| Followers | 679 |

| Posts | 141019 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Monday, April 06, 2020 3:25:29 PM

By: Lyn Alden Schwartzer | April 2, 2020

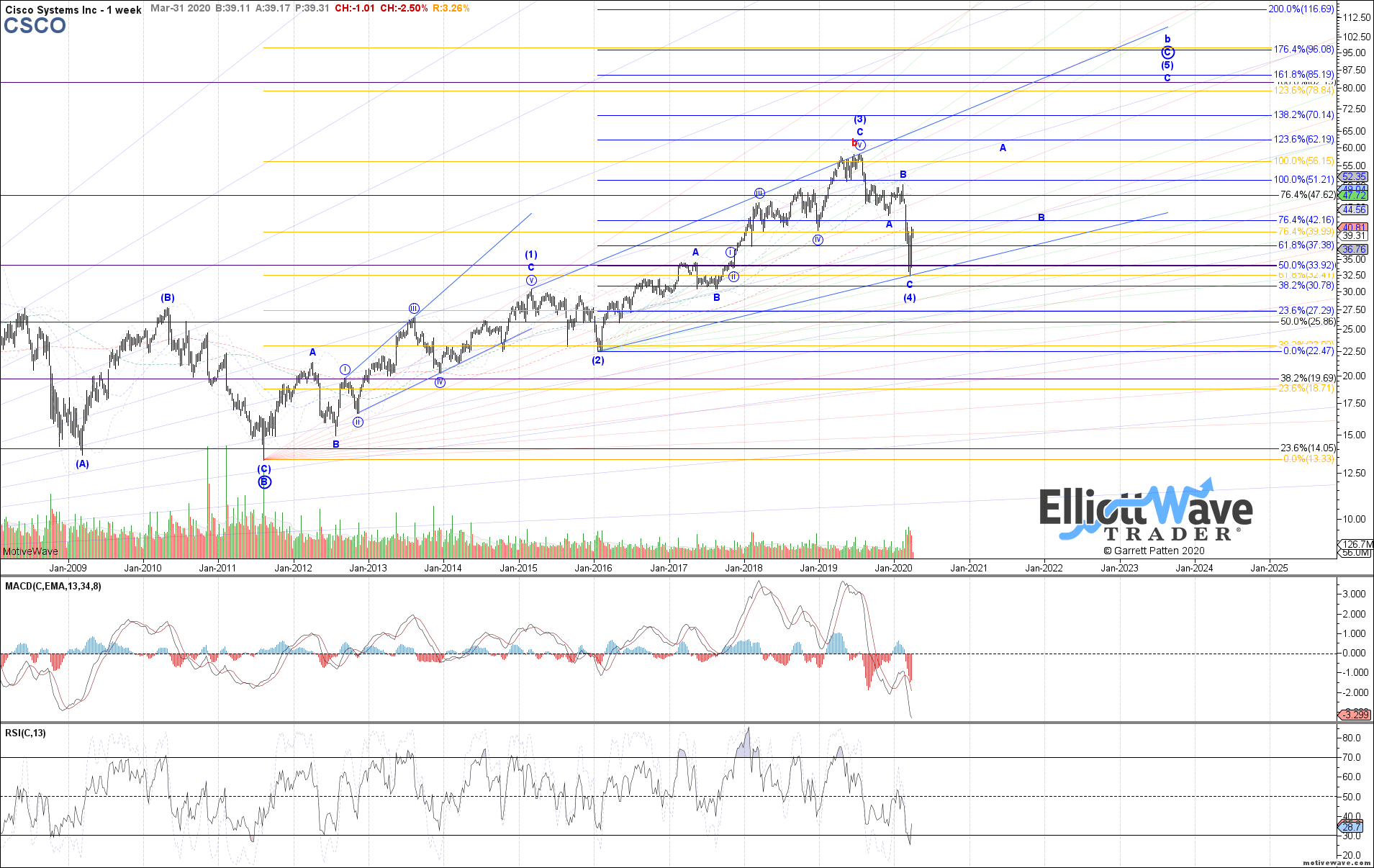

Following the Elliott Wave analysis:

Cisco (CSCO) stock is pretty interesting at current prices. The technical/sentiment analysis has been a bit mixed between our Elliott Wave analysts, but I think solid fundamentals represent a reasonable tiebreaker here. Count me in the long-term bullish camp.

The Valuation

Unlike many stocks, Cisco was in a downtrend before this virus/recession struck. The stock topped out in mid-2019 in overvalued territory based on over-optimistic assumptions, and then began to fall back down to what I would consider approximately fair value relative to its growth rate, opportunities, and risk. The virus, economic shutdown, and broad market crash then of course pulled it still lower.

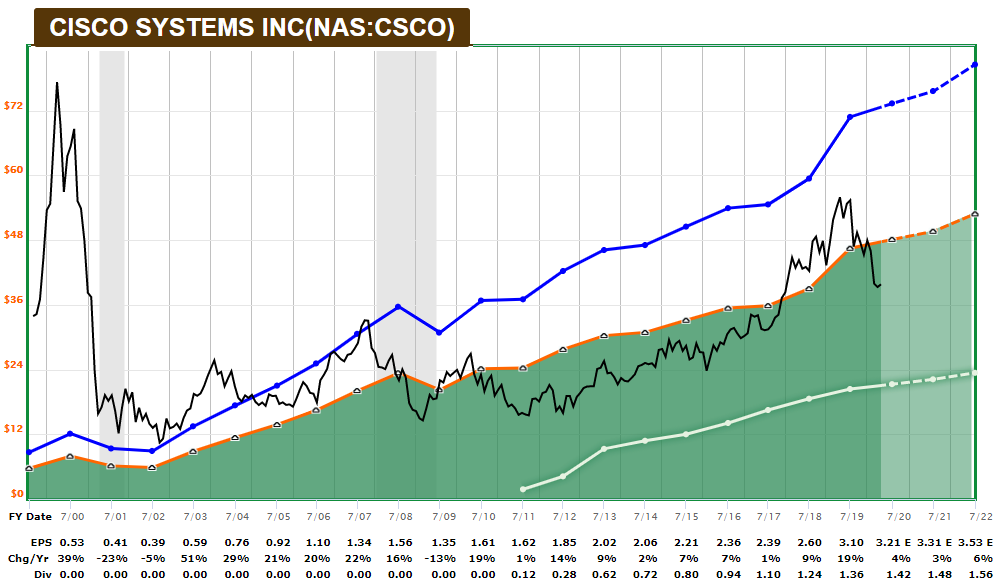

Two decades ago, Cisco was one of the quintessential dotcom bubble stocks. The long-term F.A.S.T. Graph shows the magnitude of how its stock price outpaced fundamentals back then:

Since then, the stock itself never reached that level again due to obscene overvaluation, but the company itself has done very well. Their revenue and earnings have continued to grow, and within the past decade they initiated a growing dividend as well.

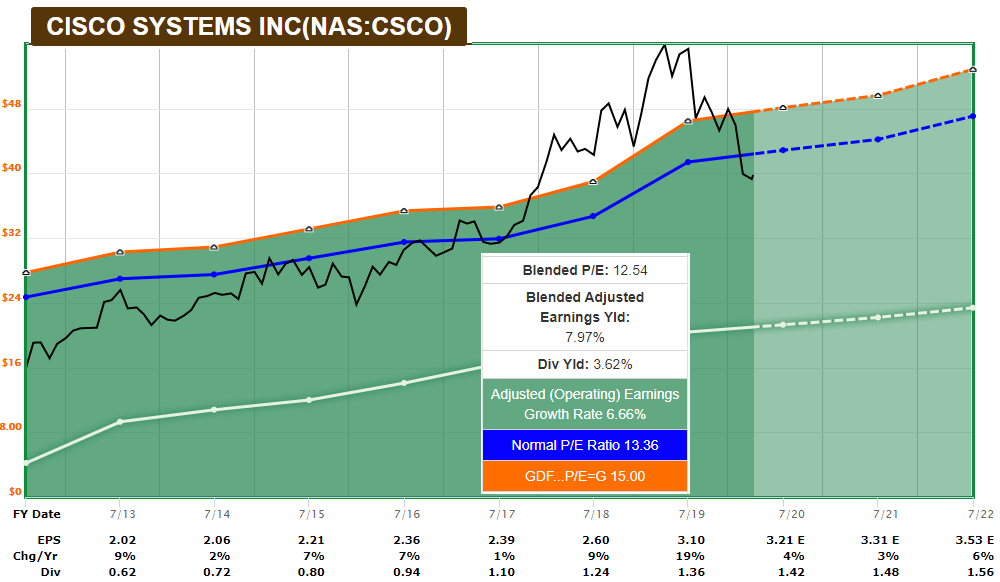

Here is a look at the more recent F.A.S.T. Graph, which re-sets the lines based on more recent data within the selected timeline:

Before the virus, analysts were looking for 5% annual growth for the next 3 years. Now the estimates are a couple percent lower, but forward estimates for the next year or two need to be taken with a grain of salt in this environment, for better or worse. We’re in depression conditions with ten million Americans unemployed in 2 weeks with an unusual viral event and economic shutdown response.

The company makes over $11 billion in net income per typical year, and its annual free cash flow levels tend to be even higher. Last year, free cash flow was over $14 billion. The trailing price to earnings ratio is around 15x, and the trailing price to free cash flow ratio is a little over 12x.

The dividend yield is currently around 3.6%, meaning the stock can provide solid total returns even with modest growth, and is a nice candidate for a dividend growth portfolio.

The Transition

Cisco is a business in transition. They are the worldwide leader in network switches and routers, which form the hardware backbone of the internet. They also make wifi hardware and a variety of other networking equipment, and have a large business in network security, VOIP software, IoT, and other areas.

The key risk for the company is that network switches and routers have become somewhat commoditized, especially as many things shift towards the cloud.

Many of the hyperscale datacenter companies (think the FAANG stocks and Microsoft) now use their own white-box network equipment, sourced from the same chip providers that Cisco sources from, including Broadcom (AVGO). Basically, these hyper-cap companies are far bigger than even Cisco (which itself is a mega-cap stock), so it’s cost-effective for them to make their own.

Some smaller businesses choose to use generic switches and routers as well. So, Cisco needs to differentiate itself.

Over the past few years, Cisco has been shifting more towards software and subscription revenue, particularly with their highly-successful Catalyst 9000 set. Rather than just sell networking hardware, they are transitioning to selling hardware that comes with an annual payment to receive various support and software.

This business transition for such a large company comes with risks. Revenue has been relatively flat, but operating margins have been on the rise after bottoming back in 2014. After the company completes its transition, it should be able to boost revenue growth a bit, although there is execution risk for the company.

The IoT opportunity is a long-term additional speculative growth area for the company, as it will take a lot of networking equipment and software to tie that all together for enterprises. Cisco has a nice place in this market unless they drop the ball.

Despite not being a very cyclical stock or very hard-hit by the virus yet, the company is doing layoffs at some level to trim where appropriate and keep costs under control.

The Balance Sheet

Cisco is a financial fortress, with one of the best corporate credit ratings; AA- from Standard & Poor’s.

As of the most recent quarter, Cisco has $27 billion in cash-equivalents and $16 billion in total debt, meaning they are net-debt free and have a ton of liquidity. This also gives them ongoing ability to buy competitors or bolt-on hardware and software technologies.

The Technicals

In terms of sentiment, Garrett sees Cisco as potentially already having bottomed in this cycle, with the potential to double within five years in addition to annual dividends:

I don’t know how it’ll play out in detail, but considering the fundamentals, it looks like reasonable, at last for the higher-end of possible outcomes.

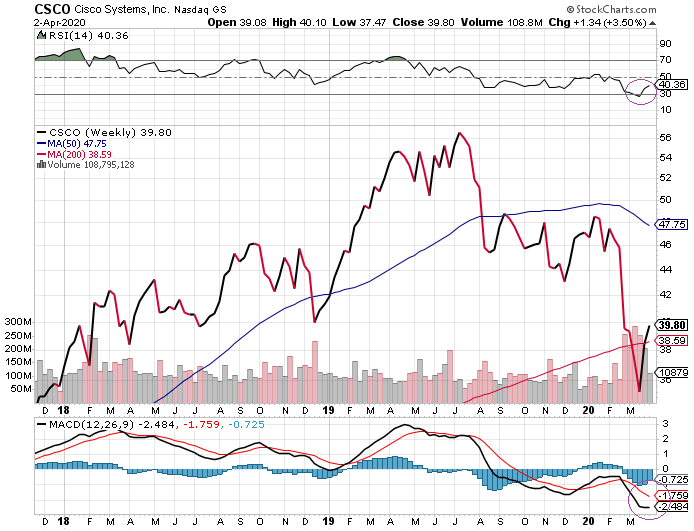

From a basic technical view on the weekly chart, the company recently reached oversold levels on the weekly RSI indicator, and has turned up but remains relatively depressed, which gives a nice runway for further increases.

MACD on the weekly chart is also very low, but with early signs of it starting to form a base. MACD hasn’t formed a bullish crossover yet on the weekly chart, but the 12-week line is starting to flatten its curve at least.

It’s of course still possible that Cisco could sell-off deeper, especially if the overall market turns down again, which is my base case probability.

However, now that the initial “Oh god sell everything!” margin call phase of this bear market with breathtaking volatility is seemingly done with for now, sell-off days seem more selective in nature, and Cisco is a stock that I suspect will hold up better than the broad market from here. We’ll see...

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent CSCO News

- BHP Bids $38.8 Billion for Anglo American; Biden Unveils Historic Micron Technology Deal, and More News • IH Market News • 04/25/2024 11:48:40 AM

- Cisco and Morgan Solar unlock clean energy adoption in office spaces • GlobeNewswire Inc. • 04/22/2024 03:00:54 PM

- Li Auto Stock Drops 7.3% Amid Tesla Price Cuts, Salesforce Retreats from Informatica Deal, and Other Market Updates • IH Market News • 04/22/2024 12:09:21 PM

- Cisco Reimagines Security for Data Centers and Clouds in Era of AI • PR Newswire (Canada) • 04/18/2024 07:00:00 AM

- Cisco Reimagines Security for Data Centers and Clouds in Era of AI • PR Newswire (US) • 04/18/2024 07:00:00 AM

- Cisco Completes Acquisition of Isovalent to Define the Future of Multicloud Networking and Security • PR Newswire (US) • 04/12/2024 10:35:00 PM

- Cisco to Host Tech Talk on Splunk • PR Newswire (US) • 04/10/2024 08:30:00 PM

- FMP Alliance Forms to Advance Innovative Fault Managed Power Technology • PR Newswire (US) • 04/08/2024 01:15:00 PM

- Cisco and BoA to Host Tech Talk on Security from RSA 2024 • PR Newswire (US) • 04/04/2024 12:00:00 PM

- Leading Companies Launch Consortium to Address AI's Impact on the Technology Workforce • PR Newswire (US) • 04/04/2024 11:30:00 AM

- Analysts’ Recommendations for March 27th: FedEx, Visa, Uber, Adobe… • IH Market News • 03/27/2024 12:13:10 PM

- Cisco Study Reveals Very Few Organizations in Canada Prepared to Defend Against Today's Rapidly Evolving Threat Landscape • GlobeNewswire Inc. • 03/27/2024 10:00:00 AM

- Cisco Study Reveals Very Few Organizations Prepared to Defend Against Today's Rapidly Evolving Threat Landscape • PR Newswire (US) • 03/27/2024 07:17:00 AM

- Cisco Hybrid Work Study Reveals Companies' Need to Modernize Offices • PR Newswire (US) • 03/26/2024 03:00:00 PM

- Cisco and Ford Motor Company Rollout Webex App for Productivity on the Move • PR Newswire (US) • 03/26/2024 03:00:00 PM

- Cisco Furthers Customer Experience Momentum with New Offerings That Extend Customer Value • PR Newswire (US) • 03/26/2024 03:00:00 PM

- Cisco Announces New Multifunctional Collaboration Devices for Hybrid Work • PR Newswire (US) • 03/25/2024 03:00:00 PM

- Cisco Completes Acquisition of Splunk • PR Newswire (US) • 03/18/2024 12:40:00 PM

- Cisco Completes Acquisition of Splunk • PR Newswire (Canada) • 03/18/2024 12:30:00 PM

- Cisco Completes Acquisition of Splunk • PR Newswire (US) • 03/18/2024 12:30:00 PM

- Adobe Stock Drops Following Below-Estimate Projections, Cardlytics Surges with Unexpected Profit, and More News • IH Market News • 03/15/2024 11:30:55 AM

- Cisco and Raymond James to Host a Tech Talk at OFC 2024 • PR Newswire (US) • 03/13/2024 12:00:00 PM

- RAI Amsterdam Selects Cisco and Radware for Cloud Security • GlobeNewswire Inc. • 03/13/2024 10:00:00 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/11/2024 08:32:23 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/07/2024 09:21:02 PM

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM