Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Does anyone else notice how the administration (DOI/DOE) chooses to interchange ‘renewable’ and ‘green’ when it suits their fancy? Or how the EIA can arbitrarily omit references to WTI from their reports. I suppose they hope we will not miss it and forget it exists in the world of energy. It appears they want to only focus on international prices and production. For what purpose I wonder?

The DOI recently referred to strip mining of minerals as being ‘green’. SINCE WHEN? Just like all other mining practices, there will be no replenishment of these minerals and the environmental impact will live indefinitely in the form of erosion, pollution of groundwater, and damage to the landscape. So it is amusing when they cherry-pick and choose to utilize the word ‘green’ for effect. Is it only camouflage? Or deceit?

For the record, all heavy mining equipment will be powered by diesel for the foreseeable future. And of course the environmental impact of strip mining must be overlooked to pursue this agenda to ‘save the planet’. The hypocrisy is undeniable. The biggest talent of these politicians is keeping a straight face when they speak.

Not such a subtle difference between renewable and green after all. Too bad the administration cannot find time to focus on inflation and energy independence. It makes me wonder what the real agenda could be. What are the options? The Great Upset?

When it comes to domestic wind farms and mining of minerals over the last two years, is it a big surprise how generous the DOI has been to grant the special interest’s wish list?

If we look deep enough I predict we will find a particular set of political donors lined up to benefit from the ‘windfall profits’ bestowed on ‘green projects’ by our government. Is there a 10% in play somewhere?

Creating renewable energy technology, materials, infrastructure, and capital will not come over night. It will take a couple of decades and cost us dearly. This is a known fact.

Yet Joe’s plan is to cut US oil and gas production now, lowering our standard of living by increasing the costs to live. But, it is going to all be okay, we can get it from other places. Like Venezuela. At what cost to the USA in revenue, wealth created, jobs, national security?

Oil and gas is already a proven means of efficient energy, and will be utilized for decades to come. We are already feeling the effects of under investment in the oil and gas sector because, without new investments, there will be higher prices and shortages. That appears to be the plan. But the end game is no longer hidden to those that take a critical look. Check for yourself.

Remember, if these green initiatives were viable in the marketplace, they would not need subsidies or need to have the government artificially raise the price of oil to make renewables competitive.

This reliance on wind and solar without gas or coal will result in us being forced to freeze in the dark. And without electricity to charge that EV, we lack the ability to flee or find food. But if we can kiss enough government ‘fanny’ perhaps they will allow us to survive for a while longer. The Great Reset in action. Be warned.

Mrs. Smith

I read this article on how offshore wind farms might change oceanographic and marine ecosystem conditions.

Not having training or expertise in marine biology, I cannot vouch for the veracity of the article. But it did cause me to wonder if these green projects in the USA are required to do an environmental impact study ‘to the same degree’ oil and gas projects are? Were these effects considered?

It seems to me that any permit to build offshore wind farms in U.S. waters would be in jeopardy until such time as these concerns are addressed.

Double standard?

https://www.workboat.com/wind/wind-turbines-will-affect-base-of-ocean-food-chain-study-predicts

Mrs. Smith

Hi GSPE

I’m patiently waiting on the moons to align. We ought to feel those good vibes down here too. What’s gonna be even more amazing is when GSPE’s atomic nucleus electrifies our ASK!

“Faith is the highest passion in a human being. Many in every generation may not come that far, but none comes further.”

Ya know you can jingle those bells as loud as you want. Have fun with friends and family this weekend ![]()

WTI tumbles to $70 and JPM strategist says sell oil sector …

…. at least for the short term

Covering?

Fearful Friday headlines

GSPE has a dirt bid still but sheesh, she got beat down a bit

Green for the close at least

About as helpful as putting pumpkin spice on a cheeseburger

Anyway…..

Have a great weekend y’all

Spread some Christmas cheer ![]()

spec

Yep, these are “Hero or Zero” levels

Someone threw away shares

But just a few mil in the past few days

WTI in the low $70’s is welcome news for gasoline prices but can’t be a sustainable level in this market turmoil

Going forward, the only certainty is the passage of time

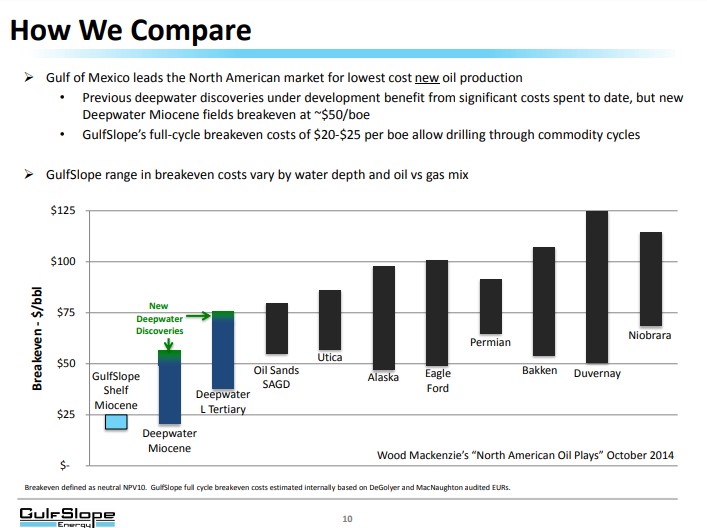

I’m nearly 100% certain tha GOM exploration drilling will see a sustained uptick as soon as policies allow

And I’m pretty confident that GulfSlope intends to, and will, participate in that renaissance

Another passage of a full moon and all of the primal forces that are connected deeper than we can understand

spec

Am I the only one concerned with the .003/.0035 bid / ask?

I guess there is no fear of it becoming a takeover target after the recent board vote, so who cares how low price goes as long as operations don’t completely shut down and the towel is thrown in.

PS - I picked up more shares yesterday at .00325 and .0035 which will either be incredibly sharp or incredibly dull. No in between. lol

I prefer we flood it with oil from tau2

Celebrating falling gasoline prices is the top priority for the spin masters

Ignore the overall picture because it clearly illustrates the political failings and market manipulations responsible for the energy/economy crisis we are facing

Ignore the inconvenience of exposing DEEP corruption at the HIGHEST levels of our government

Ignore the fact that cherry picking is the only way for Brandon’s crew to find a good metric to hang your hat on

Commodity supercycle is in motion and continues to be increasingly involved as weapons/targets of war

You can’t heat your home with shares of Amazon or Microsoft

Alas, some days I would like to do just that

Maybe draining the swamp is the wrong medicine

Maybe what it needs is to be flooded

Filled with good, capable, smart, honest, people

spec

The Boss - “GSPE just needs a nice firm ASK slapping to get it headed the correct way”

It’s the season of celebration and giving

spec

Do ya know what today’s GSPE stock chart reminded me of? A discombobulated ASK ![]()

Your GSPE mood

https://m.facebook.com/ElfMovie/videos/elf-son-of-a-nutcracker/1336464816554938/

Now I’ve really gone and done it!

WG

Cognitive dissonance is the trade of the day as crude futures are trading at lows for the year, totally pricing out the precariousness of the global supply situation

Drone strikes deep in Russia (on energy and military assets) are a significant escalation as they reveal that Putin himself is within the striking distance of Ukraine’s military

EU caps on Russian oil

API reports crude inventories continue to shrink (a build in products is welcome news)

Oil majors file suit against the government for illegally halting the oil lease process

Simple questions get a blank stare, a mumbled catch phrase, or a tired campaign slogan

The world looks on with deep concern as the world’s greatest and most triumphant society waffles, stumbles, and decays visibly at its central command responsibilities

It’s already acknowledged by the majority of economists that we’re going into a recession as layoffs begin to hit at a time when it hurts the most

Moving toward raising more cash in portfolios and tax loss harvesting are doubling the selling impulse on high risk trades

I like to think of diversification as having one extra consideration in addition to the typical factors - it’s a term from biology that I think works well in evaluating how to allocate risk/capital

r/K selection

GLTA

spec

While I 100% agree with you, it’s still troubling to see the share price reach new lows.

Yikes

Bid / ask is .0034 / .0035 which is the lowest I’ve ever seen. Yikes.

Hi GSPE

I’ve been busy ordering matching Xmas jammies and tryin’ to stay off the naughty list!

Wishing you oodles of merry adventures ![]()

Trying to read the tea leaves of the market whilst it it being bombarded by a mud pit belly-flop competition

The hot war heats up, energy targets again, WTI and the market overall fall off a cliff, red lights across the boards…

Oil/energy are increasingly becoming weaponized, leading me to think the risk premium is not being fully priced in for the longer term

It only takes a shift in the policy (where the political rubber hits the reality road) . …

… to make investment in domestic oil and gas cool again …

Make GOM oil & gas cool again

(Do NOT try to make an acronym for that phrase, people might choke saying it)

‘tis the season for tax …. ahemm… “adjusting”

and discounts

Sure would like to see a Hallmark Channel ending for us all

spec

“You miss 100% of the shots that you don’t take” - Wayne Gretzky

spec

That would be amazing to wake up to a giant deal announcement. I truly think it happens because they would have folded this up along time ago if there wasn’t a plan to do so.

I think Tau's lease expires in 2025, so at least you have ur end target to keep an eye on. If oil prices were $30, it would easy to say I have had a enough. I think it's easy to say that oil prices will be north of $50 for quite awhile, barring that someone doesn't decide to start lobbing nuclear bombs in which they would be no winners. For that I am going to trust God. But who knows maybe Putin wakes up one day and has a change of heart, better yet he doesn't wake up at all, and it changes the landscape of everything. Anyhoo I think we are closer than we know. And who doesn't like waking up to a deal out of nowhere.

More confirmation that oil and gas will not be denied.

I also believe that politicians can not overcome physics or economics.

Keep your energy investments in oil/gas. That is where all the money will end up.

https://www.realclearenergy.org/articles/2022/12/02/siemens_power_ceo_confirms_the_iron_law_of_power_density_867905.html

Mrs. Smith

The one thing that I have in abundance is opinions. But first, any comment here is not meant to denigrate any other opinion.

To me, the difference is a matter of scale. True, you and others have holdings large enough to drive the stock price lower, even to ‘zero’.

But for how long? Hours? A day? Days?

Once those holdings are exhausted, if there were not enough others frightened in to following with a similar reaction, then the price will rebound. Upwards. And then, it was all for naught. That is the real ‘zero’ in the equation.

It is simply a matter of scale. And our level of scale simply does not matter. At least, not that much.

As was mentioned by spec, there are 1.3B shares in play. I think that is a good number. So to me, that means we (all of us here), are shrimps and minnows swimming in a sea of whales and sharks.

Until those guys break ranks, nothing the rest of us can do will cause very much of a permanent ripple in that sea.

So I say that the time to “fold ‘em” is when the whale gives up his stake. So as you surmised, like it or not, we are all in it to the end from here. But at least the trend is turning.

The whales just really do not care about the stock price at this point. They are not trying to make enough profit to pay for an appetizer with their meal. Not even enough to pay for the whole meal.

No, they want to be able to buy the restaurant and the building it is located in. So they are looking far down the road, not looking at their watch.

It may be wearing us out, but the best strategy could be to sit back and watch it play out. As long as the whale does not see the road ahead as a dead end, the journey continues.

After all, there is no real volume to sell to at these price levels anyway.

I suppose that prices must make a fairly large upward move if there is to be any meaningful increase in trading volumes.

I can only imagine how crazy things might get when any news breaks. Just the thought leaves me giddy.

Once the stock makes it’s move, I hope I can keep up with it, and not be tempted to quickly sell out. Another reason I am destined to never be a trader.

For those feeling the frustration in this situation, just rejoice that you did not already sell your shares, while hoping to buy the shares back at a lower cost basis. Good luck with that plan.

Also remember, this is but another opinion amongst many others. And do not shoot any of the messengers.

Be comfortable with the investment decisions being made. This advice alone is worth the full price being paid.

Finally, the Covid Crisis appears to be waning. And even better, obstructionist government is about to be stalled.

The demand for oil and gas will not be diminished. Therefore, the money will follow that demand. And the game is not ended. Still in early innings.

Mrs. Smith

When do you fold? That’s the question we don’t usually have a fixed answer for

It’s easier to know when to say “uncle” if it’s an ordinary pinky scam draining the cash through insider pockets

Easy to bail on those when the lobster and limousine fizzle out

GulfSlope never was that, still isn’t, IMO

Legit team, got funded, struck out first inning …

Regrouped but got slammed and rained out second inning

The sky has finally

stopped

raining

Everything is wet, muddy, cold …

But it’s still real and I won’t leave the ship until the last bit slips beneath the waves

The question I have - Can they bring the spark of life to GSPE?

spec

‘White House Mulls Additional Oil And Fuel Releases This Winter’

https://oilprice.com/Latest-Energy-News/World-News/White-House-Mulls-Additional-Oil-And-Fuel-Releases-This-Winter.html

‘White House asks Congress for $500 million to modernize oil reserve’

https://www.reuters.com/business/energy/white-house-asks-congress-500-mln-modernize-oil-reserve-2022-11-16/

Mrs. Smith

The letter sent to the DOE from the U.S. Senate Committee on Energy and Natural Resources and the House Committee on Energy and Commerce is asking some very important questions.

If you are concerned about the Strategic Petroleum Reserve (SPR), this is very much worth the time needed to read.

Note: The SPR has decreased by 214 million barrels from a year ago.

https://www.energy.senate.gov/services/files/72620615-48FE-43F7-85C5-9B3A11594848

Mrs. Smith

‘OPEC+ switch to virtual meeting on Sunday, December 4th signals policy roll-over ahead of Russian oil price cap’

https://www.reuters.com/business/energy/opec-virtual-meeting-signals-little-likelihood-policy-change-ahead-russian-oil-2022-11-30/

Still holding not folding but watching this for the last 7 years has worn me out. I own too much to dump. I could drive the price to zero by myself. I was a true believer I believe if it hadn’t been for Covid we might have something here and still holding out hope. At what point do you fold? And I know everyone has their own opinion and that’s what I after. Have a great night all

No smoke on the tape here

The thing that “wasn’t happening” that I alluded to earlier was shares being sold off …

dumped into the abyss as the bid would get hammered

Nah, for almost 1.3B shares out, hardly a whiff changing hands

The bid isn’t strong by any stretch of imagination, but the shares being sold off are finding a bottom

So there’s a lot of holding

Not much folding

I remain hopeful

spec

Knowledge is power

and I want warp 9 now!

New Speaker McCarthy said….. one of the first orders of business is to get back to the energy policies that make the US energy independent.

Wash. Rinse. Repeat. (Also for that Venezuelan oil Because the Venezuelan oil is dirty in more ways than one)

You might have noticed the cyclical headlines, always a surprise every 2 weeks or so. Surprise draw on stockpiles! Crude higher

2 weeks later, Surprise build in stockpiles, crude falls

Many variations of the same “push-pull” rowing along sideways and scalping the fear spread

Longer trend is awareness of what has caused the hardships in energy, more and more pressure to unshackle domestic oil and gas

The good news out of the recent Climate Summit (COP27) is that there is NO verbiage in the agreement calling for the phasing out of fossil fuels.

Is this a case of being more sensible and finally accepting that most of the world’s energy now comes from and will continue to come from fossil fuels? I suspect this is not the case.

In many ways, the ‘climate disaster’ ideology is partially being driven by the desire for the transfer of wealth. Yes. It is the transfer of wealth from the USA into the pockets of other foreign political bureaucrats. In this country, that used to be called ‘kickbacks’. Will we ever know what is actually being bought with our freshly printed tax money?

How can these foreign governments sermonize to the world about helping less energy fortunate underdeveloped nations, when they do not even advocate for them to have access to the most convenient and affordable form of energy out there, fossil fuels.

We are talking about billions of dollars of ‘hand outs’ to these foreign government officials. Who honestly believes they can be trusted to build electrical grids and charging stations in these poorer cities and villages?

What is more likely is that whatever monies finally make it past the pockets of these foreign politicians will be used to mostly improve their own personal neighborhoods. There will be little to nothing left for the poor.

Well, maybe a few token charging stations for appearance purposes along the way, but the communities themselves will not have direct access to electricity. Most of these people cannot even afford cooking utensils, much less a $50,000 EV. That is worse than donating a refrigerator with no food in it.

I’m all for creating drought resistant seeds, providing clean water, basic shelter, and cheap energy to the poorer countries, but most of these good works are already being provided by donations through vetted organizations, not through suspicious political mandates. Yes. A proposed 100 billion USD per year. Once again, I say that what this is really about is taking hard-earned money out of our pockets and lining theirs.

And I am still curious about who is getting the 10%? Any guesses?

Just to recap, the USA will pay to run power lines and install charging stations in underdeveloped nations. Perhaps I just do not get it, but it would seem to me to be a better plan to get a little more developed before we worry about charging an EV in any deep African nation.

But, I am adventurous. Let us all have an African EV Safari. I will meet you there and we will cross the continent together (while Tau 2 is being drilled). You are driving.

What could go wrong? I hope we will not need to walk back. Pack accordingly.

Government money? Do you not just love it?

I just voted hoping for the 118th Congress to slowdown this agenda over the next two years, and to initiate and implement ‘energy independence’ strategies for the USA.

Some light articles of interest…

https://hotair.com/jazz-shaw/2022/11/28/how-joe-biden-caused-the-diesel-supply-crisis-he-is-complaining-about-n513984

https://dailycaller.com/2022/11/28/democrats-congress-lame-duck-roundup/

https://www.breitbart.com/economy/2022/11/28/u-s-auction-almost-1-million-acres-alaskan-coast-oil-drilling/

https://hotair.com/david-strom/2022/11/28/they-really-really-want-you-to-eat-bugs-n513838

https://redstate.com/robert_a_hahn/2022/11/28/a-tesla-smartphone-is-not-an-idle-threat-n665632

Mrs. Smith

It really is almost incomprehensible how poorly our “leaders” are dealing with a number of situations and events as they stumble over themselves to profit and retain power

Meanwhile, crude markets are whipsawing on China/covid headlines which are clearly a “big fear” factor for global crude demand projections

WTI crashed to $74 yesterday and might hit $80 today, currently $79 on December contracts

Nat Gas creeping back up into the low 7’s, currently $7.35

Distillate inventories are below normal and prices are already adding to demand destruction pressures

I hesitate to point out something that hasn’t happened yet to GSPE, lest I get my ASK handed to me on a silver platter

But it’s there to (not) see on the tape, zoom out

Inertia …… with a big share number on it

Know when to hold them

Even the crickets are quiet

spec

For future discussion, please note that more than 67% of the earth’s surface is covered by oceans.

In my opinion, many of the oil deposits on land have already been discovered.

That makes our energy future offshore.

As an example, Exxon has expanded it’s offshore Guyana discovery to 11 billion BOE.

So it is highly likely the GOM and other offshore sites will remain significant participants in future global oil supplies.

Please ask those windmills and solar collectors to kindly move aside.

Sorry, Joe.

Mrs. Smith

‘Biden Administration to grant Chevron license to pump oil in Venezuela, where dirty oil is name of the game’

Venezuela has thick, dirty, gooey, sludgy oil. One of the few places left to refine this low-quality dirty oil is on the US Gulfcoast, which is the exact reason China has not bought it all up. At least Joe is okay with the U.S. chasing after oil no one else wants.

https://mustreadalaska.com/leak-biden-administration-to-grant-chevron-license-to-pump-oil-in-venezuela-where-dirty-oil-is-name-of-the-game/

Hola, el Mucho Lurko.

Mrs. Smith

OIL MARKET: Washington eases its oil sanctions on Venezuela, allowing Chevron (for the next 6 months) to pump crude in the Latin American nation and export it into the United States. A major shift in the White House policy | #OOTT #Venezuela $CVX 🇻🇪 ⛽️ 🇺🇸 pic.twitter.com/fM1F6lOtJ2

— Javier Blas (@JavierBlas) November 26, 2022

Crude remains considerably less than I had expected under the current circumstances

WTI currently <$77

Demand destruction is the worry of the day, both from China Covid lockdowns and high distillate prices

The tape is showing shareholder inertia …

… shareholders at rest

How Newtonian we are !

Better than Brownian motion, less jittery

Chillin for the holidays is a good strategy whilst preparing for the next unbalanced force to energize an upward movement

spec

Anticipating an awesome future

![]()

In less than 5 weeks, Gulfslope’s annual 10-K is to be filed with the SEC somewhere around December 29th.

This 10-K is ‘audited’ and should contain specific items that could provide information that may supply clues, or at least hints, about what is next on the company agenda and the when of it all.

This report will likely require a thorough reading, especially with a filing date just prior to the New Year’s Eve holiday. A good time to have something slip by. Therefore, ‘skimming’ will not be adequate.

Fortunately, I have blocked out time over the New Year to take a look to ‘see what we can see’.

Bear in mind that this will most likely require some level of interpretation and speculation, but I will do my best to detect any useful nugget(s) of information. I intend to keep you all informed of whatever I find. Even if it is nothing.

The crystal ball is polished, cleaned-up, powered-up, and ready to go.

Be in touch in 2023.

Mrs. Smith

Add another offshore terminal to the list.

’Biden administration quietly approves huge Texas oil export project’

https://abc13.com/biden-plans-largest-oil-export-terminal-texas-gulf-coast-us-capacity-sea-port/12490194/

Excerpts:

“The construction and operation of the Port is in the national interest because the Project will benefit employment, economic growth, and U.S. energy infrastructure resilience and security,” the administration wrote. “The Port will provide a reliable source of crude oil to U.S. allies in the event of market disruption and have a minimal impact on the availability and cost of crude oil in the U.S. domestic market.”

“It will process more oil than the largest U.S. export terminal currently operating, Moda Ingleside Crude Export Terminal, owned by Enbridge in Texas, which moves up to 1.6 million barrels per day at the Port of Corpus Christi, the nation's top port for oil exports.”

Mrs. Smith

BOEM proposes to hold GOM Lease Sale 259 at 9:00 am on Wednesday, March 29, 2023.

“The Bureau of Ocean Energy Management (BOEM) proposes to open and publicly announce bids received for blocks offered in the Gulf of Mexico (GOM) Region-wide Outer Continental Shelf (OCS) Oil and Gas Lease Sale 259 (GOM Lease Sale 259) on Wednesday, March 29, 2023.”

https://www.boem.gov/sites/default/files/documents/oil-gas-energy/leasing/Proposed-NOS-259.pdf

The Vegas odds are 8-5, but I did not catch which way the bet is for.

Mrs.Smith

All is crickets on the GSPE tape

Relax and enjoy time with family, be thankful

Cheers

spec

Tuna charter sportfish detects, chases foreign submarine away from GOM offshore oil rig ??

Really?

No

It’s fictional and sarcastic to point out …

1) …the total BS article posted by WSJ yesterday that caused. $5 dip in crude futures for a couple of hours

Fake News market manipulation, caught red-handed

2) another oil terminal attack yesterday (Yemen), and these trends are alarming to me

Errbuddy chill

Make common sense fashionable again,

Peace

spec

Gasoline prices are eased, with WTI slipping further below $80

Good news for traveling and family connections for the Thanksgiving holidays

Distillates, diesel and heating oil, are the hot topic at the moment

GSPE is the winter wheat seed, just needs a little favorable shift in conditions (and there’s plenty of encouraging rhetoric from the swamp) and it can sprout just in time for the renaissance of domestic offshore oil drilling ….

…. if it hasn’t been pulverized by a hoofed beast

Come on man!

It can be done, and should be

spec

Curing the domestic oil sector damage is the Snake vs Rat

The snake is ready to eat the rat

But it will take time

To swallow and digest

As the Rat passes through

“and so we watch - LJ”

WTI - steep decline toward $80 - shocking

I wonder what direction the next surprise will point ???

Eye on the swamp rats and snakes, ear to the ground

Drill some USA oil (like Tau2)

spec

PS - suddenly the Commonwealth LNG export project on the Gulf Coast gets approved (it was going to happen because of the shift in power, now who gets to claim the credit for a no-brainer?)

Fingers crossed!

New Speaker McCarthy said, more than once, on Kudlow's show this afternoon when asked about US energy, one of the first orders of business is to get back to the energy policies that make the US energy independent. I guess we'll see if they can get that done.

Tiger

Good info, thanks

The biggest surprise (for me) in the LSU/CES study is the projection that significant investment in pipelines is not needed

Maybe it’s just a matter of definition, where is the line drawn for what level is “significant” ?

It seems to me that credible sources in the sector have said otherwise

Time will tell and the Winter chill is in the air

Time to crank up the heater in the hobby workshop

GulfSlope is chilling, perhaps frozen

When things heat up, and they inevitably will …

….exploration in GOM waters will play a big role in domestic oil production

Within that expansion of activity, prospects having a quick return will take priority (GSPE has targeted that as a priority in ranking their prospects)

In addition, there is a possibility that having the first well drilled on an approved exploration plan for Tau might put that property in a category of “current exploration drilling leases/permits” rather than “NEW leases/permits”

Anyone care to chime in on that?

If we’re going to struggle to get “new drilling” for 2 more years, can we get investment to continue in our “current” drilling plan, as approved by BOEM?

That said, I would rather see GulfSlope cut a deal on operation of producing shallow shelf properties that have unexplored subsalt prospects ….

… and Drill Tau2

spec

John Stossel: ‘Inconveint Facts’ on oil vs batteries Part 1 and 2.

So it is not going to happen. At least not on the scale or the timeline that has been proposed.

Part 2 video, released November 15th:

Gulf Coast Energy Outlook 2023 - LSU|Center for Energy Studies

Slideshow:

https://www.lsu.edu/ces/publications/2022/gceo-2023-kickoff-slides-full-reduced.pdf

Highlights:

* Long-run energy demand growth will lead to increased U.S. energy exports; however, a global recession would reduce demand for energy products.

* An ongoing Russo-Ukrainian conflict will force global energy supply adjustments. Crude oil prices will gradually attenuate over the next several years, while Gulf Coast natural gas prices will likely remain elevated (relative to post-2008 historic trends) due to LNG export pressures.

* Supply chain constraints—caused by the economic recovery from COVID-19, sanctions resulting from the war in Ukraine, and continued Trump-era trade policies with China—will continue for the next year.

* Decarbonization policies will challenge existing Gulf Coast energy manufacturing but also create opportunities for the region to take the lead in developing low- and net-zero emissions products. Over the forecast horizon, the GCEO sees decarbonization creating considerable regional capital investment opportunities.

* Drilling activity will continue to increase but is unlikely to return to pre-pandemic levels. Oil production is expected to reach pre-pandemic levels over the forecast horizon, a sign of continued efficiency improvements.

* Both oil and natural gas prices are anticipated to fall over the coming year. While long-run oil prices are anticipated to converge back to pre-Russo-Ukrainian war levels, natural gas prices will likely settle at average levels higher than those seen over the past decade.

* Both oil and natural gas production in the region are anticipated to experience a decade of growth despite the fact that oil and natural gas prices are both in backwardation, (i.e. expected to decline over the forecast horizon).

* Significant investment in crude oil pipelines is likely not needed at this time due to the investment in pipeline infrastructure over the past decade.

* While solar capacity will likely experience significant growth over the next five or so years, it is anticipated to be a small share of total electricity generated for the foreseeable future.

* As much as $175.4 billion in new energy manufacturing investment activity will occur through 2030, representing a $15 billion, or 7.9 percent, reduction in total regional capital investment relative to last year’s GCEO over a comparable period of time.

* Production in the refining industry has rebounded to pre-pandemic levels and is anticipated to continue into the future, although downward revisions may be needed if a serious global economic contraction arises in the upcoming year.

* By the second quarter of 2023, Louisiana is expected to gain about 3,500 jobs. Texas is forecasted to gain about 12,200 upstream jobs between August 2022 and the second quarter of 2023; however, these model results are not anticipating employment in either state to reach pre-COVID levels over the forecast horizon.

Mrs. Smith

‘Global oil inventory developments’, OPEC Featured Article, November 14, 2022

OPEC MOMR PDF:https://momr.opec.org/pdf-download/res/pdf_delivery_momr.php?secToken2=accept

OPEC MOMR Video:https://players.brightcove.net/34306109001/default_default/index.html?videoId=6315559296112

FEATURED ARTICLE

Global oil inventories consist of three major components. The first component is the total OECD oil stocks, commercial and Strategic Petroleum Reserves (SPRs), with OECD national government reporting systems providing data on their inventories. The second major component is non-OECD inventories, which have grown in importance in recent years as rising non-OECD oil demand which has surpassed OECD oil demand levels requires more stockpiling in these countries. Unfortunately, inventories in the non-OECD are hard to track due to incomplete data or the lack thereof. In the absence of regularly reported data, estimates are arrived at using information released by companies and ministries, as well as figures published in the Joint Organisations Data Initiative (JODI) database, which features official country data. The final component is oil at sea, which has increased in recent years, providing an important operational link between exporting and consumer countries.

Global oil inventories have increased since the beginning of this year by 158 mb and stood at 8,096mb at the of September 2022. OECD commercial stocks, non-OECD stocks and oil at sea witnessed stock builds, while SPRs in the OECD registered significant stock draws.

Over this period, total OECD commercial stocks have increased by 98 mb. At the same time, non-OECD stocks and oil at sea rose by 111 mb and 184 mb, respectively. By contrast, SPRs were expected to register a significant draw of 236 mb over the first three quarters of this year, with the bulk coming from the US, amounting to a planned 176 mb followed by OECD Europe drawing some 31 mb and OECD Asia Pacific 29 mb. These volumes are estimated to consist of 208 mb of crude and 28 mb of products, notably gasoline and middle distillates.?

In 1Q22, global oil inventory levels continued the declining trend observed since late 2020, as total oil demand outpaced global oil supply by 0.3 mb/d (Graph 2). However, this trend was reversed in 2Q22 and 3Q22, as global oil supply outpaced total oil demand by 0.2 mb/d and 1.1 mb/d, respectively. This underlines the apparent move from a balance deficit to a surplus in terms of oil supply.

During the first three quarters of this year, the observed global oil stock build reflected that the global oil market saw a supply surplus of around 0.3 mb/d vis-à-vis total world oil demand. This supply surplus was confirmed by low crude refinery runs, which are an indicator of oil demand performance. The drop in oil demand occurred on the back of weakening economic activity, spurred by rising inflation, monetary tightening by major central banks, aggravated geopolitical tensions, tightening labour markets and additional supply chain constraints.

The significant uncertainty regarding the global economy, accompanied by fears of a global recession contributes to the downside risk for lowering global oil demand growth. In addition, China’s strict adherence to the “zero COVID-19 policy” adds to this uncertainty, making the country’s recovery path even more unpredictable. To address this significant uncertainty and heightened market volatility, the proactive and preemptive decisions taken by the OPEC and non-OPEC producing countries in the Declaration of Cooperation (DoC) will continue to contribute to global oil market stability.

Mrs. Smith

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8009

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine smith199 | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |