $/t value of the rock the following calculation was made:

NSR $/t = (38.137+11.612 x Cu%) x Cu% + (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x Ag p/t

Mineral resources were estimated by Ordinary Kriging using Micromine modeling software in multiple passes using 20 meter X 20 meter X 20 meter blocks as the SMU size. Blocks have been classified as Indicated or Inferred Mineral Resources.

The Mineral Resource was estimated by Serik Urbisinov, a Principal Resource Geologist for CSA Global, who is an independent Qualified Persons as defined by National Instrument 43-101. The full Technical Report will be filed onto the SEDAR website within the next 45 days.

Mineralization and geology: The Beskauga deposit is interpreted to be a copper-gold porphyry. Pyrite, chalcopyrite and tennantite are the dominant sulphide minerals at Beskauga, with smaller amounts of bornite, chalcocite, enargite, and molybdenite, with magnetite and hematite, also described. Sulphides occur as fine-grained disseminations as well as in stockwork veins and veinlets, associated with an elongated granodiorite porphyry intrusion. The grade of the copper and gold are highly correlated.

At surface, the deposit is covered by a 30 to 40 meter thick layer of recent sediments and remains open in all directions including at depth, with many of the drill holes terminating in mineralization. The chemistry and mineralogy of the mineralization defined thus far suggests the present resource is still in the upper part of the mineralizing system. The deposit has not benefited from detailed geological study and modelling which presents an opportunity to optimize extension targeting and definition of additional resources.

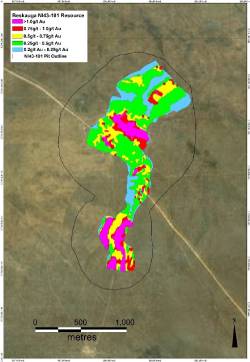

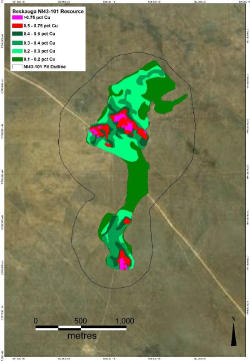

Figure 1. Surface projection of the Beskauga deposit showing the gold and the copper cut-offs. Also shown is the outline of the Lerch-Grossman conceptual pit.

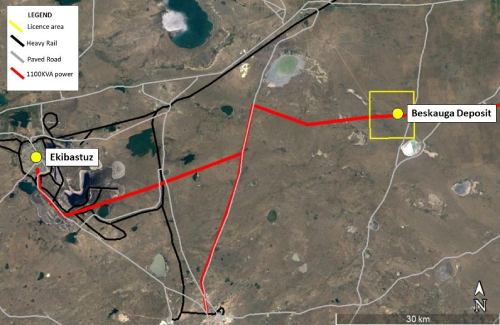

Infrastructure: The Beskauga deposit has excellent infrastructure. All operations are based out of the nearby mining town of Ekibastuz, which services the largest coal mine in Kazakhstan and provides a highly trained workforce for Silver Bull to draw upon. Paved road access, 1100 KVA power lines and heavy rail all lie within a 25 kilometer radius of the project. The capital city of Nur-Sultan, located approximately 300 kilometers along a double lane highway from the project, has a major international airport allowing for easy access and administration of the Beskauga project.

Figure 2. Map showing the location of infrastructure near the Beskauga deposit. The project is based out of the nearby mining town of Ekibastuz.

Tim Barry, President, CEO and director of Silver Bull states, “We are extremely pleased with this first NI 43-101 resource estimate at Beskauga. We believe the Beskauga project represents one of the best exploration opportunities in the world and we see significant opportunity to expand the current resource. We also believe there is considerable exploration potential in the wider region for both copper and gold and expect to have a pipeline of projects and associated news coming in from both the Beskauga Project and the wider area during 2021.

This year is shaping up to be an exciting one for Silver Bull. Presently, we are compiling the significant Soviet-era historical information in the region as well as building a team in-country. We expect to commence our on the ground exploration program at the beginning of the second quarter of this year.”

About Kazakhstan

Size: Kazakhstan is the ninth largest country in the world, covering 2,717,300 square kilometers, and has a population of 18.2 million people.

Capital City: The capital city is Nur-Sultan which is located 300 kilometers from the project. Nur-Sultan has a major international airport allowing for easy access and administration of the Beskauga Project.

Mining Law: Kazakhstan adopted a new mining code titled “Code on Surface and Subsoil Use” (the "SSU Code") on December 27, 2017, and became effective on June 29, 2018. The SSU Code is based on the Western Australian model where Kazakhstan moved from a contractual regime to a licensing regime for solid minerals (except for uranium). Coincident with the updated SSU law, the Kazakhstan government also reduced a considerable amount of the administrative burdens for subsoil users.

Tax: A summary of pertinent taxes related to exploration in Kazakhstan is as follows:

* 20% corporate tax

* 12% value-added tax (VAT) is refundable for exploration companies

* 4.7% royalty for copper

* 5% royalty for gold and silver

Geological Prospectivity: Kazakhstan is one of the most prospective countries in the world for a number of metals. According to the United States Geological Survey (USGS) Kazakhstan is:

* 1st in the world for uranium production (41% of world output)

* 2nd in the world for chromite production (18% of world output)

& 4th in the world for titanium production (6% of world output)

* 10th in the world for copper production

In addition, Kazakhstan has significant proven reserves (as yet unmined) of gold, silver, lead, zinc, tin, iron ore, nickel, cobalt, and bauxite.

The Fraser Institute Annual Survey of Mining Companies in 2017, ranked Kazakhstan the 24th best mining jurisdiction in the world.

About Silver Bull: Silver Bull is a mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States, and is based out of Vancouver, Canada. In addition to the Beskauga deposit, Silver Bull also owns the Sierra Mojada Project in Northern Mexico which is currently under a joint Venture with South32 Ltd.

About the Sierra Mojada deposit: Sierra Mojada is an open-pittable oxide deposit with a NI 43-101 compliant Measured and Indicated "global" Mineral Resource of 70.4 million tonnes grading 3.4% zinc and 38.6 g/t silver at a $13.50 NSR cutoff giving 5.35 billion pounds of zinc and 87.4 million ounces of silver. Included within the "global" Mineral Resource is a Measured and Indicated "high grade zinc zone" of 13.5 million tonnes with an average grade of 11.2% zinc at a 6% cutoff, giving 3.336 billion pounds of zinc, and a Measured and Indicated "high grade silver zone" of 15.2 million tonnes with an average grade of 114.9 g/t silver at a 50 g/t cutoff giving 56.3 million ounces of silver. Mineralization remains open in the east, west, and northerly directions. Approximately 60% of the current 3.2 kilometer mineralized body is at or near surface before dipping at around 6 degrees to the east.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

https://www.silverbullresources.com/news/silver-bull-announces-maiden-ni-43-101-resource-of-2.33-million-ounces-of-gold-476-thousand-tonnes-of-copper-in-the-indicated/

<<<Well, basserdan - got to hand it to you, Im the fool and the liar that is completely delusional. Managements honesty is impeccable and not to mention top notch. SVBL/SVBLD is going to make you "richer than rich"

Peter James Larsen - Deputy U.S. Marshal>>>

I'm glad you decided to 'own up' to making "delusional" comments about Silver Bull that you have been posting on IHub...

While searching your posting history, I came across your personal message board (linked below) and was astonished to see the following content on that board's IBox:

"Greetings, my name is Peter James Larsen - I am a United States Deputy Marshal. At the same time, I am also the richest man on the planet. I invented the internet and make money collecting royalties off industrial patents. If at any time you have a legitimate complaint about a listed company I may be able to help you if it is a criminal matter here in the United States. What you need to realize is that pink sheet and grey sheets are not listed on an exchange that can be regulated by United States Law enforcement easily. They are completely unregulated and frought with fraud so your best bet is NOT to ever place your money in either a pink sheet or grey sheet company.

Welcome to my message board - I am your connection to law enforcement in The United States on ihub."

https://investorshub.advfn.com/Deputy-US-Marshal-Peter-James-Larsen-BUSTED-38947/

Have a nice day...

Well, basserdan - got to hand it to you, Im the fool and the liar that is completely delusional. Managements honesty is impeccable and not to mention top notch. SVBL/SVBLD is going to make you "richer than rich"

Peter James Larsen

Deputy U.S. Marshal

<<<If its news released on a website and not through an actual newswire then how reliable is it??>>>

You need newswire references? No problem!

Here's three for your perusal and believe me, there's many more out there if you care to lQQk!

1) https://www.globenewswire.com/news-release/2021/01/26/2164750/0/en/Silver-Bull-Announces-the-Closing-of-the-Option-Agreement-to-Acquire-the-Beskauga-Copper-Gold-Project-in-Kazakhstan.html

2) https://www.juniorminingnetwork.com/junior-miner-news/press-releases/964-tsx/svb/91938-silver-bull-announces-the-closing-of-the-option-agreement-to-acquire-the-beskauga-copper-gold-project-in-kazakhstan.html

3) https://finance.yahoo.com/news/silver-bull-announces-closing-option-230000723.html?.tsrc=fin-srch

<<<I own half of this company - not so fast!!>>>

You're so full of crap, nutso, Silver Bull (2 words) CEO, Tim Barry (who, if you will recall, I asked you via PM to call or Email) said

to me in an email:

"He claims he’s the largest shareholder with 14.8M shares - I can confirm that there is no single shareholder with over 6 million shares – let alone 14.8M shares."

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161086693

"He claims he owns all his shares through Citibank - I am very aware where our shares sit and I can confirm that Citigroup does not manage/hold any significant shares."

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161086693

and FYI, I compiled a list of some of the other BS claims that you've posted here and other IHub boards and sent it to Tim Barry, Silver Bull's (two word's) CEO.

This is his reply to me to that list:

Hi Dan

I took a cursory read of a couple of posts you sent through. Initially I thought this guy was a short seller trying to cover off his shorts, however I don’t think this anymore - it only takes a minute to see this guy is a fraud.

1 – He claims he’s the largest shareholder with 14.8M shares - I can confirm that there is no single shareholder with over 6 million shares – let alone 14.8M shares.

2 – He claims he showed up at our recent shareholder meeting – I can confirm the meeting was held and no one showed up.

3 – He claims he owns all his shares through Citibank - I am very aware where our shares sit and I can confirm that Citigroup does not manage/hold any significant shares.

4 – He claims management is under investigation by the authorities - I can confirm that no SilverBull management or directors is or has ever been investigated by any authorities in any country.

5 – He claims he wants to open a Mint in the Sierra Mojada Valley – Clearly he knows nothing about the region - if he did he would know the current infrastructure would not support a Mint.

6 – He claims he is the richest man in the world – I believe Elon Musk just took that spot from Jeff Bezos.

7 – he claims he works for the CIA – My understanding is people who work for the CIA usually try and keep this a secret.

8 – He claims he is a US Marshall – it seems US Marshalls don’t have much to do these days except post on message boards of junior exploration companies, this is of course in addition to his job at the CIA.

As a public company listed on the OTC and TSX we report to the SEC in both Canada and the US. We are audited every year by a recognized accounting firm. All information is available for any member of the public to see.

I am more than happy to answer any reasonable questions on Silver Bull – questions that have a basis in reality.

If anyone wants to contact me directly with any questions then please have them reach out via the info@silverbullresources.com email address.

Regards

Tim

If its news released on a website and not through an actual newswire then how reliable is it?? I own half of this company - not so fast!!

Im hearing completely different things than this feel-good "fake news". This company is incorporated in the United States - what country is the company bank account in and where is the company treasurer???? Just a few questions to ask yourselves up in another country called Canada.

Peter James Larsen

Deputy U.S. Marshal

https://www.ciaeyesandears.com

Silver Bull Announces the Closing of the Option Agreement to Acquire the Beskauga Copper-Gold Project in Kazakhstan

Vancouver, British Columbia Jan 26, 2021 – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) is pleased to announce it has completed its due diligence and has closed on the option agreement with Copperbelt AG (“Copperbelt”), a public, non-listed mineral exploration company registered in Zug, Switzerland, regarding their 100% owned Beskauga copper-gold project located in northeastern Kazakhstan.

Highlights of the Agreement

* With the closing of the deal Silver Bull has paid Copperbelt a total of US$70,000 in upfront fees.

* Silver Bull has four years to conduct exploration on the property. Exploration expenditures on Beskauga and certain other licenses required to keep the option in good standing are US$2 million in year one, US$3 million in year two, US$5 million in year three and US$5 million in year four, for a total exploration spend of US$15 million over four years.

* After completing US$15 million in cumulative exploration expenditures Silver Bull can acquire the Beskauga property for a US$15 million cash payment.

* Copperbelt may receive a bonus payment of up to US$32 million should Silver Bull publish a Bankable Feasibility Study (“BFS”) with a resource of up to 10 million gold equivalent ounces on the main Beskauga prospect and 5 million gold equivalent ounces on an additional prospect. 20% of the bonus is payable 60 days after publishing a BFS, with the remaining 80% payable on the commencement of mine construction. Up to 50% of the bonus is payable in common stock of Silver Bull at Silver Bull’s election.

* Silver Bull will pay a finder’s fee to a third party upon the satisfaction of certain conditions.

Tim Barry, President, CEO and director of Silver Bull states, “We are extremely pleased to close this agreement with Copperbelt. We believe the Beskauga copper-gold project represents one of the best exploration opportunities in the world. The high quality work that has been completed on the project to date indicates that Beskauga is a huge mineralizing system that has considerable upside that has yet to be explored. We will be working closely with our partners from Copperbelt to quickly and efficiently explore these areas. In addition to the exploration potential at Beskauga, the project has excellent infrastructure.

Paved road access and, 1100 KVA power lines, heavy rail, and a highly trained workforce all lie within a 10 kilometer radius. The capital city of Nur-Sultan, located approximately 300 kilometers from the project, has a major international airport allowing for easy access and administration of the Beskauga project.

As a mining jurisdiction Kazakhstan is fast becoming a “go to” place due to its recently updated mining law and incredible geological prospectivity. In June 2018 the Kazakhstan government implemented a new mining code based on the mining code used in Western Australia and has reduced a considerable amount of the administrative burdens for subsoil users. Unlike many governments around the world today, the Kazakh government is very supportive of the mining sector, a view which is highlighted by the fact that numerous major mining companies have recently set up an office in the country and acquired exploration licenses. We expect to provide more details about the Beskauga project itself in the coming months.”

About Kazakhstan

Size: Kazakhstan is the ninth largest country in the world, covering 2,717,300 km2, and has a population of 18.2 million people.

Capital City: The capital city is Nur-Sultan which is located 300 kilometers from the project. Nur-Sultan has a major international airport allowing for easy access and administration of the Beskauga project.

Mining Law: Kazakhstan adopted a new mining code titled “Code on Surface and Subsoil Use” (the "SSU Code") on December 27, 2017, that became effective on June 29, 2018. The SSU Code is based on the Western Australian model where Kazakhstan moved from a contractual regime to a licensing regime for solid minerals (except for uranium). Coincident with the updated SSU law, the Kazakhstan government also reduced a considerable amount of the administrative burdens for subsoil users.

Tax: A summary of pertinent taxes related to exploration in Kazakhstan is as follows:

* 20% corporate tax

* 12% value-added tax (VAT) is refundable for exploration companies

* 4.7% royalty for copper

* 5% royalty for gold and silver

Geological Prospectivity: Kazakhstan is one of the most prospective countries in the world for a number of metals. According the United States Geological Survey (USGS) Kazakhstan is;

* 1st in the world for uranium production (41% of world output)

* 2nd in the world for chromite production (18% of world output)

* 4th in the world for titanium production (6% of world output)

* 10th in the world for copper production

In addition, Kazakhstan has significant proven reserves (as yet unmined) of gold, silver, lead, zinc tin, iron ore, nickel, cobalt, and bauxite

The Fraser Institute Annual Survey of Mining Companies in 2017, ranked Kazakhstan the 24th best mining jurisdiction in the world.

Sierra Mojada Update

Silver Bull’s Sierra Mojada project remains under an illegal blockade organized by a Cooperative of local Miners called Sociedad Cooperativa de Exploración Minera Mineros Norteños, S.C.L. (“Mineros Norteños”).

Due to COVID-19 the Mexican court system remains closed and the timing of reopening is uncertain. In an attempt to force Silver Bull into making a settlement, Mineros Norteños has blocked access to the project since September 2019. To ensure the safety of all involved, Silver Bull has elected to halt all operations on the project until a resolution can be found.

The joint venture option with South32 remains in good standing but under a force majeure pause.

About Silver Bull: Silver Bull is a mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-the-closing-of-the-option-agreement-to-acquire-the-beskauga-copper-gold-project-in-kazakhstan/

Silver Bull Announces the Closing of the Option Agreement to Acquire the Beskauga Copper-Gold Project in Kazakhstan

Tue, Jan 26 at 6:00 PM Via e-Mail:

Vancouver, British Columbia – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) is pleased to announce it has completed its due diligence and has closed om the option agreement with Copperbelt AG (“Copperbelt”), a public, non-listed mineral exploration company registered in Zug, Switzerland, regarding their 100% owned Beskauga copper-gold project located in northeastern Kazakhstan.

Highlights of the Agreement

With the closing of the deal Silver Bull has paid Copperbelt a total of US$70,000 in upfront fees.

Silver Bull has four years to conduct exploration on the property. Exploration expenditures on Beskauga and certain other licenses required to keep the option in good standing are US$2 million in year one, US$3 million in year two, US$5 million in year three and US$5 million in year four, for a total exploration spend of US$15 million over four years.

After completing US$15 million in cumulative exploration expenditures Silver Bull can acquire the Beskauga property for a US$15 million cash payment.

Copperbelt may receive a bonus payment of up to US$32 million should Silver Bull publish a Bankable Feasibility Study (“BFS”) with a resource of up to 10 million gold equivalent ounces on the main Beskauga prospect and 5 million gold equivalent ounces on an additional prospect. 20% of the bonus is payable 60 days after publishing a BFS, with the remaining 80% payable on the commencement of mine construction. Up to 50% of the bonus is payable in common stock of Silver Bull at Silver Bull’s election.

Silver Bull will pay a finder’s fee to a third party upon the satisfaction of certain conditions.

Tim Barry, President, CEO and director of Silver Bull states, “We are extremely pleased to close this agreement with Copperbelt. We believe the Beskauga copper-gold project represents one of the best exploration opportunities in the world. The high quality work that has been completed on the project to date indicates that Beskauga is a huge mineralizing system that has considerable upside that has yet to be explored. We will be working closely with our partners from Copperbelt to quickly and efficiently explore these areas. In addition to the exploration potential at Beskauga, the project has excellent infrastructure.

Paved road access and, 1100 KVA power lines, heavy rail, and a highly trained workforce all lie within a 10 kilometer radius. The capital city of Nur-Sultan, located approximately 300 kilometers from the project, has a major international airport allowing for easy access and administration of the Beskauga project.

As a mining jurisdiction Kazakhstan is fast becoming a “go to” place due to its recently updated mining law and incredible geological prospectivity. In June 2018 the Kazakhstan government implemented a new mining code based on the mining code used in Western Australia and has reduced a considerable amount of the administrative burdens for subsoil users. Unlike many governments around the world today, the Kazakh government is very supportive of the mining sector, a view which is highlighted by the fact that numerous major mining companies have recently set up an office in the country and acquired exploration licenses. We expect to provide more details about the Beskauga project itself in the coming months.”

About Kazakhstan

Size: Kazakhstan is the ninth largest country in the world, covering 2,717,300 km2, and has a population of 18.2 million people.

Capital City: The capital city is Nur-Sultan which is located 300 kilometers from the project. Nur-Sultan has a major international airport allowing for easy access and administration of the Beskauga project.

Mining Law: Kazakhstan adopted a new mining code titled “Code on Surface and Subsoil Use” (the "SSU Code") on December 27, 2017, that became effective on June 29, 2018. The SSU Code is based on the Western Australian model where Kazakhstan moved from a contractual regime to a licensing regime for solid minerals (except for uranium). Coincident with the updated SSU law, the Kazakhstan government also reduced a considerable amount of the administrative burdens for subsoil users.

Tax: A summary of pertinent taxes related to exploration in Kazakhstan is as follows:

20% corporate tax

12% value-added tax (VAT) is refundable for exploration companies

4.7% royalty for copper

5% royalty for gold and silver

Geological Prospectivity: Kazakhstan is one of the most prospective countries in the world for a number of metals. According the United States Geological Survey (USGS) Kazakhstan is;

1st in the world for uranium production (41% of world output)

2nd in the world for chromite production (18% of world output)

4th in the world for titanium production (6% of world output)

10th in the world for copper production

In addition, Kazakhstan has significant proven reserves (as yet unmined) of gold, silver, lead, zinc tin, iron ore, nickel, cobalt, and bauxite

The Fraser Institute Annual Survey of Mining Companies in 2017, ranked Kazakhstan the 24th best mining jurisdiction in the world.

Sierra Mojada Update

Silver Bull’s Sierra Mojada project remains under an illegal blockade organized by a Cooperative of local Miners called Sociedad Cooperativa de Exploración Minera Mineros Norteños, S.C.L. (“Mineros Norteños”).

Due to COVID-19 the Mexican court system remains closed and the timing of reopening is uncertain. In an attempt to force Silver Bull into making a settlement, Mineros Norteños has blocked access to the project since September 2019. To ensure the safety of all involved, Silver Bull has elected to halt all operations on the project until a resolution can be found.

The joint venture option with South32 remains in good standing but under a force majeure pause.

About Silver Bull: Silver Bull is a mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

it seems you have the wrong company

Go ahead and remove them - you are the one that is caught. You can lie about it all you want and remove the truth from the massage board. That is how criminals operate anyway.

The name of the company is Silverbull (one word) not Silver Bull ( two words)

SVBLD is gone - it was a pink sheet.

<<<Management has the same problem - they have been cooperating with a criminal syndicate out of Chicago.>>>

Are you nuts or what?

Send a link to that assertion or your post(s) will be removed.

<<<Is the name of this company not Silverbull (one word) and not Silver Bull (two words)??>>>

It's two words if you omit "Resources" and "Inc."

Recent News:

2020-12-23:Silver Bull Announces Voting Results Of Special Me... more

2020-12-15:Silver Bull Announces Postponement of Special Meet... more

2020-12-10:Silver Bull Reminds Shareholders of the Special Me... more

https://www.silverbullresources.com/

Management has the same problem - they have been cooperating with a criminal syndicate out of Chicago. Siverbull Resources reads Silver Bull Resources on the company website.

https://www.silverbullresources.com/

SVBLD was removed from trading today. It was a pink sheet shell game. We do have the goods on these "Moose pasture perps" here in the United States and Canada. Canadian authorities are investigating things as I write this on ihub.

Sprott and me both voted to replace management - Im an investment banker and I own a bank. I may consider taking over the CEO position myself to steward the company into production. I have the deepest pockets on the planet - me and my wife are the richest couple on the planet. You wont see me on a Forbes list or anywhere else. Its all personal income - I invented the internet and get paid through industrial patents in my social security card number. Im sure you probably think its a load of manure that someone like me would be on an ihub message board or involved in this company but Im as honest as they come.

SVB is still trading at .78

I see. Well, unfortunately, sheer stupidity isn't a crime, so I'll presume you have "the goods" on these Moose Pasture Perps in some actionable way. In the right hands, this Company is a potential gold mine. ( Malapropism intended. )

I am actually the largest shareholder - I own 14,841,843 shares which is 50.23% of the float. I own as much as can be owned according to U.S. securities laws. I have the people I do my investment banking with through Citigroup handling the situation. We showed up at the shareholders meeting in December to get a handle on these dirtbags. Criminal charges are being pursued here in the United States and in Canada. Incidentally, Im also a Deputy U.S. Marshal.

Only that it's run by clueless incompetents who probably couldn't pour sand out of a boot with instructions on the heel.

If you or some entity you control has this much skin in the game, for Heaven's sake... act. You'll get plenty of support.

https://investorshub.advfn.com/Deputy-US-Marshal-Peter-James-Larsen-38947/

Anyone care to share what information they have on the listing SVBL and its dual listing SVB.N in Canada?

A nice warm prison cell is awaiting you.

Your friend,

Peter James Larsen

Deputy U.S. Marshal

Basserdan - I have written the company but got no response. You have nothing to worry about - my wife and the people at CITIGROUP have full control over the situation. My wife couldnt stop laughing that she had to get involved in a mining company in Mexico and fly to Vancouver, B.C. Canada. She used to be on the board of Redhat before I sold the company to IBM. She will never stop laughing at how much this company is worth and that we are the largest shareholder. Giggles, giggles and more giggles!!

All I am interested in is exploiting the Sierra Mojada Valley. It is the largest known and easily exploitable silver deposit left on the planet. If it can be done I would like to build a 999.99 military grade refinery in the region by Royal Silver. Im not some piker with just a few shares of the company - its my way or the highway. So put that in your pipe and smoke it!!!!

Peter James Larsen

NOT ON MY WATCH OR MONEY

Im completely against doing anything other than developing the Sierra Mojada property. Buying properties around the world IS NOT in shareholders best interests. Management has a real problem - ME!!! I will continue to vote against management as all they are going to do is destroy the share price. We have a unique opportunity before us and a very profitable one in Mexico if we refuse to let current management galavant around the planet buying worthless properties. Im more than willing to finance the current project in Mexico but will NOT finance these other pipe dreams. If you dont like it too bad.

Peter James Larsen

Why Is The Silver Price Still 50% Below Its 1980 High (While Gold Has More Than Doubled)

A lot of investors have been confused as to why silver still sits 50% below its 1980 and 2011 highs, while just about every other asset class on the planet is at or near record levels.

Fortunately, Steve Cope of Silver Viper joined me on the show to discuss how he thinks this will be resolved, and also some of the costly mistakes mining stock investors can avoid.

So to find out what most of the world won’t realize until it’s far too late to do something about it, click to watch the video now!

Greetings Basserdan

You might remember me as the moniker: monergy or True Blue. I told my people at Citigroup to load up back in 2014. It kept the company from going BK. I also got some help from Sprott and also the private placement from the folks in Australia (South32) Maybe you have seen CITI on the bid - we will be back. My real name is Peter James Larsen - Im the richest man on the planet. Currently my assets are frozen by the Department of Justice here in the United States as I have been involved in a large scale investigation as an undercover U.S. Marshal. I was being targeted by a quasi-organized crime syndicate with a satellite stolen from us at the CIA. Anyway, maybe posters can fill me in as to how often CITI was working the bid here. 2 1/2 years ago I gave the Dept. of Justice the Right to Gain Warrant to everything in my social security card number, otherwise, I would be working the bid here still. Right now my assets are frozen and I cant move any money. There is a lot of pay dirt in the ground here and the price of Silver makes everything more than feasible.

Silver Bull Announces Voting Results Of Special Meeting Of Shareholders

VANCOUVER, BC – (December 23, 2020) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) announces the detailed voting results of the proposals considered at its special meeting of shareholders held on December 22, 2020 (the “Meeting”). A total of 14,841,843 or 50.23% of the Company’s issued and outstanding shares were represented at the Meeting. The following provides the voting results for each of the resolutions:

https://www.silverbullresources.com/news/silver-bull-announces-voting-results-of-special-meeting-of-shareholders/

SILVER BULL ANNOUNCES POSTPONEMENT OF SPECIAL MEETING OF SHAREHOLDERS

OTCQB: SVBL, TSX: SVB

VANCOUVER, BC – (December 15, 2020) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) today announced that it is postponing its 2020 special meeting of shareholders (the “Meeting”) to December 22, 2020 to provide its shareholders with additional time to vote on the proposals submitted for shareholder approval at the Meeting. Shareholders are advised that because the proposals involve proposed amendments to the Company’s articles of incorporation, the holders of a majority of the outstanding shares of Silver Bull common stock must approve them.

The record date for determining the shareholders eligible to vote at the Meeting will remain the close of business on October 23, 2020. Shareholders who have already submitted a proxy do not need to vote again for the postponed Meeting rescheduled for Tuesday, December 22, 2020 at 10:00 a.m. Pacific time at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, as the proxies submitted will remain valid.

The Company’s board of directors strongly recommends that all shareholders to vote “FOR” both proposals to increase the number of authorized shares and to change the Company’s name to MaxMetals Corp.

Silver Bull shareholders as of close of business on October 23, 2020 who have not voted are encouraged to vote online at www.proxyvote.com or by telephone at 1-800-690-6903. The proxy voting deadline to vote by Internet or telephone is December 21, 2020 at 11:59 p.m. Eastern time. Silver Bull shareholders who require assistance with voting their shares or have questions may contact the Company’s proxy solicitation agent, Laurel Hill Advisory Group, by telephone at 1-877 452-7814 (North America toll-free) or 1-416-304-0211 (collect calls outside North America) or by e-mail at assistance@laurelhill.com.

Shareholders who have already submitted proxies and want to change their proxy can update their vote at any time before the votes are cast at the Meeting. Your vote will be recorded at the Meeting in accordance with your most recently submitted proxy.

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Meeting. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on November 6, 2020. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.co

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Meeting. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2019 filed with the SEC on January 13, 2020, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the Meeting filed with the SEC on November 6, 2020.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. This agreement is subject to on the ground due diligence, which is now underway, and is expected to be completed on or before January 15, 2021. In addition, Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-postponement-of-special-meeting-of-shareholders/

An excerpt from the Silver Bull (TSX: SVB, OTCQB: SVBL) news release dated 12/10/20 9:00:07AM that is linked below:

President and CEO Tim Barry stated,

I have just returned from an "on the ground" due diligence trip to the Beskauga project in Kazakhstan and I was extremely impressed by the mineralization I saw in the drill core, and the extensive infrastructure that surrounds the project. Additional due diligence is currently underway on the Beskauga project, which if acceptable, will allow us to bring a second project into the Company. This would give shareholders exposure to silver and zinc on our Sierra Mojada project in Mexico, and copper and gold at the Beskauga project in Kazakhstan. It is well known that gold and silver prices have had big run-ups over the last six months; however, it is less appreciated that copper (US$2.60 in June 2020 to US$3.50 in December 2020) and zinc (US$0.92 in June 2020 to US$1.28 in December 2020) prices have been running up as well. By increasing the number of authorized shares now, we will be able to act in a timely manner when the need to raise equity capital arises or when the board believes it is in the best interests of the Company and its shareholders to take action, and to maximize the opportunities that both the Sierra Mojada and Beskauga projects present to shareholders.

As outlined in our news release on November 30, 2020, it is no small point that both of the leading independent proxy advisor firms Institutional Shareholder Services (ISS) and Glass Lewis & Co. agreed with Silver Bull's board of directors on the need for additional shares to enable the Company to raise additional capital for furthering the development of the Sierra Mojada project in Mexico and the Beskauga property in Kazakhstan. Additionally, Glass Lewis noted that "it would be in shareholders' best interest to provide the board with flexibility to obtain additional capital—including through participation in private placement transactions—going forward.

More at...

https://www.silverbullresources.com/news/silver-bull-reminds-shareholders-of-the-special-meeting-of-shareholders-on-december-16-2020/

Silver Bull Announces Independent Proxy Advisory Firms ISS And Glass Lewis Recommendations “For” Both Proposals At Upcoming Special Meeting Of Shareholders

VANCOUVER, BC – (November 30, 2020) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) is pleased to report that, in respect of its upcoming special meeting of shareholders, both Institutional Shareholder Services (“ISS”) and Glass, Lewis & Co. (“Glass Lewis”), the leading independent proxy advisor firms who provide voting recommendations to institutional investors, have recommended that the Company’s shareholders vote FOR the proposals to increase the number of authorized shares of Silver Bull common stock and to change the Company’s name to MaxMetals Corp. (collectively, the “proposals”).

YOUR VOTE IS IMPORTANT –

PLEASE VOTE TODAYThe proxy voting deadline is 11:59 p.m. ET on December 15, 2020.

We encourage you to vote well in advance of the deadline.

In their recommendations to shareholders on voting FOR the increase in the number of authorized shares, both ISS and Glass Lewis agreed with the Company’s board of directors on the need for additional shares to enable the Company to raise additional capital for furthering the development of the Sierra Mojada Project in Mexico and the Beskauga property in Kazakhstan. Glass Lewis further noted that “it would be in shareholders’ best interest to provide the board with flexibility to obtain additional capital—including through participation in private placement transactions—going forward.”

Authorized Share Increase Proposal

By increasing the number of authorized shares of Silver Bull common stock now, the Company will be able to act in a timely manner when the need to raise equity capital arises or when the Company’s board of directors believes it is in the best interests of the Company and shareholders to take action, without the delay and expense that would be required at that time to obtain shareholder approval to increase the authorized shares. Business purposes for which the Company could seek to raise additional capital including furthering the development of the Sierra Mojada project in Mexico and the Beskauga property (and other properties) located in Kazakhstan. Virtually all junior exploration companies like the Company remain as viable companies and conduct their mineral exploration activities by raising funds by issuing shares from time to time. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have an insufficient number of authorized shares to raise funds to fund general corporate overhead or cover the costs associated with maintaining its interests in the Sierra Mojada project in Mexico or its potential mineral interests in Kazakhstan.

Name Change Proposal

The board of directors of Silver Bull unanimously recommends that Silver Bull shareholders vote FOR both proposals.

The Company’s board of directors believes that the proposed name change from Silver Bull Resources, Inc. to MaxMetals Corp. is appropriate to better describe the Company’s focus and anticipated exploration activities.

Silver Bull Special Meeting of Shareholders

The special meeting of shareholders of Silver Bull is scheduled for 10:00 a.m. PT on Wednesday, December 16, 2020, at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia.

Additional information concerning the proposals can be found in the definitive proxy statement dated November 6, 2020. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com , on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

How to Vote Your Shares

By Internet: If you received a Notice of Internet Availability of Proxy Materials (the “Notice”), you can access the Company’s proxy materials and vote online at www.proxyvote.com. Further instructions to vote online are provided in the Notice.

By Telephone: You may vote your shares by calling 1-800-690-6903. You will need to follow the instructions on your proxy card and the voice prompts.

Due to the essence of time, shareholders are encouraged to vote by Internet or telephone as set out above.

Shareholder Questions and Assistance

Silver Bull shareholders who require assistance with voting their shares can contact the Company’s proxy solicitation agent, Laurel Hill Advisory Group:

Laurel Hill Advisory Group

North America Toll-Free: 1-877-452-7184

Collect Call Outside North America: 1-416-304-0211

Email: assistance@laurelhill.com

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Company’s upcoming special meeting of shareholders. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on November 6, 2020. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Company’s upcoming special meeting of shareholders. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2019 filed with the SEC on January 13, 2020, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the upcoming special meeting of shareholders filed with the SEC on November 6, 2020.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. This agreement is subject to on the ground due diligence, which is now underway, and is expected to be completed on or before January 15, 2021. In addition, Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-independent-proxy-advisory-firms-iss-and-glass-lewis-recommendations-for-both-proposals-at-upcoming/

Via e-Mail: Name change coming again...

Silver Bull Announces Independent Proxy Advisory Firms ISS And Glass Lewis Recommendations “For” Both Proposals At Upcoming Special Meeting Of Shareholders

VANCOUVER, BC – (November 30, 2020) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) is pleased to report that, in respect of its upcoming special meeting of shareholders, both Institutional Shareholder Services (“ISS”) and Glass, Lewis & Co. (“Glass Lewis”), the leading independent proxy advisor firms who provide voting recommendations to institutional investors, have recommended that the Company’s shareholders vote FOR the proposals to increase the number of authorized shares of Silver Bull common stock and to change the Company’s name to MaxMetals Corp. (collectively, the “proposals”).

YOUR VOTE IS IMPORTANT – PLEASE VOTE TODAY

The proxy voting deadline is 11:59 p.m. ET on December 15, 2020.

We encourage you to vote well in advance of the deadline.

In their recommendations to shareholders on voting FOR the increase in the number of authorized shares, both ISS and Glass Lewis agreed with the Company’s board of directors on the need for additional shares to enable the Company to raise additional capital for furthering the development of the Sierra Mojada Project in Mexico and the Beskauga property in Kazakhstan. Glass Lewis further noted that “it would be in shareholders’ best interest to provide the board with flexibility to obtain additional capital—including through participation in private placement transactions—going forward.”

Authorized Share Increase Proposal

By increasing the number of authorized shares of Silver Bull common stock now, the Company will be able to act in a timely manner when the need to raise equity capital arises or when the Company’s board of directors believes it is in the best interests of the Company and shareholders to take action, without the delay and expense that would be required at that time to obtain shareholder approval to increase the authorized shares. Business purposes for which the Company could seek to raise additional capital including furthering the development of the Sierra Mojada project in Mexico and the Beskauga property (and other properties) located in Kazakhstan. Virtually all junior exploration companies like the Company remain as viable companies and conduct their mineral exploration activities by raising funds by issuing shares from time to time. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have an insufficient number of authorized shares to raise funds to fund general corporate overhead or cover the costs associated with maintaining its interests in the Sierra Mojada project in Mexico or its potential mineral interests in Kazakhstan.

Name Change Proposal

The board of directors of Silver Bull unanimously recommends that Silver Bull shareholders vote FOR both proposals.

The Company’s board of directors believes that the proposed name change from Silver Bull Resources, Inc. to MaxMetals Corp. is appropriate to better describe the Company’s focus and anticipated exploration activities.

Silver Bull Special Meeting of Shareholders

The special meeting of shareholders of Silver Bull is scheduled for 10:00 a.m. PT on Wednesday, December 16, 2020, at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia.

Additional information concerning the proposals can be found in the definitive proxy statement dated November 6, 2020. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

How to Vote Your Shares

By Internet: If you received a Notice of Internet Availability of Proxy Materials (the “Notice”), you can access the Company’s proxy materials and vote online at www.proxyvote.com. Further instructions to vote online are provided in the Notice.

By Telephone: You may vote your shares by calling 1-800-690-6903. You will need to follow the instructions on your proxy card and the voice prompts.

Due to the essence of time, shareholders are encouraged to vote by Internet or telephone as set out above.

Shareholder Questions and Assistance

Silver Bull shareholders who require assistance with voting their shares can contact the Company’s proxy solicitation agent, Laurel Hill Advisory Group:

Laurel Hill Advisory Group

North America Toll-Free: 1-877-452-7184

Collect Call Outside North America: 1-416-304-0211

Email: assistance@laurelhill.com

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Company’s upcoming special meeting of shareholders. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on November 6, 2020. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Company’s upcoming special meeting of shareholders. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2019 filed with the SEC on January 13, 2020, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the upcoming special meeting of shareholders filed with the SEC on November 6, 2020.

Silver Bull Announces Closing of Second Tranche of Private Placement for Cumulative Gross Proceeds of US$1.85 Million

VANCOUVER, British Columbia, Nov. 10, 2020 -- Silver Bull Resources, Inc. (TSX: SVB; OTCQB: SVBL) (“Silver Bull” or the “Company”) is pleased to announce that it has completed the second and final tranche of its previously announced private placement (the “Private Placement”). Under the second tranche, the Company issued 319,000 units (the “Units”) at a price of US$0.47 per Unit for aggregate gross proceeds of US$149,930. Each Unit consists of one share of common stock in the Company (a “Common Share”) and one half of one transferable Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire one Common Share at a price of US$0.59 per Common Share until the fifth anniversary of closing of the second tranche of the Private Placement.

Under the initial tranche of the Private Placement, which closed on October 27, 2020, Silver Bull issued a total of 3,623,580 Units for aggregate gross proceeds of USD$1,703,083.

Directors and management (and their affiliates) of the Company purchased 1,159,000 Units (approximately US$545,000) in the Private Placement.

The net proceeds of the Private Placement will be used by Silver Bull for general working capital purposes.

All securities issued pursuant to the Private Placement are subject to a hold period under applicable Canadian securities laws, which will expire four months plus one day from the date of closing of the Private Placement, and will be restricted securities for purposes of U.S. securities laws.

The securities issued under the Private Placement have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and accordingly, may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. The Company plans to file a registration statement pursuant to the U.S. Securities Act which, when effective, will permit the resale of the Common Shares issued in connection with the Private Placement as well as the Common Shares issuable upon exercise of the Warrants. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of Silver Bull’s securities in the United States.

About Silver Bull: Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. This agreement is subject to on the ground due diligence, which will occur once safe travel to the region is allowed due to current COVID-19 related restrictions. In addition, Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-closing-of-second-tranche-of-private-placement-for-cumulative-gross-proceeds-of-us-1.85-million/

Gold and silver - don't fear the wall of worry

Lobo Tiggre - Tuesday October 27, 2020 15:29

https://www.kitco.com/commentaries/2020-10-27/Gold-and-silver-don-t-fear-the-wall-of-worry.html

Key Point: We don’t actually need higher gold prices to make lots of money.

Imagine what would happen if gold did “nothing,” fluctuating sideways for years…

That would mean $1,900–$2,000 gold for quarter after quarter after quarter.

Unless management of the world’s gold producers turn criminally stupid all at once, that would make gold miners a stellar market sector for long enough to attract a lot of generalist investors. That’s all the more so with Berkshire Hathaway’s purchase of Barrick Gold shares appearing to give “Buffett’s Blessing” to gold stocks. Those of us who already own the best producers would be well rewarded.

There’s been little money spent and fewer major gold and silver discoveries made for years. Larger companies will have to take over smaller ones that have made economic discoveries. That wave of takeovers has been held back by COVID-19 this year, but I think that will just make the tsunami all the bigger when it does arrive. Those of us who already own the most likely takeover targets should make a bundle.

Such a stable, relatively high gold price environment would make many marginal projects more robust. Better yet, it would turn already robust projects into prospective cash geysers. Such advanced exploration and development stories should deliver in spades for those of us who already own shares—even in a flat market.

Success in production and development companies would provide the cash needed to fund more high-quality exploration plays. Mines are, by definition, self-depleting assets. All miners know they must explore (or buy other companies that do it). It’s either that or they mine themselves out of business. Even if gold went nowhere for years, I think we’d see an explosion of exploration such as we’ve not had for years. Those of us who own the best explorers would be well rewarded in due course.

Silver & The Epochal Maldistribution Of Wealth

by Tyler Durden - Sun, 10/18/2020 - 22:00

https://www.zerohedge.com/markets/silver-epochal-maldistribution-wealth

Most importantly, silver should be bought for wealth preservation purposes and not for speculation. Therefore it must be held in physical form outside a fragile banking system.

Via e-Mail: Silver Bull Announces Closing of Initial Tranche of Private Placement for US$1.70 Million

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC – (October 27, 2020) – Silver Bull Resources, Inc. (TSX: SVB; OTCQB: SVBL) ("Silver Bull" or the "Company") is pleased to announce that it has completed the initial tranche of its previously announced private placement (the "Private Placement"). The initial tranche consisted of 3,623,580 units (the "Units") of the Company at a price of US$0.47 per Unit for aggregate gross proceeds of US$1,703,083. Each Unit consists of one share of common stock in the Company (a "Common Share") and one half of one transferable Common Share purchase warrant (each whole warrant, a "Warrant"). Each Warrant entitles the holder to acquire one Common Share at a price of US$0.59 per Common Share until the fifth anniversary of closing of the initial tranche of the Private Placement.

Directors and management (and their affiliates) of the Company are purchasing 1,159,000 Units (approximately US$545,000) in the Private Placement.

The net proceeds of the Private Placement will be used by Silver Bull for general working capital purposes. The Company paid an aggregate finder's fee on the initial tranche of the Private Placement of US$26,000 (1.5%).

The second tranche of 319,000 Units (US$149,930) is expected to close on or about November 6, 2020.

All securities issued pursuant to the Private Placement are subject to a hold period under applicable Canadian securities laws, which will expire four months plus one day from the date of closing of the Private Placement, and will be restricted securities for purposes of U.S. securities laws.

The securities issued under the Private Placement have not been registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and accordingly, may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. The Company plans to file a registration statement pursuant to the U.S. Securities Act which, when effective, will permit the resale of the Common Shares issued in connection with the Private Placement as well as the Common Shares issuable upon exercise of the Warrants. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of Silver Bull's securities in the United States.

About Silver Bull: Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. This agreement is subject to on the ground due diligence, which will occur once safe travel to the region is allowed due to current COVID-19 related restrictions. In addition, Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

Via e-Mail: Silver Bull Announces Private Placement of US$1.85 Million and Corporate Update

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC – (October 14, 2020) – Silver Bull Resources, Inc. (TSX: SVB; OTCQB: SVBL) (“Silver Bull” or the “Company”) is pleased to announce its intention to complete a private placement (the “Private Placement”) of up to 3,942,590 units (the “Units”) of the Company at a price of US$0.47 per Unit for gross proceeds of approximately US$1,853,000. Each Unit will consist of one share of common stock in the Company (a “Common Share”) and one half of one non-transferable Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire one Common Share at a price of US$0.59 per Common Share until the fifth anniversary of closing of the Private Placement.

Directors and management of the Company have committed approximately US$545,000 of the Private Placement. Additionally, clients and affiliates of the Sprott Group of Companies have committed to participate for a minimum of US$500,000.

The Private Placement is expected to close on or before November 20, 2020, subject to receipt of the necessary approvals, including approval of the Toronto Stock Exchange (“TSX”).

The Company has agreed to pay a cash commission of up to 4% of the gross proceeds raised by finders in the Private Placement, and the net proceeds will be used by Silver Bull for general working capital purposes.

Tim Barry, Silver Bull President and CEO, stated, “As announced by the Company on August 17, 2020, the Company entered into an option agreement to acquire the Beskauga Copper-Gold Project from Copperbelt AG (“Copperbelt”). After closing the Private Placement, the Company expects to complete remaining due diligence to finalize the agreement with Copperbelt, and then proceed with an initial geophysics program at site.”

Furthermore, the Company is expecting a final ruling in the lawsuit originally filed in 2014 by the group Mineros Norteños, which has appealed three prior rulings of the court. The last court ruling in favor of the Company was delivered in March 2020, but unfortunately due to the rapid spread of COVID-19 in Mexico, the court system in Mexico has been shut down until very recently, which has caused a significant delay in potentially settling this case. We strongly believe the lawsuit filed by Mineros Norteños is without merit and is largely being driven by the group’s lawyer, who stands to gain a considerable contingency payment if successful, and a small radical group of approximately 10 Mineros Norteños members who do not accurately reflect the sentiment of the much larger Mineros Norteños group. According to our employees who live in the community, the illegal blockade on the Sierra Mojada Project is manned by this small group, and it is an attempt to try and force the Company into making a settlement on a lawsuit that in our view is frivolous. We remain committed to good faith dialogue with the Mineros Norteños group, many of whom have worked for Silver Bull, to find a solution, but to date any proposal put forward by Silver Bull has been rejected, and any counter proposals from Mineros Norteños have been completely unrealistic.

The Sierra Mojada Project remains under an option with South32 International Investment Holdings Pty Ltd and is currently under a force majeure due to the illegal blockade. As soon as we are able access the project, we expect to recommence the drilling program that was halted.

All securities issued and issuable pursuant to the Private Placement are subject to a hold period under applicable Canadian securities laws, which will expire four months plus one day from the date of closing of the Private Placement, and U.S. securities laws, which will expire six months from the date of the closing of the Private Placement.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

About Silver Bull: Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. This agreement is subject to on the ground due diligence, which will occur once safe travel to the region is allowed due to current COVID-19 related restrictions. In addition, Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

Silver Bull Appoints Chief Financial Officer

VANCOUVER, BC – (September 28, 2020) – Silver Bull Resources, Inc. (TSX: SVB; OTCQB: SVBL) ("Silver Bull" or the "Company") is pleased to announce the appointment of Christopher Richards as Chief Financial Officer effective September 28, 2020, replacing Sean Fallis in that role.

Mr. Richards has a distinguished 20 year career in the mining industry and as a CPA (Chartered Professional Accountant, British Columbia), CA, bringing broad experience in all aspects of financial management, reporting, technical accounting, risk advisory, corporate finance and tax management. Prior to joining the Company, Mr. Richards most recently served as the Vice President of Finance for Great Panther Mining Limited, a U.S. and Canadian dual-listed gold and silver producer. Prior to Great Panther, he served as a senior financial consultant at various public and private mining companies in Vancouver, providing his expertise to merging and newly formed project development-staged entities. Prior to that, he spent 7 years as the Vice President Finance and Corporate Secretary of Kazakhstan-focused Kyzyl Gold Ltd., was Corporate Controller at NovaGold Resources Inc. and a Senior Manager at KPMG LLP.

Mr. Richards holds a Bachelor of Business Administration degree from Simon Fraser University and a Certificate in Mining Studies from the Norman B. Keevil Institute of Mining Engineering at the University of British Columbia.

Silver Bull would like to thank Mr. Sean Fallis for his years of service as Chief Financial Officer. Brian Edgar, Chairman and director of Silver Bull states, “Mr. Fallis has been an outstanding member of our core management team for nearly 10 years. During his tenure as our Chief Financial Officer he has proven to be a consummate professional meeting all challenges in a calm and confident manner. We wish him the very best in his new role as Vice President of Finance for Sierra Wireless.“