Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Deninski; Situation Update ~ World War III and the Imminent Collapse of the US Dollar.

Situation Update Published July 16, 2022

https://rumble.com/v1ci0qj-situation-update-world-war-iii-and-the-imminent-collapse-of-the-us-dollar..html

JUDY BYINGTON INTEL: RESTORED REPUBLIC VIA A GCR HUGE UPDATE AS OF JULY 16, 2022 - TRUMP NEWS

Trump News Channel Published July 16, 2022

https://rumble.com/v1chjk7-judy-byington-intel-restored-republic-via-a-gcr-huge-update-as-of-july-16-2.html

UPDATES COMING IN THE NEXT 24H - DONALD TRUMP INITIATED A CONTINUITY OF GOVERNMENT PLAN

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce91j-updates-coming-in-the-next-24h-donald-trump-initiated-a-continuity-of-gover.html?mref=6zof&mrefc=8

Clif High: The Jabbed Are About To Get A Rude Awakening!

Patriot Movement Published July 15, 2022

https://rumble.com/v1ceigp-clif-high-the-jabbed-are-about-to-get-a-rude-awakening.html

BIG SITUATION SHOCKING NEWS & JUDY BYINGTON INTEL UPDATE TODAY 07/11/2022 - TRUMP NEWS

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce7lv-big-situation-shocking-news-and-judy-byington-intel-update-today-07112022-t.html

PRESIDENT DONALD J. TRUMP LIVE FROM PRESCOTT, AZ JULY 22ND, 2022

by RSBN Studio

07/13/22

President Donald J. Trump, 45th President of the United States of America, will be

joined by endorsed candidates, members of the Arizona congressional delegation,

and other special guests on Saturday, July 22, 2022, in Prescott Valley, AZ.

This Save America rally is a continuation of President Trump’s unprecedented effort

to advance the MAGA agenda by energizing voters and highlighting America First candidates and causes.

((( Saturday, July 22, 2022, at 4:00 PM MST )))

President Donald J. Trump, 45th President of the United States of America, Delivers Remarks

https://www.rsbnetwork.com/video/president-donald-j-trump-live-from-prescott-az-july-16th-2022/?mc_cid=d10c22f780&mc_eid=a19c8148b2

Venue:

Findlay Toyota Center

3201 Main St.

Prescott Valley, AZ 86314

Special Guest Speaker:

Kari Lake, Trump Endorsed Candidate for Governor of Arizona

Blake Masters, Trump Endorsed Candidate for U.S. Senate in Arizona

Abe Hamadeh, Trump Endorsed Candidate for Attorney General of Arizona

State Rep. Mark Finchem, Trump Endorsed Candidate for Secretary of State of Arizona

and State Representative from Arizona’s 11th District

Sheriff Mark Lamb, Pinal County Sheriff

Kelli Ward, Chairwoman of the Republican Party of Arizona

Mike Lindell, Inventor and CEO of My Pillow

Timeline of Events:

6:00AM – Parking and Line Opens

11:00AM – Doors Open and Entertainment Begins

1:00PM – Special Guest Speakers Deliver Remarks

4:00PM – 45th President of the United States Donald J. Trump Delivers Remarks

General Admission Tickets:

REGISTER HERE

Request Media Credentials:

REGISTER HERE

All requests for media credentials must be submitted by Thursday, July 14, 2022, at 4:00PM MST.

https://www.rsbnetwork.com/video/president-donald-j-trump-live-from-prescott-az-july-16th-2022/?mc_cid=d10c22f780&mc_eid=a19c8148b2

CDD; SOUND THE ALARM! DECISION SOON? DURHAM MOVES! BIDEN EXPOSURE! NATO EXPOSED! NOW! PRAY!

Trump News Channel Published July 15, 2022

https://rumble.com/v1ce6ot-7.14.22-sound-the-alarm-decision-soon-durham-moves-biden-exposure-nato-expo.html

Are Corrupt Feds Distracting Us From The Truth About Everything? | Justinformed News

Patriot Movement Published July 15, 2022

https://rumble.com/v1cbzon-are-corrupt-feds-distracting-us-from-the-truth-about-everything-justinforme.html

ATTENTION! Dr. 'Judy Mikovits' "WARNING TO HUMANITY" 'David Nino Rodriguez' Interview

AndreCorbeil Published July 12, 2022

https://rumble.com/v1c1qal-attention-dr.-judy-mikovits-warning-to-humanity-david-nino-rodriguez-interv.html

US Navy Revolt Slams Biden Secret Plot To Oust Over 500,000 Troops

https://www.whatdoesitmean.com/index3977.htm

Iran Plotting to Assassinate Trump and Pompeo in Revenge for Soleimani Killing, US Intel Leak Shows

David HawkinsJuly 14, 20222 Comments

https://slaynews.com/news/us-intel-leak-says-iran-plotting-to-assassinate-donald-trump-and-mike-pompeo-in-revenge-for-soleimani-drone-strike/

2000 MULES BY DINESH D’SOUZA DOCUMENTARY - best news here

This is the official 2000 Mules movie.“2000 Mules,” a documentary film created

by Dinesh D’Souza, exposes widespread, coordinated voter fraud in the 2020

election, sufficient to change the overall outcome. Drawing on research provided

by the election integrity group True the Vote, “2000 Mules” offer..

https://bestnewshere.com/2000-mules-by-dinesh-dsouza-documentary/

THE EU FINALLY ADMITS THE VACCINE DESTROYS YOUR IMMUNE SYSTEM COMPLETELY - TRUMP NEWS

Trump News Channel Published July 10, 2022

https://rumble.com/v1bqnvt-the-eu-finally-admits-the-vaccine-destroys-your-immune-system-completely-tr.html

$CH Excellent Video Thanks;

https://live.aflds.org/

God Bless America

Amen

$Codelco raises Europe copper premium by 31% in bullish signal

Bloomberg News | October 11, 2021 | 8:42 am Markets Europe Copper

https://www.mining.com/web/codelco-raises-europe-copper-premium-by-31-in-bullish-signal/

Source: Codelco

Codelco offered to supply copper to European customers at a $128 premium over futures next year, signaling that the world’s biggest copper miner expects strong demand to continue even as growth headwinds swirl.

Codelco boosted its annual premium by $30 a ton, according to a person familiar with the matter who asked not to be identified discussing private information. The offer is $5 higher than the premium announced by leading European producer Aurubis.

SIGN UP FOR THE COPPER DIGEST

The miner made its offer at the start of London Metal Exchange Week, when producers, consumers and traders convene in the U.K. capital to thrash out supply deals for the coming year. While copper demand has been booming, rampant inflation and the burgeoning global energy crisis are casting a pall over the growth outlook. Rising freight rates have also raised costs for suppliers like Codelco.

One key risk for manufacturers is that the global economy shifts into a period of stagflation, where demand in sectors like consumer goods and construction plunges while raw materials prices remain stubbornly high.

Even so, with unprecedented stimulus funding now feeding its way into metals-intensive renewables projects, manufacturers are also conscious of the risk that demand will outpace supply. Nexans, a leading cable-maker, has said it will bulk up in copper recycling to insulate itself against future shortages.

The Codelco premium was earlier reported by Fastmarkets.

(By Mark Burton)

$Nevada Copper Provides Update on Accelerating Stope Production and Ramp-Up Progress and Announces Appointment of Chief Executive Officer

T.NCU

YERINGTON, Nev., Oct. 06, 2021 (GLOBE NEWSWIRE) --

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDD) (“Nevada Copper” or the “Company”) today provided a further update on positive September operational performance at the Company’s underground mine at its Pumpkin Hollow Project (the “Underground Mine”). In addition, the Company is pleased to announce the appointment of Randy Buffington as President and Chief Executive Officer, further strengthening its senior management team as operational productivity and production ramp-up at the Underground Mine.

September Operational Highlights

Higher Copper Production: Copper in concentrate produced during September increased by 265% compared to August driven by higher stope production. Approximately 30,386 tons of ore were processed yielding 682 tons of concentrate at an average grade of 22%, resulting in approximately 150 tons of copper production.

Improved rate of stope turnover: Stoping has accelerated significantly since mid-August, with the second and third stope panels fully mined and a fourth stope panel expected to be mined this week. Further stopes are planned in October and November, and the high-grade Sugar Cube zone is also expected to begin to be mined during Q4.

Increasing Development Rates: September saw the highest monthly development footage achieved since April 2021, with a 12% increase over August. Development activities included completion of the crossing of the water bearing dike, accessing additional stoping zones and installation of development infrastructure. A total of approximately 750 lateral equivalent feet was advanced in September.

Mike Brown, outgoing Interim President and Chief Executive Officer, commented: “I am very pleased to see the improved trajectory in our production ramp-up and a recovery in productivities. The increased ore production was a key objective for September, and together with the improving productivities on site, along with the ongoing management strengthening, provide further confidence in the mine ramp-up.”

Management Update

Randy Buffington will join Nevada Copper as President and Chief Executive Officer with immediate effect. With extensive experience in underground and open pit mining operations, both in Nevada and internationally, Mr. Buffington has successfully delivered multiple project ramp-ups and productivity improvements in an underground setting, in addition to overseeing the development and operation of multiple large open pit projects. Most recently at Hycroft Mining, he was responsible for the operational reforms, successfully executing a project turnaround and delivering significant shareholder value as President and Chief Executive Officer. Previously, he held various senior management positions with Barrick from 2003 to 2012, overseeing North American and Zambian operations. He also held senior management positions with Placer Dome and Cominco.

Mr. Buffington brings a deep industry network in Nevada and a strong track record of value delivery in both operating underground mines and large open pit projects, ideally positioning him to lead Nevada Copper towards the delivery of steady state production from its Underground Mine and realizing the full potential of its fully-permitted open pit project and extensive landholdings within the Yerington Copper District.

“The addition of Mr. Buffington further strengthens the Company’s senior management team and provides deeply experienced, long-term leadership as the Company moves to complete the ramp-up of the Underground Mine and go on to maximize the full value of its open pit project and exploration targets,” stated Stephen Gill, Chairman of Nevada Copper.

“I look forward to working with the team at Nevada Copper as we continue to push and improve productivity and accelerate our transition into a commercial producer,” stated Randy Buffington, President and CEO of Nevada Copper. “There is a tremendous foundation to build on at Pumpkin Hollow and I am pleased to be leading the Company towards realizing its full potential as a mid-tier copper producer.”

Mike Brown will step down as Interim President and Chief Executive Officer and continue his active involvement and oversight through his ongoing role as director.

“On behalf of the Company, I would like to thank Mike Brown for his commitment as Interim President and Chief Executive Officer, and I look forward to his continued active involvement going forward,” stated Mr. Gill.

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., VP Head of Exploration of Nevada Copper, and Neil Schunke, P.Eng., a consultant to Nevada Copper, who are both non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Randy Buffington, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Cautionary Language

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to mine development, production and ramp-up plans.

Forward-looking statements and information include statements regarding the expectations and beliefs of management----expressed or implied by such forward-looking statements or information.

https://nevadacopper.com/site/assets/files/4231/2021-10-06-ncu-nr.pdf

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=166009901

https://nevadacopper.com/news/

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA!

$Nevada Copper Provides Operations and Financing Updates

T.NCU

YERINGTON, Nev., Aug. 31, 2021 (GLOBE NEWSWIRE) --

Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the

“Company”) today provided an update regarding operations at the

underground mine at its Pumpkin Hollow project (the “Underground

Mine”), as well as an update on financing matters. All amounts below

are stated in US dollars.

Operations Update

Stoping and Lateral Development: Development and penetration through the water bearing dike has now been completed on the first crossing. Lateral development beyond this crossing is now into solid ground at a pace consistent with mine plan rates focused on establishing production from the East-North deposit. In addition, with steel support beams recently installed, a second crossing is expected in the coming weeks, further enhancing development rates.

Stoping: The Company has mined the second stope in the Alphabet Zone at a CuEq grade of 1.45% with backfilling scheduled to start in the coming week.

Surface Ventilation Fans: Delivery of the surface fans remains on schedule with installation and commissioning expected to be completed in Q4 2021 with sustainable hoisting rates of 3,000 tpd expected to follow.

“We are pleased to have completed our first crossing of the water dikeenabling our development rates to increase in line with our mine plan expectations,” stated Mike Brown, Interim Chief Executive Officer of Nevada Copper. “We look forward to continued production rate increases in Q3 and Q4 of this year.”

Financing Update

KfW Credit Facility Amendment Discussions: On August 31, 2021, the Company received an extension of the waiver from KfW IPEX-Bank (“KfW”), the Company’s senior project lender, to September 30, 2021 to complete the project completion test (the “Project Longstop Date”) under the amended and restated credit agreement (“Amended KfW Facility”). The Company is in discussions with KfW regarding a longer-term extension of the Project Longstop Date into 2023; deferral of debt servicing by up to twenty-four months; and the deferral of certain financial covenants under the Amended KfW Facility to further support the ramp-up of the Underground Mine. The Company expects to have the proposed extension and amendments finalized in the next month. However, there can be no assurance that such extension and amendments will be finalized by such times or at all. Failure to finalize the extension would result in the Company being in default under the Amended KfW Facility.

Additional $13M of liquidity: The existing Promissory Note provided by Pala Investments Limited, the Company’s largest shareholder (“2021 Promissory Note”) has been amended (subject to regulatory approval) to allow total borrowings of up to $55 million, providing an additional $13 million of liquidity to the Company. Further draws by the Company are subject to agreed use of proceeds. The 2021 Promissory Note has a maturity date of June 30, 2022, and bears interest at 8% per annum on amounts drawn. Pursuant to the amendment, the 2021 Promissory Note now provides for an arrangement fee of 6% on the full commitment amount of $55 million, which will be capitalized. The proceeds will be used to fund the development and ramp-up of the Underground Mine and related working capital needs. The amendment was reviewed and approved by a committee of independent directors of the Company.

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., and Norm Bisson, P.Eng., for Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade underground mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Brown, Interim President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

$B-H; Last Time This Happened Gold Price Soared 25X And Silver Skyrocketed

38X, But Here Is Another Bullish Surprise

July 27, 2021

The last time this happened the price of gold soared 25X and silver

skyrocketed 38X, but here is another bullish surprise.

A Copper Bullish Surprise

July 27 (King World News) –

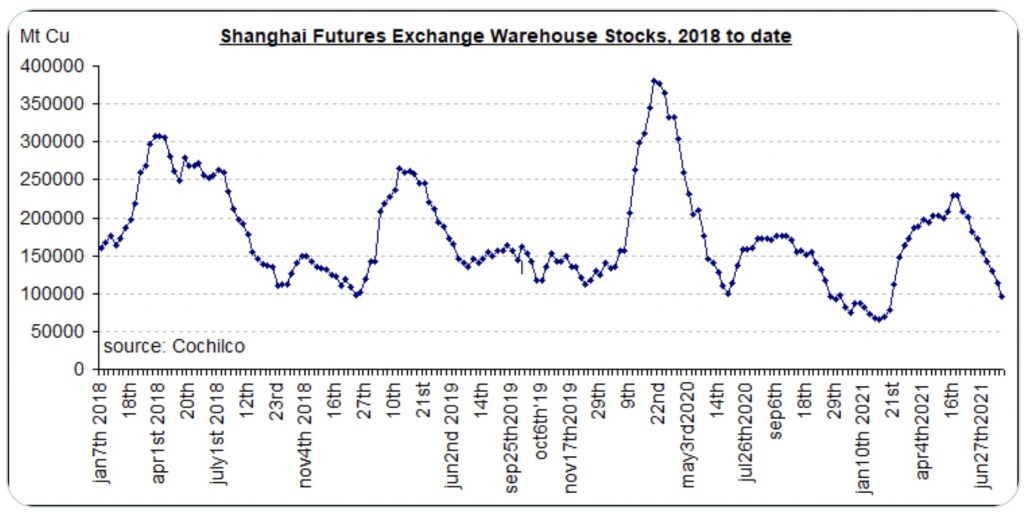

Gianni Kovacevic: Copper warehouse levels Shanghai Futures Exchange:

January 2018 to Summer 2021 (see chart below).

Copper Warehouse Levels Plummeted In Shanghai!

Copper Getting Ready To Takeoff

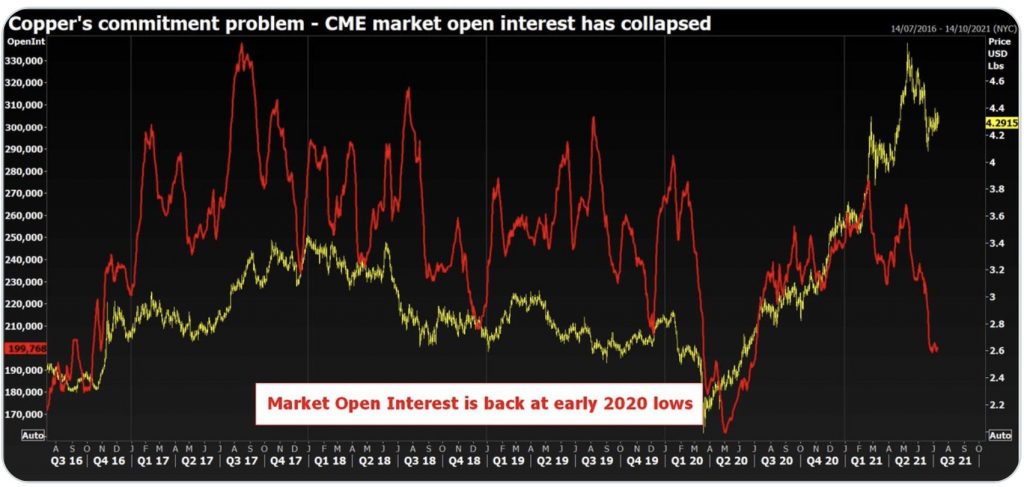

Meanwhile… the past few months speculators lost interest in the red

metal… but the price stayed well above $4 bucks. What happens next?

Stay tuned for the next exciting episode of copper decoupling from oil

(see chart below).

Copper Long Positions (RED) Have Been Liquidated

https://kingworldnews.com/last-time-this-happened-gold-price-soared-25x-and-silver-skyrocketed-38x/

$NEWS RELEASE Nevada Copper Announces Further Progress with Underground Operations and Strategic Project Development

July 12, 2021

https://nevadacopper.com/news/nevada-copper-announces-further-progress-with-underground-operations-and-strategic-project-development/

Yerington, NV – July 12, 2021 –

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the

“Company”) is pleased to provide an update regarding the ramp-up of the

Underground Mine and development activities for the Open Pit project at

its 100%-owned, fully-permitted Pumpkin Hollow Project in Nevada.

Production Ramp-Up Update

$Nevada Copper Corp (NEVDF) discussing Minerals Processing & Tailings Management

266 viewsJun 9, 2021

Globex (TSX:GMX) acquires Rockport Mining Corp.

Mining

TSX:GMX $60.05M

John Ballem

john.ballem@themarketherald.ca

21 July 2021 08:45 (EDT)

https://themarketherald.ca/globex-purchases-rockport-mining-corp-2021-07-21/?utm_source=stockhouse.com&utm_medium=widget&utm_campaign=stockhouse.com%7Cwebpart_news%7Cquote_tab

Globex Mining (GMX) has acquired Rockport Mining Corp.

Rockport held Net Smelter Royalties on two properties previously acquired by Globex

Once the amalgamation of Rockport into Globex was completed on July 14, these royalties no longer existed adding value to Globex's assets

Globex received $20,000 from the New Brunswick Exploration Assistance Program to aid in the exploration of the Bald Hill Antimony property

Globex Mining Enterprises Inc is a Canadian-based exploration company

Globex Mining Enterprises Inc. (GMX) opened trading at C$1.09 per share

Globex Mining (GMX) has acquired Rockport Mining Corp., a private company that owns royalties on two Globex properties in New Brunswick.

Previously, Globex had purchased the Devil’s Pike gold property with a reported Inferred Resource of 214,800 tonnes grading 9.6 g/t Au (cut) or 13.48 g/t Au (uncut). Rockport retained a 1 per cent Net Smelter Royalty on production after 600,000 ounces of gold is produced.

In February 2021, Globex also purchased the Bald Hill antimony deposit from Rockport. Rockport retained a 1 per cent Net Smelter Royalty on all mineral production of this property.

Once the purchase and amalgamation of Rockport into Globex was completed on July 14, the royalties no longer existed, adding value to the Globex gold and antimony assets, both of which are located in southern New Brunswick.

The purchase and amalgamation also provide Globex with contracted access to certain areas facilitating access for various types of surveys and diamond drilling.

Lastly, the amalgamation of Rockport with Globex adds non-capital losses carried forward to Globex’s balance sheet which, if applicable, will be very useful considering Globex’s increased income in 2021.

Globex would like to acknowledge the awarding of $20,000 to Globex from the New Brunswick Exploration Assistance Program to aid in the exploration of the Bald Hill Antimony property.

Globex Mining Enterprises Inc is a Canadian-based exploration company engaged in the acquisition, development, and exploration of mineral properties in North America.

Globex Mining Enterprises Inc. (GMX) opened trading at C$1.09 per share.

Stockhouse logo

Latest News

Globex Purchases Rockport Mining Corp.

GlobeNewswire 9 hours ago

Globex Options Former Eagle Gold Mine

GlobeNewswire 2 days ago

Globex Sells Tarmac Gold Property to Wesdome

GlobeNewswire 1 week ago

Globex Mining Enterprises Inc. Announces Normal Course Issuer Bid

GlobeNewswire 2 weeks ago

Globex Mining Enterprises Announces Results of Annual Meeting

GlobeNewswire June 23, 2021

Globex Completes Sale of Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for $15 Million

GlobeNewswire June 22, 2021

More T.GMX news on Stockhouse »

For further information, contact:

Jack Stoch, P.Geo., Acc.Dir.

President & CEO

Globex Mining Enterprises Inc.

86, 14th Street

Rouyn-Noranda, Quebec Canada J9X 2J1

Tel.: 819.797.5242

Fax: 819.797.1470

info@globexmining.com

HTTP://www.globexmining.com

Forward Looking Statements: Except for historical information, t

https://www.globexmining.com/staging/admin/news_pdfs/2021-07-12%20Globex%20sells%20Tarmac%20Gold%20Property%20to%20Wesdome.pdf

https://www.globexmining.com/

https://www.globexmining.com/staging/admin/news_pdfs/2021-06-14%20Globex%20sells%20Francoeur_Arntfield_Lac%20Fortune%20Gold%20Property.pdf

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$NEWS RELEASE Nevada Copper Announces Further Progress with Underground Operations and Strategic Project Development

July 12, 2021

https://nevadacopper.com/news/nevada-copper-announces-further-progress-with-underground-operations-and-strategic-project-development/

Yerington, NV – July 12, 2021 –

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (“Nevada Copper” or the

“Company”) is pleased to provide an update regarding the ramp-up of the

Underground Mine and development activities for the Open Pit project at

its 100%-owned, fully-permitted Pumpkin Hollow Project in Nevada.

Production Ramp-Up Update

$Nevada Copper Corp (NEVDF) discussing Minerals Processing & Tailings Management

266 viewsJun 9, 2021

futrcash' please, tell me more about your opinions about ex. HUDBAY, IVN and NCU -

$Bountiful_Harvest thanks; Nevada Copper Corp (NEVDF)

RE: I definitely think copper should be part of everyone's portfolio.

I appreciate your DD, NYBob.

https://www.kitco.com/commentaries/2021-06-08/Is-copper-the-new-golden-child-of-the-metals-group.html

Silver, Copper and Gold...

Note...Ex. This IVN vs. NCU

"Kamoa-Kakula Copper Mine is powered by clean, renewable hydro-generated electricity."

Climate change is causing Kariba to dry up

The world’s largest man-made reservoir, that of the Kariba Dam –

which has provided electricity to Zambia and Zimbabwe for over five

decades – hasn’t been spared by the droughts.

According to the Zambezi River Authority (ZRA), in recent months the

inflows of water from the Zambezi River that feed it have dwindled

to a third compared to a year ago.

Renewable IF climate change drought doesn't disrupt food production or

cyclones destroy transportation infrastructure

February 11, 2011 - Cyclone Bingiza emerged into the Mozambique Channel after crossing northern Madagascar.

January 17, 2012 - Subtropical Depression Dando struck southern Mozambique

January 21, 2012 - Cyclone Funso

March 2012 - Tropical Storm Irina

February 2013 - Cyclone Haruna

January 2014 -

March 26, 2014 - Cyclone Hellen formed near the northeast coast of Mozambique, bringing rainfall to the region.

April 27, 2016 - The remnants of Cyclone Fantala produced flooding in Tanzania that killed eight people.

February 15, 2017 - Cyclone Dineo struck central Mozambique, causing flooding that extended into Zimbabwe and Malawi. Dineo killed 271 people and caused over US$200 million in damage.

January 14, 2018 - A tropical depression formed over Mozambique.

January 17, 2019 - A tropical low formed over Mozambique and later intensified into Tropical Storm Desmond in the Mozambique Channel.

March 4, 2019 - A tropical depression moved ashore Mozambique, and later moved into the Mozambique Channel, strengthening into Cyclone Idai. The intense tropical cyclone made landfall near Beira. The cyclone killed 1,000 people.

April 25, 2019 - Cyclone Kenneth became the strongest tropical cyclone on record to strike Mozambique, when it moved ashore just north of Pemba. The JTWC estimated landfall winds of 220 km/h (140 mph). Kenneth killed 45 people in Mozambique, less than two months after Idai's deadly trek through the region.[12][13][14]Climate change is causing Kariba to dry up

by bogfit

----

$NEVADA COPPER | Pumpkin Hollow, 2 Mines Loaded with Copper

712 views•Premiered May 26, 2021

Deninski thanks; Copper Conference - Hudbay is presenting!

Join Peter Kukielski, President and CEO of Hudbay Minerals on Thursday

June 10th at 12 PM ET at our first ever #Copper Conference.

Registeration can be found here :

https://bit.ly/3g19asZ

https://hudbayminerals.com/

http://www.hudbay.com/news-media/default.aspx#2021#Hudbay-Announces-Release-of-its-18th-Annual-Sustainability-Report

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

HUDBAY ANNOUNCES RELEASE OF ITS 18TH ANNUAL SUSTAINABILITY REPORT

MAY 18, 2021

TORONTO, May 18, 2021 (GLOBE NEWSWIRE) --

Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX, NYSE: HBM) today announced the release of its integrated annual and sustainability report (“Annual Sustainability Report”). The Annual Sustainability Report provides transparency and progress on key accomplishments and initiatives in 2020.

http://www.hudbay.com/news-media/default.aspx#2021#Hudbay-Announces-Release-of-its-18th-Annual-Sustainability-Report

Hudbay believes that continuously improving how the company manages the social, environmental and economic risks, impacts and opportunities associated with its activities is critical for the company’s long-term success.

Hudbay’s 2020 Annual Sustainability Report disclosures were mapped to the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) Metals & Mining industry standard and the Task Force on Climate-related Financial Disclosures (TCFD).

Hudbay also provides disclosure through the CDP Climate, Water, and Forests questionnaires.

To inform Hudbay’s sustainability programs and improve its performance, the company applies and voluntarily supports several international best practice standards, including ISO 14001, ISO 45001, ISO 9001, Towards Sustainable Mining, the Voluntary Principles on Security and Human Rights and International Finance Corporation (IFC) Performance Standards.

As a member of the Mining Association of Canada, Hudbay implements the Towards Sustainable Mining (TSM) Protocols at all of its operations, with the goal to maintain a score of “A” or higher for all protocols.

The implementation of the TSM Tailings protocol and the company’s commitment to ensuring that its Tailings Storage Facilities are constructed following the Canadian Dam Safety Guidelines represents substantial alignment to the new Global Tailings Standard released in 2020.

Over 50% of Hudbay’s total energy consumption in 2020 was from renewable sources. All electricity at Hudbay’s operations is supplied by third parties via regional grids. Nearly all of the electricity produced in Manitoba is through renewable hydropower and, in Peru, over 50% is from renewable sources.

Constancia continued its leading safety track record among Peruvian copper mines and was the first mine in Peru to obtain the SafeGuard certification, recognizing full compliance with all COVID-19 safety protocols.

Manitoba achieved its annual safety targets and continuous operations in an environment of enhanced COVID-19 safety protocols and controls, while working closely with the local health authorities.

Hudbay recognizes the opportunity that the mining industry has to positively contribute to the 17 UN Sustainable Development Goals (SDGs) that are a part of the UN’s 2030 Agenda for Sustainable Development.

At the end of 2020, Hudbay established a Diversity and Inclusion Committee composed of employees at the corporate office.

The committee will advise management on diversity, inclusion and equity topics and ideas, and help further our values and commitments, including those outlined in the company’s commitment to the BlackNorth CEO Pledge.

In terms of gender diversity, Hudbay supports the Catalyst Accord 2022 and the 30% Club, both of which call for the advancement of women in business, and the Board has adopted a stand-alone Diversity Policy that includes a target for the company to have at least 30% women directors.

“In 2020, like the rest of the world, Hudbay was confronted by the challenge of COVID-19. Thanks to the dedication of the many people across our organization, we were able to meet that challenge successfully and protect the well-being of our employees and communities while continuing our operations,” said Peter Kukielski, Hudbay’s President and Chief Executive Officer.

“Against a background of challenging political situations, we acknowledged the imperative of addressing climate change, and a renewed expectation that businesses must contribute to building a more inclusive society.

While our Annual Sustainability Report focuses on what we achieved in 2020, I see these accomplishments as the foundation for long-term growth and exceptional results.”

Details of the company’s annual and sustainability results can be found on Hudbay’s website at:

https://hudbayminerals.com/disclosure-centre/default.aspx

and the full Annual Sustainability Report can be downloaded here.

https://hudbayminerals.com/

http://www.hudbay.com/news-media/default.aspx#2021#Hudbay-Announces-Release-of-its-18th-Annual-Sustainability-Report

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$Nevada Copper mines first stope at Pumpkin Hollow

Posted by Paul Moore on 18th May 2021

There were significant improvements made to the processing plant

performance and recoveries during the quarter.

The company achieved a weekly average of 4,700 t/d and a maximum

daily milling throughput of 5,000 t/d during March, while batch

processing ore.

119,000 t of ore were processed through the concentrator in Q1.

Approximately 3,173 t of concentrate was produced at a 24% average

copper grade for Q1 and reaching 26% average copper grade in March.

Recoveries improved from 82% in Q4 2020, to recovery levels above 90%

in 2021.

“I am pleased with the progress achieved in Q1 at our underground mine

and the dedication of our team,” stated Mike Ciricillo, Chief Executive

Officer of Nevada Copper.

“The operation made significant progress through the ramp-up during the

first quarter, and we look forward to the interim milestone of

production rates of 3,000 tpd expected in June, 2021 and continuing our

ramp-up to steady state production.”

https://im-mining.com/2021/05/18/nevada-copper-mines-first-stope-pumpkin-hollow/

Copper rebounds despite China trying to control

https://www.mining.com/copper-price-rebounds-demand-signals-are-still-firing-on-all-cylinders-td-securities/

Nevada Copper Corp (NCU)(NEVDF) NCU.C Analysis -

http://www.stockta.com/cgi-bin/analysis.pl?symb=NCU.C&cobrand=&mode=stock

silver_bars thanks; NvCu might start seeing a premium build up soon ...

as Chile is the #1 Copper producer in the world ....

https://www.zerohedge.com/commodities/worlds-largest-lithium-producer-crashes-10-chilean-political-storm

Growing uncertainty in Chile/Peru make Nevada Copper strategically more

important ... a hard left turn from the govts of Chile/Peru should be

very good for NvCu ....

https://www.gata.org/node/21160

https://www.reuters.com/world/americas/worlds-top-copper-region-political-risk-rises-2021-05-17/

$Nevada Copper Corp (NCU.TO)

BARCHART OPINION

https://www.barchart.com/stocks/quotes/NCU.TO/opinion

$Nevada Copper Corp. starting Cu-Bull Run has just started but

it's a long hike back UP, imo!

NvCu might start seeing a premium build up soon ... as Chile is the #1 Copper producer in the world ....

https://www.zerohedge.com/commodities/worlds-largest-lithium-producer-crashes-10-chilean-political-storm

Quote:

Growing uncertainty in Chile/Peru make Nevada Copper strategically more important ... a hard left turn from the govts of Chile/Peru should be very good for NvCu ....

https://www.gata.org/node/21160

https://www.reuters.com/world/americas/worlds-top-copper-region-political-risk-rises-2021-05-17/

$bigone thanks; Copper expected to rise to record highs later this year

433 views•May 7, 2021

Hudbay Announces First Quarter 2021 Results

May$ 11, 2021

DOWNLOADPDF FORMAT (OPENS IN NEW WINDOW)

TORONTO, May 11, 2021 (GLOBE NEWSWIRE) --

$Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX, NYSE:HBM) today

released its first quarter 2021 financial results. All amounts are in

U.S. dollars, unless otherwise noted.

First Quarter Operating and Financial Results

http://www.hudbay.com/investors/press-releases/press-release-details/2021/Hudbay-Announces-First-Quarter-2021-Results/default.aspx

Consolidated copper production in the first quarter was 24,553 tonnes at cash cost and sustaining cash cost1 per pound of copper produced, net of by-product credits, of $1.04 and $2.16, respectively.

Consolidated gold production in the first quarter was 35,500 ounces, a record for Hudbay.

Full year 2021 production and operating cost guidance reaffirmed; Pampacancha production commenced in April 2021, in line with guidance.

First quarter Manitoba copper production significantly increased from 2020 levels primarily due to higher grades at 777 and higher recoveries at the Flin Flon concentrator; sales volumes were impacted by the availability of railcars during the quarter with 5,000 tonnes of copper concentrate inventory in excess of normal operating levels, valued at approximately $18 million.

First quarter Peru sales impacted by a 10,000 tonne shipment of copper concentrate, valued at approximately $21 million, for which a payment was received but not recorded as revenue due to the timing of the shipment being delayed to early April.

Peru's production in the first quarter was impacted by increased ore hardness as well as a semi-annual scheduled plant shutdown in January.

First quarter net loss and loss per share were $60.1 million and $0.23, respectively. After adjusting for one-time financing charges mainly related to the redemption of the 2025 senior notes and a revaluation of the gold prepayment liability, first quarter adjusted net loss per sharei was $0.06. First quarter adjusted EBITDAi was $104.2 million.

Operating cash flow before change in non-cash working capital increased to $90.7 million in the first quarter of 2021, from $86.1 million in the fourth quarter of 2020 due to higher realized metal prices, offset by lower sales volumes.

Cash and cash equivalents decreased during the first quarter to $310.6 million, as at March 31, 2021, mainly as a result of $83.0 million of capital investments primarily for the New Britannia project and Pampacancha development activities, $50.8 million of interest payments and $31.0 million in net transaction and early redemption costs related to the refinancing of the company’s 2025 notes, partially offset by cash generated from operations.

Executing on Growth Initiatives

Announced three-year production guidance; consolidated copper and gold production are expected to increase by 36% and 125%2, respectively, by 2023 from 2020 levels as the company brings the Pampacancha and New Britannia growth projects into production.

Finalized the remaining land user agreement for Pampacancha in early April 2021.

This provided Hudbay with full access to the site to complete pit development and commence first ore production in late April, in line with timelines assumed in the company’s updated mine plan.

Total 2021 growth capital guidance for Peru has increased to $25 million to include the final land user costs.

New Britannia project continues to track ahead of the original schedule and is nearing completion, with approximately 82% of the project completed at the end of April; first gold production continues to be expected early in the third quarter and the new copper flotation facility remains on track for commissioning and ramp-up in the fourth quarter of 2021.

Announced a year-over-year increase to total mineral reserves of approximately 170,000 tonnes of contained copper and 360,000 ounces of contained gold, after adjusting for 2020 mining depletion.

Announced an updated Constancia mine plan resulting in an increase in average annual copper production to approximately 102,000 tonnes over the next eight years at an average cash cost of $1.18 per pound of copper produced, net of by-product credits.

Announced an updated Lalor and Snow Lake mine plan resulting in an increase in annual gold production to over 180,000 ounces during the first six years of New Britannia’s operation at an average cash cost of $412 per ounce of gold produced, net of by-product credits.

Announced a significant new discovery at the company’s Copper World properties adjacent to Rosemont on wholly-owned private land. Four deposits have been identified to date with a combined strike length of over five kilometres consisting of high-grade copper sulphide and oxide mineralization at shallow depth.

The follow-up 2021 exploration program has been expanded to further test the potential for additional mineralization, develop an initial inferred resource estimate and complete a preliminary economic assessment. As a result, Hudbay has increased its 2021 spending on Copper World by approximately $24 million.

Announced a preliminary economic assessment ("PEA") for the Mason copper project with a 27-year mine life and average annual copper production of approximately 140,000 tonnes over the first ten years of full production.

The PEA indicates an after-tax net present value3 of $519 million and approximately 14% internal rate of return at $3.10 per pound copper, which increases to $773 million and approximately 15%, respectively, at $3.25 per pound copper.

Issued $600.0 million of 4.5% senior notes due 2026 and redeemed all of the company’s outstanding $600.0 million of 7.625% senior notes due 2025, thereby reducing its annual cash interest payments.

On May 10, 2021, an amendment to the Constancia streaming agreement was signed with Wheaton Precious Metals ("Wheaton").

The amendment eliminates the requirement to deliver an additional 8,020 ounces of gold to Wheaton for not mining four million tonnes of ore from the Pampacancha deposit by June 30, 2021, while increasing the fixed gold recovery applied to Constancia ore processed during the reserve life of Pampacancha and introduces an additional potential future deposit of $4 million from Wheaton.

“Our operations remain on track to achieve full year production and unit cost guidance following a strong quarter of production at the Manitoba business unit and lower first quarter production in Peru as a result of planned mill maintenance,” said Peter Kukielski, President and Chief Executive Officer.

“We are very pleased to have commenced production at Pampacancha and we look forward to our first gold pour at the New Britannia mill, which remains on schedule for the third quarter.

We expect to begin to see increased cash flows from these high-return investments in the second half of 2021. We also expect to significantly advance our longer-term copper growth opportunities this year, including the Rosemont, Copper World and Mason projects.

We believe we will continue to leverage our exploration and development expertise to create significant value from our attractive organic growth pipeline at Hudbay.”

Summary of First Quarter Results

Consolidated copper production in the first quarter of 2021 was 24,553 tonnes, a 10% decrease from the fourth quarter of 2020, primarily as a result of lower mill throughput at Constancia due to a scheduled semi-annual mill maintenance shutdown, partially offset by higher copper grades at 777 and higher copper recoveries at the Flin Flon mill. Consolidated gold production increased by 10% compared to the fourth quarter of 2020 due to higher gold grades at 777, higher gold recoveries at the Flin Flon concentrator and higher gold grades at Constancia. Consolidated zinc production in the first quarter was 8% higher than the fourth quarter of 2020 due to higher zinc grades and throughput.

In the first quarter of 2021, consolidated cash cost per pound of copper produced, net of by-product creditsi, was $1.04, an increase compared to $0.43 in the fourth quarter due to lower copper production, higher operating costs and lower by-product credits. Incorporating cash sustaining capital, royalties, selling, administrative and regional costs, consolidated all-in sustaining cash cost per pound of copper produced, net of by-product creditsi, in the first quarter of 2021 was $2.37, which increased from $2.24 in the fourth quarter due to the same factors impacting cash costs, partially offset by lower cash sustaining capital.

Cash generated from operating activities in the first quarter of 2021 decreased to $51.8 million compared to $121.1 million in the fourth quarter of 2020, primarily as a result of changes in non-cash working capital and lower sales volumes. Operating cash flow before change in non-cash working capital was $90.7 million during the first quarter of 2021, reflecting a slight increase from $86.1 million in the fourth quarter. The increase in cash generated from operating activities is primarily the result of higher realized prices, offset by lower sales volumes during the quarter.

Net loss and loss per share in the first quarter of 2021 were $60.1 million and $0.23, respectively, compared to a net earnings and earnings per share of $7.4 million and $0.03, respectively, in the fourth quarter of 2020. First quarter earnings benefited from higher realized prices for all metals, which was offset by lower sales volumes of all metals due to the timing of sales in Peru and a buildup of copper concentrate in Manitoba caused by limited railcar availability. First quarter results included a $12.5 million non-cash gain on the revaluation of the gold prepayment liability but were negatively impacted by charges related to the refinancing of the 2025 senior notes, including a non-cash write off of $49.8 million connected with the exercise of the redemption option, a call premium payment of $22.9 million and a non-cash expense of unamortized transaction costs of $2.5 million in relation to the 2025 notes that were redeemed. A variable consideration adjustment to deferred gold and silver revenue resulted in a net increase to revenue of $1.6 million.

Adjusted net lossi and adjusted net loss per sharei in the first quarter of 2021 were $16.1 million and $0.06 per share after adjusting for the finance charges and the net mark-to-market loss on financial instruments, among other items. This compares to an adjusted net loss and adjusted net loss per share of $16.4 million and $0.06 per share in the fourth quarter of 2020. First quarter adjusted EBITDAi was $104.2 million, compared to $106.9 million in the fourth quarter of 2020.

First quarter Peru sales were impacted by a 10,000 tonne shipment of copper concentrate valued at approximately $21 million for which a payment was received but did not meet the revenue recognition criteria due to the delayed timing of the shipment into early April. First quarter Manitoba sales were impacted by a delay in accessing additional railcars after a strong copper production quarter resulting in approximately 5,000 tonnes of copper concentrate inventory in excess of normal operating levels, valued at approximately $18 million. Had both parcels of copper concentrate been sold during the first quarter, the company would have realized approximately $39 million of incremental revenue, assuming end of quarter commodity prices. The above quantities have been recognized as revenue in the second quarter of 2021. First quarter results were also negatively impacted by the realized copper price hedging of the company’s provisionally priced copper sales.

http://www.hudbay.com/investors/press-releases/press-release-details/2021/Hudbay-Announces-First-Quarter-2021-Results/default.aspx

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

HUDBAY TO HOST CONFERENCE CALL FOR FIRST QUARTER 2021 RESULTS

APRIL 16, 2021

TORONTO, April 16, 2021 (GLOBE NEWSWIRE) --

Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX, NYSE: HBM)

senior management will host a conference call on Wednesday,

May 12, 2021 at 8:30 a.m. ET to discuss the company’s first quarter

2021 results.

First Quarter 2021 Results Conference Call and Webcast

Date: Wednesday, May 12, 2021

Time: 8:30 a.m. ET

Webcast: www.hudbay.com

Dial in: 1-416-915-3239 or 1-800-319-4610

Hudbay plans to issue a news release containing the first quarter 2021

results on Tuesday, May 11, 2021 and post it on the company’s website.

An archived audio webcast of the call also will be available on

Hudbay’s website.

http://www.hudbay.com

About Hudbay

Hudbay (TSX, NYSE: HBM) is a diversified mining company primarily

producing copper concentrate (containing copper, gold and silver) and

zinc metal.

Directly and through its subsidiaries, Hudbay owns three polymetallic

mines, four ore concentrators and

a zinc production facility in northern Manitoba and

Saskatchewan (Canada) and Cusco (Peru), and

copper projects in Arizona and Nevada (United States).

The company’s growth strategy is focused on the exploration,

development, operation and optimization of properties it already

controls, as well as other mineral assets it may acquire that fit its

strategic criteria.

Hudbay’s vision is to be a responsible, top-tier operator of

long-life, low-cost mines in the Americas.

Hudbay’s mission is to create sustainable value through the

acquisition, development and operation of high-quality, long-life

deposits with exploration potential in jurisdictions that support

responsible mining, and to see the regions and communities in which

the company operates benefit from its presence.

The company is governed by the Canada Business Corporations Act and

its shares are listed under the symbol "HBM" on the Toronto Stock

Exchange, New York Stock Exchange and

Bolsa de Valores de Lima.

Further information about Hudbay can be found on

http://www.hudbay.com

For further information, please contact:

Candace Brûlé

Director, Investor Relations

(416) 814-4387

candace.brule@hudbay.com

Primary Logo

Source: Hudbay Minerals Inc.

https://www.hudbayminerals.com/news-media/default.aspx#2021#Hudbay-to-Host-Conference-Call-for-First-Quarter-2021-Results

$frenchee thanks; Ex. 'Nevada Copper Corp (NEVDF) US Dollar Share of Global Foreign

Exchange Reserves Drops to 25-Year Low -

central banks are moving to other currencies than the dollar and, in

some cases, gold -

https://blogs.imf.org/2021/05/05/us-dollar-share-of-global-foreign-exchange-reserves-drops-to-25-year-low/

$First New Source of Copper Supply in the US in a Decade Comes Online

Contributed Opinion - New Mill 5000 t/d it would take 10-20yrs for

someone else to get permits , construction development etc. -

NCU got it, made it and its a Mother Lode Cu-Au-Ag bargain today -

for fiat peanuts- slave currency IMO!

$nowwhat2 thanks; Copper outlook just became even stronger >>> maybe $20,000 !

https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

$Copper's supply crunch will drive prices to $13,000 or even $20K - Bank of America

https://www.kitco.com/news/2021-05-05/Copper-s-supply-crunch-will-drive-prices-to-13-000-or-even-20K-Bank-of-America.html

$nw2 well it's long overdue for NEVDF to move to the Cu-BULL TOP -

to Ccpycat Ex...EXMGF's BULL-RUN - NEVDF MOVE UP ROCKET TO GOOOOOO ![]() )

)

$Nevada Copper Corp. starting Cu-Bull Run - TO ROCKET Back UP $6/sh++++ BLAST IT ![]() )

)

$Why has silver price not yet spiked from demand, but copper has? Lobo Tiggre

65,199 views•Apr 28, 2021

$Deninski thanks; Copper outlook just became even stronger >>> maybe $20,000 !

https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

$Copper's supply crunch will drive prices to $13,000 or even $20K - Bank of America

https://www.kitco.com/news/2021-05-05/Copper-s-supply-crunch-will-drive-prices-to-13-000-or-even-20K-Bank-of-America.html

$nw2 well it's long overdue for NEVDF to move to the Cu-BULL TOP -

to Ccpycat EXMGF's BULL-RUN - NEVDF MOVE UP ROCKET TO GOOOOOO ![]() )

)

$Nevada Copper Corp. starting Cu-Bull Run - TO ROCKET Back UP $6/sh++++ BLAST IT ![]() )

)

$Why has silver price not yet spiked from demand, but copper has? Lobo Tiggre

65,199 views•Apr 28, 2021

Rockcliff Announces Trading on the OTCQB and Engages US Firm to Provide Investor Relations Services

April 15, 2021

Sudbury, ON – April 15, 2021 –

Rockcliff Metals Corporation (“Rockcliff” or the “Company”) (CSE: RCLF)

(OTCQB: RKCLF) is pleased to announce that the Company’s common shares

have begun trading on the OTCQB Venture Market (“OTCQB”) under the

ticker symbol “RKCLF”.

In addition, the Company has retained Arrowhead Business and Investment Decisions, LLC. ("Arrowhead") to provide investor relations services to the Company to develop its international market awareness in compliance with regulatory guidelines. Arrowhead will work closely with Rockcliff to develop and deploy a comprehensive international capital markets strategy and investor marketing program. Activities will include the publication of analysis on the company, investor targeting, disclosure distribution, non-deal roadshows and ongoing advisory.

"Listing on the OTCQB is another important milestone for Rockcliff. It provides us greater visibility within the investment community, which should enhance our liquidity and increase our access to institutional and retail investors.

With the growing focus towards energy transition in the U.S. and Europe and the importance of the copper supply chain in supporting major related infrastructure investments plans, we believe it to be strategic to strengthen our investor relations program by bolstering engagement with interested parties in those geographies. The current market environment together with the strategic location of our near-term development project supported by our recent positive PEA results (see press release date January 25, 2021), encourage us to raise the profile of Rockcliff’s equity story. We are pleased to engage Arrowhead and think they are the right partner to help expand the reach of our investor relations program in the U.S." said Alistair Ross, President and CEO of Rockcliff.

About OTCQB

The OTCQB, operated by OTC Markets Group Inc., is a premier market for entrepreneurial and development-stage U.S. and international companies that are committed to providing investors high-quality trading and improved market visibility to enhance trading liquidity. Companies must be current in their financial reporting and undergo an annual verification and management certification process, including meeting a minimum bid price and other financial conditions. With more compliance and quality standards, the OTCQB provides investors improved visibility to enhance trading decisions. The OTCQB is recognized by the United States Securities and Exchange Commission as an established public market providing public information for analysis and value of securities.

About Arrowhead

Arrowhead is a financial services firm which is headquartered in New York City and was established in 2008. Arrowhead advises public companies on investor relations, financial communications, and capital markets strategies. As a cross-border specialist Arrowhead provides idea generation, insight, and corporate access to an international network of institutional and private investors. Through targeting, research and interactions, Arrowhead helps corporations and investors to evaluate opportunities, connect, exchange information and transact. The Company has engaged Arrowhead for a minimum 3-month term with consideration for services of US$20,000 plus applicable taxes, renewable thereafter.

About Rockcliff Metals Corporation

Rockcliff is a Canadian resource development and exploration company, with a +1,000 tonne per day leased processing and tailings facility as well as several advanced-stage, high-grade copper and zinc dominant VMS deposits in the Snow Lake area of central Manitoba, Canada. The Company is a major landholder in the largest Paleoproterozoic VMS district in the world, hosting high grade mines and deposits containing copper, zinc, gold and silver. The Company’s extensive portfolio of properties totals approximately 4,500 square kilometres and includes seven of the highest-grade, undeveloped VMS deposits in the Flin Flon -Snow Lake Greenstone Belt.

For more information, please visit http://rockcliffmetals.com

YouTube: Rockcliff Metals Corporation

Twitter: @RockcliffMetals

LinkedIn: Rockcliff Metals Corp

Instagram: Rockcliff_Metals

Facebook: Rockcliff Metals Corporation

For further information, please contact:

Rockcliff Metals Corporation

Alistair Ross

President & CEO

Cell: (249) 805-9020

contact@rockcliffmetals.com

https://www.rockcliffmetals.com/investors/news-releases/rockcliff-announces-trading-otcqb-engages-us-firm-investor-relations-services/

https://www.rockcliffmetals.com/site/assets/files/3811/investors_presentation_-_feb_2021_-_final.pdf

Cautionary Note Regarding Forward-Looking Statements:

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

https://investorshub.advfn.com/Rockcliff-Metals-Corp-(TSEC-RCLF-)-Alternate-Symbol(s)-RKCLF-RKCLF-39431/

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$Deninski Welcome to Nevada Copper Mine; The new golden oil - Looks primed for another bull run ^^^^^

https://www.msn.com/en-us/money/markets/copper-is-the-new-oil-and-could-reach-15000-by-2025-as-the-world-transitions-to-clean-energy-goldman-sachs-says/ar-BB1fE8bx

https://www.cnbc.com/2021/04/14/goldman-says-copper-is-the-new-oil-raises-price-forecast.html

$Nevada Copper - Pumpkin Hollow Project Extract - will be the great new

copper, silver, gold mine - ![]() )

)

$Nevada Copper Provides Operations Update

April 21, 2021

View PDF

April 21, 2021 –

$Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF)

(“Nevada Copper” or the “Company”) provides a project update for the

underground mine at its Pumpkin Hollow project (the “Underground

Project”).

https://nevadacopper.com/news/nevada-copper-provides-operations-update/

Performance Highlights

First Stopes to Be Mined

The first stope will be mined in the East South Alphabets zone this week.

$The Alphabets zone is expected to carry copper equivalent grade of

approximately 2.5%.

Ventilation Expansion

The electrical upgrades have been completed and the fan bulkhead is in

the final stages of construction for installation of the remaining

underground ventilation fans.

Two additional underground ventilation fans, as previously announced,

are on schedule for installation in May, which should enable further

increases in underground development rates.

The surface ventilation fans remain on schedule for installation in the

third quarter of 2021.

Lateral Development

Lateral development in March increased 69% from February after the

previously announced electrical upgrades were completed.

Lateral development early in the first quarter 2021 was slower than

anticipated due to cautious progress through a water bearing dike.

Progress continues with penetration through the dike.

$Continuing to Increase Mill Throughput Rates

While we are still batch processing ore through the mill, we achieved a

weekly average of 4,700 tons per day (“tpd”) and maximum daily milling

throughput of 5,000 tpd during March.

Concentrate grade continues to be achieved that comply with off-take

specifications.

Concentrate grade has continued to rise, with an average grade of 26%

achieved in March compared to 24% during January and February.

The Company is on schedule to reach steady-state production of

approximately 5,000 tpd in the third quarter of 2021.

“We are pleased with the progress achieved in Q1 despite the challenges

with lateral development and we look forward to the imminent blasting

of our first high grade stopes,” stated Mike Ciricillo, Chief Executive

Officer of Nevada Copper.

“As well as advancing our stope development, we look forward to further

increases in underground development rates as we move closer to steady-

state production in Q3 this year.”

Qualified Persons

The information and data in this news release was reviewed by

Greg French, C.P.G., and Norm Bisson, P. Eng.,

for Nevada Copper, who are non-independent Qualified Persons

within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of

The Pumpkin Hollow Copper Mine project -

Located in Nevada, USA,

$Pumpkin Hollow Mine has substantial reserves and

resources including copper, gold and silver.

Its two fully permitted projects include the high-grade underground mine

and processing facility, which is now in the production stage, and

a large-scale open pit project, which is advancing towards

feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Ciricillo, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

https://nevadacopper.com/news/nevada-copper-provides-operations-update/

https://nevadacopper.com/

$COPPER PRICE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO APRIL 2021) (CHART 1)

Copper prices have indeed found bullish resolution, with copper prices in

the past two days rising to their highest level since February 25 –

the day that the yearly high was established.

With a strong fundamental backdrop, the technical picture looks promising

as well.

Copper prices are above their daily 5-, 8-, 13-, and 21-EMA envelope,

which is in bullish sequential order. Daily MACD

$Nevada copper very Undervalued, oversold @ a bargain -

the Cu investors have not discovered Nevada Copper yet -

its a great opportunity, imo! ![]() )

)

Ex....

$Interview with Stephen Gill, chairman of Nevada Copper

Maurice Jackson of Proven and Probable talks with

Stephen Gill, chairman

of Nevada Copper, who discusses his company's copper project,

where the underground mine is ramping up production and

the open pit is fully permitted.

https://www.streetwisereports.com/article/2021/04/13/first-new-source-of-copper-supply-in-a-decade-comes-online-in-us.html

https://www.mining.com/goldman-doubles-down-record-high-copper-price-within-a-year/

https://nevadacopper.com/news

https://investorshub.advfn.com/Nevada-Copper-Corp-NEVDF-32771/

http://ow.ly/Ir5Z50EnREY

Iorich, Vladimir

Ex...

https://www.celebritynetworth.com/richest-businessmen/richest-billionaires/vladimir-iorich-net-worth/

Ex. Iorich Vladimir bought in NCU for a much higher price and I am sure

he still will be doing very well on the LT longer term

Imo!

$Nevada Copper - Pumpkin Hollow Project Extract -

https://www.youtube.com/watch?v=fMZC65A7GPk

https://www.youtube.com/watch?v=rFw0OFaTHKs

https://nevadacopper.com/news

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Welcome to 'Nevada Copper Corp (NEVDF)

You a Master @ picking the wise purchase time {![]() )

)

Nevada copper very Undervalued, oversold @ a bargain -

the Cu investors have not discovered Nevada Copper yet -

its a great opportunity ![]() )

)

Ex....

$The Nevada Copper Cu Train moving to ProfitWille >

Imo!

$First New Source of Copper Supply in the US in a Decade Comes Online

Contributed Opinion

https://www.streetwisereports.com/article/2021/04/13/first-new-source-of-copper-supply-in-a-decade-comes-online-in-us.html

https://nevadacopper.com/investors/videos/

https://nevadacopper.com/investors/presentations/

https://nevadacopper.com/site/assets/files/4209/2021-03-ncu-cp.pdf

https://nevadacopper.com/projects/pumpkin-hollow-overview/

https://nevadacopper.com/projects/underground-mine/

$NCU:TSE / NEVDF Trafigura Sees Green Copper Supercycle Driving Prices

to $15,000

https://bloomberg.com/news/articles/2021-03-23/trafigura-sees-green-copper-supercycle-driving-prices-to-15-000

https://nevadacopper.com/investors/presentations/

$Record Copper Prices Coming Soon

$Nevada Copper Corp (NEVDF)(TSE:NCU) First New Cu Mine Source of

Copper Supply in the US in a Decade Comes Online

Contributed Opinion

https://www.streetwisereports.com/article/2021/04/13/first-new-source-of-copper-supply-in-a-decade-comes-online-in-us.html

https://nevadacopper.com/investors/videos/

https://nevadacopper.com/investors/presentations/

https://nevadacopper.com/site/assets/files/4209/2021-03-ncu-cp.pdf

https://nevadacopper.com/projects/pumpkin-hollow-overview/

https://nevadacopper.com/projects/underground-mine/

$NCU:TSE / NEVDF Trafigura Sees Green Copper Supercycle Driving Prices

to $15,000

https://bloomberg.com/news/articles/2021-03-23/trafigura-sees-green-copper-supercycle-driving-prices-to-15-000

https://nevadacopper.com/investors/presentations/

$Record Copper Prices Coming Soon

$Interview with Stephen Gill, chairman of Nevada Copper

Maurice Jackson of Proven and Probable talks with Stephen Gill, chairman

of Nevada Copper, who discusses his company's copper project,

where the underground mine is ramping up production and

the open pit is fully permitted.

https://www.streetwisereports.com/article/2021/04/13/first-new-source-of-copper-supply-in-a-decade-comes-online-in-us.html

https://www.mining.com/goldman-doubles-down-record-high-copper-price-within-a-year/

https://investorshub.advfn.com/Nevada-Copper-Corp-NEVDF-32771/

http://ow.ly/Ir5Z50EnREY

Iorich, Vladimir

Ex...

https://www.celebritynetworth.com/richest-businessmen/richest-billionaires/vladimir-iorich-net-worth/

Ex. Iorich Vladimir bought in NCU for a much higher price and I am sure

he still will be doing very well on the LT longer term

Imo!

$Nevada Copper - Pumpkin Hollow Project Extract -

Thanks for the insight! I'm in on this one.

$Nevada Copper – The Operations and Strategic Position

4

Exceptional Production Growth Profile

• One operation already in production, with expansion defined

• Second mine permitted, with multiple expansion phases

• Current reserves of 4.4Bn lbs Cu eq1,2

• Large 24,000-acre land holding in rare US copper district

Significant Exploration Upside

• Additional 2.6Bn lbs Cu eq1,2 of resources

• Multiple additional targets already defined on Nevada Copper property

Strategic Advantage in Re-emerging District

• Key position in district with significant copper resources

• Power infrastructure in-place and water rights secured

• Dry-stack tailings permitted, with large area for storage expansion

• 2015 Nevada Copper land bill has yet to be replicated by any other

project in US

(1) Source: Resource Statements (see Appendix), effective date

January 21, 2019

(2) Metals prices used for equivalent calculations:

US$1,800/oz Au, US$25/oz Ag, US$6,600

https://nevadacopper.com/site/assets/files/4209/2021-03-ncu-cp.pdf

$goldbaby thanks; Nevada Copper Corp (NEVDF) Copper Cu $4.06/lb - Great For NEVDF ![]() )

)

Alternate Symbol(s): NCU:TSE | TSE:NCU.W

$Goldman Warns Of Historic Shortage As Copper Explodes Higher

https://www.zerohedge.com/markets/goldman-warns-historic-shortage-copper-explodes-higher

$Nevada Copper Corp (NEVDF) BARCHART Overall Average: 88% BUY

Overall Average: 88% BUY

Overall Average Signal calculated from all 13 indicators.

Signal Strength is a long-term measurement of the historical strength

of the Signal, while Signal Direction is a short-term (3-Day)

measurement of the movement of the Signal.

Barchart Opinion

https://www.barchart.com/stocks/quotes/NEVDF/opinion

$NEVADA COPPER’S PUMPKIN HOLLOW COPPER PROJECT -

https://nevadacopper.com/projects/pumpkin-hollow-overview/

https://nevadacopper.com/news/nevada-copper-completes-key-underground-milestone/

$Nevada Copper - Pumpkin Hollow Project Extract -

$Nevada Copper Corp (NEVDF) Copper Cu $4.06/lb - Great For NEVDF ![]() )

)

Alternate Symbol(s): NCU:TSE | TSE:NCU.W

$Goldman Warns Of Historic Shortage As Copper Explodes Higher

https://www.zerohedge.com/markets/goldman-warns-historic-shortage-copper-explodes-higher

$Nevada Copper Corp (NEVDF) BARCHART Overall Average: 88% BUY

Overall Average: 88% BUY

Overall Average Signal calculated from all 13 indicators.

Signal Strength is a long-term measurement of the historical strength

of the Signal, while Signal Direction is a short-term (3-Day)

measurement of the movement of the Signal.

Barchart Opinion

https://www.barchart.com/stocks/quotes/NEVDF/opinion

$NEVADA COPPER’S PUMPKIN HOLLOW COPPER PROJECT -

https://nevadacopper.com/projects/pumpkin-hollow-overview/

https://nevadacopper.com/news/nevada-copper-completes-key-underground-milestone/

$GREAT NEWS RELEASE; Nevada Copper Corp. Announces Further Ramp-up

Progress & Closing of Credit Facility Increase -

January 6, 2021

https://nevadacopper.com/news/

https://nevadacopper.com/

$Nevada Copper Corp Start NEW 5000 ton per day Mill Production;

NEWS RELEASES Nevada Copper Completes Key Underground Milestone

December 29, 2020

View PDF

https://nevadacopper.com/news/nevada-copper-completes-key-underground-milestone/

Yerington, NV – December 29, 2020 –

$Nevada Copper Corp. (TSX: NCU) (OTC:NEVDF) (“Nevada Copper” or the

“Company’’) is pleased to announce the completion of the underground

materials handling system of the main shaft.

The materials handling system represents a significant milestone in the

construction of the Company’s underground project which included

sinking the vent shaft, sinking the main shaft, and construction of the

processing plant.

The completion of this milestone allows for a significant increase in

hoisting rates, from currently 1000 tpd to ultimately 5000 tpd once

commissioning and ramp-up are completed.

This is expected to enable the underground mine to deliver substantially

higher volumes of ore directly from the mine to the processing plant.

Mike Ciricillo CEO of Nevada Copper comments,

“I am very pleased we have achieved this construction milestone.

With the completion of the materials handling system, we can now

utilize the full hoisting capacity of the main shaft as we ramp up the

mine towards full production.

The team, both Nevada Copper and contractor employees, worked hard,

worked together, and more importantly, worked safely, to achieve this

result.

I’m proud of the team and proud to be a part of Nevada Copper.”

Qualified Persons

The information and data in this news release was reviewed by Greg

French, C.P.G., and David Sabourin, P.E, for Nevada Copper, who are

non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

$Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin

Hollow copper project.

Located in Nevada, USA, Pumpkin Hollow has substantial reserves and

resources including copper, gold and silver.

Its two fully permitted projects include the high-grade underground

mine and processing facility, which is now in the production stage, and

a large-scale open pit Gold, Silver & Copper project, which is

advancing

towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Ciricillo, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 355 7179

$Nevada Copper - Pumpkin Hollow Project Extract

Jun 1, 2020

NEVADA COPPER’S PUMPKIN HOLLOW COPPER PROJECT -

https://nevadacopper.com/projects/pumpkin-hollow-overview/

https://nevadacopper.com/news/nevada-copper-completes-key-underground-milestone/

GREAT NEWS RELEASE; Nevada Copper Corp. Announces Further Ramp-up

Progress & Closing of Credit Facility Increase -

January 6, 2021

https://nevadacopper.com/news/

https://nevadacopper.com/

Nevada Copper Corp Start NEW 5000 ton per day Mill Production;

NEWS RELEASES Nevada Copper Completes Key Underground Milestone

December 29, 2020

View PDF

https://nevadacopper.com/news/nevada-copper-completes-key-underground-milestone/

Yerington, NV – December 29, 2020 –

Nevada Copper Corp. (TSX: NCU) (OTC:NEVDF) (“Nevada Copper” or the

“Company’’) is pleased to announce the completion of the underground

materials handling system of the main shaft.

The materials handling system represents a significant milestone in the

construction of the Company’s underground project which included

sinking the vent shaft, sinking the main shaft, and construction of the

processing plant.

The completion of this milestone allows for a significant increase in

hoisting rates, from currently 1000 tpd to ultimately 5000 tpd once

commissioning and ramp-up are completed.

This is expected to enable the underground mine to deliver substantially

higher volumes of ore directly from the mine to the processing plant.

Mike Ciricillo CEO of Nevada Copper comments,

“I am very pleased we have achieved this construction milestone.

With the completion of the materials handling system, we can now

utilize the full hoisting capacity of the main shaft as we ramp up the

mine towards full production.

The team, both Nevada Copper and contractor employees, worked hard,

worked together, and more importantly, worked safely, to achieve this

result.

I’m proud of the team and proud to be a part of Nevada Copper.”

Qualified Persons

The information and data in this news release was reviewed by Greg

French, C.P.G., and David Sabourin, P.E, for Nevada Copper, who are

non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin

Hollow copper project.

Located in Nevada, USA, Pumpkin Hollow has substantial reserves and

resources including copper, gold and silver.

Its two fully permitted projects include the high-grade underground

mine and processing facility, which is now in the production stage, and

a large-scale open pit Gold, Silver & Copper project, which is advancing

towards feasibility status.

NEVADA COPPER CORP.

http://www.nevadacopper.com

Mike Ciricillo, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 355 7179

Nevada Copper - Pumpkin Hollow Project Extract

Jun 1, 2020

https://www.youtube.com/watch?v=BaC61zg7GYM

Nevada copper very Undervalued, oversold @ a bargain,

Imo!

Nevada Copper | Pumpkin Hollow Is Now In Production ! ! !

1,514 views •Dec 20, 2019

https://www.youtube.com/watch?v=rFw0OFaTHKs

Nevada Copper - Worth $0 or a $billion. I'm betting on a $billion.

Dec 16, 2020

Robert Pavich

Investment research and analysis of Nevada Copper.

Here is how to research a mining company in general and research on

Nevada Copper specifically.

Nevada Copper is on its way to becoming a mid tier copper producer....

https://www.youtube.com/watch?v=hk_WhFu7FlA

Is Nevada Copper now on its way to $10,000 per ton?

1,138 views•Nov 25, 2020

PRESENTATIONS

https://nevadacopper.com/investors/presentations/