Monday, April 29, 2024 2:52:59 AM

By the way, this comes after judge Sweeney's interpretation of this provision, deleted the words "authorized by this section", so she could read "take any action in the best interests of the FHFA", ending up with "the FHFA is the government". She was called out and renamed "The Tipp-Ex Queen", and it's when the big boys stepped in to give a proper interpretation of the written text. Primarily because take their capital away is NOT authorized by this section (a breach of the FHFA-C's Rehab power, knowning that "may" is imperative in legislation, once the capital has been generated, and not a choice. Already commented.)

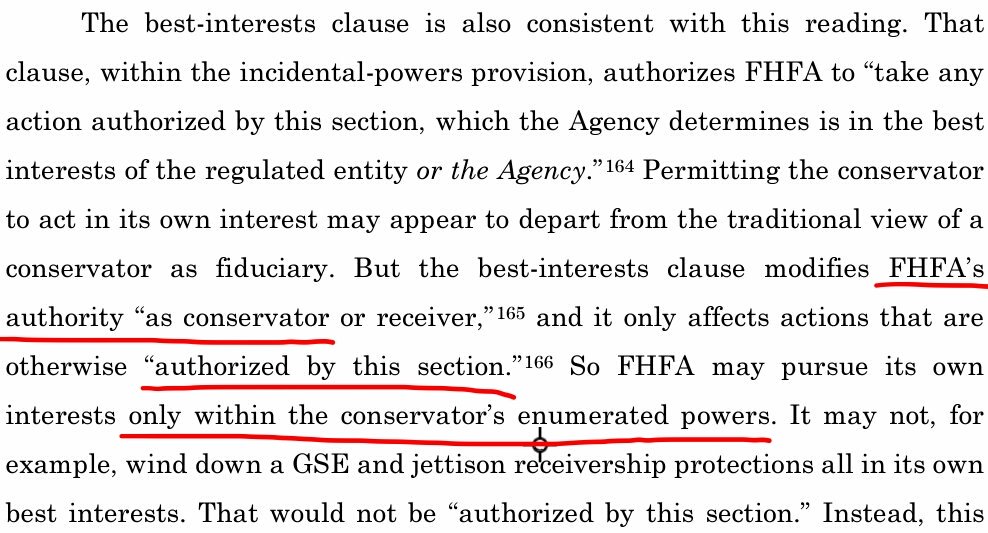

Justice Alito was just making clear what judge Willett stated in a prior ruling (5th Cir.) over the same Collins case and regarding the same provision: "Any action within the enumerated powers".

Therefore, the savy Justice Alito simply looked for the FHFA-C's Powers, something that judge Willett missed, and determined that it's about the rehabilitation of FnF, when he read: "Put FnF in a sound and solvent condition", because he knows that the soundness in a financial company is measured with the Capital levels, where the Retained Earnings are recorded as Core Capital. And solvency (ability to meet the obligations) is suitable for the reduction of the SPS (obligations in respect of Capital Stock) and restore their capital levels as well.

Both are, precisely, the exceptions to the Restriction on Capital Distributions.

Then, we can come to the conclusion that the Restriction on Capital Distributions is a tool to achieve the FHFA-C's Rehab power.

This is why the FHFA's Power is also called "the Rehab power" or the "Recap power".

You have just posted justice Alito's add-on "and the public it serves" in your piecemeal approach (The Tipp-Ex gang), that stretches the interpretation of the FHFA-C's Incidental Power, useful to use FnF for government policies and to put an example, it would allow the Congress to keep the estimated $15B it owes to FnF for managing Obama's Making Home Affordable program (HAMP and HARP), that even made FnF advance the payments to borrowers and servicers (banks), with the promise that they would be reimbursed for this cost with TARP funds, but it didn't happen.

Also, the utilization of the hedge funds as a tool for government policies, after Trump approved the debt forgiveness plan (the short-sales that DeMarco prohibited), forcing FnF to sell their NPL and RPL to the hedge funds at a deep discount, because it contains a clause that includes debt forgiveness, and with the collateral (properties) valued sky high given away. This is an incentive to prompt manufactured crisis.

Fannie Mae. Sale of RPL:

purchasers must offer delinquent borrowers a waterfall of loss mitigation options, including loan modifications, which may include principal forgiveness, prior to initiating foreclosure on any loan. Source.

This is fine. Once the dust settles, we will bring it up as windfalls for the UST, knowing that what is the bailout, it will net $0 as per the Charter Act (the amount of cumulative dividend on SPS , with a weighted-average 1.8% rate and applying a 0.5% spread over Treasuries, is netted out with the interests on the $152B cash owed to FnF)

The first part of his sentence that we are talking about, "Rehabilitate FnF in a way, although not in the interests of FnF (on paper -Balance Sheet-, just watching their awful ERCF tables you know why), it's beneficial to the Agency". We see how the justice twisted the text as it's written, just what he was told, in order to play the game of the hedge funds and private equity firms about a "Government theft story" that is what is making the stocks trade at rock bottom prices (stock price manipulation), because with "beneficial", the justice wanted to transmit the idea of "monetary benefit", when the written text states "in the best interests", and the interests in a regulatory agency are always related to activities in the regulated entities, no one can think of depleting their regulatory capital, by taking their money away in broad daylight.

BOTTOM LINE

What justice Alito was really allowing, is the rehabilitation of FnF in a Separate Account that resembles the one carried out by Congress and the FHFA in 1989 with the FHLBanks, for the repayment of principal of the RefCorp obligation, and with an extended version for their recapitalization. Either on purpose or inadvertently, because no matter how you spin the law, all roads lead to Rome.

Now we are talking.

CET1 > 2.5% of Adjusted Total Assets as of end of 2023. Even it was achieved a 25% of the Prescribed Capital Buffer under the Table 8: Payout ratio, for the resumption of dividend payments (Capital Buffer = amount of capital above the threshold Tier 1 Capital > 2.5% of ATA), after the redemption of the JPS (AT1 Capital) with the 4Q 2023 reports of the laggard Fannie Mae.

Achiving the FHFA's will of expulsion of the unwanted Equity holders in FnF (The bulk of JPS holders are hedge funds and Community Banks) in the run up to unveiling the Privatized Housing Finance System we were bound for, since it was chosen by the UST for the release from conservatorship, in a Report to Congress dated February 2011, at the request of the Dodd-Frank law.

The same "membership cleansing" was carried out by the FHFA with the FHLBanks in a Final Rule of 2016.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM