| Followers | 22 |

| Posts | 841 |

| Boards Moderated | 0 |

| Alias Born | 01/22/2018 |

Thursday, September 26, 2019 7:01:53 PM

Great Post C-note. As you got most information correct but I would just like to add a few things in hoping to make things clearer for all on this board. I don’t usually post here anymore for certain reasons that a select few here already know.

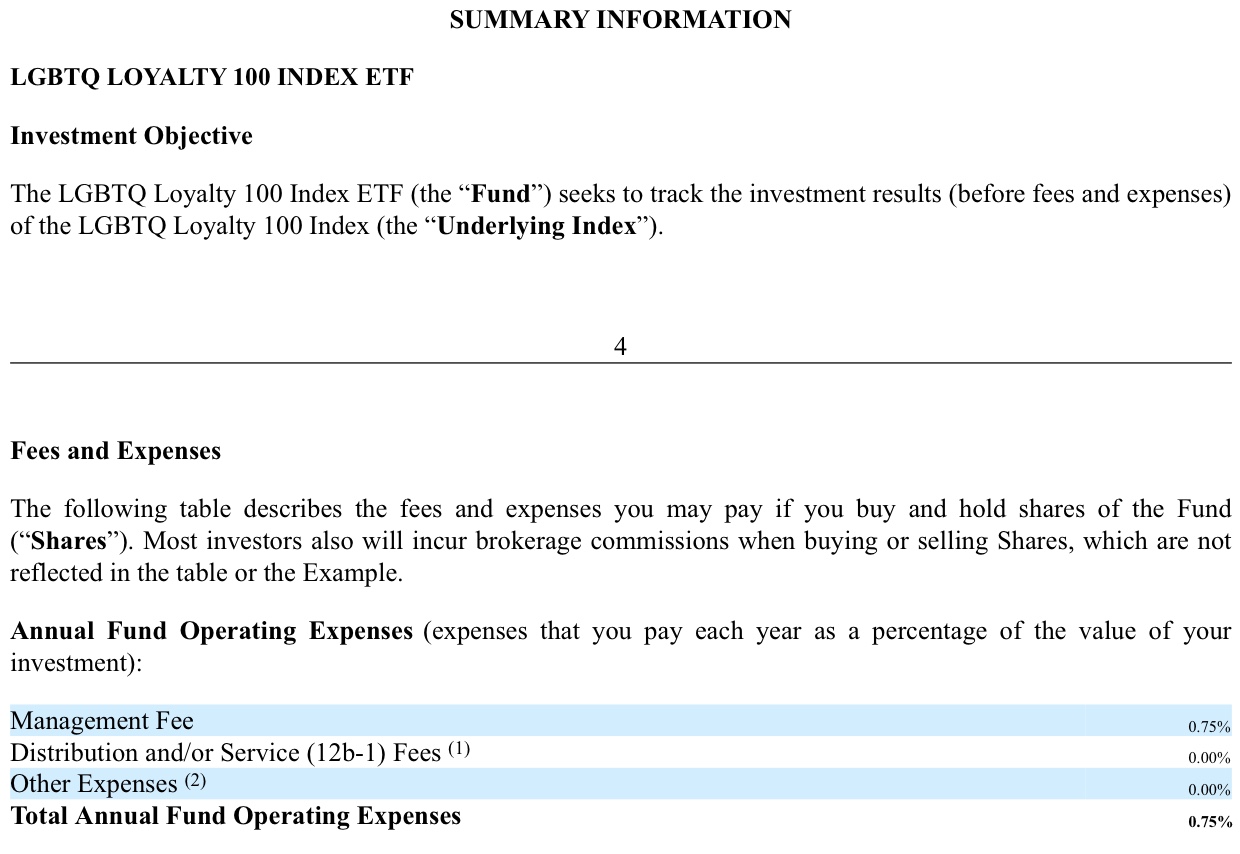

To start off LFAP is the creator of the LGBTQ Index 100 utilizing ProcureAM’s PAL (Procure Asset Launchpad) in which ProcureAM helps bring ETF ideas to life. In this situation LFAP = Creator of LGBTQ Index 100 and ProcureAM = ETF Fund Manager. ProcureAM charges a manager fee of 25BP (or in layman terms .0025%) for Assets Under Management.

The LGBTQ ETF Index 100 charges a management fee of 75BP (.0075%) on all Assets Under Management. ProcureAM is paid 25BP (.0025%) for duties as acting manager of the fund.

For Example: LGBTQ Index 100 has $1,500,000,000 AUM

LGBTQ Index 100 Management Fee:

$1,500,000,000 X .0075 = $11,250,000

LFAP keeps 50BP (.0050%) and ProcureAM is paid 25BP (.0025%) as acting manager of fund.

LFAP revenue = $1,500,000,000 X .0050 = $7,500,000

ProcureAM revenue = $1,500,000,000 X .0025 = $3,750,000

What many here don’t realize, we are entering a whole new realm of investing with this first ever “Preference Based Index”. This will be the first index ever where a selected/targeted group will select the companies that make up the ETF. Also, as technology advances, our ETF’s performance will be for-seen by using Big Data Analytics, AI, and Machine Learning. We are looking at a new way to beat the market by using big data as raw material, combined with machine learning, to build ETF portfolios that could potentially outperform active management — even actively managed ETFs.

You can read more about Big Data and ETF’s in this link provided. Also watch the video within the article of Rob Tull explaining the technology:

https://www.google.com/amp/s/www.cnbc.com/amp/2019/08/24/artificial-intelligence-and-machine-learning-are-the-next-frontiers-for-etfs.html

This is where Fuzzy Logix is tied in with our LGBTQ Index 100. Fuzzy Logix uses high powered Graphics Processing Units which can sort through data at an alarming speed. The software from Fuzzy Logix ultimately helps predetermine which companies will outperform the market. More can be explained in this video attached:

This is how the our ETF (LGBTQ Index 100) was predicted to outperform the S&P 500 (see slides 8 & 9 of attachment:

https://drive.google.com/file/d/13a-yxFXVBtt8GZXN7WmcCuu1U7i9r_5V/view

Revenue for LFAP will be accrued in 3 ways:

•Advertising

•Sales of Corporate Loyalty Program/ Loyalty Packages

•ETF Management Fee

The average ETF costs about $250,000 a year to maintain based on complexity. Our Breakeven for our ETF is approx $40,000,000 AUM. With this in mind, our ETF will have a yearly maintenance fee of $200,000 given $40,000,000 X.0050 = $200,000.

More on expenses of ETF’s can be read here:

https://www.etf.com/sections/features-and-news/cost-run-etf?nopaging=1

This ETF is rumored to be the next big thing in the ETF world. HACK accrued $1,500,000,000 AUM in approx 6 months of operation. We could possibly match pr exceed HACK’s AUM.

LFAP has little to no overhead:

•Rent

•Salaries

•ETF Maintenance Fee’s

With revenue coming from Advertising, Loyalty Packages, and ETF management fees, I think we have a good shot of a monster in the making.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM