Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks Vancmike for staying on subject.

As I have stated before, when it suits them, the govt claims the SPS was an investment. At other times that it's a loan. FnF sent their equity to the Treasury until stopped by the Fifth Circuit Enbanc. Since then the the Liquidation Preference has grown for each $ of earnings as per letter of agreement signed between Calabria and Mnuchin. When Fannie states "amounts attributable to Senior Preferred Stock" Fannie is signifying that the SPS is considered a loan.

Also, as I have repeatedly stated, if the SPS were a loan, it was paid back a decade ago. If it was an investment, then the corporations have always been capitalized, and there's been no need for the conservatorship.

bwahahah oh god man this board is funny!!!

Rick, I wish I had that kind of influence.

For all you accounting knowledgeable people, (I have a basic understanding), how does FNMA create net worth if all income is sent to the Treasury?

Inquiring minds want to know.

Good bye gains from yesterday. It was nice to meet you.

Income v Revenue v Profit

When all the dust (expenses) settle - F and F have been making profit

That profit - as cash - is kept - it does not go anywhere

BUT an obligation - an IOU - is created - $ for $ - that is given to Treasury (this smoke and mirrors is Mnuchin)

The more our capital base grows - the more we owe the Treasury in LP measuring value of senior preferred paper

That paper - obligation if one prefers - should be declared to be ZERO for the 300B cash sent to Treasury (Gov argues the 110B over "investment is 15 years of dividend and or interest - which is legit but they must kill the SP - and brag about the 100B profit for us to be free)

YES

I wish I had font 100

YES

Celebrating Fair Housing Month: Honoring Progress and Commitment

https://www.fhfa.gov//Media/Blog/Pages/Celebrating-Fair-Housing-Month-Honoring-Progress-and-Commitment.aspx

Celebrating? Gimme a BRAKE so i can stop laughing

It will NOT be a 10 cent down day, today

Umm excuse me I think your post made the price drop even more.

you think? how? every penny made is swept to spsa. what may happen if they bring back a 5 year old like caalabra who raises capital required to 5% and keep hiding stress test as he did? the problem is they can do whatever they want as a conservator and regulator. whatever happened to the cfpb case that may potentially resolve this? whatever happened to the libor money? it almost seems like the solution may come from a place that no one anticipated (if) and with no timeline. no one knows considering they are fighting unanimous jury verdict. unbelievable right?

Keep up The Fight

Fight for what is Right

Fight to Right the Wrongs done to Shareholders

From the Condensed Consolidated Statements of Operations and Comprehensive Income:

"Dividends distributed or amounts attributable to senior preferred stock (4,324) $ millions"

It appears all income was sent to the Treasury

Questions:

1. Wasn't the sweep suspended until a certain capital level was reached?

2. What is FNMA's capital requirement?

The Door is Open -

Low Volume Today

means the door is open for

new investors to LOAD UP...

you won't regret it - this is an opportunity

seldom seen for FNMA and FMCC - Pack 'em in quick

Chicago PMI is destroying markets today, its all relevant with the Fed Decision tomorrow. day before and day after are never the same. GSEs are for you and me, holding up nicely today.

You’re right no Net Income for sure. Wiseman has it right to a degree Financial Statement fraud. Net Worth reported shareholder's equity $82 billion is deceitful.

We’re wiped out if the Senior Preferred are not cancelled.

And we're red. If we were considered a tech stock these earnings would have us up 20% or more.

the shortfall of 243 billion never goes down as 100% is still taken away. they can increase capital requirement to 5% and make it even worse, just need to bring calabria back. crazy right?

"Page 105 Quote: Regulatory Capital Requirements we had positive net worth under GAAP $82 billion. EXCLUDES the stated value of the Senior Preferred Stock $120.8 billion.

Short fall of $243 billion of available capital (deficit) to the total capital requirement."

Ten more quarters like this and Fannie will be able to release itself from conservatorship!

I still believe in the thesis, I'm just reducing exposure so I can mentally move on a bit.

If you've completely sold out, you should move forward and not look back at this. Otherwise you'll just end up like Amelia.

To da moon by noon, slap the ask, ready for another run to $2. Don’t let Buffet get all the shares. Hatsmashi candle sticks baby !

Hilarious!

oh no

GOV has to pay on a TAKING ?

Hey - as I have said - often - if GOV "wants to own F and F " -- well pay me a fair price then

We'll have to gen-up a tagline for you

"Don't believe your lying eyes!" 😀

Response to a previous about the 9 supremes who railroaded the gse's. I said with him it's 10.

Q1 comprehensive income of $4.32B vs. $3.96B in Q4 2023 and $3.77B in Q1 2023.

Fannie Mae (OTCQB:FNMA) stock climbed 4.8% in Tuesday premarket trading

so if none have

have you sent emails --- (not saying they will work - just wondering ? and may have asked before)

is time available or stat of limitations

Fannie Mae GAAP EPS of $0.00, revenue of $7.1B misses by $550M

Apr. 30, 2024 7:37 AM ETFederal National Mortgage Association (FNMA) StockBy: Deepa Sarvaiya, SA News Editor1 Comment

Fannie Mae press release (OTCQB:FNMA): Q1 GAAP EPS of $0.00.

Revenue of $7.1B (+3.6% Y/Y) misses by $550M.

$4.3 billion net income for the first quarter of 2024, with net worth reaching $82.0 billion as of March 31, 2024

Home prices grew 1.7% on a national basis in the first quarter of 2024 according to the Fannie Mae Home Price Index

The U.S. weekly average 30-year fixed-rate mortgage rate increased from 6.61% as of the end of 2023 to 6.79% as of the end of the first quarter of 2024

Blowout earnings.

wiseman Quote “ Fannie Mae is not reporting under GAAP because it's accused of Financial Statement fraud (SPS LP increased for free and its offset, are missing on the balance sheet)” End of Quote

Update as of today

Page 105 Quote: Regulatory Capital Requirements we had positive net worth under GAAP $82 billion. EXCLUDES the stated value of the Senior Preferred Stock $120.8 billion.

Short fall of $243 billion of available capital (deficit) to the total capital requirement.

https://www.fanniemae.com/media/51196/display

AGAIN: “Separate Account plan” kindly, explain to us how this will unfold. And when will this take place? Hello !

That's $3.78 per share for the quarter!

FNMA Q1 2024 net income of $4.3 billion, is a greater than $16 Billion yearly run rate.

FNMA - Net Worth climbs to 82 Billion

FNMA Reports net income of 4.3 Billion First-QTR-2024

https://www.fanniemae.com/newsroom/fannie-mae-news/first-quarter-2024-financial-results

Oh wow. Big day on deck. Earnings day. I have a good feeling today.

Congrats. I sold my last JPS last week. I'm fed up with the shenangigans of the courts, the corrupt FHFA bureaucrats, and the endless lies of politicians of both parties.

By the way, we see how judge Willett, in the previous screenshot, claimed that FnF had returned to sound condition at the time, referring to the return to profitability, when, in a financial company, soundness is related to the capital levels.

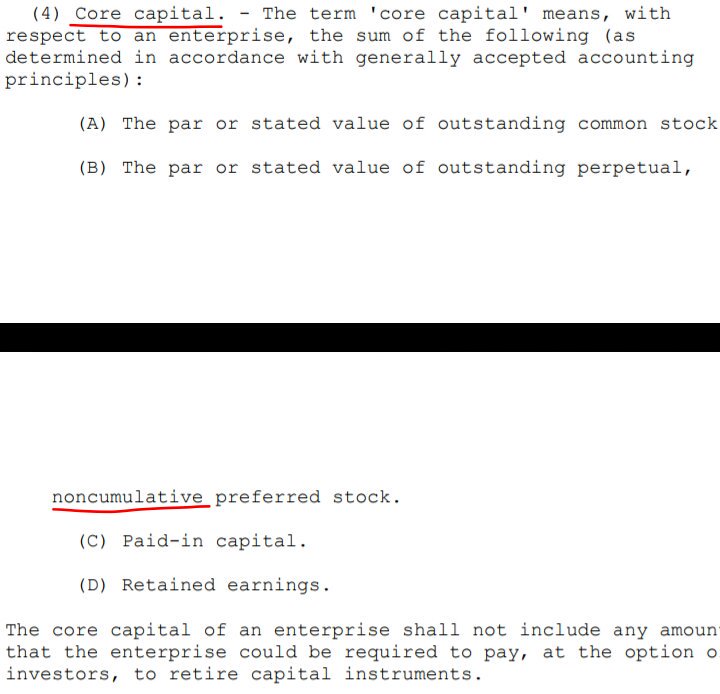

That is, RETAINED earnings (Core Capital).

Adjusted $-216B Accumulated Deficit Retained Earnings account combined as of end of December 2023 and stuck every quarter at that amount with the ongoing Common Equity Sweep (Common Equity held in escrow though, in accordance with the law)

Which reminds me of the 6th Circuit Court of Appeals in the Robinson case with the omnipresent attorney for Berkowitz, David Thompson, with the judge also mistaking sound condition for "the return to profitability, even if a large portion of that profit was sent to Treasury's coffers".

Besides, mistaking solvent condition for the UST's Funding Commitment, when it refers to solvent condition on their own, not with the existence of a UST's Funding Commitment, which existed since the Charter's inception (limited to $2.25B that had to be updated to carry out their Public Mission)

Let alone the judge's radical view, contending that "FnF likely should not return to business as usual". No one asked him for his opinion.

And "nothing in HERA's text requires the FHFA to return the Companies to business as usual", the reason why was appointed a conservator in the first place, the expulsion of the prior management, and with a Power that directs the conservator to restore (put) FnF to a sound and solvent condition. With "may" an imperative in statutes, once the capital has been generated.

This is why the judges are barred from making decisions about FnF. Lack of understanding of financial matters, which is a statutory requisite to become FHFA director and thus, the conservator of FnF.

Rogue officials are using the Judiciary to provide the alibi, and legalize what isn't stated in the law and basic Finance and has ended up with judge Lamberth openly admitting that he wants to grant back dividends to the Non-Cumulative dividend JPS, while FnF remain undercapitalized.

Everybody wants dividends when they are restricted for the recapitalization of FnF: RETAINED EARNINGS.

They should learn that a dividend is a distribution of Earnings in the first place. That's the point. Besides unavailable funds with Accumulated Deficit Retained Earnings accounts.

.jpeg)

"every circuit ***to review*** 4617f"

#FANNIEGATE ATTYS BRING 4617f UP AGAIN

— Conservatives against Trump (@CarlosVignote) April 29, 2024

Courts step in if FHFA exceeds its powers.

Willett's half-baked ruling amending Sweeney's ("authorized by this section" deleted)said YES w/ the NWS div, in a Hindes-moment(the 10%div too)

Alito corrected Willett:"Rehab FnF...Can't you read?" pic.twitter.com/2nBGuAxvJ3

You have calculated TIER 1 Capital, when I'm talking about Core Capital.

Similar, but different. Evidence that you can't follow the arguments.

I'm not going to explain more because, if you don't understand what you write, you can't understand my explanation.

Someone sent you the script.

Fannie Mae is not reporting under GAAP because it's accused of Financial Statement fraud (SPS LP increased for free and its offset, are missing on the balance sheet)

Significantly undercapitalized? How about Critically Undercapitalized with Deficit Capital available?

Fannie Mae had a GAAP positive net worth of $78 billion at YE23, the Enterprise Regulatory Capital Framework excludes the stated value of the senior preferred stock ($120.8 billion), as well as a portion of deferred tax assets, resulting in the Company being significantly undercapitalized.

The U.S. Supreme Court just gave California a major opportunity to lower housing costs

https://calmatters.org/commentary/2024/04/supreme-court-housing-impact-fees/

FNMA Earnings Report First QTR 2024 Dead Ahead

April 30 before the bell.

What did you do to detearing?

How did you get the sponsorer tag? ( See how I snuck that sponsorer in)

Thank

The Supreme Court could halt a chilling effect that has contributed to the United States housing affordability crisis.

https://www.msn.com/en-us/money/realestate/supreme-court-could-halt-chilling-effect-on-housing-market/ar-BB1hjN3e

Did you sell the 400 shares?

Oh yes. My mistake. I will now put you back on the Wynn Vegas party invitation list.

I'll still have 75% left, don't I still qualify?

Big Buys? Maybe we will have a WHALE of a time tomorrow!

Go FNF!

BOOM

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

37

|

Posts (Total)

|

802390

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |