Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I was a REAL believer in the early days 2018-2019; I think I first smelled a rat when he posted that one video where he’s standing under a lamppost in early evening, giving some pep talk on one hand, but then adding in some excuse for poor performance on the other. Something about that one stanza clued me in that’s he’s a crook. Barney and Martina, I’ve concluded that they probably just don’t give a Shiite one way or the other, my $0.02

I think you're right. And I might further add, the only thing lower than a snakes belly is con-artists that parade as social justice warriors and prey on the marginalized communities.

there is no doubt

at this point

unfortunately

total colapse of any remaining confidance

SMH

Unlikely to see any news here anytime soon…

He’s a crook what do you expect. This is one of the most obvious scams on the OTC market. It’ll pump and dump again at some point though.

LMAO I don't know.... but dang. I have been expecting way more from this CEO that has gone silent and supposedly trying to get a new deal done. We are in bargain zone and trips.....I really hope we don't see that. Looks like I will be holding and buying more. Definitely be keeping an eye on this.

Damn we got the same feeling, I was thinking of tossing a few bucks this ticker way, but I'd need some SH confidence from management stating no R/S coming. Gla

I see a revers split coming in our future for this. Only question is when......I just cant believe the silence from Bobby.

Update. Holy ****. 31 million volume now in 1.5 hours.

Looking like more Champaign and Lobster in exchange for par value cash Exchange.

I warned you all this pathetic stock is just a pump and dump. CEO using the situation. To make money

This is about to get really really ugly….

17Mil on ask @ 11

says it all

trips inbound

SMH

In today's world this kind of stock and its corresponding chart, should be in an ascending formation towards the sky, not trading at all time lows.

https://www.facebook.com/bobby.blair1

CEO (LFAP) Founder NYSE LGBTQ100 ESG Index & NASDAQ ETF. Founder DEIXA UTILITY TOKEN & NFT innovator

Just search Bobby Blair, a few will pop up but he has Lfap CEO under his name

So let me get this straight. He just went on a cruise? Will you send me his Facebook page.

Bobby is celebrating. LFAPs new start will be straight cash infusion for him. MFer couldn’t even run a couple fluff pride month events to throw us a bone before he screws us….

he sure is having a good time

is everyone here

having a good time

as well?

I can't believe

he is going to do this to us

in JUNE!

SMH

Bobby is doing everything but LFAP related business by the looks of his Facebook. He just went on a cruise, he just went home etc lol

The stock is fine, the problem is just Bobby at the moment…

deer in the headlights

Bobby the crook doing what he does best— empty promises // nonstop dilution

What a crook

the problem is that

"new day" from April 12

https://twitter.com/bobbyablair/status/1513897711333871618

turned into

"fresh start" on May 27

https://twitter.com/bobbyablair/status/1530200720284209154

while "new day" has usually friendly connotation

"fresh start" sends the chills down my spine

recent systematic dilution

doesn't give me much hope

for so long awaited Pride Month run

I hoped for LFAP to be more

than just a flip

after all

Pride Month could be just

the last excuse of failed CEO

to sell shares

I hope I'm wrong

GLTA

Wouldn't surprise me at all.

So wtf are people doing? Weathering this shit? Sell/ sold their positions? Would love to hear from some of the usual contributors to this forum.

looks like a waterfall indeed

cascading down

to a drain

this is trading like water, picked up another 600K today wow its so so cheap.

I want good news as bad as anyone here, but Is there any good reason to not assume that a r/s is the ‘new start’/ ‘plan’ that we are waiting to hear about?

I think I start

to understand what he meant by

"new start"

It will, scam scam scam. Trips and no bid coming for this pathetic stock

we could very well have

an entire remaining OS

dumped since last update

someone doesn't think

they (shares) will get more valuable

any time soon

... if at all

no one is buying

this &u/$#!t anymore

This stock is a scam just like everything else

Pride month is going to be spectacular!! Lolololololol

"A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. A cup and handle is considered a bullish signal extending an uptrend, and it is used to spot opportunities to go long."

Wooo over 11mil on bid at .0014 LFAP$$

yes. I bet this finishes in the .002s

10Mil volume in first 20 minutes?

8Mil buys vs 2Mil sells?

CFGN gone?

is OTCX dirty?

are we going higher today?

is today the day?

??????????

GL

if course we've been swindled, the OTC market is literally a legal place for crooked losers to scam people. the trick is to jump on and off the wagon during a hype pump

|

Followers

|

320

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

47943

|

|

Created

|

09/21/12

|

Type

|

Free

|

| Moderators | |||

Confirmation Regulation FD applies to social media April 2, 2013

https://www.sec.gov/news/press-release/2013-2013-51htm

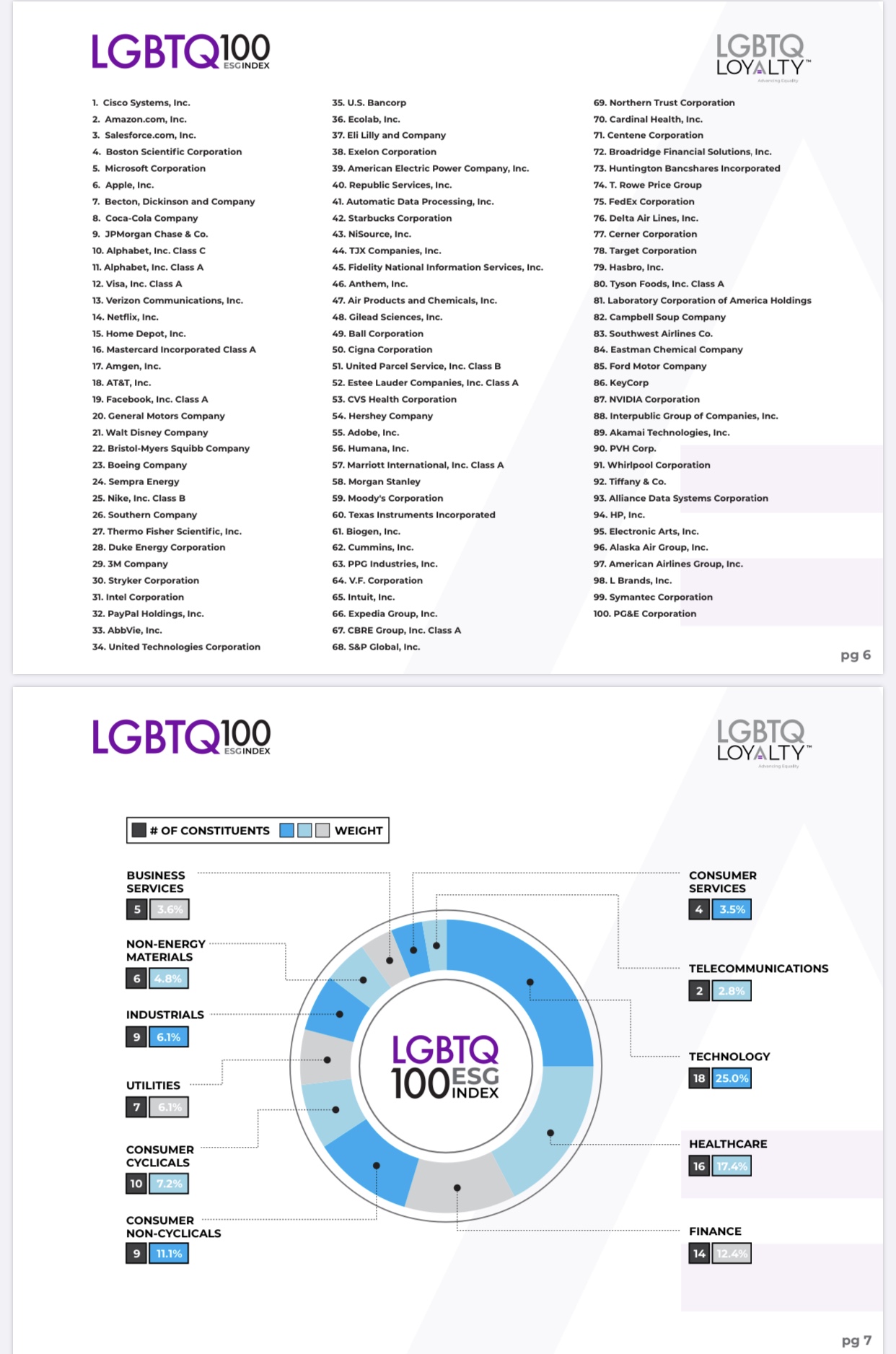

LFAP Acquires LGBT Loyalty to Create the First-Ever LGBT Loyalty ''Preference'' Index Traded Fund

ACCESSWIRE February 14, 2019 https://finance.yahoo.com/news/lfap-acquires-lgbt-loyalty-create-141500544.html?soc_src=strm&soc_trk=fb&fbclid=IwAR2qb6TXwHzF6OtARB9eg_DEg_pIHNuA0KxsKR137bR4HeVIHLBd71B3d3Q

WILTON MANORS, FL / ACCESSWIRE / February 14, 2019 / LifeApps Brands Inc., (OTC PINK: LFAP) ("LifeApps"), an emerging growth digital media company, has purchased LGBT Loyalty LLC, a New York limited liability company from Maxim Partners, LLC, a New York limited liability company. Through LGBT Loyalty, LifeApps intends to create, establish, develop, manage and capitalize a LGBT Loyalty (ETF) Index Traded Fund, supported through newly created dynamic business channels. ''Connecting the world's most supportive LGBT companies to the dynamic loyal and time-tested spending power of the LGBT community is a consequential step forward for the LGBT movement and investing community,'' said Bobby Blair, CEO of LifeApps. ''The acquisition of LGBT Loyalty from Maxim Partners provides us with a tremendous opportunity to make a major impact to the LGBT community we intend to serve.''

The LGBT Loyalty (ETF) Index Traded Fund is expected to be the first ''preference'' index fund to survey a representative group of LGBT consumers to determine the top public companies that best support and are supported by the LGBT community. We expect the S&P 500 to represent the universe of companies surveyed. Expert LGBT economists have repeatedly stressed the value of the LGBT brand loyalty to corporations. We believe the companies that best capture the spending trends and loyalty of the LGBT consumer will be better positioned for financial growth and success. In 2017, LGBT consumer buying power was over $917 billion in the US market alone. Our business strategy is targeted to part of the $3.7 trillion purchasing power of the LGBT consumer demographic worldwide.

More than 450 million people identify themselves as LGBT worldwide and the LGBT community is composed of some of the most loyalty driven consumers in the world. Same-sex households have a 23 percent higher median income compared to mainstream households. The LGBT consumer is 1.23 times more likely to buy brands that reflect their lifestyle and 1.56 times more likely to consider themselves a spender rather than a saver. Fortune 500 companies have mandated diversity and equality as part of their marketing profiles, and we intend to become a leading conduit between this incredibly powerful consumer group and respective LGBT social-impact driven companies around the world.

SEC final ruling on rule 6C-11 for open ended management ETF’s September 26, 2019

https://www.sec.gov/news/press-release/2019-190

Reference Page

https://lgbtqloyalty.com/reference-page/

Blueprint & Latest News

Initial Capital November 4, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf_exl.htm

Registration statement Form N-1A filed November 15, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf-t1_n1aa.htm

Registration statement Form N-1A filed December 10, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013782/etf-t1_n1aa.htm

short-form registration statement, Form 8-A filed January 6, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000126/etf_8a12b.htm

Statement of Additional Information (“SAI”) ,Form-497 filed January 14, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000395/etf_497.htm

LGBTQ100 ESG Index Reconstituted Ahead of LGBTQ + ESG100 ETF Launch May 14, 2021 12:03 ET

https://www.globenewswire.com/news-release/2021/05/14/2230111/0/en/LGBTQ100-ESG-Index-Reconstituted-Ahead-of-LGBTQ-ESG100-ETF-Launch.html

LGBTQ + ESG100 ETF Trading Symbol: LGBT Summary Prospectus May 14, 2021

https://www.sec.gov/Archives/edgar/data/1704174/000089418921003087/procureetftrusti497klgbt.htm

Video: LGBTQ Loyalty (OTC Pink: LFAP), (NASDAQ: LGBT) Emerging Growth Conference 5/26/21

https://www.youtube.com/watch?app=desktop&v=yk-zYu7rJak

LGBTQ Loyalty Announces $10M Financing Commitment From NYC-based Investment Group May 28, 2021 9:28AM

https://www.otcmarkets.com/filing/html?id=15000298&guid=p1RUkKQ9u5KFpth#EX99-1_HTM

CNN write-up: June is Pride Month, Wall Street has taken.notice, Tue June 1, 2021

https://www.cnn.com/2021/06/01/investing/pride-month-lgbtq-stocks/index.html

CNBC Video: What to know about the world’s first LGBTQ ETF for pride month, Wed June 2, 2021

https://www.cnbc.com/video/2021/06/02/what-to-know-about-the-worlds-first-lgbtq-etf-for-pride-month.html?&qsearchterm=etf

Market Watch Opinion: There’s a new LGBTQ-focused ETF — here’s how it differs from two others that failed June 4, 2021

https://www.marketwatch.com/story/theres-a-new-lgbtq-focused-etf-heres-how-it-differs-from-two-others-that-failed-11622821358

LGBTQ100 + ESG ETF

Shares will be listed on Nasdaq, Inc.

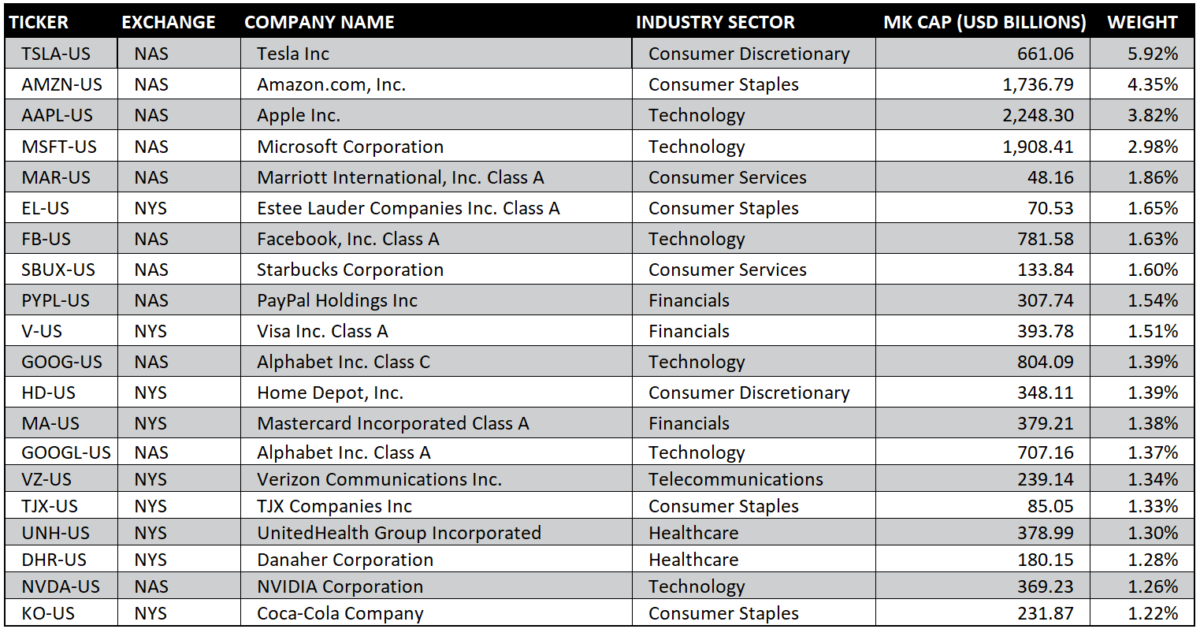

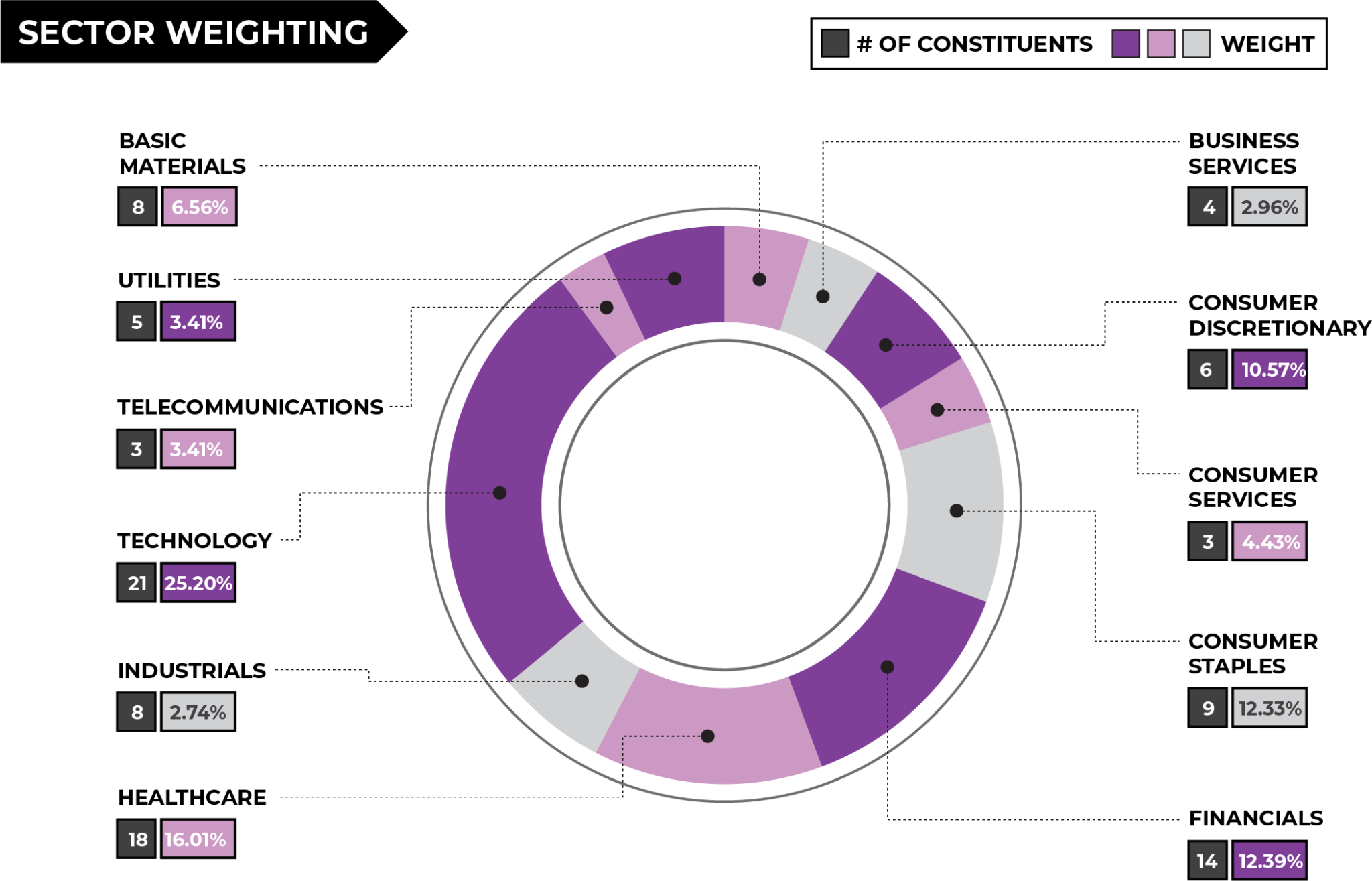

To start off LFAP is the creator of the LGBTQ Index 100

utilizing ProcureAM’s PAL (Procure Asset Launchpad) in which

ProcureAM helps bring ETF ideas to life. In this situation LFAP = Creator

of LGBTQ Index 100 and ProcureAM = ETF Fund Manager.

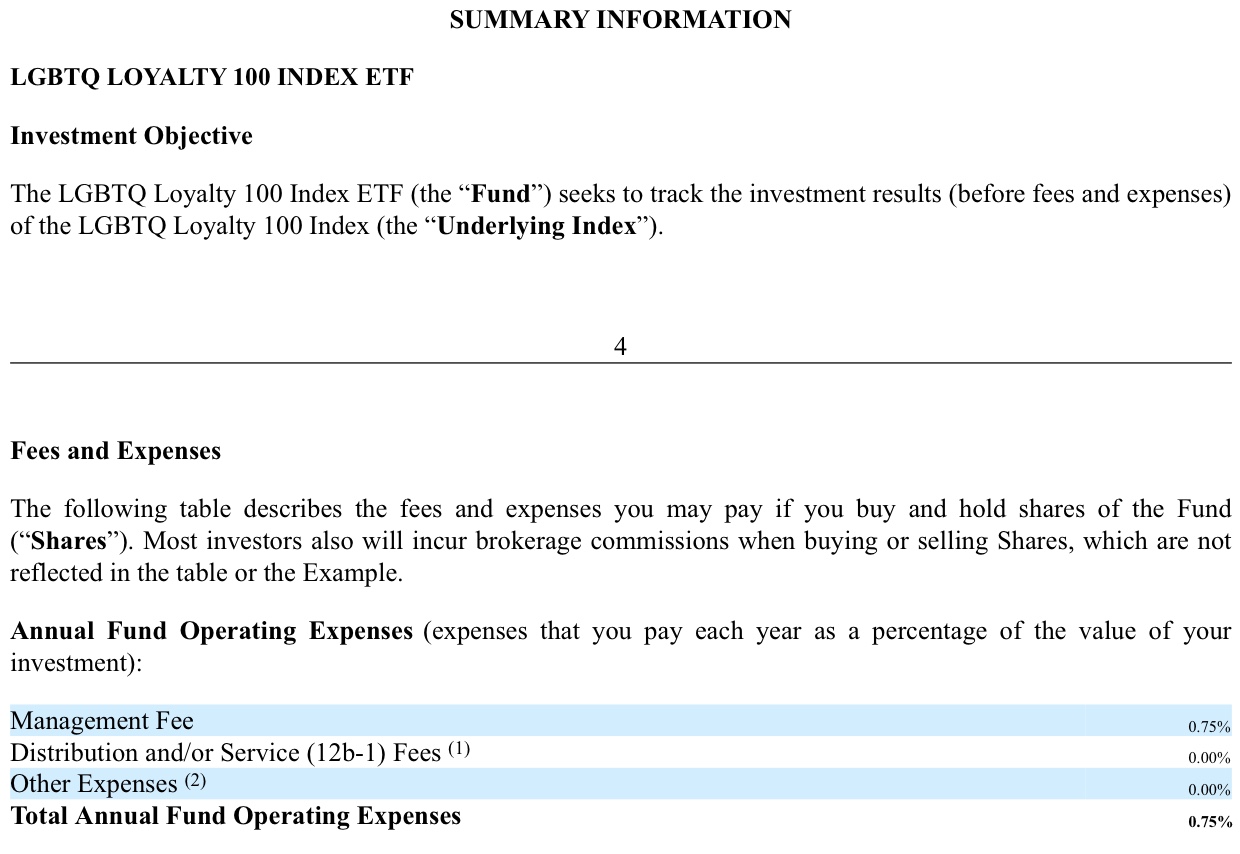

ProcureAM charges a manager fee of 25BP (or in layman terms .0025%)

for Assets Under Management.

The LGBTQ ETF Index 100 charges a management fee of 75BP

(.0075%) on all Assets Under Management. ProcureAM is paid 25BP

(.0025%) for duties as acting manager of the fund.

For Example: LGBTQ Index 100 has $1,500,000,000 AUM

LGBTQ Index 100 Management Fee:

$1,500,000,000 X .0075 = $11,250,000

LFAP keeps 50BP (.0050%) and ProcureAM is paid 25BP (.0025%) as

acting manager of fund.

LFAP revenue = $1,500,000,000 X .0050 = $7,500,000

ProcureAM revenue = $1,500,000,000 X .0025 = $3,750,000

What many here don’t realize, we are entering a whole new realm

of investing with this first ever “Preference Based Index”. This

will be the first index ever where a selected/targeted group will

select the companies that make up the ETF. Also, as technology

advances, our ETF’s performance will be for-seen by using Big

Data Analytics, AI, and Machine Learning. We are looking at a

new way to beat the market by using big data as raw material,

combined with machine learning, to build ETF portfolios that

could potentially outperform active management — even actively

managed ETFs.

You can read more about Big Data and ETF’s in this link

rovided. Also watch the video within the article of Rob Tull

explaining the technology:

https://www.google.com/amp/s/www.cnbc.com/amp/2019/08/24/artificial-intelligence-and-machine-learning-are-the-next-frontiers-for-etfs.html

This is where Fuzzy Logix is tied in with our LGBTQ Index 100.

Fuzzy Logix uses high powered Graphics Processing Units which

can sort through data at an alarming speed. The software from

Fuzzy Logix ultimately helps predetermine which companies will

outperform the market. More can be explained in this video

attached:

https://youtu.be/V8HBSfawGa8

This is how the our ETF (LGBTQ Index 100) was predicted to

outperform the S&P 500 (see slides 8 & 9 of attachment:

https://drive.google.com/file/d/13a-yxFXVBtt8GZXN7WmcCuu1U7i9r_5V/view

Revenue for LFAP will be accrued in 3 ways:

•Advertising

•Sales of Corporate Loyalty Program/ Loyalty Packages

•ETF Management Fee

The average ETF costs about $250,000 a year to maintain based on

complexity. Our Breakeven for our ETF is approx $40,000,000 AUM.

With this in mind, our ETF will have a yearly maintenance fee of

$200,000 given $40,000,000 X.0050 = $200,000.

More on expenses of ETF’s can be read here:

https://www.etf.com/sections/features-and-news/cost-run-etf?nopaging=1

This ETF is rumored to be the next big thing in the ETF world.

HACK accrued $1,500,000,000 AUM in approx 6 months of operation.

We could possibly match pr exceed HACK’s AUM.

LFAP has little to no overhead:

•Rent

•Salaries

•ETF Maintenance Fee’s

LFAP has 3 revenue streams: Advertising, Loyalty Packages, and ETF management fees.

Latest videos released 9/24 from BODs on YouTube

Robert Tull

https://youtube.com/watch?v=Mv-bTvK3acE

Billy Bean

https://youtube.com/watch?v=o0iXwXina7s

Barney Frank

https://youtube.com/watch?v=ckeEJMXObmk

Bobby Blair

https://youtube.com/watch?v=GPws-ia3Gcw

Company Contact:

LifeApps Brands Inc.

2435 Dixie Highway

Wilton Manors, FL 33305

info@lifeappsmedia.com

(954) 947-6133

https://lgbtqloyalty.com/

SOURCE: LifeApps Brands Inc

Share Structure

Chart Source: ~~~ https://www.marketscreener.com/LGBTQ-LOYALTY-HOLDINGS-IN-58457883/

Chart Source~~~ https://www.stockscores.com/charts/charts/?ticker=LFAP

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |