Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Which is why you’ve made yourself a moderator and get alerted to every post made here. Just casually popping in for fun. Terrible liar.

It doesn’t need to be. I’m merely highlight the plain fact that someone who puts money into the OTC and AAPL probably has the same chance of getting a 100% return in 5-10 years. It’s a plainly observable fact.

I was, as you know, quoting a source. And while that is true generally, it doesn't take into account the fact that CRGP has been grey for years.

I think it'd be fair to say that that inhibits price discovery.

You wrote/quoted this in an earlier post.

All else being equal, more liquid assets trade at a premium and illiquid assets trade at a discount.

It's so much fun here LOL

'Fraid not. I'm just here for fun.

When buying can happen in the US we sky rocket.

Seeing Janice here keeps me positive no better basher on ihub so her time here is valuable. She could be on some other high risk loss potential stock but she's here instead for the last 2plus years. It says alot of CRGA potential

only sensible thing I've heard you say in awhile. I would agree with your sentiment for anything but CRGP

LOLOL!! "Outside the U.S." excludes about 99% of the people who might be remotely interested in buying or selling CRGP.

How do we know that CRGP is trading at a discount.

Who said it was? I think it's trading at a large premium to what it's worth, which is nothing.

Correct me if I'm wrong, but I thought that when a sell order comes through for CRGP, it is sold quickly.

How could any of us possibly tell? We aren't MMs. And there is no Level II, because it's Grey/Expert.

In reality, FINRA is well run and is also a necessity, unless you want total chaos in our capital markets.

The exchanges are also SROs, you know. But they're okay?

Most people would be waiting 5-10 years to see a 100% return on a company as solid as AAPL...

I can't think of a SINGLE OTC company that turned out to be "as solid as AAPL". Not one. Over a period of 30 years.

And if there are, or have ever been, companies even a little like that, they do not have a history of fraud.

Hence why they attach themselves to MMTLP. This a way of sprucing up their dirty room.

Not a good way. MMTLP is a ridiculous story. For openers, MMTLP stock no longer exists. It was always meant to be cancelled.

It does seem to me that CRGP is liquid because selling and buying (not in the U.S.) are taking place the same day the sell order comes in or the buy order comes in (except there is no buying allowed in the U.S.).

Janice is literally trying to say anything that will distract from the fact that CRGP is actively trading and shares CAN be bought at the ask and sold at the bid with instant execution. Her opinion is that because US brokers have restricted their clients from buying, that the stock is somehow "illiquid"...even though one thing has nothing to do with the other. The bid/ask spread and the Expert Market status are also irrelevant. CRGP can be sold by anyone willing to accept the bid price and can be bought by anyone (outside the US) that is willing to accept the ask price. That is liquidity.

Thanks for that explanation. I didn't say that CRGP was GREY or PINK. How do we know that CRGP is trading at a discount. Maybe it's trading at fair value or maybe it's overpriced (that is if it is worthless). You are right that many/most smaller companies have a bigger bid/ask spread. I have owned shares in small companies that have had very low or no volume most days and I have had difficulty selling the shares. Correct me if I'm wrong, but I thought that when a sell order comes through for CRGP, it is sold quickly. I do know that the amount that it's sold for has varied in the last few months between .0001 and .0008, but, I believe, there are times that the bid and ask price are the same or very close to the same.

Thanks again.

A broad ruling finding industry SROs incompatible with nondelegation doctrines, for instance, could render unenforceable large swaths of the stock exchange, clearing agency, and broker-dealer laws that enable American capital markets to operate. Declaring SROs unconstitutional would unravel economic power structures. In addition, a court decision declaring a keystone SRO unconstitutional could have enormous market impacts. Lol

But you're trying to convince people to dump the junk that are all sitting on house money because the DIVY payout back then. I doubt anyone here that actually holds shares has any real incentive to sell unless they just want it cleared off their screen.

You realize waiting 5-10 years on a stock to produce a 100-1000% return is a good investment right? That’s part of the allure of the OTC. Of course there are loads of get rich quick folks in the OTC who want a 5 bagger overnight, but that’s not reality in most cases. Most people would be waiting 5-10 years to see a 100% return on a company as solid as AAPL if they invested today, so I’m not really sure what your point is. The OTC allows gains to be magnified for patient people with less capital.

100% gains in the OTC literally happen daily and can be pretty easy to find. 500-1000% gains are not uncommon. Most of these tickers just require a long basing period/consolidation and they eventually run. It’s just the reality my friend. You can scan through hundreds of charts and it’s pretty much the same every time.

You realize waiting 5-10 years on a stock to produce a 100-1000% return is a good investment right? That’s part of the allure of the OTC. Of course there are loads of get rich quick folks in the OTC who want a 5 bagger overnight, but that’s not reality in most cases. Most people would be waiting 5-10 years to see a 100% return on a company as solid as AAPL if they invested today, so I’m not really sure what your point is. The OTC allows gains to be magnified for patient people with less capital.

100% gains in the OTC literally happen daily and can be pretty easy to find. 500-1000% gains are not uncommon. Most of these tickers just require a long basing period/consolidation and they eventually run. It’s just the reality my friend. You can scan through hundreds of charts and it’s pretty much the same every time.

Hence why they attach themselves to MMTLP. This a way of sprucing up their dirty room. CRGP the gift that keeps on giving. They basically admit that its a scam but "cycles" prove that scams rise again like them mummy.

You'd think they'd find some new arguments, then.

Yet there are people here waiting 10 years.

every year is a new tax year my friend.

I'm very calm. Its the people who are selling this crap left and right that are unhinged.

as soon as the FBI and congress does their jobs.

In financial markets, liquidity refers to how quickly an investment can be sold without negatively impacting its price. The more liquid an investment is, the more quickly it can be sold (and vice versa), and the easier it is to sell it for fair value or current market value. All else being equal, more liquid assets trade at a premium and illiquid assets trade at a discount.

https://corporatefinanceinstitute.com/resources/accounting/liquidity/]

Or...

Now let’s apply these concepts to the stock market. A stock is considered liquid when its shares can be bought—and sold—quickly with minimal impact on its market price. Large-cap companies traded on the major exchanges are considered to be liquid: They are traded in high volumes, and so the price per share a buyer makes (which is known as the bid) is very close to the price a seller will accept (known as the ask).

Smaller-cap companies, which are traded on smaller exchanges more infrequently than larger-cap companies, usually have higher liquidity risk. That means that the price per share a buyer offers could be very different than the price a seller will accept. This is known as a greater spread. When these kinds of stocks witness a surge in demand, they can also experience a lot of volatility...

https://www.thestreet.com/dictionary/liquidity-market-liquidity

For heaven's sake, CRGP is GREY. That is the opposite of liquid.

Why not call your broker tomorrow, and see what you can sell it for?

If I have something and I can quickly get money for it, it's liquid. If I have a rare artifact that only a few individuals would want to buy, it's not liquid because you can't get money for it quickly. That's the only definition I know. Maybe you'll say I'm stupid and when it comes to stocks maybe I am.

Now concerning CRGP, the debate is whether it's worthless. However, if someone is buying CRGP stock, then it's not illiquid to the seller. Hence, it's liquid since the order is processed very quickly and the seller gets money. However, if buyers dry up, then the stock would be worthless which, I guess, one could say it's illiquid. In this case, I believe the better word is worthless.

If your definition is different than what I explained above, please enlighten me as to your definition of illiquid.

Back at you Upper

So... are we rich yet?

Can we make this happen like soon.

I need a lambo..😛🤣

Thanks!

No, that is not what "liquidity" means in this context.

But if you sell and receive cash for the sale, that is liquidity.

Omfg get a life

Janice is at least good at what she does

This guy is a clown

More lame excuses. The percentage change is not relevant with a ticker like this. It has traded in a consistent and predictable range for 2 years. Volatility is basically zero.

Huh? What’s with the exclamation mark. Stop yelling and calm down. You are quite unhinged.

I could think of more things that are more pathetic. check your net worth.

Think about what you are highlighting! You take yourself way too serious.

Consider the percentage difference between 0.0001 and 0.0007 or 0.0008. If there were a published bid and ask--which there is not, because CRGP is grey--the spread would be enormous, again in percentage terms.

The price does not change dramatically. It has ping ponged around the same general range for a couple years. Volatility is non-existent.

At least he “likes” all of his own posts.

You were born about 7 months ago on IHub and you have yet to get 1 follow

Bahahaha

That’s pathetic

I don’t think she is dumb at all

Quite the contrary

She’s very good at pushing buttons

If someone that is not restricted from trading by their broker puts in an order at the bid or ask, it will execute.

That is not a definition of liquidity. This is:

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price.

And CRGP's price changes dramatically just about every time it trades.

But that doesn’t change the fact that it’s not illiquid. If someone that is not restricted from trading by their broker puts in an order at the bid or ask, it will execute. It’s very simple Janice.

And yes, US brokers are most certainly gleeful at the “suckers” whose shares they are able to snag.

You can't call a stock illiquid just because brokers in one country are refusing to execute buy orders.

Oh, and I'll add: CRGP is also a Grey/Expert market stock. They are by definition illiquid. And I'll add that as far as I know, CRGP has never traded anywhere but the U.S. and Canada.

Brokers are still executing sell orders with glee.

That is interesting. How do they express their glee? By giggling? A hearty chuckle? Or do they laugh out loud and exclaim, "Another sucker!"?

I knew one of you dumbos were going to bring up the classic "tax relief" excuse despite the fact that it is January and end of year selling for tax purposes has passed. There is nobody selling now that wasn't selling in December or before.

Wrong again Janice. The stock only has restricted BUYING in the US because brokers have collectively decided not to permit buying despite no legal or regulatory obligation to put this restriction in place. Brokers are still executing sell orders with glee. You can't call a stock illiquid just because brokers in one country are refusing to execute buy orders. My god you are dumb.

Pffft find a hobby

He has a hobby. This is it.

|

Followers

|

296

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

55214

|

|

Created

|

06/19/12

|

Type

|

Free

|

| Moderators janice shell onehundredmph Cologne9672 | |||

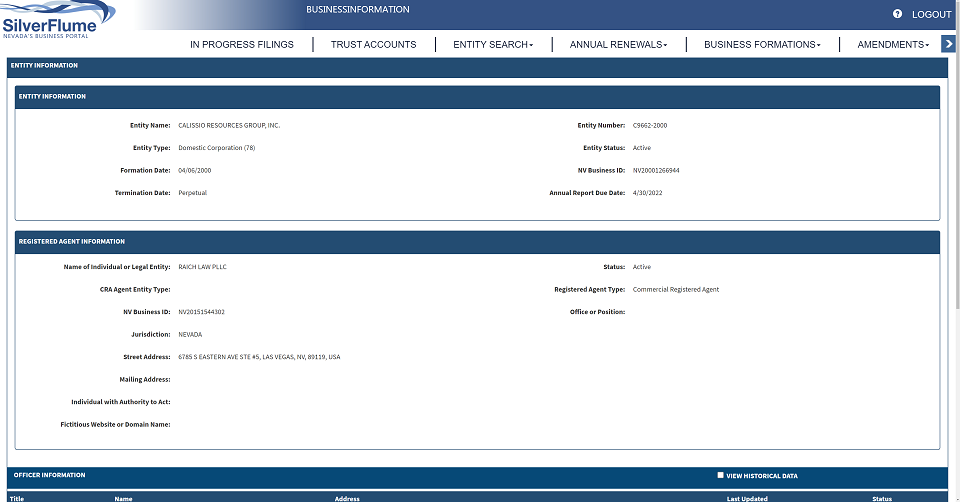

| Certificate of Reistatement - Nevada Department of State |

|

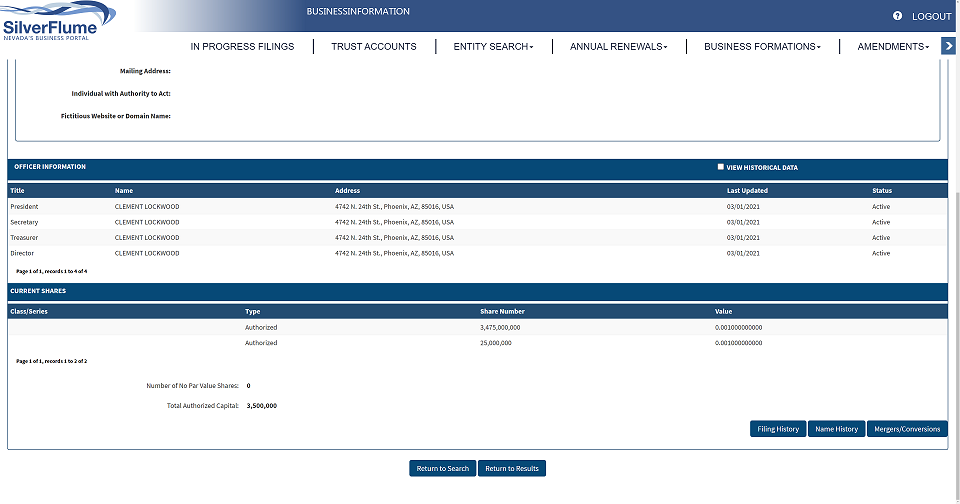

| New Director and Reduction from 145B shares to 3.475B in Authorized Shares |

| 03/01/2021 |

|

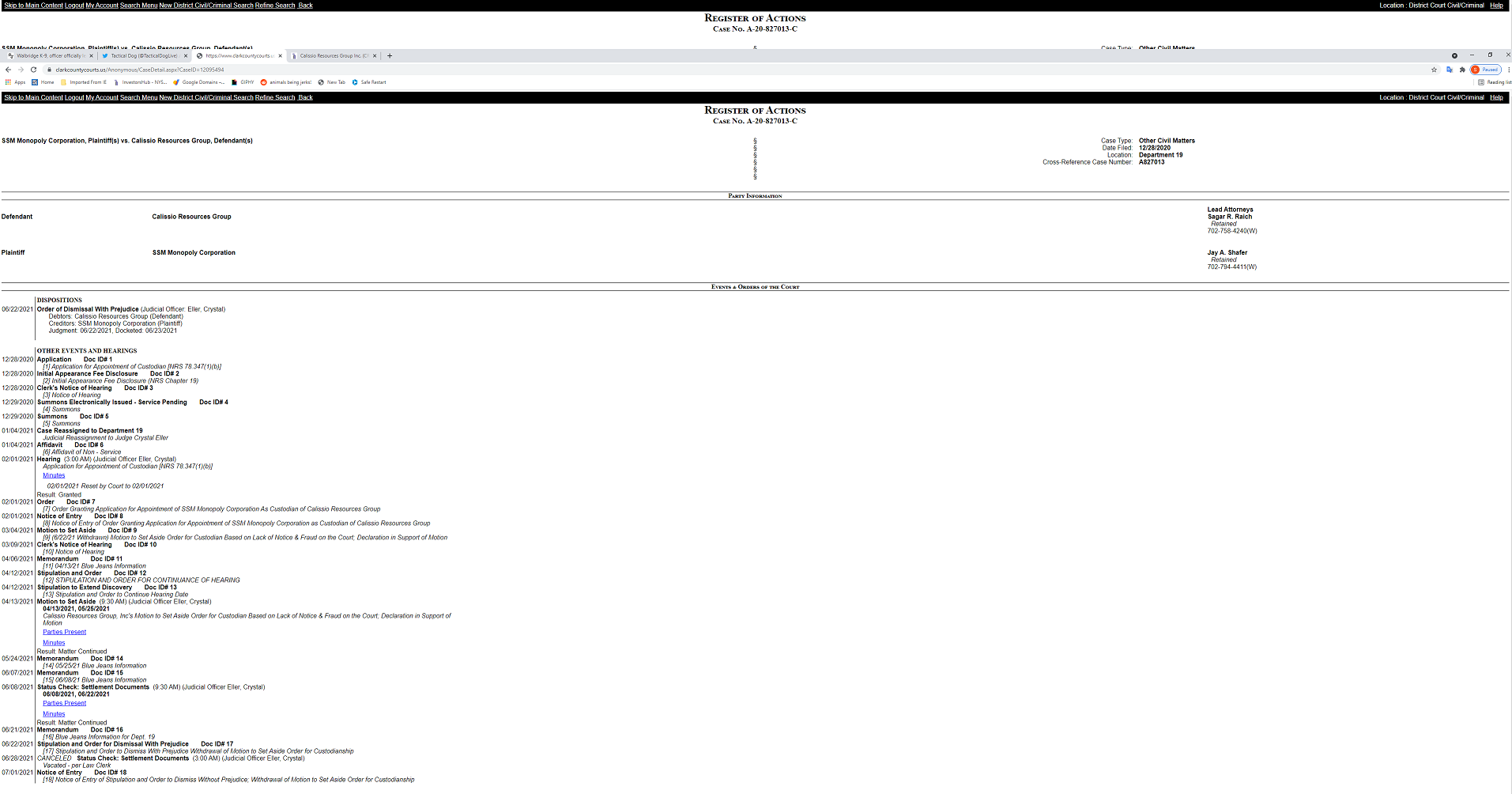

| Battle for custodianship in Clark County court |

|

|  |

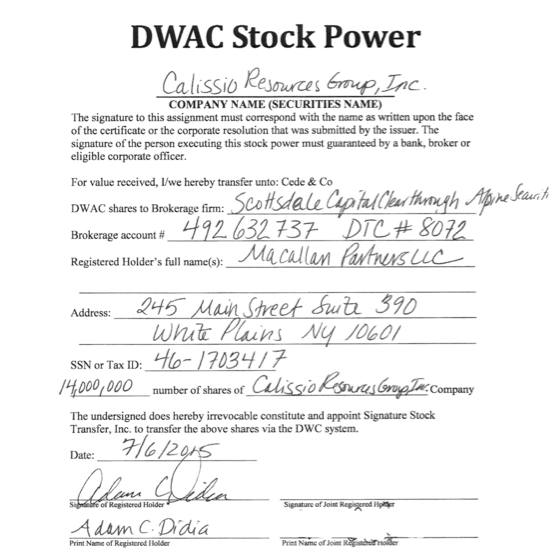

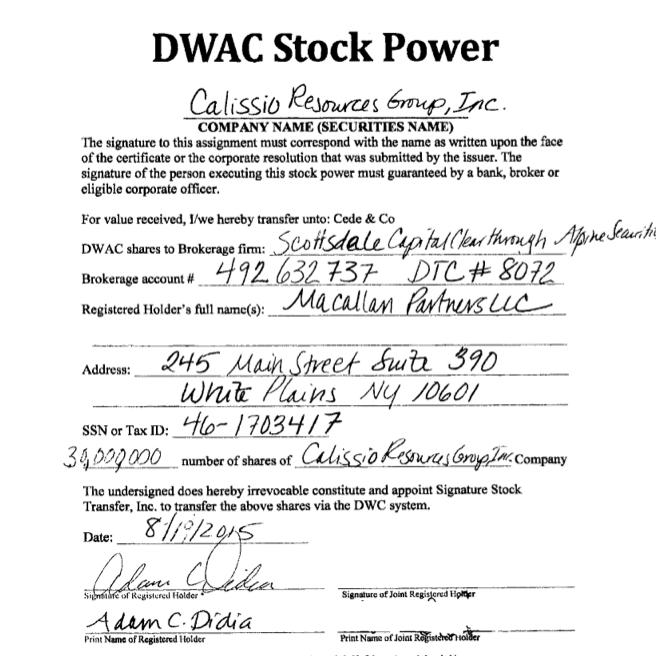

| Fishy Conversions Check: - The "a" in Scottdale, the "3" in 390. - The shifted tail of the 2nd "7" in the account number - The tip of the tail of the "7" can still be seen in the date of the 2nd. document - Portions of the deleted signature covering the same letters in Signature of Holder and Name of Holder. - 2nd. document shows bold letters and lower resolution. Image was scanned and modified. 2nd document is a counterfeit, used to create air shares and dump into the market. Those air shares were not shorted, but behave like shorts. |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |