Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

JOES's SEC filling are looking good, it appears as though the company is now profitable.

-The companies Results of Operations this quarter was a net income compared to the same quarter last year, where they were at a net loss. Their net income has increased over 700%

-The companies Total Revenues this quarter was over 80% higher than the same quarter last year

Using the same screener that gave me 100% flips, I got JOES @ 0.0092

Actually it was also a 100% flip. I forgot I picked IGNT @ 0.0095. 2 in 3 flips to 100% with this new screener.

And it did! Well, to be fair, it was 90% instead of 100%. Close enough in my book (:

What happened to QMKR could happen to IGNT. With QMKR, I bought in at the .01 area and flipped it to .02 the same day. I used the same screener and got IGNT. Same results, who know? Should be interesting to watch

From the same screener that gave me QMKR I got IGNT @ 0.0095

Yeah, I forgot to mention that. Unfortunately, to my best knowledge there is no get around to paying. I don't pay either. I plan to purchase a subscription once I make some more profits since I am still fairly new to the stock game. Apparently there is 5 day free trail which doesn't charge you if you cancel within those 5 days. That can be found here

Hey quick question. Can you that screener website for free or will they start making me pay for it? I see that If I use a custom screener, I cant get past the first page unless I pay. Im not ready for that yet, just checking it out for now.

So far I think I just found my favorite screener thanks to you. Only 5 showed up on the first page, and anything past the first page is blocked until I pay. I dont mind being stuck on the first page results for now I guess.

OK cool, im checking it out now. Yeah, ive been using finviz and scottrade screeners. then going over to stockcharts.com after ive found a few. but I like the one you got here. Going to be fun to play with. Thanks.

Not sure what program or broker you use to screen, but I have a website that I would like to recommend to you. It allows you to filter, back test, make a watch-list and create reports using an easy to use programming language which is basically English.

Here is the site

And here is the user guide to help you use it

Yeah I know your still testing your screeners. Im just sitting back watching. I like stocks just starting a steady climb. MYOS has made me plenty finally sold the other day 50%. But im having tons of trouble trying to screen for one like that. bought into the nice slow run right in the middle of it (.20). Chart looks awesome. But I was seeing to many gaps forming back off. I bet it wont slack off, since I sold out. LOL

Thanks. I just set the volume to trending upward and yea the 100% was on only a 100$ principle since it was a test screener. In theory had I put more money in, the stock would have reacted better to my purchase hence attracting more trades and more money therefore allowing me to collect 100% returns on a higher principle. Thanks for stopping by.

Interesting, but how do you pick your volume? Not much trading at all going on. QMKR is crazy lol. wished I checked your site earlier in the A.M. lol. But anyways thats low volume too. So I doubt it could have completed a decent sell size order. You made 100% but it had to have been only 100 or two bucks with that volume lol. I still wished I jumped on that INMG you called. Anyways goodluck keep the posts coming. you track record is building now. nice.

STYS Update: Broke even for the day and had 17,250 shares accumulated. Since this stock is trading similarly to QMKR in shares price and share structure, in theory we could see a similar run to .02

QMKR Update: Wow where do I start with this ticker?! I guess I'll start by saying I am out of this one. I got in today @ .01 and out @ .02. Although 100% in a day is good, I can see it closed today @ .08! Now, I understand that is just a buy at the ask and bid is currently @ .01, but who knows how this ticker will play out.

New screener results: QMKR @ .01 and STYS @ 0098

Still holding INMG from .77, currently it is at .95. A gain of 23%. I am still playing around with parameters to find a ticker pre-breakout. Hopefully I will have a new test screener ready and I will be in an additional position around the open of the market.

The others didn't have technicals as good as this one and I wasn't sure about them. Thinking back I should have saved them somewhere just to see how they did.

WOW, that chart INMG just keeps on sneaking up. Is there any more on that screener your using or jsut that company so far. Wish I knew about them a week ago lol. I think you put it on radar 2 days ago and its steady climb so far.

INMG - I'm liking this screener and this ticker. With technical all up-trending I could see this catch on to many other screeners and radars not to mention the PR's that come out. Real company with solid technicals and shockingly solid fundamentals also. They have possitive earning per share and an increase in assets in their financial statements.

Thanks. Good luck to you as well on all your trades.

Well that was a fast jump from when you started to talk about INMG. Good luck. Very interested in the direction your taking.

INMG Technicals

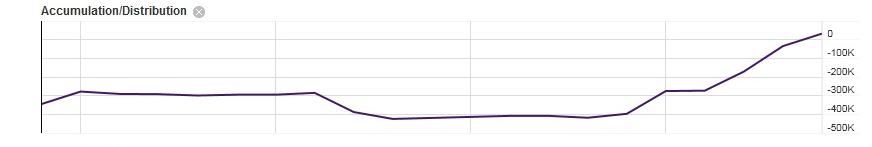

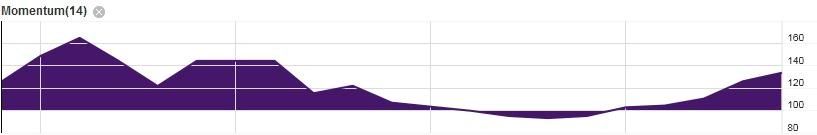

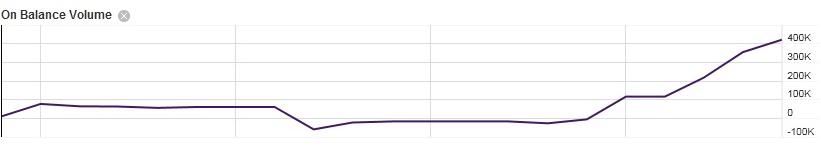

Includes: 1 month chart, 1 month accumulation/distribution, 1 month momentum, and 1 month on balance volume.

Charts created by and formulated by Scottrade.com

For those that don't know, the two main types of financial analysis on equities such as stock are fundamental and technical. Most people pick one, I use both. Bellow you will find technicals for INMG.

1) Chart: Chart shows up-trending PPS, clear and most basic sign of technical growth

2) Accumulation/Distribution: Using a formula (Acc/Dist = ((Close – Low) – (High – Close)) / (High – Low) * Period's volume) Accumulation (buying) is also up-trending

3) Momentum: Tracks acceleration of price and/or volume. Up-trending spike is seen

4) On Balance Volume: Technical indicator of cumulative volume based on price. Once again, up-trending Formula shown bellow (Source:Wikipedia)

I just played around and changed my screener once again. I am very interested in this one. I sorted them out by the lowest 4-week change (my break-out candidate theory) and got INMG @ .77

If this works well, I will test the same screener over and over and hopefully it can work consistently.

Today's test tickers:

HRBR @ .16

EAHC @ .26

IMDC @ .18

AAPT @ .06

NTII @ .25

RCHN @ .22

DUCP @ .12

Still playing around with different parameters, but my latest one that I programmed today is giving me a few tickers. But what I am doing differently this time is organizing the results of my screener by 4-week change to give me the least first. The reason being because these are the ticker that are more likely to break out double, triple, or higher rather than a ticker already doubled or tripled in that week. Number one the the list was EAHC. I got in with a small amount of principle ($100) and we shall see where that goes. I hope I finally found a system that could work; if not, at least I know a system that doesn't work.

You too. I hope your screener proves to be a useful tool to you.

Thanks and good luck with your trading.

Thanks. Sounds like a great way to catch the runners. I suspect you will see RCHN on your screener a lot this year.

These picks came from a new screener I programmed for volume trending higher, a PPS of .01 - .90, trend close to a 52 week high, and gains of 20% in the last 5 days of trading.

I would be interested in hearing what the metrics are you use for your screener.

RCHN is going to be huge. Right now we have a mm selling shares he didn't have a full .075 below the next ask.

He is going to hurt next week.

I like this new screener and I hope it is a winner. Here are it's results

Ticker, Ask, Bid

AXSI 0.56 0.41

IMDC 0.185 0.177

NTII 0.25 0.231

RCHN 0.12 0.095

Three new tickers as part of screener test

BLAK

LDHL

LVWD

Test for new screener. I am not in any of these tickers, but they came up on my new screener so this is just a public test of my new screener. I know I have no followers so I am basically talking to my self (the most intelligent conversations I have all day)

EESH @ .25

LVWD @ .18

NTII @ .205

AXSI @ .52

FMNL @ .68

GMEC @ .45

MAXC @ .40

YIPI @ .865

I am programming/testing a new screener for best performance results. I am determined to find a screener that will give tickers that will deliver explosive returns. I will have to test some tools and get back to listing them.

Screener picked up 8 stocks today. On of which was BLAK. It closed up 3.7%, but I think that may just be the beginning. Tomorrow morning should be very interesting to watch this stock.

AEMD: After AEMD came up on my screener I found a week old Press Reselase that I found to be amazing. Take a look...

Aethlon Medical, Inc. (OTCBB: AEMD), the pioneer in developing selective therapeutic filtration devices to address infectious disease, cancer and other life-threatening conditions, reported today that the presence of Hepatitis C virus (HCV) is currently undetectable in all infected patients that have been treated with the Aethlon Hemopurifier® in combination with peginterferon+ribavirin (PR) drug therapy and monitored for at least ninety days.

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

42

|

|

Created

|

05/10/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |