Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Other than $TSLA getting a reduced rating from HSBC today with a $146.00 price target, (well see how that works out) not much else worthy of mentioning I could find today.

HSBC said that Tesla CEO Elon Musk is undoubtedly an asset, but said his prominence presents a "considerable 'single man' risk" and while Tesla has many concept-stage ideas, the commercialization of these ideas may take longer than the market and stock's valuation currently reflecting.

Tomorrow is a new day. Carpe Diem mentality tomorrow.

Westrock Company ( $WRK ) is showing some interesting call activity primarily being motivated by the 15 DEC 23 $37.50C.

Volume is 5,174 compared to an Open Interest of 120.

https://www.advfn.com/stock-market/NYSE/WRK/options?expiry=20231215&strikes=10

This would imply new positions and using Options Flow, all the Call’s purchased today were bought at the ask price which to me, suggests Bullish intent.

https://www.advfn.com/tools/options-flow?symbols=WRK

After looking, their QTR earnings is scheduled prior to Thursday’s market open. This could explain the high volume today.

Staying on the sidelines for this one but I will def be putting this on my watchlist.

Happy Hunting Everyone!

Unusual Whales on Twitter: “There was a lot of unusual [put options] activity in $TSLA quote 206.55$

Saw tesla symbol on this site @unusualwales $TSLA - https://unusualwhales.com/stock/TSLA/overview

Well, it’s been a crazy week…

Another inflation warning from J. Pow yesterday,

Yields on the 10 year T-Note briefly topped 5% for the first time since July 2007,

U.S. crude oil moved back above $90 per/barrel,

And the $VIX climbed above 21 for the first time since early May… This may suggest the $SPX could experience sharper moves.

But never let a bad situation go to waste. There will be plays out there with all this uncertainty. 🧐

$AKRO - and the reason for the $1M trade way OTM is now clear

https://ih.advfn.com/stock-market/NASDAQ/akero-therapeutics-AKRO/stock-news/92230865/akero-therapeutics-to-present-results-from-phase-2

Sharing topline data in premarket Tuesday.

Stock just popped 18% in afterhours to $60. 🚀

I am guessing the $1M knew the date + results. We'll see. 👀

US economy adds 336,000 jobs in September, above expectations of 170,000.

The unemployment rate was unchanged at 3.8%, which was above expectations of 3.7%.

The US economy has now added jobs for 39 consecutive months.

IMO this likely indicates a longer Fed pause.

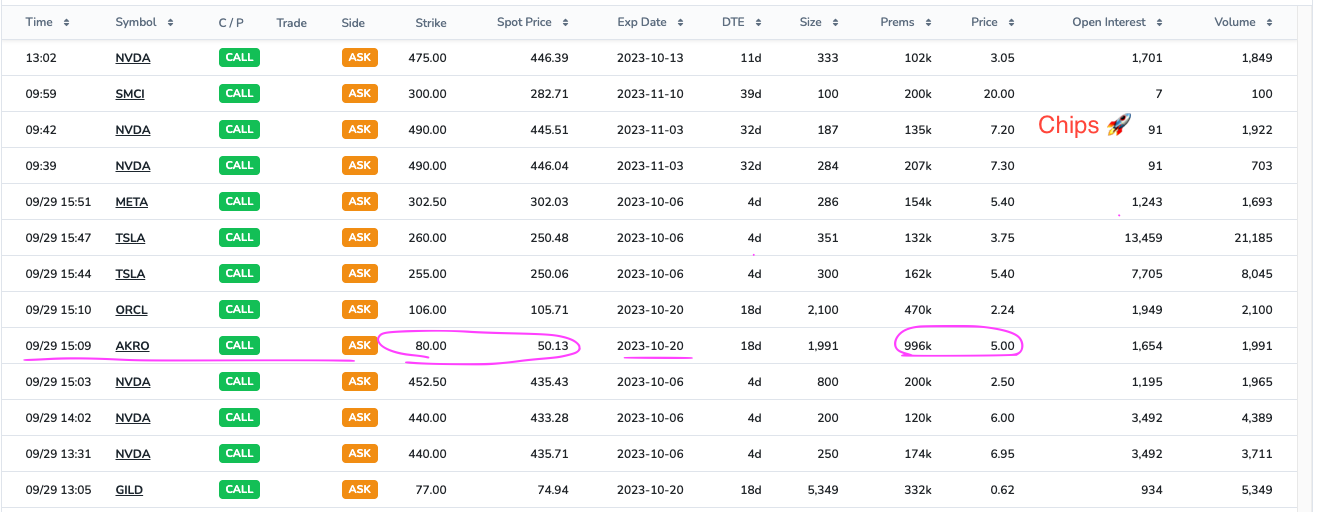

Flow Update - October 2 - Chips & $AKRO

Flow has been yelling for days about $NVDA. I ignored it. See today's action... 🚀

$AKRO is one worth noting. That's a $1M single-leg trade way OTM. This is a pharma stock so I'm guessing they've got a binary catalyst event coming up and somebody is betting it's favorable. I will look this up tonight and see what it's about. Never hold through binary events, but I'm up for a pre-data ride.

People's Bank of China injected liquidity and pledged to step up policy coordination.

Let's pray for a rebound day. My long options are getting hammered.

Happy Wednesday to Everyone.

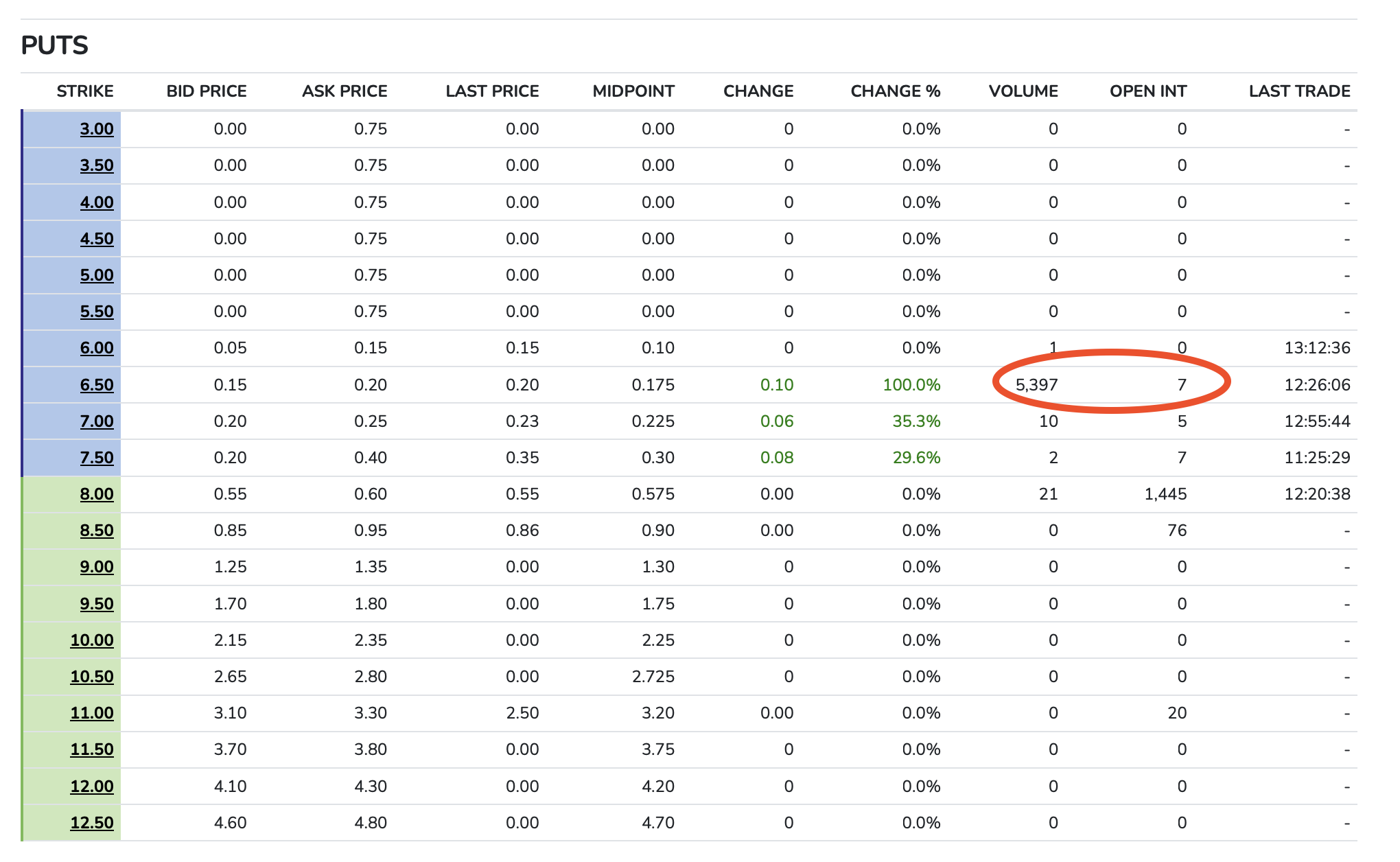

Interesting… PacWest Bancorp $PACW on the 27 OCT 23 $6.50P.

Volume on this contract is 5,397 versus open interest of 7.

After more investigation, $PACW is tentatively marked to report Q3 earnings on 26 OCT 23 after closing bell. Positioning of this size tells me that someone is trying to capitalize on the Earnings.

Staying away for now for me but still interesting. Still rolling with my $MET (which is stinky right now) and my $ABBV.

https://www.advfn.com/stock-market/NASDAQ/PACW/options?expiry=20231027&strikes=10

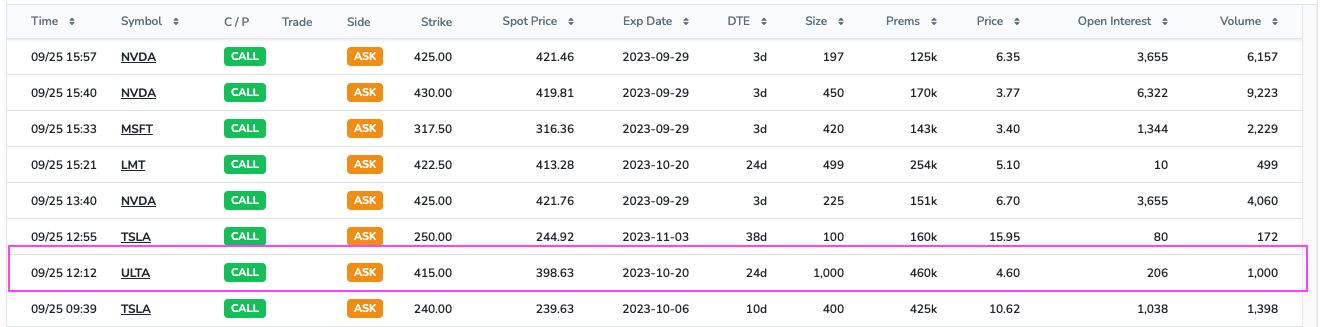

Flow Update - September 25 - $ULTA $TSLA

$TSLA flow looking for a pre-earnings run. It did it last time, why not again?

$ULTA - what is this one? This is unusual. $15 OTM, almost $500k trade on a boring retail stock. Chart has been whipped. RSI is almost oversold on the weekly. This is worth taking a ride, probably. Let's mark it @ 4.60 https://ih.advfn.com/options/NASDAQ/ULTA/ULTA231020C00415000/quote

It doesn't line up with that strike date, but TSLA earnings are coming up on October 16. How are we already looking at earnings season again???

Buying that $CVS dip was definitely the move.

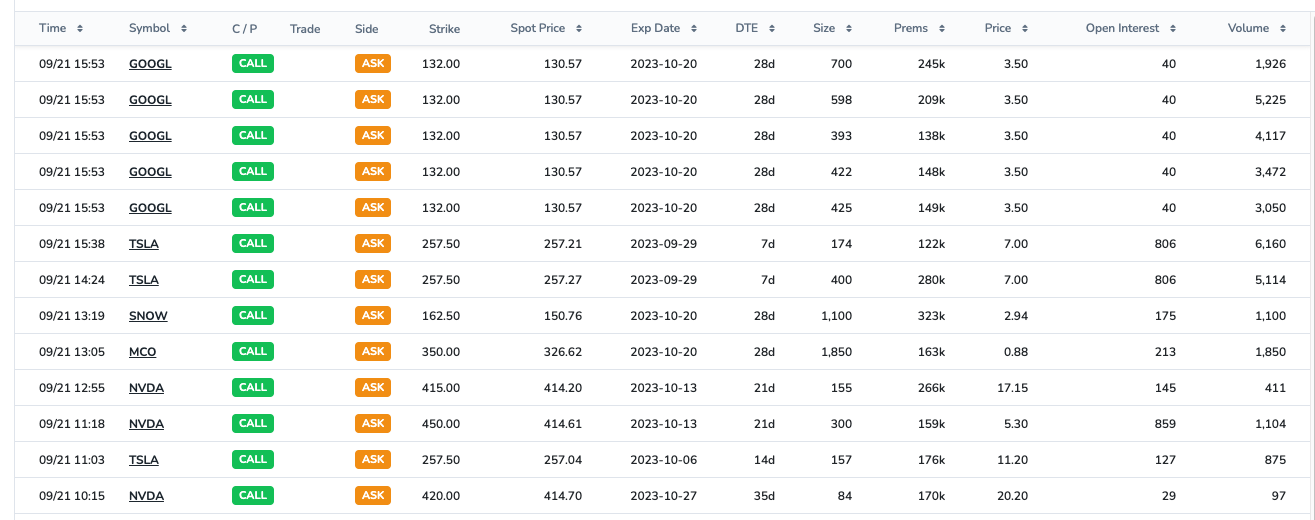

September 21 - Flow Update - $GOOGL

It's been quiet on Flow while market getting pounded last two days following JPow. End of day, some nice Flow came in on GOOGL. The handy alert was dinging, so I saw it, but didn't make a move on it. I'm interested in these Octobers for sure - no doubt they'll have another AI announcement by then.

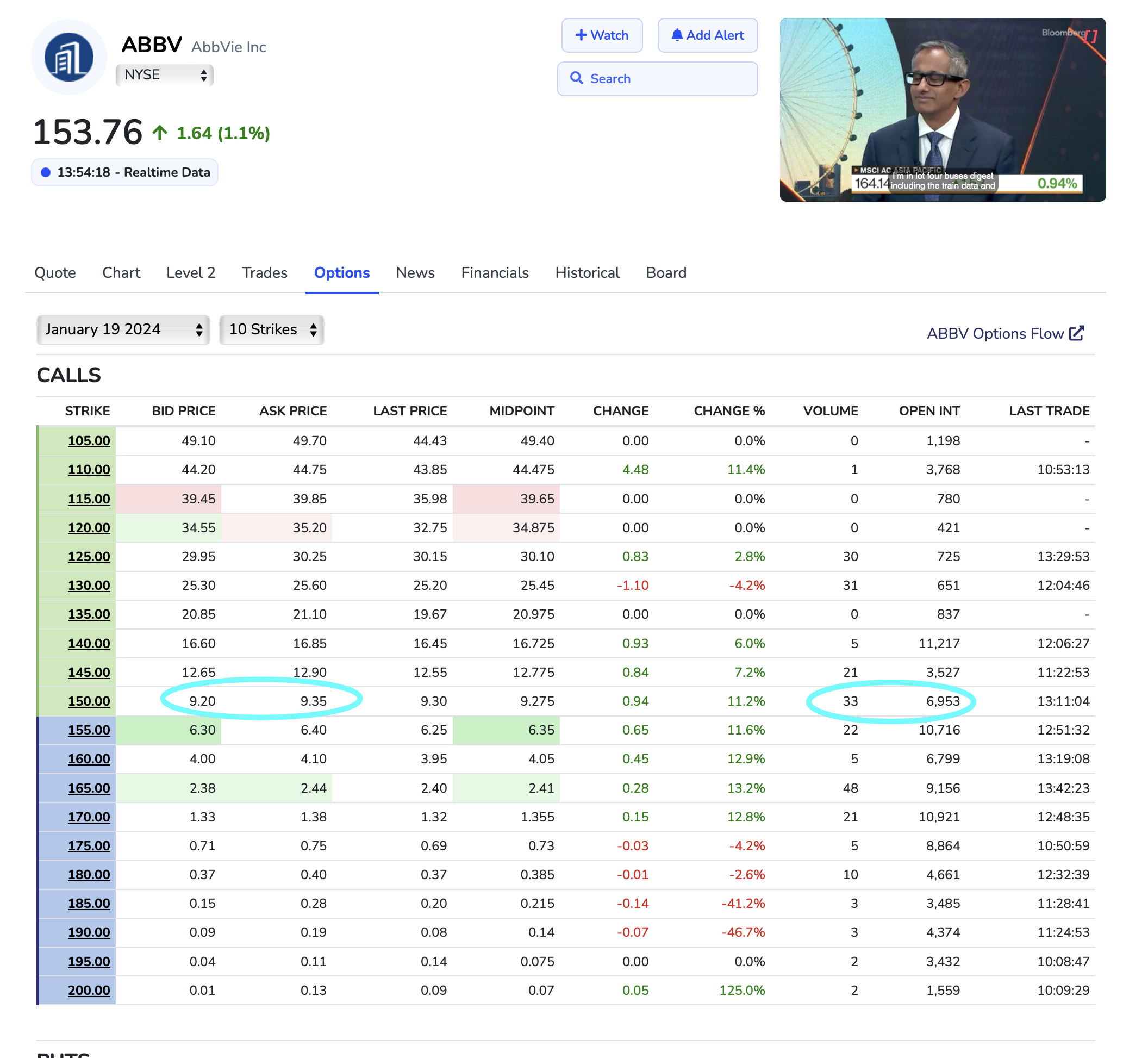

$ABBV Update:

Very Happy about this. Once I started learning the Option Flow, I took a 19 JAN 24 150C Position at $4.90 on 09/06/2023.

Today, 09/18/2023, the B/A $9.20/$9.35.

The OI right now is about 22x higher than the Volume. This may indicate a market in consolidation and or the market is prepping to break out in either direction.

Still riding this wave as of now.

Don’t forget it's flu season lol.

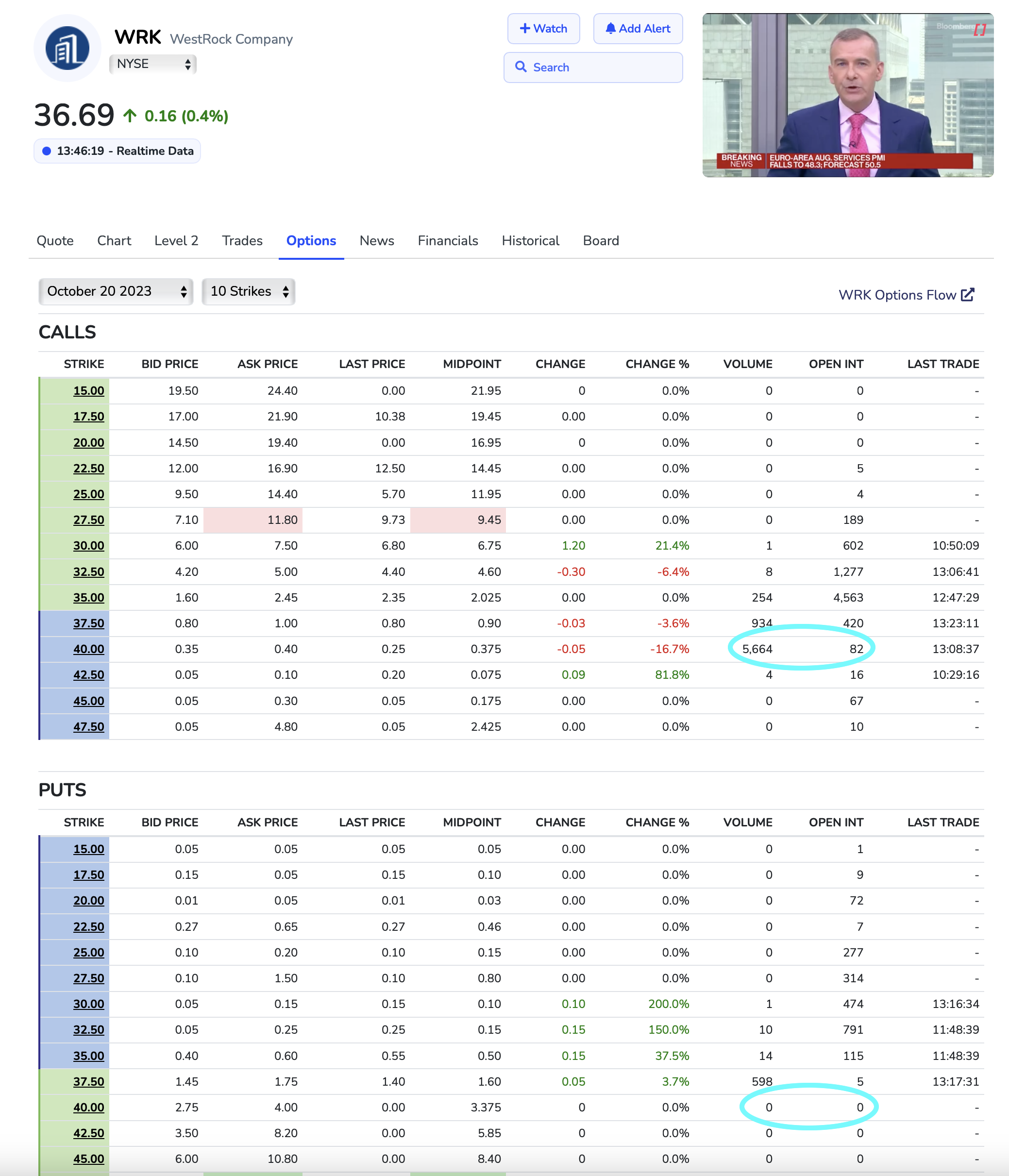

WestRock Company $WRK has some odd Call Volume vs OI activity today.

20 OCT 23 $40.00C is the position I noticed. Volume on this contract is 5,664 vs. OI 82.

With a very low B/A $0.35/$0.40, this suggests to me a bullish intent.

Westrock is America’s 2nd largest packaging company.

I would have expected a longer time frame buy with the holidays around the corner, so for now just keeping my eye on this one.

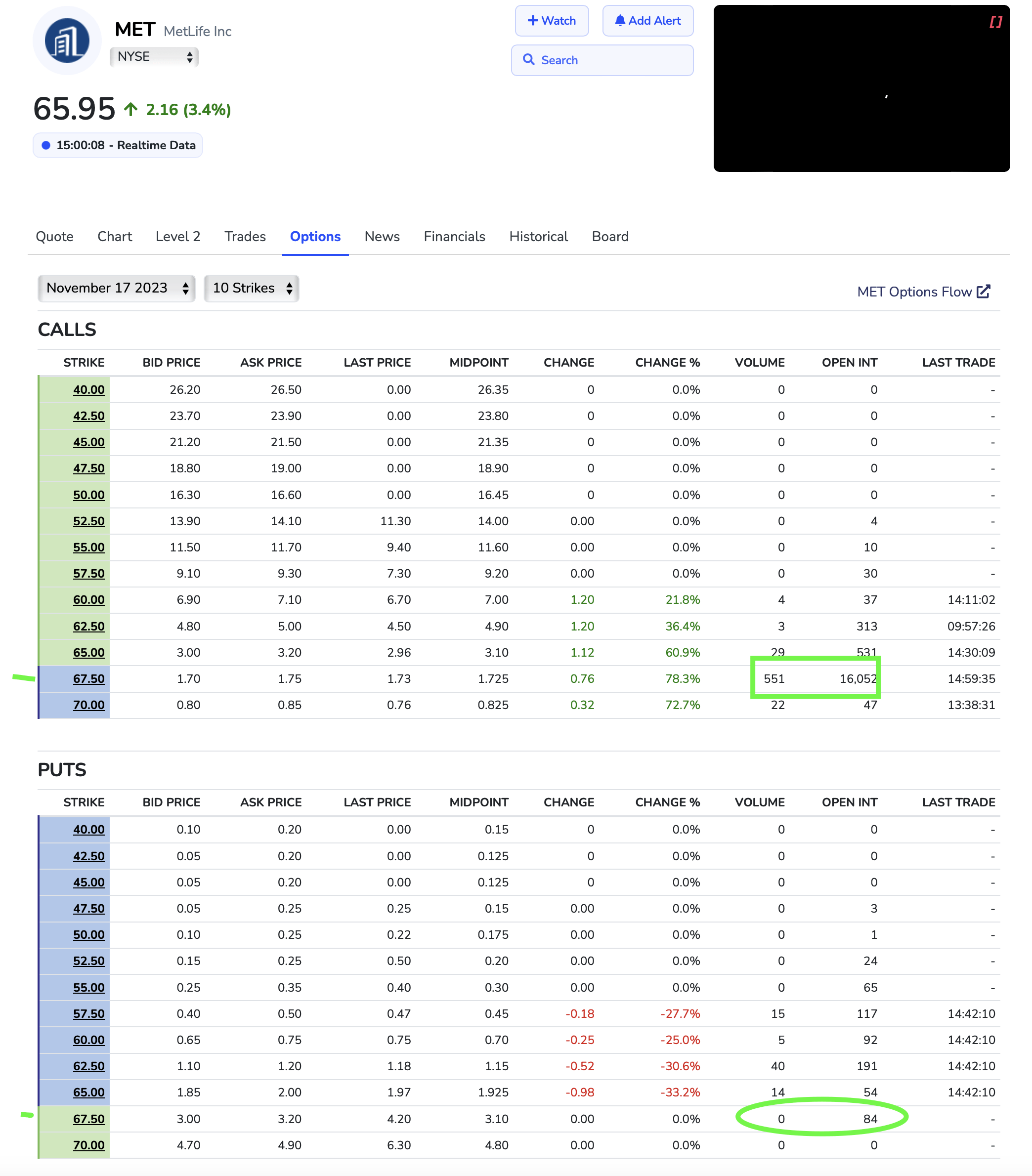

I am taking a postion today on MetLife, $MET. At time of posting the stock is pricing at $65.94, almost a 6 month high.

$MET was upgraded from a Hold to Buy rating and has a price target of $72.00 from $58.00

B +5 $MAT 17 NOV 23 $67.50C @ $1.65

B/A. $1.65/$1.75

Volume and OI are on Calls are massively outnumbering Puts.

Now I wont mind all those Insurance TV ads lol.

Hold on.

Pharm Company Update...

Moderna $MRNA is up today ~3.30%. Today they announced that a redeveloped type of its RNA-based flu shot met its initial goals in a final stage trial.

This result could facilitate the path to seek regulatory approval for the influenza vaccine.

According to a Bloomberg report, “an accelerated approval would allow the shot to be approved in the U.S. based on the current findings while Moderna conducts a larger study to confirm that the vaccine prevents disease symptoms.”

Another one to keep an eye on. No position taken as of this post, but added to the never ending watchlist.

New 52-week lows ...

(110 new lows today):

Advance Auto Parts $AAP ~$59.49

Crown Castle Inc $CCI ~$96.37

Illumina $ILMN ~$150.77

"Decongestant found in many cold, allergy medicines doesn’t actually work, FDA advisors say" - CNBC

"In a unanimous vote, advisors said oral versions of phenylephrine – found in versions of drugs like Nyquil, Benadryl, Sudafed and Mucinex – aren’t effective."

This could have a massive impact on $PG and $JNJ stock.

At time of posting, $PG is down 1.76% but $JNJ up .52%

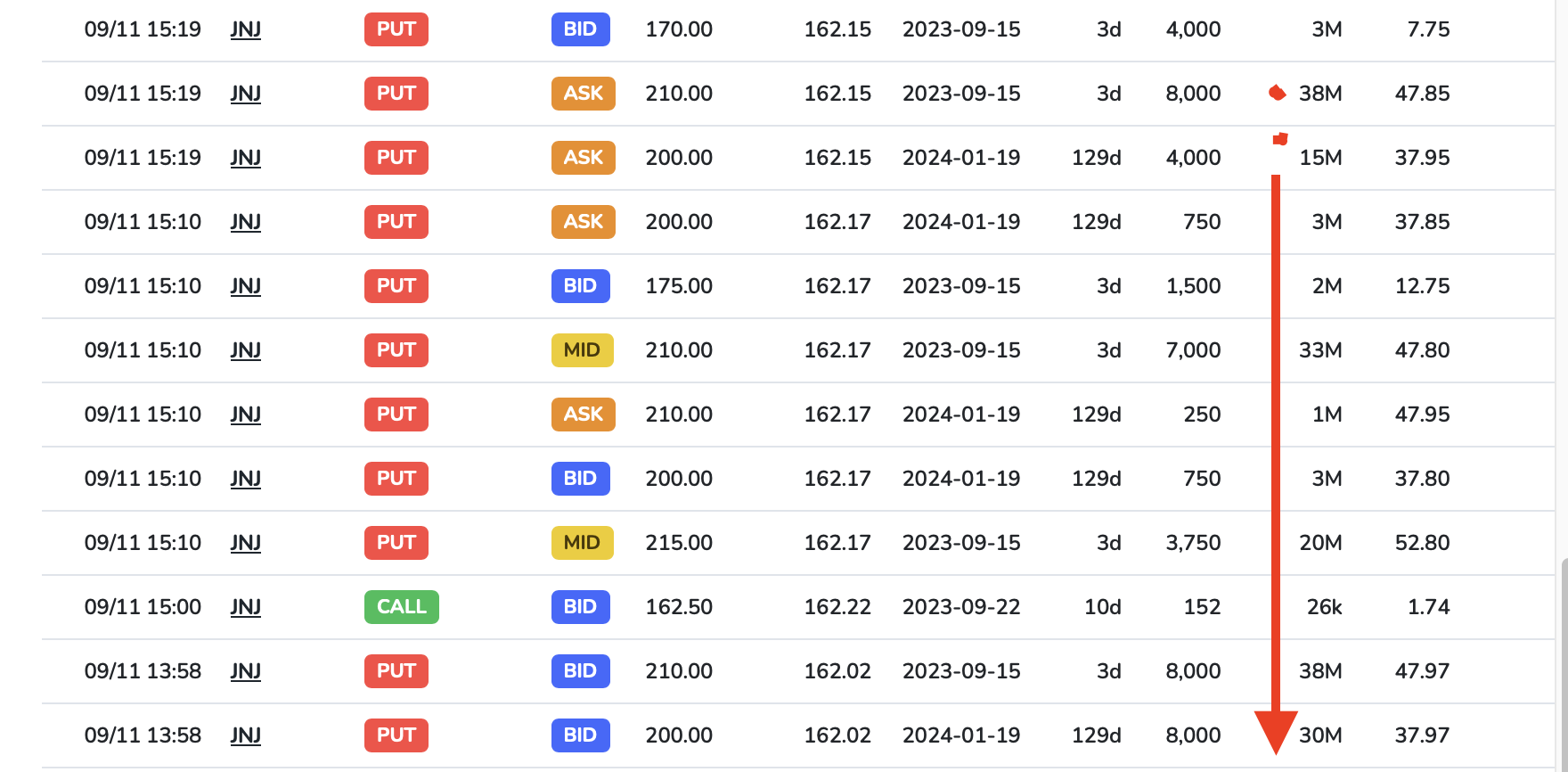

Wow lots of money being tossed around really quickly yesterday

Well... Hello there my bearish friend...

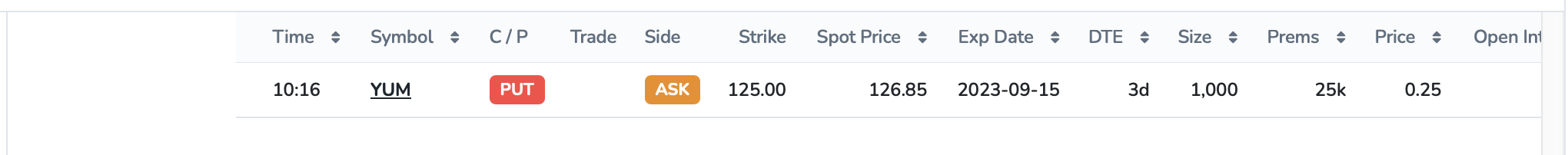

Odd put activity in Yum Brands Inc. $YUM which is up 1% as of this post...

OI on Calls vs Puts is 33 to 441 on the 15 SEPT 23 Position.

The massive Put buy was a 1,000 contract block purchased at ASK price.

One can assume this is a bearish position based on a Put @ Ask.

Not taking any position on this but just some usual put activity.

I love this tool lol. So much fun, for me.

https://www.advfn.com/options/live-options-flow?symbols=YUM

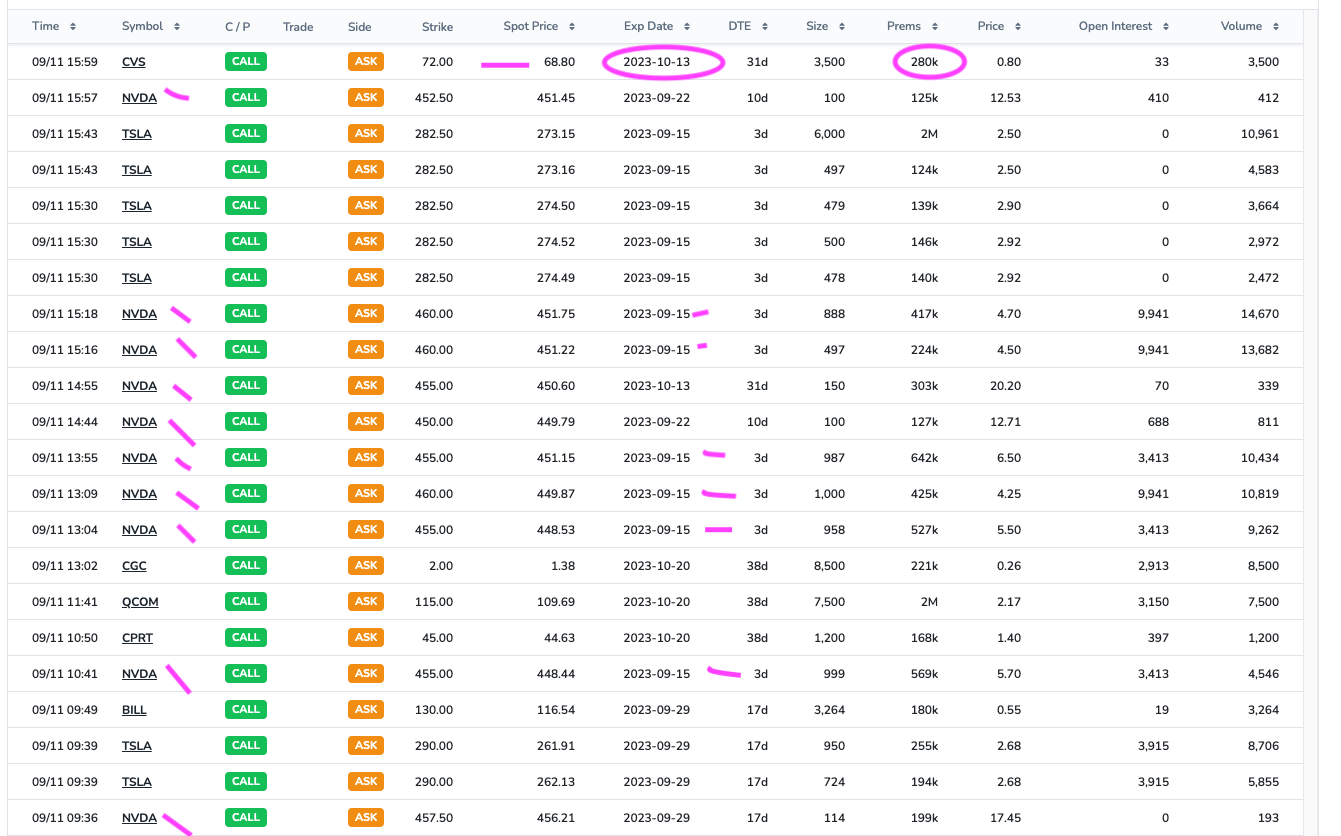

Flow Update - September 11 - $NVDA, $CVS

$NVDA looks to be setting up for a 10-15 point gamma squeeze by Friday based on the layering being done here (instead of wildly OTM).

$CVS nice one right at the buzzer. Looking at the chart for a reason, looks like a bottom is in. This should be a good one for next few weeks from here.

Just a heads up... Research to come but... Good to know...

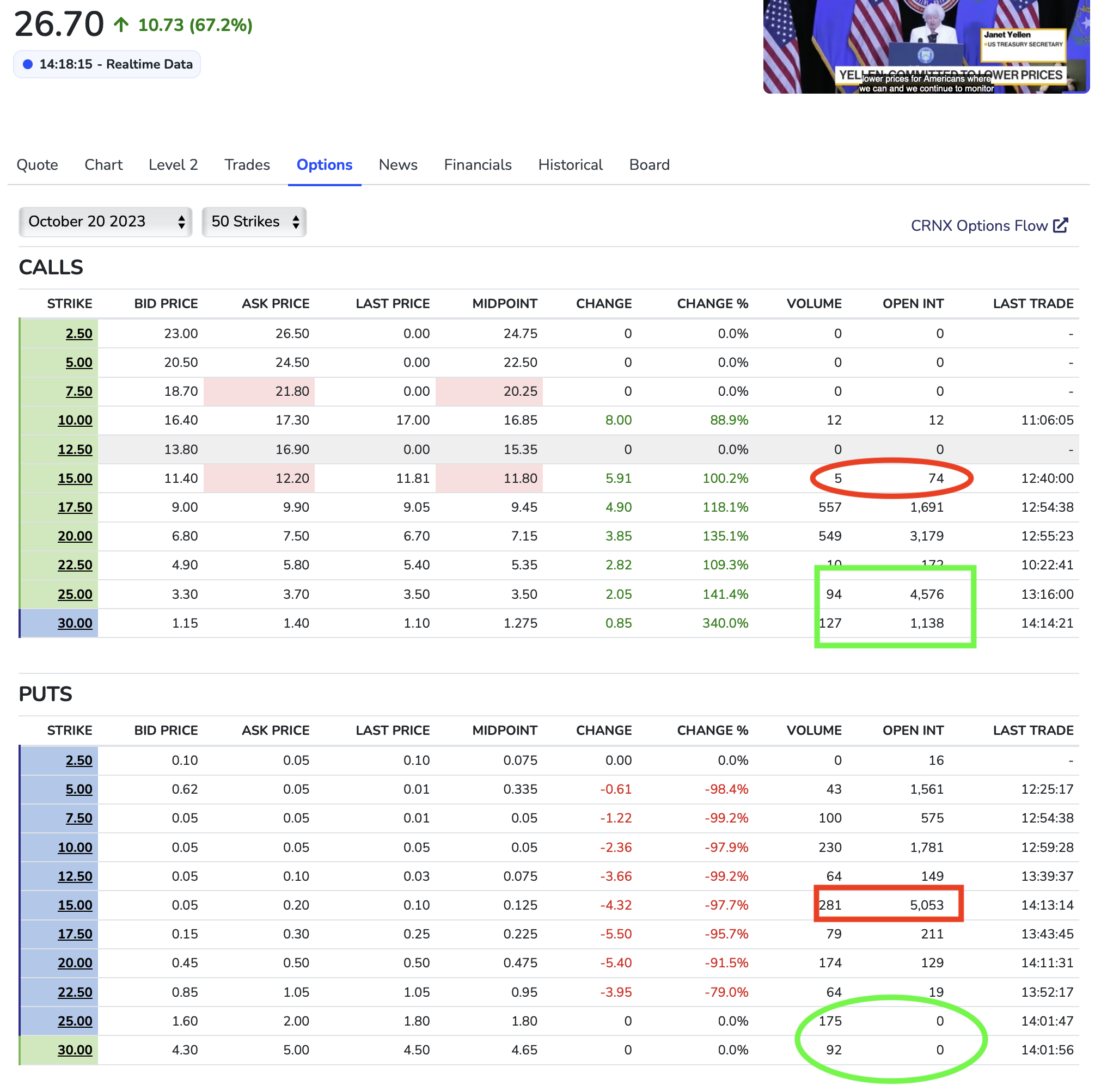

Crinetics Pharmaceuticals Inc. $CRNX is up BIG today

The Pharm Company stated that, Paltusotine, its experimental treatment for rare hormonal disorder called Acromegaly succeeded in a late-stage trial.

Sunday, Crinetics stated 83% of patients treated with paltusotine had the ability maintain growth-factor levels vs the opposite end, 4% of patients receiving the placebo.

Another late-stage trial will be conducted in 2024 Q1, the company said that it intends to submit an application to seek approval for paltusotine from the FDA next year.

OI on CvP's. wow.

https://www.advfn.com/stock-market/NASDAQ/CRNX/options?expiry=20231020&strikes=50

Whoa… Found this little nugget…

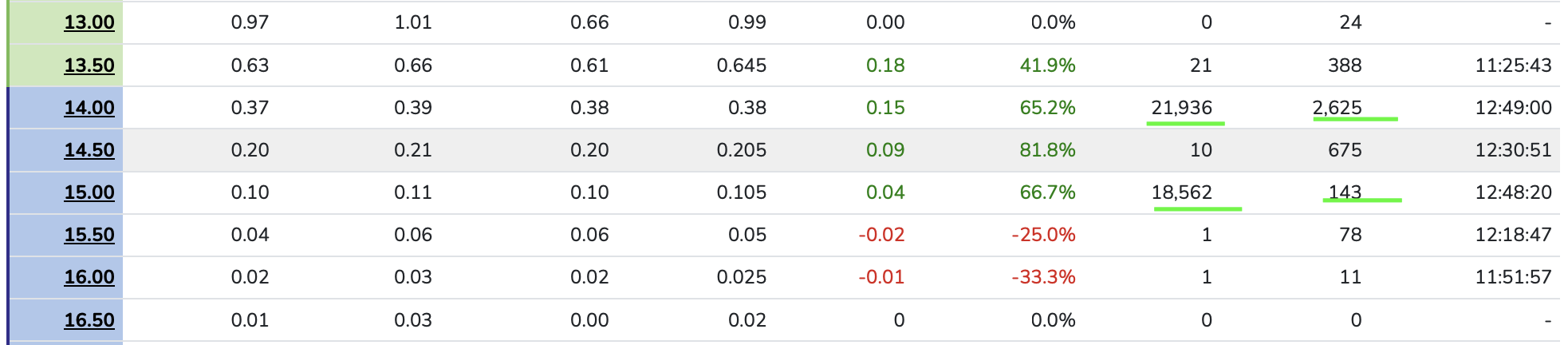

Vale S.A. $VALE:

• 06 OCT 23 $14.00C … Volume is 21,936 vs. OI of 2,625.

• 06 OCT 23 $15.00… Volume 18,562 vs. OI of 143.

Very high discrepancy with the V/OI ratio. Gut feeling the expected price to be around... $14.30???

Looking into:

https://www.advfn.com/stock-market/NYSE/VALE/options?expiry=20231006&strikes=10

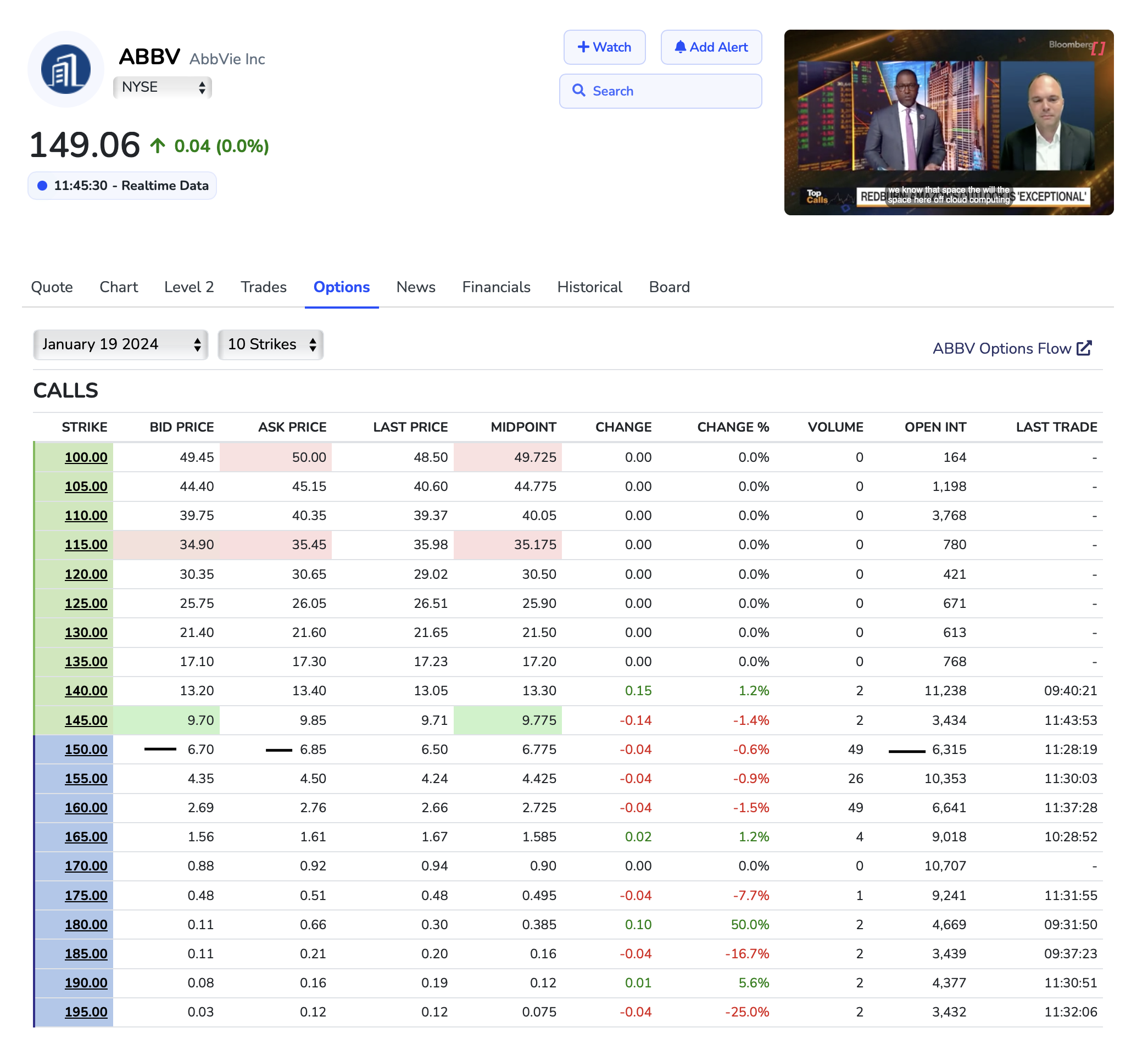

Update on $ABBV

So far so good.. $ABBV price up to ~$149 and the B/A $6.75//$6.90. The OI on the Calls to Puts is about 1.5/1 from an original 5/1 at purchase.

With the spread widening a little bit and the ratio of OI lowering, If I were to pull out now... It would be an approximate 38% profit.

Still gonna stay on the rollercoaster for now but ready to pull the zip line in necessary.

https://www.advfn.com/stock-market/NYSE/ABBV/options?expiry=20240119&strikes=10

September 8 - Flow Update

$AAPL trade from yesterday would have worked out today. The follow on QQQ signal I mentioned would have paid big. QQQ was up .70% at one point.

There's absolutely nothing interesting in the Flow today so far. 😴 The overall market reflects that as well.

Next week it's going to be a party - CPI, PPI, Retail Sales...

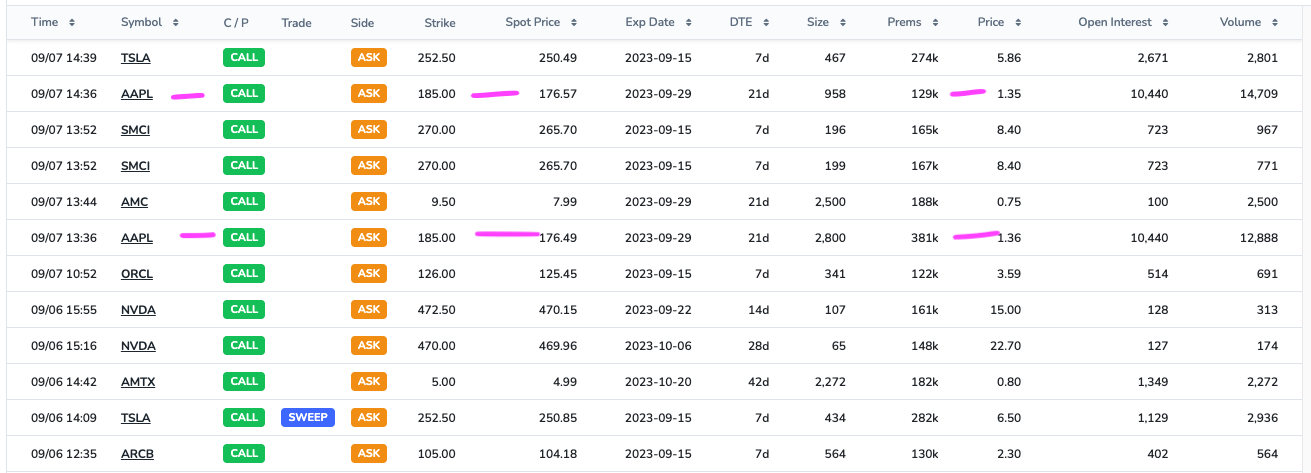

September 7 - Flow Update $AAPL

There hasn't been much to see yesterday and today. The only one that stands out is AAPL. These flagged trades are actually not too significant in the context of AAPL, BUT they are a trade that's right on. China news has hit AAPL pretty hard in the last few days, at one point pushing AAPL down about 4% at the open. I mentioned to a trading friend in premarket that it will end up being an overreaction (for now at least) and when it bounces, it'll pull the whole market up with it. You actually saw this play out today - from about 9:45am, after AAPL put the bottom in, the market started to levitate (we opened up -1.3% and closed -0.70%, which on QQQ is significant)

So these trades here I think will do well. End of month and $10 OTM. They don't need to, nor likely they will hold that long, but could easily capture a few point bounce in the next few days -- just like we saw today on it from 173 to 178. That's a mighty move in options and AAPL options are not expensive.

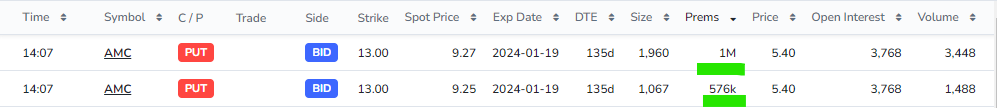

Wow $AMC getting hammered today. Decided just to take a little look see at the options flow...

~$1 Million Premium Position Put to Bid & ~$576k Premium Position Put to Bid. I figured there would be some big premiums today.

Put to Bid's, this would suggest this investor has a Bullish sentiment on $AMC

Update: I took a position on this today:

B +5 $ABBV19 JAN 24 150C @ $4.90

B/A: $4.85/$5.00

The OI on the Call was almost 5x more than the Put. Such a large difference suggests, to me, a Bullish market sentiment.

135 days out! Don't forget your flu shot this season 😛

Small sample size… However:

Stock: $ABBV

Price on Sept 5, 2019 : $66.64

Price on Jan 3, 2020: $88.17

Price on Sept 4, 2020 : $91.52

Price on Jan 4, 2021: $107.18

Price on Sept 7, 2021 : $110.45

Price on Jan 4, 2022: $135.33

Price on Sept 6, 2022: $137.30

Price on Jan 2, 2023: $162.40

Price on Sept 5, 2023: $~146.10

Price in Jan 2024: ???

Interesting. This year broke a small trend.

More to come.

$GTLB, they beat and the stock popped a little, but if they don't talk about AI non-stop on the call, then entire chain is getting crushed tomorrow. So far, very happy I didn't play. 😅

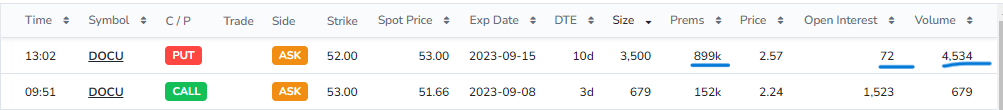

Another earnings report stock people are talking about all over is $DOCU

Earnings on Thursday.

Options Flow tracking found this little gem...

EPS forecast for the quarter is $0.11. Again, just a forecast.

Just curious what your thought is on this? Does the buyer think there will be a pop then a swift sell off?

I have been following $GTLB since you brought it up.

I read somewhere about an estimate of -0.03 EPS report. Again just a "report"

Someone is gonna get a new pair of shoes tomorrow. I think I am gonna sit this one on the sideline.

Even more on $GTLB after this post. This one is going to be interesting! 💥

(still not trading it 😬)

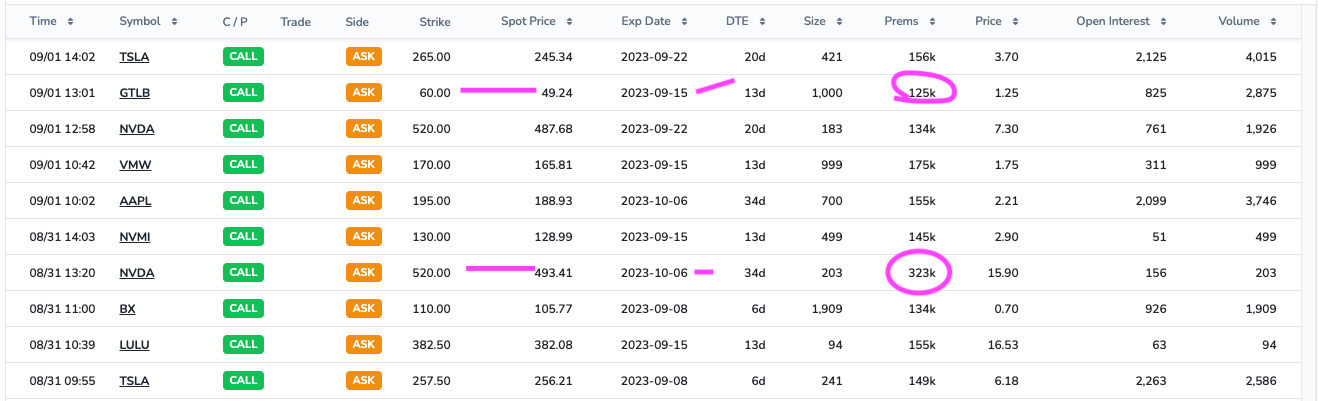

Sept 1 - Flow Update - $NVDA & $GTLB

It's like a broken record at this point, but NVDA flow continues. The circled trade actually looks pretty sensible. 520c for 10/6. I can see that. I'm looking for a QQQ dip first though.

GTLB has earnings next week. This one stood out to me because of how far OTM it is. Might be worth a trade. Let's mark it at 49.24 and the option at 1.25 and just see what happens as a papertrade. No matter what, out before ER.

@dariush9 Have you taken any positions on what you've posted so far? Or just watching?

Dollar General Corp. $DG -$7.47 to $131.03 at time of posting, probably based on yesterday's Q2 earnings results.

EPS at $2.13 per share versus the $2.47 valuation and revenue at $9.8 billion versus the $9.93 billion estimate.

The DG 01/19/2024 $115.00 Put has volume at 1,008 contracts traded versus 82 open interest.

Interesting

Nvidia Corp. $NVDA down -$7.53 to ~$486.02 at time of posting, mainly being driven by activity on short term expirations.

The NVDA 09/08/2023 $485.00 Put have traded 10,005 contracts versus open interest of 3,750, which suggests fresh positioning.

Ahh... I always love the smell of Options Flow in the Morning.

Happy Friday Everyone.

I so wish I would have long called this Thursday / Friday when it was ~$453.00

The boat as usual is on the backburner.

August 29 - Flow Update

$NVDA flow ever since ER didn't lie. Look at the impressive action today. 🚀 New closing ATH.

I don't see any unusual trades today, but I do see a reminder of $GOOGL which I like a lot and have since 116. It's the laggard of the Magnificent 7 and is going to be out there in front with AI. Some bullish flow on it today, but I think it's good to do long-term options or equity on GOOGL. Currently $134. Not to mention they own the Internet!

Interesting Activity:

Hormel Food Corp. $HRL is down $0.23 to $39.52.

Puts over Calls ~24:1 mostly on the 12/15/23 37.00.

Volume on this contract is 2,043 versus open interest of 4, indicating fresh positioning.

Bearish intent?

Chewy Inc, $CHWY, at the time of this posting, is up ~$1.33 to ~$27.43 with a ~3:1 call over put activity as traders are targeting the 10/20/23 30.00 calls.

Volume on this contract is 10,791 vs. open interest of 3,160. This suggests that the volume primarily represents fresh positioning.

August 28 - Flow Update

$NVDA flow continues - amazing. In line with what I mentioned last week though. Did you see the bounce on NVDA today? The foot is off the neck there now that mechanics are worked out from options expiration.

$DIS is the lotto trade from today. It's close to the money and for Friday. What's this trader seeing by Friday worth betting $500k on?

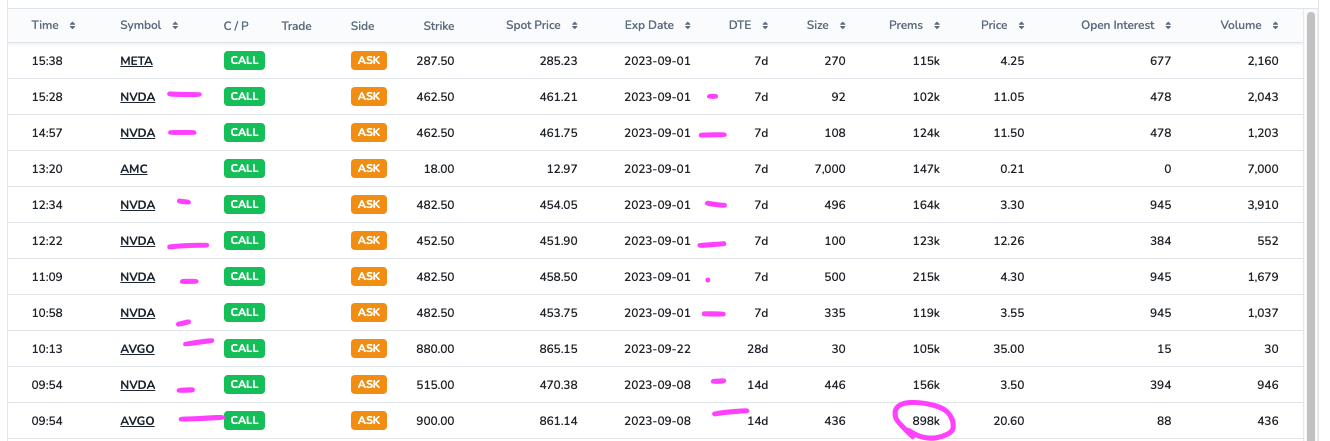

August 25 - Flow Update

$NVDA continues to be the king of flow. They're betting on a smaller move, but still up by next Friday. We saw similar feedback in yesterday's flow. Then we've got a new one with $AVGO which is tied to AI. So I'd guess next week is a good one for AI sector after all mechanical work is done by today's close. 🦾

Who remembers Rite-Aid?

Drug retailer Rite Aid prepares to file for bankruptcy - WSJ

Reuters

"Aug 25 (Reuters) - Rite Aid Corp $RAD is preparing to file for bankruptcy in coming weeks to address lawsuits the company is facing over its alleged role in the sale of opioids, the Wall Street Journal reported on Friday, citing people familiar with the plan.

Shares of the pharmacy retail chain operator fell 35% to 94 cents in afternoon trade.

The Chapter 11 filing would cover Rite Aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported."

As of this post, it was down to ~$0.70 / share.

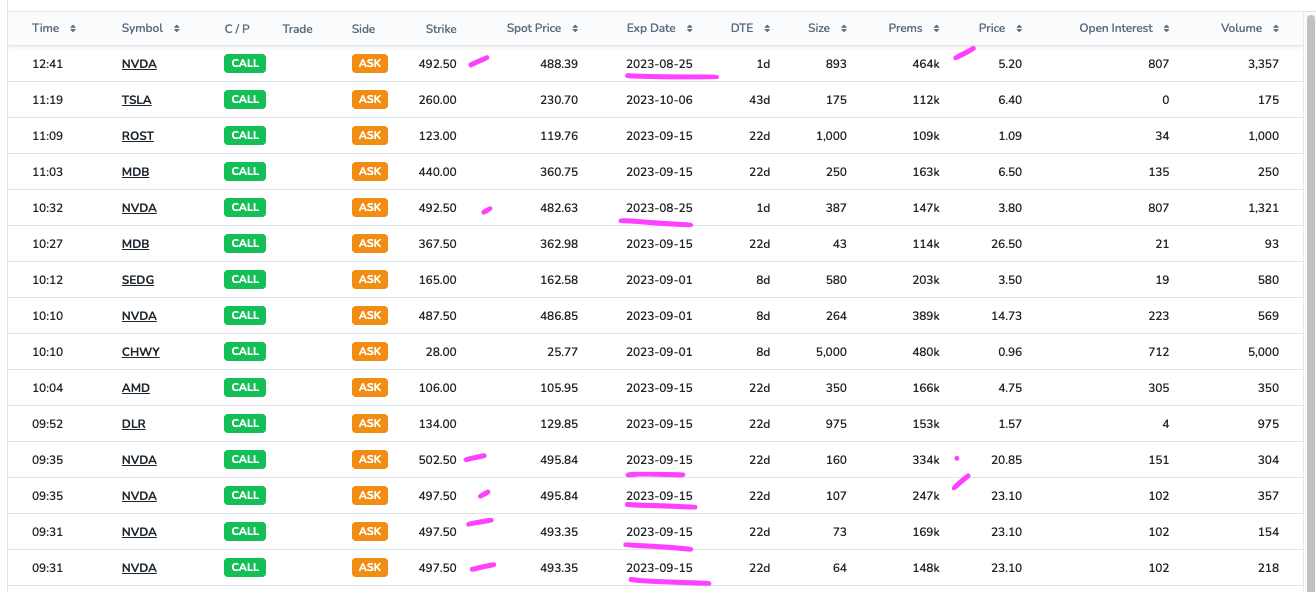

Flow Update - Aug 24

$NVDA put on a hell of a show last night for its ER. It not only met the incredible guidance it set, but beat it. Then pushed up next quarter's guidance. The problem for options is that it ran hard into the ER and the options are getting crushed today since it's under 500. The call side was looking for 510+ and puts were looking for 450-. It's sitting right in between that so both sounds are getting hit. Now, what's interesting about this is the Flow today (below). My read? Options dealers are going to hold NVDA right in this range to kill off as many puts/calls as they can through Friday's close where all the premium was. Then on Monday it can resume its march. Somebody else is thinking that because they're using the opportunity to buy relatively short-dated NVDA calls today. There was nothing in that ER that was bad. It blew away all expectations and with the new EPS, the P/E isn't going to be that bad (amazingly) in a few quarters.

|

Followers

|

5

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

85

|

|

Created

|

08/10/23

|

Type

|

Free

|

| Moderator Timmy Picklez | |||

| Assistants | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |