Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

had to borrow your chart buddy

Very nice charting analysis @tothe!

$GSAC Amazing info from Twitter! Thank you CJ2 for being so informed and sharing it!

https://twitter.com/CokeTrading/status/1671869662642962433?s=20

https://twitter.com/CokeTrading/status/1671184519544688642?s=20

@BERKSHIRE; I keep projected valuation with the relative value of the current PPO crossover to the last major crossover of June 2022. During the past year there was small 64mil dilutive eguity financing. It is like saying the speed of light is constant but you have blue and red shifts corresponding to buy-back or dilution.... so PPO signal line crossovers are the closest thing we have to relativistic calculation.

Use the 1yr. 1m. chart to see the $0.002- $0.004's of June 2022 and follow the horizontal line that utilizes time telescoping back to the big bang.

https://school.stockcharts.com/doku.php?id=technical_indicators:price_oscillators_ppo

https://stockcharts.com/h-sc/ui?s=GSAC&p=D&yr=1&mn=1&dy=0&id=p24986097784&listNum=23&a=1113701411

Moon Market watches us

Let those profit takers out of this SEC filer before the update lol Wow, can't make this shit up!

While in this quiet time, I'm loading everything I can!

Once we are updated, everyone will know what's been accomplished since March ![]()

This used to trade .02 to .05 cents. Company is about to knock our socks off soon I bet :)

https://www.otcmarkets.com/stock/GSAC/profile

https://www.stockscores.com/charts/charts/?ticker=GSAC

l@@K! macd on the chart lower indications...oh my...products, low os, what more do you need?...imo lol

LFG!!! Those .0007’s look so good in my account now :)

Dang it. I only have 21. Should’ve bought more 6’s last week.

002 breakout handful of future trading days imo.

30 million reasons to love this stock..

Hi .0014

Mentioned by Moon Market why it moved

GSAC chart~~~ Today's $0.001 resistance flipped to support.

* RSI goldilocks and Williams%R agreeing over 50%

https://investmentu.com/relative-strength-index-rsi-ultimate-overbought-oversold-indicator/

* CMF(20) volume money pressure over 20% again and agreeing MFI the RSI of volume money

* OBV diverting up from AccumDist showing free trading float seriously winding up.

* ChiOsc the MACD of AccumDist line showing buyers outnumbering sellers/

* A brief on chart Indicators

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=146368673

chart & T/A Post Thread

https://stockcharts.com/h-sc/ui?s=GSAC&p=D&yr=0&mn=5&dy=0&id=p24986097784&listNum=23&a=1113701411

Weekly volume turbulence watch

https://stockcharts.com/h-sc/ui?s=GSAC&p=W&yr=1&mn=0&dy=0&id=p34307943936&a=1105106922&listNum=2

Looking VERY good! Some serious accumulation happening here.

OoooooWeeeee.....Big Momma getting hungry!

Sounds Grrrrreat!!

Translation… hit and run cause it’s a scam. How many days of wash do you think this will support? Today was day one.

lol! I did that earlier with a couple of juicy ribeye steaks! hubby loved it, as did i!

lets do this!

How about Big Momma terms? Fire up the grill.

@Gail; The compound chart is used for modest gains on the higher exchanges and the OTC. The indicators are plug-in values used in most common algorithms found on the internet. The chart forces us to use "wetware'' rather than someone's software in decision making.

* A brief on chart Indicators

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=146368673

Compounding

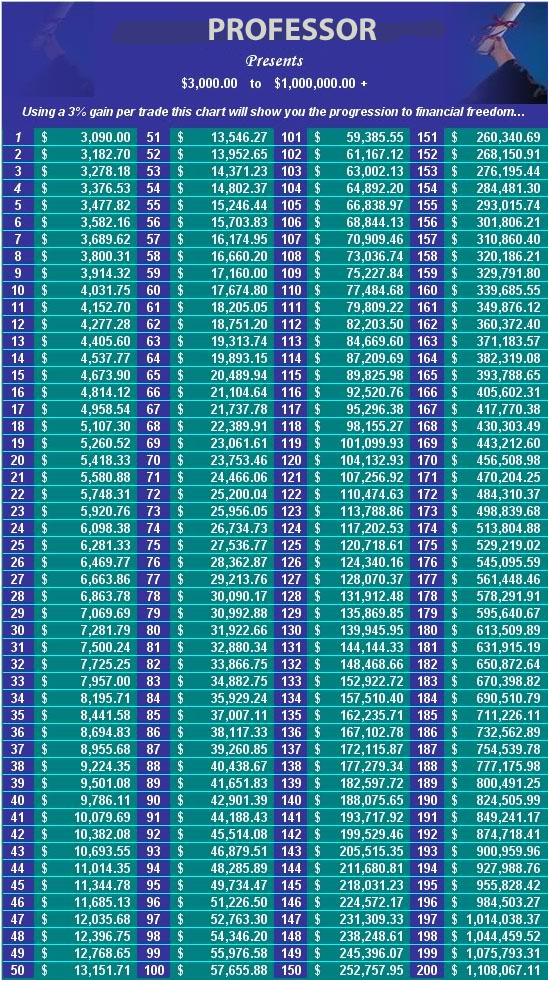

The main focus here is to compound our gains. Too many people enter the stock market with the intent of trying to hit a home run. Swinging for the fences also gives you a high strike out ratio. It is important to compound your gains and go for the singles and doubles and you will find that you eventually hit triples and home runs as well. The chart below shows how you can turn only 3k into 1 million dollars in 200 steps. So join me in moving up the steps of our compounding gains chart. Compound those gains!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=125078854

im not a chartist so, can you say that in “gail” terms? ![]()

GSAC compound chart~~~ AROON8 up from zero (\0/) was the first indicator signal, the others a day later.

chart thread post

Compound Chart

#1. AROON- 8 You watch as the AROON DOWN crosses the 75 down and the AROON UP comes up from zero. Most important. (\0/)

#2. WILLIAMS%R- 9 You watch the line cross the 50.

#3. CMF- 15 You will usually only see growth when the CMF is in the negative.

#4. ADX/DMI-5 You watch as the D+ line either crosses the D-, or crosses above the 20.

#5. MACD histogram- 5,15,10 You watch the negative bars register -50% smaller then the bar before it, or -50% smaller then the largest in the grouping.

#6. Full Stoch- 5,3 You watch the fast line cross the slow line while the AROON DOWN(8) crosses the 87.50. Crossing the 20 would be best, when the Williams agrees.

#7. Bollinger Band 20,2 You watch for the Magic Box to occur when the negative close touches above the lower bolly and the next day’s close to it is positive growth in a white candle.

#8. RSI 5 you watch as the indicator crosses above the 50 for a quick pop.

#9. MA(2) Watch the 2 day MA cross above the 5 day MA. That’s helpful.

#10. MA(2) To sell it just watch the 2 day MA kiss the bottom center of the red candle body.

https://stockcharts.com/h-sc/ui?s=GSAC&p=D&yr=0&mn=3&dy=0&id=p29397895492&listNum=23&a=1093863074

THE MAGIC BOX

(A) The Magic Box is a pure two-day pattern. Basically the "close" of a red candle printing on or near lower Bollinger Band with the next day printing an "open white candle."

A gift from The Seasonality Stock Reports Board

The reason that I named this setup the Magic Box was so that you could relate to it and remember it faster. Without relationship to something, it is nothing to us. It must be something memorable to you before you can set it into your subconscious mind and see it always.

(A1) On day one the Aroon Down is setting at 100 on the indicator and price is near the lower Bollinger Band. The Candlestick is dark-shadowed.

(A2) On day two, to form the Magic Box, the Aroon Down must drop to 87.50, and price to form a white candle, to complete the box. No other indicator is watched until this occurs for this setup, just the Bollinger Band and the Aroon Down.

If you see a Magic Box develop, that being, on the first day the Aroon Down going from 100.00 while the close is either on or just above the lower Bollinger Band and the second day the Aroon Down is now 87.50, you have a Magic Box.

(B) The buy opportunity occurs when the confirmation of two things happens: on day three or few days later the Aroon Down goes to 75.00 and the Williams%R comes above the -50%. That is the buy. The Williams must come through the -50%. It may take more than three days but you must wait for the confirmation of the William%R. I have seen again and again, the Aroon Down come down from 100.00 to zero without the Williams ever crossing the -50%, those are the ones you pass on. There will be no growth when this happens. At most there is consolidation or a small drop. During this process the Aroon Up can rise slowly but without the Williams you have nothing.

There are other Magic Boxes that develop in a stock's life cycle, too, and they, too, can give great growth. These are the supported median, the floating, and the rising Magic Boxes. The buy-in criteria, though, will remain the same for all of them. The Aroon Down comes to the 75.00 and the Williams crosses the -50%. June 7th, 8th, and 9th accomplish this in the 2007 HGR chart, though the William%R took until June 13th to confirm. You must wait.

Trading: It is highly recommended that you paper trade the system to familiarize yourself with it thoroughly. As with anything in life nothing is guaranteed, so, always use appropriate stop loss according to your risk tolerance.

Kenneth J. Goodrich

http://investorshub.advfn.com/SEASONALITY-STOCK-REPORTS-1616/

Example

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37119243

Sell trigger

https://investorshub.advfn.com/boards/replies.aspx?msg=40130527

It’s not the stock I hate…. They are 98% scams

Announce a deal is closing May31st to build anticipation to dump into.

Then reheat the same garbage. Still no deal closed. The sad part is “the deal” has no value. It’s just spin to sell shares. $GSAC

tough crowd here. grabbed …….

…

some today. hi all. ![]()

Hang out for a while then let me know. Thanks

Buyers are doing a good job picking up on the wash. The profit takers are holding cores of free shares so there really is no complete dump and the only "pump" today was my bullish chart. I followed (stalked) Dasqeezr to the chat room today and liked what I saw.

200mil volume !?

https://stockcharts.com/h-sc/ui?s=Gsac&p=D&yr=0&mn=4&dy=0&id=p24986097784&listNum=23&a=1113701411

$GSAC Just looked at L2 and the maneuvering was wildly real! WoW! MMs look to be hugely short.

Hopefully I have enough shares UGH Never satisfied lol This thing is strong! Bring those updates!

Nothing but a pump to wash T5’s

Great to see you here tothe

GLTA

#GSAC

Thanks for adding the links! Very helpful

|

Followers

|

47

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2021

|

|

Created

|

08/30/05

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |