Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

wiseman Quote “ Fannie Mae is not reporting under GAAP because it's accused of Financial Statement fraud (SPS LP increased for free and its offset, are missing on the balance sheet)” End of Quote

Update as of today

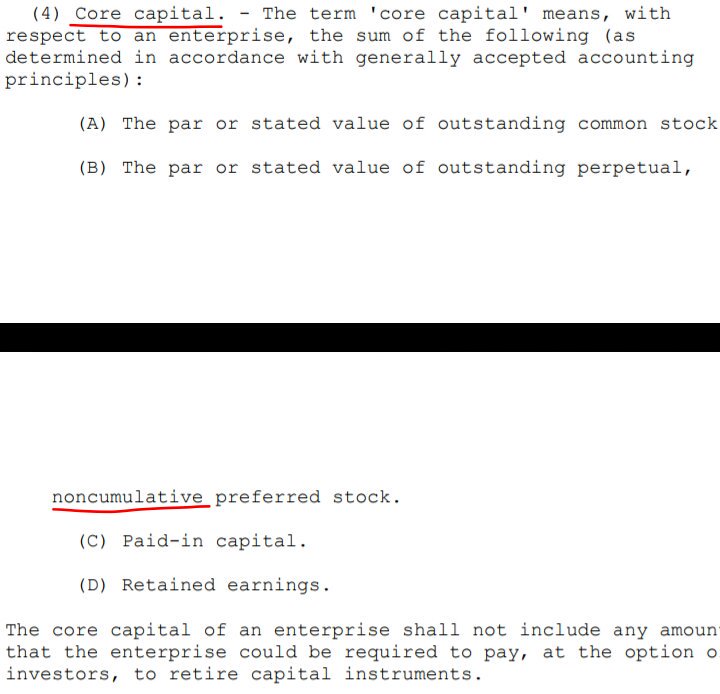

Page 105 Quote: Regulatory Capital Requirements we had positive net worth under GAAP $82 billion. EXCLUDES the stated value of the Senior Preferred Stock $120.8 billion.

Short fall of $243 billion of available capital (deficit) to the total capital requirement.

https://www.fanniemae.com/media/51196/display

AGAIN: “Separate Account plan” kindly, explain to us how this will unfold. And when will this take place? Hello !

That's $3.78 per share for the quarter!

FNMA Q1 2024 net income of $4.3 billion, is a greater than $16 Billion yearly run rate.

FNMA - Net Worth climbs to 82 Billion

FNMA Reports net income of 4.3 Billion First-QTR-2024

https://www.fanniemae.com/newsroom/fannie-mae-news/first-quarter-2024-financial-results

Oh wow. Big day on deck. Earnings day. I have a good feeling today.

Congrats. I sold my last JPS last week. I'm fed up with the shenangigans of the courts, the corrupt FHFA bureaucrats, and the endless lies of politicians of both parties.

By the way, we see how judge Willett, in the previous screenshot, claimed that FnF had returned to sound condition at the time, referring to the return to profitability, when, in a financial company, soundness is related to the capital levels.

That is, RETAINED earnings (Core Capital).

Adjusted $-216B Accumulated Deficit Retained Earnings account combined as of end of December 2023 and stuck every quarter at that amount with the ongoing Common Equity Sweep (Common Equity held in escrow though, in accordance with the law)

Which reminds me of the 6th Circuit Court of Appeals in the Robinson case with the omnipresent attorney for Berkowitz, David Thompson, with the judge also mistaking sound condition for "the return to profitability, even if a large portion of that profit was sent to Treasury's coffers".

Besides, mistaking solvent condition for the UST's Funding Commitment, when it refers to solvent condition on their own, not with the existence of a UST's Funding Commitment, which existed since the Charter's inception (limited to $2.25B that had to be updated to carry out their Public Mission)

Let alone the judge's radical view, contending that "FnF likely should not return to business as usual". No one asked him for his opinion.

And "nothing in HERA's text requires the FHFA to return the Companies to business as usual", the reason why was appointed a conservator in the first place, the expulsion of the prior management, and with a Power that directs the conservator to restore (put) FnF to a sound and solvent condition. With "may" an imperative in statutes, once the capital has been generated.

This is why the judges are barred from making decisions about FnF. Lack of understanding of financial matters, which is a statutory requisite to become FHFA director and thus, the conservator of FnF.

Rogue officials are using the Judiciary to provide the alibi, and legalize what isn't stated in the law and basic Finance and has ended up with judge Lamberth openly admitting that he wants to grant back dividends to the Non-Cumulative dividend JPS, while FnF remain undercapitalized.

Everybody wants dividends when they are restricted for the recapitalization of FnF: RETAINED EARNINGS.

They should learn that a dividend is a distribution of Earnings in the first place. That's the point. Besides unavailable funds with Accumulated Deficit Retained Earnings accounts.

.jpeg)

"every circuit ***to review*** 4617f"

#FANNIEGATE ATTYS BRING 4617f UP AGAIN

— Conservatives against Trump (@CarlosVignote) April 29, 2024

Courts step in if FHFA exceeds its powers.

Willett's half-baked ruling amending Sweeney's ("authorized by this section" deleted)said YES w/ the NWS div, in a Hindes-moment(the 10%div too)

Alito corrected Willett:"Rehab FnF...Can't you read?" pic.twitter.com/2nBGuAxvJ3

You have calculated TIER 1 Capital, when I'm talking about Core Capital.

Similar, but different. Evidence that you can't follow the arguments.

I'm not going to explain more because, if you don't understand what you write, you can't understand my explanation.

Someone sent you the script.

Fannie Mae is not reporting under GAAP because it's accused of Financial Statement fraud (SPS LP increased for free and its offset, are missing on the balance sheet)

Significantly undercapitalized? How about Critically Undercapitalized with Deficit Capital available?

Fannie Mae had a GAAP positive net worth of $78 billion at YE23, the Enterprise Regulatory Capital Framework excludes the stated value of the senior preferred stock ($120.8 billion), as well as a portion of deferred tax assets, resulting in the Company being significantly undercapitalized.

The U.S. Supreme Court just gave California a major opportunity to lower housing costs

https://calmatters.org/commentary/2024/04/supreme-court-housing-impact-fees/

FNMA Earnings Report First QTR 2024 Dead Ahead

April 30 before the bell.

What did you do to detearing?

How did you get the sponsorer tag? ( See how I snuck that sponsorer in)

Thank

The Supreme Court could halt a chilling effect that has contributed to the United States housing affordability crisis.

https://www.msn.com/en-us/money/realestate/supreme-court-could-halt-chilling-effect-on-housing-market/ar-BB1hjN3e

Did you sell the 400 shares?

Oh yes. My mistake. I will now put you back on the Wynn Vegas party invitation list.

I'll still have 75% left, don't I still qualify?

Big Buys? Maybe we will have a WHALE of a time tomorrow!

Go FNF!

BOOM

No earnings surprise for us then!!!

Seeking Alpha says $0.00 EPS. Of course we know that's because the sweet and they aren't giving credit for the earnings but how many readers DON'T know that?

Interesting what posted on my E*trade account today:

FNMA new earnings news is available

9:01 AM ET 04/26/2024

FNMA, (Trade) has reported earnings of -2.29 per share versus last year's earnings of -2.57 per share.

It starting to look like Fannie and Freddie are reversing

the several recent days in the Red. (he said, i hope)

FNMA closes at $1.52 up 6 cents on 3.1 million shares,

and bounces off low of $1.44 - Nice

FMCC c;loses at $1.44 up 6 cents on 1.8 million shares,

and bounces off low of $1.37 - Nice here, too

That sounds great if only Aldomovar was in charge of the GSEs, the problem is with can’t eat enough rubber chicken served at luncheon Sandra.

There’s nothing that fnma-fmcc shareholders can do with all of the ESG Biden BS going on.

Wonder if Sandra decides to open a new fhfa branch- all you can eat rubber chicken meals for all FHFA simili workers.

In the meantime, lI want to enjoy more seaking alfafa articles from the fanniegate zero.

Fnma

There were a lot of big buys in the last one hour of trading. Some of the blocks were for 100,000 shares. I wonder what is going on. Are we expecting a surprise at tomorrow’s earnings ? Will Aldovar say something juicy meaty tender succulent delicious mouth watering ?

"The consensus estimate is $0.00 EPS." Come on. At least give us credit for the EPS, even if the gov't is going to steal it all.

Sherwin is showing up again

will we hold $1.50??

go FnF

Must be selling his preferred’s

There are a lot of them here. They must want to remain in conservatorship forever.

yes but think of it the way i do, especially when they are wrong, which happens to be in the favor of almost everything for years, and is whey commons are coming back up to where they were before all the recievershipshit started, above 4 dollar. anything above zero will look good, real good.

I don't expect Seeking Alpha to post my comment. I question the author's knowledge of consensus and EPS.

This also from Seeking Alpha:

Federal National Mortgage Association: The Bulls Are In Control, Buy

Good afternoon Warrior! His post are for entertainment purposes only. AKA the voices ibis head!

Strong Buy for Fannie and Freddie

Anything under $2.50/share is a STEAL

Sure, here is the Collins v Yellen link as requested.

https://www.supremecourt.gov/opinions/20pdf/19-422_k537.pdf

Take Note:

The pps spread between FNMA and FMCC

is NOW only 7 cents - Forks, something

big is about to take place...don't let the

boat leave without you, and YOU, and yes, EVEN YOU!

RAISE THE ASK

FNMA/FMCC

RAISE THE ASK

you will never get a reply as this 'secret plan', 'on presidents desk' shit is all cooked in his own head. you read this shit?

you have told us before that you sold it all. zero credibility. good luck, we see a lot like you.

Hi Clarence,

It is quite a confusing situation to wrap one’s head around. There are 3 laws, and 3 potential roles for a Director of FHFA to play. First the Charter act privatized the former gov agencies and created FNMA. The safety and soundness act of 1992 established the framework for regulating the GSEs. Finally HERA came along and modified both the charter act and the safety and soundness act. HERA replaced the original regulator with the new “independent agency” FHFA. The Director of FHFA priority role is to regulate the GSEs based on the requirements enumerated in the statutes. This role of the Director establishes regulations required of him such as the Capitol rule, and new products rule. The Director in this role also issues reports and is supposed to provide in writing, permission for the GSEs to make a capitol distribution from the retained earnings account if the retained earnings account is below the statutory minimum. Thus all of these requirements of the director must follow the Administrative Procedures Act. In other words, the Directors role as regulator is Administrative and subject to potential APA claims. HERA also allows the Director in the regulator role to appoint himself as either a receiver or a conservator of the GSEs. The role of receiver is subject to the enumerated actions in the statutes to achieve the end result of liquefying the GSE. Therefore there is no guesswork to achieve the result. The law states exactly what a receiver is allowed to do. Finally, HERA allows the Director as Conservator to take any action necessary to put the GSE in a sound and solvent position and benefit the FHFA itself. Unlike a receivership, the final result of Conservatorship can’t be guaranteed by statute. It is necessary therefore to provide the Conservator the assumption of correctness in the actions that he takes to achieve the goals of rehabilitation of the GSEs and benefit the FHFA. Congress includes the anti-injunction clause only for the actions taken by the Director acting as Conservator. All of the courts have ruled that only when the Director acting as Conservator acts ultra-vires will a court step in. They have ruled that the Conservator has not acted ultra-vires. To date there have been no legal claims against the Director as regulator for violations of other laws.

Make it 10.

Royce is not who you think he is.

ok

I agree - i post too fast and sloppy

will add discipline -- at least for a while

Been saying it for years the lawyers have their ideal client, rich clients. Lawyers are smart enough to extract as much as possible.

Post judgment interest will have almost no effect.

The gubmint has done a number on you as you are thinking about this well into the night.

Can you write in English and use decent grammar????? No one can understand you. ??????

Well, we are completing another and larger Bull Pennant also!

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

802399

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |