Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

3338.77 91.24 (2.81%) @2:38:56 PM EDT

3086.56 108.61 (3.65%) @11:23:38 AM EDT right now.

DD....$Gold Breaking Out vs Commodities (Top Chart) As US Dollar Weakens (Bottom Chart)

$GOLD MINERS NEWS - $Gold now has a historical breakout vs US CPI. A very bullish chart for precious metals.

$Gold Has Also Broken Out vs CPI

The inflation-adjusted $gold price having a 44-year break out has absolutely massive implications going forward…

$15,000 GOLD Soon! Prepare for the BIGGEST $Gold & $Silver Rally in 50 Years - John Rubino

Money Sense

The Impact of Global Economic Events on Gold

Global economic events can be broadly classified into two categories:

1)Macroeconomic Events: These are large-scale events that affect the overall health of the global economy, such as changes in interest rates, inflation rates, and GDP growth.

2)Geopolitical Events: These include political upheavals, wars, and trade sanctions between countries.

Let’s see some specific examples:

1)During times of economic uncertainty, such as a recession or high inflation rates, investors tend to flock towards safe-haven assets like gold This increased demand leads to a rise in their prices.

2)Geopolitical events also play a crucial role in the prices of gold For instance, during times of geopolitical tension, investors shift funds toward precious metals as a hedge against potential volatility in other assets. for example russia vs ukraine war , israel vs palestine war etc

3) Interest rates significantly impact the prices of gold Lower interest rates make borrowing for investments more affordable, prompting investors to opt for riskier assets such as stocks and real estate, reducing the demand for gold and silver. Conversely, higher interest rates steer investors towards safer assets like gold and silver.

4)Changes in currency values can also impact the prices of gold As these precious metals are denominated in US dollars, a decrease in the value of the dollar can lead to an increase in their prices. This is because investors from other countries will need to pay more of their local currency to purchase these metals

5)Supply and demand factors this a also play important role determining prices of gold for example any tension supply chain like mining strike and natural disaster can cause decrease in supply of gold and which will cause increase in prices of gold

https://www.boldpreciousmetals.com/gold-bullion

https://www.bullionupdates.com/understanding-the-basics-of-investing/

Hello everyone,

I’d like to get your thoughts on an important topic: What are the potential impacts of de-dollarization on gold bullion prices? As more countries move away from the US dollar as the global reserve currency, how do you think this shift will affect the value of gold? Let’s discuss the possible benefits, risks, and market dynamics involved

$DOLLARS Fiats Eventual Financial Death Spiral Now Imminent – John Rubino

By Greg Hunter On March 9, 2024 In Market Analysis 83 Comments

https://rumble.com/v4i4tv5-eventual-financial-death-spiral-now-imminent-john-rubino.html

$GOLD Mining Update - GOLD WEEKLY - Unless something dramatically changes, we have a weekly breakout in gold.

A 50% rally succeeded a similar breakout in 2019.

GOLD DAILY- Gold is finally breaking above $2100, and I believe we are in the initial stages of a powerful multi-month rally.

This cycle should press to the upside into late April or early May.

RESTART GREAT GOLD MINE - ABCOURT MINES | Red Cloud's Pre-PDAC 2024 -

Red Cloud TV

.jpg)

RESTART GREAT GOLD MINE - ABCOURT MINES | Red Cloud's Pre-PDAC 2024 -

Red Cloud TV

.jpg)

Watch RE: Monument Begins Gold Concentrate Shipments at Selinsing Gold Mine

News..Close to Being Fully Commissioned ..60000 Ounces -

Figure 3: Selinsing Flotation Plant

So, 5000 tons of Concentrate averaging 1.2 ounces per ton = 6000 ounces are now being delivered

as part of the offtake agreement ......about $13 milion in USD .

99 % breast plate in June./month

We shall soon be at planned 4500 tons per month containing 1.2 ounces = 5400 ounces===which is

over 60,000 ounces per years

Monument Mining begins Au concentrate shipments

Figure 2. Concentrate Shipment at Weighbridge

2023-06-23 12:22 ET - News Release

Ms. Cathy Zhai reports

MONUMENT BEGINS GOLD CONCENTRATE SHIPMENTS AT SELINSING GOLD MINE

Monument Mining Ltd. has begun the first gold concentrate shipments and sales from the newly

constructed flotation plant at the Selinsing gold mine.

President and chief executive officer Cathy Zhai commented: "This is a momentous occasion for us as

we begin to ship and sell gold concentrates from the flotation plant.

The initial offtake of 2,000 dry metric tonnes (DMT) of concentrate from Selinsing marks the beginning

of a gold concentrate revenue stream and restores our operating cash flow.

We would like to give thanks to our hard-working operation teams, backroom administration support

personnel and our business partners to make this happen."

Gold concentrate shipments and sales

Significant interest has been received from potential buyers of the Selinsing gold concentrate.

All export and transport permits have been received and the first truckloads of concentrate were shipped from the Selinsing warehouse on June 18, 2023, to Johor Free Trade Zone.

To date 490 DMT of concentrate have been dispatched out of an initial offtake of 2,000 DMT.

Weighing, sampling and moisture determination of the delivered concentrate are being conducted at the Johor Free Trade Zone by an appointed internationally recognized survey company.

An additional 3,000 DMT of concentrate are currently available for sale.

The company intends after a trial shipment to gradually increase the number of trucks to speed up the logistic process in selling backlogged product.

In the future concentrates will be shipped to buyers on a routine basis. The backlog was caused by a lengthy initial administrative process for obtaining all relevant permits and organizing logistics. Over the past six months, the company has built a logistic team and sales chain at the Selinsing project.

Commercial production update

The flotation plant operation is improving with up to 99 per cent of design capacity achieved during June, 2023, and overall 83-per-cent capacity achieved for the 30-day period up to June 17, 2023.

Torn filter cloths remained an issue with new cloths still awaited from the filter press supplier McLanahan. New HDPE (high-density polyethylene) pipework was received to upgrade the concentrate thickener underflow pipeline. A similar upgrade was planned for the flotation cleaner concentrate pipeline which emerged as a bottleneck with increasing flotation mass pull.

Flotation recovery has shown a steady improvement as increasing proportions of newly mined transition and fresh ore were processed. Daily recoveries in excess of 80 per cent have been recorded during June, 2023, although an average of 68-per-cent recovery month to date was caused by some poorly performing old transition ore processed at the start of the month.

Construction of the concentrate shed continued with the main roof completed and the perimeter concrete wall approximately 50 per cent done. Work continued extending the lean-to roof to the filter press building. The bagging system has been prepared for shipping to Malaysia.

Mining update

Mining of Buffalo Reef stage 1 BRC2 and BRC3 pits continued with both transition and fresh ore delivered to the ROM pad and maintained around one month supply of ore feed to the flotation processing plant. A new drill rig was delivered in June, 2023, with nine grade control drilling rigs now operational; a 10th unit is scheduled for delivery in August, 2023. The mining operation is aiming to achieve and maintain a three-month supply of ore at the ROM.

Construction of the explosive's depot progressed well with delivery of the bulk emulsion gassing container and the connection to mains power completed. This is to remove dependency on explosives delivery from the sole dominant supplier in the country due to its shortfall of trucks over the past several months. The isotainer storage tanks are due for delivery in late June, 2023, and the explosives depot will be commissioned in early July, 2023.

Work started on the conversion of the old core shed to an expanded sample preparation facility capable of processing up to 700 grade control samples per day, which will remove another major bottleneck in the mining cycle.

Risks

Other operation risks in related to mining and processing processes are under continuous evaluation to improve the performance.

by nozzpackon Jun 23, 2023

Monument Begins Gold Concentrate Shipments at Selinsing Gold Mine

June 23, 2023

https://monumentmining.com/news-media/news/2023/monument-begins-gold-concentrate-shipments-at-selinsing-gold-mine/

View PDF

Vancouver, B.C., June 23, 2023,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) (“Monument” or the “Company”) is

pleased to announce the first gold concentrate shipments and sales from the newly constructed

flotation plant at the Selinsing Gold Mine.

President and CEO Cathy Zhai commented, “This is a momentous occasion for us as we begin to ship

and sell gold concentrates from the flotation plant. The initial offtake of 2,000 dry metric tonnes

(“DMT”) of concentrate from Selinsing marks the beginning of a gold concentrate revenue stream and

restores our operating cash flow. We would like to give thanks to our hard-working operation teams,

backroom administration support personnel and our business partners to make this happen.”

Figure 1. Loading Concentrate for Transport

Figure 2. Concentrate Shipment at Weighbridge

Gold Concentrate Shipments and Sales

Significant interest has been received from potential buyers of the Selinsing gold concentrate. All

export and transport permits have been received and the first truckloads of concentrate were shipped

from the Selinsing warehouse on June 18th, 2023 to Johor Free Trade Zone. To date 490 DMT of

concentrate have been dispatched out of an initial offtake of 2,000 DMT. Weighing, sampling and

moisture determination of the delivered concentrate is being conducted at the Johor Free Trade Zone

by an appointed internationally recognized survey company.

An additional 3,000 DMT of concentrate is currently available for sale.

The Company intends after a trial shipment to gradually increase the number of trucks to speed up

the logistic process in selling backlogged product. In the future concentrates will be shipped to buyers

on a routine basis.

The backlog was caused by a lengthy initial administrative process for obtaining all relevant permits

and organizing logistics.

Over the last six months, the Company has built a logistic team and sales chain at the Selinsing

Project.

Commercial Production Update

The flotation plant operation is improving with up to 99% of design capacity achieved during June

2023, and overall 83% capacity achieved for the 30 day period up to June 17th 2023.

Torn filter cloths remained an issue with new cloths still awaited from the filter press supplier

McLanahan. New HDPE pipework was received to upgrade the concentrate thickener underflow

pipeline.

A similar upgrade was planned for the flotation cleaner concentrate pipeline which emerged as a

bottleneck with increasing flotation mass pull.

Figure 3: Selinsing Flotation Plant

Flotation recovery has shown a steady improvement as increasing proportions of newly mined

transition and fresh ore were processed. Daily recoveries in excess of 80% have been recorded

during June 2023, although an average of 68% recovery month to date was caused by some poorly performing old transition ore processed at the start of the month.

Construction of the concentrate shed continued with the main roof completed and the perimeter concrete wall approximately 50% done. Work continued extending the lean-to roof to the filter press

building. The bagging system has been prepared for shipping to Malaysia.

Mining Update

Mining of Buffalo Reef Stage 1 BRC2 and BRC3 pits continued with both transition and fresh ore

delivered to the ROM pad and maintained around one month’s supply of ore feed to the flotation

processing plant.

A new drill rig was delivered in June 2023 with nine grade control drilling rigs now operational; a tenth

unit is scheduled for delivery in August 2023.

The mining operation is aiming to achieve and maintain a three-month supply of ore at the ROM.

Construction of the explosive’s depot progressed well with delivery of the bulk emulsion gassing

container and the connection to mains power completed. This is to remove dependency on explosives

delivery from the sole dominant supplier in the country due to their shortfall of trucks over the past

several months.

The isotainer storage tanks are due for delivery in late June 2023 and the explosives depot will be

commissioned in early July 2023.

Work started on the conversion of the old core shed to an expanded sample preparation facility

capable of processing up to 700 grade control samples per day, which will remove another major

bottleneck in the mining cycle.

Risks

Other operation risks in related to mining and processing processes are under continuous evaluation

to improve the performance.

The Company closely monitors uncontrollable risk factors with building and operation of the flotation

plant including but not limited to: change of market conditions, change of gold prices, operation risks

including critical parts shortages which may cause a longer than expected ramp up period, and

changes in regulatory restrictions in relation to arsenic level contained in gold concentrate.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is an established Canadian gold producer that

100% owns and operates the Selinsing Gold Mine in Malaysia and the Murchison Gold Project in the

Murchison area of Western Australia.

It has 20% interest in Tuckanarra Gold Project jointly owned with Odyssey Gold Ltd in the same

region.

The Company employs approximately 200 people in both regions and is committed to the highest

standards of environmental management, social responsibility, and health and safety for its

employees and neighboring communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at

https://www.monumentmining.com

or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102

rcushing@monumentmining.com

New development to increase production from our Floatation Plant ....

With respect to the construction of the Biox Plant and in order to reduce the initial capital investment,

the Company now plans to develop the Selinsing Sulphide Project through a two stage de-risking

process:

....Stage 1 construction of a flotation plant that was originally designed to deliver sulphide gold

concentrates as a semi product for further BIOX® leaching process.

.....Under the new approach, the flotation plant will be modified to produce higher grade saleable gold

concentrates, the cash generated from which may be used to fund upgrading of the BIOX® leaching

plant.

This is an excellent move to modify the FP to produce a higher grade gold concentrate .

This will maximize and front load our profitability, both from increased production volumes and higher

grade concentrate relative to head grade

( ie higher recovery rates ).

In other words, Mass pull will be enhanced which will result in a concentrate weighing less but

containing more gold.

I would say that Dato is once again exercising his substantial background in mining experience around

the world and introducing those efficiency activities to make Selinsing as profitable as possible .

We are in good hands,,

There is a lot going on on the Monument Mining website very interesting explanation

nozzpack thanks

https://monumentmining.com/projects/selinsing-gold-portfolio/development/

https://monumentmining.com/projects/selinsing-gold-portfolio/exploration/

https://monumentmining.com/

https://monumentmining.com/investors/presentation/

https://monumentmining.com/site/assets/files/4327/2023-03-02-cp-mmy.pdf

https://monumentmining.com/news-media/photo-gallery/

Comment on this Post

God Bless

Amen

Bullish

You Need a War Strategy – Catherine Austin Fitts

By Greg Hunter On June 3, 2023 In Political Analysis

https://usawatchdog.com/you-need-a-war-strategy-catherine-austin-fitts/

Ignore Digital Dollar’s 'Hot Air' and Watch for Gold $3,000, Silver $50

Stansberry Research

598K subscribers

GOLD - Aris Mining Corp. | Webinar Replay & 25 Milllion Oz. In ARIS - ![]() )

)

Red Cloud TV

8.89K subscribers

thank you for your thoughts, increased about 24% that year!

With the current banking issues will Gold jump dramatically as a safe haven for cash?

$PSA History Often Repeat Itself - - GOD'S $Gold On Fire - $NEWS - $Monument

Reports Second Quarter Fiscal 2023 ("Q2

FY2023") Results ![]() )

)

March 1, 2023

View PDF

Gross Revenue of US$5.87 Million and Cash Cost of US$1,507/Oz

Vancouver, B.C., March 1, 2023, Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its production and financial results for the

second quarter of fiscal 2023 and the six months ended December 31, 2022.

All amounts are expressed in United States dollars (“US$”) unless otherwise indicated

(refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented, “I am pleased to report during the second

quarter our Selinsing Gold Mine has filtered first gold concentrates with completion of

dry/wet flotation plant commissioning.

The ramp up period commenced subsequent to the second quarter yet to bring the project

to commercial production.”

Second Quarter Highlights:

https://monumentmining.com/news-media/news/2023/monument-reports-second-quarter-fiscal-2023-q2-fy2023-results/

Gold Production @ Low Cost & Very Undervalued Bargain - Thanks -

WELL; Monument Mining HAVE 3 GOLD MILLS NOW - And ![]() )

)

Selinsing have One BIOX and One New SULPHIDE - ![]() )

)

Well Monument Mining have produced 1000 Gold Bars - ![]() )

)

and the next 1000 Gold Bars should go much faster with the new MILL - ![]() )

)

https://monumentmining.com/news-media/photo-gallery/

RE: NEWS - Monument Mining President and CEO Cathy Zhai

commented, “During commissioning we have identified some

bottlenecks and are working with Mincore to fix them.

Up to date the flotation plant has delivered saleable concentrate of approximately

1,707 dry tonnes at 35.12 g/t Au with gold content of 1,928 troy ounces. ![]() )

)

Figure 2. Plant Inspection

https://www.globenewswire.com/news-release/2023/02/27/2616400/0/en/Monument-Progresses-Flotation-Commissioning-at-Selinsing.html

As of February 22nd, 2023, a total of 1,707 dry metric tonnes of gold concentrate have been

produced with an average gold grade of 35.12 g/t Au (1,928 troy ounces).

A fast Production Gold Au Estimate DD by a Monument Mining Investor: -

Ex.gracia -

Scoping of concentrate Production…52,000 ounces

We have some very interesting tidbit provided in todays NR which can be combined with

FS information to scope out annual concentrate production

...950,000 tons of mill feed per year ( about 3000 tpd )

....Mass pull of 5% ( ie 100 tons of ore is concentrated by a factor of 20 to 5 tons of

concentrate )

..head .grade of 1.95 gms per ton ( oxides removed )

....recovery of 85%

So , we have 1.95 gms/ ton. X 20 X 85 % = 35 gms per ton which is spot on the

performance reported today.

950,000 tons of head feed is concentrated by a factor of 20 ( ie Mass pull of 5% ) to 47000

tons of concentrate containing 1.1 ounces of gold per ton .

This computes to about 52,000 ounces of gold per year contained within 47000 tons of gold

concentrate

The Feasability Study included Biox and also oxides .

It quoted 60.000 ounces per year in the initial years of production .

So, removing the oxides from the mill feed and 53,000 ounces of sulphide gold produced

per year seems quite good and meets breast plate production rates.

Reducing production by about 10 % for smelting and transportation costs and our net gold

sales will be about 48,000 ounces per year which at current POG of $2259 CAD per ounce

will result in about $105 million CAD in annual revenues.

The FSR analyst report calculated a 30% cash flow margin which is just over $30 million

CAD per year.

As we have nearly $45 million US in forward non capital tax loss pools to offset income

taxes, that amount ($30 m CAD ) is essentially free cash flows.

There will be need for sustaining capital , so remove $5 million for that and we have about

$25 million or about $0.08 per share in free cash flows or equivalently in the absence of

taxes, net earnings

This gets us to about book value of $0.48 per share at a very modest 6 times annual

earnings

So todays NR provided an excellent insight into our FP production outlook .

As importantly , it confirms and conforms quite well with the 2019 Feasability Study which is

quite reassuring.

Considering that we have over $75 million in asset value in our Murchison

Project, Monument is now a screaming buy.

" As of February 22, 2023, a total of 1,707 tonnes of flotation concentrate have been

produced at an average grade of 35.12 g/t Au...1928 ounces of gold"

Comment on this Post

(All time best to make your own DD)

Welcome ; Can we produce/ sell 10,000 ounces in Q3

Q3 is this quarter ending March 31/23.

We have 30 days in March to do so .

Head feed is 3000 tons per day, so if all goes well, we should

produce 90,000 tons of ore in March.

With a mass pull of 5%, that will result in about 4500 tons of

concentrate , containing 1.1 ounces per ton which is

about 5000 ounces of gold.

We have already produced 1829 ounces to date during ramp it ,

up to a week or so ago.

Now, we have ....recalling from memory ..about 3000+ ounces of

bullion in Inventory that was saved from Q2 and

Q3 production in F22..

So, with breast plate production of about 5000 ounces for

March....if no more significant hiccups.. and

nearly 2000 ounces in the bag already ,

along with over 3000 ounces of bullion in our vaults,

we could see up to 10,000 ounces sold in Q3...?..if

all going good -

About $23 million in gross sales .

The FSR projected 22,000 ounces in F 2023.

That looks reasonably certain right now....if ramp up proceeds

without any major hiccups.

This is the best news we have had - so.. more Great PR NEWS

this week at PDAC should be made -

Company Profile & Information (TSXV:MMY)

Contact Information

Address

1100 Melville Street, Suite 1580, Vancouver, BC, CA, V6E 4A6

Telephone

+1 604 638-1661

Website

http://www.monumentmining.com

Fax

+1 604 638-1663

Email

info@monumentmining.com

Details

CEO

Cathy Zhai

Issue Type

Common Stock

ISOCFI

ESVUFR

Auditor

GRANT THORNTON LLP

Last Audit

Unqualified Opinion

Well we have produced 1000 Gold Bars - ![]() )

)

and the next 1000 should go much faster with the new MILL - ![]() )

)

https://monumentmining.com/news-media/photo-gallery/

PennyStockAlert Welcome - Production Restart Will Make The Gold Project Be Worth Easy 10 Times More IMO! - Monument Mining Ltd Also Own The Murchison Gold Mines Project and it is very valuable to

be more developed soon for milling restart -

The construction and commissioning of the new SELINSING GOLD Floatation Plant has

diverted our attention -

including the phase 2 drilling program , but that should change soon.

Our Murchison Gold Project is a premium asset that could be brought to resume

production once cash flows from the Selinsing Gold mine begins to fill our coffers.

Murchison Photo Gallery

https://monumentmining.com/news-media/photo-gallery/

Just below the NOA #1 pit we struck bonanza gold of 4m of 32grams .

This was open to the east , the south and at depth , and ended in mineralization .

Very cheap to access by an existing decline ramp from the pit bottom . And literally a stone

throw from our Burnakurra mill

.

Further , recent and historical drilling has shown that this rich basement lode under pit # 1

extends all the way from NOA pits 1 through 8 .

Average grades below pit #8 is in excess of 6 gms per ton which is very rich compared to

2.9 grams for nearby Big Bell

appear to be joined at depth and open to the north and south . Do they also have grades like

NOA#1 at depth ?

We also discovered potentially new resources at the Junction and have yet to even scratch

the surface at the other 16 shallow targets .

There is also a stockpile of decent grade ore near our Burnakura mill and enough high

grade ore in the historic tailings dump a few kms away to get the mill going

Few other companies can only dream about these assets matched up with a fully

operational mill.

Our 80 % partner ODY has made some truly amazing intersections at Tuckanarra and this

current drill program should lead to a Feasability study.

We know that WestAim is drooling at these 4 tenements owned either 100% by us (2 ) and

20% of the other two with ODY.

We should get an update on our new drilling program when Q2 reports

https://monumentmining.com/projects/murchison-gold-portfolio/

Corporate Presentation December 2022

https://monumentmining.com/site/assets/files/4320/mmy-corporate-presentation-december-2022.pdf

https://monumentmining.com

https://investorshub.advfn.com/Monument-Mining-Ltd-MMY-13403

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/live/au0001wb.gif

https://www.kitconet.com/images/live/ag0001wb.gif

https://www.kitco.com/images/live/gold.gif?0.8344882022363285

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

[Suppressed Image]

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless America

$Gold Standard & Large Deposits Of Gold Needed; ARIS Mining Corp. seems so undervalued

this is a valuation only based on production numbers... but ARIS devolopement-pipeline

has a much bigger value .. the vbest part is..they can develope all projects step by step

without the need of external financings... i hope not all warrants will be exercised ->

less dilution of future profits...

additional so this i hope they will start repay the notes soon

by kkkrrr

https://www.aris-mining.com

$Aris Mining Corp. TM RE :The train is leaving the station? $10 coming soon?

Red Cloud raised their price target from $11.50 to $12 on Monday ![]() )

)

with an outperform rating.

by Dom

Well they talking about some of their shares went from pennies to $100s would be nice

with a great repeat ![]() )

)

https://mebfaber.com/2022/07/20/e430-frank-giustra-ian-telfer/

$TM yes; all low ball targets;

$TM Aris Mining Corp. GoldTown44 The train is leaving the station? $10 coming soon?

Noticed this... some price targets from analysts:

Targets:

Cormark: C$10.0

Stifel: C$8.50

NBF: C$5.50

Canaccord: C$7.50

Red Cloud: C$11.00

Haywood: C$6.75

Average: C$8.20

They are aiming for $250,000 ounces of production this year. The team is proven mine

builders and is ramping things up regarding growth prospects.

Gold near all-time highs. Seems like the perfect storm?

geodan Watch; Aris Mining Corp. The genesis of following management for exponential gains

If you haven't already listened to the podcast I'm linking to in this post, do yourself a favor and

take the time to listen carefully to the genesis of Aris Mining.

https://mebfaber.com/2022/07/20/e430-frank-giustra-ian-telfer/

ARIS seems so undervalued

challenger426 just crunched some numbers using the POG around $1900 and ARIS seems

extremely undervalued.

2023 Forecasts include:

230,000-270,000 oz production

$1050 - $1150 AISC

$19M non sustaining CAPEX costs

136M shares outstanding

$1900/oz gold price

Using the above numbers on a worst and best case scenario, I get these share price

forecasts:

$11.48 Worst Case

$15.47 Best Case

Each $100 change in the average price of gold can swing the needle in those scenarios by

$1.50 - $2.00 in the share price value. Therefore, even if the POG fell back to $1700/oz,

ARIS is still undervalued by at least $3/share on a worst case scenario meaning they

produce near the bottom of the range and the AISC comes in near the top of the range for

2023.

Rocket blasting off. Moon mission.

https://www.zerohedge.com/commodities/high-profile-sound-money-bills-introduced-mississippi

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/live/au0001wb.gif

https://www.kitconet.com/images/live/ag0001wb.gif

https://www.kitco.com/images/live/gold.gif?0.8344882022363285

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

[Suppressed Image]

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless America

Watch Gold; China just SHOCKED the world and the U.S. is in real trouble | Redacted with Clayton Morris Redacted

1.42M subscribers

Gold Low Cost Producer; The World Is Quickly Approaching A Hyperinflation Disaster

November 09, 2022

https://kingworldnews.com/the-world-is-quickly-approaching-a-hyperinflation-disaster/

GREAT WATCH LIVE: PRESIDENT DONALD J. TRUMP HOLDS RALLY IN MIAMI, FL – 11/6/22

by RSBN

Sunday, November 6, 2022: Join the RSBN broadcast crew LIVE from Miami, FL

for all day coverage of President Donald J. Trump’s “Get Out the Vote Rally” with

Senator Marco…

https://www.rsbnetwork.com/category/video/donald-trump/

DOLLAR TO COLLAPSE! - SAUDI ARABIA TO LEAVE DOLLAR FOR BRICS! - MASSIVE POWER SHIFT!

WATCH

https://www.bitchute.com/video/O9ky2nStDghK/

Thanks Al44

ARIS Great Gold Producer;

https://seekingalpha.com/article/4527727-aris-gold-gcm-mining-merger-makes-sense

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF)

Great Gold, Global Population And Propaganda

https://kingworldnews.com/gold-global-population-and-propaganda/

$370 Silver Target, Plus Major Economic Trend Forecasts Issued By Gerald Celente

October 26, 2022

https://kingworldnews.com/370-silver-target-plus-major-economic-trend-forecasts-issued-by-gerald-celente/

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) Highest

Close in 2 Weeks on the ARIS;

The $3.04 close is the highest since October 13th. Maybe the jaded seller

lamenting the loss of the dividend is sold out? With the US dollar index closing

below its 50 dma today, Gold may continue higher and bring a lift to the PM sector.

There are 556,000 shares short as of October 14th (per yahoo finance), which is 3

days of average trading volume. If they were smart, the covered under $3.

We should see the 3Q earnings report next month. I am hoping for a definitive

gold production forecast for 2023 and 2024. Marmato underground operations

and the mill capacity up grade at Segovia from 1500 to 2000 tpd, are near term

drivers for the company.[/b[

by tobinator01 (sth)

Aris Mining appoints Mónica de Greiff as a member of the Board of Directors

October, 04, 2022

VANCOUVER, BC, Oct. 4, 2022 /PRNewswire/ -

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) announces

that, effective October 1, 2022, Mónica de Greiff was appointed as an

independent member of the Board of Directors, and as Chair of the Sustainability

Committee of the Board.

ARIS Mining (CNW Group/Aris Mining Corporation)

Mónica de Greiff was a member of the GCM Mining board of directors from 2018 to 2020, when she left to accept the position of Colombian Ambassador to Kenya. She has held positions in both the public and private sectors, including as Minister of Justice for the Republic of Colombia and Vice Minister of Mines and Energy. Ms. de Greiff is also a former member of the Board of Directors of the United Nations Global Compact, the world's largest corporate sustainability initiative.

Ian Telfer, Chair of Aris Mining, stated "I am delighted to welcome Mónica to our Board of Directors. She brings considerable experience within Colombia and in the highly valued and important area of sustainability. We look forward to her contributions to our business as we continue to grow and enhance our commitment towards ESG."

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record

of creating value through building globally relevant mining companies.

In Colombia, Aris Mining operates several high-grade underground mines at its

Segovia Operations and the Marmato Mine, which together produced 230,000

ounces of gold in 2021.

Aris Mining also operates the Soto Norte joint venture, where environmental

licensing is advancing to develop a new underground gold, silver and copper

mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper

project with expected average gold production of 225,000 per year over the life of

mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process

enables all miners to operate in a legal, safe and responsible manner that protects

them and the environment.

Additional information on Aris Mining can be found at

http://www.aris-mining.com

and www.sedar.com.

https://www.aris-mining.com/operations/operating-mines/segovia/overview/default.aspx

https://www.aris-mining.com/investors/events-and-presentations/default.aspx

https://www.aris-mining.com/news/news-details/2022/Aris-Mining-appoints-Mnica-de-Greiff-as-a-member-of-the-Board-of-Directors/default.aspx

CisionView original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-appoints-monica-de-greiff-as-a-member-of-the-board-of-directors-301640112.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

GCM Mining Corp. (formerly Gran Colombia Gold)

(TSX: GCM / OTCQX: TPRFF)

Accretive Acquisition to Drive Valuation Higher

BUY

https://www.researchfrc.com/wp-content/uploads/2022/08/GCM-Aug-2022-Update-1.pdf?vgo_ee=TMO54WfXmKl1gA%2FTEb1O1%2FlMy%2BOWWuyaZunZiCXh6gI%3D

Current Price: C$3.35

Fair Value: C$10.09

Risk: 3

GCM Mining Corp. PowerPoint Presentation

https://s28.q4cdn.com/389315916/files/doc_downloads/2022/07/Aris-Gold-GCM-presentation-25-July-2022.pdf

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

https://www.cs.mcgill.ca/~rwest/wikispeedia/wpcd/wp/g/Gold_standard.htm#:~:text=Advocates%20of%20a%20variety%20of,basis%20for%20a%20monetary%20system.

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.America

https://www.silverdoctors.com/headlines/world-news/u-s-dollar-to-collapse-saudi-arabia-to-leave-the-dollar-for-brics-in-massive-power-shift/

KICK1; Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF)

Low Bargain Close -

We should see the 3Q earnings report Nov. I am hoping for a definitive

gold production forecast for 2023 and 2024.

Marmato underground operations and the mill capacity up grade at Segovia

from 1500 to 2000 tpd, are near term

drivers for the company.

Aris Mining appoints Mónica de Greiff as a member of the Board of Directors

October, 04, 2022

VANCOUVER, BC, Oct. 4, 2022 /PRNewswire/ -

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) announces

that, effective October 1, 2022, Mónica de Greiff was appointed as an

independent member of the Board of Directors, and as Chair of the Sustainability

Committee of the Board.

ARIS Mining (CNW Group/Aris Mining Corporation)

Mónica de Greiff was a member of the GCM Mining board of directors from 2018 to 2020, when she left to accept the position of Colombian Ambassador to Kenya. She has held positions in both the public and private sectors, including as Minister of Justice for the Republic of Colombia and Vice Minister of Mines and Energy. Ms. de Greiff is also a former member of the Board of Directors of the United Nations Global Compact, the world's largest corporate sustainability initiative.

Ian Telfer, Chair of Aris Mining, stated "I am delighted to welcome Mónica to our Board of Directors. She brings considerable experience within Colombia and in the highly valued and important area of sustainability. We look forward to her contributions to our business as we continue to grow and enhance our commitment towards ESG."

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record

of creating value through building globally relevant mining companies.

In Colombia, Aris Mining operates several high-grade underground mines at its

Segovia Operations and the Marmato Mine, which together produced 230,000

ounces of gold in 2021.

Aris Mining also operates the Soto Norte joint venture, where environmental

licensing is advancing to develop a new underground gold, silver and copper

mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper

project with expected average gold production of 225,000 per year over the life of

mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process

enables all miners to operate in a legal, safe and responsible manner that protects

them and the environment.

Additional information on Aris Mining can be found at

http://www.aris-mining.com

and www.sedar.com.

https://www.aris-mining.com/operations/operating-mines/segovia/overview/default.aspx

https://www.aris-mining.com/investors/events-and-presentations/default.aspx

https://www.aris-mining.com/news/news-details/2022/Aris-Mining-appoints-Mnica-de-Greiff-as-a-member-of-the-Board-of-Directors/default.aspx

CisionView original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-appoints-monica-de-greiff-as-a-member-of-the-board-of-directors-301640112.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

GCM Mining Corp. (formerly Gran Colombia Gold)

(TSX: GCM / OTCQX: TPRFF)

Accretive Acquisition to Drive Valuation Higher

BUY

https://www.researchfrc.com/wp-content/uploads/2022/08/GCM-Aug-2022-Update-1.pdf?vgo_ee=TMO54WfXmKl1gA%2FTEb1O1%2FlMy%2BOWWuyaZunZiCXh6gI%3D

Current Price: C$3.35

Fair Value: C$10.09

Risk: 3

GCM Mining Corp. PowerPoint Presentation

https://s28.q4cdn.com/389315916/files/doc_downloads/2022/07/Aris-Gold-GCM-presentation-25-July-2022.pdf

$2.5 Quadrillion Disaster Waiting to Happen – Egon von Greyerz

By Greg Hunter On November 1, 2022 In Market Analysis 98 Comments

https://usawatchdog.com/2-5-quadrillion-disaster-waiting-to-happen-egon-von-greyerz/

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

https://www.cs.mcgill.ca/~rwest/wikispeedia/wpcd/wp/g/Gold_standard.htm#:~:text=Advocates%20of%20a%20variety%20of,basis%20for%20a%20monetary%20system.

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.America

PennyStock Thanks; https://www.rsbnetwork.com/video/watch-live-president-donald-j-trump-holds-save-america-rally-in-vandalia-oh-11-7-22/

Some new pictures, so pieces from china arrived i think

https://monumentmining.com/news-media/photo-gallery/

GoldSeek Radio Nugget

GoldSeek Radio Nugget -- Peter Schiff: Gold is going to take-off and mining stocks

will go ballistic

November 06, 2022

Profile picture for user Chris Waltzek

https://goldseek.com/sites/default/files/styles/thumbnail/public/pictures/2020-08/WALTZEK_1.jpg?itok=pEXxIBSP

Chris Waltzek

GoldSeek Radio

154 Shares

https://sp.rmbl.ws/s8/2/A/2/d/y/A2dyg.caa.mp4?u=4&b=0

facebook-white sharing button twitter-white sharing button linkedin-white sharing button telegram-white sharing button email-white sharing button print-white sharing button

GoldSeek Radio Nugget -- Peter Schiff: Gold is going to take-off and mining stocks will go ballistic

Head of SchiffGold.com

Peter Schiff...

00:25 - Gold +$50 today...

03:40 - Specific Gold and Silver stocks.

06:23 - Gold is going to take-off and mining stocks will go ballistic.

........ Richard (sth)

https://stockhouse.com/companies/bullboard/v.mmy/monument-mining-ltd?postid=35080317

ARIS Large Gold Position Needed By US Gold Standard -

PEACE LOVE MUST WATCH LIVE: PRESIDENT DONALD J. TRUMP HOLDS SAVE AMERICA RALLY IN LATROBE, PA – 11/5/22

by RSBN

https://www.rsbnetwork.com/video/watch-live-president-donald-j-trump-holds-save-america-rally-in-latrobe-pa-11-5-22/

Saturday, November 5, 2022: Join the RSBN broadcast crew LIVE from Latrobe,

PA for all day coverage of President Donald J. Trump’s SAVE AMERICA rally.

President Donald J. Trump, 45th President of the United States of America, will

hold a rally in Latrobe, Pennsylvania on Saturday, November 5, 2022, at 7:00PM EDT.

Saturday, November 5, 2022, at 7:00PM EDT

GOLD SURGES $55: Nomi Prins Says China & Russia Will Use Their Massive Gold Hoards To Form A New Currency

November 05, 2022

https://kingworldnews.com/gold-surges-55-nomi-prins-says-china-russia-will-use-their-massive-gold-hoards-to-form-a-new-currency/

BOMBSHELL: Dr. David E. Martin Gives Explosive Jaw Dropping Info!

Patriots Base Published November 4, 2022

https://rumble.com/v1rff5c-bombshell-dr.-david-e.-martin-gives-explosive-jaw-dropping-info.html

Derek Johnson: Intel: Law & Order, Trump, Midterm - What's Next?

Patriots Base Published November 3, 2022

https://rumble.com/v1r86ey-derek-johnson-intel-law-and-order-trump-midterm-whats-next.html

Situation Update: Worldwide Military Coups Activated! DOD Law Of War Activated!

Patriots Base Published November 3

https://rumble.com/v1r7q7m-situation-update-worldwide-military-coups-activated-dod-law-of-war-activate.html

https://www.rsbnetwork.com/video/watch-live-president-donald-j-trump-holds-save-america-rally-in-sioux-city-ia-11-3-22/

KICK1 or anyone; please; what about; The Great Unwind II

Nov 2, 2022

·

Alasdair Macleod

With price inflation rising out of control and interest rates rising strongly, the trading

environment for commercial banks has fundamentally changed.

With bad debts looming and bond prices in entrenched downtrends,

procrastination is now the enemy of bankers.

We are at the beginning of The Great Unwind, and this article elaborates on my

first article for Goldmoney on the subject published here.

https://www.goldmoney.com/research/the-great-unwind-1?gmrefcode=gata

.jpg)

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF)

Low Bargain Close -

We should see the 3Q earnings report next month. I am hoping for a definitive

gold production forecast for 2023 and 2024.

Marmato underground operations and the mill capacity up grade at Segovia

from 1500 to 2000 tpd, are near term

drivers for the company.[/b[

b]Aris Mining appoints Mónica de Greiff as a member of the Board of Directors

October, 04, 2022

VANCOUVER, BC, Oct. 4, 2022 /PRNewswire/ -

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) announces

that, effective October 1, 2022, Mónica de Greiff was appointed as an

independent member of the Board of Directors, and as Chair of the Sustainability

Committee of the Board.

ARIS Mining (CNW Group/Aris Mining Corporation)

Mónica de Greiff was a member of the GCM Mining board of directors from 2018 to 2020, when she left to accept the position of Colombian Ambassador to Kenya. She has held positions in both the public and private sectors, including as Minister of Justice for the Republic of Colombia and Vice Minister of Mines and Energy. Ms. de Greiff is also a former member of the Board of Directors of the United Nations Global Compact, the world's largest corporate sustainability initiative.

Ian Telfer, Chair of Aris Mining, stated "I am delighted to welcome Mónica to our Board of Directors. She brings considerable experience within Colombia and in the highly valued and important area of sustainability. We look forward to her contributions to our business as we continue to grow and enhance our commitment towards ESG."

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record

of creating value through building globally relevant mining companies.

In Colombia, Aris Mining operates several high-grade underground mines at its

Segovia Operations and the Marmato Mine, which together produced 230,000

ounces of gold in 2021.

Aris Mining also operates the Soto Norte joint venture, where environmental

licensing is advancing to develop a new underground gold, silver and copper

mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper

project with expected average gold production of 225,000 per year over the life of

mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process

enables all miners to operate in a legal, safe and responsible manner that protects

them and the environment.

Additional information on Aris Mining can be found at

http://www.aris-mining.com

and www.sedar.com.

https://www.aris-mining.com/operations/operating-mines/segovia/overview/default.aspx

https://www.aris-mining.com/investors/events-and-presentations/default.aspx

https://www.aris-mining.com/news/news-details/2022/Aris-Mining-appoints-Mnica-de-Greiff-as-a-member-of-the-Board-of-Directors/default.aspx

CisionView original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-appoints-monica-de-greiff-as-a-member-of-the-board-of-directors-301640112.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

GCM Mining Corp. (formerly Gran Colombia Gold)

(TSX: GCM / OTCQX: TPRFF)

Accretive Acquisition to Drive Valuation Higher

BUY

https://www.researchfrc.com/wp-content/uploads/2022/08/GCM-Aug-2022-Update-1.pdf?vgo_ee=TMO54WfXmKl1gA%2FTEb1O1%2FlMy%2BOWWuyaZunZiCXh6gI%3D

Current Price: C$3.35

Fair Value: C$10.09

Risk: 3

GCM Mining Corp. PowerPoint Presentation

https://s28.q4cdn.com/389315916/files/doc_downloads/2022/07/Aris-Gold-GCM-presentation-25-July-2022.pdf

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

https://www.cs.mcgill.ca/~rwest/wikispeedia/wpcd/wp/g/Gold_standard.htm#:~:text=Advocates%20of%20a%20variety%20of,basis%20for%20a%20monetary%20system.

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.America

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF)

Low Bargain Close -

We should see the 3Q earnings report Nov. I am hoping for a definitive

gold production forecast for 2023 and 2024.

Marmato underground operations and the mill capacity up grade at Segovia

from 1500 to 2000 tpd, are near term

drivers for the company.

Aris Mining appoints Mónica de Greiff as a member of the Board of Directors

October, 04, 2022

VANCOUVER, BC, Oct. 4, 2022 /PRNewswire/ -

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) announces

that, effective October 1, 2022, Mónica de Greiff was appointed as an

independent member of the Board of Directors, and as Chair of the Sustainability

Committee of the Board.

ARIS Mining (CNW Group/Aris Mining Corporation)

Mónica de Greiff was a member of the GCM Mining board of directors from 2018 to 2020, when she left to accept the position of Colombian Ambassador to Kenya. She has held positions in both the public and private sectors, including as Minister of Justice for the Republic of Colombia and Vice Minister of Mines and Energy. Ms. de Greiff is also a former member of the Board of Directors of the United Nations Global Compact, the world's largest corporate sustainability initiative.

Ian Telfer, Chair of Aris Mining, stated "I am delighted to welcome Mónica to our Board of Directors. She brings considerable experience within Colombia and in the highly valued and important area of sustainability. We look forward to her contributions to our business as we continue to grow and enhance our commitment towards ESG."

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record

of creating value through building globally relevant mining companies.

In Colombia, Aris Mining operates several high-grade underground mines at its

Segovia Operations and the Marmato Mine, which together produced 230,000

ounces of gold in 2021.

Aris Mining also operates the Soto Norte joint venture, where environmental

licensing is advancing to develop a new underground gold, silver and copper

mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper

project with expected average gold production of 225,000 per year over the life of

mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process

enables all miners to operate in a legal, safe and responsible manner that protects

them and the environment.

Additional information on Aris Mining can be found at

http://www.aris-mining.com

and www.sedar.com.

https://www.aris-mining.com/operations/operating-mines/segovia/overview/default.aspx

https://www.aris-mining.com/investors/events-and-presentations/default.aspx

https://www.aris-mining.com/news/news-details/2022/Aris-Mining-appoints-Mnica-de-Greiff-as-a-member-of-the-Board-of-Directors/default.aspx

CisionView original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-appoints-monica-de-greiff-as-a-member-of-the-board-of-directors-301640112.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

GCM Mining Corp. (formerly Gran Colombia Gold)

(TSX: GCM / OTCQX: TPRFF)

Accretive Acquisition to Drive Valuation Higher

BUY

https://www.researchfrc.com/wp-content/uploads/2022/08/GCM-Aug-2022-Update-1.pdf?vgo_ee=TMO54WfXmKl1gA%2FTEb1O1%2FlMy%2BOWWuyaZunZiCXh6gI%3D

Current Price: C$3.35

Fair Value: C$10.09

Risk: 3

GCM Mining Corp. PowerPoint Presentation

https://s28.q4cdn.com/389315916/files/doc_downloads/2022/07/Aris-Gold-GCM-presentation-25-July-2022.pdf

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

https://www.cs.mcgill.ca/~rwest/wikispeedia/wpcd/wp/g/Gold_standard.htm#:~:text=Advocates%20of%20a%20variety%20of,basis%20for%20a%20monetary%20system.

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.America

Gold Standard Legal Tender & Gold, Global Population And Propaganda

https://kingworldnews.com/gold-global-population-and-propaganda/

$370 Silver Target, Plus Major Economic Trend Forecasts Issued By Gerald Celente

October 26, 2022

https://kingworldnews.com/370-silver-target-plus-major-economic-trend-forecasts-issued-by-gerald-celente/

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) Highest

Close in 2 Weeks on the ARIS;

The $3.04 close is the highest since October 13th. Maybe the jaded seller

lamenting the loss of the dividend is sold out? With the US dollar index closing

below its 50 dma today, Gold may continue higher and bring a lift to the PM sector.

There are 556,000 shares short as of October 14th (per yahoo finance), which is 3

days of average trading volume. If they were smart, the covered under $3.

We should see the 3Q earnings report next month. I am hoping for a definitive

gold production forecast for 2023 and 2024. Marmato underground operations

and the mill capacity up grade at Segovia from 1500 to 2000 tpd, are near term

drivers for the company.[/b[

by tobinator01 (sth)

Aris Mining appoints Mónica de Greiff as a member of the Board of Directors

October, 04, 2022

VANCOUVER, BC, Oct. 4, 2022 /PRNewswire/ -

Aris Mining Corporation (Aris Mining) (TSX: ARIS) (OTCQX: TPRFF) announces

that, effective October 1, 2022, Mónica de Greiff was appointed as an

independent member of the Board of Directors, and as Chair of the Sustainability

Committee of the Board.

ARIS Mining (CNW Group/Aris Mining Corporation)

Mónica de Greiff was a member of the GCM Mining board of directors from 2018 to 2020, when she left to accept the position of Colombian Ambassador to Kenya. She has held positions in both the public and private sectors, including as Minister of Justice for the Republic of Colombia and Vice Minister of Mines and Energy. Ms. de Greiff is also a former member of the Board of Directors of the United Nations Global Compact, the world's largest corporate sustainability initiative.

Ian Telfer, Chair of Aris Mining, stated "I am delighted to welcome Mónica to our Board of Directors. She brings considerable experience within Colombia and in the highly valued and important area of sustainability. We look forward to her contributions to our business as we continue to grow and enhance our commitment towards ESG."

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record

of creating value through building globally relevant mining companies.

In Colombia, Aris Mining operates several high-grade underground mines at its

Segovia Operations and the Marmato Mine, which together produced 230,000

ounces of gold in 2021.

Aris Mining also operates the Soto Norte joint venture, where environmental

licensing is advancing to develop a new underground gold, silver and copper

mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper

project with expected average gold production of 225,000 per year over the life of

mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process

enables all miners to operate in a legal, safe and responsible manner that protects

them and the environment.

Additional information on Aris Mining can be found at

http://www.aris-mining.com

and www.sedar.com.

https://www.aris-mining.com/operations/operating-mines/segovia/overview/default.aspx

https://www.aris-mining.com/investors/events-and-presentations/default.aspx

https://www.aris-mining.com/news/news-details/2022/Aris-Mining-appoints-Mnica-de-Greiff-as-a-member-of-the-Board-of-Directors/default.aspx

CisionView original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-appoints-monica-de-greiff-as-a-member-of-the-board-of-directors-301640112.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

GCM Mining Corp. (formerly Gran Colombia Gold)

(TSX: GCM / OTCQX: TPRFF)

Accretive Acquisition to Drive Valuation Higher

BUY

https://www.researchfrc.com/wp-content/uploads/2022/08/GCM-Aug-2022-Update-1.pdf?vgo_ee=TMO54WfXmKl1gA%2FTEb1O1%2FlMy%2BOWWuyaZunZiCXh6gI%3D

Current Price: C$3.35

Fair Value: C$10.09

Risk: 3

GCM Mining Corp. PowerPoint Presentation

https://s28.q4cdn.com/389315916/files/doc_downloads/2022/07/Aris-Gold-GCM-presentation-25-July-2022.pdf

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

GOLD STANDARD; THE REAL LEGAL MONEY:

https://www.cs.mcgill.ca/~rwest/wikispeedia/wpcd/wp/g/Gold_standard.htm#:~:text=Advocates%20of%20a%20variety%20of,basis%20for%20a%20monetary%20system.

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.America

Can gold and silver stocks expect +5,000% returns again?

An astute investor could have turned $10,000 into more than $7 million

With what has happened in the world of late and what will be unfolding in the next five years or so those few investors who fully understand the impact the current economic situation is going to have on future inflation, the USD, interest rates, the stock market, physical gold and silver and gold and silver stocks and warrants in particular are going to be in the unique position of being the benefactors of currently unimaginable returns and wealth. All they need do, as I like to say, is “Just prepare and prosper!”

Back in the mid- to late 1970’s, as gold went up from its 1972 low of $60 to $850 in 1980 (and silver to $50), gold and silver stocks realized absolutely amazing gains:

· Lion Mines – 1975 price: $0.07 / 1980 price: $380 i.e. an increase of 542,757%.

· Azure Resources - 1975 price: $.05 / 1980 price: $109 i.e. an increase of 217,900%.

· Wharf Resources - 1975 price: $.40 / 1980 price: $560 i.e. an increase of 139,000%.

· Mineral Resources - 1975 price: $.60 / 1980 price: $415 i.e. an increase of 69,067%.

· Steep Rock - 1975 price: $.93 / 1980 price: $440 i.e. an increase of 47,212%.

· Bankeno - 1975 price: $1.25 / 1980 price: $430 i.e. an increase of 34,300%.

The percentage returns above, averaging 70,627%, seem totally unbelievable but they are verifiable. They were achieved by investing in the right stocks at the right time. Imagine, and the above companies were only a handful of the gold and silver stocks that generated such astounding returns.

To put things in perspective let’s look at it this way. Had an astute investor divided a $10,000 investment equally among the six companies mentioned above in 1975 it would have grown to $7,072,700 just five years later. I can’t imagine that ever happening again but that is what actually happened back then. It is absolutely amazing, isn’t it? Even a 10,000% appreciation would have turned that $10,000 into $1 million dollars.

Remember, it only takes a few good investment decisions in one’s life to be exceedingly successful and that was such a time....

Full article at: http://www.stockhouse.com//Columnists/2009/Oct/6/Can-gold-and-silver-stocks-expect--5,000--returns-

kiwi

Report TOS

Monster nugget discovered in Butte, CA foothills

https://www.youtube.com/watch?v=-Q8e9Mid3Dk

Thracian Gold Treasure Discovered in Bulgaria (Pictures)

http://news.nationalgeographic.com/news/2012/11/pictures/121109-thracian-gold-hoard-treasure-bulgaria-science/

Gold treasure found in ocean...

http://www.cnn.com/video/data/2.0/video/us/2014/07/31/pkg-gold-treasure-discovered-ocean-florida.wpbf.html

I was doing my research at the time the gold prices were peaking, almost breaking $1700/oz. I sold 22 oz. for $1,640/oz, not a bad price considering the year I started prospecting, the gold price was $180 something an oz, if I remember correctly. 23 seasons of dredging.....

Although I had title the board Bold Bullion, it was, at the time, I was researching the price gold and seeking awareness of the market factors influencing gold prices.

I have now sold all my placer gold I recovered over the years and am becoming interested in the game of gold again, and may be seeking others with similar interests.

This board was enititated quite awhile ago when I was getting ready to sell my placer gold from years of dredging. I am thinking about activating it again.

Gold nugget worth $300,000 discovered in Australia

By Ramy Inocencio, for CNN

updated 4:04 AM EST, Fri January 18, 2013

(CNN) -- One Australian gold prospector has hit pay dirt.

The man, described as an amateur explorer who wants to remain anonymous, unearthed a 5.5 kilogram golden nugget 60 centimeters in the ground outside Ballarat, a city about an hour and a half drive west of Melbourne.

Experts say the value of the find is at least $300,000.

"He came in to my shop at 12:30 p.m. on Wednesday and had a grin from ear to ear," Cordell Kent, owner of The Mining Exchange Gold Shop, told CNN. "His eyes were sparkling."

The 47-year resident of Ballarat says that gold has been continuously found in the region since 1851, but technology has recently become an essential aid for modern prospectors.

"In the last 10 years it's gotten very, very hard to find nuggets over a kilo, so this (5.5 kilogram) one is extremely rare," says Kent. "In the old days miners could only see or feel gold - but now with detectors they can hear it."

A Minelab GPX Model 5000 metal detector was used to find the nugget, Kent says. In Australia, the machine retails for nearly $7,000, according to Gary Shmith, Minelab's General Manager for the Asia Pacific.

Shmith expects collectors may already be eyeing a potential purchase of the Ballarat nugget because of its rarity.

"My guess is that it would sell at 20% or 30% above its weight in gold. A nice, small nugget would already sell for 10% to 15% above its weight in gold."

Kent says the lucky prospector is back at work, "detecting right as we speak."

"He doesn't want anyone to know his bit of ground. There are only four people who know that he found it -- he and his wife and me and my wife. And he's hoping the one he found this week is a small piece and that there are bigger ones still out there."

While many people in the region have been searching for gold for decades, Kent's friend only started last year.

Other prospectors -

http://www.cnn.com/2013/01/18/business/australia-gold-nugget-discovery/index.html?hpt=hp_c3

Fancy a chunk? No, it's not chocolate... lol

http://www.dailymail.co.uk/sciencetech/article-2251757/Fancy-chunk-No-chocolate--Its-future-money-euro-goes-under.html

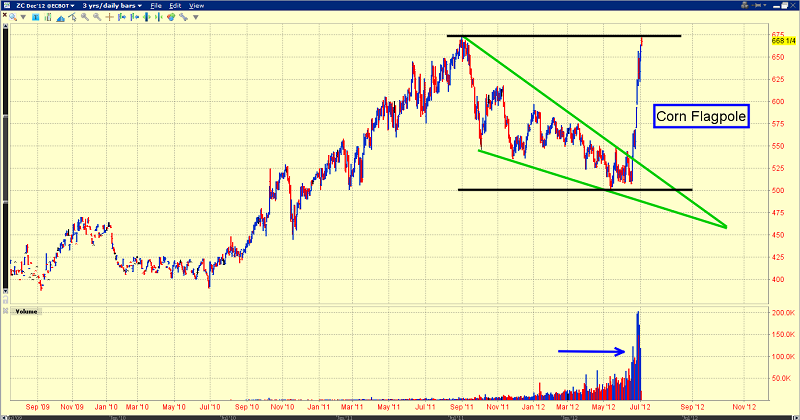

CALVF $GOLD LT, the global financial crisis will probably push Gold

thousands of dollars higher - In the shorter term -

rising commodity prices are Gold's best friend -

E.g.,

Most importantly, a large CRB index rally could be -

the catalyst that blasts Gold up -

out of its 10 month "super-wedge" consolidation pattern -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76118595

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77214768

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77192196

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77294660

High Risk Paying High REWARDS -

Iceland boasts a 4.5% growth rate -- the best in the Eurozone -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77290131

God Bless

ST. ANDREW GOLDFIELDS (TSE:SAS)

http://www.sasgoldmines.com/i/pdf/Presentation.pdf

http://www.sasgoldmines.com/s/Home.asp

http://www.sasgoldmines.com/s/History.asp

Welcome To QMX Gold Corporation

QMX Gold Corporation is a dynamic and aggressive mining company

operating in Canada’s richest mining regions in Val-d’Or Quebec and

Snow Lake, Manitoba.

Gold production is a priority as QMX continues underground

operations at its Lac Herbin Mine and will be ramping up to mid-

tier productions levels with its Snow Lake Mine.

Exploration efforts are focused in the mineral rich Abitibi

District of Northern Quebec where the company has 100% ownership

of over 200 sq. km.

The company is also exploring its 88 sq. km property in

Snow Lake where historic production exceeded 1 million ounces.

LEARN MORE

http://alexisminerals.com/English/Investor-Centre/News/News-Details/2012/QMX-Gold-Corporation-to-Begin-Trading-on-the-TSX1130072/default.aspx

http://alexisminerals.com/Theme/Alexis/files/Alexis%20Marketing%20Presentation_JUL142012_v001_w3z9b7.pdf

http://www.alexisminerals.com/

http://alexisminerals.com/Our-Company/Corporate-profile/default.aspx

http://alexisminerals.com/Theme/Alexis/files/201207%20QMX%20Fact%20Sheet_v001_t88428.pdf

Goldcorp Incorporate (GG) fiat$37.58 UP $1.48 +4.10% ![]()

Volume: 5,711,787 @ 4:42:10 PM ET STRONG DEMAND ![]()

Bid Ask Day's Range

- - 36.91 - 37.8

GG Detailed Quote Wiki

BIX WEIR Q's Answered: -- The Future -

Gold bugs need help from Fed

By Paul R. La Monica

June 20, 2012: 1:40 PM ET

Scrooge McDuck and other gold fans may want to hold off on diving into the metal until the Fed announces more stimulus.

Gold has enjoyed a mini-rally in the past few weeks even as other commodities have plunged on continued concerns about the health of the global economy.

Through Tuesday's close, gold was up 2% since mid-May. Meanwhile, prices of the far more useful copper were down 3%. Corn futures are down 4%. Other demand-sensitive commodities like oil and wheat have each fallen nearly 10%. And coffee is in decaf mode. Prices have tumbled more than 15%.

But hopes for a sustained rally in the yellow metal pretty much begin and end with the Federal Reserve. Gold is viewed as a classic inflation hedge and any further stimulus from the Fed during the next few months would likely be viewed as bad for the dollar and good for gold.

Investors are clearly betting that the crisis in Europe, slowdown in China and continued sluggishness in the U.S. (Is that some dry rub I see on the job market? Yes kids, we're still in a low and slow BBQ recovery!) will eventually lead the Fed to do a lot more to lift the financial markets (and perhaps even the economy) out of its funk.

But the market didn't get what it wanted Wednesday. The Fed simply decided to extend its Operation Twist program (swapping short-term bonds for longer-term debt) instead of announcing a third round of quantitative easing, or QE3. Gold was trading about 1% lower prior to the Fed announcement and continued to drop in mid-afternoon trading.

Gold bugs obviously want (and need) the Fed to be more aggressive. Still, it's not clear just how high gold could really go in the coming months even if the Fed eventually changes its tune on the need for QE3. While more Fed accommodation should, in theory, be a plus for gold, the reasons that the Fed needs to consider more bond purchases in the first place is not positive for gold.

Sure, gold does tend to rise and fall in line with inflation expectations. But you can't completely remove the Economics 101 law of supply and demand from the investing equation. As I pointed out in a column last month, the awful conditions in Europe may lead to a prolonged period of "Au"-sterity for the metal, especially if the PIIGS pain is followed by reduced purchases of gold from Europe's biggest trading partner China and, to a lesser extent, India.

Given all the chatter about central banks around the world potentially easing en masse, it's a bit surprising that gold hasn't rallied even harder than it has in the past month. In fact, the SPDR Gold Shares Trust ETF (GLD) has lagged the S&P 500 (SPX) during the past month.

Richard Ross, global technical strategist with Auerbach Grayson in New York, points out that gold actually has been a disappointing investment if you back out its nearly 4% jump on June 1 -- the day when a woeful U.S. jobs report kicked QE3 talk into high gear.

The lack of a bigger jump in gold is also unusual when you look at what the dollar has done lately.

The greenback has weakened against the euro in recent weeks as the favorable (for now) outcome to the elections in Greece and hopes that European leaders will eventually step in with a formal plan to save Spain and Italy (unveiled at next week's ubiquitous EU summit perhaps?) have boosted the odds of the euro currency surviving in its current form.

Ashraf Laidi, chief global strategist with City Index Ltd. in London, wrote in a report Wednesday that gold may now be "out of touch" with the euro. With so many investors flocking into U.S. debt simply because they are not Southern European bonds, yields have plummeted to ridiculously low levels. If the safe haven trade is finally unwinding, 10-year Treasury yields may have nowhere to go but up -- even if the euro gains more ground versus the dollar.

So much for a weaker dollar being good news for gold.

"Gold has not been able to build on its gains and that is somewhat curious," Ross said. But he added that all it may take for gold to break through technical levels of $1630 and start climbing even higher is for more hints from Bernanke about additional stimulus.

Unless the U.S. economy roars to life in the coming months, there's still a good chance that those hints will come. Keep in mind that the Bernanke playbook for the past few years has been to sit patiently during the summer to see if the economy still needs a jolt following the typical May-July slump. The answer was yes in 2010 and last year. It may be yes again this year.

With that in mind, Bernanke likely will tip his hand about what the Fed plans to do next at its annual confab in Jackson Hole, Wyoming in August. That's where Bernanke introduced the notion of QE2 in August 2010 and it's where he teased the idea of Operation Twist last year.

Marshall Berol, c0-manager of the Encompass Fund (ENCPX) in San Francisco, considers himself a gold bull and he expects that an eventual Fed move will be a catalyst to lift gold to new highs near $2000 an ounce.

"Gold has come down enough from its highs that it should find a base and resume its upward move," he said.

But Berol, who prefers to invest in mining companies as opposed to actual metals, said that firms like Freeport-McMoRan Copper & Gold (FCX), which he owns in the fund, may be better bets than the metal. That approach may make more sense than trying to invest in gold itself.

Mining companies have actually outperformed gold lately. The Market Vectors Gold Miners ETF (GDX), which owns big stakes in industry leaders like Barrick Gold (ABX), Goldcorp (GG), Newmont Mining (NEM) and AngloGold Ashanti (AU), is up more than 10% in the past month. And those four stocks, as well as Freeport-McMoRan, all pay dividends to boot.

Frank Holmes, chief investment officer of U.S. Global Investors in San Antonio and the author of the book "The Goldwatcher," also likes gold miners that pay dividends. His firm owns shares of Franco-Nevada (FNV), Yamana Gold (AUY) and Randgold (GOLD) and he said the lack of QE3 for now does not mean gold's run is over.

"The fear trade for gold is that the government is devaluing the dollar. That has not gone away," he said.

So if you think gold may soon be heading higher, you may want to consider miners instead. Time to channel my inner Warren Buffett here. Good luck trying to get quarterly dividend payments from a cube of bullion.

http://buzz.money.cnn.com/2012/06/20/gold-bugs-need-help-from-fed/?iid=EL

A Byproduct Of Twist? Gold Manipulation

June 18, 2012

Gary Tanashian | includes: GLD As Greece took the spotlight last week, there was an auction going on in the U.S.: "Treasurys rise after record-setting auction."

Our great nation sold more bonds (aka debt) last week to keep itself afloat. Demand was strong.

10 and 30 year bonds were peddled with the Fed on the bid, either in action or in implied waiting.

"On Tuesday, the government garnered weak demand at its sale of 3-year notes. That could have been due to expectations for more Twist from the Fed, which may entail selling that maturity. That logic would also have lent support for the 10-year auction, and presumably the long bond sale in the coming session."

The indisputable message of this chart is that gold generally goes in alignment with the 30 year/2 year yield spread.

What a world; all a great and powerful entity has to do is cannibalize the unproductive legacy debt of the nation, eating what suits him (long term bonds) and serving what doesn't to others (short term bonds) in hopes that they eat the stuff. They are hopped up on deflation fear after all. They'll eat anything that is "risk off" after all.

Point is, we have been following the correlation between gold and the 30-2 spread for many weeks now in NFTRH. The gold correction out of the hysterical phase of the euro crisis was very normal and indeed, expected. But the normal correction was then aided and abetted by the Fed's stated intention of Twisting (aka sanitizing*) its monetization of Treasury debt.

Really, how long can they keep it up? The fact is that whether they Twist again or go for the good old fashioned straight on monetization, we are off the charts and officials are just rearranging deck chairs on the Titanic as far as inflation is concerned. They have been, are and will likely continue to ram inflation into the pipeline through whatever means suits the agenda in the best way.

It will be interesting to see if gold obediently maintains the correlation. When the Twist manipulation scheme was originally cooked up and served in September, all the over bought metal needed was a shove in a southerly direction to get it to go with the program. Now, after what would qualify as a healthy intermediate correction, doing the Twist may not work as well.