Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Dup. Update. I would suggest that there is a lack of support for competent help at OTCM and there is a lack of pay for competent help at OTCM as there are with many firms now current a days.

Too many jobs available but nobody is working.

I would suggest that there is a lack of support for competent help at OTCM and there is a lack of pay for competent help at OTCM as there are with many firms now current a days.

Too many jobs available but nobody to fulfill the positions with the qualified requirements. Can't have that. The pay isn't there.

OTCM stock dropping. Markets change.

It is quite an indictment against OTC Link and by association OTC Markets. How many hundreds to thousands of other suspicious trading activities occurred without OTC Links submitting mandatory Suspicious Activity Reports (SARs).

That's quite interesting. Thanks for sharing 😀

OTC Link, a subsidiary of OTC Markets: SEC Charges OTC Link LLC with Failing to File Suspicious Activity Reports

https://www.sec.gov/newsroom/press-releases/2024-96

The Order:

https://www.sec.gov/files/litigation/admin/2024/34-100692.pdf

Although OTC Link’s AML Policies specified certain “red flags” indicative of suspicious activity relating to potential microcap fraud, there was no reference to any red flags associated with other risks relevant to OTC Link’s business, including: (a) sell orders from subscribers representing a large volume of trading relative to the average daily trading volume in thinly-traded microcap issuers; (b) consistent one-sided trading by a subscriber in a particular thinly-traded microcap issuer accompanied by a significant increase in stock price; (c) trading activity by subscribers involving apparent pre-arranged securities trading, including wash or cross trades, in thinly-traded microcap securities; or (d) transactions involving subscribers who were publicly known to be the subject of criminal, civil or regulatory actions for crime, corruption, or misuse of public funds. Additionally, OTC Link’s AML Policies provided that “[s]ince the firm does not have customer information or insight into the client (or retail broker) entering orders the firm is somewhat limited in its ability to identify fraud.”

OUT & looking at $54-$56 DMA's for another SHORT... I EXPECT it to overshoot them but my STARTER will be in that range in the coming weeks!!

This morning offered a PERFECT point to INCREASE my short position. The chart GAP FILL was just.... CLASSIC!!

A perfect spot. So glad I kept my orders in there...

Now the question is will it go BACK to where I've been anticipating it will?

I think we see $40's by next month!

$OTCM

..

.

Curious to see what tomorrow brings but I SURE DID think my SHORT POSITION would be DEEPER in the green...

Maybe this needed a bit of a breather, but if that 50 stayed a BIT more stable then I thought.

Not surprised but it was accelerating so we'll have to see what tomorrow brings & how it

closes out the week!

Wow! That took NO TIME at all,... within minutes BOOM down into $49's...

STILL EXPECTING more capitulation here & the stock to go lower!

As I've said: SHORT HERE!

$OTCM

...

EXPECTING that $50 breach TODAY!

Betting on it even!

As I am SHORT here...

$OTCM

...

..

.

SHORT HERE: Looks like those $50's are NOT HOLDING (AS PREDICTED)

https://ih.advfn.com/stock-market/USOTC/otc-markets-qx-OTCM/trades

As I have said, EXPECTING more downside on this one...

Still quite a ways to go according to my charts

& ANALYSIS!

$otcm

...

..

$OTCM is about the lose that $51 support JUST AS I PREDICTED!! This is going LOWER no doubt now...

The only question is HOW LOW before I have to COVER MY SHORT position!!

LOVE IT!! GREEN baby GREEN in my account...

This LOOKS like it wants to head to $25-ish! Is this going to get CUT IN HALF!!

Took a SHORT position here... Wondering if I should ADD to it!!

Seriously... Chart looks like it is STREAKING DOWN to find support... & there is NO ONE THERE....

MONEY!! Memorializing this post, will try to check back at end of year or so....6-9mos or so of DOWNSIDE I think..

Depending upon -- PERHAPS -- what happens in the election... From ~$64.00 in July I'm expecting this to DROP

into the $40's here soon... & likely FURTHER DOWN from there!!

$OTCM

...

START OF SANTA CLAUZ Rally

Interesting....probably a few employees of OTCM....who have a LOT of advance info that can be used to trade stocks.........

z

That is not the whole story either. Check this out about the new OTCM scandal that is brewing right now.

#Rico Releasing non public Insider Info to a phone caller, before OTC made it public? In fact, OTCM never made it public....

Looks like a strong sell on OTCM stock to me. IMO

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=166218787

LMFAO BULLSHIT,

OMG is this true? A RICO Investigation of OTCM???

$OTCM $NWGC #Pennystocks #RICO #FRAUD #CNBC pic.twitter.com/r4OUKzjEXP

— NotTheMoma (@NotTheMoma2) October 1, 2021

I agree, Congress needs to investigate this for sure.

Buyer Beware:

Orchestrated manipulation of publicly traded companies(?) is going to cost OTC Markets a lot of money.

I'd hate to be on the losing end like this:

https://www.accesswire.com/665967/new-world-gold-corporation-general-announcement

NWGC gets sent to the graveyard, by a for profit company while:

Ok let me see if I have this right?

$NWGC trading is illegally blocked, violating my constitutional rights, because a for profit, non court, non Gov company wants to help shorts murder a stock price, by blocking its ability to file its attorney letter?

Harming shareholders like me?

While Alstom Power, 3 drug companies, Nokia and Siemens trades with no problem while this news comes out?

DOJ Says Three Generic Drug Companies Resolve Price-Fixing Allegations

https://ih.advfn.com/p.php?pid=nmona&article=86194328

and:

Spain's Competition Authority Fines Cartel Including Alstom, Siemens and Nokia Around $147 Million

https://ih.advfn.com/p.php?pid=nmona&article=86193908

Sounds legit right?

Sounds fare right?

Like hell it does.

OMG is this true? A RICO Investigation of OTCM???

$OTCM $NWGC #Pennystocks #RICO #FRAUD #CNBC pic.twitter.com/r4OUKzjEXP

— NotTheMoma (@NotTheMoma2) October 1, 2021

watch too $PRDL and $CZNI could be the next runner soon

Yeah.....current Sizzles on $GVSI are:

1. Court grants Custodianship.

2. Merger candidate announced.

z

Dont sell too early... ima wait to see the merging company first... gltu

Iol i had great luck Accumulating so far. One these days im gonna sign up for your ddAmanda again.

At this point I'm trying to figure out where to sell......lol

z

Grab all the Gvsi shares you can!!!

His is that short position going? Ba ha ha ha ha ha ha ha

As an example of this fraud, take ticker APRU. OTC Markets Group website indicates that APRU has 4.83 Billion common shares outstanding, yet just today APRU files its 2016 & 2017 Annual Reports (today is 10-10-18 and now suddenly APRU is reporting nearly 22 BILLION common shares outstanding. This is a prime example how OTCM allows it’s listed companies to scam retail investors on its platform. OTCM companies can tell investors there are 4.83 Billion shares outstanding, allow the company to trade on this false information and data, when in reality there are nearly 22 Billion common shares outstanding. Retail investors are clearly getting scammed by OTCM seriously lax reporting standards and complete lack of accurate outstanding share counts. Criminal IMO.

A very high percentage of OTC listed Pink companies are scams. OTC Markets should tighten up its minimum listing requirements to rid its trading platform of non reporting dilution entities. OTC Markets should require any OTC Markets company must have “frequently updated” share counts on all companies trading on the OTC Markets platform. Too many OTC Markets listed companies are turning out to be non reporting delution frauds. Look no further than the SEC Enforcement Actions, and virtually all these fraudulent companies are raising equity capital via OTCM’s ECN. The level of manipulation and corruption on OTCM’s marketplace is out of control and the SEC needs to regulate OTCM, and require OTCM to raise the minimum listing and disclosure requirements of any OTC listed security. Investors in any OTCM listed company should have an outstanding share count, updated bimonthly, reported by the listed company’s transfer agent. OTCM’s ECN facilitates way too many scam companies and OTCM’s lax listing requirements perpetuate the frauds.

Wow, were you ever wrong. Lol.

Whos who and whos true? Fully reporting and verified but trashed all the same. Go Figure. OTC or wild wild west at least here my expectations are not skewed by some false sense of security! Remember Enron? FVRD in at .........011 on Wed Morn because they trashed it go figure one mans trash another mans treasure or not will see!

Hearing they might shut this scam down $otcm

Should let me short this before y’all slap a CE on this ;)

OTCM Corporate Actions; The Problem..

The level of uncertainty displayed on both of these situations is untenable. An investor cannot consume his time and mind resources caring about how his stocks will handle common corporate actions. He cannot consume his time and mind share worrying that the handling of corporate actions in his unsponsored ADRs will be anything buy perfectly in line with what happens on the underlying stock, or any other stock or ADR.

The result of this uncertainty is obvious: The investor will take his business elsewhere. He'll either take it to the underlying markets or to other stocks altogether.

For OTCM, the result also is obvious. These unsponsored ADRs, whose number of listings has been growing strongly, will fail to ultimately catch the fancy of investors. These stocks will turn into low-volume listings which will be prone for litigation, as investors are unjustly burned on them due to non-transparent handling of common corporate actions. As a result, adoption of their use will suffer.

Conclusion

The present handling of corporate actions on unsponsored ADRS quotes in OTCM's Pink Sheets segment (originally wrongly stated as the OCTQX segment) is wildly flawed. This handling of corporate actions will ultimately burn the segment.

While ultimately depositary banks are guilty of these flaws, for OTCM whoever is guilty is irrelevant. The fact is that an investor cannot spend his resources trying to understand if his stock will behave like the rest of the supposedly pari-passu stock on the same company. Mishandling of these corporate actions presents the risk of loss for investors dabbling in them, at no fault of their own.

I believe this is an underappreciated problem for OTCM, which will become a large obstacle to its continued growth. A strong stance on this issue, with the guarantee of transparent corporate events, is the only thing which can save this segment over time.

https://seekingalpha.com/article/4056605-otc-markets-group-wasting-good-opportunity

Buyer Beware:

Orchestrated manipulation of publicly traded companies is going to cost OTC Markets a lot of money.

I'd hate to be on the losing end.

Word on the street is SEC is already triggered. Maybe we will see a CE pop here soon, until they can "sort it out"

OTCM throws CE on stocks that have run so they can manipulate price and short into the ground

Yup, $OTCM a complete corrupt company! Selling every share I own because the SEC will be knocking on their door soon.

OTCM has been doing some shady shiz lately with these CEs

Blockchain technology is the key to the new otc stock marketplace. So many shares. So many companies. Might seem like millions. But like bitcoin is only limited to so many. At least stocks are backed by something versus a bitcoin backed by nothing. But hey. At least your exchanges allow them to mine fire something of electronic digits. I cannot wait for the treasury to shut down bitcoin. Buy I honestly cannot enforce it though until our dollar is backed by gold. . I love you Chicago. My heart melts away in the beauties of the otc marketplace. Can I be a future ceo of your company. I thought about creating a facebook stock exchange but I cannot support zuckerberg and his government of via and do censorship associated with fiat federal reserve monopolies. But the otc markets is what I believe in and love. From the bottom of my heart to yours atop the skyscrapers of a new age America. I love you otc markets. For in you my eyes when searching can find.a gem. Much luv.. mwaaaaah!

|

Followers

|

22

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

279

|

|

Created

|

10/26/03

|

Type

|

Free

|

| Moderators | |||

CAVEAET EMPTOR

BUYER BEWARE:

THERE IS A PUBLIC INTEREST CONCERN ASSOCIATED WITH THE COMPANY, WHICH MAY INCLUDE A SPAM CAMPAIGN, QUESTIONABLE STOCK PROMOTION,

KNOWN INVESTIGATION OF FRAUDULENT ACTIVITY COMMITTED BY COMPANY OR INSIDERS, REUGLATORY SUSPENSIONS, OR DISRUPTIVE CORPORATE ACTIONS

THE PROBLEM

The level of uncertainty displayed on these situations is untenable. An investor cannot consume his time and mind resources caring about how his stocks will handle common corporate actions.

He cannot consume his time and mind share worrying that the handling of corporate actions in his unsponsored ADRs will be anything buy perfectly in line with what happens on the underlying stock, or any other stock or ADR.

The result of this uncertainty is obvious: The investor will take his business elsewhere. He'll either take it to the underlying markets or to other stocks altogether.

For OTCM, the result also is obvious. These unsponsored ADRs, whose number of listings has been growing strongly, will fail to ultimately catch the fancy of investors.

These stocks will turn into low-volume listings which will be prone for litigation, as investors are UNJUSTLY BURNED on them due to non-transparent handling of common corporate actions. As a result, adoption of their use will suffer.

CONCLUSION

The present handling of corporate actions on unsponsored ADRS quotes in OTCM's Pink Sheets segment (originally wrongly stated as the OCTQX segment) is wildly flawed. This handling of corporate actions will ultimately burn the segment.

While ultimately depositary banks are guilty of these flaws, for OTCM whoever is guilty is irrelevant. The fact is that an investor cannot spend his resources trying to understand if his stock will behave like the rest of the supposedly pari-passu stock on the same company.

Mishandling of these corporate actions presents the risk of loss for investors dabbling in them, at no fault of their own.

I believe this is an underappreciated problem for OTCM, which will become a large obstacle to its continued growth. A strong stance on this issue, with the guarantee of transparent corporate events, is the only thing which can save this segment over time.

https://seekingalpha.com/article/4056605-otc-markets-group-wasting-good-opportunity

INVESTORS BEING BURNED CONTINUOUSLY BY OTCM's "AGENDA"

OTCM is not obligated to vet any of the stocks they quote. And only FINRA and the SEC can legally halt all brokers from trading in a company's shares.

In Cynk's case, OTCM flagged the stock with a "caveat emptor" skull and crossbones symbol on July 9, after Cynk's shares had more than doubled. Cynk shares thus traded another day, rising as high as $21.50; they'd traded as low as $0.08 last year.

The SEC issued its halt order July 11. "I Tweeted on Thursday saying it was not a question of if the SEC halts this, it's when," Coulson said. "It was going to trade at some ludicrous level for some amount of time — which was a day —

the SEC was going to halt it, and everyone involved in that stock are going wish they weren’t involved."

"If you point to the people who were buying Cynk and told them, You really should buy [a community bank], this great bank that pays dividends, that's close to you, you might even be a depositor there — they’d tell you that’s boring."

OTC Markets Group Acquires theOTC.today to "Help Investors"

http://www.otcmarkets.com/stock/OTCM/news?id=160544

"Manipulative stock promotion harms all public markets. This acquisition continues our strategy of increasing the quality and availability of unique market data to help investors, broker-dealers and regulators make better informed decisions," said R. Cromwell Coulson, President and CEO of OTC Markets Group

http://www.theotc.today

OTCM GETS ACCESS TO A "PROMOTERS" LIST SO THEY CAN USE IT TO LABEL STOCKS AS "CAVEAT EMPTOR."

THEY CLAIM TO BE INVOLVED IN THE BUSINESS OF VERIFICATION, BUT WHO IS VERYIFYING THEIR ACTIONS?

Murky Corner of U.S. Stock Market Takes Step to Clean Up Fraud

November 7, 2017, 2:10 PM EST

OTC Markets Group Inc., which runs markets for over-the-counter trading in more than 10,000 securities, released a new policy on Tuesday to stem fraudulent stock promotion --

or ginning up positive attention for a security, while being compensated in secret by the company itself.

Companies were reminded they need to make timely disclosures about important developments, which includes dispelling anything misleading spread by promoters.

Earlier this year, the U.S. Securities and Exchange Commission went after 27 individuals and groups that promoted stocks, including on investing websites like SeekingAlpha.com.

The SEC said the fraudulent promoters gave the impression they were providing independent analysis while secretly taking payments for their work.

The SEC agreed to several settlements, including one of almost $3 million.

“This is a problem, so for us to show leadership on improving transparency is a good thing,” Cromwell Coulson, president and chief executive officer of OTC Markets, said in an interview.

To address the issue, OTC Markets says it will start flagging dubious securities that are being promoted in the first quarter of 2018.

It will also start asking some companies that are the subject of stock promotions to notify investors.

If OTC Markets deems them a threat, they’ll be labeled with a skull-and-crossbones icon on its website.

(That buyer-beware signal is already used on the site, but this broadens the use.)

https://www.bloomberg.com/news/articles/2017-11-07/in-a-fraud-addled-part-of-stock-market-clean-up-attempt-arrives

Facts and circumstances may differ, however generally, OTC Markets Group will remove the Caveat Emptor designation once the company meets the qualifications for Pink Current Information, has verified the information on its company profile on www.otcmarkets.com, and demonstrates that there is no longer a public interest concern. The Caveat Emptor designation is typically not removed within the first 30 days. During the time it is labeled Caveat Emptor, any stock that is not in Pink Current Information will also have its quotes blocked on www.otcmarkets.com.

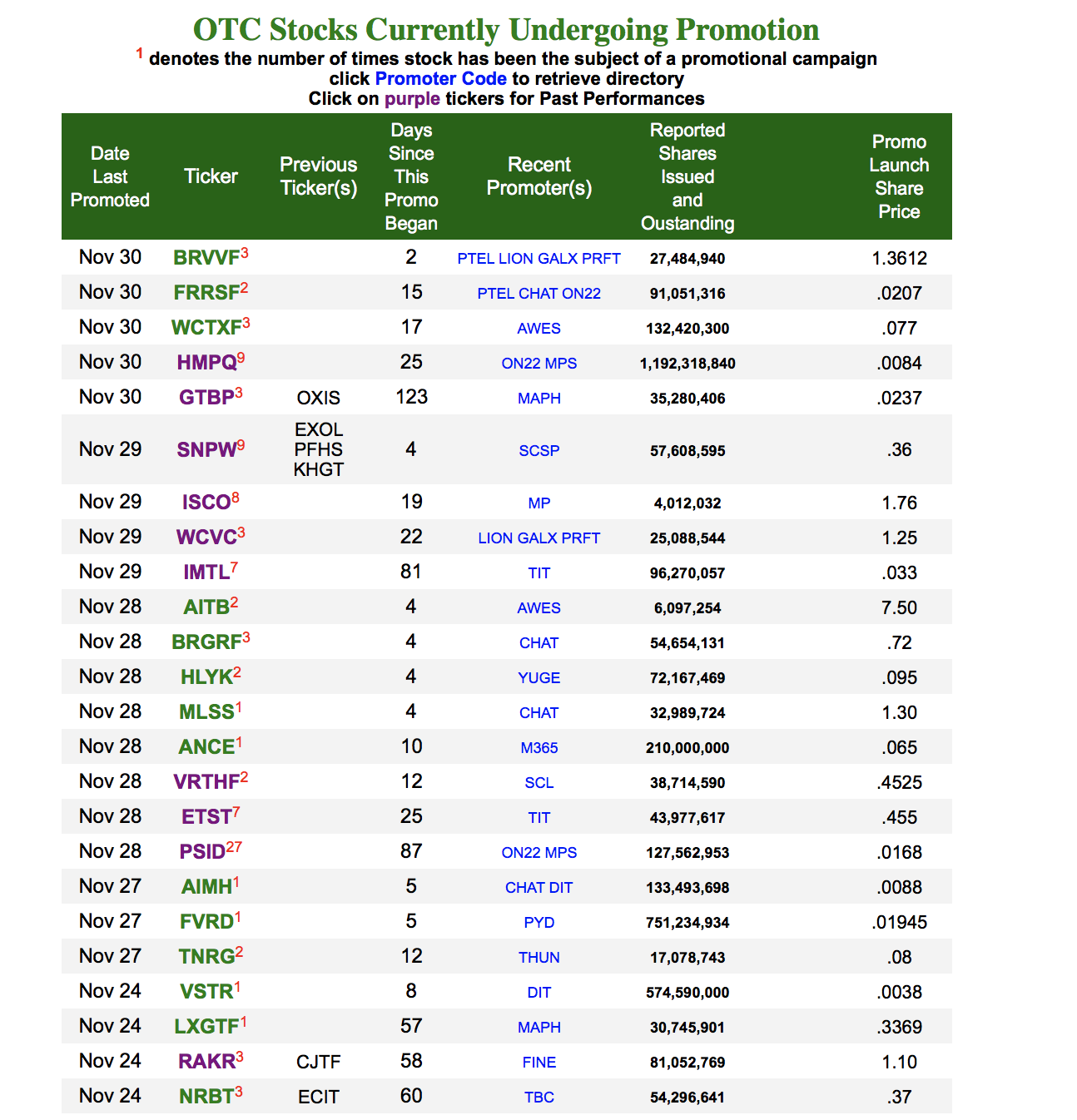

OTC Markets Group monitors for potential promotional activity relating to securities trading on our markets.

We review for anonymous paid promotions, possible connections to bad actors, and evaluate the promotions potential impact on trading.

A company whose security is being promoted may not be directly involved or even aware of a promotion campaign for their securities,

however all public companies have an obligation to provide accurate disclosure to investors and quickly address any misleading information that could affect the trading market for their securities.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |