Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

now why would they need to do a r/s with half the a/s left to issue and making the revenue they show here in the $$$$ Millions

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=9439881

New Symbol: RBCLD. 1-500 (one for five hundred) Reverse Split immediately followed by 50-1 (fifty for 1) Forward Split. Each stockholder entitled to receive a fractional share of Common Stock as a result of the Reverse Split shall receive cash equal to 105% of the average closing price of the Pre-Reverse Split Stock for the ten business days preceding the effective date, multiplied by each such stockholders fractional share interest.**

Form 10-K RBC LIFE SCIENCES, INC. For: Dec 31 03/28 08:04 AM

http://xml.10kwizard.com/filing_raw.php?repo=tenk&ipage=8825373

News..Patent Granted

US Patent Granted to RBC Life Sciences for Supplement that Supports Cognitive Function

IRVING, Texas, Jan. 30, 2013 /PRNewswire/ -- RBC Life Sciences, Inc. (OTCQB: RBCL) (the "Company"), has been granted US Patent 8357422, which protects its unique dietary supplement formulation that nutritionally supports cognitive function, learning and remembering. The Company markets this supplement under the name "Neurobright®." The grant of this patent evidences the Company's continued commitment to bring effective science-based dietary supplements to the market.

"The basis for the patent was an 18-month controlled animal study conducted by Dr. Tres Thompson of the School of Behavioral and Brain Sciences at the University of Texas at Dallas," said Clinton Howard, CEO. "The study showed that Neurobright increased both cognitive function and psychomotor abilities in animals."

Dr. Thompson presented the report on this study at the 2008 annual conference of the Society for Neuroscience. The report stated, "Neurobright enabled aging animals to have memory and learning function like younger animals." In describing his observations from the study, Dr. Thompson said, "Some prescription drugs will improve cognitive function, but not once in my 25-year tenure, have test subjects improved so dramatically from a safe and natural product."

In addition to improved cognitive function, the animals that received Neurobright lived longer than the control animals that were not given Neurobright.

About RBC Life Sciences

Through wholly owned subsidiaries, RBC Life Sciences develops, markets and distributes high-quality nutritional supplements and personal care products under its RBC Life brand to a growing population of consumers seeking wellness and a healthy lifestyle. Through its wholly owned subsidiary, MPM Medical, the Company also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the company's website at www.rbclifesciences.com.

True that, if one of those pretty girls was live on webcam explaining why I should ask slap she would need a weekly chart imo.

nice PR here jut needs volume.

RBC Life Sciences Reports Second Quarter 2011 Results

| 7:00 AM | By PR Newswire Association LLC. |

IRVING, Texas, Aug. 11, 2011 /PRNewswire/ -- (RBC Life Sciences: OTCQB: RBCL) - RBC Life Sciences, Inc., a provider of proprietary nutritional supplements, wound care and pain management products, today reported consolidated net sales of $7.5 million for the quarter ended June 30, 2011,...

Related News: Similar Content, By PR Newswire Association LLC., Earnings http://www.prnewswire.com/news-releases/rbc-life-sciences-reports-second-quarter-2011-results-127513583.html#rssowlmlink

RBCL Security Details

Share StructureMarket Value1 $6,890,939 a/o Aug 10, 2011

Shares Outstanding 22,228,834 a/o Feb 28, 2011

Float 7,500,000 a/o Mar 20, 2009

Authorized Shares 50,000,000 a/o Aug 25, 2009

Par Value 0.001

http://www.rbclifesciences.com/

Market cap of $8.6M, revenues on pace for $32M and...PROFITABLE! EPS on pace for $.04-$.05. With a PE ratio of 20 the price per share would be $.80-$1.00...AND...the company is enjoying significant growth {16% Q over Q} in this Great Recession. A 1:1 Price/Sales ratio would equate to a price per share of $1.45, almost a 4 bagger from here {$.39}. Can you picture a Price/Sales ratio of 2? Or 3?

OS is 22M. Float 7.5M. CEO owns 44% of the OS.

Can you say...UNDERVALUED? I can. Just waiting for this gem to be "discovered"...and the ensuing liquidity.

Good day.

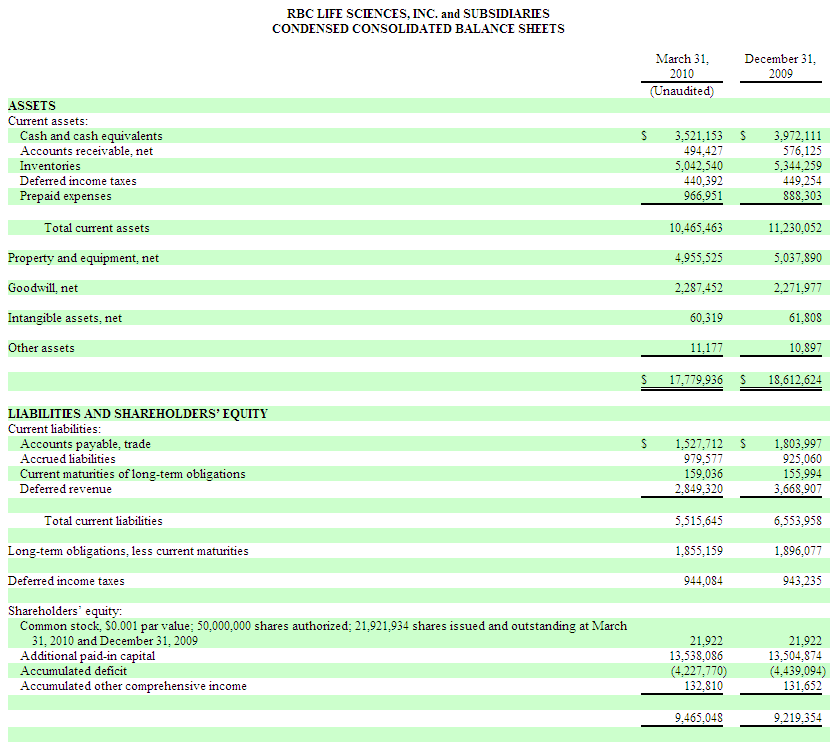

Take a quick peek at last Q's balance sheet. Note current assets vs current liabilities and total assets vs total liabilities:

RBC Life Sciences Reports 16% Second Quarter Sales Growth

Press Release Source: RBC Life Sciences, Inc. On Tuesday August 3, 2010, 8:00 am EDT

IRVING, Texas, Aug. 3 /PRNewswire-FirstCall/ -- (RBC Life Sciences: OTC Bulletin Board: RBCL) -- RBC Life Sciences, Inc., a provider of proprietary nutritional supplements, wound care and pain management products, today reported company-wide net sales of $7.8 million for the second quarter ended June 30, 2010, compared to net sales of $6.8 million for the same period during 2009, an increase of 16%. Net sales for the six months ended June 30, 2010 also increased 16% to $14.8 million compared to net sales of $12.8 million during the same period in 2009.

For the second quarter of 2010, the Company reported net earnings of $172,000, or $0.01 per share, compared to net earnings of $277,000, or $0.01 per share, during the same quarter in 2009. Net earnings for the six months ended June 30, 2010 were $383,000, or $0.02 per share, compared to $106,000, or $0.00 per share, during the same period in 2009.

"We are pleased to report year over year sales growth in both of our industry segments as well as significant improvement in earnings during the first six months of 2010," said RBC Life Sciences President and CEO, Clinton H. Howard. "We are particularly pleased with continued recovery of our international licensee business after the challenges we faced in that market last year."

Net sales to licensees, which represent 59% of consolidated net sales, increased 28% during the first six months of 2010 over the comparable period in 2009.

About RBC Life Sciences

Through wholly owned subsidiaries, RBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products under its RBC Life brand to a growing population of consumers seeking wellness and a healthy lifestyle. Through its wholly owned subsidiary, MPM Medical, the Company also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the company's Web site at www.rbclifesciences.com.

http://finance.yahoo.com/news/RBC-Life-Sciences-Reports-16-prnews-2468334811.html?x=0&.v=1

RBC Life Sciences Announces Third Quarter 2009 Results

On 8:00 am EST, Friday November 20, 2009

IRVING, Texas, Nov. 20 /PRNewswire/ -- RBC Life Sciences, Inc. (OTC Bulletin Board: RBCL - News), a provider of proprietary nutritional supplements, wound care and pain management products, reported today company-wide net sales of $6.49 million for the quarter ended September 30, 2009, compared to net sales of $9.93 million for the same quarter last year.

The company also reported a net loss of $152,000, or $0.01 per share, during the third quarter of 2009, compared to net earnings of $846,000, or $0.04 per share, during the same quarter in 2008.

"The global economy has continued to impact sales, particularly with our international licensees," said RBC Life Sciences President and CEO John W. Price. "Domestically, we're starting to see positive returns from recent initiatives designed to grow North American network marketing sales. Sales in North America increased 11 percent during the third quarter, year over year. We also more than doubled our current Associate network base in this market during the first nine months of 2009."

Within the last year, RBC Life Sciences has launched a company-wide branding effort that encompassed everything from redesigned labeling and new, streamlined product offerings to a new Associate compensation plan. In August, RBC Life Sciences introduced an industry-first brain health product, NeuroBright. A recent animal study showed that NeuroBright increased subjects' learning and memory by nearly 50 percent.

The patent pending product was released at the same time RBC Life Sciences announced the ClearPay System, the industry's first virtually balancing flex compensation plan. The ClearPay System was designed to reward the company's Associates more quickly, more often and more abundantly compared to other compensation plans.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Quarters Ended September 30,

----------------------------

2009 2008

---- ----

Net sales $6,487 $9,925

Gross profit 3,215 4,710

Operating profit (loss) (154) 1,387

Earnings (loss) before income taxes (195) 1,344

Provision (benefit) for income taxes (43) 498

Net earnings (loss) (152) 846

Earnings (loss) per share - basic and

diluted $(0.01) $0.04

Weighted average shares outstanding - basic 21,922 21,587

Weighted average shares outstanding -

diluted 21,922 22,906

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Nine Months Ended

September 30,

--------------------

2009 2008

---- ----

Net sales $19,262 $23,160

Gross profit 9,875 11,909

Operating profit 192 2,499

Earnings before income taxes 68 2,367

Provision for income taxes 114 890

Net earnings (loss) (46) 1,477

Earnings (loss) per share

Basic $(0.00) $0.07

Diluted $(0.00) $0.06

Weighted average shares outstanding - basic 21,920 21,315

Weighted average shares outstanding -

diluted 21,920 22,923

RBC Life Sciences, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

----------

September 30, December 31,

------------- ------------

2009 2008

---- ----

Assets

Cash and cash equivalents $3,518 $4,973

Inventories 4,886 5,707

Other current assets 2,128 2,245

----- -----

Total current assets 10,532 12,925

Other assets 7,346 6,841

----- -----

Total assets $17,878 $19,766

======= ======

Liabilities and shareholders' equity

Accounts payable and accrued liabilities $2,746 $3,228

Deferred revenue 2,843 4,279

Other current liabilities 153 144

--- ---

Total current liabilities 5,742 7,651

Other liabilities 2,665 2,728

Shareholders' equity 9,471 9,387

----- -----

Total liabilities and shareholders'

equity $17,878 $19,766

======= =======

IMO it is a tough call. From reading the filing it sounds like they will have at least a few more difficult quarters with results similar to Q3 (e.g. break even to slight loss). Having said that, the stock is trading at less than 1/2 book value. Furthermore, they have cash of $0.16/share. If it were my money I would hold at $0.20 but would definitely sell if I had the opportunity at $0.30 or more. Between $0.20 and $0.30 it gets fuzzier. Call it as you see fit.

Disclosure: I have no position in RBCL.

Unfortunately I still have a tiny position in this. What is your thinking considering bid/ask 16 to 20?

sam

RBCL reported a Q3 loss of $0.007/share on revenue of $6,487,110.

Yep. It was pretty fluffy.

That PR belongs in the Fluff Hall of Fame...

RBC Life Sciences Ranked as One of the Top 100 Workplaces in the Dallas-Fort Worth Area

On 7:30 am EST, Monday November 9, 2009

IRVING, Texas, Nov. 9 /PRNewswire-FirstCall/ -- RBC Life Sciences, Inc. (OTC Bulletin Board: RBCL - News), a provider of proprietary nutritional supplements and wound care/pain management products, has been named one of the Top 100 workplaces in the Dallas-Fort Worth area.

Conducted by The Dallas Morning News, the Top 100 Places to Work 2009 competition surveyed more than 33,400 employees at hundreds of small, medium and large firms throughout the DFW metropolitan area. The employees ranked their companies on merits such as corporate leadership, compensation, training, workplace flexibility and diversity.

RBC Life Sciences, which was ranked as the area's 57th best workplace, was one of only 22 small companies to make the Top 100 Places to Work 2009.

"Employees are the life blood of any organization," said RBC Life Sciences President and CEO, John W. Price. "It's humbling that our employees, even in the midst of trying economic times that require workplace sacrifices, showed they are satisfied."

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets quality nutritional supplements and personal care products to a growing population of consumers under the auspices of its networking marketing arm, RBC Life. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

RBC Life Sciences Unveils the ClearPay System - the Industry's First Balancing Compensation Plan That Pays Quickly and Abundantly

On Tuesday September 8, 2009, 8:23 am EDT

IRVING, Texas, Sept. 8 /PRNewswire-FirstCall/ -- RBC Life Sciences, Inc. (OTC Bulletin Board: RBCL - News), a provider of proprietary nutritional supplements and wound care/pain management products, announced today that RBC Life has launched the ClearPay System, a compensation plan that rewards the company's independent Associates quickly, abundantly and deeply within their organizations.

The ClearPay System is the direct selling industry's first flex compensation plan that is balanced monthly by computer to maximize commission payouts to Associates. ClearPay allows Associates to build their organizations over five legs. Three of these are flex legs that Associates can move within their organization to reward or motivate members of their down lines.

RBC Life is the network marketing arm of publicly held RBC Life Sciences.

"We built the ClearPay System from the ground up to immediately reward and energize new Associates as they start to build their businesses," said RBC Life Sciences President and CEO, John W. Price.

"The ClearPay System rewards them earlier and better than other pay plans," he said. "We give them 10 ways to earn income while rewarding them immediately with direct commissions and power bonuses, supporting longterm income with dynamic matching and participation in qualified pool payouts."

RBC Life unveiled the ClearPay System during its 2009 North American Summit, a gathering of its independent North American sales force held August 14 and 15 in Dallas. The pay plan is the centerpiece of the company's focus on building its North American sales market.

As part of this effort, RBC Life recently introduced NeuroBright, the nutritional supplements industry's first cognitive function product of its kind. NeuroBright was shown in a recent animal study to improve test subjects' learning and memory by nearly 50 percent. NeuroBright is a synergistic blend of 11 herbal antioxidants and Microhydrin, RBC Life's super-antioxidant.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

RBC Life Sciences Launches New Initiatives Aimed at Building Its Network Marketing Business Across North America

On Thursday September 3, 2009, 8:15 am EDT

IRVING, Texas, Sept. 3 /PRNewswire-FirstCall/ -- RBC Life Sciences, Inc. (OTC Bulletin Board: RBCL - News), a provider of proprietary nutritional supplements and wound care/pain management products, announced today that it has implemented several company-wide initiatives aimed at helping to grow its North American independent sales base.

The new initiatives include launching an industry-first compensation plan, giving independent Associates a new back-office platform, streamlining the company's product offering, changing the name of the company's network marketing arm and rebranding Websites, product labeling and logos. It also included the August 14 launch of NeuroBright(TM), a synergistic formulation of antioxidants that improved test subjects' learning and memory by nearly 50 percent during a recent animal study.

"These strategic initiatives and reorganizations better position RBC Life Sciences to capture market share," said RBC Life Sciences President and CEO, John W. Price. "The compensation plan will reward our independent Associates generously while the new back-office platform will help them monitor, motivate and grow their organizations throughout Canada and the United States."

RBC Life Sciences also changed the name of its network marketing arm to RBC Life(TM). The new name, along with a streamlined product offering, redesigned labeling and revamped Websites, better reflect the vitality and community aspect of the network marketing company.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

Study: RBC Life Sciences' Patent-Pending Nutritional Supplement, NeuroBright, Improved Learning and Memory By Nearly 50%

On Thursday August 20, 2009, 8:00 am EDT

IRVING, Texas, Aug. 20 /PRNewswire-FirstCall/ -- (RBC Life Sciences: OTC Bulletin Board: RBCL) -- RBC Life Sciences, Inc., a provider of proprietary nutritional supplements and wound care/pain management products, announced today the debut of NeuroBright(TM), a patent-pending, nutritional supplement that improved test subjects' learning and memory skills by 50 percent during a recent laboratory trial.

(Read about NeuroBright here on Life Sciences Today.com)

The veteran researcher who conducted the NeuroBright trial said few of the studies he has conducted in his 25 years in the field of neuroscience saw such dramatic improvements in cognitive function.

Lucien Thompson, head of the neuroscience program in the School of Behavioral and Brain Sciences at the University of Texas at Dallas, said that his two-year animal study of NeuroBright showed that both young and aging rats in controlled trials saw marked improvement in learning and memory tasks similar to those that confront elderly populations. NeuroBright also improved psychomotor skills, including strength, endurance and balance, according to the study.*

"NeuroBright looks like it has a lot of promise to improve memory and learning, not just in rats but in people as well," Thompson said. NeuroBright showed the potential to enhance ". . .the ability to learn new things, remember those things and then use that information."

NeuroBright is a synergistic blend of herbs, whole food nutrients and RBC Life Sciences' Microhydrin®, a uniquely formulated antioxidant whose health benefits have been detailed in numerous clinical and peer-reviewed studies. The company has filed for a composition-of-matter patent to protect NeuroBright's formulation.

"One of our greatest fears is losing our mental capacity during the aging process," said RBC Life Sciences President and CEO, John W. Price. "NeuroBright is the industry's first and only product to combine Microhydrin with research-supported ingredients shown to support cognitive function--all in the convenience of a single nutritional supplement."

"We believe NeuroBright will become one of RBC Life Sciences' flagship products and a major contributor in the effort to help people address their fears of cognitive decline. NeuroBright is a natural, safe and effective way of helping us to think, learn and remember."

The species of rat chosen for the double-blind, placebo-controlled trial shares many important biological attributes with humans. In addition to sharing just about every important protein, we share most of the same genome, similar developmental patterns and many of the same nervous system mechanisms, Thompson said.

The learning and memory portion of the study monitored the animals as they navigated a spatial maze. Subjects were fed one of four foods: a placebo, Microhydrin, a formula of 11 herbal antioxidants, and NeuroBright (Microhydrin combined with the 11 herbal antioxidants).

Thompson said typically 25 percent of any control group of rats is identified as slow learners. Microhydrin alone, as well as the 11 herbal antioxidants alone, improved the subjects' learning and memory. When the formulas were combined, as they are in NeuroBright, memory and learning improved dramatically. In fact, NeuroBright completely eliminated the slow learners, Thompson said. Every animal exhibited improved learning and memory.

As we age, our brains are increasingly ravaged by the effects of free radicals. Consequently, we require more antioxidants to repair the damage done. Recognizing the important role antioxidants play in brain function, the U.S. Department of Agriculture has conducted many studies on the abilities of different antioxidants to improve brain function.

Thompson said USDA studies of some of the most well-known antioxidant-laden foods, such as walnuts, blackberries and grape juice, can produce a 20 percent improvement in memory. By comparison, NeuroBright improved memory by nearly 50 percent, indicating that a synergy of ingredients were at work in the new nutritional supplement.

Most people do not consume the optimum amount of antioxidants in their diets. Those who don't may take nutritional supplements containing antioxidants to compensate. But this alone may not be sufficient, Thompson said.

"The study showed that combining Microhydrin with these other antioxidants produced a significant benefit above what supplementing with antioxidants alone produced," he said.

* -- No animals were harmed while conducting this trial

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

They reported EPS of $0.012 this quarter which is good for a $0.41 stock.

RBC Life Sciences Announces Second Quarter 2009 Results

On Wednesday August 5, 2009, 8:23 am EDT

IRVING, Texas, Aug. 5 /PRNewswire-FirstCall/ -- RBC Life Sciences, Inc. (OTC Bulletin Board: RBCL - News), a provider of proprietary nutritional supplements, wound care and pain management products, reported today company-wide net sales of $6.76 million for the quarter ended June 30, 2009, compared to net sales of $6.89 million for the same quarter last year.

The company also reported net earnings of $277,000, or $0.01 per share, during the second quarter of 2009, compared to net earnings of $276,000, or $0.01 per share, in 2008.

"The current global economic decline has presented its challenges, especially to our international licensees, and was the main cause of the quarterly sales decline," said RBC Life Sciences President and CEO, John W. Price. "Meanwhile, we're pleased with the progress of our planned expansion of the U.S. and Canadian independent sales market. Continuing the first quarter trend, we more than doubled the number of new Associates during the second quarter of 2009 compared to last year."

Mr. Price said RBC Life Sciences is entering the second phase of the expansion by rolling out a company-wide rebranding effort encompassing everything from redesigned labeling to new and streamlined product offerings.

At its national convention in August, RBC Life Sciences will unveil a revolutionary, new product that the company believes will become one of its best sellers. Mr. Price said the company also will introduce the ClearPay System, the industry's first virtually balancing flex compensation plan. The new five-leg compensation plan emphasizes business building by giving Associates 10 ways to earn money without the inherent weaknesses of binary systems.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Quarters Ended June 30,

-----------------------

2009 2008

---- ----

Net sales $ 6,759 $ 6,887

Gross profit 3,521 3,697

Operating profit 508 501

Earnings before income taxes 466 456

Provision for income taxes 189 180

Net earnings 277 276

Earnings per share - basic and diluted $ 0.01 $ 0.01

Weighted average shares outstanding - basic 21,922 21,243

Weighted average shares outstanding - diluted 22,477 22,944

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Six Months Ended June 30,

-------------------------

2009 2008

---- ----

Net sales $12,775 $13,234

Gross profit 6,660 7,199

Operating profit 347 1,112

Earnings before income taxes 263 1,023

Provision for income taxes 157 392

Net earnings 106 631

Earnings per share - basic and diluted $ 0.00 $ 0.03

Weighted average shares outstanding - basic 21,920 21,179

Weighted average shares outstanding - diluted 22,509 22,920

RBC Life Sciences, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

June 30, December 31,

-------- ------------

2009 2008

---- ----

Assets

Cash and cash equivalents $ 4,097 $ 4,973

Inventories 5,608 5,707

Other current assets 1,875 2,245

----- -----

Total current assets 11,580 12,925

Other assets 7,221 6,841

----- -----

Total assets $18,801 $19,766

======= =======

Liabilities and shareholders' equity

Accounts payable and accrued liabilities $ 2,545 $ 3,228

Deferred revenue 3,837 4,279

Other current liabilities 150 144

----- -----

Total current liabilities 6,532 7,651

Other liabilities 2,693 2,728

Shareholders' equity 9,576 9,387

----- -----

Total liabilities and shareholders' equity $18,801 $19,766

======= =======

Horse Study: RBC Life Sciences' Antioxidant, Microhydrin, Reduced Lactic Acid Buildup and Improved Hydration During Strenuous Exercise

Press Release

Source: RBC Life Sciences, Inc.

On Monday June 22, 2009, 9:02 am EDT

Buzz up! 0 Print

IRVING, Texas, June 22 /PRNewswire-FirstCall/ -- RBC Life Sciences, Inc., (OTC Bulletin Board: RBCL - News) a provider of proprietary nutritional supplements and wound care/pain management products, announced today that the company's flagship antioxidant, Microhydrin, "significantly" reduced lactic acid buildup and improved hydration in horses during strenuous exercise.

The three-week Rutgers University study corroborates more than a dozen anecdotal and clinical studies that show the uniquely formulated Microhydrin antioxidant reduces lactic buildup, improves hydration and increases blood oxygen levels in humans.

"This and previous clinical trials prove that Microhydrin antioxidant has some very distinct and significant benefits to humans and animals participating in strenuous exercise or competition," said RBC Life Sciences' CEO and President John W. Price. "Studies have shown that lactic acid buildup can contribute to muscular acidosis and may inhibit optimal performance."

Conducted by the Equine Science Center at Rutgers, the horse trial measured blood lactate levels and weight loss of mares. During the week preceding exercise, half of the mares received Microhydrin antioxidant in their morning feed while the others received feed without the nutritional supplement. At the end of this weeklong preparation, all the mares underwent a standard exercise test on an equine treadmill. The equine center later switched the control group of mares and retested.

The study found that the mares who received Microhydrin antioxidant in their feed had more than 13% lower blood lactate levels when they reached a fatigued state. The lactate levels were nearly 15% less up to 30-minutes after exercise. A similar study in human cyclists undergoing an endurance test showed a nearly 24% reduction in blood lactate concentration.

The mares fed Microhydrin antioxidant also lost less water weight during exercise, according to the study. Similarly, the human study showed that the cyclists maintained a better state of hydration after strenuous exercise.

Microhydrin's unique hydration characteristics stem from its unique composition of silica, potassium, magnesium and vitamin C. The antioxidant's colloidal silicate minerals display a variety of properties, including an increase in surface area--bonding absorbed water as well as minerals. Specific silicate interactions play a substantial role in nutrient bioavailability by enhancing solubility properties, improving ion and water transport and also providing free radical antioxidant protection.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

All Seven Members of RBC Life Sciences' Board of Directors Were Re-Elected During the Company's 2009 Annual Shareholders Meeting

On Tuesday June 16, 2009, 8:13 am EDT

IRVING, Texas, June 16 /PRNewswire-FirstCall/ -- RBC Life Sciences: (OTC Bulletin Board: RBCL - News) -- RBC Life Sciences, Inc., a provider of proprietary nutritional supplements and wound care/pain management products, announced today that all seven members of the board of directors were re-elected during the company's 2009 shareholders meeting.

RBC Life Sciences CEO and President John W. Price opened the meeting recapping the factors that led to the 13 percent growth in net sales during 2008 and the company's prospects for continued growth throughout 2009. Despite the slow economy, an estimated 2,500 new independent Associates have joined RBC Life Sciences during the last seven months -- more than a 25 percent increase in the number of Associates the company had when it launched efforts to build its North American sales base in November 2008.

Re-elected to the board of directors in the meeting were: Clinton H. Howard, outside director and chairman of the board; Mr. Price; Steven E. Brown, chief financial officer and vice president of finance; Kenneth L. Sabot, senior vice president of operations; Paul Miller, president of MPM Medical, Inc.; Joseph P. Phillip, independent director; and Robert A. Kaiser, independent director.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than 30 countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange

Thanks Mike.

Appreciate your comments.

RBCL has had long term growth and has a solid balance sheet. They have started an aggressive effort to grow their North American Nutritional supplement business which has been their only business that wasn't growing. I think they will be able to continue to grow but it may take a little bit of time and patience.

MikeDDKing - If you get a chance, could you please share your latest thoughts on RBCL? There has been little activity in the stock since their last earnings report. I initially bought it because that had such a strong balance sheet and a lot of cash, along with sequential earnings growth. Obviously, last quarter was not as good but the same could be said for a lot of companies in this financial environment.

Thank you.

On a positive note, they had decent revenue considering the economy, and appear to be making efforts to become a larger company. In the past, they've struck me as comfortable with the business, trying to add some products, but not really driven in the same sense as Herbalife, Medifast, or any of those kind of companies.

Still remains to be seen, but these "Roach Motels" can turn into big gains if things develop <g>.

RBC Life Sciences' North American Nutritional Supplements and Medical Products Sales Increased, Year Over Year, During the First Quarter of 2009

May 8, 2009 4:05:00 PM

Email Story Discuss on ZenoBank

View Additional ProfilesIRVING, Texas, May 8 /PRNewswire-FirstCall/ -- (OTC Bulletin Board: RBCL) -- RBC Life Sciences, Inc., a provider of proprietary nutritional supplements, wound care and pain management products, reported today that its North American nutritional supplements and medical products sales grew, year over year, during the first quarter of 2009.

U.S. and Canadian sales of RBC Life Sciences' nutritional supplements and body care products increased to $1.49 million during the first quarter of 2009 compared to $1.47 million during the first quarter of 2008. The company's MPM Medical, Inc., brand saw its wound care and pain management products sales increase 10 percent to $1.50 million during the first quarter this year compared to $1.36 million during the same quarter of 2008.

RBC Life Sciences reported company-wide net sales of $6.02 million for the quarter ended March 31, 2009, compared to net sales of $6.35 million for the same quarter last year. The company also reported a net loss of $171,000, or $0.01 per share, during the first quarter of 2009 compared to net earnings of $355,000, or $0.02 per share, in 2008.

"One of our priorities late last year was to invest in the expansion of our domestic network marketing sales base," said RBC Life Sciences President and CEO, John W. Price. "We believe this investment is bearing fruit and will reward us moving forward, although our first quarter expenses exceeded the gross profit we generated from increased sales.

"Meanwhile, MPM Medical's pain management and wound care products are becoming increasingly popular within the medical field."

In addition to the investment to expand the North American sales base, first-quarter results were also affected by the delay in planned shipments to certain international licensees. As a result of some logistical factors, certain shipments scheduled for March 2009 were not shipped until April 2009.

Despite tough economic conditions, RBC Life Sciences has added approximately 2,000 new independent Associates since launching its domestic network marketing rebuilding effort in November 2008. The company soon will introduce a revised Associate compensation system that will be one of the industry's most-rewarding commission plans.

Mr. Price, who was promoted to CEO in January, began laying the framework in early 2008 for increased domestic and international growth across the company's nutritional supplements and medical products brands. In addition to hiring a sales director, communications director, science and technology director and a new vice president of marketing, Mr. Price recruited a strategic-growth veteran to the board of directors.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange.

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Quarters Ended March 31,

2009 2008

Net sales $6,016 $6,348

Gross profit 3,139 3,503

Operating profit (loss) (161) 612

Earnings (loss) before income taxes (203) 567

Provision (benefit) for income taxes (32) 212

Net earnings (loss) (171) 355

Earnings (loss) per share - basic and

diluted $(0.01) $0.02

Weighted average shares outstanding -

basic 21,917 21,114

Weighted average shares outstanding -

diluted 21,917 22,573

RBC Life Sciences, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

March 31, December 31,

2009 2008

Assets

Cash and cash equivalents $5,631 $4,973

Inventories 5,202 5,707

Other current assets 2,467 2,245

Total current assets 13,300 12,925

Other assets 7,031 6,841

Total assets $20,331 $19,766

Liabilities and shareholders' equity

Accounts payable and accrued liabilities $2,781 $3,228

Deferred revenue 5,450 4,279

Other current liabilities 147 144

Total current liabilities 8,378 7,651

Other liabilities 2,708 2,728

Shareholders' equity 9,245 9,387

Total liabilities and shareholders'

equity $20,331 $19,766

SOURCE RBC Life Sciences, Inc.

----------------------------------------------

Alan Van Zelfden

+1-972-893-4050

alan.vanzelfden@rbclifesciences.com

or Steve Brown

+1-972-893-4000

steve.brown@rbclifesciences.com

both of RBC Life Sciences

Well that is true. I've thought this rally would of ended much sooner. But I believe a Major Selloff is coming, and will not probably buy anything until this market does so.

But Back to RBCL.OB the good news is the Balance sheet is still strong with .26 in cash. So that should provide some support. I just don't see the excitement on the upside here, that doesn't mean that I think their is enormous downside either, because my guess is the cash level will provide support. Just my opinion though.

Of course you ran out of patience...

with the market about 800 DJIA points ago as well...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36768301

There's been some serious money-making opportunities in the micros over that period, perhaps RBCL will surprise us.

Can't say I blame you, I ran out of Patience months ago.

RBCL reports Q1 loss ($.01) vs EPS $.02

gotta say I'm running out of patience with this one...

http://finance.yahoo.com/news/RBC-Life-Sciences-North-prnews-15187737.html?.v=1

Leading Nutritional Supplements Firm RBC Life Sciences Chooses ProPay Merchant Payment Services to Speed Commissions, Track Costs

Last update: 5/7/2009 6:15:01

AMLEHI, Utah, May 07, 2009 (BUSINESS WIRE) -- RBC Life Sciences, a leading provider of proprietary nutritional supplements, wound care and pain management products, has selected ProPay's payment services as the foundation of its new ClearPay Solution payment plan. The RBC Life Sciences ClearPay Solution speeds commission payments to North American Associates as well as giving them increased resources for managing and tracking their costs. The ClearPay Solution plan is provided by ProPay, the industry's leader in credit card processing and electronic payment services.

"With the ClearPay Solution, our Associates no longer have to wait for a commission check," said Kevin Young, RBC Life Sciences' Director of Sales. "Our Associates love that. We see this as an important advancement which will better serve and reward our Associates for their hard work and loyalty."

The new solution seamlessly credits monthly commissions to Associates' ProPay accounts. The Associates can use the funds in their accounts to conveniently purchase more products from RBC or move the funds to their verified bank accounts. Associates can access the funds via an RBC Life Sciences-branded debit card for purchases wherever MasterCard is accepted or to withdraw funds at ATMs around the world. In addition to giving Associates immediate access to funds, the ProPay account is also a convenient way to separate and track the business income and expenses that are associated with their RBC sales activities.

"Electronic commission payment services with customized debit cards are an ideal solution for companies such as RBC Life Sciences, which has thousands of independent sales Associates to pay," said Bryce Thacker, ProPay Executive Vice President of Sales & Marketing. "It ensures, speeds, and simplifies paying these independent Associates. We are extremely pleased at the tremendous impact this application is having on RBC and other companies who rely upon geographically-dispersed independent sales Associates."

About ProPay

Since 1997, ProPay has led the market in providing simple, safe and affordable credit card processing and electronic payment services for businesses ranging from the small, home-based entrepreneur to multi-billion-dollar enterprises.

ProPay understands the unique needs of these businesses and has created merchant services specifically for them. With ProPay, merchants can set up accounts online and begin accepting credit cards without buying special equipment or making long-term commitments or investments. ProPay leads out in educating merchants about how to reduce or eliminate the risk of touching or holding sensitive cardholder data. The company also leads the payments market in the development of secure end-to-end solutions for protecting sensitive data and alternative payment options that significantly reduce business costs.

ProPay is a privately held company, headquartered in Lehi, Utah. For information, visit .

About RBC Life Sciences

RBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the Company's Web site at .

SOURCE: ProPay

Snapp Conner PR Clay Blackham or Josh Berndt clay@snappconner.com or josh@snappconner.com (801) 994-9625

There isn't any news.

Came across this one while screen trolling the bottom. Then ran through the yahoo ms. board and saw none other than mikeddking there. now i am here. and this is on the radar.

- p

Patients Say MPM Medical's Regenecare Gel Significantly Reduced the Itching and Pain of Skin Rashes Triggered by Anti-Cancer Drugs

Monday March 30, 2009, 8:50 am EDT

IRVING, Texas, March 30 /PRNewswire-FirstCall/ -- Patients undergoing cancer treatment reported that using Regenecare hydrogel significantly reduced the pain and itching associated with the sometimes-severe skin rashes caused by anti-cancer drugs.

Conducted by the Western University of Health Sciences, the study substantiated the findings of nine previous clinical trials recognizing Regenecare for its pain-relieving and wound-healing benefits. Manufactured by MPM Medical, Inc., Regenecare is the only wound and pain management product of its kind on the market.

"Pain management is one of the most-significant issues facing healthcare today," said MPM President Paul Miller. "Many patients stop or forgo treatment because they cannot tolerate the itching and painful side effects often associated with these treatments. Regenecare is a unique hydrogel whose benefits are substantiated by science and validated by patients."

The six-week study followed 13 patients who were taking a class of anti-cancer drugs that, while effective, often produce a severe rash on a patient's face, neck, back and legs. If scratched, these rashes can become infected. Patients reported "significant reduction" of itching when using Regenecare, according to the study.

Researchers credit Regenecare's unparalleled pain relief and wound healing to its formulation of 2% lidocaine (for local pain management), marine collagen (to promote tissue formation), Aloe vera (to enhance circulation and to promote emollient effect) and sodium alginate (to absorb exudates).

"Pain is the leading cause of disability in the United States and is straining our healthcare system," according to the National Pain Care Policy Act of 2008 (H.R. 2994). Among other things, the pending legislation seeks "to improve the assessment, understanding and treatment of pain."

MPM offers Regenecare HA as an over-the-counter version of the prescription Regenecare. Regenecare HA has the same formulation, but it also contains hyaluronic acid, which enhances moisture and healing. Consumers may purchase Regenecare and other MPM products online at www.MPMmedicalinc.com.

About RBC Life SciencesRBC Life Sciences (OTC Bulletin Board: RBCL - News) develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical, Inc., brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange Commission.

Robert Kaiser had more insider purchases as follows:

03/04/09 1800 @ 0.3628

03/17/09 5000 @ 0.3125-$0.36

Bob Kaiser, Director, bought 7500 @ $.34

according to today's Form 4

I verified that CCI revenue is denominated in US dollars.

RBCL medical revenue continues to increase. Based upon their comment of a 41% increase in annual medical revenue I calculate that Q4 medical revenue was a record at roughly $1.8M. It was $1.64M last quarter and $1.23M in Q4'07.

Revenue from the former soviet union was probably closer to 50% of total revenue in Q4. We will know for sure when the 10-K come out. Russia has been experiencing inflation while RBCL has been growing their revenue there so negative trends in exchange rates don't necessarily portend problems although they certainly aren't helpful.

The 10-K stated the following: "We had approximately 10,200 active Associates in North America at December 31, 2007." The 1,100 that they have added since November 1 is roughly 10% growth and probably is more. Most of that increase hasn't hit the P&L.

Mike, these earnings may be built into the stock price at .40+, but I also think RBCL faces headwinds:

Posted by: nelson1234 Date: Wednesday, February 25, 2009 9:47:13 AM

In reply to: None Post # of 112209

rbcl - poor earnings report imo (I think they made less than a penney on $7+ million in sales). They were able to turn their backlog into decent sales, but couldn't convert to earnings. I also don't like their near term prospects, althought they could always have a better qtr than this one.

Two-thirds of their sales (per the last 10q) are to what they call the former soviet union. I imagine much is to Russia. RBCL's backlog hit the roof while the ruble-dollar xchange rates were very low. For instance, in late August it was around 24 rubles/dollar. On 12/31 it was at 30 rubles/dollar, and now its at 36 rubles/dollar. So, either the price of their goods has gone up by 50% in Russian Currency, or their margins are going down dramatically going forward. Plus, I think the Russian economy is very messy right now (join the club).

Here's a dollar/ruble chart: http://www.exchange-rates.org/history/RUB/USD/T

Addendum: in fact, the ruble had been at the 23.xx/dollar the whole time RBCL built up that huge backlog, so I think its fair to say the dollars value has increased over fifty percent since then. Here's a more complete table: http://www.bankofcanada.ca/cgi-bin/famecgi_fdps

RBCL does have a pretty strong balance sheet so don't think there is too much downside at .43, but I still don't like their prospects as much as I used to.

here's the earnings report: http://biz.yahoo.com/prnews/090225/da74953.html?.v=1

best.

For the quarter, revenue was about where I expected it but EPS was a tad short. Earnings do bounce around a bit so this wasn't a complete surprise. From the press release it sounds like they are continuing to grow. As long as they continue to grow they will do well in the long run.

Mike,

Seems to me that downside is probably limited, but are you still excited about this one?

sam

Q4 revenue was $7.25M or a 9% increase over Q4 revenue of $6.63M. Q4 diluted EPS was $0.006 but had an unusually high tax rate of 55.2% vs 39.6% for the entire year. If the average tax rate had applied in Q4 they would have had an EPS of $0.008. Q4 was a decent quarter but not a great quarter.

They are making great progress with rebuilding their domestic business while international sales are strong.

Book value is now $0.44 which includes $0.23 in cash!

RBC Life Sciences' 2008 Net Sales Increase 13 Percent as Its Nutritional Supplements and Medical Products Brands See Continued Growth

Wednesday February 25, 8:00 am ET

IRVING, Texas, Feb. 25 /PRNewswire-FirstCall/ -- (OTC Bulletin Board: RBCL - News) -- RBC Life Sciences, Inc., a provider of proprietary nutritional supplements, wound care and pain management products, announced today that 2008 net sales increased 13 percent year over year as the company continued its domestic and international growth.

The company reported net sales of $30.4 million for the year ended December 31, 2008, compared to $27 million during the same period in 2007. It also reported net earnings of $1.62 million, or $0.07 per diluted share, in 2008 compared to net earnings of $1.69 million, or $0.08 per diluted share, in 2007.

"In 2008, RBC Life Sciences continued the surge in growth that the company witnessed in 2007, when the firm produced record-setting earnings," said President and CEO John W. Price. "Sales generated by our international licensees grew 18 percent year over year while sales generated by our medical products brand, MPM Medical, Inc., grew 41 percent during that time. This growth is occurring at the same time that we are beginning to see good gains in our domestic, independent sales force."

Mr. Price, who was promoted to CEO last month, began laying the framework in early 2008 for increased domestic and international growth across the company's nutritional supplements and medical products brands. In addition to hiring a sales director, communications director, science and technology director and a new vice president of marketing, Mr. Price recruited a strategic-growth veteran to the board of directors.

With international sales running strongly, Mr. Price redoubled the company's focus on rebuilding the independent Associate base responsible for driving domestic sales of nutritional supplements. Since launching the first phase of this effort on November 1, more than 1,100 new Associates have joined RBC Life Sciences. The second phase of the rebuilding effort will include revising the Associate compensation system to make it one of the industry's most-rewarding commission plans.

Mr. Price said that 2008 net earnings were affected by improvements to RBC Life Sciences headquarters' facility and upgrades to its operational infrastructure.

About RBC Life SciencesRBC Life Sciences develops, manufactures and markets high-quality nutritional supplements and personal care products to a growing population of consumers seeking wellness and a healthy lifestyle. Under its MPM Medical brand, RBC Life Sciences also develops and markets to health care professionals in the United States proprietary prescription and nonprescription products for advanced wound care and pain management. All products are tested for quality assurance in-house, and by outside independent laboratories, to comply with regulations in the U.S. and in more than thirty countries in which the products are distributed. For more information, visit the Company's Web site at www.rbclifesciences.com.

The statements above, other than statements of historical fact, may be forward-looking. Actual events will be dependent upon a number of factors and risks including, but not limited to, changes in plans by the Company's management, delays or problems in production, changes in the regulatory process, changes in market trends, and a number of other factors and risks described from time to time in the Company's filings with the Securities and Exchange

RBC Life Sciences, Inc.

Summary Results of Operations

(in thousands, except per share data)

(unaudited)

Years Ended December 31,

2008 2007

Net sales $ 30,409 $ 27,029

Gross profit 15,494 14,899

Operating profit 2,852 2,899

Earnings before income taxes 2,677 2,689

Provision for income taxes 1,061 997

Net earnings 1,616 1,692

Earnings per share - basic $ 0.08 $ 0.08

Earnings per share - diluted 0.07 0.08

Weighted average shares outstanding -

basic 21,465 20,396

Weighted average shares outstanding -

diluted 22,839 22,206

RBC Life Sciences, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

December 31, December 31,

2008 2007

Assets

Cash and cash equivalents $ 4,973 $ 6,369

Inventories 5,707 4,725

Other current assets 2,245 1,334

Total current assets 12,925 12,428

Other assets 6,841 6,730

Total assets $19,766 $ 19,158

Liabilities and shareholders' equity

Accounts payable and accrued liabilities $ 3,228 $ 4,431

Deferred revenue 4,279 4,323

Other current liabilities 144 136

Total current liabilities 7,651 8,890

Other liabilities 2,728 2,690

Shareholders' equity 9,387 7,578

Total liabilities and shareholders'

equity $ 19,766 $ 19,158

|

Followers

|

9

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

180

|

|

Created

|

07/22/07

|

Type

|

Free

|

| Moderators | |||

Overview

RBC Life Sciences, Inc., together with its subsidiaries, engages in the marketing and distribution of nutritional supplements and personal care products in the United States, Canada, South Korea, and Japan. It operates in two segments, Nutritional Products and Medical Products. The Nutritional Products segment offers a line of approximately 75 nutritional supplements and personal care products, including herbs, vitamins, and minerals, as well as natural skin, hair, and body care products under the RBC Life Sciences brand. It markets these products in four categories: wellness products, weight loss products, fitness products, and skin care products. This segment markets its products through a network of independent distributors, as well as through licensing arrangements with third parties. The Medical Products segment markets a line of approximately 28 wound care and oncology products under the MPM Medical brand throughout the United States. The wound care products are for the treatment and healing of wounds, such as pressure ulcers, leg ulcers, cuts, burns, and abrasions. These products include wound and skin cleansers, wound dressings, a moisture barrier cream, and hydrogel wound dressing with Lidocaine. The oncology products are designed to reduce destruction to skin and tissue caused by radiation, and to reduce pain and itching caused by radiation reactions in the skin and the internal mucosa. This segment distributes these products to hospitals, nursing homes, clinics, and pharmacies through medical/surgical supply dealers and pharmaceutical distributors.

Web Sites

http://www.rbclifesciences.com

http://www.mpmmedicalinc.com

Sample Products

Investment Thesis

1. Rapidly Growing Earnings - RBCL had record EPS of $0.037 in Q3, the most recent quarter. Given their backlog, 2008 likely will produce record annual earnings. 2007 earnings were a huge improvement over 2006 ($0.08 in 2007 vs. $0.02 in 2006). They have a very strong trend of improvement in earnings over a long period of time and I expect that trend to continue.

2. Huge Backlog - Backlog is $8.7M for their CCI account in the most recent quarter which is the second highest level in history. Also, the backlog only represents a portion of their sales going forward. They have GM of 47.5% so additional sales drop rapidly to the bottom line.

3. Rapidly Growing Medical Sales - Medical sales jumped 42% year-over-year and looks like it will continue. At the end of March they announced an expansion of their medical segment into Latin America. They also announce in February that they would begin selling their products in Kroger. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=28065107 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=26926765

4. Expanding Nutritional Sales - Nutritional sales increased 23.5% in the most recent quarter due to international expansion. The company has embarked on some new initiatives to expand their US and Canadian nutritional sales.

5. Strong Balance Sheet - RBCL has a book value of $0.44 which includes $0.23 in cash. That puts them in a strong position financially to continue growing.

6. Recession Resistant Business - Their business is recession resistant which is a strong plus in this economic environment.

Historical Financial Information

| Quarter | Revenue | Diluted EPS |

| Q3'09 | $6.49M | -$0.007 |

| Q2'09 | $6.76M | $0.012 |

| Q1'09 | $6.02M | -$0.008 |

| Q4'08 | $7.25M | * $0.006 |

| Q3'08 | $9.93M | $0.037 |

| Q2'08 | $6.89M | + $0.012 |

| Q1'08 | $6.35M | $0.016 |

| Q4'07 | $6.63M | x $0.008 |

| Q3'07 | $7.86M | $0.029 |

| Q2'07 | $7.15M | $0.023 |

| Q1'07 | $5.39M | $0.015 |

| Q4'06 | $5.28M | $0.005 |

| Q3'06 | $5.40M | $0.004 |

| Q2'06 | $6.20M | $0.013 |

| Q1'06 | $4.81M | -$0.002 |

| Q4'05 | $4.95M | $0.003 |

| Q3'05 | $4.91M | $0.007 |

| Q2'05 | $5.36M | $0.018 |

| Q1'05 | $4.14M | -$0.000 |

| Q4'04 | $5.24M | $0.014 |

| Q3'04 | $4.07M | $0.001 |

| Q2'04 | $4.72M | $0.007 |

| Q1'04 | $4.24M | $0.004 |

* Q4'08 results had unusually high tax at 55.2% vs. 39.6% for the entire year. If the average tax rate had applied they would have had EPS of $0.008.

+ Q2'08 EPS was impacted by some one-time items. They incurred expenses for an event to train/motivate their sales associates and also had expenses for renovations on their headquarters' building. They

didn't quantify the costs for these one time items but certainly EPS would have been higher without them. I suspect the EPS impact was on the order of $0.008/share. Also they had some shipping delays

that impacted Q2. Without these one-time items the Q2 report would have been much better.

x Without a one-time write-off they would have made $0.023/share. See the following post for details:

http://investorshub.advfn.com/boards/read_msg.asp?message_id=27753484

Earnings Reports

Q4'08 - http://investorshub.advfn.com/boards/read_msg.aspx?message_id=35859247

Q3'08 - http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33448261

Q2'08 - http://investorshub.advfn.com/boards/read_msg.aspx?message_id=31228787

Q1'08 - http://investorshub.advfn.com/boards/read_msg.asp?message_id=29030527

Q4'07 - http://investorshub.advfn.com/boards/read_msg.asp?message_id=27391526

Q3'07 - http://investorshub.advfn.com/boards/read_msg.asp?message_id=25632255

Backlog Information

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33513933

Charts

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |