Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Big tits out Lfgo

Seems like they’re gearing up

Come on Bobby no one gives a shyt about your DEI BS…. Just vax up and pump this to the moon! We have waited too damn long!

$LFAP We had a very productive board meeting today/The board requested all of the details in writing for a vote/Our focus is on diversity,inclusion & equality driven global financial product development/monetizing our annual proprietary data with corporate America/JV partnerships

$LFAP management team wants to pursue data monetization experts/proven Index/ETF leaders to help us evolve/broaden our scope to serve all communities within the diversity,inclusion space/Equality best practices must be engaged in the corporate world/We will guide to excellence.

https://twitter.com/bobbyablair/status/1557161748733444096?s=21&t=4t30dm5Cb2ld9fsOsde_Kw

Still good SS… wouldn’t take much

LMAO Bobby still hasn’t fixed the issue with E*Trade……….

“Announcement forthcoming” for the millionth times

$LFAP supporters. We are having a board of directors meeting this coming Tuesday at 5 pm est. Company will be announcing updates as board finalizes next steps for the company. Announcements forthcoming. Thank you for your patience and support. $LFAP #LFAP

https://twitter.com/bobbyablair/status/1555319216957317120?s=21&t=pmU1i6osc0psdN8caH6Q3Q

Come on Bobby time to get the Swedish pump out and get this moving :)

Lol that's a huge if. Chances are slim to none of the SS staying the same.

If the SS remains close to where it is now… and these guys don’t totally poo the bed… this should go up from here lol … imo…

LFAP: Share structure

https://www.otcmarkets.com/stock/LFAP/security

Authorized Shares

2,000,000,000

07/08/2022

Outstanding Shares

1,167,725,270

07/08/2022

Restricted

261,934,853

07/08/2022

Unrestricted

905,790,417

07/08/2022

Held at DTC

843,698,523

07/08/2022

Authorized Shares

2,000,000,000

02/14/2022

Outstanding Shares

912,068,287

02/14/2022

Restricted

261,934,853

02/14/2022

Unrestricted

650,133,434

02/14/2022

Even cheaper now. Nott inexpensive, merely cheap. Like junk. Itsa scam.

Turned out to be just a scam after all. I’m guessing we will get five zeroes (.00000xx) soon

It means the distractions are working!

$LFAP what this all 20k vol trades in between bid-ask price means?

It's just a slow bleed until this is no bid. gutter trash. no reason to even keep an eye on this scam

Just in case any was wondering… this is what a ‘thriving index’ looks like.

.0009 bid is dissolving. Absolute garbage.

the dilution is insane. they try to hide it with 20k bids but we all know what it is.

all this is good for is dilution. they have no intention of doing anything real with this trash ticker

Seriously. You know things are grim when the best he’s got to offer is a tweet about pitching ideas. There are dozens of pressing issues that a real community leader could be using as talking points and actually doing something about…. But we’ve got Bobby.

IMO Bobby just wants to milk LFAP as long as he can to collect his paycheck, which he’s been using to get his DEIXA company off the ground.

Then when LFAP eventually goes to no bid, he will proclaim LFAP a historic success and a great step forward for equality.

It’s a pretty great gig when you can make millions over several years without ever actually producing any results, and claim it was a success.

Yes Bobby always says they are “working hard.” I don’t know exactly who “they” are, as the BOD hasn’t met for months, and Bobby’s Facebook page indicates he’s focusing on other endeavors.

They have been “working very hard” for 2+ years without much results

There wasn't any big tweet out. "We're working hard".

Wow so huge. Gimme a break.

interesting, lot of vol the last couple trading days. got my eye on it.

Big tweet out Friday I spoke to the ceo im adding a bunch

why is it moving today? did I miss something?

Load zone brew sit at .001 with me

The real kicker is that this month - particularly today - the LGBTQ community could really use a rally call. SCOTUS has it sights on taking away the rights of the community and all we’ve got is a fake ass activist and fake ass index.

Based on Bobby’s Facebook activity, it seems he’s been focusing on other ventures for quite a while. But it’s in his best interest to keep LFAP solvent as long as possible so he can keep collecting a paycheck. So always possible he could try to generate another spike. But not sure BOD members Barney and Martina are even willing to put in a few minutes of time per quarter anymore…

6x the average volume and watch it finish at .001. I think a lot of people got out. Will they be thankful or regret it?

6x the average volume and watch it finish at .001. I think a lot of people got out. Will they be thankful or regret it?

Yeah that’s looking like it was a smart move….

I don’t blame you one bit

I flipped this

for the last time

I hope it runs hard

so everyone here can bank

I will watch

but

I'm out

I don't trust any of board members

want to have anything to do with

1Billion and growing LFAP

This "We are doing due diligence"

sounds like it will take

forever

and when is he doing this "due diligance"

when he is so busy

with dicksia?

GLTA

anyone know where all the volume is coming from? also I see that the OS count has increased beyond a billion shares, not happy about that at all. I am starting to think to myself that once we get a rally, I'm going to be selling some, I've had about enough, though I am willing to wait out at least to see what progress they have made.

About time Bobby wakes up and moves this!

$LFAP LFAP loyal team of global supporters. I want you to know we are working very hard. We are doing due diligence on a few terrific opportunities to present to our board. Our INDEX on the NYSE is strong. Please stay patient. Have a great weekend. $LFAP

https://twitter.com/bobbyablair/status/1540368362009612288?s=21&t=Xl_KytJrAzqVbthM0sTp-w

lol, well that bid was

spooked quick

just more bulls#it?

looks like OTC

is waking up

I like the bid

ask thinning out as well

we'll see

GLTA

sure CFGN @21

but OTCX still here

Friday "news"

is always

S#IT

we'll see

Yuge volUME !

Go time no rs

Big tweet out don’t listen to this fool

Added a bunch of .001s

|

Followers

|

320

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

47943

|

|

Created

|

09/21/12

|

Type

|

Free

|

| Moderators | |||

Confirmation Regulation FD applies to social media April 2, 2013

https://www.sec.gov/news/press-release/2013-2013-51htm

LFAP Acquires LGBT Loyalty to Create the First-Ever LGBT Loyalty ''Preference'' Index Traded Fund

ACCESSWIRE February 14, 2019 https://finance.yahoo.com/news/lfap-acquires-lgbt-loyalty-create-141500544.html?soc_src=strm&soc_trk=fb&fbclid=IwAR2qb6TXwHzF6OtARB9eg_DEg_pIHNuA0KxsKR137bR4HeVIHLBd71B3d3Q

WILTON MANORS, FL / ACCESSWIRE / February 14, 2019 / LifeApps Brands Inc., (OTC PINK: LFAP) ("LifeApps"), an emerging growth digital media company, has purchased LGBT Loyalty LLC, a New York limited liability company from Maxim Partners, LLC, a New York limited liability company. Through LGBT Loyalty, LifeApps intends to create, establish, develop, manage and capitalize a LGBT Loyalty (ETF) Index Traded Fund, supported through newly created dynamic business channels. ''Connecting the world's most supportive LGBT companies to the dynamic loyal and time-tested spending power of the LGBT community is a consequential step forward for the LGBT movement and investing community,'' said Bobby Blair, CEO of LifeApps. ''The acquisition of LGBT Loyalty from Maxim Partners provides us with a tremendous opportunity to make a major impact to the LGBT community we intend to serve.''

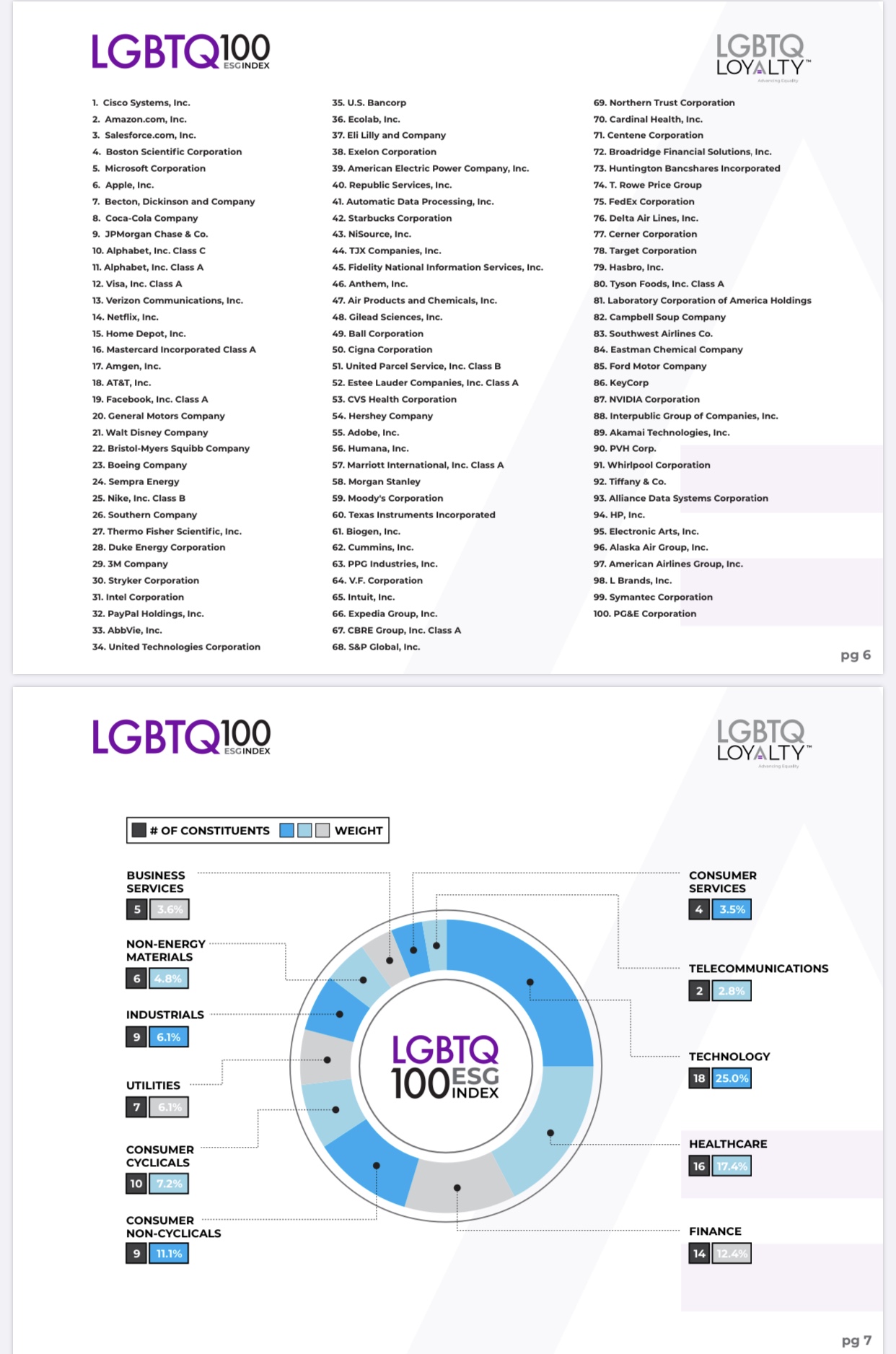

The LGBT Loyalty (ETF) Index Traded Fund is expected to be the first ''preference'' index fund to survey a representative group of LGBT consumers to determine the top public companies that best support and are supported by the LGBT community. We expect the S&P 500 to represent the universe of companies surveyed. Expert LGBT economists have repeatedly stressed the value of the LGBT brand loyalty to corporations. We believe the companies that best capture the spending trends and loyalty of the LGBT consumer will be better positioned for financial growth and success. In 2017, LGBT consumer buying power was over $917 billion in the US market alone. Our business strategy is targeted to part of the $3.7 trillion purchasing power of the LGBT consumer demographic worldwide.

More than 450 million people identify themselves as LGBT worldwide and the LGBT community is composed of some of the most loyalty driven consumers in the world. Same-sex households have a 23 percent higher median income compared to mainstream households. The LGBT consumer is 1.23 times more likely to buy brands that reflect their lifestyle and 1.56 times more likely to consider themselves a spender rather than a saver. Fortune 500 companies have mandated diversity and equality as part of their marketing profiles, and we intend to become a leading conduit between this incredibly powerful consumer group and respective LGBT social-impact driven companies around the world.

SEC final ruling on rule 6C-11 for open ended management ETF’s September 26, 2019

https://www.sec.gov/news/press-release/2019-190

Reference Page

https://lgbtqloyalty.com/reference-page/

Blueprint & Latest News

Initial Capital November 4, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf_exl.htm

Registration statement Form N-1A filed November 15, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf-t1_n1aa.htm

Registration statement Form N-1A filed December 10, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013782/etf-t1_n1aa.htm

short-form registration statement, Form 8-A filed January 6, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000126/etf_8a12b.htm

Statement of Additional Information (“SAI”) ,Form-497 filed January 14, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000395/etf_497.htm

LGBTQ100 ESG Index Reconstituted Ahead of LGBTQ + ESG100 ETF Launch May 14, 2021 12:03 ET

https://www.globenewswire.com/news-release/2021/05/14/2230111/0/en/LGBTQ100-ESG-Index-Reconstituted-Ahead-of-LGBTQ-ESG100-ETF-Launch.html

LGBTQ + ESG100 ETF Trading Symbol: LGBT Summary Prospectus May 14, 2021

https://www.sec.gov/Archives/edgar/data/1704174/000089418921003087/procureetftrusti497klgbt.htm

Video: LGBTQ Loyalty (OTC Pink: LFAP), (NASDAQ: LGBT) Emerging Growth Conference 5/26/21

https://www.youtube.com/watch?app=desktop&v=yk-zYu7rJak

LGBTQ Loyalty Announces $10M Financing Commitment From NYC-based Investment Group May 28, 2021 9:28AM

https://www.otcmarkets.com/filing/html?id=15000298&guid=p1RUkKQ9u5KFpth#EX99-1_HTM

CNN write-up: June is Pride Month, Wall Street has taken.notice, Tue June 1, 2021

https://www.cnn.com/2021/06/01/investing/pride-month-lgbtq-stocks/index.html

CNBC Video: What to know about the world’s first LGBTQ ETF for pride month, Wed June 2, 2021

https://www.cnbc.com/video/2021/06/02/what-to-know-about-the-worlds-first-lgbtq-etf-for-pride-month.html?&qsearchterm=etf

Market Watch Opinion: There’s a new LGBTQ-focused ETF — here’s how it differs from two others that failed June 4, 2021

https://www.marketwatch.com/story/theres-a-new-lgbtq-focused-etf-heres-how-it-differs-from-two-others-that-failed-11622821358

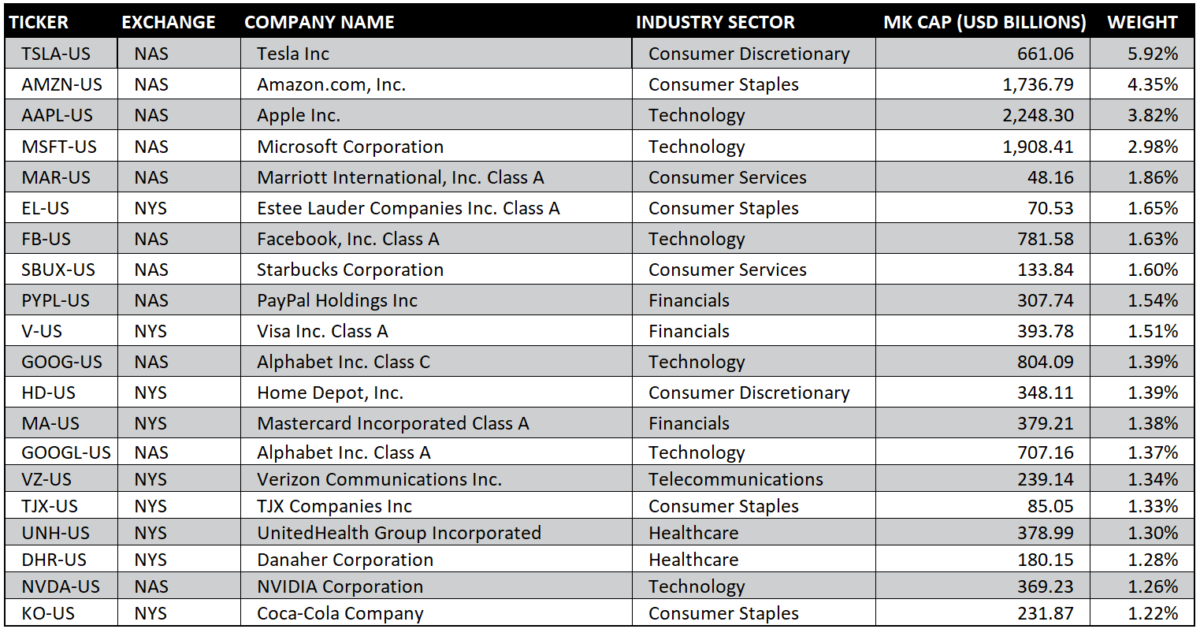

LGBTQ100 + ESG ETF

Shares will be listed on Nasdaq, Inc.

To start off LFAP is the creator of the LGBTQ Index 100

utilizing ProcureAM’s PAL (Procure Asset Launchpad) in which

ProcureAM helps bring ETF ideas to life. In this situation LFAP = Creator

of LGBTQ Index 100 and ProcureAM = ETF Fund Manager.

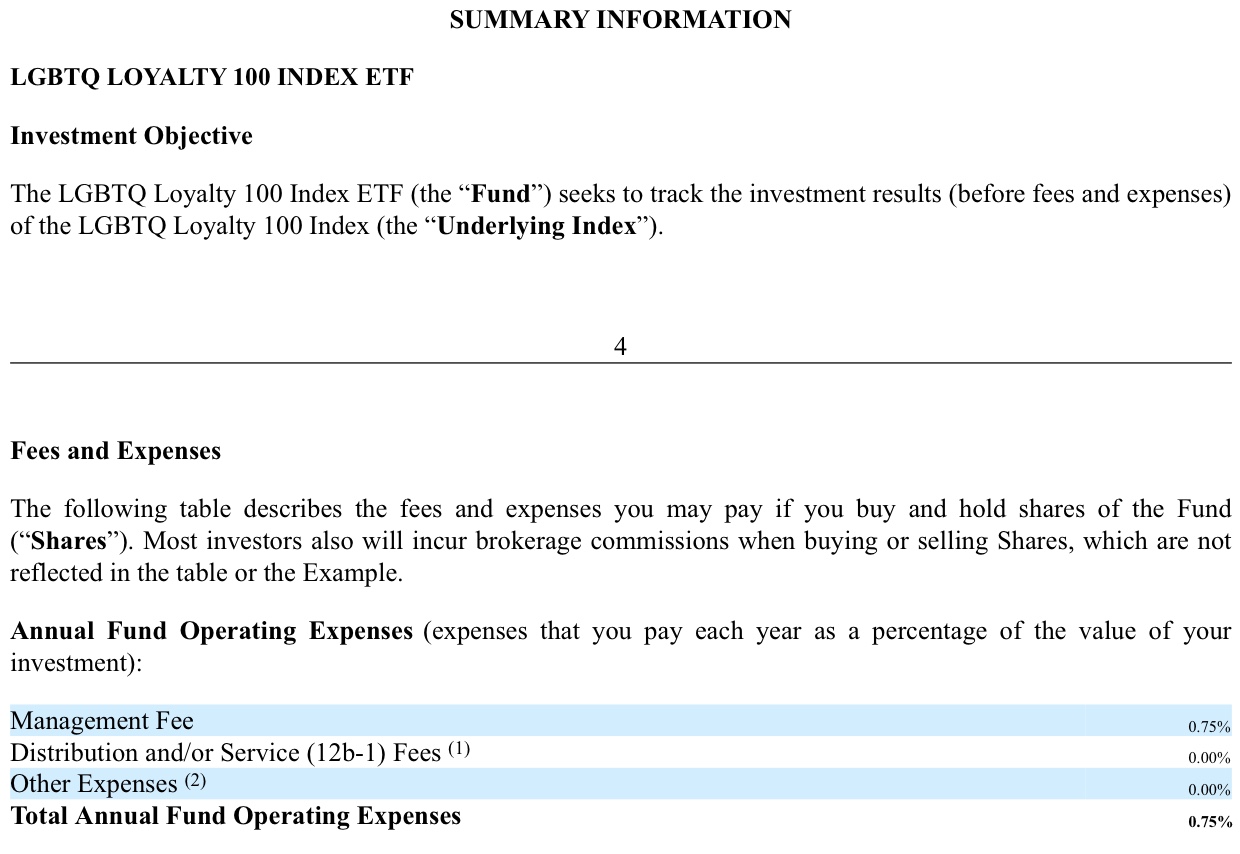

ProcureAM charges a manager fee of 25BP (or in layman terms .0025%)

for Assets Under Management.

The LGBTQ ETF Index 100 charges a management fee of 75BP

(.0075%) on all Assets Under Management. ProcureAM is paid 25BP

(.0025%) for duties as acting manager of the fund.

For Example: LGBTQ Index 100 has $1,500,000,000 AUM

LGBTQ Index 100 Management Fee:

$1,500,000,000 X .0075 = $11,250,000

LFAP keeps 50BP (.0050%) and ProcureAM is paid 25BP (.0025%) as

acting manager of fund.

LFAP revenue = $1,500,000,000 X .0050 = $7,500,000

ProcureAM revenue = $1,500,000,000 X .0025 = $3,750,000

What many here don’t realize, we are entering a whole new realm

of investing with this first ever “Preference Based Index”. This

will be the first index ever where a selected/targeted group will

select the companies that make up the ETF. Also, as technology

advances, our ETF’s performance will be for-seen by using Big

Data Analytics, AI, and Machine Learning. We are looking at a

new way to beat the market by using big data as raw material,

combined with machine learning, to build ETF portfolios that

could potentially outperform active management — even actively

managed ETFs.

You can read more about Big Data and ETF’s in this link

rovided. Also watch the video within the article of Rob Tull

explaining the technology:

https://www.google.com/amp/s/www.cnbc.com/amp/2019/08/24/artificial-intelligence-and-machine-learning-are-the-next-frontiers-for-etfs.html

This is where Fuzzy Logix is tied in with our LGBTQ Index 100.

Fuzzy Logix uses high powered Graphics Processing Units which

can sort through data at an alarming speed. The software from

Fuzzy Logix ultimately helps predetermine which companies will

outperform the market. More can be explained in this video

attached:

https://youtu.be/V8HBSfawGa8

This is how the our ETF (LGBTQ Index 100) was predicted to

outperform the S&P 500 (see slides 8 & 9 of attachment:

https://drive.google.com/file/d/13a-yxFXVBtt8GZXN7WmcCuu1U7i9r_5V/view

Revenue for LFAP will be accrued in 3 ways:

•Advertising

•Sales of Corporate Loyalty Program/ Loyalty Packages

•ETF Management Fee

The average ETF costs about $250,000 a year to maintain based on

complexity. Our Breakeven for our ETF is approx $40,000,000 AUM.

With this in mind, our ETF will have a yearly maintenance fee of

$200,000 given $40,000,000 X.0050 = $200,000.

More on expenses of ETF’s can be read here:

https://www.etf.com/sections/features-and-news/cost-run-etf?nopaging=1

This ETF is rumored to be the next big thing in the ETF world.

HACK accrued $1,500,000,000 AUM in approx 6 months of operation.

We could possibly match pr exceed HACK’s AUM.

LFAP has little to no overhead:

•Rent

•Salaries

•ETF Maintenance Fee’s

LFAP has 3 revenue streams: Advertising, Loyalty Packages, and ETF management fees.

Latest videos released 9/24 from BODs on YouTube

Robert Tull

https://youtube.com/watch?v=Mv-bTvK3acE

Billy Bean

https://youtube.com/watch?v=o0iXwXina7s

Barney Frank

https://youtube.com/watch?v=ckeEJMXObmk

Bobby Blair

https://youtube.com/watch?v=GPws-ia3Gcw

Company Contact:

LifeApps Brands Inc.

2435 Dixie Highway

Wilton Manors, FL 33305

info@lifeappsmedia.com

(954) 947-6133

https://lgbtqloyalty.com/

SOURCE: LifeApps Brands Inc

Share Structure

Chart Source: ~~~ https://www.marketscreener.com/LGBTQ-LOYALTY-HOLDINGS-IN-58457883/

Chart Source~~~ https://www.stockscores.com/charts/charts/?ticker=LFAP

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |