Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I think I was to surprised a real person answered the phone and a verry chatty person as well. The number is on the website if you want to try it.

Still signs of operations…

Stock up 28.5% today…

Some good laughs in our message board…

As good of a day as I could expect here on a casual Monday in February.

You should have told her it was an emergency. We are all dying here.

Something else I should have thought of. I did call their number last night fully expecting to get a recording. To my surprise a real person answered. it was an answering service. Th voice on the line identified the line as Golfslope then asked if this was an emergency. The whole call surprised me. When I told her it wasn't an emergency, she provided me with an email address at Gulfslope. I did email the address no reply yet.

Now we are talking! LOL

Clerk at jail: “Sorry sir we don’t accept your pennies to bail out your internet friend.”

Me: “no I said penny stocks”

Maybe someone can borrow a uniform from J-Bar-M Barbecue and deliver an order

Take a couple extra plates to “tip” the building’s doorman, receptionist, security….

A gopro body cam, a good line of BS, and a smile

“Yeah, I got a delivery for suite xxx , supposed to be a surprise from Carol …. uhhh, can’t read the last name …..”

I got the tab if someone wants to try ![]()

spec

LOL mine as well donate them to a good cause at this point!

Jezz more than likely the entire board would have to donate if we are going to use GSPE shares

Hahahahha just make sure the courts accept GSPE stock as payment.

Do you intend to send bail money if I go back?

LOL just pull up your phone and say “I am here to represent this thread…” would have been worth the story. There is always next time!

Why didn't I think of that ☹️

Did you inform security that you were there on behalf of the investorhub GSPE message board? That should have done the trick lol

No, I couldn't get into the building without a badge. That wasn't a big surprise. I've worked in several buildings that required a badge to enter Although I tried. I started to get some attention from security. I even tried to go through the parking garage. So, I can report nothing of interest. It was just kind of my science project while I was in Houston.

Punxsutawney Phil didn’t see his shadow yesterday so Spring should be early this year

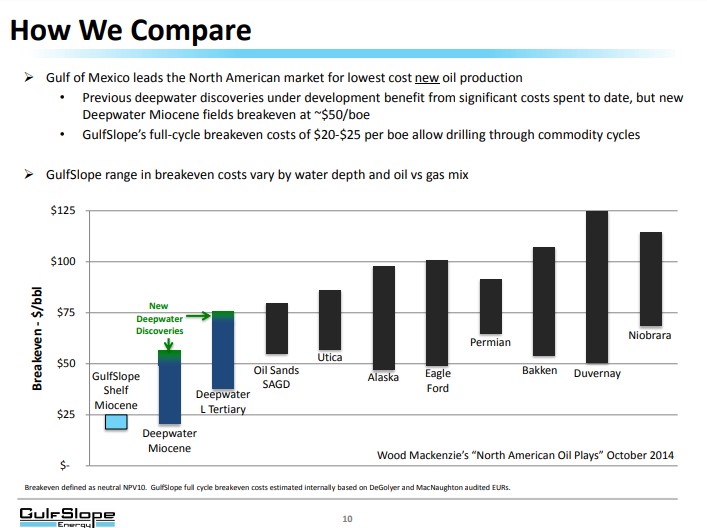

That said, it feels like GulfSlope is still dragging butt until someone cracks open the checkbook for some investment in GOM exploration (or currently operating properties)

There are a few possible funding entities like Quantum Capital Partners that invest directly into this type of project

Direct M&A is also a potential route besides Delek as a duet partner (they certainly have the capital to fund another drilling program)

The parts and pieces are all there, it just takes the willingness to accept the risk/reward spread that is presented

There’s no question that a shift in sentiment for GOM oil and gas is upon us

All that is needed is the leverage to pry the heavy boot of regulatory abuse off the neck of domestic energy production

When that happens, it’ll be like a champagne cork popping

I look forward to that and I am certain it is coming

Cheers

spec

Did you ever see the office @noroilguy1? Sorry I don’t have DMs in here so asking publicly.

Thanks, I did

Have a good weekend spec.

Great info, thanks for posting that ![]()

The latest magazine (winter 2024) has a pretty good article with a section about the policy issues currently hindering GOM upstream

A link to the main NAPE website

https://napeexpo.com/

The magazine can be reached through the main menu, the section on current policy/permitting that I referenced is at page 57-58

WTI still upper $70’s, situation continues to deteriorate in the Middle East, ESG investments are post peak, Cushing crude inventories are low

Not a peep from GulfSlope so even with a strengthening bid there’s no volume and no urgency to slap the ASK

Current situation leaves a lot to be desired but I am still optimistic that there is a lot brighter future and a pathway to get there

Cheers

spec

Next week is the NAPE conference, hopefully the CEO is mingling and rubbing elbows.

Miracles can happen! ElCheepo commented and GSPE went up 10% the following day! Let’s gooooooo!!!!

.0011 is the highest we have traded at in some time!

Have a good weekend spec.

Enjoy your weekend

I will

Absolutely ![]()

spec

WTI jitters up to high $70’s and the cost of supply disruptions in the Red Sea are just starting to be reflected in the prices of end products

“Don’t mess with Texas” is the mantra on the southern border in the battle to determine if we will regain our Constitutional Republic status or devolve further into a lawless, Marxist, dictatorship

I’m not shocked by the craziness

I’m shocked by how much resilience and normality remains in the face of current political realities

I thought something might be wrong with me

So I got checked out by a new doctor

I returned to his office today to hear the results

He said my cognitive functioning is perfect and I was thrilled!!

I’m a little worried about him though

He insisted my name is Frank (it’s not) and he had my DOB wrong, even my address

I didn’t want to alarm him so the third time he asked me, I just looked over his shoulder and read the info on the top sheet he was holding

That seemed to calm him down

I figured it was the least I could do for the poor guy, he was really confused about it all for a few moments

I’m cruising on a high now, knowing that I haven’t lost my marbles

Domestic energy production is still under fire, now a halt on LNG export project permitting …

When this pendulum starts to swing back toward USA first, it’s going to be glorious!

The climate for upstream domestic oil and gas will be the best in our generation

Bring it

spec

WTI is holding mid $70’s and M&A is active in the sector for the big players

U.S. Oil Industry Sets Record With $144 Billion of M&A Deals in Q4

Understandably quiet here and micro caps in general

Waiting for the tide to change for GSPE and the speckled trout within my casting reach

![]()

GLTA

spec

If someone has, or can look up, the current regs/restrictions, it would be appreciated

It is unfortunate that these developments are not keeping up with our preferred time table but recall there are reasons to not be more faithless.

Maybe we should all take up short positions. Although this may not work out for us because, if there is no one with faith left in the stock, what will be the value of our investments?

One final comment, searching for oil and gas is not for anyone that has a low tolerance for risk. No virtue signaling here just being realistic.

Signing off for now.

Mrs. Smith

"You bastards I'm still here" but getting older while we wait and wait and wait.

Thank you spec. You found the words I was hoping for. An excellent post with a top-tier summation. I could not have said it any better (and did not). Primo.

Mrs. Smith

There’s still a requirement to file financial statements but the different tiers and trading restrictions have changed since I last followed anything that wasn’t current on all filings

Pink sheet is still a term used in discussions but it’s not even the same definition from the “old days”

“Pink - limited information” is where I think GSPE is now, or will be, if they’re not current in fillings within some extended period

I don’t know what that time frame is, maybe 60-90 days

Then there is “Pink-no information”

I believe at that point it becomes restricted and some brokers will not accept opening orders

Like I said, it’s been a while

If someone has, or can look up, the current regs/restrictions, it would be appreciated

I think the data point that Smith199 mentioned is worthy of consideration and correlates with my opinion that the prospect is still viable and just in hibernation until it is time to make a move

When brown bears come out of hibernation …. ya better be on your toes and fully alert

If there wasn’t a plethora of reasons to delay committing to a drilling program at this time in geopolitical history, I would be more concerned

Our country, our partner’s country, and most of the world’s oil producers countries are in escalating wars at this very moment in time

Crazy, volatile times

GOM is almost certainly in the top 2 or 3 safest places to invest in upstream oil and gas, that’s not going to change

The regulatory and financial components are still in absolute chaos

A good 2024 election result will change everything

If it is a waiting game, it could pop sooner on a calculated risk that the results will unleash domestic oil and gas

I’m disappointed with the delay but still confident that there’s a smoldering ember and a big stack of processed seismic data in GulfSlope just waiting for a “drill baby drill and slap that ASK” event

![]()

spec

At first, I thought that GSPE not filing on time was most likely a positive sign. Possibly an indication that they had some deal in the works the last quarter of 23 but I’ve lost that loving feeling whoa ooo. Now since still no report has been released, I’m losing faith quickly.

Since we are trading on the pink sheets now, I do not believe there is a SEC requirement to file so I don’t think GSPE is delinquent per se, but up to this point they have continued to file their quarterly statements in good faith for when the time comes to get called back up into the big leagues.

Here is another tidbit of ‘who knows what this means’, but I noticed that the Tau partner made the effort to ensure that their “qualification information” on record at the BOEM was updated and accurate. The changes were accepted and processed on October 23rd by the BOEM.

I take this as an indicator that the partner remains engaged with the BOEM and the Tau lease. It is most certainly not a sign of disinterest coming from the Partners. The Tau lease remains ‘active’.

BOEM Chief Notes 1/8/2024 Weekly Report, page 6 under ‘Qualification Updates that were accepted and processed’: https://www.boem.gov/sites/default/files/documents/oil-gas-energy/Industy%20Report%2001082024.pdf

Mrs. Smith

LOL, I hit that link and I think my eyes were thinking on their own

I didn’t have my reading glasses on and saw the name, my brain saw Vicki Hottub

Wow!

Then I saw that the CEO’s name is Hollub

Ah well… she’s right though, exploration deficit is looming

I think the filing window has lapsed and that would mean that GulfSlope is delinquent

Dang, don’t like that

I know the filings take work and require accuracy

But there wasn’t anything unusual or complex in fiscal 2023, I don’t understand why there’s a delay

Something up? I hope so

Hard to focus

Mind keeps going to Hot tub

![]()

Fingers crossed for something good to be happening

Cheers

spec

“….fossil fuels and the affordable energy they bring are still fundamental building blocks of modern society”

Demand destruction seems to be capable of reducing demand growth rates but fossil fuels and the affordable energy they bring are still fundamental building blocks of modern society

Developing countries and the advancement/spread of modern amenities they strive for represent an unstoppable demand for decades ahead

Thankfully, there are brilliant people formulating strategic plans for our energy mix, including advances in utilization and development of alternative energy

Free markets and decentralized political power could avoid bumble-headed policies and the enormous amount of pain they’re currently inflicting on every socio-economic tier (except those immune due to their proximity to the ruling elite)

Bring on the GulfSlope annual report, the 24hr shot clock has started

Hoping for some transparency on the status of potential partnerships

Cheers ![]()

spec

PS let’s hope we aren’t sleepwalking into a third war in the Middle East

Oops, problem! I understand that beginning in 2024 ‘Lambos’ are only going to be available as EVs. So back to the drawing board.

That is okay. No one wants to be driving a Lambo in the snow anyway.

Let us not forget that the important point of my recent post was about the ‘Big Guys’, their commitment to oil and gas, and not necessarily EVs.

Happy Winter! And Go Houston Texans, because if the Texans can do it, so can Gulfslope Energy.

Mrs. Smith

The cold weather here in the North is an annual reminder of why EVs just aren’t sustainable here.

Thank you. You made a great point too.

Demand for hydrocarbons does not appear to be diminishing anytime soon. In fact, the January ‘24 EIA Short-term Energy Outlook (STEO) forecast ‘global’ demand for Petroleum and Other Liquid Consumption to increase by almost 1.4% and 1.2% in 2024 and 2025, respectively. The EIA forecast U.S. demand to rise by almost 1.4% in 2024 and to remain basically unchanged in 2025.

https://www.eia.gov/outlooks/steo/tables/pdf/3atab.pdf

https://www.eia.gov/outlooks/steo/tables/pdf/4atab.pdf

And recall, the USA is the number one exporter of LPG and LNG. And I believe in Q4 ‘23 Petroleum held the title as our top export product.

Also, the STEO forecast reflects the ‘average’ price of WTI to remain relatively unchanged in 2024 from the prior year and indicates a slight decline in 2025.

https://www.eia.gov/outlooks/steo/tables/pdf/2tab.pdf

Mrs. Smith

Preach Mrs Smith! I have a friend who works at a Ford Dealership who today told me the F-150 Ford Lightning EVs are just sitting on the lot and no one is even test driving them. Just taking up space collecting dust. No consumer demand whatsoever.

I want to share the best article and facts about EVs, climate change, and energy that I have come across lately.

My favorite quote from the article is “Those with the greatest knowledge, betting real money, know oil and gas are here to stay. ”

Knowledge that the major oil companies and renowned investors are making these large monetary commitments to the oil and gas sector should be the very best confirmation needed for us to keep our investments focused in oil and gas as well. These are among the biggest of the real Big Guys in the pursuit of profit.

And this all just highlights and accentuates that the potential rewards of a starting off E&P player such as Gulfslope Energy could turn out to be an astute investment as well.

And, all things considered, next to a drilling contract, continuing to maintain the Tau lease was the best outcome for anyone invested in GSPE at this time.

And until the challenges before us are worked out, we only need to continue ignoring the negativity of those self-serving attempts to cover positions which are of no concern to anyone else.

Despite that it seems this level of reward is not easily captured, we just need do as we have been doing. Sustaining our ‘hanging tough’ posture by standing our ground in the face of the risk and the adverse comments is the best strategy for us.

Another sound strategy we have all often heard before is to “Follow the Money”. In the past I have found this tactic to be Good Advice. Now might be a good time to do it again.

It is uplifting to know that these Big Guys are seriously in pursuit of profit by investing large sums of capital in oil and gas. Rather than blindly following the lead of that other so-called ‘Big Guy’ that is seeking political favor and/or his 10%….

So, “Drill Tau 2” continues to be the GSPE motto I stand behind and support.

I encourage all to read this article as it addresses future issues that none of us will be able to avoid. Please enjoy the article and feel free to share it with others.

https://www.americanthinker.com/articles/2024/01/the_electric_car_con_explained.html

The Electric Car Con Explained, By William Levin, released January 11th

Is electricity a source of energy? Most people will answer yes, which is incorrect. Electricity carries energy but it is not itself a source of energy, which in the U.S. is supplied 60% by natural gas and coal, 18% nuclear and 22% renewables (hydro, solar and wind).

The related question is whether cars are a major consumer of energy and hence a significant contributor of Co2 emissions? Again, most people believe both statements are self-evidently true, hence the importance of moving to electric cars.

In fact, cars (light-duty transportation) account for less than 5% of global energy demand, with U.S. cars accounting for 19% of the global car fleet, declining to under 15% by 2050 as car demand grows faster outside the U.S.

Putting these facts together, and they are indisputable facts, provides a stunning insight.

The U.S. car fleet accounts for a mere 1.0% of global energy demand (5% x 19%), declining to 0.8% by 2050. So even if the U.S. shifts 100% to electric-powered cars, the maximum climate impact in 2050 is a meaningless 0.2% (22% x 0.8%) reduction in global Co2 emissions from the current electric grid, up to a maximum of 0.5% assuming solar, wind, and hydro can, implausibly, power 60% of electric demand.

In other words, there is no factual basis to claim that the government mandate to switch to electric cars will have any material impact on global Co2 emissions.

This is not a debatable point -- it is easily verified, it is correct under any view of climate science, and it remains true even if solar and wind magically grow sixfold over the next 25 years, which is highly unlikely given the need to build a new transmission network, estimated at more than 200,000 miles of wires crisscrossing the country, and devise totally unknown, unproven, and likely impossible to achieve large-scale, economic battery storage.

Nor does the picture change materially if the entire world goes 100% electric for cars. In that case global Co2 emissions fall a mere 3.5% in 2050 versus a baseline of 24% electric adoption by 2035.

Put simply, cars are not a meaningful source of global emissions and electric cars do not and cannot curtail the continued reliance on fossil fuels in electric generation. On top of this, counting all sources, the U.S. is responsible for only 14% of all global Co2 emissions, declining to 9% by 2050 due to rest of world economic growth.

But facts count for nothing in the Biden era. The EPA seeks to force conversion to electric cars through draconian limits on tailpipe emissions. American taxpayers foot the bill for billions in subsidies to electric cars. California leads the way in mandating conversion to electric cars. Perversely, the major auto companies have signed onto the electric agenda, the harbinger of future bailouts.

Perhaps most galling is the continuous misleading of the public.

By law every new car must affix a window sticker with the following statement: “Vehicle emissions are a significant cause of climate change and smog.“ Any private company marketing such demonstrably false claims would be subject to ruinous civil and criminal liability.

If going electric yields virtually no climate benefit, why bother buying a battery-powered car, with limited range, high purchase cost, and low resale value, the death knell to affordable leasing costs?

Consumers are smarter than the government in figuring out that battery-powered cars are a raw deal, resulting in widespread reports of missed sales forecasts, high unsold inventories, and cancellation of future projections by the major auto companies.

Here again the new car sticker hides economic reality by featuring in bold type a hypothetical five-year operating saving versus an average conventional car, based on the cost of gas and electricity.

By sticker math, savings rise as gasoline prices increase, hence the perverse and persistent administration incentive to force high gas costs on Americans, except in an election year. And the savings disappear as electric costs increase.

Already there is no operating benefit when charging stations routinely cost $.40/kwh-$.50/kwh, a fact conveniently not mentioned in the sticker calculation. Nor are consumers warned of the inevitable sharp increase in electric rates if the grid must absorb high-cost solar and wind, as in Germany where electric rates already are $.45/kwh, removing any incentive for electric cars. At current gas prices, a typical hybrid costs less to run on gas once electric prices exceed $.24/kwh.

Taking the broader view, fossils fuels currently account for 80% of global energy supply. Even if the world aggressively grows solar and wind, fossil fuels in 2050 continue to supply 68% of all energy.

The reason is quite straightforward. The major sources of energy, and hence global energy emissions, come from non-car sources that are extremely difficult or technologically infeasible to convert to renewables, namely industrial, commercial transportation (heavy-duty trucking, aviation, marine, and rail), and residential/commercial. The government focus on cars is political theater.

Nuclear energy can uniquely reduce emissions to zero in these sectors, but for reasons well-known, war has been successfully declared on nuclear energy in the U.S. and it is not growing globally at the exponential rates needed to solve global Co2 emissions permanently.

The continued dominance of fossil fuels explains what is otherwise inexplicable: Warren Buffet’s multi-billion-dollar investment in oil companies, especially Occidental Petroleum, and the recent surge in oil acquisitions, notably ExxonMobil paying $58 billion for Pioneer Natural Resources and Chevron’s purchase of Hess Corp. for $60 billion.

Those with the greatest knowledge, betting real money, know oil and gas are here to stay. Without skillful, continuous oil and gas investment in the billions and trillions in the U.S. and the world, global oil and gas production by 2050 would drop more than 70% from current levels, yielding economic Armageddon.

The Biden Administration response is astonishing. As reported by the Department of Energy in September 2023, the National Security Council has issued an edict banning government employees from attending any international conference that promotes fossil fuel production, with limited exceptions.

Yet even at 68% market share for fossil fuels, global emissions will be cut significantly. By a factor of three, the most important lever of global greenhouse gas reduction is not growth in solar and renewables, but continuous private sector innovation in energy efficiency, reducing energy content per unit of output.

Missing in climate change discussions is its inhumane logic. Global emission increases through 2050 are due to population growth and rising economic activity in China, India, and the rest of the developing world (i.e., non-U.S. and Europe). GDP growth raises living standards. Falling GDP and population reduction outside the developed nations are the true, but strategically hidden, moral epicenter of the climate change agenda.

China, India, Asia, and Africa are not buying what world elites are selling as they self-righteously jet to exhilarating climate confabs. No one should. Demanding that 80% of the world, or some six billion humans, sacrifice their well-being, and their children, is an immorality never before articulated and rationalized.

The hard truth is that no set of actions can remotely meet the arbitrary IPCC requirement for a 70% reduction in global Co2 by 2050, certainly not the puny contribution from electrified cars and indeed nothing short of a horrific determination to strangle the world whole.

By all means purchase a battery-powered vehicle if it pleases you. But do not imagine for a moment that it saves money or is doing anything that matters for climate change.

We are ruled by liars, fools and demons, too often all three in one.

Mrs. Smith

More reasons why Hydrocarbons are King. “At some point America’s power grid will fail. What happens then? Dennis Quaid on a risk the government seems to be ignoring”. Worth your time.

Time stamp:

Grid Down, Power Up (00:40 - 24:99)

Ep. 64 At some point America’s power grid will fail. What happens then? Dennis Quaid on a risk the government seems to be ignoring. pic.twitter.com/EzX2e4NfU2

— Tucker Carlson (@TuckerCarlson) January 13, 2024

The BOEM has released a monthly report dated January 10th which shows the Tau lease G36121 active. This confirms the annual rental payment of $105,000 was paid by November 1st and the lease status is still considered ‘primary’ and has not been relinquished.

So my question for those predicting that the company will fold is, if this were actually the case, why would the company and it’s partner pay the $105,000 rental fee and continue to hold the Tau lease?

The answer is they would not. So since they did pay, it appears there is no evidence to support that the company (or partner) is considering ceasing efforts to drill.

Not wishing to be confrontational, I will just say those predictions appear to mostly be attempts to drive the share price lower for some undeclared reason.

This is my take on it.

Link to BOEM report ‘Lease Data’ (Gulfslope Lease G36121 on page 2694):

https://www.data.bsee.gov/Leasing/Files/1221.pdf

Mrs. Smith

This is a Tucker Carlson video interview with Dr. Willie Soon for a different perspective on how the ‘sun’ and not ‘fossil’ fuels is responsible for any changes in the environment or global warming.

Also they circle back to NASA’s Cassini spacecraft discovery of Saturn’s orange moon Titan “having hundreds of times more liquid hydrocarbons than all the known oil and natural gas reserves on Earth”. These were ‘not’ created from fossils, but rather formed in the atmosphere and deposited on Titan.

There is also discussion of the general scientific opinion of ‘climate change’ that I found interesting. Truth should never be silenced.

I recently saw a 45 year old news clip of an environmental group shouting that ‘Big Oil’ should be shut down.

Speaking of creating energy poverty, imagine if these extremists had their way at the time, the majority of people today would have suffered all these years (that is us). And the impoverished would have suffered the most. It is obvious there is a lack of concern and compassion for those less fortunate.

Extreme environmentalists and simple-minded politicians and elites today howl ‘there are way too many internal combustion engines, appliances, people, animals, plants, etc.

Even considering 80% of the World’s energy is generated by hydrocarbons, extremists would still today have the populations of the world suffering. They will even block out the sun if they are allowed to have their way. Makes one wonder what is the real reason to force the world populations into poverty, hardship, and starvation.

There has got to be a ‘grand goal’ in mind to pursue such a devastating outcome on a global scale. Anyone care to hazard a guess?

For now, renewable projects and the green ideology is staying afloat by way of government subsides and credits because the general population does not support paying the higher costs of these renewables. Those costs are funded by our tax dollars and will leave future generations paying a debt of +$34 trillion and counting. No tax breaks for them.

One must love the ‘D’ level of fiscal responsibility. Or not, could be an ‘F’.

Link to Tucker Carlson X interview, episode 62:

Ep. 62 If fossil fuels come from fossils, why have scientists found them on one of Saturn’s moons? A lot of what you’ve heard about energy is false. Dr. Willie Soon explains.

— Tucker Carlson (@TuckerCarlson) January 9, 2024

TIMESTAMPS

(01:49) Fossil Fuels in Space

(14:27) Global Warming Throughout History

(25:31) Outside… pic.twitter.com/GMaDkDl8z9

a GSPE Wednesday playlist ![]()

I think I was wrong on a previous point

A while back in summarizing my opinions on the energy markets as they relate to the prospects and potential for GSPE going forward ..

I stated that I see an energy/oil supercycle like nothing before in my lifetime

I was way off, even when I later started including commodities as a whole being part of the impending supercycle

I maintain that production of basic needs of civilization will be prioritized, food, shelter, energy, ... clothing optional ![]()

But the global forces on the markets are much bigger

A cultural tsunami is forming globally and it's possible that most of the damage can be mitigated

We, as a nation, are capable of withstanding the upheaval but that is certainly not guaranteed

Especially if global leaders are in denial of the magnitude and divided about what course of action is required

Clear heads and a moral compass are required

Those are currently in short supply

As for GulfSlope, I truly believe the prospect and intrinsic value represented are an attractive package that has substantial potential to generate massive upside if utilized according to the plans that have been outlined

So that's my take for hump day as I wax philosophical on the BIG picture

Cheers

spec

You're absolutely right about GSPE

It's in a position (if a partnership/funding/M&A event happens) to get the ASK slapped North, South, East, and West

Several perfect Orbits and a shot to the Moon

Drill baby drill, to meet the demand

Apply the power with the palm of the hand

Peace ☮️

spec

Okey Dokey and cheers to you too!

My GSPE Sunday rhyme ![]()

I believe there was a typo/error in the NT-10K filed by GulfSlope

I the narrative explanation for the delay it states that they will file by the fifth calendar day following the original deadline

I thought it was odd when I first read that because the deadline is the 15th calendar day past the due date

Tuesday Jan 16 is the correct deadline for the late 10-K

Cheers to everyone in 2024

New Beginnings

spec

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8012

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine smith199 | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |