Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Using S&P multipliers:

Trailing P/E puts the value of the company at $4.50

P/S is about right on target betwein $4.50 and $5.00

The profit margin is 11%, which is slightly lower than the 13% of the S&P.

*All of this are trailing numbers

Based on my numbers, it is only slightly overvalues (should be around $4.50), but the dividend yield (which is 10 times the S&P average) and concentrated holding (directors and managers hold 4.85 million of the 10.467 million shares outstanding) accounts for that.

There are only 244 beneficial owners of the company. Most of those holders are insiders or debt holders. So, there cannot really be any bag holders...

If you say the company should be caveat emptor, tell us why. I personally think you don't know what caveat emptor means. In market terms, to be marked as caveat emptor a company has not provided financials, has not complied with the SEC's or one of its SRO's (in this case FINRA's) transparency requirements, or has otherwise been the subject of promotional activities. Clearly this is not the case with OTCM, otherwise FINRA would have stepped in. Ergo, it isn't a caveat emptor, but rather a stock that is compliance with the regulators set forth by FINRA and the ECN.

I sure feel bad for the bagholders here. OTCM has now traded 200 shares.

You are allowed to post opinions. It's my opinion as well as others that OTCM should be caveat emptor.

I would like to be an assistant mod. The ibox really needs work.

Totally agree. OTCM should be a skull and crossbones.

Big volume today. A whole 100 shares. And that news was horrible.

Float is way to high for this pps. This company is not worth 10% of it's market cap.

Do your own DD on this dog

Provide a metric please to back up said statement.

Low float, look at amount of shares outstanding, then look how much is in

Number of shares authorized 14,000,000

Number of shares outstanding 10,467,922

Number of shares freely tradable 5,484,086

Total number of beneficial shareholders 244

Total number of holders of record 120

If you dive down further into the float, most of it is owned by management. So there is really nothing to trade with.

Are you one of those 244 beneficial shareholders?

OTC markets group is very overvalued. Pps going below $1 in the near future IMHO.

I'm sure people moving to the BSE should impact thier earnings. Maybe they will just raise fees on the poor PS companies they hold hostage.

You are wasting your time on this. OTC markets group is a scam.

The only one side opinion I've heard is you simply stating your opinion without providing any type of proof or facts. My guess is you've made several bad investments in the last two years and need someone to blame, so you're blaming the thing that you see as changing the most.

Provide me some statistics, provide me some facts, provide me some historical relevance. I provided you with the historical narrative of the OTC market, I've providing you with the liquidity amounts, I've provided you with the increased FINRA regulations, I've shown you the decreased number of stocks solely listed on OTCBB rather than OTC Markets Group (something that you have avoided three times now; I again ask if OTC Markets is screwing companies, how come they are fleaing OTCBB?), and I provided you with the increased costs that are outside of OTC Markets control (for instance, the CUSIP link I provided). I've also provided you a logical argument.

The simple fact is all you have done in whine without providing any validity to your post; furthermore you haven't even put forth a logical argument. If that's not a one-sided opinion, I don't know what is.

P.S. You make yourself look ignorant when you complain about having to read 10-15 sentences.

I've lived it. I do not need to read message boards or the useless OTC site ( with one sided opinions)

Maybe they will purchase Ihub. Then otcmarkets group will have perfected their scam.

And, the truth is it hasn't. Your ignorance and unwillingness to actually understand the world around you has blinded you to reading facts. I think your complaining about the length of my posts proves that. God forbid you had to do a little research and objective thinking. I have also yet to see a cohesive and convincing argument on your part other than stating your angry opinion without backing it up with facts or historical knowledge.

And, P.S. It's "you're" not "your".

Your upto a novel now. Plain and simple OTC markets group has destroyed the avg investor.

Just to give you an idea of increasing costs being beyond the control of OTC Markets Group (which has actually lowered cost in the aggregate on what they can control compared to their competitor), just look at the increasing cost of CUSIPs: http://www.onwallstreet.com/news/SEC-cusip-2669713-1.html

On the contrary, I'm well aware of the costs of public a publicly traded company. Those costs - auditing, filing for CUSIP numbers, bookkeeping, etc- haven't gone up because of OTC Markets Group, they've gone up because of inflation, market forces, and increasingly complexity in FINRA regulation and the tax system. You seem to have a simplified view of how the world works if you think the ECN is to blame - especially when there are alternatives (which you, for a second time, failed to address, yet again). If you want to know what small publicly traded companies are really bitching about [in the aggregate, look no further than uncertainty, FINRA, and lack of access to capital in the banking sector - it isn't OTC Markets Group their complaining about [in the aggregate].

You seem to have a wonderful fantasized opinion, but you have yet to provide any numbers (like I have) or provide any insight into history (like I have) to actually back up your warped sense of reality.

Furthermore, it just seems like you think companies should have unfettered access to the capital markets without having to provide any information whatsoever. If they shouldn't have to file SEC forms and they shouldn't have to file the "non-required" unaudited financial forms (the alternative OTC Markets provides), why should they have access to the national capital market? They can always go to the bank, find private investors, etc - just like any other private company. To echo my last response, you seem to bad mad at the SEC and FINRA for demanding higher levels of transparency, not OTC Markets Group for doing what they were pushed to do by not-so-veiled threats from regulators. You want a casino, and that was determined to not be in the best interests of the NMS - most of which is beyond the control of the ECN. The same issues you say apply to OTC Markets Group apply to FINRA's OTCBB.

And, besides, if there was really a market/need for the type of capital market you want, a competitor would have sprung up. Except it hasn't - which means there isn't a need and/or the SEC and FINRA won't allow it.

Lol you have no real idea what the costs are of being a public co. It sounds so simple to do your so called Edgar filings. Call around and see how much it actually costs to do audits, hire council, pay a guy for a 15c-211. 5 years ago these markets were great. They allowed people to invest in small companies and some worked and some didn't. Now the little guy has no shot. He buys a so called OTC Pink company and when they stop filing Non Required unaudited financials a stop sign gets slapped on them and liquidity dries up.

Good luck here. OTC Markets is being sued by plenty of guys for manipulation.

Eh, you have a misinformed opinion. If a company wants to report without having to pay OTC Markets Group, they can file through the SEC. Look at a company like VIDA or really any other company that is listed as OTCQC - they all file directly with the SEC rather than having to file through OTC Markets Group. Or, a company can simply list on FINRA's OTCBB and avoid OTC Markets Group although (something you failed to respond to) - except, as I noted before, only 28 companies do so as their sole listing place. Then again, I think you still need to use EDGAR to do so on OTCBB.

There seems to be plenty of liquidity in legit companies on the OTC, especially compared to the Pink Sheets of yesteryears. Where has the liquidity dried up? Simple: the shitty caveat emptors, gray markets, and other crap-shoot shell and spam companies. If you want to know what's really killed liquidity its transparency; that's right, transparency made it so companies can dupe their investors (many of which fail to do any research). Beyond that there have been changes at the SEC itself as to how CUSIPs are handled and how public companies can trade; so there are tangential happenings. These markets aren't meant to be casinos, they supposed to be legitimate places to conduct business. Prior to 5 years ago or so it was really questionable as to what companies were legitimate and which weren't. Investors failed to do their research and the industry was forced to step in order avoid federal intervention. The markets are still complicated - hence why there are tons of penny chaser websites in existence, including some right here on this websit (TecNasty and his group).

I have the data to back it up too that transparency has helped steer investors aware from the shitty companies of yesteryear that you claim OTC Markets killed. All you have to do is look at the trading that occurs in each tier (daily numbers as of today):

OTCQX: Volume: $153,632,376; trades: 6,742; number of securities: 273

OTCQB: Volume: $86,426,937 ; trades: 22,519; number of securities: 3,675

Pink: Volume: $366,765,912; trades: 32,241; number of securities: 6,166

Other markets (dark pools): volume: $202,696,691; trades:

4,979; number of securities: 9,159

P.S: looks like the number of securities only listed on FINRA's OTCBB is down to 18, not 28.

P.P.S: And, lets be clear out of the nearly 4,000 stocks listed as OTCQX and OTCQB, only 4 are caveat emptors. Compare that to the 380 listed as Pinks and 240 on the grey/other markets. I bet if you were to pull the volume number apart from the other markets I listed above, most of it would be in the 18 FINRA OTCBB companies rather than the 9,148 other gray market securities.

Thanks for the book. It's pretty simple to me. They charge to report and are acting as a regulator. The market has been destroyed by them the last couple of years. What's better a person invested in a company that can now not even function because of the lack of liquidity. The person that now gets the pleasure of an RS to have shares clear. If people want transparency go trade NYSE or NASDAQ. If OTC markets group were looking out for the investor they would at least offer companies a way to report basics and stay yield on thier bogus site. They killed the pinksheets market as well as the investors they supposedly were trying to protect.

Very true, but I fail to see how they do that when the cost is about half that of the previously FINRA sponsored OTCBB. What would you rather a company do, attempt to list of NASDAQ? Ain't going to happen, most of these companies are trading OTC because they don't have the liquidity. Same reason why none of these companies are going to list on DirectEdge or BATS. I know of companies that stopped cross listing on FINRA's OTCBB simply because the cost was no longer competitive compared to OTC Market Link. Maybe you will be happy once the OTCBB sale is complete, but I doubt it (especially considering it was bought by a market market - cannot remember the name off the top of my head).

And, you're right, OTC Markets is not a regulatory authority, but they have effectively filled that role in the last year or two as they have stratified the market. Notice what they are doing: they are giving investors clues as to the transparency/stability of a compnay. Investors now know there are a some "quality" investments now. They can easily get clued in as to whether a company is grey market, pink sheet, or has some actual value - like OTCQX or OTCQB (which do comply with SEC standards). You can particularly look at OTCQX and the quality ADRs that have been listed there: Adidas, Roche, d Deutsche Telekom. One of my favorite ADRs is a pinkie: Opera Software (OPESY).

I don't know how long you have been trading, but I remember the off-Wall Street market (that's what I call it - you can call it OTC if you want) of three years ago (when Pink Sheets was the name), five years ago, and 10 years ago (just before real-time quotes). The market has evolved a lot in the last two years or so - in part because of the stratification that is going on, and that can be shown by what has happened in FINRA's OTCBB: only 28 companies are solely listed on that, whereas like 95% of all OTC companies were listed on OTC Markets ECN. So, OTC companies are shit in general, but at list we have some clues now as to compliance, transparency, and legitimacy.

Be a regulator, but don't extort companies and promote yourself as a regulator when you have no authority. They are a joke and have made the markets worse actually.

Low float, look at amount of shares outstanding, then look how much is in

Number of shares authorized 14,000,000

Number of shares outstanding 10,467,922

Number of shares freely tradable 5,484,086

Total number of beneficial shareholders 244

Total number of holders of record 120

If you dive down further into the float, most of it is owned by management. So there is really nothing to trade with.

Yeah, god forbid their be a regulator in what would otherwise be dark markets.

OtcMarkets is such a crock, but I guess they are making money, by forcing payments to them otherwise you get the Skull and Crossbones

CARR SECURITIES CORPORATION

14 VANDERVENTER AVENUE, SUITE 210

PORT WASHINGTON, NEW YORK

PHONE 516-944-8300

FAX 516-944-9029

December 17, 2009

Ms. Elizabeth M. Murphy

Secretary

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549-1090

Re: Comments to Securities Exchange Act Release No. 60999

File No. SR-FINRA-2009-077

Dear Ms. Murphy:

I write to express my strong opposition to FINRA’s proposal to establish a Quotation Consolidation Facility (QCF). This is a bad idea that will raise trading costs without providing any benefits, do nothing to improve regulation of the OTC markets and create unnecessary confusion among investors.

I am the head trader at Carr Securities Corporation, a small broker-dealer located in Port Washington, New York. We are primarily engaged in the trading of OTC equity securities and are active users of Pink Quote and the OTCBB, which are the only interdealer quotation systems operating in the market for OTC equity securities.

I also have a substantial personal investment in Pink OTC Markets Inc., the owner of Pink Quote. I made an initial investment in Pink OTC’s predecessor, National Quotation Bureau, in 1997 when new management acquired the business. I made this very risky investment with the expectation that new management would establish a badly needed, modern interdealer quotation system in the OTC equity market. I hoped that the interdealer quotation system to be established by Pink OTC would provide some meaningful competition to the OTCBB, which was suffering from neglect by the NASD, its owner at the time.

Pink OTC established its interdealer quotation system in 1999 and has continued to improve its functionality, reliability and speed, as well as reducing the costs of using it. In contrast, I can’t think of a single improvement in the OTCBB that has been made by the NASD, or its current owner FINRA, during the same period. As a result, like most other firms with trading operations in the OTC equity markets, we have shifted most of our business away from the OTCBB and into Pink Quote.

1

FINRA now proposes to shut the OTCBB down. This is not necessary. I doubt that any firm will continue to use it much longer anyway. The proposed QCF is not a replacement for the OTCBB. It is instead a costly, useless and potentially misleading system for reporting a consolidated NBBO. When the OTCBB ceases to operate, Pink Quote will be the only surviving interdealer quotation system in the market for OTC equity securities. The QCF’s publication of an NBBO can do nothing more than duplicate the NBBO already published by Pink Quote somewhat earlier in time. If the difference in publication times results in a different NBBO, investors will be misled or at least confused, since the difference in prices would be attributable solely to differences in dissemination times.

It is unrealistic to suppose that another interdealer quotation system will emerge in the foreseeable future to compete with Pink Quote. FINRA was required to launch the OTCBB in the first place because no private entity believed it would be profitable to operate an interdealer quotations system in the OTC market. The market for OTC equity securities is a difficult environment, and it is not clear that there are sufficient revenues available to support another system. It took years for Pink OTC to develop a profitable system, and it may be a very long time before any other entity decides to provide a competitive system. In the meantime, there is no reason to institute a QCF to consolidate quotations, when there is nothing to consolidate.

It is therefore extremely frustrating that FINRA seeks to charge our firm a position fee for securities that we quote in Pink Quote. This fee is apparently designed to replace the revenues lost due to the business failure of the OTCBB, or perhaps to punish the industry for shifting business away from FINRA’s OTCBB system to Pink Quote, FINRA’s competitor. These are not valid reasons to impose this position fee. In any event, if FINRA had invested a small portion of the position fees we have already paid to improve the OTCBB, the industry might have continued to use it.

The position fee will only be charged when a quote is published on Pink Quote. This will cause fewer quotes to be published and cause more OTC equity securities to be traded in the gray market. It is much more difficult for investors to monitor execution quality when their orders are not displayed in the public markets.

The industry has shifted to Pink Quote because it is a better system that enables firms like ours to provide our customers with best execution. FINRA’s QCF will add nothing to execution quality. The QCF does not serve any valid regulatory purpose because FINRA already has access to quotations published on Pink Quote under FINRA Rule 6330. It is an outrageous abuse of FINRA’s regulatory power to punish us because we shifted out business to a competitor’s system to satisfy our obligation of best execution.

Moreover, as a shareholder in Pink OTC, I am outraged that the intellectual property lawfully developed using my investment dollars and owned by Pink OTC is being taken without compensation. This reduces by fiat the value of my investment

2

without providing any corresponding benefit to the public. I believe this violates the U.S. Constitution. It is also extremely unfair and smacks of dictatorship.

I urge the Commission to reject FINRA’s unlawful proposal. Please call me at (516) 944-8300 if you have any questions.

Very truly yours,

Walter P. Carucci President, Carr Securities Corp

http://www.sec.gov/comments/sr-finra-2009-077/finra2009077-4.pdf

Does anyone understand why OTCM trades so thinly? It's almost painful to look at the historical trading record

http://ih.advfn.com/p.php?pid=historical&symbol=OTCM

Maybe Krauts should buy this instead of NYSE

OTC Markets Changes Name.Related Quotes

Symbol Price Change

PINK.PK This symbol is now: OTCM.PK

{"s" : "","k" : "a00,a50,b00,b60,c10,g00,h00,l10,p20,t10,v00","o" : "","j" : ""} Press Release Source: OTC Markets Group Inc. On Tuesday January 18, 2011, 4:15 pm EST

NEW YORK, Jan. 18, 2011 /PRNewswire/ -- Pink OTC Markets Inc., operator of the largest electronic marketplace for broker-dealers to trade unlisted stocks, announced today that it has changed its name to "OTC Markets Group Inc." The Company's stock will continue to trade on OTCQX under its new symbol, "OTCM."

"As OTC Markets Group, we remain committed to providing broker-dealers, OTC-traded companies, advisors and investors with high-quality information and innovative technology services," said R. Cromwell Coulson, President and Chief Executive Officer. "Pink will always be a part of our history, and we will continue to use it to describe our lowest, speculative market tier. Today, our market is also home to a more investor-friendly group of companies that have chosen the quality-controlled OTCQX. The name change will attract better companies to our higher tiers and expand our opportunities to have other classes of unlisted securities on our platform."

"Our transformation began with the idea that allowing broker-dealers to electronically quote and negotiate trades in Pink Sheets securities would be a great improvement for all market participants," Mr. Coulson continued. "We built a network that allows leading broker-dealers to easily provide the best prices to investors, advertise their liquidity, and trade directly with their competitors. Next, we improved the investor experience by introducing market tiers to segment the OTC markets by levels of investor engagement and transparency. Companies choose which tier they qualify for based on the amount and quality of information they provide to investors. Investor focused companies are now incentivized to provide greater information to the marketplace so they can rise to the highest possible tier. With these fundamental changes, our information network brings transparency and connectivity to the unlisted markets."

The name change was previously approved by the Company's Board of Directors and shareholders in November 2010. The Company's interdealer quotation system, formerly known as Pink Quote, will now become OTC Link, and will also encompass the Company's trade messaging service, formerly known as Pink Link.

"The word 'Sheets' will be dropped from the description of our OTC Pink lower market tier to reflect the dynamic, real-time nature of the electronic marketplaces we operate. We will, instead, use the name Pink Sheets to refer to our historical static quote and reference price database as recognition of our long history as an information source to the financial markets," said Mr. Coulson.

In connection with its name change, the Company is releasing a new logo:

(Logo: http://photos.prnewswire.com/prnh/20110118/MM31963LOGO )

In 2010, securities on OTCQX, OTCQB and OTC Pink traded $144 billion in dollar volume, making OTC Link the third largest U.S. equity trading venue after NASDAQ and the New York Stock Exchange. The combined market capitalization of securities traded on our venue is over $10 trillion.

Launched in 2007, OTCQX is the highest OTC market tier, and today accounts for 14% of the dollar volume traded in all stocks on the Company's platform. More recently, the Company introduced the OTCQB market tier to help investors identify OTC-traded companies that report to the SEC or banking regulators.

"We are proud of our success in increasing the availability of information to investors, and will continue to work to make the OTC marketplace open, transparent and connected," concluded Mr. Coulson.

About OTC Markets Group

OTC Markets Group Inc. (OTCQX: OTCM) operates the world's largest electronic marketplace for broker-dealers to trade unlisted stocks. Our OTC Link platform supports an open network of competing broker-dealers that provide investors with the best prices in over 10,000 OTC securities. In 2010, securities on OTC Link traded over $144 billion in dollar volume, making it the third largest U.S. equity trading venue after NASDAQ and the New York Stock Exchange. We categorize the wide spectrum of OTC-traded companies into three tiers– OTCQX (the quality-controlled marketplace for investor friendly companies), OTCQB (the U.S. reporting company marketplace for development stage companies), and OTC Pink (the speculative trading marketplace) -- so investors can identify the level and quality of information companies provide.

To learn more about how we make the OTC market more efficient and transparent, visit us at www.otcmarkets.com

Congrats four id like to be assistant

No action here, the board was created in 03

pinksheets shows share prices 5.97x 6.22

why does this board come up as royce micro

otcm changes name to otc markets group

Gotta love it, as I predicted, just another Pinkie Scam. Should list themselves on the OTCBS market instead of the OTCQX4.9 market.

Pink OTC Markets Announces It Will Restate Previously Issued Financial Statements

Aug 6, 2010

Pink OTC Markets News Service

New York - August 6, 2010 - Pink OTC Markets Inc. (OTCQX: PINK) announced today that the Company has determined that previously issued financial statements as of and for the years ended December 31, 2006 and 2007 for Pink Sheets LLC, and 2009 for Pink OTC Markets Inc., the balance sheet for the year ended December 31, 2008, the statements of income, changes in shareholders’ equity, and cash flows for the nine months ended December 31, 2008 as to Pink OTC Markets Inc. and the three months ended March 31, 2008 as to Pink Sheets LLC, and the interim financial statements for the quarters ended March 31, 2008, March 31, 2009, June 30, 2009, September 30, 2009 and March 31, 2010, should no longer be relied upon due to errors in the financial statements related to the validity of certain of its accounts receivable. As a result, the Company will restate the affected financial statements to make corrections to prior-period retained earnings for the year ended December 31, 2006 as well as to operating results for all subsequent reporting periods.

The decision to restate the Company’s financial statements was made by management and the Audit Committee of the Board of Directors, following consultation with Pustorino, Puglisi & Co., LLP, the Company’s independent auditing firm, on August 5, 2010.

The Company has determined that approximately $1.3 million in accounts receivable from the Company’s Market Data Licensing line of business may be uncollectable primarily due to errors in collection procedures for market data sales reported by third-party vendors during the period from 2003 through 2008. It is estimated that the after-tax effect on operating results for the years 2003 through 2008 will be a net reduction of a total of approximately $800,000. The Company concluded that proper control procedures were not followed due to the lack of segregation of duties within its Accounting department.

The errors in collection procedures took place for market data sales prior to 2009. In late 2008, the Company retained a third party reporting service through which market data vendors report usage, and in early 2009 the Company upgraded its billing and accounting system and revised its collection procedures.

The Company has subsequently upgraded the personnel in its accounting department, hiring Todd A. Graber as Chief Financial Officer in May of 2010 and Mary Phelan as Corporate Controller in July of 2010. Mr. Graber and Ms. Phelan, both Certified Public Accountants, each have extensive experience in leadership roles with public company accounting departments including the proper establishment and oversight of control procedures.

The Company also plans to undertake remedial action, including:

Making outstanding accounts receivable and aging reports accessible and transparent to senior management;

Establishing policies regarding accounts receivable collection, and eliminating service to customers not in compliance with Company policy; and

Providing a comprehensive accounts receivable report to senior management on a weekly basis, and to the Board of Directors on a quarterly basis.

The Company does not anticipate that the restatement will delay the publication of earnings for the second quarter of 2010. Subsequently, the Company expects to present the restated results for the years ending December 31, 2007 and December 31, 2009, as well as the balance sheet for the year ended December 31, 2008, the statements of income, changes in shareholders’ equity and cash flows for nine months ended December 31, 2008 as to Pink OTC Markets Inc. and the three months ending March 31, 2008 as to Pink Sheets LLC, in an audited annual report, and present the restated results for the quarterly periods ended March 31, 2009, June 30, 2009, September 30, 2009 and March 31, 2010 in restated quarterly reports, as well as provide pro-forma summary numbers for the year ended December 31, 2006.

For more information, contact Todd Graber at (212) 896-4446 or by email at todd@pinkotc.com

About Pink OTC Markets Inc.

Pink OTC Markets Inc. (OTCQX: PINK) operates the leading electronic interdealer quotation and trading system for over 9,000 securities not listed on a U.S. stock exchange. Pink OTC Markets segments these securities into three tiers: the quality-controlled OTCQX marketplace, the U.S. registered and reporting OTCQB marketplace, and the speculative trading Pink Sheets marketplace. These three tiers constitute the third largest U.S. liquidity pool for trading public company shares, after The NASDAQ Stock Market, Inc. and The New York Stock Exchange. Our products and services promote market transparency, improve price discovery, facilitate regulatory compliance, and increase the quality of issuer disclosure, to the benefit of all OTC market participants. To learn more about how Pink OTC Markets’ products and services make OTC markets more transparent, informed, and efficient, please visit our websites at www.otcmarkets.com, www.pinkotc.com and www.otcqx.com or contact us at info@pinkotc.com

http://www.otcmarkets.com/about/news.jsp?id=248

Question:

If a OCTBB company goes to the pinksheets because of the costs associated with, can it still report financial information at no cost on through pinksheet filings? Thx

I'm down 20 percent on it. These guys need to get to pumping! They should send some SPAM messages out then put a caveat emptor on themselves.

They uplifted to their OTCQX whatever it is and the stock didn't change at all.

I may not like the color Pink but i sure as hell do like this Stock!

![]()

Peace

|

Followers

|

22

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

281

|

|

Created

|

10/26/03

|

Type

|

Free

|

| Moderators | |||

CAVEAET EMPTOR

BUYER BEWARE:

THERE IS A PUBLIC INTEREST CONCERN ASSOCIATED WITH THE COMPANY, WHICH MAY INCLUDE A SPAM CAMPAIGN, QUESTIONABLE STOCK PROMOTION,

KNOWN INVESTIGATION OF FRAUDULENT ACTIVITY COMMITTED BY COMPANY OR INSIDERS, REUGLATORY SUSPENSIONS, OR DISRUPTIVE CORPORATE ACTIONS

THE PROBLEM

The level of uncertainty displayed on these situations is untenable. An investor cannot consume his time and mind resources caring about how his stocks will handle common corporate actions.

He cannot consume his time and mind share worrying that the handling of corporate actions in his unsponsored ADRs will be anything buy perfectly in line with what happens on the underlying stock, or any other stock or ADR.

The result of this uncertainty is obvious: The investor will take his business elsewhere. He'll either take it to the underlying markets or to other stocks altogether.

For OTCM, the result also is obvious. These unsponsored ADRs, whose number of listings has been growing strongly, will fail to ultimately catch the fancy of investors.

These stocks will turn into low-volume listings which will be prone for litigation, as investors are UNJUSTLY BURNED on them due to non-transparent handling of common corporate actions. As a result, adoption of their use will suffer.

CONCLUSION

The present handling of corporate actions on unsponsored ADRS quotes in OTCM's Pink Sheets segment (originally wrongly stated as the OCTQX segment) is wildly flawed. This handling of corporate actions will ultimately burn the segment.

While ultimately depositary banks are guilty of these flaws, for OTCM whoever is guilty is irrelevant. The fact is that an investor cannot spend his resources trying to understand if his stock will behave like the rest of the supposedly pari-passu stock on the same company.

Mishandling of these corporate actions presents the risk of loss for investors dabbling in them, at no fault of their own.

I believe this is an underappreciated problem for OTCM, which will become a large obstacle to its continued growth. A strong stance on this issue, with the guarantee of transparent corporate events, is the only thing which can save this segment over time.

https://seekingalpha.com/article/4056605-otc-markets-group-wasting-good-opportunity

INVESTORS BEING BURNED CONTINUOUSLY BY OTCM's "AGENDA"

OTCM is not obligated to vet any of the stocks they quote. And only FINRA and the SEC can legally halt all brokers from trading in a company's shares.

In Cynk's case, OTCM flagged the stock with a "caveat emptor" skull and crossbones symbol on July 9, after Cynk's shares had more than doubled. Cynk shares thus traded another day, rising as high as $21.50; they'd traded as low as $0.08 last year.

The SEC issued its halt order July 11. "I Tweeted on Thursday saying it was not a question of if the SEC halts this, it's when," Coulson said. "It was going to trade at some ludicrous level for some amount of time — which was a day —

the SEC was going to halt it, and everyone involved in that stock are going wish they weren’t involved."

"If you point to the people who were buying Cynk and told them, You really should buy [a community bank], this great bank that pays dividends, that's close to you, you might even be a depositor there — they’d tell you that’s boring."

OTC Markets Group Acquires theOTC.today to "Help Investors"

http://www.otcmarkets.com/stock/OTCM/news?id=160544

"Manipulative stock promotion harms all public markets. This acquisition continues our strategy of increasing the quality and availability of unique market data to help investors, broker-dealers and regulators make better informed decisions," said R. Cromwell Coulson, President and CEO of OTC Markets Group

http://www.theotc.today

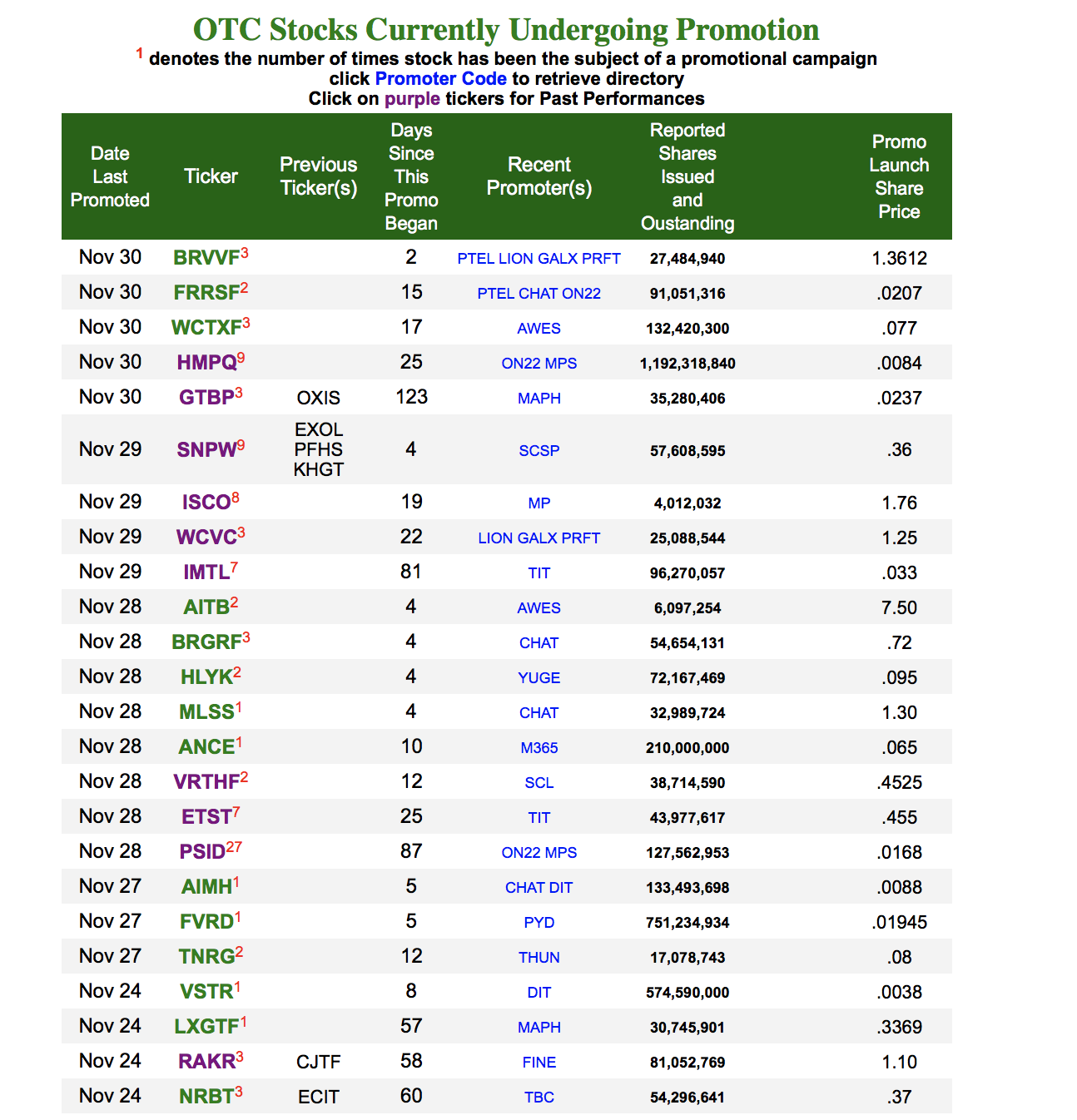

OTCM GETS ACCESS TO A "PROMOTERS" LIST SO THEY CAN USE IT TO LABEL STOCKS AS "CAVEAT EMPTOR."

THEY CLAIM TO BE INVOLVED IN THE BUSINESS OF VERIFICATION, BUT WHO IS VERYIFYING THEIR ACTIONS?

Murky Corner of U.S. Stock Market Takes Step to Clean Up Fraud

November 7, 2017, 2:10 PM EST

OTC Markets Group Inc., which runs markets for over-the-counter trading in more than 10,000 securities, released a new policy on Tuesday to stem fraudulent stock promotion --

or ginning up positive attention for a security, while being compensated in secret by the company itself.

Companies were reminded they need to make timely disclosures about important developments, which includes dispelling anything misleading spread by promoters.

Earlier this year, the U.S. Securities and Exchange Commission went after 27 individuals and groups that promoted stocks, including on investing websites like SeekingAlpha.com.

The SEC said the fraudulent promoters gave the impression they were providing independent analysis while secretly taking payments for their work.

The SEC agreed to several settlements, including one of almost $3 million.

“This is a problem, so for us to show leadership on improving transparency is a good thing,” Cromwell Coulson, president and chief executive officer of OTC Markets, said in an interview.

To address the issue, OTC Markets says it will start flagging dubious securities that are being promoted in the first quarter of 2018.

It will also start asking some companies that are the subject of stock promotions to notify investors.

If OTC Markets deems them a threat, they’ll be labeled with a skull-and-crossbones icon on its website.

(That buyer-beware signal is already used on the site, but this broadens the use.)

https://www.bloomberg.com/news/articles/2017-11-07/in-a-fraud-addled-part-of-stock-market-clean-up-attempt-arrives

Facts and circumstances may differ, however generally, OTC Markets Group will remove the Caveat Emptor designation once the company meets the qualifications for Pink Current Information, has verified the information on its company profile on www.otcmarkets.com, and demonstrates that there is no longer a public interest concern. The Caveat Emptor designation is typically not removed within the first 30 days. During the time it is labeled Caveat Emptor, any stock that is not in Pink Current Information will also have its quotes blocked on www.otcmarkets.com.

OTC Markets Group monitors for potential promotional activity relating to securities trading on our markets.

We review for anonymous paid promotions, possible connections to bad actors, and evaluate the promotions potential impact on trading.

A company whose security is being promoted may not be directly involved or even aware of a promotion campaign for their securities,

however all public companies have an obligation to provide accurate disclosure to investors and quickly address any misleading information that could affect the trading market for their securities.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |