Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The stock price jumps .08 and not a single post? No comments?

ha-ha indeed but still so peculiar if true.....

Market is factoring in a Trump win (the undoing of anything having to do with electricity)

Altho actually now that I think about it some more.....

It's almost certainly just mainly largely attributable to cryptos......Trump would just be icing on the cake.

There WAS once a time when people would speculate on "resources".....

But yeah, good point about the irony of it all.

Question is......Will there EVER be a revival of speculation in commodities.

Because, it SEEMS LIKE one WILL NEED TO at least (eventually) manifest !

Anyways, thanks for your thoughts......Fare well !

.

.

I agree with your statement "Theory = Market is factoring in a Trump win (the undoing of anything having to do with electricity)

Bottom-line tho for a long time has been (from a technical perspective at least), is that commodity and market-timing-wise, it's just "all-about" monitoring Canadian Resource Indexes

The Cryptos have decimated participation in commodities"

The irony about the whole scenario is cryptos complete reliance on endless electricity.

No electricity=no crypto...

crypto has become one of the biggest new creators of carbon emissions

futr

Struggling with nameplate plus who in the heck knows what carbon's going for these days ?

https://www.nextsourcematerials.com/nextsource-materials-provides-update-on-molo-graphite-mine-commissioning/

The lithium market's been under complete decimation

Same I imagine with manganese & nickel

Theory = Market is factoring in a Trump win (the undoing of anything having to do with electricity)

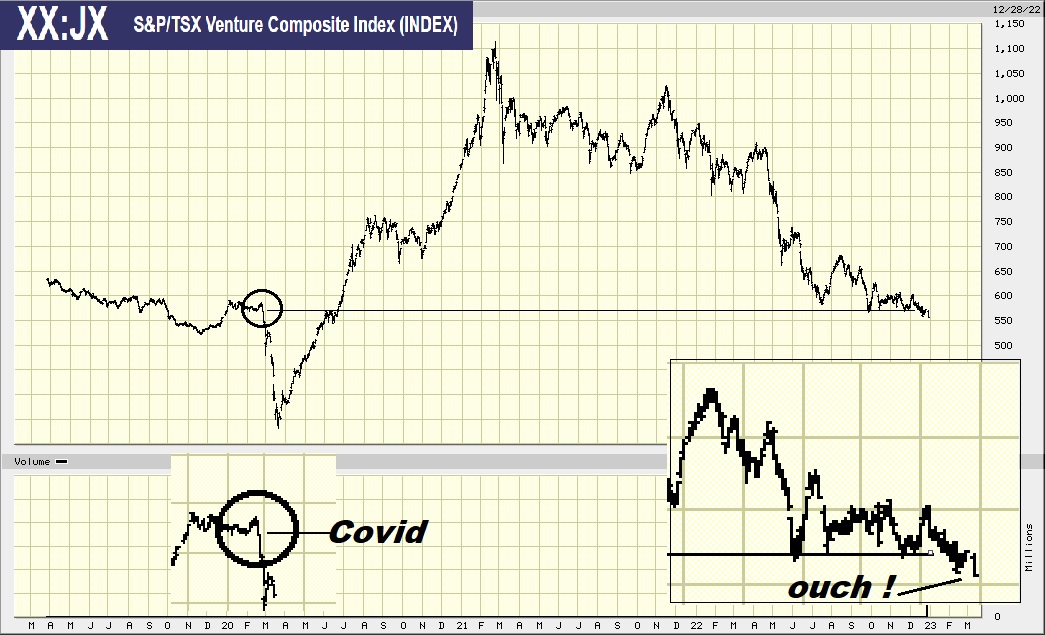

Bottom-line tho for a long time has been (from a technical perspective at least), is that commodity and market-timing-wise, it's just "all-about" monitoring Canadian Resource Indexes

The Cryptos have decimated participation in commodities

December 2022

November 2023

February 2024

Revisit the 500 at least - maybe worse

.

Price is now at 61 cents after a little flush to 52.5 cents.

I started a small position just to keep my eyes on how the project is progressing after share

price has been washed out. The financing for the expansion of the mine is the one thing that

concerns me in terms of how they will mitigate the dilution. Will they get an joint partnership on

the Green Giant (vanadium rich deposit) to finish out the drilling of proven and probable??

Yeesh https://www.nextsourcematerials.com/nextsource-materials-provides-update-on-molo-graphite-mine-commissioning/

Looks like they're just gonna wind up making PENCILS

They're just gonna become a damned PENCIL manufacturer

.

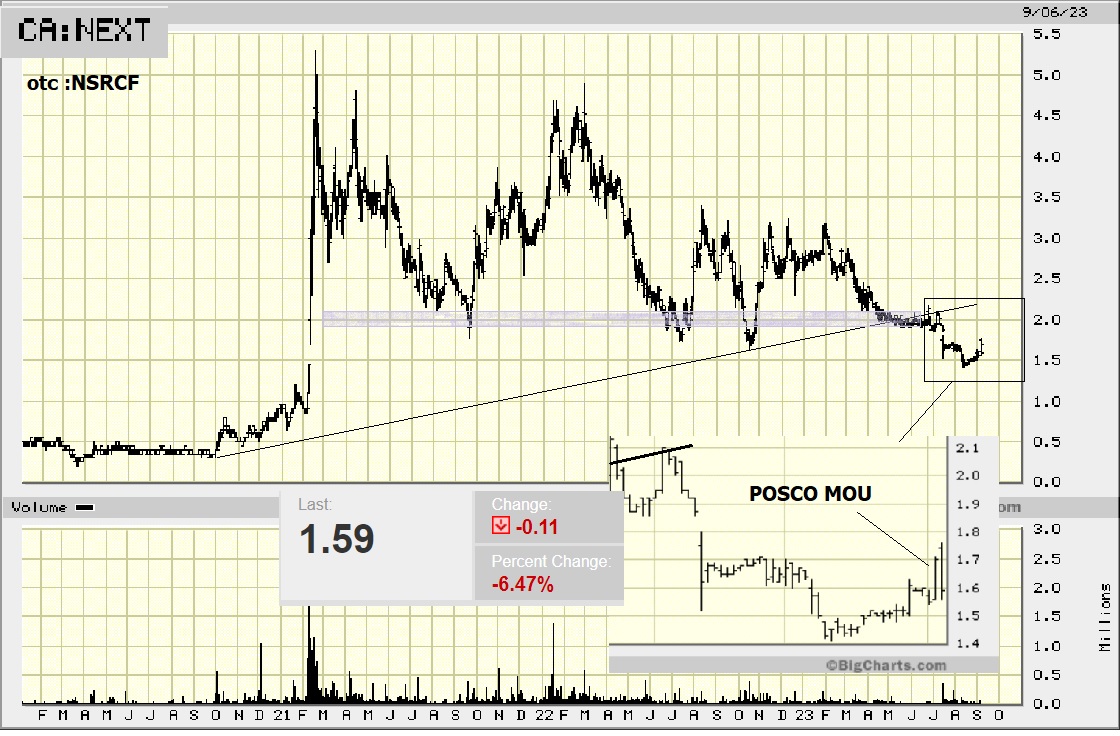

Looks like today may be a good day to re-enter a position in NEXT after its very weak stock performance the past few years.

Appears to be a bottom to me, and washed out.

NEXTSOURCE MATERIALS ANNOUNCES FIRST BULK SHIPMENT OF SUPERFLAKE® AND FULL OPERATION OF ITS SOLAR HYBRID PLANT AT MOLO GRAPHITE MINE

NEWS RELEASE – TORONTO, October 23, 2023

NextSource Materials Inc. (TSX:NEXT) (OTCQB:NSRCF) (“NextSource” or the “Company”) is pleased to announce it has made its first bulk container shipment of SuperFlake® graphite from the Company’s Molo Mine (“Molo”) in Madagascar.

This first shipment of Molo SuperFlake® graphite has been sent to the Company’s downstream technical partner’s Battery Anode Facility (BAF) to be processed into spheronized, purified graphite (SPG) that will then be further processed into coated SPG (CSPG) as part of large scale, multi-step verification tests being conducted by automotive EV supply chains in South Korea and Japan. The Company expects to receive its first series of verification test results starting in December 2023.

Shipment-of-SuperFlake

Solar Hybrid Plant Now Fully Operational

The Company is also pleased to announce it has completed commissioning and achieved full operations of its solar and battery hybrid power plant (the “Solar Hybrid Plant”) at Molo. The Solar Hybrid Plant is owned and operated by CrossBoundary Energy (CBE) under a 20-year power purchase agreement and comprises a 2.69 MWp solar photovoltaic array (“PV array”) combined with a 1.37 MWh battery energy storage system (BESS), and a 3.1 MW thermal (diesel) generator plant. The entire PV array, incorporating 4,902 photovoltaic panels covering an area of 12,663 square metres (~1.3 hectares), has been fully integrated with the BESS.

Together with load balancing provided by the BESS, the Solar Hybrid Plant will be capable of supplying up to 100% of the Molo processing plant’s power requirements during peak daylight hours, with the thermal facility supplying all baseload and off-peak power requirements, to ensure uninterrupted power supply to the mine.

The Solar Hybrid Plant has a dedicated connection to the mine camp and all auxillary buildings ensuring maximum usage of renewable energy generated. The Solar Hybrid Plant will be able to provide up to 35% of Molo’s complete system power needs from renewable energy, significantly reducing all-in sustaining costs and carbon emissions by 2,275 tonnes annually.

President and CEO, Craig Scherba, commented:

“Completing our first bulk shipment is a significant accomplishment and the result of the hard work and dedication of our operations team. As we continue the optimization phase of the commissioning process and towards rampup to nameplate production capacity for Phase 1 of Molo mine operations, NextSource is well positioned to play a critical role in the global, sustainable lithium-ion battery supply chain that is expected to see exponential growth over the next few decades. We are also delighted to have completed commissioning of our Solar Hybrid Plant, which will enable us to significantly reduce our carbon emissions and all-in sustaining costs. NextSource is committed to playing our role in global decarbonization.”

The Solar Hybrid Plant will generate clean power to a capacity of 4 GWh, with the current PV array designed with extra capacity such that no expansion of the PV array will be required for Molo production capacity increases of up to 32,000 tpa.

NextSource and CBE are committed to optimizing the solar component and increasing the amount of renewable energy available to the mine, which could include expansion of the Solar Farm or installation of wind turbines. In support of this, CBE has installed a wind measuring LIDAR device to evaluate the wind resource at the site and studying the feasibility of adding wind generation in the short term. As part of any potential future expansion of the Molo mine, the Company has set a goal of increasing the percentage generated by renewable power to at least 50 percent.

ABOUT NEXTSOURCE MATERIALS INC.

NextSource Materials Inc. is a battery materials development company based in Toronto, Canada that is intent on becoming a vertically integrated global supplier of battery materials through the mining and value-added processing of graphite and other minerals.

The Company’s Molo graphite project in Madagascar is one of the largest known and highest-quality graphite resources globally, and the only one with SuperFlake® graphite. The Molo mine has begun production, with Phase 1 mine operations currently undergoing ramp up to reach its nameplate production capacity of 17,000 tpa of graphite concentrate.

The Company is also developing a significant downstream graphite value-add business through the staged rollout of Battery Anode Facilities capable of large-scale production of coated, spheronized and purified graphite for direct delivery to battery and automotive customers, outside of existing Asian supply chains, in a fully transparent and traceable manner.

NextSource Materials is listed on the Toronto Stock Exchange (TSX) under the symbol “NEXT” and on the OTCQB under the symbol “NSRCF”.

For further information about NextSource visit our website at www.nextsourcematerials.com or contact us at +1.416.364.4911 or email Brent Nykoliation, Executive Vice President at brent@nextsourcematerials.com or Aura Financial nextsource@aura-financial.com.

futr

Handy site indeed - Just learned of this today

https://www.stocktitan.net/news/NSRCF/next-source-announces-mo-u-for-strategic-collaboration-with-south-gc16yy97l9tt.html

Am in up at 2.81 there - LoL - Am down 43 percent !........

As you know - The Battery METALS Sector has NOT been much FUN !

Seems rather POSITIVE (gap has been filled), etc.

Thought they already HAD an MOU with someone tho.

MIGHT BE worth dollar-cost averaging on todays' pullback.....

And probably WOULD if it waren't for THIS status :

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172766145

.

NextSource Materials Plans Strategic Collaboration With Posco International

7:41 am ET September 5, 2023 (Dow Jones) Print

By Robb M. Stewart

NextSource Materials is moving toward a supply deal with Posco International and could see it receive an investment from the South Korean trading company.

NextSource said Tuesday it signed a nonbinding memorandum of understanding with Posco for a strategic collaboration that could involve an equity investment, as well as a long-term offtake agreement for spheronized and purified graphite and the company's other graphite products.

Certain technical and economic studies will need to be completed before a definitive agreement, NextSource said.

The memorandum proposed a definitive deal for 30,000 metric tons a year of NextSource's SuperFlakegraphite concentrate and 10,000 to 15,000 tons annually of spheronized and purified graphite over a 10-year period, which would be supplied to Posco's subsidiary responsible for electric vehicle battery businesses and supplies all of South Korea's major battery cell manufacturers with finished cathode and anode materials.

Write to Robb M. Stewart at robb.stewart@wsj.com

futr

I have been an optomistic share holder of this compamy for many years, thinking that their flake graffite would indeed fill a world wide need in the science and manufactuing communities. Unfortunately, this has not come to but I can hardley afford to sell out at these prices. When are they going to make a go of it?

Huh, that's some gap! I exited NEXT at around $3.30's canadian in June 2021. Has been on a very tough road.

sorry no $4 easy, more like a $1.62 Canadian after today's PR release on large dilution from 30 mil shares placement.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172335399

Big dilution too. off 13% Sweet Dilly won't be happy.

https://finance.yahoo.com/news/nextsource-announces-pricing-overnight-marketed-144900143.html

Yup - NEXT has become the next Syrah alright

https://www.nextsourcematerials.com/nextsource-materials-announces-first-production-of-superflake-graphite-at-molo-mine-in-madagascar/

But gee......I wonder what thier ACTUAL reasons are for selecting Mauritus as thier main operating location

Things to do ;

NextSource Materials Announces First Production of SuperFlake(R) Graphite at Molo Mine in Madagascar

NSRCF

-0.66%

NextSource Materials Inc.

Thu, June 22, 2023 at 7:00 AM EDT

In this article:

NSRCF

-0.66%

Watchlist

Watchlist

TORONTO, ON / ACCESSWIRE / June 22, 2023 / NextSource Materials Inc. (TSX:NEXT)(OTCQB:NSRCF) ("NextSource" or the "Company") is pleased to announce the first production of SuperFlake® graphite concentrate at its Molo mine in Madagascar.

President and CEO, Craig Scherba, commented:

"First production of our SuperFlake® graphite is a significant achievement for NextSource and a testament to the dedication and hard work of our commissioning and operations teams, our employees and contractors, as well as the ongoing support that we have received from the local community and government. As we ramp up the production stage of operations, the Company is in the enviable position of transitioning into a significant and sustainable global producer of high-quality graphite and anode material just as demand for their use in lithium-ion batteries is growing exponentially."

NextSource Materials Inc., Thursday, June 22, 2023, Press release picture

Molo mine workforce alongside first tonne of SuperFlake® graphite concentrate

As part of the commissioning and optimization of the processing plant, the commissioning sequence was prioritized for initial production of coarse flake concentrate, with the first tonne of production consisting of +48 mesh (jumbo size) SuperFlake® graphite.

Since initiation of plant commissioning on March 23, 2023, the commissioning and operations teams have progressed methodically through debottlenecking and optimization activities. The operations team will now shift their focus to ramping up the plant throughput to its nameplate capacity of 17,000 tonnes per annum.

The Company expects to sell all the flake graphite produced at the Molo Graphite Mine to key customers under existing offtake agreements, which includes Germany's thyssenkrupp Materials Trading GmbH and the Company's Japanese technical partner, whom is the main supplier of value-added graphite to Japan's largest anode processor that in turn supplies multiple Japanese and international OEMs with graphite anode material.

The Company continues to be engaged in advanced discussions with several major EV companies (OEMs) and has received requests for multi-tonne samples of battery anode material as part of the OEMs qualification process. As such, the Company will begin sending flake graphite qualifying material to its Battery Anode Facility (BAF) technical partners for conversion into coated, spheronized, purified graphite ("CSPG"), which is the final form of anode material that is assembled along with cathode material into finished lithium-ion batteries used in electric vehicle ("EV") applications.

Mauritius Battery Anode Facility and Global BAF Strategy

The Company announced on February 28, 2023 its strategy for the staged buildout of a series of BAFs in key geographic locations. The BAFs are value-added processing facilities that convert flake graphite into CSPG.

BAF Strategy Highlights:

Plans to construct multiple BAFs capable of producing CSPG anode material for use in lithium-ion batteries for EV applications in key jurisdictions. The BAF designs will leverage the Company's exclusive partnership with two leading value-added graphite processors and use their proprietary and well-established graphite anode processing technology, which currently produces CSPG for the supply chains of major OEMs, including Tesla and Toyota.

The first BAF will be in Mauritius (the "Mauritius BAF"), which was selected due to its proximity to the Molo Graphite Mine in Madagascar and its position on strategic shipping routes to Asian markets.

A long-term industrial lease has been signed to build the Mauritius BAF within an exisiting industrial facility in Port Louis, Mauritius. The BAF site location is also classified as an Industrial Freeport, with a 3% corporate tax rate and 0% VAT.

A technical study for the Mauritius BAF with an initial production capacity of 3,600 tpa (Line 1) of CSPG (the "Mauritius BAF Technical Study") dated February 28, 2023 estimated initial capital costs and working capital investments of US$32.8 million and annual revenues at US$33.7 million with an EBITDA of US$13.2 million. The resulting post-tax economic results demonstrated an NPV of US$106.9 million using an 8% discount rate, an IRR of 42.7% and a payback of 2.2 years.

Adding 3 additional lines (Lines 2,3,4) to the Mauritius BAF for a total capacity of 14,400 tpa of CSPG demonstrated a total post-tax NPV8% of US$439.7m, incremental capex US$74m, IRR of 45.8%

Subject to obtaining necessary funding, completion of the front-end engineering and design (FEED) study, and completion of the environmental and social impact assessment (ESIA) process, the Company is targeting the start of a 12-month construction process in Q3 2023 resulting in potential initial production at the Mauritius BAF in Q3 2024.

Evaluation of the potential construction of a BAF in North America and initiation of the application process to access various financial loans and grants offered under Canadian federal and provincial programs and under the U.S. Inflation Reduction Act.

Evaluation of the potential construction of a BAF in the United Kingdom (UK) and initiation of the application process to access various financial loans and grants offered under the UK Government Automotive Transformation Fund.

Evaluation of the potential construction of a BAF in the European Union.

Evaluation and potential construction of an artificial graphite (AG) production facility, which would enable the Company to supply AG anode material along with natural flake-based anode material.

About NextSource Materials Inc.

NextSource Materials Inc. is a battery materials development company based in Toronto, Canada that is intent on becoming a vertically integrated global supplier of battery materials through the mining and value-added processing of graphite and other minerals.

The Company's Molo graphite project in Madagascar is one of the largest known and highest-quality graphite resources globally, and the only one with SuperFlake® graphite. The Molo mine has begun production, with Phase 1 mine operations currently being optimized to reach its nameplate production capacity of 17,000 tpa of graphite concentrate.

The Company is also developing a significant downstream graphite value-add business through the staged rollout of Battery Anode Facilities capable of large-scale production of coated, spheronized and purified graphite for direct delivery to battery and automotive customers, outside of existing Asian supply chains, in a fully transparent and traceable manner. The first of its Battery Anode Facilities will be located in Mauritius with initial production targeted in Q3 2024.

NextSource Materials is listed on the Toronto Stock Exchange (TSX) under the symbol "NEXT" and on the OTCQB under the symbol "NSRCF".

For further information about NextSource visit our website at www.nextsourcematerials.com or contact us at +1.416.364.4911 or email Brent Nykoliation, Executive Vice President at brent@nextsourcematerials.com or Craig Scherba, President & CEO at craig@nextsourcematerials.com.

Safe Harbour: This press release contains statements that may constitute "forward-looking information" or "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation. Readers are cautioned not to place undue reliance on forward-looking information or statements. Forward looking statements and information are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "potential", "possible" and other similar words, or statements that certain events or conditions "may", "will", "could", or "should" occur. Forward-looking statements include any statements regarding, among others, timing of, and completion of, commissioning the processing plant, construction of the Solar Hybrid Battery System, and commissioning of the Molo mine, timing of construction and completion of the Mauritius BAF and proposed timing of future locations of additional BAFs, timing and completion of front-end engineering and design and ESIA permitting, the economic results of the BAF Technical Study including capital costs estimates, operating costs estimates, payback, NPV, IRR, production, sales pricing and working capital estimates, the construction and potential expansion of the BAFs, expansion plans, as well as the Company's intent on becoming a fully integrated global supplier of critical battery and technology materials. These statements are based on current expectations, estimates and assumptions that involve several risks, which could cause actual results to vary and, in some instances, to differ materially from those anticipated by the Company and described in the forward-looking statements contained in this press release. No assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur or, if any of them do so, what benefits the Company will derive there from. The forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements, whether because of new information, future events or otherwise, except as may be required by applicable securities laws. Although the forward-looking statements contained in this news release are based on what management believes are reasonable assumptions, the Company cannot assure investors that actual results will be consistent with them. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

SOURCE: NextSource Materials Inc.

View source version on accesswire.com:

https://www.accesswire.com/762947/NextSource-Materials-Announces-First-Production-of-SuperFlakeR-Graphite-at-Molo-Mine-in-Madagascar

Good article

Explains a lot regarding the market for battery materials and prices

Fact is that declining prices for battery materials has an immediate impact on the bottom line of businesses selling the product

On another note...that modular plant sure looks impressive and state of the art...should have a positive impact on the business proposition over the long-term

futr

Seems like they're on drugs or something......(judging from the sp) https://www.fastmarkets.com/insights/nextsource-targets-2024-graphite-project

Robin Borley update on the molo graphite mine w/ pictures

https://www.linkedin.com/posts/robinborley_molo-graphite-mine-madagascar-activity-7057959332922990592-mh-B/?utm_source=share&utm_medium=member_ios

Yes, I'am sure your right ! I guess I need a little more patients.

Haven't heard anything. Apparently company management is busy getting mining and manufacturing up and running. Probably be another month or two before we get an update

Anybody hearing anything fun ? I'am feeling abit nervous.I don't know why, Sence I've been in it Sence the fall 2014 Energizing day's !!!

The whole scenario of bank loan was released by the company in a damn conference call and they even had some power point graph that is floating around somewhere maybe even be on the website. So dude everything you are saying is public information. You dont have any inside information. Your stupid polymer whatever company will also have forward looking statements and risks attached to the filings. So your whole argument is just silly. Move on. NSRCF$$

Hah, I'll keep taking your posts seriously, just like last year to buy from the $3's and downward and further downward to today's $1.95, as you though NEXT was soon, in few months to go to $4s and likely higher to $15 once they have graphite coming out of new mine. You provided great spurious vision 20-20 !

LOL forward looking statements yes. All companies have them. I have spoke with Brent not sure how speaking with him helps anything? You expect him to give inside information? You sure ask funny questions. Him like any other from any other company will only give you what they have released in SEC filings or to the public you aren't getting any special treatment trust me. Also he has never been reliable as they had other game plans long ago that didn't go as he said they would so his words dont mean shit. They can't give you anything else it is against the law. So what is the point of asking if I spoke to Brent? You feel special because you spoke with him? I mean the guy is easy for any shareholder to get ahold of or at least was. Bank debt is an obvious possible option as when you have functional machines, product and cash flow banks will lend money to companies based on expected cash flow. Banks dont lend money in this day and age to something risky not producing. Anyway you go around in circles and words. I know what I own and as I stated many times I have made a butt load of money here and will make a butt load more. You stick to your sky is falling scenario. You have investors holding 100s of millions in stock. The PPS slid before the $1 investors where even able to sell their shares so you can't blame price slide on the recent capitol fund raise. As stated before the company has done awesome maintaining PPS value. They can't do retail dilution it would drop the PPS to 2 cents as the current volume demand is way to low. You keep failing to understand the product they have will be sold for cash and they will have cash flow so your whole entire argument is just plane silly. But stick with it and keep investing in your 2024 polymer dont worry about NSCRF$$

But only time will tell. PPS speculation is much different then hypothetical speculation of what the company is going to do next.

The Company cautions that the PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability and there is no certainty that the PEA will be realized.

As I stated a few messages ago. NSRCF is very slow getting to production much much slower then they originally said to be in production. That has been dragged out. But if all goes as planned I for sure stick to the $4+ in next 3 months and I also stick to $15 tag if not much higher. But only time will tell. PPS speculation is much different then hypothetical speculation of what the company is going to do next. I have always worked upon info provided by the company. 50% from the high of course because they aren't generating any forging cash not to mention the whole entire stock market is down or sideways so I am sorry to say considering NSRCF has held up very very well. I guess you forgot it was trading at 2 cents before RS so you are leaving a lot out like when it ran from 2 cents to 48 cents which is $4.80 post RS. But anyway. Invest dont I dont care I am in it to win it no matter what you buy or dont. But your questions dont stimulate my mind or make me question where this is going. NSRCF

Well all I can say is your speculation, projections, educated guesses, or whatever you want to call it on Feb 4, 2022 (link below) were grossly incorrect. Instead of your $15, NEXT is down 50% from Feb 2022 highs to $1.95 (US, nsrcf). So, I agree, speculation on the company or share prices in the future "would be silly", or in fact, "very silly".

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167764043

Once they got investors it happened with ease. None of us knew if they where going to do a joint venture or just sell the property entirely to a larger miner at the time so there where lots of scenarios in the air. Point is Ease means investors forked up cash. Of course incentive was to get shares at half price. But big point is it wasn't done through retail dilution which would of destroyed the PPS. Matter of fact it is obvious those who bought these shares at a major discount not only exercised their right to invest more but they haven't sold. Because if they are selling our PPS would be shit already with the current low volume. So there is no exiting and anyone investing would have known through due diligence that volume then and now wouldn't support any profit selling of millions of dollars. Big difference between retail dilution and investor dilution. It isnt rocket science. It makes little difference if you are buying shares at$1 if there is no demand for the shares. If they dump those millions of dollars in shares now the PPS would sink below $1 and they would have zero profit. NSRCF

I may get things mixed up on whatever what is you invest in. But all good. I guess you just want to have hypothetical conversation. I dont run the company so for me to even speculate would be silly. I only know what they are doing now and the product they are producing and where that product fits into industry. NSRCF$$

I am not ignoring anything. I only work in here and now. I dont see them doing an interest based loan if that is what you are asking. Why would they. The investors that put money into the first tranche didn't have any issue with doing it on the second as they are getting deeply discounted shares that they can sell at any time for profit. Why wouldn't someone invest to get 100%+ back on their investment. Post I am making is I am not going to speculate who is going to invest. Reality is investors have already put multi millions of dollars in twice. Those both went through without a hitch. So when phase 2 gets there one driving force is they will already be producing product and bringing in cash to further back any investment. Why would they raise capitol now for phase 2 when phase 1 hasn't even been achieved? Makes little sense in my opinion. But I guess you are saying you want all the money to be there for both phases. What do they do with the money made on product from phase 1 flush it down the toilet?

I am more longterm, but my other key holding, which you believe is a fiber optic company (that made me laugh) is a proprietary polymer(s) that will revolutionize the Electro-Optical interface industry. Maybe when that one gets commercial in 2024 I'll look back at NEXT to see how they are progressing for long term buy and hold.

Just like everyone questioned how they going to finance phase 1. Yet it happened with ease for both amounts. Investors bought more and are heavily invested. NSRCF$$

I am not saying any of their mineral product has no value. It has tremendous value (SuperFlake graphite and Vanadium Green Giant holding; I originally bought in 2009 for Green Giant, then they ran into issues with how to roast and convert it easily....then discovered the graphite and that because the easiest past to a money making mine, as it is near surface, and easy to process). My premise is how are they going to do the CAPEX raise for Phase 2, which you keep ignoring. EOM

To add to the whole subject what is the point of investing if you dont think the company has product and potential to be cash flow positive? Are you saying NSRCF will go bankrupt? I dont understand any of the questions at all. This can be a short term/mid term/or long term play all require different investment strategies. Your questions seem to be long term and if so long term is golden in my opinion. Billions of dollars in resource no brainer. NSRCF$$

All speculative. As I stated in previous message shares have been handed out to board/management that was addressed if you go back and read. Again they have product. Are you saying the product has no value. Of course someone is going to be compensated for acquiring $hundreds of millions of dollars in investors. What makes you think they will be taking out loans? These are all speculative questions. Brent doesn't answer anything about phase 2 financing but he has mentioned cash will be there when needed to go. Phase projects are phase projects meaning they are done in phases. Whole point. I know about your fiber optic virtual world investment and I know when you sold. I have bought and sold here countless times and made a butt load of cash and plan to make a butt load more. That is only reality I know. I am not going to take a sky is falling investment strategy. That being said as inflation rises so will the price of graphite matter of fact you should probably research the coming demand for graphite alone with cobalt, nickel and lithium. research how much lithium has gone up in past 15 years and it will answer your questions more in my opinion. We dont just own worthless dirt. Vanadium is just icing on the cake but to even focus on that now isn't even realistic. One step at a time. Just like everyone questioned how they going to finance phase 1. Yet it happened with ease for both amounts. Investors bought more and are heavily invested. NSRCF$$

I'm bringing it up as a simple financial question. I sold my position at $2.7 US price June 2021, as I had a much more promising opportunity to pursue. That said, if you have been here that long, you know when Mic took over, he got a large chunk of shares (major dilution, Feb 2021) in order to help them just finance Phase 1. Phase 2 will cost how much? I forget, 80 mil? Do you realize we're in a much higher inflationary period today versus 3 years ago. What will the going rate be for debt in today's market? I'm just asking basic questions as a way to understand risks/barriers that need to be managed in order to get that 2, 3, 4x you are all talking about will happen very fast (months to year).

Have you are anyone else asked Brent about how they are going to approach the financing questions? The Vanadium property will need more work to prove out according to my last conversation with him 3 years ago. Maybe a JV. Haven't followed Vanadium prices lately, are they a lot higher?

Well if they managed to Get investors twice for Phase 1 I wouldn't worry to much about that. I guess we can expect the worse case scenario but I dont see why they would dilute when they have avoided it all this time. Outside of all the executives taking shares as paychecks they have managed well. Also we have damn product so cash will come from product and contracts. But not sure why you ask the question? You have been here awhile. I have been here since this was double zero long before URST even purchased the Africa property. Not many even know this traded that low because they came after. I been here since they promoted at monster truck rally and before. Never the less that is all I can offer on that subject as it is speculative. NSRCF$$

Any idea how NEXT is going to finance their high CAPEX Phase II modular expansion after Phase 1 is up and running? Dilutions or ??

Yeah as you see we have maybe 3 more months till the production is jamming. No bugs. There has been issues all along with access to power and access to roads. But those things are easily worked out as time passes. We are sharing a major road to port however the port itself has transformed massively and will more in future. Country is relatively stable so that is good. But dont forget this mine being used is a first of its kind for this industry. So even though it was preassembled in South Africa reassembly takes time and leveling all parts into place. There will be a few dry runs, then dirt runs to test everything in coming weeks. But I suspect we beat the 3 month processing date even though NSRCF has nearly always been behind on dates. However cash is there so it is really about how good the ground team is and as far as I know ground team has some seasoned players for a desert island in Africa. Hold strong we got $4+ plus coming very soon should be easy 100% in next 3 months then if you hold out long term much more IMO. $NSRCF

ya we have good news now!!!!

Are the bugs large or small ? Thats the question !!!

Obviously there's been some bugs to fix.....

Does'nt look to promising to me as no new updates. AS it is 3mo with no progress reports as they promised !!!!

|

Followers

|

121

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

14019

|

|

Created

|

01/03/07

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |