Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Question:

If a OCTBB company goes to the pinksheets because of the costs associated with, can it still report financial information at no cost on through pinksheet filings? Thx

I'm down 20 percent on it. These guys need to get to pumping! They should send some SPAM messages out then put a caveat emptor on themselves.

They uplifted to their OTCQX whatever it is and the stock didn't change at all.

I may not like the color Pink but i sure as hell do like this Stock!

![]()

Peace

Pinksheets.com Changes to OTCMarkets.com

Pinksheets.com Changes to OTCMarkets.com

NEW YORK, Feb. 16 /PRNewswire-FirstCall/ --

Pink OTC Markets(TM) has renamed pinksheets.com, its investor website for financial news and information on OTC securities, to otcmarkets.com. The new website name reflects Pink OTC Markets' position as the leading provider of quotes and financial information in all stocks not listed on U.S. stock exchanges. Otcmarkets.com is the most comprehensive source for investors for quotes, trading data and company information in over 9,300 OTCQX®, Bulletin Board and Pink Sheets® stocks.

(Logo: http://www.newscom.com/cgi-bin/prnh/20090623/NY36558LOGO )

In order to provide greater transparency to companies dually quoted by market makers on both the Pink Quote and the FINRA OTCBB platform, beginning Tuesday, February 16th, Pink OTC Markets will make Real-Time Level 2 market maker quotations published in the Pink Quote inter-dealer system available on http://www.otcmarkets.com/ for all OTCQX and dually quoted OTCBB securities.

"The superior technology of our inter-dealer quotation system is now attracting more and more consolidation of broker-dealer quotation activity in unlisted stocks," said R. Cromwell Coulson, President and CEO of Pink OTC Markets Inc. "By making Real-time Level 2 Quotes available on Otcmarkets.com in OTCQX and OTCBB securities, we are continuing to expand the availability of investor information in the OTC market."

Pink OTC Markets' inter-dealer quotation and trading platform has become the leading quotation platform for market makers in the U.S. OTC market. More broker-dealers are choosing the superior performance and functionality of Pink Quote over FINRA's OTCBB for publishing two-sided priced quotes in OTC securities.

Year Ended Pink Quote OTCBB December 31 Quotations Quotations ----------- ---------- ----------

2009 47,004 16,002 2008 41,289 26,670 2007 34,171 37,171

This data represents two-sided priced quotations only on both the Pink Quote and OTCBB platforms. There were a total of 81,786 priced and un-priced quotations on Pink Quote and 23,129 on the FINRA OTCBB in December 2009.

About Pink OTC Markets Inc.

Pink OTC Markets Inc. (Pink Sheets: PINK) is a financial information and technology services company that operates the leading electronic quotation and trading system in the Over-the-Counter, or OTC, securities market. The OTCQX and Pink Sheets® marketplaces that we operate constitute, by dollar volume, the third largest U.S. liquidity pool for trading public company shares, after The NASDAQ Stock Market, Inc. and The New York Stock Exchange. Our technology platform provides a comprehensive suite of information products and trading services for OTC market participants. Our products and services promote market transparency, improve price discovery, facilitate regulatory compliance, and increase the quality of issuer disclosure, to the benefit of all OTC market participants. To learn more about how Pink OTC Markets' products and services make OTC markets more transparent, informed, and efficient, please visit our websites at http://www.pinkotc.com/, http://www.otcmarkets.com/ and http://www.otcqx.com/ or contact us at .

Pink OTC Markets is headquartered in New York City.

OTC Bulletin Board and OTCBB are common law trademarks of FINRA.

http://www.newscom.com/cgi-bin/prnh/20090623/NY36558LOGODATASOURCE: Pink OTC Markets Inc.

CONTACT: Matthew Sheldon, CCG Investor Relations, +1-310-954-1346,

Web Site: http://www.otcmarkets.com/

I hope it falls to a penny. ![]() .

.

let her drop way down and than I'll back up the truck. You silly rabbit...you must not of ate yout Trix this morning.

If everyone in the city bought shares of PINK and then invested just $5000 they could have Shakerzzzzz pump it and sell off their shares for double their investment. If they do this 50 times a year, the residents of the city would all move out of the city to higher class neighborhoods creating a poor destitute city all because of a brilliant idea.

American Coins and Stock Certificates - How any City or Group of Citizens can Invest in a New Tomorrow

To all those fellow Citizens that grace this Land from all across the World

And to their Kids in our Republic that dream all that they can be

It is here that I am telling you to open up your Coin Jar and break open your Piggy Bank

So that you all can join me in investing in the American Dream

If you want to be the wealthy Americans of tomorrow

Then put your heads together to collaborate with one another

For I know the Key that will bring prosperity to everyone of you

So long as the Money continues to circulate all around our Republic

To all those Kids that are have the craziest of Dreams

And to their Parents that wonder if they have the Money to send them off to College

I say to you that this is the Hour of our Time to come together

So that you will no longer have to rely on the Government to help you get ahead

Imagine if a 6th Grader had but the cleverest of all ideas

That would allow himself and his Fellow Classmates to invest in a Brighter Tomorrow

It’s really not that hard to do and I am here to show you how it is all possible

As a group of Citizens come together to set these Stocks and their Exchanges on fire

Let’s say you have a Stock that trades as $.05 with 50,000,000 Shares outstanding

In which the Market Cap of the Company is $2,500,000 and will be less if the Stock drops in Price

So if you have a Graduating Class of 150 Students and each put in $15 a Month into that One Stock

Would equate to $2,250 a Month or $27,000 a Year that would be used to purchase Shares

This would mean that in one year your fellow classmates could purchase 540,000 Shares of Stock

In which you will own 1.08% of the Outstanding Stock of what I hope is a successful Company

The best Companies to seek out of course are those with positive Earnings Per Share or those that are paying Dividends

In which you could see the P/E Multiple increase or maybe they will pay $.0025/Share in Dividends a Year meaning you will get $1,350 Cash to further invest

Let’s say a City like Crookston with 8,000 Citizens looked to create a buying frenzy for the Stock PINK

In which Citizens put a $50 a Month into picking up Shares of this Dividend producing Stock

With 10,000,000 Class A Shares outstanding while the Stock trades around $5.00 a Share

Leaves the Market Cap of the Company to be a mere $50,000,000

If 8,000 People put $50 a Month into this Stock that will mean that you have $400,000 to pick up Shares

In which you will be able to pick up 80,000 Shares every Month

If you do it over the course of a Year than you will have $4,800,000 that could be invested

In which a Little Community could accumulate 960,000 Shares of the 10,000,000 Outstanding

This means that you will hold 9.6% of what I see is going to be a successful Company

That will pay to your Citizens dividends of around $.05 a Share every Quarter

Those 960,000 Shares of which you all accumulated that pays around $.15 to $.20 a Year in Dividends

Means that your Citizens in your City alone will get a Cash payout in the amount of $144,000 to $192,000 a Year

This is just one little City that if they brought their Heads together could accumulate a Great Chunk of Wealth

As the Citizens of which surround you and me put a Few of their Dollars into what a Community could call a Gem

And once they have started accumulating that Stock that they feel there is huge potential in

Than just wait until the rest of America creates a buying frenzy for those remaining Shares that will drive the Stock Price up

The Company may even decide to do a Stock Buyback in which they will purchase outstanding Shares on the Market

That will reduce the number of Shares outstanding as they return them once again to their Treasury

This means that you will own an even greater stake in the Company so long as you hold onto yours with an Iron Fist

As the Earnings Per Share grows along with what hopefully becomes that of a larger Dividend Yield since there is less Stock outstanding

This is why I see that Gold is a Barbaric Relic so long as our Dollar can still be invested to return even more Riches

For what good is a Precious Metal other than the fact that it is a Stone that came from somewhere in the Earth

It leaves me to believe that you should sell a Few Ounces of that Stone Age Relic since what good is it doing you

When you can instead invest that Cash to make it work for you in those Companies that will reward you with those Corporation Profits

If only Cities across America came together to dump Money into a Stock of their liking

Would they see that the Certificates all around us are up for sale at Bargain Prices

You can pick up Stocks that will continue to pay you Cash Dividends throughout that of their existence

And when the buying pressure begins you may even see that of your Share Price rapidly increasing

Either way it is a win-win situation from what I can tell

As stocks like PINK are going to be around for awhile

And with so few Shares being traded each and every day

Leaves me to believe that you should start buying them up before no one sells them at its Current Price

It just amazes me how you can take some of those American Coins to buy those Stock Certificates

That will over the course of their existence pay to you many Dollars alone in Dividends

And when they start buying back Shares or increase that of their Dividend Yield

Is when the Price of that Certificate will shoot up to the sky as well

Shaun

Pink OTC Markets Announces 2009 Trading Statistics

NEW YORK, Feb. 5 /PRNewswire-FirstCall/ --

Pink OTC Markets Inc. (Pink Sheets: PINK), which operates the leading inter-dealer quotation system in the Over-the-Counter (OTC) market, today announced 2009 trading results and marketplace trends. Pink OTC Markets upgraded its trading and quotation systems in 2009 to accommodate the growth in OTC trading activity and to continue to provide its broker-dealer customers the best platform for trading OTC stocks. Quotations on Pink OTC Markets' system grew by 15% in 2009, attributable to both an overall increase in foreign stocks traded in the U.S. and to broker-dealers choosing to publish more priced quotations in Pink Quote(TM) to take advantage of the only market-wide quotation and trading platform for OTC securities

(Logo: http://www.newscom.com/cgi-bin/prnh/20090623/NY36558LOGO )

Pink OTC Markets continues to see strong growth in its OTCQX® Marketplace and industry adoption of the Pink Sheets® disclosure tiers. The OTCQX tier reached $550 billion in market capitalization in 2009. It grew by 63% as 30 new companies, including global leaders such as Allianz SE, Gazprom Neft, JBS S.A., Craftmade International Inc., Sangold Corp, and Peugeot S.A., began trading on this premier tier of the U.S. OTC marketplace

The global growth and trading performance of the OTCQX tier, the industry acceptance of Pink Sheets' disclosure categories, and the increasing number of broker-dealers choosing the Pink Quote platform as their inter-dealer quotation system of choice for all their OTC quotation activity, are the result of Pink OTC Markets' continued investment in its technology platform and leadership as the financial information provider for the OTC market

Liquidity follows transparency. Over 92% of all dollar volume traded in OTCQX, OTCBB, and Pink Sheets securities in 2009 was in companies that provided current disclosure to the public markets, either through a regulator or directly to Pink OTC Markets

OTC # of Securities % Total 2009 Avg. 2009 $ Volume Market Tier at Dec. 31, 2009 Dollar Volume Per Security

----------- ---------------- ------------- ------------

OTCQX 78 9.5% $131,448,901

OTCBB on Pink Quote 3,321 15.1% $4,935,986

OTCBB Only 69 0.2% $2,883,275

Pink Sheets Current Information 1,695 67.6% $43,282,661

Pink Sheets Limited Information 739 5.6% $8,198,443

Pink Sheets No Information 3,445 2.4% $743,063

In 2009, OTCQX was the leader by average dollar volume per security among alternative or entry level markets, demonstrating strong demand for trusted companies among U.S. investors:

# of Securities 2009 Avg. $ Volume Market Tier at Dec. 31, 2009 Dollar Volume Per Security

----------- ---------------- ------------- ------------

OTCQX 78 $10,253,014,306 $131,448,901

LSE AIM 1,293 $53,623,863,165 $41,472,439

Pink Sheets 5,879 $81,982,612,533 $13,944,993

TSX Venture 2,375 $15,334,615,907 $6,456,680

OTCBB 3,390 $16,591,354,365 $4,894,205

Over 160 broker-dealers access Pink Link®, Pink OTC Markets' electronic messaging system, to send, execute, negotiate, or decline orders in OTCQX, Pink Sheets, and OTCBB securities. In 2009, broker-dealers communicated 35% of all OTCBB trades via Pink Link

Top 25 broker-dealers in 2009 by Pink Link volumes:

Firm Name Share Volume Dollar Volume

--------- ------------ -------------

Knight Equity Markets, LP 342,569,949,272 $8,991,471,641

Archipelago Trading Services Inc. 10,864,101,143 $8,983,755,511

Jane Street Markets, LLC 366,810,773 $6,282,823,082

Automated Trading Desk Fincl Svcs 84,233,698,610 $4,750,325,885 UBS Securities, LLC 84,659,502,599 $4,444,186,052

E*Trade Capital Markets, LLC IMM 162,616,565,628 $3,761,520,503

Intl Trading, Inc. 282,504,907 $3,416,284,350

Domestic Securities, Inc. 85,629,635,404 $2,729,396,768

Natixis Bleichroeder, Inc 21,909,430,577 $2,425,732,347

Merrill Lynch, Pierce, FS 203,842,125 $2,243,656,317

Hudson Securities, Inc 58,750,052,549 $2,221,175,375

Pershing Trading Company 17,945,525,490 $1,681,411,584

StockCross Financial Services 2,261,670,038 $971,090,679

Citigroup Global Markets Inc. 816,797,163 $823,347,508

BTIG LLC 1,105,190,863 $770,304,279

GFI Securities LLC 41,752,553 $708,213,100

Vandham Securities Corp. 10,651,951,956 $634,771,377

Collins Stewart Inc. 690,196,294 $632,181,618

Maxim Group LLC 7,513,892,563 $613,518,320

The Vertical Group Inc. 66,109,124,586 $593,615,153

Lighthouse Financial Group LLC 11,132,919,353 $487,900,675

LaBranche Financial Services, Inc. 2,655,037,122 $442,082,874

Ticonderoga Securities LLC 400,623,736 $427,043,631

Pali Capital Inc 1,943,165,815 $384,098,234

Noble International Inc. 7,379,916,305 $370,847,131

All broker-dealers using Pink OTC Markets' quotation and trading services are regulated by FINRA for their quotations, trade reporting, and best execution of customer orders

E*Trade, Fidelity, Scottrade, TD Ameritrade, and other online broker-dealers provide real-time Pink OTC Markets' quotation information to their customers for point and click trading. Real-time market data for professional traders is available from Bloomberg, Thomson Reuters and other leading market data providers

More broker-dealers are choosing the superior performance and functionality of the Pink Quote inter-dealer quotation system over FINRA's OTCBB(TM) for publishing priced quotes in OTC securities:

Year Ended Pink Quote OTCBB December 31 Quotations Quotations ----------- ---------- ----------

2009 47,004 16,002

2008 41,289 26,670

2007 34,171 37,171

*There were a total of 81,786 priced and un-priced quotations on Pink Quote and 23,129 on the FINRA OTCBB in December 2009

About Pink OTC Markets Inc

Pink OTC Markets Inc. (Pink Sheets: PINK) is a financial information and technology services company that operates the leading electronic quotation and trading system in the Over-the-Counter, or OTC, securities market. The OTCQX and Pink Sheets marketplaces that we operate constitute, by dollar volume, the third largest U.S. liquidity pool for trading public company shares, after The NASDAQ Stock Market, Inc. and The New York Stock Exchange. Our technology platform provides a comprehensive suite of information products and trading services for OTC market participants. Our products and services promote market transparency, improve price discovery, facilitate regulatory compliance, and increase the quality of issuer disclosure, to the benefit of all OTC market participants. To learn more about how Pink OTC Markets' products and services make OTC markets more transparent, informed, and efficient, please visit our websites at http://www.pinkotc.com/, http://www.pinksheets.com/ and http://www.otcqx.com/ or contact us at

About OTCQX

The OTCQX Marketplace is the premier tier of the U.S. Over-the-Counter Market. Investor-focused companies use the quality controlled OTCQX listing platform to offer investors transparent trading, superior information, and easy access through their regulated U.S. broker-dealers. The innovative OTCQX platform offers companies and their shareholders a level of marketplace services formerly available only on a U.S. exchange. For more information and to see a full list of OTCQX listed companies, visit http://www.otcqx.com/.

http://www.newscom.com/cgi-bin/prnh/20090623/NY36558LOGODATASOURCE: Pink OTC Markets Inc

CONTACT: Matthew Sheldon, CCG Investor Relations, +1-310-954-1346,

, http://www.ccgir.com/

Web Site: http://www.pinkotc.com/

PINK.PK and the Pink OTC Markets on SeekingAlpha Post by James Levy on 27 December 2009

Learning to Love the Pink Sheets...Not Just Penny Stocks Anymore (pink.pk)

Oh this POS is boring. I say we buy it all up, run it, spam it, fax it, and otherwise pump it. We'll see if they put a caveat emptor logo by their name.

I'm down 20% I should have bidsat instead of slapping the pink ask

lol, the pink is calling to me as well will be joining you soon ![]()

I'm in for 150 shares, I just couldn't help myself. I had to do it. It made me.

Should we be buying this? LOL, if they do a name change or reverse split, will they rate themselves caveat emptor?

hi aqua i got your pm. i dont have pm service so i couldnt get back to you. i actually transfered those shares to another account. and i do still hold it. hope this helps :)

TPT, are you going to keep this thread open to all stocks or mod it for PINK?

thx

Yep it Looks like ya cant at .0001

i'm not sure if ya can get it down there but maybe.

I agree and I think it could run hard on any merger news.

Is that one hard to buy at .0001?

Keep an eye on CLXX in the Future as Well.

i think a reverse merger is definately in the cards here.

FCRZ...I think we are close to a reverse merger here. New 8k out. The first 8k since 2004. David Fesko doing the finishing touches of getting this one ready for a reverse merger. This will be huge when merger news comes out. It ran to .10 a couple years back on no news so I think we could see close to $1 on news. The float is very low with this one.

Future Carz, Inc (FCRZ) has entered into an Offer in Compromise agreement with the Internal Revenue Service to settle amounts due for the tax periods 06/2001 through 06/2002. The agreement requires monthly payments which when completed will result in the release of all liens currently held by the Internal Revenue Service.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: September 14, 2009 Future Carz, Inc

By: /s/ M. David Fesko

------------------------------------

M. David Fesko

Chief Executive Officer, Treasurer,

Director and Chief Financial Officer

There is no moderator at the current time. This class of stock just started trading 3 days ago I believe. The dividend would be cool for someone who has a ton of money to buy a lot of shares in this.

Are you the unlisted mod for this board?

This will be a busy board once it gets interest.

I wish I had been more alert to get into this ticker. A dividend in under a month?

fcrz has an 8k out showing there willingness to clean up with the irs. a good sign. keep an eye on CLXX this grey sheet low floater i've been hearing rumblings on it for some time. they need to get back to the pinks first imho. FCRZ could get interesting. at least i hope so.

I guess their 'jump start' is working.

2.75 to 10.00

MK

It would appear PINK is going to be giving a dividend of .03 for anyone who is a shareholder as of the 20th of this month.

Wow, just had a chance to look over PINK's financials they are on track to do about 20M in revenues 2M in net income so about 20% profit margin for the fiscal year. Pretty impressive. I am seeing what could be a nice trade at some point in the future when this starts to get some attention.

Yeah, its legit now

they will not screw around with their own

listing

profitable too

have to read up if there s any fwd looking events

such as higher expected eps, etc

MK

I see they got 1 trade through.

Not grey anymore, current now

http://www.pinksheets.com/pink/quote/quote.jsp?symbol=pink

no inside ask but a 3.50 showing

MK

I guess no one wants to take a stab at it just yet lol.

2.10 bid no ask

MK

Well this should be a really interesting stock to watch over the next couple of days. It really seems funny to have a company quote itself on it's own market as well as the BB.

Only 14 mill a/s

8 o/s

4 in the float

.06 eps

this probably will start trading around 2 to 3 bucks

MK

thanks for the heads up mk :)

Lots of filings today look under filings

http://www.pinksheets.com/pink/quote/quote.jsp?symbol=pink

MK

hopefully it'll at least move back to the pinks. it used to run like crazy on volume.

This start trading

tomorrow

its still grey though

MK

FCRZ Time to Put on Radar .006 Low Float Moves Fast..

thanks coolwhip

|

Followers

|

22

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

281

|

|

Created

|

10/26/03

|

Type

|

Free

|

| Moderators | |||

CAVEAET EMPTOR

BUYER BEWARE:

THERE IS A PUBLIC INTEREST CONCERN ASSOCIATED WITH THE COMPANY, WHICH MAY INCLUDE A SPAM CAMPAIGN, QUESTIONABLE STOCK PROMOTION,

KNOWN INVESTIGATION OF FRAUDULENT ACTIVITY COMMITTED BY COMPANY OR INSIDERS, REUGLATORY SUSPENSIONS, OR DISRUPTIVE CORPORATE ACTIONS

THE PROBLEM

The level of uncertainty displayed on these situations is untenable. An investor cannot consume his time and mind resources caring about how his stocks will handle common corporate actions.

He cannot consume his time and mind share worrying that the handling of corporate actions in his unsponsored ADRs will be anything buy perfectly in line with what happens on the underlying stock, or any other stock or ADR.

The result of this uncertainty is obvious: The investor will take his business elsewhere. He'll either take it to the underlying markets or to other stocks altogether.

For OTCM, the result also is obvious. These unsponsored ADRs, whose number of listings has been growing strongly, will fail to ultimately catch the fancy of investors.

These stocks will turn into low-volume listings which will be prone for litigation, as investors are UNJUSTLY BURNED on them due to non-transparent handling of common corporate actions. As a result, adoption of their use will suffer.

CONCLUSION

The present handling of corporate actions on unsponsored ADRS quotes in OTCM's Pink Sheets segment (originally wrongly stated as the OCTQX segment) is wildly flawed. This handling of corporate actions will ultimately burn the segment.

While ultimately depositary banks are guilty of these flaws, for OTCM whoever is guilty is irrelevant. The fact is that an investor cannot spend his resources trying to understand if his stock will behave like the rest of the supposedly pari-passu stock on the same company.

Mishandling of these corporate actions presents the risk of loss for investors dabbling in them, at no fault of their own.

I believe this is an underappreciated problem for OTCM, which will become a large obstacle to its continued growth. A strong stance on this issue, with the guarantee of transparent corporate events, is the only thing which can save this segment over time.

https://seekingalpha.com/article/4056605-otc-markets-group-wasting-good-opportunity

INVESTORS BEING BURNED CONTINUOUSLY BY OTCM's "AGENDA"

OTCM is not obligated to vet any of the stocks they quote. And only FINRA and the SEC can legally halt all brokers from trading in a company's shares.

In Cynk's case, OTCM flagged the stock with a "caveat emptor" skull and crossbones symbol on July 9, after Cynk's shares had more than doubled. Cynk shares thus traded another day, rising as high as $21.50; they'd traded as low as $0.08 last year.

The SEC issued its halt order July 11. "I Tweeted on Thursday saying it was not a question of if the SEC halts this, it's when," Coulson said. "It was going to trade at some ludicrous level for some amount of time — which was a day —

the SEC was going to halt it, and everyone involved in that stock are going wish they weren’t involved."

"If you point to the people who were buying Cynk and told them, You really should buy [a community bank], this great bank that pays dividends, that's close to you, you might even be a depositor there — they’d tell you that’s boring."

OTC Markets Group Acquires theOTC.today to "Help Investors"

http://www.otcmarkets.com/stock/OTCM/news?id=160544

"Manipulative stock promotion harms all public markets. This acquisition continues our strategy of increasing the quality and availability of unique market data to help investors, broker-dealers and regulators make better informed decisions," said R. Cromwell Coulson, President and CEO of OTC Markets Group

http://www.theotc.today

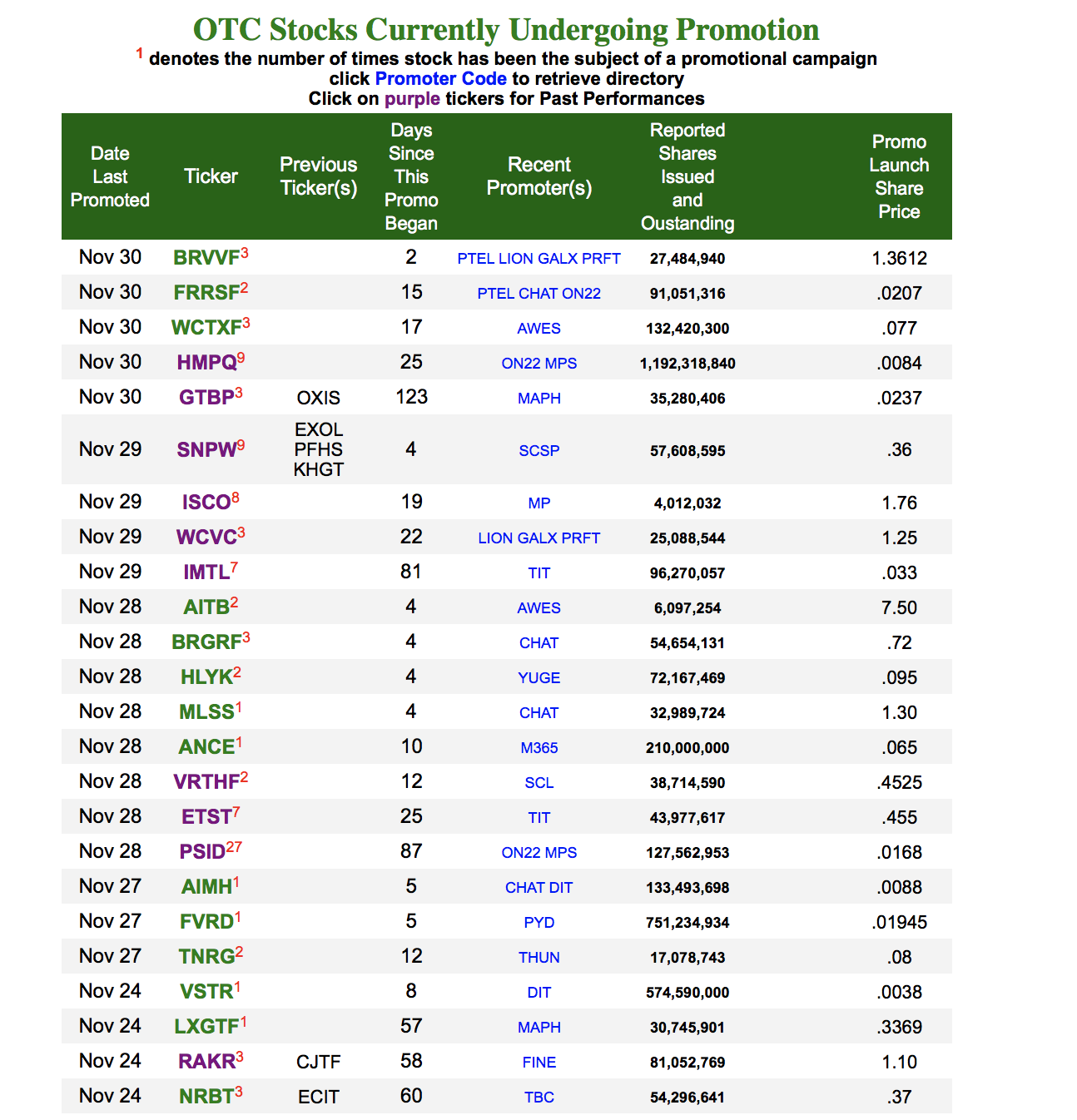

OTCM GETS ACCESS TO A "PROMOTERS" LIST SO THEY CAN USE IT TO LABEL STOCKS AS "CAVEAT EMPTOR."

THEY CLAIM TO BE INVOLVED IN THE BUSINESS OF VERIFICATION, BUT WHO IS VERYIFYING THEIR ACTIONS?

Murky Corner of U.S. Stock Market Takes Step to Clean Up Fraud

November 7, 2017, 2:10 PM EST

OTC Markets Group Inc., which runs markets for over-the-counter trading in more than 10,000 securities, released a new policy on Tuesday to stem fraudulent stock promotion --

or ginning up positive attention for a security, while being compensated in secret by the company itself.

Companies were reminded they need to make timely disclosures about important developments, which includes dispelling anything misleading spread by promoters.

Earlier this year, the U.S. Securities and Exchange Commission went after 27 individuals and groups that promoted stocks, including on investing websites like SeekingAlpha.com.

The SEC said the fraudulent promoters gave the impression they were providing independent analysis while secretly taking payments for their work.

The SEC agreed to several settlements, including one of almost $3 million.

“This is a problem, so for us to show leadership on improving transparency is a good thing,” Cromwell Coulson, president and chief executive officer of OTC Markets, said in an interview.

To address the issue, OTC Markets says it will start flagging dubious securities that are being promoted in the first quarter of 2018.

It will also start asking some companies that are the subject of stock promotions to notify investors.

If OTC Markets deems them a threat, they’ll be labeled with a skull-and-crossbones icon on its website.

(That buyer-beware signal is already used on the site, but this broadens the use.)

https://www.bloomberg.com/news/articles/2017-11-07/in-a-fraud-addled-part-of-stock-market-clean-up-attempt-arrives

Facts and circumstances may differ, however generally, OTC Markets Group will remove the Caveat Emptor designation once the company meets the qualifications for Pink Current Information, has verified the information on its company profile on www.otcmarkets.com, and demonstrates that there is no longer a public interest concern. The Caveat Emptor designation is typically not removed within the first 30 days. During the time it is labeled Caveat Emptor, any stock that is not in Pink Current Information will also have its quotes blocked on www.otcmarkets.com.

OTC Markets Group monitors for potential promotional activity relating to securities trading on our markets.

We review for anonymous paid promotions, possible connections to bad actors, and evaluate the promotions potential impact on trading.

A company whose security is being promoted may not be directly involved or even aware of a promotion campaign for their securities,

however all public companies have an obligation to provide accurate disclosure to investors and quickly address any misleading information that could affect the trading market for their securities.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |