Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

DRMX: SEC Suspension:

http://www.sec.gov/litigation/suspensions/2013/34-68835.pdf

ORDER:

http://www.sec.gov/litigation/suspensions/2013/34-68835-o.pdf

ADMIN Proceeding:

http://www.sec.gov/litigation/admin/2013/34-68836.pdf

I bet it is him...message is too detailed and operations specific - if it was just some guy having fun, no way would the message be written that way. As to lawsuit, get real - won't ever be one and its likely he had absolutely nothing to do with the PR that Yosako posted - the only thing the mattered here. The company came out real fast with the PR clarifying the situation (while not clear), it came out while the price was still up - by no means an after thought.

His only fault is not being upfront on the way the transaction was executed and not coming out and stating in black and white that the PR for 72m was fake. That isn't lawsuit material.

As for the hundreds/thousands...thats just hilarious. 150 traders tops were on this and likely only 10 or 20 were foolish enough to still be holding shares that weren't free shares. If they chose to ignore all the warnings I provided, that is their own fault.

Pink sheets = buyer beware, end of story.

First off I doubt it's really the him. Probably someone playing games. Second if it is him what is that lame apology going to do for the hundreds / thousands of investors scammed by this. I dunno I still don't doubt seeing a major lawsuit pop up soon and getting a letter in the mail asking to join. All I know is alot people get scammed , CEO says nothing until after days of pumping this "fake pr" then he says oh it's fake don't listen to it and leaves the company.. Sounds suspicious to me.

He came to this board to address us.. so have to give him some credit.

To be honest, dont think he would come here if he had something to hide.

Do i still dont understand why they didn't just say the PR was false from the get go?? YES

Do i still get a funny feeling in my stomach that something isnt right here? YES

DO i think we ever know the truth 100%?? NO

~~~~

So who is still holding this POS, im stuck with some shares.. hoping for a dead cat bounce

Lol as he leaves a worthless company and scammed investors.. he says sorry. I would not be surprised to see a huge lawsuit against him.

I really was refering to the CEO of a publicly traded company who is responsible to shareholders for correcting misinformation in a timely matter. But thanks for your input. I only lost about 50.00 dollars as I bailed quickly but clearly some here lost alot more. For him to respond with this babbling nonsense to me seems unacceptable.

He didn't address that PR probably the stock wasn't in public attention (well, it did a couple low volume spikes) until I mentioned it at Stockgoodies subforum.

I guess he has more things to do than googling up his name to check if there are any fake PRs.

PD: Who sold 500.000 shares the day before the run? (whover I bought from, that is)

What I would like to know is why you failed to address this false PR immediately?,Who in relationship to the company sold if anybody? And did the O/S change during this time? Simple fact is while you took the real value private it was share holders who kept you afloat while developing this strategy. Now you are no longer interested in being associated with pink sheets? Well I guess that is convinient after all.

What I mean is that even if there is a PR out there or a stock blatantly undervalued, there is a chance that no eyes follow it. Haven't you ever seen a company release news on a stock that doesn't do anything after? Or a stock that pops on no news?

Those aren't the big boards...usually when a stock moves is because some group plays it.

I sold, I think the SEC will suspend DRMX soon.

They got a lot of complaints on this one, I filed one myself.

there was no promotion here, that link was 2009 and it doesn't even say if they were compensated or not. That PR, and that PR alone set the ihub crowd off on it...you are the one that brought it into the arena.

Like I said, count your money and quietly slip into the background is the ticket here.

1600 shares for sale at .05

No one can care about a stock they don't know about. Without promotion, penny stocks can't go anywhere.

the balance sheet is out there but they stopped filing last year - you can see the trend and know that nothing drastic would have happened in the economy or the company last year to suddenly see sales up 50 fold to justify that kind of buyout.

Yes, you are to blame...sure, you had no clue perhaps that was fake, but yeah, it could be said that this stock never would have gone anywhere if you didn't post that. Why? Because no one would have cared about the stock to do any DD on it to discover that PR...no one cared the day before, why would a new day matter? Heck, no one cared for 2 months before you posted.

Yes, you, and your action entirely created the spike. Take your money, be thankful you got lucky in the pennies, and quietly move on...that is what you do in those situations.

Hah, now I am to blame, right? Come on.

I was following this stock before the run because it had low-volume mini pumps a couple months ago. When volume showed up down there it made me wonder what was happening and, doing some DD, I found both PRs and posted about them.

How can you really know if a PR is real or fake if there isn't any balance sheet out there for you to check? One has to rely on whatever info you find out there.

PD: Not to mention, even if the whole $72 million story was something that someone made up, heck it was awesome. ![]()

Not sure if you'll be back to answer questions, but i have one more.

If Euoko was taken private via a transaction, why wouldnt you state that in your PR? All your PR did was state a buyout, and based on your quote, it would lead folks to believe it was bought out by someone else...

A simple "We are taking Euoko private via a transaction" would be good enough.

Instead you put out a PR that leaves tons of Grey Area. And then you complain about speculators, when thats all BUYOUT PRs do... cause speculation.

Either way, GLTU.

and none of this would likely have happened if you didn't post that bogus PR. Yes, you, entirely you, were responsible for the headaches you created the company.

Fact is, you first posted about the company on the 4th - bottom play - it did nothing the whole day on next to no volume because no one was going to touch it and no one cared.

Juice it up pre-market with that unknowingly fake PR on the 5th though, different story!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=61717138&txt2find=drmx

Ihubber does an all-in-one, goes through your messages, sees the PR and realize its pumpable, starts loading and tell his buddies, they load, then they post, it goes viral. That's how penny trading works.

So while its great and all making decent money on a fake PR, coming here to brag about it while there are many bagholders and a CEO now concerned about his ability to run his business because of YOU should at least be a bit humbling.

Times like this, you should just count your money quietly and move on. Just saying.

Brandon,

Appreciate your time coming to this board and trying to give closure to this mess.

As much as you guys want to put all the blame on speculating investors, i honestly dont think thats where all the fingers should be pointed.

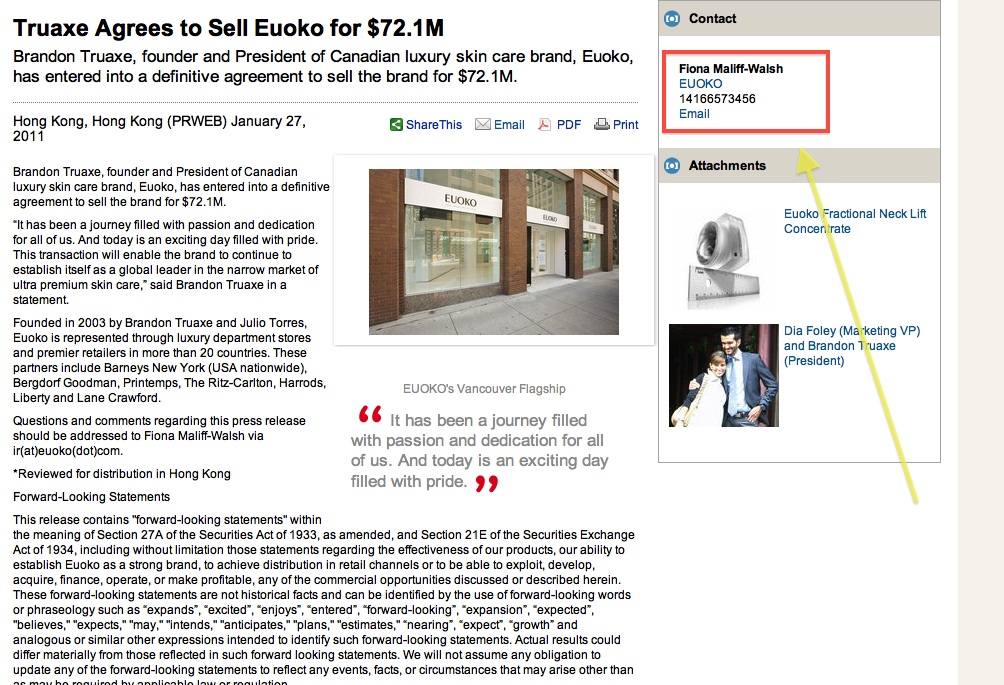

So first, your going to see your company associated with the stock ticker because your company was paying for promotions: http://www.tmcnet.com/usubmit/2009/02/13/3988843.htm

Not sure if the finance guys told you to do that or not, but as CEO, regardless if you authorized it or not, you are responsible for it.

Second, you said a simple search of Euoko resulted in mostly stock information.. Since it sounds like you check your brand via google/bing/yahoo search, woudn't you recognize the $72.1 Mil buyout PR on Jan 27th VIA the PRWEB service? Its the 10th item down on the first page? http://www.google.com/#hl=en&sugexp=ldymls&xhr=t&q=euoko&cp=4&qe=ZXVvaw&qesig=-Gw1hHqc5E3fT1ts9NCf0A&pkc=AFgZ2tk3a4fYrpzhIHs0AqbP-PQg77vkBN4_YHsOonvMlcxz9Unkss-thacqDsvgUtgSBD-tD6Rw_nwkqFLBUzX7faF-AU5lew&pf=p&sclient=psy&site=&source=hp&aq=0p&aqi=&aql=&oq=euok&pbx=1&bav=on.2,or.r_gc.r_pw.&fp=1d936f5c490597a0

Third, you say During the first week of April, hyped up information started spreading across the Internet promoting the Dermaxar stock around{the $72.1 Million buyout PR} . I sent numerous emails to IR for clarification of the release. It actually says on the PR without the $72.1 Mil headline, to send questions and comments to your IR. What we received were general releases. All that was needed to put this to rest, was a direct statement to whether or not the $72.1 MIL buyout PR was false. We have 2 PRs and your post on this board, and to be quite honest, there has been no direct statement around the PR. I included links to my email requests as I am sure others did as well. IS THE PR FALSE?

The good thing is, your product gets some extremely favorable reviews everywhere i look. So hopefully the information you would like to see when you search your brand, will be the first ones listed as times go by.

I've seen many CEOs, wh know little about OTC/Pinksheet, get taken advantage of by financing folk, who talk the CEO into the same sort of thing that happened to you... then leave the stock and the company in the crapper, while they leave with their $$$$ ... and your left to deal with the unhappy investors.

I wish you the best and thanks for your time.

Jimmybob

Brendan, any anger I personally have is directed at the person who put out the bogus PR which made all us victims in this whole mess.

I do apologize of any comments I made pertaining to you or any others for that matter who are also now victims.

It is just human nature to focus anger at the CEO, but since you stated you did not cash out that would make you the biggest victim of all and by comparison you have lost more as a shareholder than anyone else.

We do wish you well.

Congrats on your profits.

Many shareholders were venting (myself included) about Brandon Truaxe hiding the fact we was serving as both buyer and seller in the buy-out and about being duped into buying DRMX stock because of the PR on the buy-out.

I'm not in DRMX that deep, only bought a mere $350 bucks worth @ around .14 so it's really no big deal for me at all.

Prosecuting this "garbage"...lol!

Garbage? Then I want more garbage like this. Gotta love those Pump and Dump stories. ![]()

OK: I couldn't say anything in this board before because I got banned a few days ago for using some offensive word which is forbidden at iHub.

Jail for Brandon Truaxe? What are you saying? I'd congratulate him and whoever was able to bring such amount of attention to this stock. I alerted on it BEFORE the run but I have zero influence as far as stock promotion goes whatsoever. However if someone at iHub wants to consider me a stock guru and follow me on some of my picks it'd be another thing, the more the merrier ![]() .

.

This pick has been one of the best pinkie one-day runs I've ever seen and I'd love to get more like this.

If you got in suckered on the $0.30s or like that, it's YOUR fault for getting in late, don't put blame on someone else for your own mistakes. Nobody had put a gun on your head and forced you to buy this stock.

Personally I made $2470 or like that by getting in 40k @ $0.008 the day before the run after noticing abnormal volume (which I alerted at Stockgoodies subforum) and then selling the day of the run, 10k @ $0.085 and 30k @ $0.065 (damn, I chickened out on a MM shake ![]() ).

).

thanks for the summary and the reasoning behind it all - I understand the desire to go private again and I suppose the norm is to 'just do it' for x cents/share...seems a pretty odd way to go about and of course you would have to understand how it would look from an investors point of view when this wasn't 'explained' publicly and the buyout company happens to be yours.

I understand your concern as a business owner, but I don't believe your image will be harmed at all from this in terms of the business end of things. For 1, if someone wants to know about the company, they will google Euoko - the first 7 hits are exactly what you want. Only the 8th hit is undesirable and it would be advisable for you to get to the bottom of who posted it since that is the only thing that started the chaos you saw last week:

http://www.prweb.com/releases/2011/01/prweb5012604.htm

Either someone within the company (perhaps overseas as it does claim to be from Hong Kong), or perhaps someone that frontloaded shares to dump on unsuspecting types set that up. I saw right through it as a fake PR just looking at your balance sheet, but of course it was impossible to get anyone here to believe that until you released the official PR clarifying.

2. Any 'image' you are worried about in terms of the last few days only relates to penny traders. I am guessing none of them were planning to buy your products in the first place as 99% of them likely never even heard of the product brand. This is not the focus group you would have any concern about as a business owner.

My only comment would be about Fiona, you worry about image, and obviously she probably had a pile of calls and was getting frustrated, but she was rude immediately when I called, wondering why the hell an investor would be calling since Euoko was private, barely even let me ask a single question, and in the end didn't even acknowledge what Dermaxar was even though she was supposedly the one writing the PR's for you:

http://finance.yahoo.com/news/Tatler-Pacific-Acquires-iw-2166432059.html?x=0&.v=1

If she was there to just let me ask questions (after all, that is what IR does), then mention, sorry, that PR regarding $72 million buyout was not authorized by the company, this could have been much smoother for you in terms of the public judgement.

Anyhow, hopefully you can move on with things and turn your company around. Good luck.

Branden, thank you for posting, it is greatly appreciated by all.

I have no problem with the fact you wish to buy back the product line you originally created, it is how you are going about it that raises many questions and is the cause of all the speculation as you have phrased it, surrounding this matter.

Questionable PR's that were sent out in January 2011 stating a purchase price of EUOKO assets for $72.1 million and the fact the buyer TATLER PACIFIC INC. stated in those PR's was created by you, Dermaxar Inc. and Euoko Group Inc CEO and President and the time of the PR release which makes you both the buyer and seller but did not disclose that information.

I do not pretend to know who it was that released those PR's in question, but it is obvious they had insider info, so that narrows the field down dramatically.

If you did not send out those PR's in question, I strongly recommend you report it to the U.S. Securities and Exchange Commission as quickly as possible.

http://www.sec.gov/

thnx for the response!!! if u put your name in any search engine the first thing that pops up is that $72.1 million buyout. thats what this "hype" was all about. ur stock fell to 52 week low, the bottom fishers got it then searched ur name and see that $72.1 million buyout that somehow slipped past everyone back in january.

i never heard of u or ur stock till last week. i see $72.1 million buyout and $.03 a share and I buy now ask questions later. i think thats what everyone did and thats what happens in the POS PINKSHEET market. it sux, but that what it is.

but we buy cause we never know, VKNG a while back went from sub-pennies to dollars. a stock not long ago went from $.01 to $5!! so it happens and when u see such a big money NUMBER $72.1 million associated with a $.03 - $.04 stock u take the chance and buy. thats what i did and everyone else did.

good luck to u and ur brand!

Hello:

I am writing this note personally as much speculation is spreading across the Internet, achieving nothing more than tarnishing my and my team’s image for absolutely no just reason.

I founded the brand, EUOKO, in the Canadian company, Euoko Inc., in 2003, with the objective of building a luxury skin care brand. I invested my own funds, which were very limited, to develop a line of products and start selling them on our website. In 2006, I met an investment team who agreed to invest further funds into the business to grow it. It took our team more than a year of solid effort to land our first retailer, Bergdorf Goodman, in New York City.

Luxury is not an easy business. Branding in this complex world is very difficult, especially with limited funds. Furthermore, building a luxury brand is a slow process that requires patience. In reality, the reason today’s luxury brands are timeless is because they have been around for a very long time. I personally and our team worked very hard to grow and establish the brand in major department stores and premier retailers in more than 20 countries.

During this development, in 2007, our primary financier wished to take the company public on the OTC board. I resisted this request very heavily and our relationship almost ended over this topic, because I did not understand the public market extensively and, furthermore, did not wish for the luxury brand’s image to be damaged by being listed on the OTC board.

Unfortunately, without agreeing to go public, no further funds would have been made available by our financier and the brand would have died. After the initial reverse merger, so much information started spreading on the Internet about the stock and a simple search for the brand, Euoko, resulted in mostly stock information, instead of information about the luxury brand, which harmed our position in our industry for quite some time.

Time went by, funds were always limited and we reached the point of being unable to file further financials, as audit and legal costs were too high to bear. The company failed to meet its OTC reporting obligations and eventually got moved to the Pink Sheets, further damaging the image of the brand. Yet, our very small team continued to grow and support the brand worldwide.

Finally, in late 2010, the original investment team recognized that there was no value in remaining public and I personally did not want to have any association between the brand, myself and the Pink Sheets market. The financier agreed to invest further funds if the subsidiary is brought private through a loan facilitated in the private company, which would be used to pay back some of the loans in the public company, incurred to grow the brand. (The public company still owns Hewitt-Vevey Pharma Sciences Ltd. which sells products like www.complex31.com. Some of the debt of the public company relates to this subsidiary and this debt would remain in the business). I helped the investor and the team incorporate the private entity that would eventually arrange the loan from the investor to pay back toward the loan in the public company and acquire Euoko Inc. (The public name change was done so that , once private, there is no association with the brand).

In January, the first stage of this purchase agreement was signed. Naturally, there was no impact on the stock market, as this news did not really make a different in the position of the public or the private company, other than the fact that the brand would continue to live in some way.

During the first week of April, hyped up information started spreading across the Internet promoting the Dermaxar stock around this transaction. I do not know the source of this communication that resulted in a 2-day price and volume increase and clearly a significant amount of speculation and accusations that have achieved nothing other than tarnish my image and that of my assistant, Fiona, and our co-founder, Julio. A simple investigative effort will show that neither I, nor any director or officer of the company, has ever sold a single share to anyone and the accusations regarding “cashing out” of any venture are simply unfounded.

Last week, I instructed two news releases from the public company to be sent out to warn investors that we do not understand the price and volume increase in response to unauthorized and hyped-up information. And the resignations of I and Julio on that day were simply a reflection of the fact that we were tired with the amount of headache and issues that being on the Pink Sheets had caused us and the brand, for absolutely no reason or benefit to anyone.

There have been also multiple mentions of my stock ownership in Uniontown Energy across the Internet. I helped build and develop technology solutions for this company in 2008 and 2009, and these shares were acquired for that effort and at that time. They have no relationship with EUOKO and, furthermore, I have not yet sold a single share. The accusations that I am “cashing out” or “fleeing the country” are simply based on unjust speculations and are defamatory.

Our team invested 8 years of effort, often without salaries, to gain shelf space in department stores across the world, where no other Canadian brand has ever been. The company was grown with a solid passion for quality and a simple visit to one of our counters will show the commitment our team has put into building this brand. And, at this stage of our growth, I am now truly unsure of the state of the brand, its possible survival, its ability to raise further financing from our investor or of my own interest to stay on board with the brand given how its image has been tarnished even further, in whatever company it may exist.

Genuine people and genuine companies can truly be sabotaged in the presence of speculations that the nature of these exchanges causes people to raise. It is unfortunate for the brand, for the company, for our team and for you. I wish everyone well.

Brandon

Is it coincidental all the big pumpers are gone? Makes sense, right?

I hear ya, a OTC education can be expensive. I got burned on a few stocks the past year, even some on the big boards like RPC which is on AMEX.

Investing in RPC is how I learned about The Rosen Law Firm.

Good for you, makes sense man. Money lost is not deal, principle of the matter is what needs to come front to center. I got bit here on this, learn and burn.

They take on a lot of cases, even PR it when they do, they don't give up either :o)

Check out their list of lawsuits at:

http://www.rosenlegal.com/

I don't care about the money lost, just want those lawyers to be haunting Brendan for a very long time!

The guy does have a lot of money, so the lawyers will be very interested in taking the case.

Brendan also would have to pay attorneys fee's :o)

In the pinky land, the SEC doesn't care so much. The SEC is a **cking joke. Good luck with the law firm, sure they have bigger fish to fry. Seems we have to take this one on the chin, unfortunately.

Probably be slapped with a SEC suspension soon, but I am sending all my info I got to the The Rosen Law Firm, P.A. they should file a lawsuit on behalf of investors...hopefully!

At least then Brendan won't profit from this and those lawyers will be dogging him for decades to come.

There was an obvious cashing out on his other stock, maybe it wasn't him but it seems fitting. I hope you are right about prosecuting this garbage, needs to happen. This has held well, what is your take on that? I was expecting a fallout, could we see a bounce here?

Brandon Truaxe is probably cashing out and planning to flee to a country were there is no extradition treaty.

Gig is up for him, only a matter of time before the U.S. Government provides a nice Federal Prison cell for him.

UTOG dropped almost 22% on 7 million volume. Was somebody, Brandon possibly, selling off their shares? Interesting that UTOG dropped and we held strong at DRMX.....none the less this is getting interesting.

The Rosen Law Firm represents investors that fall victim to securities fraud and corporate misconduct.

They investigate and file lawsuits on behalf of investors.

I strongly suggest all shareholders who have any information on Brandon Truaxe corporate misconduct, breach of fiduciary duties and or securities fraud relating to Dermaxar Inc. or Euoko to report it not only to the SEC but send it to The Rosen Law Firm, P.A. via email at reportfraud@rosenlegal.com or visit their website for more info.

http://www.rosenlegal.com/

http://www.rosenlegal.com/report-fraud.php

You need to try and read back on some posts here... alot of the questions you bring been answered.

Brandon created Euoko, no need to buyout: http://www.wmagazine.com/beauty/2008/04/euoko

Only problem was, he rolled it into a public company.

Guess it was more then he could chew, and maybe didnt like the idea of folks seeing how well/or poor his product line was doing.

Incorporated Tatler Pacific in Canada in OCT of 2010 with the apparent intention of using that to take Euoko private.

Now as for who created the 72.1 mil PR... thats the big questions.

I really dont think it was to create a pump to have folks dump positions. Stocks dont usually move on old news.

Havent been too many movers past week or so, and the old DRMX pr seemed to be the right info, at the right time to be discovered by someone.

Its my opinion he created that PR to show some value for his company. Maybe it's for a possible future sale?

Who knows... but not sure how anyone can get away with being a private company, buying the subsidiairy of a public company, and Being a DIrector/CEO for both... ~~~

Wish i saw or you pointed out those subtle differences in the PRs the other day ~ Makes a strong case for those PRs being crafted from 2 separate accounts. ~ nice catch

Don't know why he's even interested yet in Euoko, most if not all his shares of UTOG were acquired at about .70, now valued at 2.30 a share!

Unless Brandon sees a good opportunity to buy Euoko product line cheap latest PR suggests price would be less than current debt.

Or purchase price may go up now if he is afraid SEC may file charges if he buys too low.

yeah, i see 6.5m shares owned....definitely makes it interesting to me as now we are talking the promo world that I usually trade in

Brandon Truaxe and Julio Torres both were listed as employees of UTOG back in Sept. 2008.

Julio Torres was a technology director and Brandon Truaxe was branding and technology advisor for UTOG.

http://yahoo.brand.edgar-online.com/DisplayFilingInfo.aspx?Type=HTML&text=%2526lt%253bNEAR%252f4%2526gt%253b%28%22BRANDON%22%2c%22TRUAXE%22%29&FilingID=6161669&ppu=%2fPeopleFilingResults.aspx%3fPersonID%3d4546141%26PersonName%3dBRANDON%2bTRUAXE

You have to look at latest UTOG SEC filings, the 10k if I remember right. It lists Brandon and the number of UTOG shares he owns.

I think it was a shareholder who wanted to get pps up after r/s.

Their are two versions of that same PR.

The real one (released first) was released out of Toronto, Canada and made no mention of sales price.

The fake one came out of Hong Kong and states the 72.1 million.

With over $20 million in UTOG stock, Brandon Truaxe is far from being in need of risking all of it over the chump change made scamming DRMX stock.

as I said, I don't believe she wrote that one - I think that was a fake PR using her name, but perhaps a different email to allow for the new account. It doesn't say Euoko Inc, it says Euoko - when you set up an account, you would enter the account information once and that would always display on the side the same - just that one doesn't though (same with number all crunched together instead of dashes).

It's someone else, and wouldn't surprise even if it was Brandon seeing that the 'crooked' activity seems to lead to him (but that is just opinion).

As for the UTOG thing - interesting, will look into that more as I played the promo for decent dough.

Brendon Truaxe buys the product line and transfers ownership to Tatler-Pacific.

He owns well over 10 million shares of UNIONTOWN ENERGY INC. OTC:UTOG which currently trades at $2.30 a share.

Means he can come up with $20 million in cash minimum.

http://yahoo.brand.edgar-online.com/PeopleFilingResults.aspx?PersonID=4546141&PersonName=BRANDON%20TRUAXE

Fiona Walsh maybe in trouble for the PR that states the 72.1 million sale price especially if she is a shareholder and profited from it.

Brendon has covered his butt pretty well legally.

So he is, thanks I missed that.

Fiona Walsh, since she and only she has her fingerprints all over the PR's except the newest ones which don't state a name, interesting newest ones don't give a name.

All other people at Dermaxar Inc. can say they simply didn't have any knowledge of it.

|

Followers

|

13

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

732

|

|

Created

|

06/25/07

|

Type

|

Free

|

| Moderators | |||

| Main Distribution Office Suite 535, 67 Mowat Avenue Toronto, Ontario M6K 3E3 Canada | 1-800-98-EUOKO (38656) +1-416-657-4141 help@euoko.com http://www.euoko.com/ |

| Euoko, Inc., is an emerging luxury brand that develops, markets and distributes scientifically-advanced skin treatments. Euoko’s current portfolio spans five treatment collections that target aging, dull skin tones, skin protection, uneven pigmentation and blemishes. This product line offers comprehensive solutions to such skin concerns as wrinkles, fine lines, under-eye dark circles, dark spots, cellulite, acne, oxidation, environmental exposure and skin fatigue. Combined with innovative products for basic daily cleansing and facial priming, Euoko offers a complete line of synergistic formulations that target the most demanding luxury consumer. Euoko’s well-appointed, understated primary and secondary packaging communicates innovation, science and sophistication, while reflecting the prestige positioning of the portfolio. Euoko sells its product line through varied distribution channels in select North American, European and Middle Eastern markets, as well as globally through its internally-operated, multicurrency, multilingual website. Products Y (Aging) Company Officers: |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |