Tuesday, April 30, 2024 1:19:48 AM

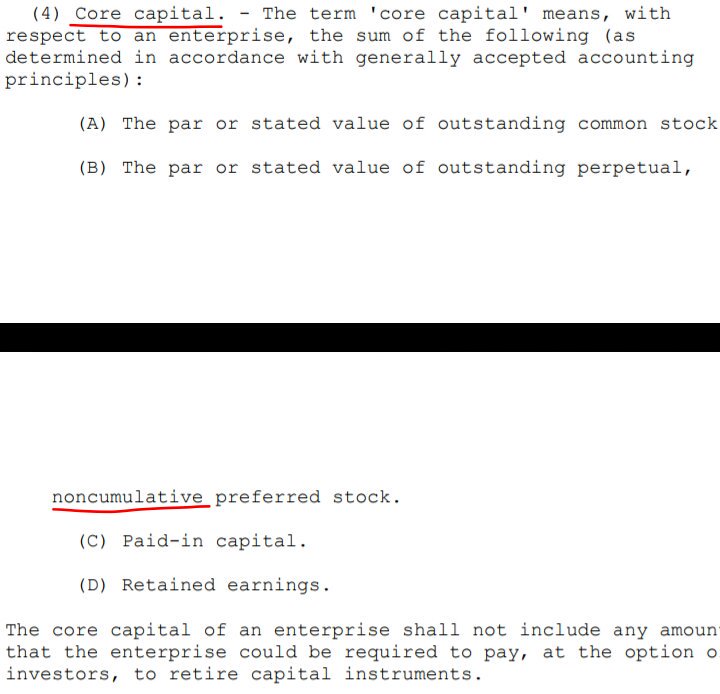

That is, RETAINED earnings (Core Capital).

Adjusted $-216B Accumulated Deficit Retained Earnings account combined as of end of December 2023 and stuck every quarter at that amount with the ongoing Common Equity Sweep (Common Equity held in escrow though, in accordance with the law)

Which reminds me of the 6th Circuit Court of Appeals in the Robinson case with the omnipresent attorney for Berkowitz, David Thompson, with the judge also mistaking sound condition for "the return to profitability, even if a large portion of that profit was sent to Treasury's coffers".

Besides, mistaking solvent condition for the UST's Funding Commitment, when it refers to solvent condition on their own, not with the existence of a UST's Funding Commitment, which existed since the Charter's inception (limited to $2.25B that had to be updated to carry out their Public Mission)

Let alone the judge's radical view, contending that "FnF likely should not return to business as usual". No one asked him for his opinion.

And "nothing in HERA's text requires the FHFA to return the Companies to business as usual", the reason why was appointed a conservator in the first place, the expulsion of the prior management, and with a Power that directs the conservator to restore (put) FnF to a sound and solvent condition. With "may" an imperative in statutes, once the capital has been generated.

This is why the judges are barred from making decisions about FnF. Lack of understanding of financial matters, which is a statutory requisite to become FHFA director and thus, the conservator of FnF.

Rogue officials are using the Judiciary to provide the alibi, and legalize what isn't stated in the law and basic Finance and has ended up with judge Lamberth openly admitting that he wants to grant back dividends to the Non-Cumulative dividend JPS, while FnF remain undercapitalized.

Everybody wants dividends when they are restricted for the recapitalization of FnF: RETAINED EARNINGS.

They should learn that a dividend is a distribution of Earnings in the first place. That's the point. Besides unavailable funds with Accumulated Deficit Retained Earnings accounts.

.jpeg)

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM