Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

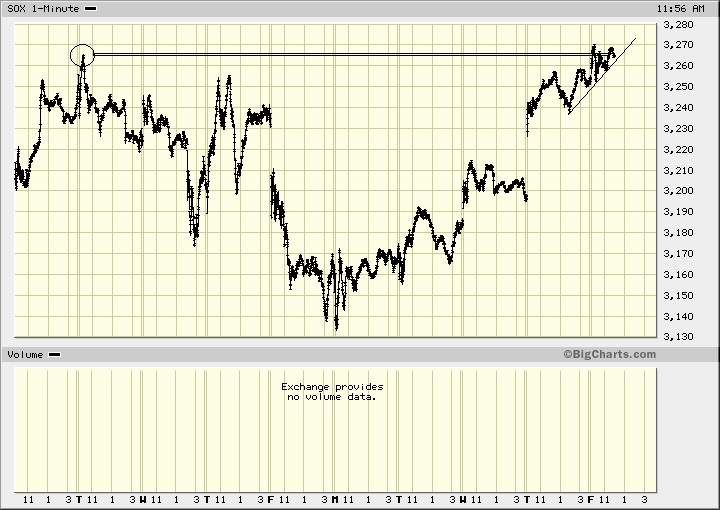

2 weeks earlier :

Now.....

Yesterday :

Today :

https://investorshub.advfn.com/Philadelphia-Semiconductor-Index-SOX-7855/

5 months ago :....Last 3268

LOL

Is today volume spike on $SOX normal or just a stockcharts.com glitch. It appears to be the first of its kind if it's not a glitch... its also looking a bit toppy.

$SOX

http://schrts.co/QutUuTqp

It seems to just continuously be all-about the SOX Index....

https://www.investopedia.com/articles/etfs/top-semiconductor-etfs/

But I mean it's like, are semi-conductor products even important ?

Last time I looked was a whole bunch of months ago.....(way back there in MAY)

Why, it went from (that) 1500 down to 1300 but now it's back up where it is !

$SOX Phili Semi Index not finished with Volatility

What a difference a few weeks make, things really have got very ugly very quickly, the POTUS is willing to use the tech industry as leverage against China in the escalating trade war. It may be a case that investors became complacent once again as when we now look in Hindsight at the indicators, they RSI , MACD and Stoch had all reached quite elevated levels and the Momentum indicator had started to decline quite drastically, and is now at a historic low.

One worrying element of the chart is that Gaps exist below, which is understandable given the velocity of the recovery from December lows, it is very likely that the decline will continue until those gaps are filled at a minimum. The outlook for trade is not good, so there is no stimulus but possibly more negative pre announcement from companies warning of earnings declines ,due to lost business in CHINA and Huawei in particular.

Broadcom, Nvidia , Amd , INTC and Xlnx have suffered horrendous losses in value since the beginning of May and it would take a brave or stupid investor to start buying while the sentiment is so poor.

The Semi stocks are often seen as leading indicators for the entire market, which was the case in 2018, from their January 2018 high they were bleeding lower while the market continued to rally until the october massacre set in.

We are Bulls but can only say, Proceed with extreme caution if you intent bottom feeding on these stocks.

RSI tells the full story in the SOX.

Maybe we are guilty of looking for the positives but the SOX has respected the technical perfectly and what is amazing, is the accuracy of the RSI H&S correction which has taken place. IS the market as a whole can avoid another tremor from trade talks the SOX has plenty of upside to go.

And now, worse.

$SOX:$NDX,uu[1320,1080]dalaynay[d19940101,20121231][pb21!b55!b144][iub9][J3457344,N]" rel="nofollow noopener noreferrer ugc" aria-label="user uploaded image">$SOX:$NDX,uu[1320,1080]dalaynay[d19940101,20121231][pb21!b55!b144][iub9][J3457344,N]">

$SOX:$NDX,uu[1320,980]dalaynay[ds][pb21!b55!b144][iub9][J3457344,N]">

This chart is at an all time low. Semiconductors are a commodity.

$SOX:$NDX,uu[1320,1080]dalaynay[d19940101,20121231][pb21!b55!b144][iub9][J3457344,N]" rel="nofollow noopener noreferrer ugc" aria-label="user uploaded image">$SOX:$NDX,uu[1320,1080]dalaynay[d19940101,20121231][pb21!b55!b144][iub9][J3457344,N]">

all chart code now dead. will start over if anybody is reading

if not, i won't

SOX low today 386. Always amusing when it's an old Intel chip.

$SOX,uu[1320,1320]dacaynay[d20090301,20121221][pb89%21b144%21b233][iub13]" rel="nofollow noopener noreferrer ugc" aria-label="user uploaded image">$SOX,uu[1320,1320]dacaynay[d20090301,20121221][pb89%21b144%21b233][iub13]">

SOX approaching 420 resistance, a point at which to exit long positions, imo

$SOX&p=D&yr=0&mn=6&dy=0&i=p58385164902&a=206966496&r=875" rel="nofollow noopener noreferrer ugc" aria-label="user uploaded image">$SOX&p=D&yr=0&mn=6&dy=0&i=p58385164902&a=206966496&r=875">

SOX Weekly 330 call open interest is high. These expire today.

http://online.wsj.com/mdc/public/page/2_3043-indOpt_C_SOX.html

Data feeds not available via Ameritrade. Can't trade them, either.

Piper Jaffray Predicts Semiconductor Super Cycle With Internet TV, Manufacturing Plant Underinvestment, And Infrastructure Driving Growth

TWST: Give us a broad overview of where semiconductors are now.

Mr. Richard: I think the industry is in the early innings of a super cycle. There was a super cycle in the late 1970s and early 1980s, and then one in the mid- to late 1990s, and I think we entered one exiting the Great Recession.

The chip industry is highly cycle- and capital-intensive. A new product comes along, like a digital watch or a calculator, and everyone wants one. Companies like Texas Instruments (TXN), Hewlett-Packard (HPQ) and National Semiconductor (NSM) jumped into the calculator market. Moore's Law drives new features for a while, keeping pricing stable. But ultimately pricing falls and the market reaches saturation. In the case of calculators, the PC market emerged as the calculator market was in decline. However, the Japanese wanted to own the DRAM market at the time and invested for market share and not profitability. This created a significant overshoot in chip-making capacity. For this reason, after 1984 the chip industry was relatively weak even though PCs were growing rapidly.

Another super cycle occurred from about 1993 to 2001 driven by the Internet, corporate IT and Microsoft (MSFT) Windows. Underinvestment in chip-manufacturing capacity in the 1980s caused a lack of supply in the 1990s. This drove pricing and profitability within the chip supply chain during the 1990s.

In 2001 the semiconductor industry had the mother of all overbuilds in chip-making capacity, and the dot-com bubble burst. The supply chain idled back on investment now for almost 10 years, punctuated by the worst recession since the Great Depression. During the last decade, the industry consolidated and many companies went fabless rather than building a new $4 billion manufacturing plant. However, the foundries, like TSMC (TSM), haven't invested enough and there is more demand than supply, and that takes several years to fix.

This underinvestment was punctuated by the recent recession. In the recession, chip-making and other related capacity was shuttered; existing equipment was cannibalized as spare parts to conserve cash and inventory was purged across the supply chain. At the same time, the fall-off in demand wasn't as bad as people thought it would be. The industry has been struggling to catch up with inventory since, and the industry is still not back to where the supply chain is running smoothly. I also believe that the investment community is also underestimating demand.

When the global economy is considered, there are a couple of obvious observations. One is the developing economies are growing rapidly. The second is that in the developed world, there is too much debt and not enough value creation. I would expect nominal GDP in the developed world to grow by 2%. However, China, India, Brazil, Russia and most of the emerging economies have growth rates of 6% to 12%.

The Chinese didn't loosen the renminbi relative to the dollar to be nice guys; they did it to drive the standard of living in China. Wages are starting to increase in China as well, driving a growing global middle class that will use its increased discretionary income to buy TVs and PCs. Demand for these items has been much stronger than expected. One of the best anecdotes, in my view, is the World Cup. I've watched semiconductors for 26 years; every Olympic year, Japanese consumer electronic suppliers have a great first half due to demand for Blu-ray recorders or VCRs or TVs for the event. Super Bowls also drive some TV sales - these are developed-world economy activities.

Soccer, on the other hand, is a developing-world sport; all you need is a soccer ball. So the point is that disproportionately soccer is a developing-economy sport, and the World Cup drove very strong TV demand for the first time. In the first half of this year, there was a shortage of 32-inch TVs due to this demand. So you can tell that this global demographic shift is driving incremental demand.

Finally, in the U.S., Apple (AAPL) came out with an iPad. It is a cool new product. The forecasts have done nothing but go up. There is demand at the high end for the next new thing. There always is. Finally, there has been an almost 10-year hiatus on investment in technology infrastructure. As an example, how is your iPhone coverage in New York or San Francisco? There needs to be a build of infrastructure for new smartphones, like the transition from voice to data in wireline. You are seeing that cell phones today are driving demand for infrastructure.

Not only that, there are other new drivers of demand, such as connecting the Internet to TV. Google (GOOG) TV has been announced, and Apple is going introduce an Apple TV next year. Whenever Internet Protocol, IP, gets connected to something like a cell phone or a telephone or a computer, it is very transformative and new ways of doing things emerge, driving demand for all things tech. To summarize, there is a combination of underspending in infrastructure, telecom, corporate IT, data centers, an emerging middle class, and rich people in the developed economies are still spending money. This is coupled with a decade of underinvestment in semiconductor manufacturing capacity. While there is a lot of angst regarding the overall economy, things in the chip business haven't been this good since 1993.

TWST: Which stocks stand out right now and why do you like them?

The Wall Street Transcript is a unique service for investors and industry researchers - providing fresh commentary and insight through verbatim interviews with CEOs and research analysts. This special issue is available by calling (212) 952-7433 or via The Wall Street Transcript Online .

The Wall Street Transcript does not endorse the views of any interviewees nor does it make stock recommendations.

For Information on subscribing to The Wall Street Transcript, please call 800/246-7673

http://finance.yahoo.com/news/Piper-Jaffray-Predicts-twst-3433552805.html?x=0&.v=1

Can the consolidation end? Can there be a breakout?

look at the blue line where it crossed the red line - mid October - and both are trending up. This is a very bullish setup.

$SOX:$NDX,uu[1180,1180]walaynay[d19940101,20121231][pb50!b55!b89][iub14]" rel="nofollow noopener noreferrer ugc" aria-label="user uploaded image">$SOX:$NDX,uu[1180,1180]walaynay[d19940101,20121231][pb50!b55!b89][iub14]">

$SOX,uu[1180,1180]walaynay[d19940101,20121231][pb50!b55!b89][iub14]">

$DJUSSC - Dow Jones US Semiconductor Index - 60 min, daily, weekly, monthly

SMH - 1day2min, 3day5min, 10day15min charts

SMH - Daily, Weekly, Monthly charts

FOCUS: Semiconductor Sector On Its Way To Recovery

Last update: 9/11/2009 1:30:00 AM

(This story was originally published Thursday.)

By Archibald Preuschat and Maarten van Tartwijk

Of DOW JONES NEWSWIRES

DUESSELDORF (Dow Jones)--European technology stocks rose Thursday as the latest set of revised outlook statements from semiconductor firms lent support to the view that a recovery in the sector is underway, fuelled by demand for the latest smartphones and portable computers.

Significantly, industry participants and analysts said the upturn isn't solely due to restocking, after inventories were drawn down during several quarters of poor performance in the segment.

"What we now see in the industry is an upward trend fueled by a combination of restocking, seasonality and growing demand especially from the U.S. and Asia," said Royal Bank of Scotland analyst Didier Scemama. "We are starting to see growing demand from the consumer, especially for portable computers and smartphones," Scemama said, adding that the semiconductor industry has shown steady month-on-month improvement now for five months and "the markets are starting to realize it now."

Dutch semiconductor equipment maker ASML Holding NV (ASML.AE) Thursday raised its outlook, saying it now expects net sales will be above EUR500 million both in the third and the fourth quarter and it expects bookings in the third-quarter will be "significantly above that level." ASML previously expected sales in the third-quarter to be around EUR450 million, and in the following quarters to be in a range of EUR400 million-EUR500 million.

ASML's improved guidance follows that of industry heavyweight Texas Instruments Inc. (TXN), which produces chips used in a wide range of items from cell phones to industrial machinery. Wednesday, Texas Instruments upgraded its outlook, saying it now expects earnings of $0.37 to $0.41 a share on revenue of $2.73 billion to $2.87 billion, up from previous predicted earnings of $0.29 to $0.39 cents a share on revenue of $2.5 billion to $2.8 billion.

Shares across the sector gained Thursday in Europe. By mid-afternoon, ASML rose 4.2% to EUR20.97, Germany's Infineon Technologies AG (IFX) was up over 3% to EUR3.94, and STMicroelectronics NV (STM), Europe's largest chipmaker, was up 2% to EUR6.59.

The latest outlook revisions come after Intel Corp. (INTC), the world's largest chip maker, last month boosted its third-quarter sales forecast on improving demand for its microprocessors.

Computer maker Dell Inc. (DELL) reported better-than-expected quarterly results and the world's largest PC maker, Hewlett-Packard Co. (HPQ), recently said it was seeing a stabilizing market.

Texas Instruments said it expects analog chips, which are widely used in consumer electronics, to be the biggest growth driver.

Demand for memory chips and data-processors, which are used in mobile phones, DVDs and video games has also strongly improved and chip makers are now looking to produce faster-working chips at lower costs, ASML company spokesman Lucas van Grinsven said.

ASML is the world's largest maker of lithography systems, which map out tiny electronic circuits on silicon wafers. It counts Intel, Samsung Electronics Co. Ltd. (005930.SE) and Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) among its customers.

Meanwhile, as the mobile handset industry begins to emerge from its worst-ever decline in sales, mobile-phone manufacturers are trying to reverse a narrowing of their margins by introducing an eye-catching clutch of new devices that fuse communications capabilities with powerful computing and Internet functions.

Already, Apple Inc. (AAPL) has launched its latest iPhone 3GS. Nokia Corp. (NOK), the world's biggest handset manufacturer, recently announced a clutch of new devices including its first netbook, a smaller, lighter version of a lap-top. Sony Ericsson, a joint venture of Sweden's Telefon L.M. Ericsson (ERIC) and Japan's Sony Corp (SNE) will launch three new entertainment-oriented phones in the fourth quarter.

Improved consumer sentiment and attractive new phones should help the handset market return to volume growth, said Carolina Milanesi at research firm Gartner in a recent interview, which will further support the improvement in the chip segment.

"We have definitely started to see a little bit of light," she said. The chip industry has significantly underspent on capex over the last two years, and foundries have been particularly reticent to add capacity, said Evolution Securities director John McPate in a note.

ASML's higher bookings in the third-quarter are mainly a result of chip makers investing in new technology rather than restocking as "inventories at clients appear to remain very healthy," ASML's van Grinsven said. Still, the company remains cautious.

"It's hard to say if the pick-up in demand is sustainable, as this depends entirely on economic growth," van Grinsven said, and he declined to give any long-term demand forecasts.

-By Archibald Preuschat and Maarten van Tartwijk , Dow Jones Newswires; +49 211 13872 18; archibald.preuschat@dowjones.com (Jerry Dicolo in New York contributed to this article.) (END) Dow Jones NewswiresSeptember 11, 2009 01:30 ET (05:30 GMT)

MARKET TALK: Baird Upgrades Chip Names; 3Q Looks Brighter

Last update: 8/13/2009 8:28:40 AM

Edited by John Shipman

Of DOW JONES NEWSWIRES

(call: 212 416 2181; e-mail:john.shipman@dowjones.com)

MARKET TALK can be found using N/DJMT

Visit the Market Talk blog at www.djnmarkettalk.com.

8:28 (Dow Jones) Orders for semiconductors in August suggest that normal buying patterns are emerging in the sector, Baird says, giving hope that 3Q could show strong growth relative to 2Q.

Also, firm sees chip shipments peaking later than normal this year, with "positive implications" for 4Q revenue that could extend the recent chip rally into 2010.

Firm upgrades

Analog Devices (ADI),

Diodes (DIOD) to outperform;

Texas Instruments (TXN) to neutral.

Raises estimates for Fairchild (FCS),

Monolithic Power (MPWR). (JDC)

(END) Dow Jones NewswiresAugust 13, 2009 08:28 ET (12:28 GMT)

The volume indicators on all the NYSE stocks are wrong today. no idea why

holy smokers batman, thats alot of charts

USD -2x-Semiconductors Proshares- 1day2min, 3day5min, 10day15min charts

The SOX Index can't lag NDX forever...

$SOX:$NDX,uu[1080,1580]walaynay[d19940101,20121231][pb21!b55!b144][iub9][J3457344,N]">

$SOX - 1day2min, 3day5min, 10day15min charts

ALTR - 1day2min, 3day5min, 10day15min charts

AMAT - 1day2min, 3day5min, 10day15min charts

AMD - 1day2min, 3day5min, 10day15min charts

BRCM - 1day2min, 3day5min, 10day15min charts

INTC - 1day2min, 3day5min, 10day15min charts

KLAC - 1day2min, 3day5min, 10day15min charts

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

988

|

|

Created

|

12/29/06

|

Type

|

Free

|

| Moderators | |||

Silicon Investor has an active message board to discuss Semiconductor Equipment Stocks and the SOX Index. I would encourage all iHub members to sign up on SI, and to mark THIS message board for review and discussion of the SOX Index topic as well: Wennerstrom Semi Equipment Analysis http://siliconinvestor.advfn.com/subject.aspx?subjectid=37144

SOX component update: http://www.phlx.com/products/sectors/soxcomp.htm

.

.

SOX option chain from OptionsXpress

http://www.optionsxpress.com/OXNetTools/Chains/index.aspx?SessionID=&Symbol=SOX&Range=4&lstMarket=0&ChainType=&AdjNonStdOptions=OFF&lstMonths=&FromVB6=True

--------------------------------------------------------------------------------------------------------------------------------

Ted Burge StockCharts.com public Support and Resistance chart -- these S&R lines are based on multiple years of data.

This chart is from Ted's Public Chartlist: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2684038

| Volume: | 4,646 |

| Day Range: | |

| Last Trade Time: | 7:43:52 AM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |