Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Could be much higher too.

Say $28.00 ???

Hey badog

I think you are short many millions of ERHE shares

Good luck with trying to cover under $10.00 a share

jmho

Funny. If I'd clocked in at Harvey's....LOL. The lottery may be better odds than ERHE. So there's a reason I only bought 60,000 shares. And if I lose this $12 I'll still be ahead overall on ERHE. I'll never be underwater. I mean I didn't fall for the dilution insurance. I didn't double or triple down when ERHC did the reverse split. I think I posted that ERHC would probably do a reverse split and everyone told me I was crazy...management would never do something that harmful to shareholders. But then they did it. The sp was on it's way down and I wanted no part of it. Thought I was safe at .002 just to find out $12 now buys 1.2 million shares. I thought ERHC was cratering well enough on it's own and then SEO/PN had no sympathy for you all as he found more and more ways to crater and dilute the sp. And these guys are who you trust to make you millionaires? IMHO they will do what works best for themselves and tell everyone else to pound sand. In the end investors could easily be left with that WTF look on their face History has a way of repeating itself.

people with insider knowledge, like executives or close to the situation, can’t legally buy shares

You are so full of bull lmao. Close to 30 companies lumped together in revocation action dismissal, but according to you and only you, erhc's had something to do with "the gag order", which miraculously allows 8-K's about lawsuits as long as specific company names aren't mentioned but doesn't allow redacted financials. Again, such bull. The SEC even has a specific procedure for companies to release financials and handle confidentiality requirements.

Regarding the new asinine narrative that Offor received convertible debt and converted it into half or even all the erhe shares but erhc didn't report any of it because of, wait for it.....the gag order is more bullshit. Look at the filings erhc did release. They clearly show the share count after the reverse split, all the convertible debt issues and conversions as the share count grew from about 29 million to 2.9 billion as Offor's and Chrome's ownership dropped from close to 40% to less than 1/10 of a percent. Only one transaction by Chrome for $250,000 that was almost immediately converted into less than 1 million shares was listed, and nothing by Offor. Stop trying to rewrite the facts under your ridiculous, unproven gag order excuse. Every time you are trapped like a rat in one of your bullish lies, you drag out the worn out gag order crap with no facts to back it up. Pathetic.

And why is it so important to you to speculate and lie in so many different ways to try and perpetuate your made up story about Offor owning almost all the erhe shares while the company has never mentioned a word about it? Where is this huge short squeeze you've been "speculating" about for so many years? Where is any proof any erhe short positions exist? Better draw yourself another sketch.

Ah, Badog, I gotta hand it to ya, buddy. You're watchin' this stock like a hawk who only put down $12, eh? I mean, think about it—you're spendin' all this time on iHub for the price of a double-double and a couple Timbits! If you'd clocked in at Harvey’s instead, you'd be swimmin' in loonies by now. But hey, here we are.

Now, I know you like to think you're sittin' pretty with that $12 in 60,000 shares, but let’s take a look at what’s really goin’ on, eh? You mentioned that if you could get in today, you’d be scoopin’ up 1.2 million shares. Well, there’s a reason that ain’t happenin’—people with insider knowledge, like executives or close to the situation, can’t legally buy shares, and it’s not just anyone who's locked out. Americans are also restricted from gettin’ in on the action right now because of some good ol' SEC rules. So, your idea that insiders would be jumpin' in at ten or twenty-five cents? Not quite, bud. They’re tied up tighter than a toque on a windy day.

Now, I’ve been thinkin’, for someone who’s only got $12 ridin’ on this, you’re soundin’ pretty concerned, eh? Could it be, just maybe, you’ve got a few more loonies in the pot than you’re lettin’ on? I mean, when you're talkin' about shortin' against the box, that’s a classic move, but it’s also a tricky one. You see, those shares you’ve got long? They might just be hedgin’ a much bigger play—millions short, perhaps? If that's the case, bud, you might wanna start lookin' for a comfy bridge, 'cause when the stock pops, you’re gonna need more than a Trudeau relief program to keep ya from settlin’ in under there with the raccoons.

But hey, if I’m wrong, you’re out $12, and that’s nothin’, right? You can still grab yourself a Harvey’s burger and fries. But if I'm right? Well, let’s just say the short squeeze is gonna hit harder than a moose on a winter road. So keep your eyes peeled, 'cause when the ice starts crackin’, you’ll want to be on the right side of this play.

And don’t forget, the offer’s still standin’, eh—if this all makes sense and you stop with the same ol' questions, that Timmy's donut is on me! Keep that chin up, Badog. You’ll need it when those shorts come callin’. Cheers!

Krombacher

Like I said, I have 60,000 shares for $12. Today that same $12 would buy me 1.2 million shares but then I couldn't buy any today so it's probably good I got them when I did. I'll wait to see the outcome and will hope you are correct. If not I'm out $12. Still seems that if you are correct there would be others that would have a good idea of the outcome and be scrambling to put in offers for $.10, $.25, etc. But I don't see that.

Badog

Oh, buddy, I see what you're saying, but I’m gonna politely disagree here, like a good ol' buddy, eh! Now, I get it—you’re lookin’ at the past and thinkin’, “Here we go again, another overhyped oil story.” Fair enough. But hear me out, bud, this ain’t just wishful thinkin’ fueled by Timbits and maple syrup.

1. Past Failures Don’t Predict the Future, Eh

You mention the JDZ drills that didn’t pan out as everyone hoped. Yeah, that stung, like gettin' cross-checked into the boards, but here’s the thing: deepwater drilling is a high-stakes game, and even the best players sometimes miss the net. That doesn’t mean we’re skatin’ on thin ice this time around.

Sinopec wasn’t an expert in those conditions—true—but that’s exactly why the data collected matters so much now. Oranto isn't tossin’ darts in the dark; they’ve reviewed the same seismic data, and their numbers aren’t just outta thin air. They’ve got skin in the game, and they’ve seen enough to stick a price on it. You don’t see that every day from companies who are playin’ with billions.

2. Big Oil's Models – More Reliable Than You Think

Now, I get it, you’re skeptical of Big Oil's estimates. Models fail sometimes, just like the Leafs in the playoffs, right? But these models are based on more than just a lucky guess. These companies have access to geological data that most investors, you and me included, never get to see. They’ve got full-time teams runnin’ this stuff through the wringer, and while nothing is ever guaranteed in this game, the valuation from these experts should carry more weight than past failures alone.

3. The Short Squeeze – It Ain’t a Fantasy, Eh

I see ya still thinkin’ that the short squeeze is some pipe dream like finding the Stanley Cup under your bed. But lemme tell ya, these short sellers are in a precarious position. Like I said before, they’re trapped because of the way the SEC stopped the revocation without addressing the gag order properly. They can’t just walk away from this without gettin’ hit with those margin calls when the share price starts tickin’ up. And trust me, the price will rise once the curtain on the gag order is lifted and some of that buried news comes to light.

We’ve seen these squeezes before in other companies where the situation looked bleak for a while, but once the stock starts movin’, those shorts get hit harder than a snowplow on an icy road, eh. So don’t write off the squeeze so quick—it’s happened before, and it can happen again.

4. Snowstorms in July – Rare, But Not Impossible!

Now, you’re comparing this to a snowstorm in July. I get it—it seems like a long shot. But y’know what, bud? Snowstorms in July actually do happen, especially up north! So maybe this situation isn’t as far-fetched as you’re thinkin’. If you’ve got $12 in the game, then you’re in, and when things take off, you’ll be smilin’ like a Mountie at the finish line, trust me on that.

The Donut’s Still On Me

Look, I get that you're cautious, and that’s fine, we’re all just havin’ a friendly chat over a coffee here. But keep this convo goin’, and when you see things start to turn around, that Tim Hortons donut is still on me, eh! And if we do see that squeeze, you’ll have more than enough loonies to buy the whole shop... unless you're short and in that case you can domicile under a bridge, eh?

So let’s keep those sticks on the ice and keep watchin’. Things are gonna heat up soon enough!

Krombacher

SSC, once again, you're twisting facts and intentionally avoiding the core issues. Let’s address your points systematically:

1. Gag Order: You consistently downplay the importance of the gag order, but it is a documented and critical part of ERHC’s legal landscape. I’ve never claimed to have seen the exact wording, but its presence is clearly mentioned in numerous court documents, including those from the Harris County Court and the London Court of Arbitration. The gag order is referenced multiple times, and it was upheld by the Harris County judge, which indicates its significant legal weight.

You mock the idea that the gag order had any impact on ERHC’s ability to release information, but the very fact that ERHC carefully avoided mentioning the names of "Kosmos" and "Total" in their 8-Ks (while confirming the finality of the case) strongly suggests that the gag order is still in effect and restricts specific disclosures. Why else would ERHC continue to be so selective in their language if there wasn’t a legal restriction? Your dismissal of this point is naive and shows you’ve overlooked these details.

2. Convertible Debt: You keep pointing to old filings, yet you refuse to consider that not all convertible debt was necessarily publicized, especially when legal constraints (like the gag order) may have prevented ERHC from making full disclosures. I never said the existing filings show 90% ownership. What I said was, "While this may not have been the exact scenario for the reported convertible debt, it’s certainly possible that additional convertible debt could have been issued under gag, which may have allowed for further conversions at such favorable rates." But instead of acknowledging this as a possible scenario, you fixate on outdated filings and create a false narrative.

3. Control Deficiency vs. Administrative Error: The SEC’s decision to dismiss ERHC’s case was based on a control deficiency related to the separation of enforcement and adjudicatory functions, not the mere administrative error you keep pushing. You can’t just lump ERHC together with the 30 or so other companies whose cases were dismissed for the same reason. ERHC had a very specific set of circumstances, including ongoing legal battles, gag orders, and negotiations with major oil companies, making it entirely plausible that these factors complicated the SEC’s ability to pursue the case as they would with simpler companies. The control deficiency was likely exacerbated by the gag order and other legal entanglements.

If it were a simple, cut-and-dry case, like you claim, ERHC would’ve been revoked along with others like IDriven. But it wasn’t. That should tell you there’s more to the story, and the gag order is a plausible reason for why ERHC’s case was more complicated. You can mock all you want, but you're sidestepping critical details.

4. The 8-Ks Issued Under Gag: Despite the gag order, ERHC did manage to issue a few 8-Ks, which shows they aren’t completely restricted from providing updates. However, the fact that they were so cautious about not mentioning Kosmos or Total—even when discussing finality in their legal battles—speaks volumes. This is a classic sign of legal constraints, where selective information can be shared, but specific details (like names of involved parties) cannot be disclosed. So, yes, the gag order is "gagging" selective information, not total communication. If you’re genuinely interested in understanding the situation, you’d acknowledge that legal orders like this often allow partial disclosure in controlled circumstances, which is exactly what happened here.

5. My Conversation with the CEO: Let’s clear this up for the last time: my conversation with the CEO was over text, not a phone call, and the only topic discussed was the death of our mutual friend Sunny Oputa. The erroneous statement about Offor being chairman was brought up by Sunny, and we both mourned his passing together. That’s it. I’m not sure why you’re trying to turn this into something more nefarious. You’re reaching here, and it's honestly distasteful. Sometimes people communicate to mourn the death of a friend, and that’s exactly what happened. Trying to make this seem like insider dealings is not only a stretch but also just plain disrespectful.

6. Double Jeopardy: Since the case against ERHC was dismissed, this implies double jeopardy applies. The SEC cannot pursue further penalties against ERHC for the same reason, which means the company is free to make its own strategic choices, including choosing not to report, without fear of retribution. This allows ERHC to focus its resources on building shareholder value rather than wasting time and money on pointless filings. And again, legal agreements and confidential restrictions (potentially gag-related) could easily explain why ERHC chooses not to file. The fact that you ignore these possibilities only shows your bias.

7. Caveat Emptor and Your Social Justice Mission: It's quite interesting that you’re doing all this work, digging through SEC filings for a stock that doesn’t even trade in America anymore and is on the Caveat Emptor list. While I can appreciate your diligence, it seems like a lot of effort for a stock that you claim to believe is “doomed.” ERHC remains alive, issuing 8-Ks and still in business, even if its situation isn’t ideal. Yet you seem to think that spending your time tearing down a company with limited trading activity is a noble pursuit.

---

In conclusion, SSC, you continue to misconstrue facts, ignore legal realities, and dismiss critical details regarding the gag order, convertible debt, and ERHC’s dismissal. You can laugh all you want, but the facts speak for themselves, and the complexities surrounding ERHC’s legal situation cannot be boiled down to your oversimplified narrative.

Krombacher

You are missing the point that nobody believes your made up bullshit.

Sorry bud....but you can't talk your way into this. No one is buying it except for a few hugely underwater gamblers that probably buy any get rich story. And a snowstorm in July always fizzles like a fart in the wind...as will your short squeeze fantasy...and your valuations. Same as all the valuation predictions in the JDZ prior finding zilch for oil. It's always a crap shoot and even big oil estimates are only models that often fail.

What the hell, if ERHC's sp goes ballistic I will be glad to share the profits. I'm rootin for your valuations. But what are the odds? 'bout the same as a snowstorm in July I'd say. But I did put down my $12 for the dance.

Badog

Uh, yeah, the control deficiency that resulted in the SEC dropping revocatin actions against close to 30 companies out of its own descretion was all cause by the all powerful gag order. lmao.

Seems like dickran's entire delusional, deceitful world revolves around a gag order issued years ago, the contents of which dickran has never seen. Predictably, whenever trapped like a rat by his/her own deceit, dickran plays the worn out, ridiculousl gag order card. Add to that the fact that we don't know if that gag order is still in effect. It would also have to be a gag order that prohibits a public company from issuing financials, releasing material information about partnerships and deals, or providing updates to shareholders, has caused erhe stock to remain near zero for 6 years, and doomed it to the Caveat Emptor list BUT, incredibly it does allow erhc to issue 8-K's and permits its CEO to have private phone conversations to discuss things like share structure and chairman of the board with guerguerian dickran. In short, dickran is full of it every time he uses this old gag order from a legal matter that has been "ended with finality" quite some time ago.

Regarding this new bag of lies about Offor acquiring 1/2 or as much as 90% or more of erhe shares from the company (now twisted and squirmed into a new explanation: via undisclosed convertible debt conversion), again let's look at the facts even as dickran attempts to lie about them. From erhc filings:

On February 17, 2015, the Company entered into a convertible debt agreement with Chrome Oil Services, Limited, majority shareholder, for a principal amount of $250,000 ... On February 19, 2015, the debt was converted into 928,254 shares of common stock and the Company recognized resolution of derivative liability of $432,646 in APIC conversion.

Let me clarify a few things regarding the share structure and the convertible debt situation. First, ERHC’s authorized shares are capped at 3 billion, and any increase to this limit would require a formal change to the company’s articles of incorporation and bylaws, which we have not seen. What ERHC has done in the past when approaching its authorized share limit is to execute a reverse split. This increases the share price while proportionally reducing the number of outstanding shares, creating room to issue more shares through convertible debt while remaining within the authorized 3 billion cap.

Now, regarding Offor potentially gaining 90% of the shares outstanding: It's conceivable that he did so through convertible debt conversions. For example, if he bought $250k of convertible debt with a covenant allowing conversion at 50% of the market price when the stock was trading at $0.0002, he would convert at $0.0001, receiving 2.5 billion shares. While this may not have been the exact scenario for the reported convertible debt, it’s certainly possible that additional convertible debt could have been issued under gag, which may have allowed for further conversions at such favorable rates.

However, no new reverse split has been reported. If shareholders like my group own 55% of the shares outstanding, then every share beyond the 3 billion authorized shares would have to be accounted for. Since no reverse split has occurred, any shares beyond the authorized 3 billion must be naked shorted shares. This aligns with my point that substantial short interest exists due to the mathematical impossibility of issuing more shares beyond the authorized limit without a reverse split or other corporate action.

In short, the situation points to the existence of naked shorting, as the number of shares being traded exceeds what should be legally possible (if Offor really did convert that many shares) based on the authorized and outstanding shares. So, rather than dismissing the reports or assuming everything is ‘totally different by now,’ the numbers strongly suggest substantial naked short positions.

Krombacher

Alright, Badog, grab yer toque and settle in, ‘cause we’re gonna get this sorted out like true buddies, eh! And if you follow along, maybe we’ll even grab a box of Timbits after. Let’s hit the rink, buddy!

1. Block 4 – She Ain’t Gone, Bud

Now listen here, hoser. Block 4 isn’t just some puff of smoke in the wind, eh? ANP-STP’s got 15%, sure, but ERHC still has their option to grab up to 15% of any EEZ block. Now that could be Block 4, or we could be lookin’ at a little behind-the-scenes deal with Shell. Remember, ERHC had 100% of Block 4 before Shell swooped in for their 85% cut. But here’s the kicker, bud—Shell hasn’t announced it on their website yet. You know what that means, right?

They’re prob’ly waiting for a big ol’ joint announcement with ERHC—and trust me, when Shell’s involved, they don’t go small, eh. It’s gonna be like winning gold at the Winter Olympics—there’s gonna be fanfare and confetti! So don’t be too quick on the ol’ trigger there, bucko. Big things are brewin’.

2. Valuations – Not Just Some Poutine-Fueled Guesswork

Now, ya say ya don’t care what Oranto or Kosmos value their JDZ or EEZ assets at, but lemme tell ya, bud—they’re not just sittin’ around with a hockey stick and a dartboard guessin’ this stuff. These estimates come from data, and not just any data, eh—this is seismic and drilling info collected by Sinopec. Sure, Sinopec ain’t exactly Wayne Gretzky in deepwater drilling, but they collected the data for those who are pros.

Companies like Oranto and Kosmos have had a look at that data from their fancy data rooms, and they're puttin’ their money where their poutine-filled mouths are. They're valuing Block 4 at around 17-20 cents per share and JDZ at 80 cents per share. That's like hearing Don Cherry himself say it’s gonna be a great game—it means something, eh!

3. Shorts – Time to Pay the Piper, Bud

Now let’s talk about suppression and why that share price is sittin’ so low, buddy. We got no financials ‘cause of that gag order, and the SEC stopped the revocation ‘cause they didn’t address the gag order right—control deficiency, buddy! You can’t just ignore that, eh.

Now, when all that gets cleared up, those T+3 margin calls are gonna hit those shorts harder than a slapshot from the blue line! You betcha the backstop’s there, whether or not the squeeze happens, so we’ve got ourselves a safety net, pal. The shorts? They’re gonna be wishin’ they stayed home in their igloos.

4. What’s ERHC Really Worth, Eh?

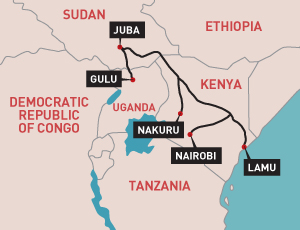

Now you’re askin’ what ERHC’s real value is without all this suppression? Lemme lay it out for ya like a perfectly folded Maple Leaf flag. Oranto pegs JDZ at 80 cents per share, Kosmos and Oranto put Block 4 in the EEZ around 17 to 20 cents per share. Add in Block 4’s source oil (the good stuff, eh), possible mergers with Chrome or Starcrest, and don’t forget ol’ Peter Ntephe flexin’ his muscles in Uganda—he’s got things movin’, buddy.

You add all that up, and we’re lookin’ at a fair value of over $1 per share—and that’s before we even talk about a potential short squeeze or backstop scenario. Those shorts’ll be feelin’ it worse than a snowstorm in July, eh.

Tim Hortons Reward

Now, if ya finally get what I’m puttin’ down here, and we can stop goin’ round in circles like we’re at a curling bonspiel, there’s a Tim Hortons donut in it for ya. And if you still got questions after that? Well, looks like I’ll be orderin’ a double-double ‘cause it’ll be a long chat, eh!

So keep yer stick on the ice and don’t get lost in the zamboni fumes, buddy.

Krombacher

SSC, you’re still missing the point, and your insults don’t make your argument any stronger.

The control deficiency you mention regarding the separation of enforcement and adjudicatory functions is clearly the reason given for the dismissal of multiple cases, including ERHC’s. I never disputed that. But you keep glossing over the fact that ERHC's case is unique due to the gag order that was in place. This gag order, by its nature, could have complicated ERHC's compliance and reporting requirements, which differentiates it from the other companies whose cases were dismissed.

Nowhere did I state that the SEC directly linked the dismissal to the gag order. What I said, and stand by, is that the gag order is a reasonable factor that could have complicated ERHC’s situation, leading to a dismissal because the entire scenario was not as straightforward as with other companies.

Instead of continuing to label this as deceit or a lie, try acknowledging the actual context here. A gag order is a significant legal constraint that could easily have contributed to the control deficiency cited by the SEC. The fact that you’re refusing to even consider this possibility shows more about your unwillingness to have a nuanced conversation than it does about the accuracy of my statements.

If you want to keep throwing out accusations without acknowledging the complexities of the situation, then we’re just going in circles. But the bottom line is this: The dismissal of ERHC’s case had more going on than a simple administrative error, and pretending otherwise doesn’t make your argument any more valid.

Krombacher

Again he bails out and refuses to answer the question. Show just how dishonest he is.

When I mentioned all the shares required to be able to convert debt into shares you brushed it off, inferring that most everyone who bought debt was out of luck due to timing. Yet, somehow, Chrome and Offor ended up with the majority of stock because of that minority of debt that they held (according to you).....and somehow you still believe the stock issuance hasn't occurred to make the outstanding stock number way above what was last reported. Why anyone would trust anything that was reported way back when they actually reported hasn't completely changed, I have no idea. If they simply did what they were required to do by the circumstances they did report, then everything has to be totally different by now.

Oh, I just checked and my $12 today would buy 12 million shares. I overpaid for my 60,000 shares. They are only worth a total of .06...that's total value of my investment in ERHC. I'm severely underwater with the rest of you.

Badog

OK....so lets try again.

I don't care what someone values their JDZ assets at. We already saw what value our 3 drilled JDZ assets obtained. And those were thought to be the best. They were going to make us millionaires. So as you can see...until ERHC can prove what they have it is not relevant to potential investors. If I remember correctly Block 1 was supposed to have a river of oil. We saw how that turned out also. So scratch that .80/share.

And Block 4 EEZ. Same as above. Estimates are just that. There is nothing proven. Can ERHC go to a bank and get a loan on what someone estimates the value of some other block. Again, estimates are easy to throw around. So scratch that .17-.18 / share.

So that leaves us at a sp where I could buy 60,000 shares for $12. That's the true known value I see at this point in time. No one knows whether ERHC has even held onto the rights to Block 4. They could be gone. I don't say for a fact they are gone....and you can't say for a fact that they are not. But based on the statement that Shell now has 85% of block 4 makes it questionable.

So again...you claim that you put out facts regarding share price suppression. All I see is speculation...based on other speculation. Not facts. And you continue to refer back to massive shorting yet you admit that you are merely speculating on that also.

You can continue to state as if a fact that... 'ERHC assets are clearly worth more than $1/share'....but

IMHO they are not. Not here...not now. Not in the real world. Only in your fantasy world of crazy speculation. You can value anything you want at any price you want but .000001 is the current sp. And that is a fact!

Badog

When cornered like a rat, dickran just lies and lies. Latest whopper:

The control deficiency suggests that there were specific circumstances complicating ERHC’s case, which likely involve the ongoing gag order.

The review team’s investigation thus uncovered no evidence that the control deficiency resulted in harm to any respondent or affected the commission’s adjudication in any proceeding.3 We have nevertheless determined to dismiss, as a matter of discretion, all pending

proceedings that the review team found to be connected to the control deficiency, as to which the Commission is seeking relief, and in which there is no final order against a respondent

SSC, you’re misinterpreting both the documentation and my statement.

First, let me clarify: the SEC's documentation does not use the term "administrative error"—as you claim—but refers to a "control deficiency." That’s an important distinction. You might want to reread the actual filing because you’re conflating terms that don’t exist in the official language.

Now, to the main point. The fact that ERHC wasn’t revoked, like other companies such as iDriven is precisely the key indicator that there was something unique about ERHC’s situation. This isn’t a "blatant lie" as you claim—it’s an observation based on the outcome. The control deficiency suggests that there were specific circumstances complicating ERHC’s case, which likely involve the ongoing gag order. Given that gag orders can significantly impact transparency and reporting, it’s entirely reasonable to believe it played a part in the dismissal.

If ERHC were under the same conditions as the other companies, they would have faced the same fate—revocation. The fact that they didn’t strongly suggests that this gag order was, in fact, a complicating factor that led to the control deficiency and the eventual dismissal of the case.

So, instead of jumping to conclusions and accusing others of lying, it would be more productive if you took the time to analyze the context and the actual documentation.

Krombacher

Flat out blatant lie. You just can't control that urge. This is as false as it gets:

The case was dismissed due to a control deficiency because the SEC Division failed to address the gag order as they were required to.

Alright, Badog, let’s keep this as smooth as a Zamboni on fresh ice, eh?

First off, about the SEC:

Just to clarify once more: the SEC didn’t revoke ERHC’s shares. The case was dismissed due to a control deficiency because the SEC Division failed to address the gag order as they were required to. That’s what locked in the shorts, plain and simple. If the SEC had acted on that, we wouldn’t even be having this conversation.

Now, about the share price:

The current price? Not even close to reflecting reality. Let’s break it down, eh?

Oranto values its JDZ assets at the equivalent of 80 cents a share, and ERHC’s JDZ assets are directly comparable to Oranto’s. That’s already 80 cents right there.

Then, you have Block 4 in the EEZ, valued at 17 cents per share by Kosmos, and Oranto values adjacent Block 3 at 20 cents per share. So, for Block 4, we’re looking at a 17-20 cents valuation minimum.

With just JDZ and EEZ Block 4, you’ve got a fair valuation of around $1 per share.

And that doesn’t even consider a merger with Chrome or Starcrest, or any new African assets that ERHC might’ve picked up (which seems likely based on that Ugandan minister interview).

Toss in a short squeeze and the backstop?

When T+3 rolls around, the shorts’ brokers start liquidating to cover, and the price will skyrocket. This is why T+3 is critical—margin calls hit, and the squeeze can drive prices way higher than $1 a share. The backstop ensures that if nothing happens, longs still win, so shareholders don’t have to worry.

On price suppression:

Without shorts manipulating the stock and the gag order in place, the price would undoubtedly be much higher. We’re talking over $1, and that’s without even factoring in a short squeeze.

In conclusion:

The SEC case was dropped, ERHC’s assets are clearly worth more than $1 a share, and a short squeeze could push that even higher. And if you finally get this without having to repeat the same questions, a Tim Hortons donut is on me as a reward!

Cheers, bud!

Krombacher

Ssc,

You can start your research with this link:

https://www.erhc.com/news/erhc-energy-issues-convertible-note-to-the-chrome-group/

SSC, it seems you’re still struggling with what constitutes fact versus speculation. Let me address your questions and claims one by one, since you seem to continuously overlook key information while fixating on trying to discredit my statements.

1. Offor’s Convertible Debt: We’ve discussed Offor's convertible debt before, and if you don’t remember or can’t find it, feel free to spend some time in the SEC filings and look for it yourself. I’m not your employee, and I’m certainly not hired to do your research for you. ERHC didn’t have the funds to allow Offor’s debt to mature, which is why his convertible debt was converted into shares. While we don’t have direct knowledge that Offor bought shares during the gag order—because of the gag order itself—it’s reasonable to think he did. As one of the architects of the EEZ and JDZ and the founder of ERHC, it would be absurd to assume he would allow his shares to be diluted to oblivion without doing anything about it. His convertible debt conversion certainly means he was partially made whole by receiving shares.

2. Share Dilution and Reverse Split: Yes, the 1:100 reverse split affected shareholders, but Chrome’s position is not something to be brushed off as "decimated." If you understood convertible debt, you'd know that it often protects certain shareholders during such events. Chrome owned shares both pre-split and post-split, and the level of ownership post-split remains significant. You are too quick to assume that a reverse split means their stake became insignificant—quite the contrary.

3. T+3 and Short Squeeze: Regarding the short squeeze and margin calls, you’re right that no one except the short sellers knows the exact average margin price for their positions. However, in the case of a buyout or dividend event, the buyout price or dividend amount will most likely be above the margin call price, meaning it will trigger margin calls and force the covering of short positions. In that scenario, there won't be as much guesswork involved—short sellers will have no choice but to cover, which could lead to significant price movement.

4. The Alleged Absence of Short Shares: It’s interesting how you remain adamant that no short positions exist, despite clear evidence that manipulation tactics, including short-selling, are a tool used to suppress penny stocks like ERHC. The absence of formal reporting of these shorts doesn't equate to their non-existence. A tactic that is common in smaller markets is to use Canadian brokers to hide such positions, something you seem conveniently unaware of.

5. William of Occam: Since you brought up Occam’s Razor, let’s use it. The simplest explanation here is that ERHC’s assets are undervalued due to a long period of stock suppression, driven in part by convertible debt dilution and short-selling tactics. Offor and his entities—ERHC, Chrome, and Starcrest—are all strategically aligned, with Offor consolidating assets and potentially preparing for an exit through a merger or buyout with a major oil player. These are facts grounded in filings, corporate behavior, and market conditions.

Instead of constantly accusing me of lying or speculating, maybe take a moment to read the filings and understand the nature of convertible debt and corporate strategy. Everything I’ve stated can be backed by publicly available information, but I’m not here to spoon-feed it to you.

Until you’re willing to actually engage with the facts, your arguments are just noise.

Krombacher

Just as I suspected, nothing but another snarky, lightweight reply. Too cowardly to answer 2 simple questions. I'll give you another chance. Your leader dickran, who repeatedly claims Offor owns more than half and as many as 90% or more of the erhe shares, just made this statement:

Offor's shares didn’t come from the open market; they were part of a legitimate financial arrangement between him and the company.

"just lookin out for everyone else's welfare" - that's not such a bad thing to do. Maybe you should give it a try instead of your snarky, lightweight remarks.

Or how about an objective look for a change? Your leader dickran, who repeatedly claims Offor owns more than half and as many as 90% or more of the erhe shares, just made this statement:

Offor's shares didn’t come from the open market; they were part of a legitimate financial arrangement between him and the company.

Can you provide a link that shows Offor's convertible debt transactions? That would make it easy to see how many shares he actually purchased. It would also prove if your allegations that Offor defied SEC reporting regulations are true or just more "speculation". I'm willing to bet it won't show 3 billion shares or even 1.5 billion as you have so often spewed out as fact. You say this is a "documented fact", so let's see that link showing when and how Offor acquired 50% or as many as 90% or more of erhe shares directly from the company. Or start squirming again lmao.

Regarding Chrome, weren't those shares decimated by the 1:100 reverse split like every other shareholder's? How many do they actually own after that massacre?

Please provide links to these things you say are documented facts, or are you lying, or "speculating" lmao yet again?

If you want to have a productive discussion, stick to the facts instead of twisting my words to suit your narrative.

WHY do you continue to beat the short seller drum when this issue has been subzero for 6 years? Plus I notice you never answer that question.

More made up bullshit.

Please dont say to stick to the facts when you yourself dont present verifiable facts.

Fact is your bullshit is devoid of facts. Nothing you have ever predicted has come to fruition even though you claimed it to be fact also.

This is quite literally the BIGGEST windbag statement I have ever seen on this site. You're clearly desperate for people to buy shares of this worthless scam. What's wrong? Your boss pressing on your balls to meet your quota this month?

You may deny being involved in shorting, but that doesn’t change the fact that there are clear efforts to suppress ERHC’s stock price

The fact remains that there are forces working to depress ERHC’s stock price, and short sellers are a likely part of that equation.

To clarify after those long and winding posts of yours, I state for the record I have never been short, directly or indirectly, any erhe shares in Canada or anywhere else in the world.

Now back to your latest dung pile. Can you provide a link that shows Offor's convertible debt transactions? That would make it easy to see how many shares he actually purchased. It would also prove if your allegations that Offor defied SEC reporting regulations are true or just more "speculation". I'm willing to bet it won't show 3 billion shares or even 1.5 billion as you have so often spewed out as fact. You say this is a "documented fact", so let's see that link showing when and how Offor acquired 50% or as many as 90% or more of erhe shares directly from the company. Or start squirming again lmao.

Regarding Chrome, weren't those shares decimated by the 1:100 reverse split like every other shareholder's? How many do they actually own after that massacre?

Please provide links to these things you say are documented facts, or are you lying, or "speculating" lmao yet again?

Regarding your t+3, backstop smokescreen, remember when you told everyone the epic short squeeze was going to happen t+3 after erhe shares closed above .0005? Then it was .001, now it seems to be what, $1? Call it speculating, I call it purposeful deception, to put it nicely, followed by dickran squirming and you do it day in and day out for a decade or more. And yes, you have never been right, mba, cpa, cfa and 5 D's not withstanding. You seem to be a fan of Occam's razor - what would William have said if he observed your search for years for more than a billion shorted erhe shares and couldn't find 1? Hint, he would have added eggplant in chief to your resume after year 1, probably after month 1.

Alright, Badog, let me break it down for ya in the nicest, most polite way, eh?

So, here's the thing about this T+3 business. You might think there's some trickery goin' on, but let me tell ya, there's no need to worry, buddy. The backstop, ya see, is like a safety net—it's a guarantee. Whether or not a big ol' short squeeze happens on T+3, shareholders still get the backstop price. So even if no fireworks happen on that day, everyone’s still covered, eh? Like a warm toque in a winter storm, ya know?

Now, T+3 is only a big deal if there are short sellers out there. That’s when margin calls happen, and they get squeezed like a tube of toothpaste, forced to buy shares at whatever price they can get. But even if there are no short sellers, nobody’s left out in the cold, ‘cause the backstop still kicks in. So, no harm, no foul, eh?

And about watchin' the volume—sure, it’s always good to keep an eye on things, but nobody’s trickin’ folks into waitin' while someone dumps shares. The backstop guarantees a minimum price, so no matter what, shareholders aren't gettin' hosed, eh?

So in summary, here’s the scoop:

1. The backstop guarantees a minimum price, even if there’s no short squeeze.

2. T+3 is just a chance to score even higher gains if there are shorts, but it’s not the only thing protecting folks.

3. Shareholders aren’t being tricked into waitin’—they’re just playin’ it smart, eh, and no matter what, they’ve got that guaranteed backstop to fall back on. So everyone's safe, like a hockey game that ends in a handshake.

Hope that clears it up, buddy!

Krombacher

SSC, once again, you’re twisting my words and creating scenarios to suit your narrative. You consistently misrepresent what I’ve said, and now you’re trying to put entire paragraphs in my mouth. Let’s break this down clearly:

1. Your claim that my ERHC speculation has always been wrong: Speculation is exactly that—an educated guess based on available data. Speculation does not equate to falsehood, nor does it guarantee a certain outcome. ERHC’s oil exploration is a long-term process. I’ve always been transparent in noting when something is speculative. The dynamics of the oil market and ERHC’s assets make my views reasonable. You labeling them as “wrong” doesn’t make it so—especially as events are still unfolding.

2. Short positions and Canadian connection: You seem defensive when the topic of shorting comes up. Short-selling of OTC stocks is allowed in Canada, which is why I’ve speculated about your possible Canadian connection. You may deny being involved in shorting, but that doesn’t change the fact that there are clear efforts to suppress ERHC’s stock price, and short selling is a common tactic in such situations. Your defensiveness doesn’t negate these realities.

3. Ownership and involvement of Offor: You continually dismiss my claims about Offor's involvement, but the fact remains that Offor has owned ERHC shares through convertible debt, and that debt was converted into shares issued directly from the company. This is all documented in ERHC’s filings, making it a fact, not speculation. Furthermore, Offor also owns shares of ERHC through Chrome Energy, and the press release confirming the MOU deal between ERHC and Starcrest is public information, not speculation.

4. Potential merger and Offor's exit strategy: The possibility of a merger between ERHC and Starcrest, and potentially with Chrome, is grounded in the fact that these are all Offor-owned companies. If Offor is willing to merge Starcrest with ERHC, per the MOU, it’s reasonable to speculate that Chrome could also be part of an exit strategy for Offor, allowing him to consolidate his assets for a potential sale to a major player like Shell or Total. Offor is a 65-year-old billionaire who may very well be looking to transition into philanthropy, and such a merger would make strategic sense for him.

5. Starcrest and major oil companies: When it comes to speculation about deals with major oil companies like Total or Shell, it’s based on ERHC’s assets and positioning in regions where these companies operate. Dismissing this as "fantasy" ignores how business works. Companies with valuable assets often attract interest from larger players, and Offor has the track record to position ERHC in such a way. This isn't delusional; it's grounded in reality.

6. ERHC's value: It’s interesting how you avoid discussing the disconnect between ERHC’s stock price and its true potential. With a market cap at 0.0006 per share and around 3 billion shares outstanding, the current valuation doesn't reflect the underlying value of ERHC’s assets. You’ve called Offor’s debt “toxic” in the past, but conveniently ignore that it was Offor himself who bought that convertible debt. This doesn’t align with your narrative, so you choose to brush it aside.

You continuously try to reframe the conversation with personal attacks and misrepresentations, rather than addressing the factual points I’ve raised. The press releases, financial filings, and logical conclusions I’ve drawn are based on actual, documented information, not baseless rumors.

Instead of resorting to ad hominem attacks and twisting words, let’s stick to the facts. Offor’s deep involvement in ERHC is undeniable, and the potential for a merger or buyout with major oil companies remains a legitimate speculation based on his business strategy and asset positioning. The value of ERHC is far greater than its current market cap suggests, and time will prove that these assets hold significant worth.

If you want to have a productive discussion, stick to the facts instead of twisting my words to suit your narrative.

Krombacher

SSC, your insistence on labeling everything you disagree with as a "lie" is a weak attempt to distract from the valid points raised. Let’s clarify a few things for the sake of the truth:

First, your attempt to debunk my statement about Offor receiving shares directly from the company is futile. It is a known fact that Offor bought convertible debt from ERHC, which he later converted into shares. Those shares were issued directly by the company—this is how convertible debt works. It’s not some grand mystery or conspiracy. Offor's shares didn’t come from the open market; they were part of a legitimate financial arrangement between him and the company. Whether you choose to acknowledge this fact is up to you, but the truth doesn’t depend on your agreement.

Also, you conveniently mock the idea of "toxic debt" while ignoring the fact that Offor was one of the convertible debt holders, as was clearly shown in ERHC’s financial filings. So when you deride these convertible debt deals as "toxic," you're in fact mocking Offor’s own financial involvement with the company. Once again, your narrative doesn’t hold up when confronted with documented facts.

Regarding the ERHC-Starcrest merger, I am not presenting speculation without basis. The MOU deal for Starcrest was, in fact, press released, and it's public information. This isn’t some wild guess; it’s a matter of record. The market may not have fully absorbed the significance of that MOU, but it’s there for anyone willing to do their research. If you choose to ignore official releases, that’s on you, but don’t accuse me of making things up when the evidence is out in the open.

Furthermore, Offor also owned shares of ERHC through Chrome Energy, another of his ventures. Given the MOU between ERHC and Starcrest, it’s reasonable to speculate that a merger between Offor-owned companies like ERHC and Starcrest is part of a broader strategy. Why? Because if Offor is willing to merge one of his companies with another per the MOU, then it’s entirely grounded speculation that Offor could do the same with Chrome Energy. Such a move would allow Offor, a billionaire who is 65 years old, to create a favorable exit strategy by merging with a major player like Shell or Total. This would be a perfect path for someone of his stature to transition into philanthropy, a common goal for billionaires at that stage of life. This speculation isn’t wild—it’s based on Offor’s business patterns and the logical progression of his ventures.

As for your repetitive insistence that I’m "squirming out" of the Block 4 timeline, I’ve been clear from the beginning that March 2025 is my estimate based on available data, which includes timelines and possible developments. I never stated it as a guarantee, but as speculation rooted in logic. You seem to confuse an estimate with a promise, which only demonstrates your lack of understanding of how business projections work. If drilling is completed earlier or later, it will be due to circumstances beyond anyone's control, not because someone "lied."

Regarding the Caveat Emptor status of ERHC, it’s true that ERHC has only been on that list for a few years—not decades, as you point out. I never claimed the Caveat Emptor status has been around for decades; I referred to your obsession with ERHC, which seems to span decades. Regardless, the Caveat Emptor list today clearly restricts trading to the Expert Market, which should raise serious questions about your interest in continuing to post here with such dedication.

You seem obsessed with denying the existence of short selling, despite the well-known fact that short-selling of OTC stocks is legal in Canada, which is why I suspect you might be Canadian. I’ve pointed this out multiple times, yet you ignore it while insisting there’s "no evidence" of shorting. The lack of transparency around short positions in OTC stocks doesn’t mean shorting isn’t happening—it just means it’s harder to track. Your refusal to address the short-selling dynamics in this context is telling. The fact remains that there are forces working to depress ERHC’s stock price, and short sellers are a likely part of that equation.

As for the ERHC share price, it currently sits at $0.0006 with 3 billion shares outstanding, giving it a market cap that nowhere near reflects the true value of ERHC's assets and potential. The market cap is wildly disconnected from the underlying assets, including valuable rights in oil blocks and other opportunities, which you conveniently ignore in your assessments. This undervaluation is a result of suppressed trading and the current limitations placed on the stock. If you truly believe the company has no value, why do you spend so much energy trying to discredit it?

To conclude: You may continue dismissing facts and labeling them as "lies," but that doesn’t change the reality of the situation. I’ve laid out logical explanations for why I believe what I believe, and I stand by those points. If you can’t provide better evidence or reasoning for your counter-claims, then your accusations of "falsehoods" will continue to fall flat.

Krombacher

LOL LOL

May be you can explain WHY any short seller would hold a short position when this issue went SUB-ZERO over 5-6 years ago before it became untradeable ????

I will hang up and listen. Im sure your answer will be very illuminating.

OK chum... we shall see

The word is Moot. There is a reason your stuck.

Once again, there is nothing in any known documentation that says that signing an operator will extend ERHC's rights in the blocks. Now, being a party to a PSC probably would but ERHC is only a party to the JDZ Block 2 PSC, if that PSC is still in force. And ERHC can easily still be a company that can attend conferences without holding any assets, especially since PNs involvement at the conference does not entail him discussing ERHC or its assets or lack thereof.

Sadly, your bet about not seeing an 8-K is probably well placed. But not for the reasons you state.

.

Regarding drilling in Block 4 by March 2025, the available information is a PSC that gives Shell four years to complete an Environmental Impact Assessment and, basically, do nothing else if they so choose. And then another two years to drill an exploration well.

If I've learned anything from this investment, it's that nothing happens quickly in the oil patch and, unless a company has something they know is worth going after (e.g. a Namibia), they tend to take all the time they have available to accomplish the required work.

Of course I would be thrilled with drilling by March 2025, as long as ERHC is involved. I'm just very doubtful that it will happen.

.

Of course you meant "moot", although regarding any material information or financial disclosure required by SEC law, erhc management has been "mute" for 7 years. Whatever your lightweight remark was supposed to mean, some type of communication from erhc management regarding rights now that 9/30 has come and gone or any type of deal they may have made is required by law. The fact that management continues to shirk its fiduciary responsibilities is just one more reason why erhe investors, stuck with shares near zero for 6 years, are not likely to share in any new found riches that might or may have already come erhc's way.

To dickran and his minions, please not the gag order again lmao.

ERHE is required by law, to report any material fact asap. Strategy that doesn't include this makes them liable to shareholders, which would negate any benefit withholding info may allow. Offor owning anywhere near the shares you claim would falsify his last reporting which would make both him and the company acting illegally, which, since you bothered to file, seems like you would not be claiming is a good thing. ERHE still retaining any assets in the JDZ or EEZ is material and required by law to report, since it would go against their last filing about it that the rights are gone.

I happen to find it totally comprehensible and believable that SSC does continue here to combat lies and disinformation. Makes a lot of sense to me. That it doesn't to you, I believe, speaks more to your value system than his.

OR they have a deal and expiration of rights is Mute

The company has probably not addressed the short-selling issue because it’s been focused on securing deals across Africa and dealing with the merger between Starcrest and ERHC.

The company has limited resources and staff, and addressing short sellers is simply not the priority.

The outstanding thing about your endless stream of bullish erhe "speculation" that spans many, many years is that it has been wrong every time. I see you haven't taken my advice on this, but I suggest again that if you actually want to stop being known as a liar, consider issuing the following statement:

In an effort to untarnish by reputation and credibility I, guerguerian dickran, admit that I knew there was no cease and desist order or letter to ssc and no libel suit on the Harris County website but I posted those lies anyway.

I have no proof of any erhe short positions, no proof ssc is from Canada, no proof ssc is or ever was short erhe shares or any other stocks which I all falsely claimed again and again for years and years.

I do not know how many erhe shares Offor or erhc management own. I admit I falsely stated that Offor is erhc's chairman. I have no knowledge that erhc will ever issue a dividend to common stock shareholders.

All my statements regarding any type of deals with Total, Shell, or anyone else are pure speculation. Same for all the claims I have made about an erhe short squeeze, merger with Starcrest, drilling in EEZ block 4, erhc efforts in Uganda and Kenya, and any erhc buyout or merger.

To sum it up, I own close to 400 million erhe shares and, due to the total absence of erhc compliance with SEC disclosure regulations, am totally in the dark with all matters regarding this company. For years I have been making bullish speculations, saying and doing anything I could dream up, hoping at least something might come true and I will be able to exit my erhc position without a huge loss. I apologize for my hubris and countless misrepresentations of things "about to happen any day now" with erhc. In the future, as I have started doing recently, I will clearly note when my posts are not based in reality, and I will stop the false claims about erhe shorting. I will reign in my tendencies to make desperate, delusional assertions like the ones that an epic erhe short squeeze would destroy the Canadian financial markets and bring an end to naked short selling all over the world, or that a sketch of a head I drew and created a fake Facebook account for is erhe's largest short seller. Did I really say those things? Yes I did. Again, I apologize.

Something like this, if adhered to by you, will be a great start on the long and difficult journey towards regaining credibility and respect. Simply labeling all your falsehoods as speculation won't cut it, but your "not based in reality" disclaimer is spot on and a good first step. Good luck. I hope someday my motivation will lead you to face and acknowledge the truth.

You don't get it. I understand what your are pushing here. But what happens when T+3 comes around and it becomes apparent that there were no shorts...therefore no short squeeze? Everyone better keep an eye on the volume of shares being traded prior to T+3 or they could find out that they were tricked into waiting while someone with hundreds of millions of shares was dumping. Does that clear it up for you?

Oh...and this T+3 crap only happens if ERHC announces something positive to create an increase in the sp....and there are actually massive shorts. Highly unlikely IMHO.

Badog

I realize guerguerian dickran lives by the pledge "It's not a lie if you say you believe it", but I am confident most honest people would disagree with that. Here we see another stream of falsehood based sewage from a known liar, mostly re-re-regurgitated bullshit. I will debunk a few of the most egregious claims:

As I predicted, dickran is already squirming out of the drilling completed in block 4 by March 2025. No surprise there.

We all know your greed and hubris won't allow you to accept the concept that some one is motivated to do something just because it is good and just. For the record, I have debunked lies from unscrupulous traders on many different ihub boards over the years. Another pesky fact: erhe has only been on the Caveat Emptor list a few years, not decades and decades.

When someone claims there are over a billion shorted erhe shares but can't find proof of any of them, that is the definition of a baseless claim.

Again the gag order silencing a public company for 7 years? That's not speculation, it is a lie. Now a new "revelation" by liar in chief - "Offor, whose shares likely come directly from the company". Can you explain exactly how that worked, especially since you claim Offor owns half or as much as 90% or more of the erhe shares, and not a word about this ever reported or even mentioned by erhc management?

Again you present a merger between erhc and Starcrest as fact, not speculation. Where is any actual proof to validate your assertion?

Finally you put the cherry on top of your newest pile of baseless claims, false rumors and outright lies by saying about me: "You consistently refuse to address the short-selling issue or your involvement". As blatant as a lie can be since I openly, repeatedly state I have never shorted erhe shares, there is no evidence any short positions exist, and your entire made up, sketched headed short story was created in a failed attempt to justify you and your group's ownership of close to 2 billion shares. I state with impunity that guerguerian dickran is lying when he falsely repeats that ssc has been served with cease and desist orders or letters and that ssc is short erhe shares directly or indirectly, in Canada or anywhere else in the world.

|

Followers

|

745

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

363158

|

|

Created

|

08/07/03

|

Type

|

Free

|

| Moderators ssc Homebrew BearRickPunch | |||

ERHC's common stock is traded on the OTC Grey Sheets (No Bid/Ask) under the symbol "ERHE."

ERHC Energy Inc. is a Houston-based independent oil and gas company focused on exploration of its working interests in the Gulf of Guinea, off the coast of central West Africa. We are proud of our heritage of visionary leadership that was responsible for ERHC being among the first to identify the possibility of significant oil reserves in what was once an undeveloped oil region of the world. We continue to build upon that heritage by continuing to be willing to take chances and having the commitment to do the hard work necessary to realize the value of our assets.

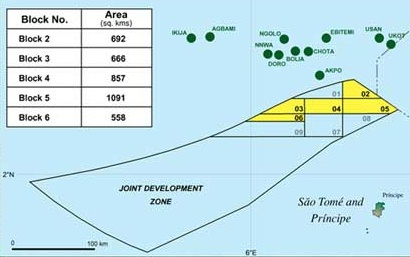

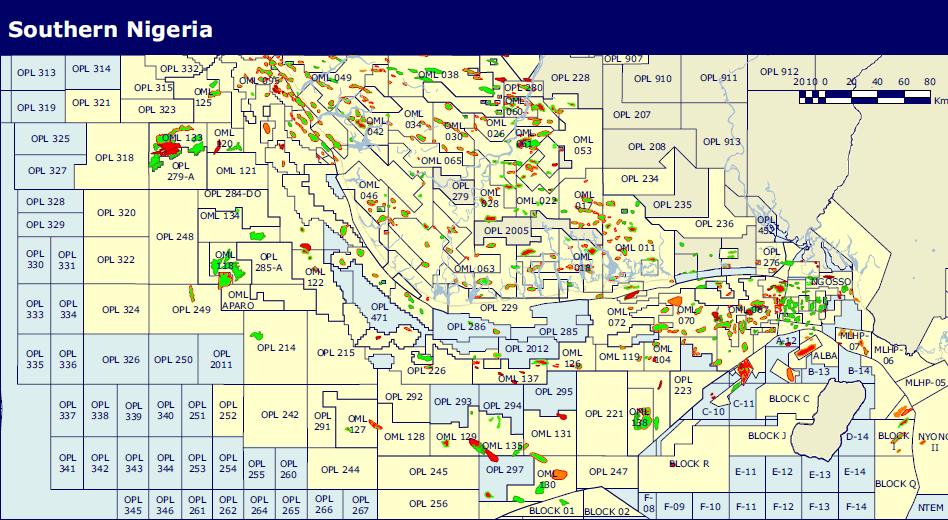

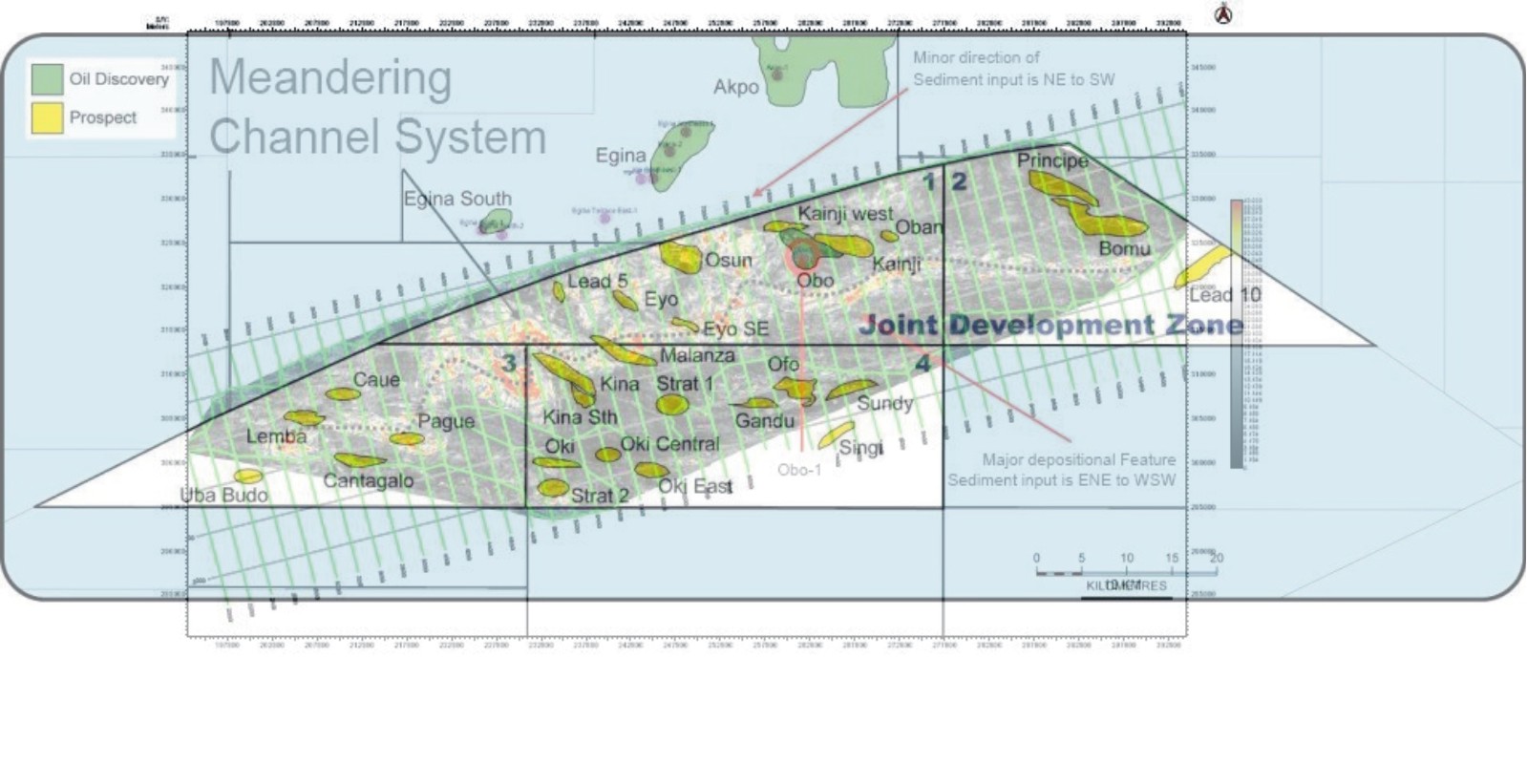

Today, ERHC has interests in Blocks 2, 3, 4, 5, 6, and 9 in the offshore Joint Development Zone (JDZ) of Nigeria and the island nation of Sao Tome and Principe. The National Petroleum Agency of São Tomé & Príncipe (ANP-STP) on behalf of the Government of São Tomé and Principe has awarded ERHC Energy 100 percent working interests in Blocks 4 and 11 of the São Tomé & Príncipe Exclusive Economic Zone (EEZ). In addition to the two Blocks already awarded, ERHC has rights to acquire up to a 15 percent paid working interest in two additional blocks of its choice in the EEZ.

The Company has signed participation agreements with subsidiaries of Addax Petroleum Inc. and Sinopec Corp. The operators of JDZ Blocks 2 (Sinopec), 3 (Anadarko) and 4 (Addax) have secured approval from the Joint Development Authority for drilling locations. Additionally, ERHC continues to pursue other potential oil and gas acquisitions, where feasible.

JDZ Block 2: 22.0%

JDZ Block 3: 10.0%

JDZ Block 4: 19.5%

JDZ Block 5: 15.0%

JDZ Block 6: 15.0%

JDZ Block 9: 20.0%

ERHC will be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The São Tomé & Príncipe EEZ encompasses an area of approximately 160,000 square kilometers south and east of the Nigeria/São Tomé & Príncipe Joint Development Zone and surrounding the volcanic islands of Príncipe and São Tomé. Block 4 is situated directly east of the island of Principe. Block 11 is directly east of the island of Sao Tome.

Ocean water depths around the two islands exceed 5,000 feet, depths that have only become feasible for oil production over the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo.

The African coast is less than 400 nautical miles offshore, which means the exclusive economic zones of the concerned countries overlap.

Operations in JDZ Block 2

ERHC's consortium partner Sinopec Corp. is the operator in JDZ Block 2. In August 2009, Sinopec commenced exploratory drilling of the Bomu-1 well, which was completed in early October 2009. The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 2 totaled 77 million barrels of oil and 93.9 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 2 totaled 38.3 million barrels of oil and 47.9 billion cubic feet of natural gas (P50).

Operations in JDZ Block 3

The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 3 totaled 27.3 million barrels of oil and 32.9 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 3 totaled 8.7 million barrels of oil and 10.5 billion cubic feet of natural gas (P50). The operator, Addax Petroleum, began drilling the Lemba-1 well in October 2009 and completed drilling in November 2009.

Operations in JDZ Block 4

ERHC's consortium partner Addax Petroleum is the operator of JDZ Block 4. In August 2009, Addax took possession of the Deepwater Pathfinder deepwater drill ship and started drilling the Kina prospect. The NSAI report estimated ERHC's unrisked prospective resources in JDZ Block 4 totaled 231.6 million barrels of oil and 245 billion cubic feet of natural gas (P50). The NSAI report estimated ERHC risked prospective resources in JDZ Block 4 totaled 88.4 million barrels of oil and 86.2 billion cubic feet of natural gas (P50). In 2009, Addax Petroleum drilled the Kina, Malanza-1 and Oki East wells.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2012 (from 10Q)

| Weighted average number of shares of common shares outstanding | 738,933,854 |

Authorized shares: 950,000,000

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ERHC Energy Milestones

In May 1997, ERHC entered into an exclusive joint venture with São Tomé & Príncipe. ERHC sought that agreement because it identified the possibility of significant reserves offshore of Sao Tome & Principe years before anyone else did and was willing to undertake the hard work necessary to realize the value of these assets.

All of the proceeds from these sales were received by the Company during the quarter ending March 31, 2006.

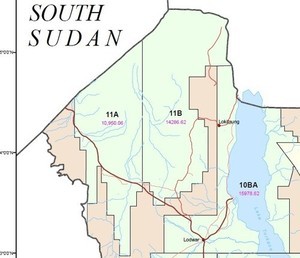

Block 11A encompasses 11,950.06 square kilometers or 2.95 million acres (click on map to enlarge). The Block is situated on Kenya's border with South Sudan to the north, Block 11B and Lake Turkana to the east and near Kenya's border with Uganda to the west.

-Link to the June 2009 Sao Tome and Principe AAPG (American Association of Petroleum Geologists) Conference slide presentation in Denver. It shows EEZ Block delineations and much more: http://www.internationalpavilion.com/ip_2005/Denver09_Talks/Presentation%20Sao%20Tome%20&%20Principe%20AAPGv3%20(2)_files/frame.htm

-The National Petroleum Agency of São Tomé & Príncipe (ANP-STP) on behalf of the Government of São Tomé and Principe has awarded ERHC Energy 100 percent working interests in Blocks 4 and 11 of the São Tomé & Príncipe Exclusive Economic Zone (EEZ). The ANP-STP has indicated that it expects to invite ERHC to negotiate Production Sharing Contracts (PSCs) on the two Blocks in due course. In addition to the two Blocks already awarded, ERHC has rights to acquire up to a 15 percent paid working interest in two additional blocks of its choice in the EEZ. The ANP-STP has informed the Company that selection of these other blocks will take place at a later date to be determined.

-Another great post on the EEZ can be found here: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36450859

-Possible pre-salt oil deposits in the EEZ: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36565661 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36570193 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36596746 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=36450859 http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43260765

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Operators/ partners for Blocks 2,3 and 4

http://www.addaxpetroleum.com/home (Block 4)

http://www.addaxpetroleum.com/home(Block 3)

http://english.sinopec.com/ (Block 2)

Deepwater rigs

http://www.pacificdrilling.com/

http://www.fredolsen-energy.no/?aid=9048927

http://www.seadrill.com/

http://www.deepwater.com/fw/main/default.asp

http://www.saipem.eni.it/index.asp

http://www.deepwater.com/fw/main/Sedco-702-92C77.html?LayoutID=17

http://www.marinetraffic.com/ais/nl/shipdetails.aspx?MMSI=636014746

Deepwater rigs video's and animations

http://www.youtube.com/watch?v=Ii2zOZh41eA

http://www.deepwater.com/fw/main/Discoverer-Clear-Leader-Begins-Operations-410C1.html?LayoutID=6

Presentations

Growth Company Investor Show 2008 in London

http://www.youtube.com/watch?v=sgXCHO-Ot4E part 1

http://www.youtube.com/watch?v=OQm6SwY5ceo part 2

http://www.youtube.com/watch?v=aaam9Tyh4DE Q&A part

ERHC Web TV presentation to RedChip Conference

http://www.modavox.com/events/redchip/0608/room1.html

CEO Peter Ntephe Interview - on RedChip TV

http://www.modavox.com/events/redchip/0608/ceo_interviews.html

DD web sites

Facts about ERHC/ERHE: http://www.erhc.com/en/cms/?60

FAQ about ERHC/ERHE: http://www.erhc.com/en/cms/?56

http://www.anp-stp.gov.st/eng/

http://www.enercominc.com/

Track drillships marinetraffic.com/ais/default.aspx

http://www.erhc.com

http://finance.yahoo.com/q?s=erhe.ob

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000799235

http://www.otcbb.com/asp/Info_Center.asp

http://www.nigeriasaotomejda.com/

http://www.investorshub.com/boards/read_msg.asp?message_id=5721853

http://www.equatorialoil.com/pages/TechReview.html

http://www.nigeria-oil-gas.com/

http://www.sao-tome.com/englisch/index.htm

http://www.eia.doe.gov/emeu/cabs/nigeria.html

www.ods-petrodata.com/odsp/day_rate_index.php

Industry News

http://www.rigzone.com/news/

http://www.oil.com/

http://www.platts.com/

Articles

The New Yorker, 10/07/2002, OUR NEW BEST FRIEND, by JON LEE ANDERSON,post #3510

http://investorshub.advfn.com/boards/read_msg.asp?message_id=6512250

DAILY INDEPENDANT, Tuesday May 24th, 2005, The long wait for JDZ deal POST #3035

http://investorshub.advfn.com/boards/read_msg.asp?message_id=6479732

Area News & Newspapers

http://www.allAfrica.com

http://www.nigeriamasterweb.com/paperfrmes.html

http://www.nigeriamasterweb.com/newsfrmes.html

http://www.independentng.com

http://www.ngrguardiannews.com/

http://www.newswatchngr.com/

http://www.punchng.com

http://www.thisdayonline.com/

http://www.vanguardngr.com/

http://www.jornal.st/index.php

http://www.tekoilandgas.com/technology/glossary-of-terms

AKPO information

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=48439213

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=48446472

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ERHE 8K 4-24-2017

http://archive.fast-edgar.com//20170424/AI22B22CZC228JGU22222Z32GOMFIC22Z292/

https://www.otcmarkets.com/stock/ETBI/overview

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |