Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hello,

What ever happened to this? Will this forever be abandoned or what?

(fka MFST): Final Judgment Entered Against Medifirst Solutions, Inc.

https://www.sec.gov/litigation/litreleases/lr-25886

https://www.sec.gov/files/litigation/complaints/2023/comp25886.pdf

Is there anything going on with this company or is it done?

(fka MFST): SEC Litigation:

https://www.sec.gov/litigation/litreleases/2022/lr25446.htm

SEC complaint:

https://www.sec.gov/litigation/complaints/2022/comp25446.pdf

SEC Sues New York Based Firm and Its Managing Member for Acting as Unregistered Securities Dealers

Litigation Release No. 25410 / June 7, 2022

Securities and Exchange Commission v. LG Capital Funding, LLC., and Joseph I. Lerman, et. al, 1:22-cv-03353 (E.D.N.Y. filed June 7, 2022)

The Securities and Exchange Commission today announced charges against LG Capital Funding, LLC ("LG Capital") and its managing member Joseph Lerman of Brooklyn, New York, for failing to register as securities dealers with the SEC. LG Capital and Lerman allegedly bought and sold billions of newly-issued shares of microcap securities, or "penny stocks," which generated millions of dollars for LG Capital and Lerman.

The SEC's complaint, filed in the Eastern District of New York, alleges that between at least January 2016 and December 2021, LG Capital engaged in the business of purchasing convertible notes from penny stock issuers, converting the notes into shares of stock at a large discount from the market price, and selling those newly issued shares into the market at a significant profit. LG Capital allegedly purchased over 300 convertible notes from more than 100 separate issuers and sold more than 22 billion shares of newly issued penny stock into the market, generating sales proceeds of approximately $30 million and net profits of approximately $20 million. As alleged, neither LG Capital nor Lerman were registered as a dealer with the SEC or associated with a registered dealer, in violation of the mandatory registration provisions of the federal securities laws. By failing to register, LG Capital and Lerman avoided certain regulatory obligations for dealers that govern their conduct in the marketplace, including regulatory inspections and oversight, financial responsibility requirements, and maintaining books and records.

The SEC's complaint charges LG Capital and Lerman with violating the registration provision of Section 15(a)(1) of the Securities Exchange Act of 1934, and charges Lerman with violating Section 20(a) of the Securities Exchange Act of 1934. The SEC seeks a permanent injunction, disgorgement of ill-gotten gains plus prejudgment interest, a civil penalty, a penny stock bar, and other equitable relief. The complaint also names as relief defendants LG Capital's two other members, Daniel Gellman and Boruch Greenberg, and LG Capital's primary employee, Eli Safdieh, who all allegedly received illicit proceeds from LG Capital and Lerman's violations.

The SEC's investigation was conducted by Elliot Weingarten, assisted by Suzanne Romajas and Robert Nesbitt, and supervised by Fuad Rana and Carolyn M. Welshhans. The litigation will be led by Suzanne Romajas and Elliot Weingarten, and supervised by Melissa Armstrong.

——-

https://www.sec.gov/litigation/complaints/2022/comp25410.pdf

——

This stock is mentioned in litigation complaint

Thanks for the info Jonathan !!!

Lol.....Good Luck Bro.

Shareholder Conference Call -

Medifirst Shareholder -

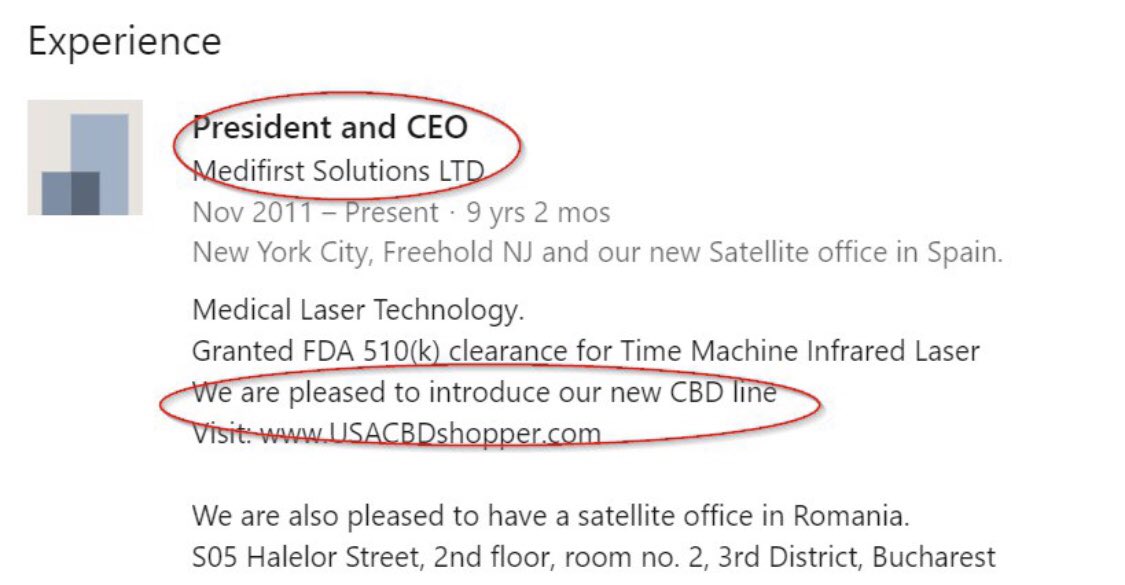

You may or may not be aware that I took over as CEO of Medifirst a few months after the previous CEO, Bruce Schoengood, was convicted.

My first task was to bring the company current with its SEC reporting; this proved to be very daunting.

Among the myriad challenges was the fact that the company needed to restate its financials for a number of periods. In order to do this, we needed access to the banking records; which Mr. Schoengood refused to provide.

Therefore, as you are no doubt aware, the company is no longer a public company.

Nevertheless, next week, we will be scheduling a conference call to discuss the company, the events that brought it to where it is today, and the future of the company.

If you are interested, you should be on the lookout for notice of the date and time of the conference call.

I look forward to meeting you.

Jonathan

MFST - Revoked?????????????????????????

What a shock!!!!

Bruce Shoengood is a criminal. The criminal complaint filed against him was damning.

He should be in jail for a while......I hope.

Anyone who held or bought this stock after the criminal complaint was filed is not too bright.

I read that as Microsoft (MSFT) and fully agree.

MFST is already dead just needs the grave to be ready

No need. Retail has already killed it off.

So much water under the fridge since I was in this.

It was a shit show. Insiders were such duchebags snd unprofessional. It’s why I got out ASAP

Was the shell left with tons of debt?

A R/S and new control officers is an easy fix.

Return all restricted shares back into treasury and turn it into a 2m or less float.,

Rehab it snd sell it. Nothing really dies till the DTCC says so.

https://www.synergymgtgroup.com/

Still Looks dead err than the deadest dead thing to me.

Caveat Emptor and skull and crossbones.

Reinstated?? Buying on Ameritrade Monday if I can .

Saw this old turd on the Tier change list today.

Grey to Expert.

Some MM must have noticed they still had short shares in this and want to cover.

This belongs on the greys.

Maybe the new CEO will R/S the piss out of it and start the sell process of looking for a story.

Till then, it’s stuck.

Thoughts today?

Didn’t you know this was coming?

I bailed out of all of mine but one weeks yo months ago. culled the herd. Roll that $ into others.

This stock was a share selling scam ftom way back.

It belongs in CE Hell.

It’s never coming back

Thanks SEC! That's like 15 you suspended on me now! Good thing I have plenty of big winners to make up the slack! I thought this would go Pink!

no, i said you will have great difficulty monetizing that value and if there ever is any value it will be at least a year before you can get to it.

I fully trust you !!! Keep up the good work !!!

Yea, I get it. Thanks for the info. Look, I work for you guys and I will run through fire to create value. I will not pump a stock but I will run through fire.

It sounds like you are saying I can’t create value here.

when revoked this will be a private company. it's hard to have value when there is no public market for the shares.

Only time will tell. My job is to create value and that is happening here; it just isn’t apparent yet.

The other deal we are on right now (THCT) is up over 100% since we started a month ago. This is just the beginning.

We plan the same thing here once we get over these hurdles.

every company that gets suspended for delinquency eventually gets revoked. the options now are:

1) ignore the revocation notice and be revoked.

2) contest the revocation notice and be revoked, it just takes longer.

3) accept the sec offer of voluntary revocation leaving the door open to filing a Form 10 registration and becoming a public company again.

I also told people NOT to buy the stock - what CEO tells you that?

I promised transparency - if anyone has questions they can reach me directly at jcross@sheffordcapitalpartners.com.

We are doing everything we can and we will get things turned around here.

Thanks Jonathan, and you are right, you told us about the risk…keep us updated !!!

If you look back at my previous posts, you will see that I clearly stated that “it is going to get worse before it gets better.”

We have been unable to access the company’s financial information; if you recall the founding CEO was arrested. He will not help us.

Therefore, we can not bring the reporting current. We continue to move things forward for alternatives.

and what do you say now that you have been suspended and revocation proceedings have begun?

MFST SEC Suspension for severely delinquent Financials:

https://www.sec.gov/litigation/suspensions/2021/34-93030.pdf

Order:

https://www.sec.gov/litigation/suspensions/2021/34-93030-o.pdf

Admin. Proceeding:

https://www.sec.gov/litigation/admin/2021/34-93028.pdf

Slightly off the thread, but as I understand it only accredited investors and institutions will be able to purchase stock in the open market after September 28?

1. How do accredited investors or institutions purchase shares of $MFST?

2. Do you know if there will be forced liquidations by brokerages of $MFST stock?

3. Will $MFST be releasing an 8-K prior to September 28 to to inform shareholders of what's happening / what the plan is post September 28?

Thanks for reading, and hopefully responding.

Did they ever put out the shareholder update being discussed in here?

Company has zero chance of being current by the deadline

Agreed. Jonathan does state he plans to have things heading in the right direction within a few months though. So ill make a determination closer to that time period

Don't buy until it comes back to the current levels. It always happens. RS is the kiss of death.

Expect an RS. After things settle I will buy

The worse before the better occurring

I was just wondering that myself.

Hi Jonathan, Any updates coming soon?

We are hoping to have things by the end of the day today. It looks like Mr. Schoengood is helping and we are making some headway with the bank.

Will you need to obtain a subpoena to force the bank(s) to open $MFST's corporate accounts? That's going to take some time to accomplish.

Therefore, we have to reconstruct everything from the bank records, which we don’t have access to yet, to create the accounting to be presented to the auditor. While this will take time, we believe we can get it done in time.

THINGS ARE GOING TO GET WORSE BEFORE THEY GET BETTER!

I came in to transform the company and I have been on this board trying to stop people from losing money. I have been telling people, for over a month, not to buy the stock.

Go back and read the posts.

Every penny lost here goes into the pockets of TOXIC LENDERS.

Thank you JC for your honesty.

We are planning to be current before the deadline. I am making this public information…

We have no accounting for 2020 through now (18 months). In speaking with the accountant: Mr. Schoengood called him early in 2020 and notified him that the company was “going dark.” I confirmed this with the Auditor.

Therefore, we have to reconstruct everything from the bank records, which we don’t have access to yet, to create the accounting to be presented to the auditor. While this will take time, we believe we can get it done in time.

|

Followers

|

346

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

37664

|

|

Created

|

07/29/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |