Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

SMP; Situation Update ~ World War III and the Imminent Collapse of the US Dollar.

Situation Update Published July 16, 2022

https://rumble.com/v1ci0qj-situation-update-world-war-iii-and-the-imminent-collapse-of-the-us-dollar..html

JUDY BYINGTON INTEL: RESTORED REPUBLIC VIA A GCR HUGE UPDATE AS OF JULY 16, 2022 - TRUMP NEWS

Trump News Channel Published July 16, 2022

https://rumble.com/v1chjk7-judy-byington-intel-restored-republic-via-a-gcr-huge-update-as-of-july-16-2.html

UPDATES COMING IN THE NEXT 24H - DONALD TRUMP INITIATED A CONTINUITY OF GOVERNMENT PLAN

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce91j-updates-coming-in-the-next-24h-donald-trump-initiated-a-continuity-of-gover.html?mref=6zof&mrefc=8

Clif High: The Jabbed Are About To Get A Rude Awakening!

Patriot Movement Published July 15, 2022

https://rumble.com/v1ceigp-clif-high-the-jabbed-are-about-to-get-a-rude-awakening.html

BIG SITUATION SHOCKING NEWS & JUDY BYINGTON INTEL UPDATE TODAY 07/11/2022 - TRUMP NEWS

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce7lv-big-situation-shocking-news-and-judy-byington-intel-update-today-07112022-t.html

PRESIDENT DONALD J. TRUMP LIVE FROM PRESCOTT, AZ JULY 22ND, 2022

by RSBN Studio

07/13/22

President Donald J. Trump, 45th President of the United States of America, will be

joined by endorsed candidates, members of the Arizona congressional delegation,

and other special guests on Saturday, July 22, 2022, in Prescott Valley, AZ.

This Save America rally is a continuation of President Trump’s unprecedented effort

to advance the MAGA agenda by energizing voters and highlighting America First candidates and causes.

((( Saturday, July 22, 2022, at 4:00 PM MST )))

President Donald J. Trump, 45th President of the United States of America, Delivers Remarks

https://www.rsbnetwork.com/video/president-donald-j-trump-live-from-prescott-az-july-16th-2022/?mc_cid=d10c22f780&mc_eid=a19c8148b2

Venue:

Findlay Toyota Center

3201 Main St.

Prescott Valley, AZ 86314

Special Guest Speaker:

Kari Lake, Trump Endorsed Candidate for Governor of Arizona

Blake Masters, Trump Endorsed Candidate for U.S. Senate in Arizona

Abe Hamadeh, Trump Endorsed Candidate for Attorney General of Arizona

State Rep. Mark Finchem, Trump Endorsed Candidate for Secretary of State of Arizona

and State Representative from Arizona’s 11th District

Sheriff Mark Lamb, Pinal County Sheriff

Kelli Ward, Chairwoman of the Republican Party of Arizona

Mike Lindell, Inventor and CEO of My Pillow

Timeline of Events:

6:00AM – Parking and Line Opens

11:00AM – Doors Open and Entertainment Begins

1:00PM – Special Guest Speakers Deliver Remarks

4:00PM – 45th President of the United States Donald J. Trump Delivers Remarks

General Admission Tickets:

REGISTER HERE

Request Media Credentials:

REGISTER HERE

All requests for media credentials must be submitted by Thursday, July 14, 2022, at 4:00PM MST.

https://www.rsbnetwork.com/video/president-donald-j-trump-live-from-prescott-az-july-16th-2022/?mc_cid=d10c22f780&mc_eid=a19c8148b2

CDD; SOUND THE ALARM! DECISION SOON? DURHAM MOVES! BIDEN EXPOSURE! NATO EXPOSED! NOW! PRAY!

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce6ot-7.14.22-sound-the-alarm-decision-soon-durham-moves-biden-exposure-nato-expo.html

Are Corrupt Feds Distracting Us From The Truth About Everything? | Justinformed News

Patriot Movement Published July 15, 2022

https://rumble.com/v1cbzon-are-corrupt-feds-distracting-us-from-the-truth-about-everything-justinforme.html

ATTENTION! Dr. 'Judy Mikovits' "WARNING TO HUMANITY" 'David Nino Rodriguez' Interview

AndreCorbeil Published July 12, 2022

https://rumble.com/v1c1qal-attention-dr.-judy-mikovits-warning-to-humanity-david-nino-rodriguez-interv.html

US Navy Revolt Slams Biden Secret Plot To Oust Over 500,000 Troops

https://www.whatdoesitmean.com/index3977.htm

Iran Plotting to Assassinate Trump and Pompeo in Revenge for Soleimani Killing, US Intel Leak Shows

David HawkinsJuly 14, 20222 Comments

https://slaynews.com/news/us-intel-leak-says-iran-plotting-to-assassinate-donald-trump-and-mike-pompeo-in-revenge-for-soleimani-drone-strike/

2000 MULES BY DINESH D’SOUZA DOCUMENTARY - best news here

This is the official 2000 Mules movie.“2000 Mules,” a documentary film created

by Dinesh D’Souza, exposes widespread, coordinated voter fraud in the 2020

election, sufficient to change the overall outcome. Drawing on research provided

by the election integrity group True the Vote, “2000 Mules” offer..

https://bestnewshere.com/2000-mules-by-dinesh-dsouza-documentary/

THE EU FINALLY ADMITS THE VACCINE DESTROYS YOUR IMMUNE SYSTEM COMPLETELY - TRUMP NEWS

Trump News Channel Published July 10, 2022

https://rumble.com/v1bqnvt-the-eu-finally-admits-the-vaccine-destroys-your-immune-system-completely-tr.html

$CH Excellent Video Thanks;

https://live.aflds.org/

God Bless America

Amen

NWO Hidden History of the Incredibly Evil Khazarian Mafia -

Tuesday, March 10, 2015 4:22

http://beforeitsnews.com/alternative/2015/03/the-hidden-history-of-the-incredibly-evil-khazarian-mafia-3119728.html?currentSplittedPage=0

Brother Nathanael - BRICS...Breaking The Jewish Money Power 2015 -

Glenn Beck Warns: Move To Canada Before Obama Revolutionaries Start To ‘Scoop People Up’

Monday, October 7, 2013 15:08

http://beforeitsnews.com/obama/2013/10/glenn-beck-warns-move-to-canada-before-obama-revolutionaries-start-to-scoop-people-up-2456414.html

BS Osama Uses Own Money To Open Muslim Museum Amid Government

Shutdown -

See more at:

http://nationalreport.net/obama-uses-money-open-muslim-museum-amid-government-shutdown/#sthash.WAgxpq23.VhSHUm15.dpuf

ex.

BS osama supply of weapons to his brotherhood -

http://weaselzippers.us/2013/09/26/al-shabaab-brutally-tortured-hostages-during-kenyan-mall-siege-men-castrated-gouged-eyes-out-fingers-and-noses-removed-with-pliers/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92659734

Seymour Hersh: Story About Killing Osama Bin Laden is One Big Lie

Plus, 90% of lamestream editors should be fired.

http://www.alternet.org/media/seymour-hersh-story-about-killing-osama-bin-laden-one-big-lie

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92659734

http://beforeitsnews.com/

God Bless

Who Is Winning the Shutdown Message War?

Monday’s BlazeCast Rewind

JER1

Thanks, you to...

Nice to be trading again

JER1

JER1 welcome back good to see you again ![]()

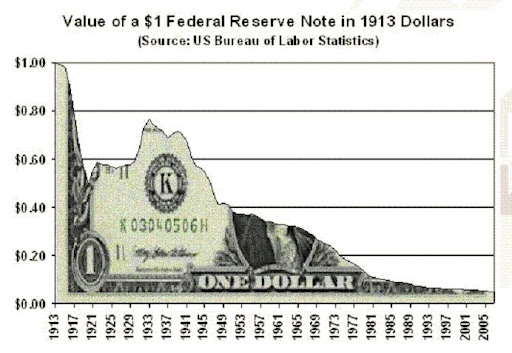

We are on a gold standard now, even though it is

not recognized -

Breaking News 27 mins ago

http://rinf.com/alt-news/breaking-news/we-are-on-a-gold-standard-now-even-though-it-is-not-recognized/71719/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92290936

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92268951

The Real Legal Money Tender =

http://www.biblebelievers.org.au/monie.htm

God Bless

Great Post Thanks bud

JER1

Well it's been awhile since I have been over here and posted on I-Hub. Life has been crazy but getting close to getting things together so I can finally get back on here. Look forward to getting this blog up and running again soon.

JER1

Spirit of Liberty Lives -

2013 Ron Paul -

Money Managers are BULLISH at the highest level since January 2011. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, December 26, 2012

The NAAIM Number

88.10

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

In this tough market, you need to look for clues to get ahead:

From the ADIA Blog..http://www.kindbacteria.com/

"We are working on a new and exciting project at Adia and really excited to share it with you and hope that you will all be a part of it! We cannot tell you specifically what it is yet but we think you will enjoy it and it will help spread the word on Adia."

Share Structure:

Authorized shares: 100,000,000

Free trading public float: 13,848,781

Outstanding shares: 71,899,861

a/o September 30, 2012

Might seem illiquid right now, but this is simply the calm before the January storm...

Estimated Long-Term Mutual Fund Flows

* Wednesday, December 12, 2012

Washington, DC, December 12, 2012 - Total estimated outflows to long-term mutual funds were $2.01 billion for the week ended Wednesday, December 5, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $7.16 billion for the week, compared to estimated outflows of $627 million in the previous week. Domestic equity funds had estimated outflows of $5.84 billion, while estimated outflows from world equity funds were $1.32 billion.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated outflows of $70 million for the week, compared to estimated inflows of $144 million in the previous week.

Bond funds had estimated inflows of $5.23 billion, compared to estimated inflows of $4.25 billion during the previous week. Taxable bond funds saw estimated inflows of $4.15 billion, while municipal bond funds had estimated inflows of $1.07 billion.

http://www.ici.org/research/stats/flows/flows_12_12_12

George.

Click on "In reply to", to see report from prior week.

Money Managers are back in the bullish side. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, December 5, 2012

The NAAIM Number

75.71

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 12/5/2012

Bullish 42.2%

Bullish 42.2%

Neutral 23.2%

Neutral 23.2%

Bearish 34.6%

Bearish 34.6%

Change from last week:

Bullish: +1.3

Neutral: -1.5

Bearish: +0.2

Long-Term Average:

Bullish: 39.0%

Neutral: 30.5%

Bearish: 30.5%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Estimated Long-Term Mutual Fund Flows

* Wednesday, December 5, 2012

Washington, DC, December 5, 2012 - Total estimated inflows to long-term mutual funds were $4.09 billion for the week ended Wednesday, November 28, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $496 million for the week, compared to estimated outflows of $8.81 billion in the previous week. Domestic equity funds had estimated outflows of $481 million, while estimated outflows from world equity funds were $15 million.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated inflows of $143 million for the week, compared to estimated outflows of $1.20 billion in the previous week.

Bond funds had estimated inflows of $4.44 billion, compared to estimated inflows of $4.44 billion during the previous week. Taxable bond funds saw estimated inflows of $3.13 billion, while municipal bond funds had estimated inflows of $1.31 billion.

http://www.ici.org/research/stats/flows/flows_12_5_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, December 3, 2012

http://tickersense.typepad.com/ticker_sense/2012/12/december-3rd-blogger-sentiment-poll.html

George.

Click on "In reply to", to see charts from prior week.

Money Managers are more cautious since September 2012. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, November 28, 2012

The NAAIM Number

55.19

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 11/28/2012

Bullish 40.9%

Bullish 40.9%

Neutral 24.7%

Neutral 24.7%

Bearish 34.4%

Bearish 34.4%

Change from last week:

Bullish: +5.1

Neutral: +1.3

Bearish: -6.4

Long-Term Average:

Bullish: 39%

Neutral: 31%

Bearish: 30%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Estimated Long-Term Mutual Fund Flows

* Wednesday, November 28, 2012

Washington, DC, November 28, 2012 - Total estimated outflows from long-term mutual funds were $5.52 billion for the six-day period ended Tuesday, November 20, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $8.82 billion for the week, compared to estimated outflows of $8.39 billion in the previous week. Domestic equity funds had estimated outflows of $7.51 billion, while estimated outflows from world equity funds were $1.31 billion.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated outflows of $1.19 billion for the week, compared to estimated outflows of $1.22 billion in the previous week.

Bond funds had estimated inflows of $4.50 billion, compared to estimated inflows of $6.62 billion during the previous week. Taxable bond funds saw estimated inflows of $3.13 billion, while municipal bond funds had estimated inflows of $1.37 billion.

http://www.ici.org/research/stats/flows/flows_11_28_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, November 26, 2012

http://tickersense.typepad.com/ticker_sense/2012/11/november-26th-blogger-sentiment-poll.html

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment

* Wednesday, November 21, 2012

The NAAIM Number

64.20

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

Happy Thanksgiving to everyone!

George.

Estimated Long-Term Mutual Fund Flows

* Wednesday, November 21, 2012

Washington, DC, November 21, 2012 - Total estimated outflows from long-term mutual funds were $2.99 billion for the week ended Wednesday, November 14, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $8.38 billion for the week, compared to estimated outflows of $1.84 billion in the previous week. Domestic equity funds had estimated outflows of $6.63 billion, while estimated outflows from world equity funds were $1.75 billion.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated outflows of $1.22 billion for the week, compared to estimated inflows of $553 million in the previous week.

Bond funds had estimated inflows of $6.61 billion, compared to estimated inflows of $7.47 billion during the previous week. Taxable bond funds saw estimated inflows of $5.35 billion, while municipal bond funds had estimated inflows of $1.26 billion.

http://www.ici.org/research/stats/flows/flows_11_21_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, November 19, 2012

http://tickersense.typepad.com/ticker_sense/

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment continues to be bullish. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, November 14, 2012

The NAAIM Number

67.22

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 11/14/2012

Bullish 28.8%

Bullish 28.8%

Neutral 22.4%

Neutral 22.4%

Bearish 48.8%

Bearish 48.8%

Change from last week:

Bullish: -9.7

Neutral: +0.8

Bearish: +8.9

Long-Term Average:

Bullish: 39%

Neutral: 31%

Bearish: 30%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Estimated Long-Term Mutual Fund Flows

* Wednesday, November 14, 2012

Washington, DC, November 14, 2012 - Total estimated inflows to long-term mutual funds were $6.24 billion for the week ended Wednesday, November 7, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $1.82 billion for the week, compared to estimated outflows of $2.49 billion in the previous week. Domestic equity funds had estimated outflows of $2.12 billion, while estimated inflows from world equity funds were $300 million.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated inflows of $553 million for the week, compared to estimated outflows of $673 million in the previous week.

Bond funds had estimated inflows of $7.50 billion, compared to estimated inflows of $2.59 billion during the previous week. Taxable bond funds saw estimated inflows of $6.42 billion, while municipal bond funds had estimated inflows of $1.08 billion.

http://www.ici.org/research/stats/flows/flows_11_14_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, November 12, 2012

[img][/img]

http://tickersense.typepad.com/ticker_sense/2012/11/november-12th-blogger-sentiment-poll.html

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment

* Wednesday, November 7, 2012

The NAAIM Number

57.95

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 11/7/2012

Bullish 38.5%

Bullish 38.5%

Neutral 21.6%

Neutral 21.6%

Bearish 39.9%

Bearish 39.9%

Change from last week:

Bullish: +2.8

Neutral: -1.7

Bearish: -1.1

Long-Term Average:

Bullish: 39%

Neutral: 31%

Bearish: 30%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Estimated Long-Term Mutual Fund Flows

* Wednesday, November 7, 2012

Washington, DC, November 7, 2012 - Total estimated outflows from long-term mutual funds were $488 million for the week ended Wednesday, October 31, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $2.43 billion for the week, compared to estimated outflows of $2.47 billion in the previous week. Domestic equity funds had estimated outflows of $1.89 billion, while estimated outflows from world equity funds were $548 million.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated outflows of $672 million for the week, compared to estimated inflows of $1.32 billion in the previous week.

Bond funds had estimated inflows of $2.62 billion, compared to estimated inflows of $6.61 billion during the previous week. Taxable bond funds saw estimated inflows of $2.23 billion, while municipal bond funds had estimated inflows of $385 million.

http://www.ici.org/research/stats/flows/flows_11_07_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, November 5, 2012

http://tickersense.typepad.com/ticker_sense/2012/11/november-5th-blogger-sentiment-poll.html

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment continues to be bullish. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, October 31, 2012

The NAAIM Number

75.11

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 10/31/2012

Bullish 35.7%

Bullish 35.7%

Neutral 23.3%

Neutral 23.3%

Bearish 41.0%

Bearish 41.0%

Change from last week:

Bullish: +6.5

Neutral: -4.4

Bearish: -2.1

Long-Term Average:

Bullish: 39%

Neutral: 31%

Bearish: 30%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Analyze Investments Quickly With Ratios

» Profitability Ratios

» Liquidity Ratios

» Solvency Ratios

» Valuation Ratios

* Wednesday, October 31, 2012

http://www.investopedia.com/articles/stocks/06/ratios.asp#axzz2AVRJWzUh

George.

Estimated Long-Term Mutual Fund Flows

* Wednesday, October 31, 2012

Washington, DC, October 31, 2012 - Total estimated inflows to long-term mutual funds were $5.45 billion for the week ended Wednesday, October 24, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $2.49 billion for the week, compared to estimated outflows of $2.49 billion in the previous week. Domestic equity funds had estimated outflows of $1.87 billion, while estimated outflows from world equity funds were $620 million.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated inflows of $1.32 billion for the week, compared to estimated inflows of $837 million in the previous week.

Bond funds had estimated inflows of $6.62 billion, compared to estimated inflows of $8.84 billion during the previous week. Taxable bond funds saw estimated inflows of $5.66 billion, while municipal bond funds had estimated inflows of $952 million.

http://www.ici.org/research/stats/flows/flows_10_31_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, October 29, 2012

http://tickersense.typepad.com/ticker_sense/

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment continues to be bullish. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, October 24, 2012

The NAAIM Number

64.39

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

The AAII Investor Sentiment

* Sentiment Survey Results Week ending 10/24/2012

Bullish 29.2%

Bullish 29.2%

Neutral 27.7%

Neutral 27.7%

Bearish 43.1%

Bearish 43.1%

Change from last week:

Bullish: +0.6

Neutral: +0.9

Bearish: -1.5

Long-Term Average:

Bullish: 39%

Neutral: 31%

Bearish: 30%

http://www.aaii.com/sentimentsurvey/

George.

Click on "In reply to", to see past Survey Results.

Estimated Long-Term Mutual Fund Flows

* Wednesday, October 24, 2012

Washington, DC, October 24, 2012 - Total estimated inflows to long-term mutual funds were $7.95 billion for the week ended Wednesday, October 17, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Equity funds had estimated outflows of $1.73 billion for the week, compared to estimated outflows of $2.61 billion in the previous week. Domestic equity funds had estimated outflows of $1.36 billion, while estimated outflows from world equity funds were $369 million.

Hybrid funds, which can invest in stocks and fixed income securities, had estimated inflows of $818 million for the week, compared to estimated inflows of $242 million in the previous week.

Bond funds had estimated inflows of $8.86 billion, compared to estimated inflows of $9.51 billion during the previous week. Taxable bond funds saw estimated inflows of $7.58 billion, while municipal bond funds had estimated inflows of $1.29 billion.

http://www.ici.org/research/stats/flows/flows_10_24_12

George.

Click on "In reply to", to see report from prior week.

Sentiment Poll

* Monday, October 22, 2012

http://tickersense.typepad.com/ticker_sense/

George.

Click on "In reply to", to see charts from prior week.

The NAAIM Survey of Manager Sentiment continues to be bullish. - George.

The NAAIM Survey of Manager Sentiment

* Wednesday, October 17, 2012

The NAAIM Number

65.38

Last Quarter Average

71.96

http://www.naaim.org/news/naaim-survey-of-manager-sentiment/

George.

Click on "In reply to", to see The NAAIM Number from prior week.

|

Followers

|

33

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3350

|

|

Created

|

08/09/11

|

Type

|

Free

|

| Moderator StkMktPirate | |||

| Assistants NYBob DiscoverGold RC Philly warpig38 | |||

The History of Austrian Economics, Part 1 | Dr. Israel Kirzner

The History of Austrian Economics, Part 2 | Dr. Israel Kirzner

|

Posts Today

|

0

|

|

Posts (Total)

|

3350

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |