Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Out of options. Nice gain. Looks weak compared to market today.

Cisco Remains Very Attractively Valued

By: TheStreet | May 15, 2020

• Too much negativity has been priced into Cisco's stock, and strong dividends and repurchases make it even more compelling.

Right now, Cisco is very attractively valued and has too much negativity priced into its valuation.

Cisco's (CSCO) fiscal Q4 2020 guidance points at its top-line revenue growth rate contracting by 10% year-over-year, after falling by 8% during its most recent quarter.

However, that aside, Cisco has very high gross margins, while it trades for just 14x free cash flow, with approximately 5.6% shareholder return via dividends and buybacks.

Macroeconomic Uncertainty Is Weighing on Cisco

The global economy continues to cause headwinds for Cisco, with management stating that supply chain and component constraints are having an impact on Cisco's near-term. However, management believes the aspects are temporary.

Given that close to 70% of Cisco revenues are hardware-based, this impact is understandable. Indeed, it echoes the narrative of many Fortune 500 companies, including the biggest tech companies, such as Apple (AAPL) and Microsoft (MSFT).

Having said that, a large portion of these headwinds have already been priced into its shares, and I believe there’s too much negativity been priced into Cisco.

Cisco’s Operations Become Increasingly Subscription-Based

Cisco derives close to 30% of its revenues under its Service Segment. Within this segment, approximately 74% is now subscription-based, compared with just 65% a year ago.

The more of Cisco’s Services segment that becomes subscription-based, the more predictable Cisco’s revenue stream becomes, and the more efficient Cisco can become with planning its expenses. This translates to Cisco’s already high margins becoming higher in time, as Cisco can be run as lean as possible.

In fact, we already saw this occurring this quarter, where Cisco’s Services non-GAAP gross margins reached 68.9% versus 67.3% in the same period a year ago. This is impressive, particularly when we note that these high margins are taking place during a period when Cisco’s total revenues are falling.

On the other hand, the details here are crucial. According to Cisco’s management, its Service segment lags the rest of Cisco’s performance. Consequently, although Cisco’s Service segment was a strong performer this quarter, over the coming quarters, Cisco expects that trend to reverse in its upcoming quarter, and for Services to be under pressure.

In fact, according to Cisco’s CFO Kelly Kramer within its Services unit, Cisco’s ability to upsell to existing enterprises will be limited in the upcoming quarters, seeing that many companies are hesitant to adopt long-term subscriptions, and Cisco’s ability to sell value-added and consulting services become hindered. But Kramer argues that its Service business is attractive, resilient, and has been through cycles before and came out strong.

Valuation - Very Attractive Investment

Cisco remains committed to returning approximately 80% of its free cash flow to investors via dividends and share repurchases.

Indeed, despite its revenues contracting during the quarter, together with its unimpressive guidance on top of the overall global uncertainty, Cisco continues to return to shareholders huge sums of capital.

Specifically, despite its total revenues contracting by 8% during the quarter, Cisco didn’t shy away from returning $2.5 billion to shareholders. At the present run rate, Cisco will return to shareholders close to 5.3% of its market cap via a combination of dividends and repurchases over the coming twelve months.

Presently, investors are only being asked to pay 14x its free cash flow, thus being presented with a very attractive investment opportunity. Note, this is free cash flow, which is more attractive than earnings.

The Bottom Line

Large and established tech companies are rarely cheaply valued, particularly when they have strong competitive advantages, as is the case with Cisco.

Considering Cisco’s high gross margins, strong returns of capital to shareholders and compelling business model, Cisco's stock is not likely to remain priced at 14x free cash flow for too much longer.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco Analysts Raise Share-Price Targets After Strong Earnings

By: TheStreet | May 14, 2020

• Cisco reported that profit and revenue beat forecasts for its fiscal third quarter, prompting higher price targets at Wall Street firms.

Cisco Systems (CSCO) shares rose Thursday, as analysts raised their share-price targets after the networking-technology giant reported stronger-than expected earnings for its fiscal third quarter.

In the quarter ended April 25, GAAP earnings per share totaled 79 cents on 8% lower revenue to $12 billion. Analysts were expecting the company to report earnings of 71 cents a share on revenue of $11.88 billion.

Cisco also forecast higher-than-expected earnings per share for the fourth quarter.

As for the analysts, “this was one of the most positive Cisco earnings calls in a while,” Citi’s Jim Suva wrote in a commentary cited by Bloomberg.

Not only were the results and outlook “materially stronger than expected,” but Cisco “also laid out how the company is offering more flexible payment terms” during the coronavirus pandemic, which should generate more customer loyalty.

Suva lifted his price target to $48 from $40 and affirmed his buy rating.

Meanwhile, Jefferies analyst George Notter was “quite impressed with the company’s ability to hit top-line expectations, guide in-line for July, and post consistent product order growth rates,” he wrote in a report cited by Bloomberg.

The factors attracting enterprises to Cisco “aren’t going away - even in a softer economic environment,” he said.

Notter boosted his share-price target $49 from $45 and maintained his buy rating.

Cisco shares recently traded at $44.16, up 5.3%. The stock has slid 6.6% over the past three months, compared with an 18% drop for the S&P 500 index.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco persevered in a brutal economic climate, offering what one analyst called ‘a glimmer of confidence’

By: MarketWatch | May 14, 2020

Cisco Systems Inc. is weathering what Chief Executive Chuck Robbins calls the worst economic crisis it has encountered since it was founded in 1984.

That’s saying a lot, considering it endured the dot-com crash of the early 2000s and the Great Recession in 2008-09. But persevere Cisco did, with revenue ($12 billion) and adjusted earnings (79 cents per share) that beat Wall Street estimates and an adjusted earnings forecast (72 cents to 74 cents a share) that eclipsed the average analyst expectation of 71 cents a share, according to FactSet.

“Cisco beat in a very difficult climate. Furthermore, Cisco suggested business was unlikely to worsen beyond F4Q absent a worsening pandemic,” Instinet’s Jeff Kvaal said in a note Thursday titled “A Glimmer of Confidence.” He raised his price target to $46 from $43 while retaining a neutral rating on the stock.

In maintaining an outperform rating and price target of $50, Evercore ISI analyst Amit Daryanani pointed to diversity in Cisco’s product portfolio.

“While there was some rightful investor apprehension around headwinds in the core infrastructure platform business (down 15%) the offsets were better performance in Security (+6%) and Services (+5%), though the declines in Applications segment (down -5%) is somewhat surprising,” Daryanani wrote Thursday. “While we understand CSCO performance will be driven by macro dynamics to some extent, we do think the diversity of their portfolio will enable better performance vs. past recessions.”

A good deal of Cisco’s fortunes are tied to the digital transformation plans of large companies, which “aren’t going away,” Jefferies analyst George Notter muses in a Thursday note that maintains a buy rating and price target of $49. “We’re quite impressed with the company’s ability to hit top line expectations, guide in-line for July, and post consistent Product order growth rates in the wake of the current WFH environment,” he wrote.

That sentiment was echoed by RBC Capital Markets analyst Robert Muller. “While we expect Enterprise weakness from an uncertain macro, we believe that CSCO is positioned well for the long run and could emerge from the pandemic relatively stronger,” Muller said in a Wednesday note that maintained an outperform rating and price target of $47.

Still, current quarter guidance for an 8.5% to 11.5% year-over-year decline in revenue implies a much steeper decline in product sales of 12.5% to 16.5%, warns Needham analyst Alex Henderson, who has a hold on Cisco shares with no price target.

“We expect recovery to be a slow process for Cisco,” he said in a note Thursday.

Cisco shares, which were up 4% in early-afternoon trading Thursday, are down 22% over the last year. The broader S&P 500 index SPX, 0.14% has declined 1.5% the past year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Holding the huge gain on most of the options to sell on a better day hopefully. Stock position is longer term while everyone works from home. This was another Covid no brainer.

CSCO. Sure beats riding a pinky down to zero. LOLOL

![]()

Citigroup Maintains Buy on Cisco Systems, Raises Price Target to $48

5/14/20, 10:15 AM

May 14, 2020 11:15 AM ET (BZ Newswire) -- News

Citigroup maintains Cisco Systems (NASDAQ:CSCO) with a Buy and raises the price target from $40 to $48.

Copyright © 2020 Benzinga (BZ Newswire, http://www.benzinga.com/licensing). Benzinga does not provide investmentadvice. All rights reserved. Write to editorial@benzinga.com with any questions about this content. Subscribe to Benzinga Pro (http://pro.benzinga.com).

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pre earnings CSCO calls blowing up. Sweet.

Options Bulls Surround Streaking Cisco (CSCO) Stock Ahead of Earnings

By: Schaeffer's Investment Research | May 12, 2020

• Cisco is expected to post earnings after the market closes tomorrow

• The Dow stock looks to halt its streak of post-earnings bear gaps

For better or worse, the only Dow name stepping into the earnings confessional this week is Cisco Systems, Inc. (NASDAQ:CSCO), with the tech giant set to report first-quarter earnings after the close tomorrow, May 13. Ahead of the event, CSCO options traders are coming out in droves.

By noon, 60,000 Cisco calls have already changed hands, quadruple the average intraday amount and more than triple the number of puts traded. Leading the charge is the May 45 call, but there are new positions are being opened at the weekly 5/22 47-strike call. Buyers of that latter call are banking on a possible CSCO post-earnings rally to last through the next 10 days, when the options expire.

Looking back at the past two years, the stock has a choppy history following quarterly reports. Of the eight previous reports, the last three have been negative, including a 5.2% swing lower in February. The security averaged a 5.2% swing, regardless of direction, the day after its last eight reports, and this time around the options pits are pricing in a much larger 9.2% shift.

This preference for calls has been the norm in recent weeks, though. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), nearly five calls have been bought for every put during the past 10 days. This resultant 10-day call/put volume ratio ranks in the 88th percentile of its annual range, indicating a healthier-than-usual appetite for calls in the last two weeks.

While Cisco stock is up 1.6% today to trade at $44.01, it's still wrangling with a 8% year-to-date deficit, despite 63% of analysts holding "buy" ratings and not a single "sell" to be found. And while the shares are eyeing their fourth straight win today, they remain stuck between a trendline lower and their 1,000-day trendline.

Read Full Story »»»

DiscoverGold

DiscoverGold

Looking To Pack On The performance - Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | April 24, 2020

On Thursday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of -0.34% and closed at $41.62

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 176.59B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of -0.34 in a total of its share price and finished its trading at 41.62.

Cisco Systems, Inc. institutional ownership is held at 74.40% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.43, 15.11 and 4.97 respectively. Its P/Cash is valued at 6.53.

The stock has observed its SMA50, which is now 1.90%. In looking at the SMA 200, we see that the stock has seen a -11.05%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.12% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 46.73 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 2.90% volatile for the week and 3.98% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at 0.29%, resulting in a performance for the month at 7.82%.

Therefore, the stated figure shows a four-month performance of -15.06%, bringing the 6-month working result to -12.47% and YTD performance of -13.22%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.43, and 4.97 respectively. Its P/Cash is valued at 6.53.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco Allows Customer Payment Deferrals in $2.5 Billion Financing Program

By: TheStreet | April 14, 2020

• Cisco will waive payments for the next three months and then require just 1% for each of the year's final five months.

Cisco Systems (CSCO), the technology networking giant, announced a $2.5 billion financing program in response to the coronavirus pandemic that allows customers to defer 95% of their payments due this year until next year.

"Cisco's customers and partners are under enormous pressure to keep their businesses connected while remaining productive and secure," Cisco CEO Chuck Robbins said in a statement.

"Whether it's technology, financing or helping those most in need, Cisco is committed to working together to fight this pandemic on every front," he said.

As the coronavirus pandemic has sent many workers home, internet activity has soared, leading to more usage of Cisco’s networking equipment.

And, of course, the at-home workers are deploying video conferencing and virtual private network software in a big way, which can include Cisco's Webex and AnyConnect.

The financing program offers a complete break from payment by Cisco’s customers for three months. They then pay 1% of the money they owe in each of the last five months of the year.

Cisco appears to be the only top technology company offering such an opportunity to its customers. The program is available around the world.

Morningstar analyst Mark Cash likes the company. It “continues to execute on its strategic focus of increasing recurring revenue via selling software and services to supplement its hardware products,” he wrote in a report last week.

Cash places fair value for the stock at $48.

It recently traded at $42.26, up 2.54%. It has dropped 12% over the past three months, compared to a 14% fall for the S&P 500.

Read Full Story »»»

DiscoverGold

DiscoverGold

Likely To Continue Rising To New Highs - Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | April 9, 2020

On Wednesday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 2.71% and closed at $41.74

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 180.37B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of 2.71 in a total of its share price and finished its trading at 41.74.

Cisco Systems, Inc. institutional ownership is held at 74.40% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.50, 15.15 and 4.98 respectively. Its P/Cash is valued at 6.66.

The stock has observed its SMA50, which is now -0.67%. In looking at the SMA 200, we see that the stock has seen a -12.13%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.60% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 47.77 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 4.90% volatile for the week and 7.23% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at 8.90%, resulting in a performance for the month at 4.14%.

Therefore, the stated figure shows a four-month performance of -12.16%, bringing the 6-month working result to -10.02% and YTD performance of -12.97%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.50, and 4.98 respectively. Its P/Cash is valued at 6.66.

Read Full Story »»»

DiscoverGold

DiscoverGold

Latest Performance - Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | April 7, 2020

On Monday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 6.07% and closed at $41.43

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 179.03B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of 6.07 in a total of its share price and finished its trading at 41.43.

Cisco Systems, Inc. institutional ownership is held at 74.40% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.47, 15.04 and 4.94 respectively. Its P/Cash is valued at 6.62.

The stock has observed its SMA50, which is now -2.07%. In looking at the SMA 200, we see that the stock has seen a -13.08%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.60% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 47.77 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 4.37% volatile for the week and 7.54% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at 2.75%, resulting in a performance for the month at 4.41%.

Therefore, the stated figure shows a four-month performance of -13.33%, bringing the 6-month working result to -12.82% and YTD performance of -13.62%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.47, and 4.94 respectively. Its P/Cash is valued at 6.62.

Read Full Story »»»

DiscoverGold

DiscoverGold

Where Fundamentals Meet Technicals: CSCO and Review

By: Lyn Alden Schwartzer | April 2, 2020

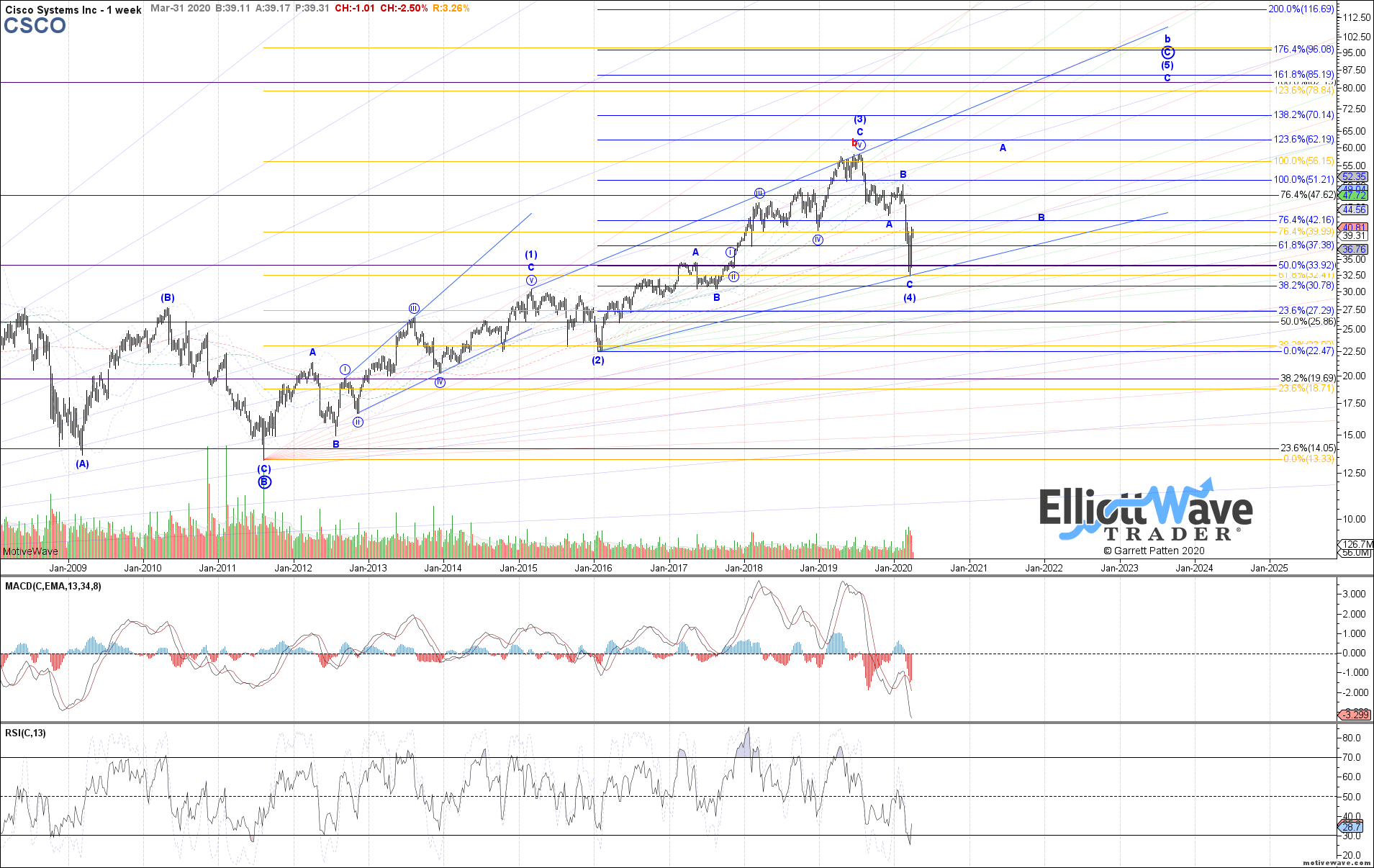

Following the Elliott Wave analysis:

Cisco (CSCO) stock is pretty interesting at current prices. The technical/sentiment analysis has been a bit mixed between our Elliott Wave analysts, but I think solid fundamentals represent a reasonable tiebreaker here. Count me in the long-term bullish camp.

The Valuation

Unlike many stocks, Cisco was in a downtrend before this virus/recession struck. The stock topped out in mid-2019 in overvalued territory based on over-optimistic assumptions, and then began to fall back down to what I would consider approximately fair value relative to its growth rate, opportunities, and risk. The virus, economic shutdown, and broad market crash then of course pulled it still lower.

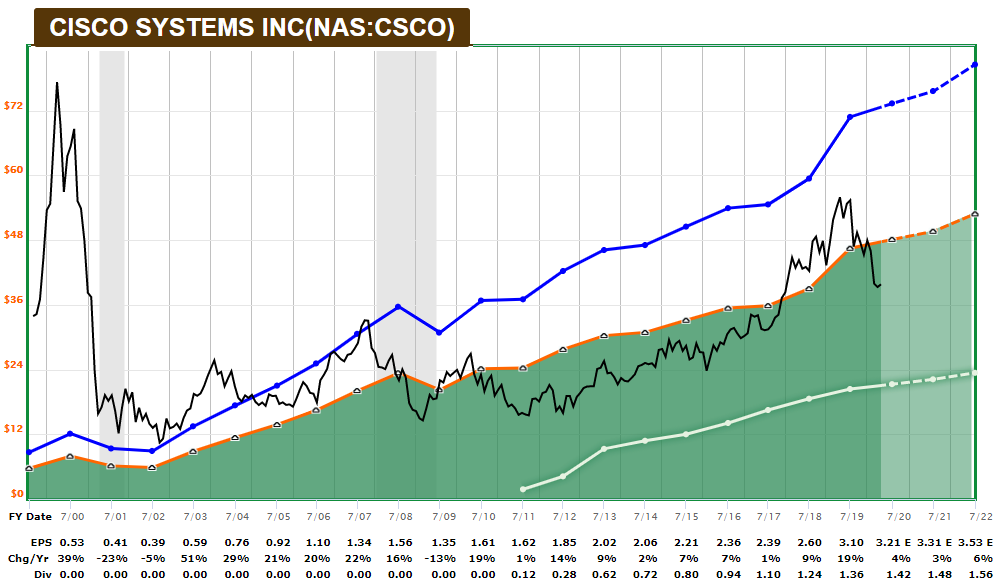

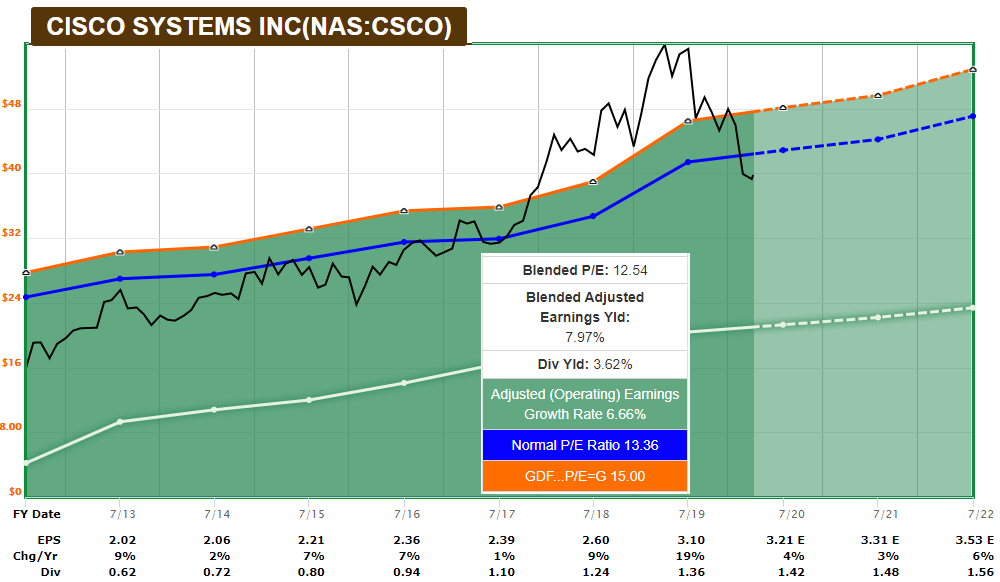

Two decades ago, Cisco was one of the quintessential dotcom bubble stocks. The long-term F.A.S.T. Graph shows the magnitude of how its stock price outpaced fundamentals back then:

Since then, the stock itself never reached that level again due to obscene overvaluation, but the company itself has done very well. Their revenue and earnings have continued to grow, and within the past decade they initiated a growing dividend as well.

Here is a look at the more recent F.A.S.T. Graph, which re-sets the lines based on more recent data within the selected timeline:

Before the virus, analysts were looking for 5% annual growth for the next 3 years. Now the estimates are a couple percent lower, but forward estimates for the next year or two need to be taken with a grain of salt in this environment, for better or worse. We’re in depression conditions with ten million Americans unemployed in 2 weeks with an unusual viral event and economic shutdown response.

The company makes over $11 billion in net income per typical year, and its annual free cash flow levels tend to be even higher. Last year, free cash flow was over $14 billion. The trailing price to earnings ratio is around 15x, and the trailing price to free cash flow ratio is a little over 12x.

The dividend yield is currently around 3.6%, meaning the stock can provide solid total returns even with modest growth, and is a nice candidate for a dividend growth portfolio.

The Transition

Cisco is a business in transition. They are the worldwide leader in network switches and routers, which form the hardware backbone of the internet. They also make wifi hardware and a variety of other networking equipment, and have a large business in network security, VOIP software, IoT, and other areas.

The key risk for the company is that network switches and routers have become somewhat commoditized, especially as many things shift towards the cloud.

Many of the hyperscale datacenter companies (think the FAANG stocks and Microsoft) now use their own white-box network equipment, sourced from the same chip providers that Cisco sources from, including Broadcom (AVGO). Basically, these hyper-cap companies are far bigger than even Cisco (which itself is a mega-cap stock), so it’s cost-effective for them to make their own.

Some smaller businesses choose to use generic switches and routers as well. So, Cisco needs to differentiate itself.

Over the past few years, Cisco has been shifting more towards software and subscription revenue, particularly with their highly-successful Catalyst 9000 set. Rather than just sell networking hardware, they are transitioning to selling hardware that comes with an annual payment to receive various support and software.

This business transition for such a large company comes with risks. Revenue has been relatively flat, but operating margins have been on the rise after bottoming back in 2014. After the company completes its transition, it should be able to boost revenue growth a bit, although there is execution risk for the company.

The IoT opportunity is a long-term additional speculative growth area for the company, as it will take a lot of networking equipment and software to tie that all together for enterprises. Cisco has a nice place in this market unless they drop the ball.

Despite not being a very cyclical stock or very hard-hit by the virus yet, the company is doing layoffs at some level to trim where appropriate and keep costs under control.

The Balance Sheet

Cisco is a financial fortress, with one of the best corporate credit ratings; AA- from Standard & Poor’s.

As of the most recent quarter, Cisco has $27 billion in cash-equivalents and $16 billion in total debt, meaning they are net-debt free and have a ton of liquidity. This also gives them ongoing ability to buy competitors or bolt-on hardware and software technologies.

The Technicals

In terms of sentiment, Garrett sees Cisco as potentially already having bottomed in this cycle, with the potential to double within five years in addition to annual dividends:

I don’t know how it’ll play out in detail, but considering the fundamentals, it looks like reasonable, at last for the higher-end of possible outcomes.

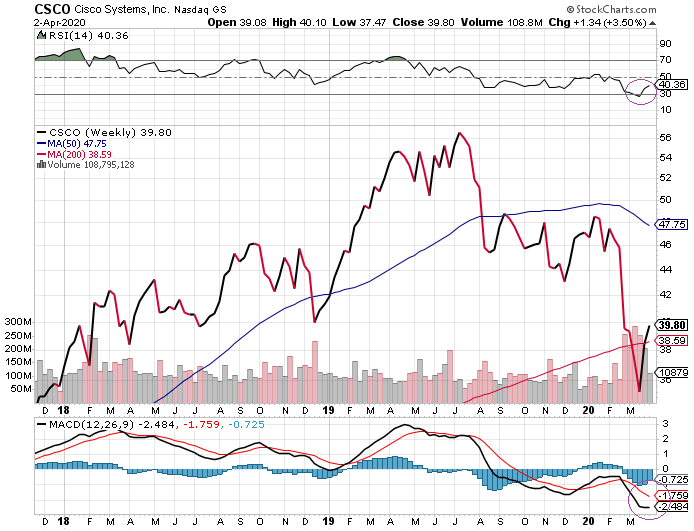

From a basic technical view on the weekly chart, the company recently reached oversold levels on the weekly RSI indicator, and has turned up but remains relatively depressed, which gives a nice runway for further increases.

MACD on the weekly chart is also very low, but with early signs of it starting to form a base. MACD hasn’t formed a bullish crossover yet on the weekly chart, but the 12-week line is starting to flatten its curve at least.

It’s of course still possible that Cisco could sell-off deeper, especially if the overall market turns down again, which is my base case probability.

However, now that the initial “Oh god sell everything!” margin call phase of this bear market with breathtaking volatility is seemingly done with for now, sell-off days seem more selective in nature, and Cisco is a stock that I suspect will hold up better than the broad market from here. We’ll see...

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco's Webex draws record 324 million users in March

By: Reuters | April 3, 2020

(Reuters) - Cisco Systems Inc's video-conferencing app Webex registered a record 324 million attendees in March, with usage more than doubling in the Americas, as the coronavirus-led lockdowns forced businesses to have employees work from home.

Webex and rival meeting platforms from Zoom and Microsoft Corp's Teams are being used worldwide to host everything from virtual classrooms and business meetings to church services, as people stay at home to restrict the spread of the pandemic.

Zoom's daily users ballooned to more than 200 million in March from a previous maximum total of 10 million, the company said https://blog.zoom.us/wordpress/2020/04/01/a-message-to-our-users on Wednesday. It was, however, not clear if the number was comparable with Cisco's due to the different ways the companies calculate meeting attendees.

"Webex grew 2.5 times in Americas, four times in Europe and 3.5 times in Asia Pacific. Our growth is sourced from enterprise expansion, education and telehealth," said Sri Srinivasan, senior vice president and general manager, Cisco Collaboration.

About 73 million meetings took place in March and well over 22 million meetings per week in the last two weeks, Sri Srinivasan added.

Cisco said the latest user numbers have more than doubled since January.

The explosion in demand has spurred a huge boom for what were often relatively small businesses while raising issues of privacy and abuse.

Zoom's share price has surged five-fold in value since going public in April last year, but the company has faced a backlash in the past week from users worried about the lack of full encryption of sessions and zoombombing, where uninvited guests crash meetings.

Cisco said its Webex system, which includes teleconferencing and is older, was fully encrypted.

Read Full Story »»»

DiscoverGold

DiscoverGold

Latest Trend:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | March 31, 2020

On Monday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 3.86% and closed at $40.32

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 178.74B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of 3.86 in a total of its share price and finished its trading at 40.32.

Cisco Systems, Inc. institutional ownership is held at 74.30% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.47, 14.64 and 4.81 respectively. Its P/Cash is valued at 6.61.

The stock has observed its SMA50, which is now -6.81%. In looking at the SMA 200, we see that the stock has seen a -16.13%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.85% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 48.14 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 6.66% volatile for the week and 7.66% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at 16.53%, resulting in a performance for the month at 0.98%.

Therefore, the stated figure shows a four-month performance of -15.60%, bringing the 6-month working result to -17.44% and YTD performance of -15.93%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.47, and 4.81 respectively. Its P/Cash is valued at 6.61.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco: Too Cheap to Be Ignored for Too Long

By: TheStreet | March 30, 2020

• Cisco is a well-positioned networking company with strong free cash flows that is valued in the bargain basement.

Cisco Systems' (CSCO) share price has fallen close to 20% in the past six weeks, slightly less than the rest of the market as measured by the S&P500, which has fallen close to 25%.

But Cisco is a hidden gem that is remarkably well-positioned to rapidly recover once investors’ fears have calmed. For now, it's unjustifiably cheap as it trades for just 11 times free cash flow. Here’s why:

During the coronavirus outbreak, as workforces embrace work from home as the new normal, investors are scrambling to pick out which stocks are better to positioned to be winners and rapidly exit likely losers.

This is the wrong investment strategy, as attempting to pick out winners that aren't already fully priced is a challenging and largely foolish endeavor. A superior investment strategy is to buy stocks of established companies that are selling cheaply.

Presently, investors are still indiscriminately selling irrespective of valuation. The stocks that investors were doubtful about before the general selloff are now trading in the bargain basement, whereas investors’ favorites have remained somewhat fairly priced (vs. overpriced as they had been during the bulk of 2019).

Well-Positioned for Work-From-Home Environment

Cisco sells technology that allows companies to network and collaborate, making it well-positioned at this critical time.

Ironically, however, some of Cisco's smaller peers, such as Juniper Networks (JNPR), possibly will still struggle in the coming months as we face a global recession. International Business Machines (IBM), with its overextended balance sheet, will have to go into a defensive strategy at precisely the time when it should be playing offense.

On the other hand, Cisco - which was already trading cheaply - has now certainly fallen from grace.

Further, given that its balance sheet carries $11 billion in net cash, Cisco has significant flexibility to navigate this economic contraction and more options at its disposal than its peers. Investors should watch Cisco turn toward M&A and pick up strategically important peers during this selloff.

Cash Flows Will Start to Matter Once Again

During the past couple of years, investors were willing to value companies’ rhetoric far above company cash flows. Today, investors are in a totally different mindset. Cash flow visibility and predictability will far outstrip any growth potential in the future. During a time of substantial uncertainty, strong and recurring cash flows are once more highly valued.

As it stood in the second quarter of 2020, Cisco derives approximately 30% of its revenue from software sales, which are mostly subscription-based. As companies look to cut back on any discretionary expenses during these uncertain times, companies such as Cisco, that are not having to entice customers to make purchases, are better positioned to withstand the downturn.

Valuation - Large Margin of Safety

The demand for fast and secure networking has huge secular tailwinds to its back and Cisco is a meaningful beneficiary of this continuously expanding sector.

What’s more, although there are very near-term uncertainties regarding our economy, over the medium-term Cisco is highly likely to return to generating close to approximately $15 billion of free cash flow.

Given that its market cap is only $165 billion, this puts this large and established business trading at just 11 times normalized free cash flows.

Investors do not get this sort of compelling valuation for too long.

The Bottom Line

Cisco is very well-positioned to benefit from our new normal environment, one where we work from home and require secure connectivity. This well-known household name is too cheaply valued and will reprice higher when investors' fears have calmed down.

Read Full Story »»»

DiscoverGold

DiscoverGold

Latest Movement:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | March 27, 2020

On Thursday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 7.72% and closed at $40.58

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 172.14B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of 7.72 in a total of its share price and finished its trading at 40.58.

Cisco Systems, Inc. institutional ownership is held at 74.30% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.34, 14.73 and 4.84 respectively. Its P/Cash is valued at 6.36.

The stock has observed its SMA50, which is now -6.92%. In looking at the SMA 200, we see that the stock has seen a -15.88%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.59% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 49.18 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 7.94% volatile for the week and 7.77% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at 7.61%, resulting in a performance for the month at -3.75%.

Therefore, the stated figure shows a four-month performance of -15.07%, bringing the 6-month working result to -18.19% and YTD performance of -15.39%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.34, and 4.84 respectively. Its P/Cash is valued at 6.36.

Read Full Story »»»

DiscoverGold

DiscoverGold

An In-Depth Look At:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | March 23, 2020

On Friday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of -5.60% and closed at $35.60

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 151.02B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of -5.60 in a total of its share price and finished its trading at 35.60.

Cisco Systems, Inc. institutional ownership is held at 74.30% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 2.93, 12.92 and 4.25 respectively. Its P/Cash is valued at 5.58.

The stock has observed its SMA50, which is now -19.94%. In looking at the SMA 200, we see that the stock has seen a -26.78%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 3.59% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 49.18 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 10.54% volatile for the week and 6.97% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at -5.42%, resulting in a performance for the month at -24.01%.

Therefore, the stated figure shows a four-month performance of -23.67%, bringing the 6-month working result to -27.63% and YTD performance of -25.77%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 2.93, and 4.25 respectively. Its P/Cash is valued at 5.58.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco commits $225 million to global coronavirus response

By: MarketWatch | March 22, 2020

Cisco Systems Inc. CSCO, -5.59% on Sunday said it will commit $225 million toward aiding the global response to the coronavirus pandemic. In a blog post, Chief Executive Chuck Robbins said the network-equipment company will allocate $8 million in cash and $210 million in product to local and international health-care, education and government groups, including the United Nations Foundation's COVID-19 Solidarity Response Fund. The product offerings include free video conferencing and security products. "Cisco must, and will, do even more to help others respond to this global pandemic," Robbins wrote. "In addition, we are rallying our 77,000 employees and encouraging them to give what they can to help our community partners on the front lines bolster their operations in this time of need."

Read Full Story »»»

DiscoverGold

DiscoverGold

CSCO is very attractive at $33-$36

Definitely want 10,000 shares but I'll try to get 100 soon

Why Cisco Stock Is Becoming Attractive Following the Coronavirus Sell-Off

By: Motley Fool | March 19, 2020

• The solid tech giant should profit from its work-at-home solutions, and it remains exposed to long-term technology tailwinds.

The market isn't sparing Cisco Systems (NASDAQ:CSCO) from the brutal sell-off triggered by the coronavirus pandemic. Granted, a recession would have a negative effect on the company's short-term performance. But the tech giant should also profit from the stay-at-home policies that are being enforced in several countries. And with long-term tailwinds that should still materialize, Cisco has become an attractive investment opportunity for patient investors.

Work-at-home solutions

Cisco's core business consists of selling network devices and software. During the last quarter, the company's infrastructure platform segment, which mostly includes computer networking solutions, represented 54.4% of the total revenue. That segment is exposed to the expected worldwide computing infrastructure reduced spending. Because of the uncertainties related to the coronavirus outbreak, the research company IDC communicated a pessimistic scenario where IT spending is forecasted to increase by only 1% in 2020, compared to 4% previously.

But Cisco also proposes communication solutions such as Webex and Jabber for remote workers to communicate and collaborate from anywhere. These solutions represent an important part of the company's applications segment that reached 11.2% of the total revenue during the last quarter. In the context of the work-from-home policies that are enforced because of the coronavirus outbreak, Cisco has seen a 22-fold traffic increase in its Webex cloud backbone over the last few weeks. A part of this growth is due to the expansion of free Webex offerings to support the quick implementation of work-from-home policies, though. But this development is likely to benefit Cisco over the long term since it gives enterprises the opportunity to become familiar with these types of solutions.

Cisco's security segment also includes cloud-based solutions such as Umbrella and Duo Security. These tools protect and authenticate employees from anywhere, which complements the use of Cisco's remote communication tools. Again, Cisco doesn't provide detailed information about the performance of these individual solutions, but CEO Chuck Robbins highlighted during the latest earnings call that Duo Security and Umbrella were important growth drivers for the company's security business, which represented 6.2% of total revenue during the last quarter. The work-at-home measures that are being taken to deal with the coronavirus situation are likely to boost the demand for these cloud-based security solutions.

Long-term opportunity

The effect of the coronavirus outbreak remains uncertain, but the company can stomach such a challenging environment for many years. Its cash exceeded its total debt by $11.1 billion at the end of last quarter. Management can also use this comfortable safety net to acquire tech stocks that have recently become cheaper.

In addition, Cisco has shown its capacity to generate free cash flow over the last decades, including during the financial crisis of 2008. And despite short-term volatility, free cash flow has been steadily growing over the long term.

Looking forward, Cisco is still exposed to the growth opportunities 5G and 400G technologies represent over the next years. For instance, the giant telecommunications provider Verizon recently announced an increase in its 2020 capital program range to accelerate the deployment of 5G. And IDC forecasts 5G infrastructure spending to increase annually by 118% by 2022.

Following Cisco's latest results one month ago, I argued its valuation was reasonable at that time. Since then, Cisco's stock price dropped by 34%, which led to an increase in its dividend yield to 4.3%.

A recession should have a negative effect on the company's results in the short term, and the stock price could remain volatile. But Cisco seems ready to face these challenges, and its long-term tailwinds remain intact. Thus, the market is now offering long-term investors an opportunity to consider buying Cisco's stock at a low forward P/E ratio of 12.2.

Read Full Story »»»

DiscoverGold

DiscoverGold

Latest Movement:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | March 18, 2020

On Tuesday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 5.31% and closed at $35.50

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 168.01B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of 5.31 in a total of its share price and finished its trading at 35.50.

Cisco Systems, Inc. institutional ownership is held at 74.30% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.26, 12.89 and 4.24 respectively. Its P/Cash is valued at 6.21.

The stock has observed its SMA50, which is now -21.31%. In looking at the SMA 200, we see that the stock has seen a -27.33%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 4.23% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 51.00 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 10.26% volatile for the week and 5.77% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at -11.43%, resulting in a performance for the month at -24.42%.

Therefore, the stated figure shows a four-month performance of -21.63%, bringing the 6-month working result to -28.94% and YTD performance of -25.98%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.26, and 4.24 respectively. Its P/Cash is valued at 6.21.

Read Full Story »»»

DiscoverGold

DiscoverGold

At Critical Support, Is It A Break Or Bounce?: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | March 6, 2020

On Thursday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of -4.40% and closed at $39.57

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 168.27B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of -4.40 in a total of its share price and finished its trading at 39.57.

Cisco Systems, Inc. institutional ownership is held at 74.50% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.26, 14.36 and 4.72 respectively. Its P/Cash is valued at 6.22.

The stock has observed its SMA50, which is now -15.44%. In looking at the SMA 200, we see that the stock has seen a -20.13%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 31.50%, 11.70% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.76, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 4.43% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 52.50 while analysts mean suggestion is 2.20.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 4.87% volatile for the week and 2.99% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at -1.17%, resulting in a performance for the month at -16.90%.

Therefore, the stated figure shows a four-month performance of -10.64%, bringing the 6-month working result to -16.38% and YTD performance of -17.49%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.26, and 4.72 respectively. Its P/Cash is valued at 6.22.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tempting to jump in on this as it keeps going down to cheap prices

Cisco Systems plans a new round of layoffs amid an uncertain outlook for the economy

By: Silicon Valley Business Journal | February 28, 2020

A round of job cuts is coming to Cisco Systems Inc. as the company — and nearly all of the rest of the tech industry — faces uncertain economic prospects for the near future.

The Wall Street Journal reports that the networking equipment maker is planning a round of layoffs, but didn’t say how many or what jobs would be affected.

Cisco said it would offer support to employees affected by the layoffs.

Business Journal research shows that, as of August 2019, San Jose-based Cisco — led by CEO Chuck Robbins — employed 14,185 people in Silicon Valley, out of a global workforce of about 74,200. This places it at No. 4 on SVBJ’s List of the largest technology employers in the region, and No. 6 on the List of the largest employers in Silicon Valley overall.

Earlier in February, Cisco reported a 3.5 percent fall in revenue in its latest quarter, ended Jan. 25, and predicted a continuing slowdown in the current quarter along the same lines. It reported $12 billion in revenue for the quarter, in line with analyst predictions, though down slightly from the $12.45 billion in revenue it reported for the same period last year.

Cisco’s stock was valued at $38.72 a share as markets opened on Friday, down from a closing price of $40.04 the day prior — roughly the lowest point it has ever reached in the last year or so. The company currently holds a market cap of $164.38 billion.

The company is currently in the midst of shift toward a software and subscription business model, which has resulted in a number of high-level departures in recent years. In December, Cisco unveiled a slate of silicon, software and router products that one executive said were “so significant and expansive, they will change the economics of the Internet for the next generation.”

In January, Cisco also added AMD CEO Lisa Su to its board.

The cuts come amid a time of growing uncertainty for the tech industry and the economy in general. The coronavirus outbreak has sent global markets into a tailspin as governments impose quarantines and companies suspend operations in an effort to stem the spread. Tech companies are also feeling the heat as their supply chains — many of which are rooted in Chinese manufacturing facilities — are disrupted.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco unleashes ‘Thanos’ in hopes for a ‘radical simplification’ of security software

By: MarketWatch | February 24, 2020

SecureX platform, code-named after Marvel villain, combines disparate security products from Cisco and competitors into a single interface

Cisco Systems Inc. is hoping to restore order into a universe of frazzled security professionals through a “radical simplification” that could reduce the number of hungry mouths in a crowded marketplace.

Sound familiar? Well, Cisco CSCO, -2.15% did internally code-name the product “Thanos,” after the Marvel supervillain who believes he will bring order to a resource-taxed universe by randomly killing half its inhabitants. By launch on Monday, the first day of the 2020 RSA Conference for the cybersecurity industry in San Francisco, Cisco had renamed the product SecureX.

In a statement, Cisco said the product “was code-named to demonstrate similar abilities/powers — strength and speed that SecureX can offer to customers.”

Evil connotations aside, the culling spirit of Thanos plays well into what chief information security officers have long been demanding from their products: Ways of simplifying their information-security needs with scarce resources. Cisco said the SecureX platform is a single, cloud-native interface that brings together threat visibility from all Cisco products as well as third-party products in less than 15 minutes.

“The industry has been flooded with thousands of point products that were meant to help customers but instead created unmanageable environments with products that don’t work together, which has created gaps in businesses’ security posture,” Gee Rittenhouse, the head of Cisco’s security business, said in a statement.

Cisco’s pitch is that SecureX is the scalable platform that can simplify the security environment in which companies currently patch together products from up to dozens of vendors. Of course, Cisco — believed to be the largest single security vendor in terms of revenue after years of costly acquisitions — would like to replace many of those products with its own. Cisco said SecureX will be available in June.

“Nearly one-third (31%) of organizations base cybersecurity monitoring and protection on more than 50 different security products,” said Jon Oltsik, senior principal analyst at the Enterprise Strategy Group, in a statement. “This not only adds cost and complexity but also makes it harder to detect and respond to cybersecurity incidents in a timely fashion.”

Cisco and its competitors will gather in San Francisco this week for RSA, which runs through Friday. Verizon Communications Inc. VZ, -0.36% , AT&T Inc. T, -1.43% and International Business Machines Corp. IBM, -2.86% have canceled their plans for RSA due to COVID-19 fears, but conference organizers said in an update Friday that they still expect more than 40,000 attendees.

Over the past 12 months, Cisco shares have declined nearly 8%, while the ETFMG Prime Cyber Security ETF HACK, -2.09% has advanced more than 11%. In comparison, the Dow Jones Industrial Average DJIA, -0.78% , of which Cisco is a component, has risen 12%, the S&P 500 Index SPX, -1.05% has grown 20% and the tech-heavy Nasdaq Composite Index COMP, -1.79% has advanced 28%.

Read Full Story »»»

DiscoverGold

DiscoverGold

A better Deal:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | February 14, 2020

On Thursday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of -5.23% and closed at $47.32

EPS growth is a significant number as it suggests the performance of a company. It is generally exposed as a percentage and is then referred to as the E-P-S growth rate. Growth in E-P-S is an essential measure of administration performance because it shows how much money the company is making for its investors or stakeholders, just not changes in profit but also after-effects of issuance of new shares (this is especially important when the growth comes as a result of acquisition).

Cisco Systems, Inc., NASDAQ: CSCO):

Cisco Systems, Inc., belongs to the Technology sector and Communication Equipment industry. The company’s Market capitalization is 203.76B with the total Outstanding Shares of «Outstanding». CSCO stock construct a change of -5.23 in a total of its share price and finished its trading at 47.32.

Cisco Systems, Inc. institutional ownership is held at 75.50% while insider ownership was 0.10%. As of now, CSCO has a P/S, P/E and P/B values of 3.92, 17.41 and 5.83 respectively. Its P/Cash is valued at 7.27.

The stock has observed its SMA50, which is now 0.32%. In looking at the SMA 200, we see that the stock has seen a -5.87%..

Profitability ratios:

Looking into the profitability ratios of CSCO stock, an investor will find its ROE, ROA, ROI standing at 30.20%, 11.30% and 20.80%, respectively.

Earnings per Share Details of Cisco Systems, Inc.:

The E-P-S of CSCO is strolling at 2.72, counting Earning per Share growth this year at 30.30%. As a result, the company has an earning per share growth of 4.91% for the next year.

Given the importance of recognizing companies that will make sure earnings per share at a high value, we later obsession to umpire how to recognize which companies will get high amassing standards. One major show off to recognize high annual net index count combined of all companies, which are to mention the companies that have demonstrated such build up beyond the p.s. 5 to 10 years.

We can’t have too much stability the once will always reflect the difficulty, but practically United State stock exchange which has grown earnings per allowance sharply in the after are an excellent results makes a continuing effect is a finding of continues struggle.

Analyst’s mean target price(TP) for the company is 52.30 while analysts mean suggestion is 2.30.

A beta(B) factor is used to measure the volatility of the stock. The stock remained 1.97% volatile for the week and 1.63% for the month.

Historical Performance Of CSCO In The News:

Taking a look at the performance of Cisco Systems, Inc. stock, a stockholder knows that the weekly performance for this stock is valued at -2.81%, resulting in a performance for the month at -0.98%.

Therefore, the stated figure shows a four-month performance of -2.17%, bringing the 6-month working result to -6.50% and YTD performance of -1.33%. As of now, Cisco Systems, Inc. has a P/S, P/E and P/B values of 3.92, and 5.83 respectively. Its P/Cash is valued at 7.27.

Read Full Story »»»

DiscoverGold

DiscoverGold

This POS is much closer to its 52 week LOW than it is to its 52 week HIGH . . . all while the markets are booming!

Guidance Cut Buries Cisco Stock

By: Schaeffer's Investment Research | February 13, 2020

• Analysts have weighed in bullishly and bearishly today

• Cisco attributed global economic uncertainty to the forecast cut

The worst Dow stock so far this morning is Cisco Systems, Inc. (NASDAQ:CSCO), down 5.4% to trade at $47.25. While the tech giant reported second quarter earnings and revenue that topped analyst forecasts, the company warned of a larger-than-expected third quarter revenue drop of 1.5% to 3.5%. Cisco attributed the surprise drop to global economic uncertainties that will slow tech investments.

Analysts have begun to weigh in. Three brokerages have cut their price targets, the lowest coming from Credit Suisse to $45 from $46. However, Instinet and Cowen both raised their price targets to $47 and $60, respectively. More broadly, analysts hold a bullish tilt toward the equity, with 14 out of 20 in coverage rating it a "buy" or better, coming into today.

Just yesterday, Cisco stock had closed atop its 320-day moving average for the first time since late September. Now, the shares have given this trendline back, as well as their 12-month breakeven level. And if you're looking for additional explanation behind today's pullback, look no further than CSCO's 14-Day Relative Strength Index (RSI). It closed yesterday at 63, on the cusp of overbought territory -- indicating today's dip may have already been in the cards.

What's interesting to note is CSCO has been more volatile than expected during the past 12 months. This is based on its Schaeffer's Volatility Scorecard (SVS) of 87 (out of 100.)

Read Full Story »»»

DiscoverGold

DiscoverGold

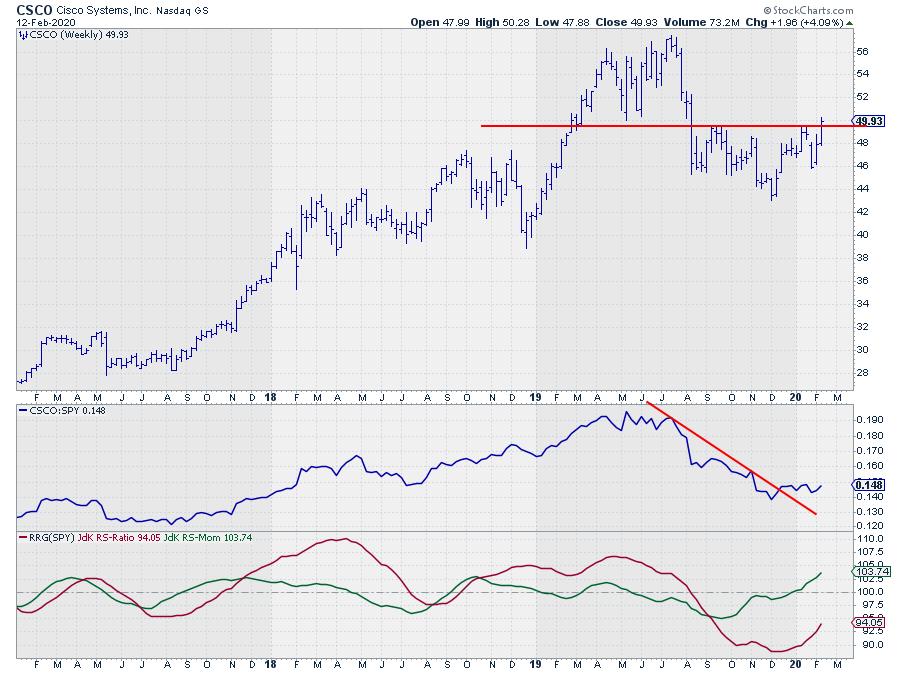

Opposite Rotations Suggest an Outperformance for CSCO over WMT in Coming Weeks

By: Julius de Kempenaer | February 13, 2020

* (Click Read Full Story »»» at the bottom of the page for the charts to appear on the post)

CSCO peaked in the first half of 2019. The first time at $ 56.30 in April and then again in July at $ 57.40. A typical failure to convincingly break above a previous high. From July onward CSCO moved lower to a low around $ 43 at the start of December.

The formation that triggers my interest is the inverted H&S like pattern that traced out after the first steep drop.

This stock also caught the attention on the Relative Rotation Graph for Dow components, where it is positioned inside the improving quadrant and travelling towards leading at a strong RRG-Heading.

At the same time we find WMT inside the lagging quadrant and travelling further into it.

The price chart of WMT also looks quite the opposite of CSCO with a potential top being put into place and price now struggling to hold at or above the rising support line.

The relative strength of WMT (vs SPY) is sending a very clear signal. The upward trend has been broken and the most likely move is further down.

This opposite rotation on the RRG in combination with strong, for CSCO, and weak, for WMT, price charts make a direct comparison between these two stocks interesting.

The ratio of CSCO vs WMT shows a rally out of its December low which has taken out two previous highs after which a first higher low has been set. At the moment the ratio is pushing against the early Jan high and a break of that level will very likely ignite more upside.

The positive divergence between the ratio and its RSI is supportive for a further move higher, which makes an outperformance of CSCO over WMT in coming weeks likely.

-- Julius

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco Reports Earnings on Wednesday: 5 Important Things to Watch

By: TheStreet | February 11, 2020

• Telco orders, IT hardware demand and software sales are among the things to keep an eye on as Cisco reports.

Cisco Systems’ (CSCO) stock has mostly been treading water since the networking giant issued light guidance in November, and remains more than 15% below its mid-2019 highs.

That probably spells tempered expectations going into Cisco’s January quarter (fiscal second quarter). Currently, the consensus among analysts polled by FactSet is for revenue of $11.97 billion (down 4% annually) and non-GAAP EPS of $0.76 (up 4% with the help of stock buybacks).

For the April quarter -- Cisco provides quarterly guidance within its reports -- the consensus is for revenue of $12.63 billion (down 2.5%) and EPS of $0.80 (up 2.5%).

Here are a few things to watch as Cisco reports after the bell on Wednesday and hosts an earnings call at 4:30 P.M. Eastern Time.

1. Service Provider Demand

Weak demand from telcos has been weighing on Cisco’s sales lately. Total service provider product orders, a large portion of which are believed to involve routers, fell 13% annually in the October quarter, following a 21% drop in the July quarter. Comments made this earnings season by hardware and chip suppliers with strong exposure to this space, such as Juniper Networks (JNPR), Nokia (NOK) and Xilinx (XLNX), suggest telecom capital spending remains under pressure (mobile infrastructure spending particularly).

In addition to its service provider orders, keep an eye out for any comments made the initial reception Cisco has seen for its efforts (announced in December) to supply switching/routing processors and optics on a standalone basis to major cloud service providers, a group of companies that have grown their capex considerably in recent years and which Cisco has relatively limited exposure to.

2. Enterprise Hardware Demand

Enterprise hardware sales have also been under pressure lately. In the October quarter, Cisco’s enterprise product orders fell 5%, while its giant Infrastructure Platforms segment, which covers its core hardware franchises and related software, saw revenue drop 1% thanks to both corporate and service provider sales pressures.

Infrastructure Platforms has a low bar to clear for the January quarter: The consensus is for its revenue to be down 8% to $6.58 billion. Cisco’s Catalyst 9000 switch family, which launched in mid-2017 and supports a slew of innovative software features, has been a bright spot for the segment.

3. Security Sales

Though much smaller than Infrastructure Platforms, Cisco’s Security segment was a strong point in the October quarter, with revenue growing 22% thanks to both organic growth and the Oct. 2018 Duo Security acquisition. With Cisco having lapped the 1-year anniversary of the Duo deal, the consensus is for Security revenue to be up 13% in the January quarter to $742 million.

4. The Shift Towards Software

While enterprise IT and telecom hardware spending are under pressure, the good times continue for the enterprise software market. That in turn might help Cisco beat subdued analyst forecasts for its Applications segment, which among other things covers the AppDynamics application performance monitoring (APM) business and the WebEx collaboration software business. Currently, the consensus is for Applications revenue to be down 3% to $1.43 billion.

In November, Cisco disclosed that 71% of its software revenue (whether from Applications or other segments) involved subscriptions, up from 59% in the year-ago quarter. That number might have risen again in the January quarter.

5. Stock Buybacks

Cisco spent $768 million on stock buybacks in the October quarter -- a relatively modest sum by the company’s standards. With Cisco possessing $15 billion in net cash (cash minus debt) and expected to produce over $13 billion in free cash flow this fiscal year, the company has a lot of leeway to spend more on buybacks if it wishes.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cisco Analysts Approach Stock With Caution Before Second-Quarter Report

By: TheStreet | February 10, 2020

• Cisco Systems analysts are taking a cautious approach to the networking giant, which on Wednesday is scheduled to report fiscal-second-quarter earnings.

Analysts are taking a cautious approach to Cisco Systems (CSCO), which on Wednesday is scheduled to report fiscal-second-quarter earnings.

Shares of the San Jose, Calif., networking company at last check were up 0.9% at $48.41. The stock is little changed in 2020. It's up 11% from its 52-week low of $43.40, set in early December.

Wall Street is expecting Cisco to report earnings of 76 cents a share for the quarter ended Jan. 25.

Morgan Stanley analyst Meta Marshall, who rates the stock equal weight with a $50 price target, expects Cisco met or slightly outperformed the consensus.

"With Cisco returning to pre-fiscal-first-quarter-print levels, we think improved macro data points since November have been digested by the market today," Marshall said in a note to investors.

"Our reseller checks were also indicative of a more stable spending environment heading into the quarter end, and we see less downside risk heading on Cisco's fiscal-second-quarter print."

Marshall added, however, that "what keeps us from taking a more positive view is ... that improved data points and channel feedback are more reflective of stabilization vs. ability to turn to growth, leaving [the] current valuation about appropriate."

Marshall could turn more positive if Cisco "were to see more pull-through of growth from acquired companies into core networking categories; or if IT-spending trends reaccelerated. We could turn more negative if enterprise-spending intentions begin to meaningfully turn negative."

Piper Sandler analyst James Fish, who rates the stock neutral with a $50 target, said in a research note that "we are expecting a 'typical' Cisco quarter in the fiscal second quarter, after management significantly lowered expectations last quarter and in which the company slightly beats expectations."

"The stock lacks a catalyst and will remain pressured by the cyclical slowdown," Fish said. "[And] as such, ... investors should look to other plays like F5 (FFIV) that have catalysts, are growing faster and going through a faster software transition, and trades at a lower valuation."

Fish said that given the continuation of issues around the business-cycle slowdown and macro issues, he expected Cisco to "guide to -4% to -2% year-over-year growth ($12.57 billion vs. Wall Street's $12.63 billion) that implies another estimate cut is likely to occur."

In November, Cisco posted stronger-than-expected fiscal-first-quarter earnings. But it said uncertain conditions would hit client orders in the months ahead in what CEO Chuck Robbins called "a challenging macro environment."

Read Full Story »»»

DiscoverGold

DiscoverGold

Everything A Value Investor Could Want:: Cisco Systems, Inc., (NASDAQ: CSCO)

By: NyseStockAlerts | February 7, 2020

On Thursday Shares of Cisco Systems, Inc., (NASDAQ: CSCO) generated a change of 0.50% and closed at $48.69