Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

CF$ GOING HIGHER

Hell yeah brother been a long term hold in shelf sure wish I bought more.

CF Industries Holdings, Inc. (NYSE:CF) Stake Raised by Mackenzie Financial Corp

Posted by Stephan Byrd on Mar 7th, 2021

CF Industries logoMackenzie Financial Corp grew its holdings in shares of CF Industries Holdings, Inc. (NYSE:CF) by 41.8% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 676,218 shares of the basic materials company’s stock after buying an additional 199,382 shares during the period. Mackenzie Financial Corp owned 0.32% of CF Industries worth $26,176,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds have also added to or reduced their stakes in the company. Principal Financial Group Inc. increased its stake in shares of CF Industries by 523.7% during the fourth quarter. Principal Financial Group Inc. now owns 2,991,595 shares of the basic materials company’s stock valued at $115,805,000 after acquiring an additional 2,511,928 shares during the period. UBS Asset Management Americas Inc. increased its stake in shares of CF Industries by 119.7% during the third quarter. UBS Asset Management Americas Inc. now owns 4,585,337 shares of the basic materials company’s stock valued at $140,816,000 after acquiring an additional 2,497,867 shares during the period. Arrowstreet Capital Limited Partnership increased its stake in shares of CF Industries by 38.6% during the third quarter. Arrowstreet Capital Limited Partnership now owns 2,883,671 shares of the basic materials company’s stock valued at $88,558,000 after acquiring an additional 802,493 shares during the period. BlackRock Inc. increased its stake in shares of CF Industries by 2.6% during the fourth quarter. BlackRock Inc. now owns 20,149,458 shares of the basic materials company’s stock valued at $779,986,000 after acquiring an additional 517,704 shares during the period. Finally, Teachers Retirement System of The State of Kentucky increased its stake in shares of CF Industries by 1,640.7% during the third quarter. Teachers Retirement System of The State of Kentucky now owns 379,382 shares of the basic materials company’s stock valued at $11,651,000 after acquiring an additional 357,587 shares during the period. 91.04% of the stock is currently owned by institutional investors.

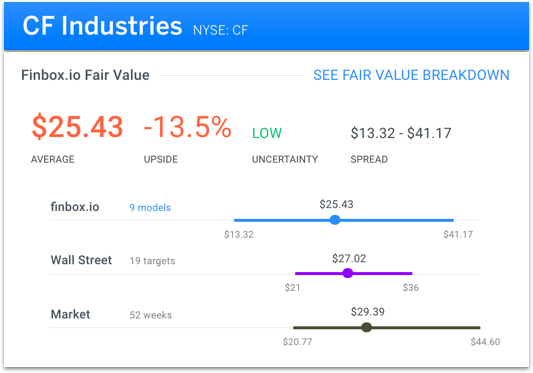

CF Industries $CF may be trading at a 20% premium prior to earnings Wednesday:

Fair Value Source

CF will continue to rise on commodities long term hold

Barclays downgraded CF Industries from Overweight to Equal Weight. Shares traded lower by 6% following the downgrade. Nine valuation models conclude that the company still has a negative 14% margin of safety.

Top Wall Street Ratings

I owned it a few years ago. I've been thinking about jumping back in, all the way down. I might pull the trigger after I do some DD.

Fertilizer is a great business, but you have to hedge against energy prices. Oil is a quirky market. Hard to trade.

Downgraded today

after horrible earnings miss

8/5/2016 Atlantic Securities Downgrade Overweight -> Neutral

Press Release: S&PGR Affirms CF Industries 'BBB-' Ratings; Outlook Negative

6:57 pm ET August 4, 2016 (Dow Jones

The following is a press release from Standard & Poor's:

-- We expect that U.S. nitrogen fertilizer producer CF Industries Inc.'s

operating performance will continue to be weak in 2016 and most of 2017, while

improving thereafter.

-- We are affirming our ratings on CF Industries Inc., including the

'BBB-' corporate credit and senior unsecured issue-level ratings.

-- We are also issuing an unsolicited 'BBB-' rating to the company's

amended $1.5 billion credit facility.

-- The negative outlook indicates at least a one-in-three chance we could

lower the ratings in the next 24 months if business conditions or management's

financial policies result in weighted average adjusted debt to EBITDA

consistently above 3x.

NEW YORK (S&P Global Ratings) Aug. 4, 2016--S&P Global Ratings today affirmed

its 'BBB-' corporate credit and senior unsecured issue-level ratings on

Sure looks like it

Shorts taking control of this stock...

Headed down to $20 IMO.

Thanks! If you have time (an hour or two) check out this podcast with regards to market tops and bottoms. Very good!

http://media.bloomberg.com/bb/avfile/Masters_in_Business/vpGnCg0OyEnc.mp3

no not really, sorry :( I haven't been trading since I sold a BIG portion of my postitions to buy a car and been enjoying that car tinting the windows upgrading it. I should be back trading late December early January. I hope you make some profit during this end of the year, Lots of people will be selling right now due to Christmas and the holidays that are coming up.

Any thoughts on the recent price dip? Who's selling and why?

yeah BABY! This stock given time and we need a least a year to hold to fit into that tax bracket we will be in for some fat profits!!

I'm interested in CF. But have alot of questions. How will moving corporate head quarters over seas effect the dividend tax basis? Are there institutional investors who will be required to sell due to CF becoming a foreign company? Also seems to have a poor credit rating from Moodys. Thoughts?

Now with the merger done...or has it? This Company's stock has got to show some value on whats been created with the merger...hoping soon but might not happen till end of 2016 first Quarter.

Am I the only one interested in this Gem? I think we will see in a couple of months when the world settles with it's global problems and starts to move north in the direction of profitable returns..remember after this merger CF will be one of the biggest fertilizer companys in the world and if I am right it will climb faster with the merger in place to where this stock was once before the split and the gradual climb in the chart before the split was a buet ..alone without the merger one would have even guess (like myself) it will eventually come back up to where it once was with time, but now with the merger it's a plus that it will, in a rather shorter period of time. JMO and my wallet to back this theory up!

Merger coming up and that would bring $CF stock back up to the old days price!

Here we go back up to where we left off..soon we will be in the tripple digits once again and more mula in my pocket!! ha ha ha

Hello people wake up , stock split has happened start buying your shares now dirt cheap before they go up theres alot of action going on this year to change a lot...get ready for the ride. $CF

5-1 split coming up if you buy before june 1st? scottrade has it as 4-1 stock split which one is it?

Developing nations = good for CF

Countries like China, India, and Brazil are industrializing their agriculture and this means more global demand for the products that CF makes. These nations have only just begun to industrialize their farming.

Population explosion = good for CF

Any schlamiel with access to a 100 year global population graph can see that there is an exponential rise that is exploding with no signs of slowing down. Unless there is a mass extinction in the human race, CF is a strong buy for the buy & hold investors.

Inflation = good for CF

As the government spends, we'll see more quantitative easing, and rising prices in commodities.

This means more non-prime ag land will get put into crop production, and higher prices on CF products.

From Investors Place:

Agriculture has been a staple in the world economy since the very first farm. Consequently, agricultural stocks have proved to be a stable, reliable choice for consistent growth and income. Constant advances in farming technology, more refined methods of crop cycling, and an increased demand for organic foods have put the agricultural industry in an economic position that is ripe for the picking.

Within agriculture are the markets of crops such as corn, wheat, and potatoes as well as livestock such as cows, sheep, and chickens. Because these are all finite resources, all of these commodities hold significant value. Some of the largest agricultural corporations include Monsanto (NYSE:MON), Mosaic (NYSE:MOS), and CF Industries (NYSE:CF).

http://investorplace.com/hot-topics/agriculture-stocks/#.VTbO-hZeIS0

$CF DD Notes ~ http://www.ddnotesmaker.com/CF

bullish

buy low

$CF recent news/filings

## source: finance.yahoo.com

Thu, 11 Sep 2014 18:44:40 GMT ~ Third Point Boosts Assets Managed to About $17.5 Billion

read full: http://www.bloomberg.com/news/2014-09-11/third-point-boosts-assets-managed-to-about-17-5-billion.html?cmpid=yhoo

*********************************************************

Tue, 09 Sep 2014 19:12:29 GMT ~ RBC Upgrades Nitrogen-Maker CF Industries Holdings, Inc.

read full: http://finance.yahoo.com/news/rbc-upgrades-nitrogen-maker-cf-191229948.html

*********************************************************

Fri, 29 Aug 2014 17:04:00 GMT ~ BAK, SMG And CF, Pushing Chemicals Industry Downward

read full: http://www.thestreet.com/story/12861446/1/bak-smg-and-cf-pushing-chemicals-industry-downward.html?puc=yahoo&cm_ven=YAHOO

*********************************************************

Mon, 18 Aug 2014 19:11:43 GMT ~ Its All About the Nitrogen - CF Industries

read full: http://finance.yahoo.com/tumblr/blog-its-all-about-the-nitrogen-cf-industries-191145509.html

*********************************************************

Mon, 18 Aug 2014 16:20:02 GMT ~ CF Industries (CF) Remains on Track with Expansion Projects

read full: http://finance.yahoo.com/news/cf-industries-cf-remains-track-162002778.html

*********************************************************

$CF charts

basic chart ## source: stockcharts.com

basic chart ## source: stockscores.com

big daily chart ## source: stockcharts.com

big weekly chart ## source: stockcharts.com

$CF company information

## source: otcmarkets.com

Link: http://www.otcmarkets.com/stock/CF/company-info

Ticker: $CF

OTC Market Place: Not Available

CIK code: 0001324404

Company name: CF Industries Holding, Inc.

Incorporated In: DE, USA

$CF share structure

## source: otcmarkets.com

Market Value: $12,833,923,217 a/o Sep 19, 2014

Shares Outstanding: 49,670,730 a/o Jul 31, 2014

Float: Not Available

Authorized Shares: Not Available

Par Value: 0.01

$CF extra dd links

Company name: CF Industries Holding, Inc.

## STOCK DETAILS ##

After Hours Quote (nasdaq.com): http://www.nasdaq.com/symbol/CF/after-hours

Option Chain (nasdaq.com): http://www.nasdaq.com/symbol/CF/option-chain

Historical Prices (yahoo.com): http://finance.yahoo.com/q/hp?s=CF+Historical+Prices

Company Profile (yahoo.com): http://finance.yahoo.com/q/pr?s=CF+Profile

Industry (yahoo.com): http://finance.yahoo.com/q/in?s=CF+Industry

## COMPANY NEWS ##

Market Stream (nasdaq.com): http://www.nasdaq.com/symbol/CF/stream

Latest news (otcmarkets.com): http://www.otcmarkets.com/stock/CF/news - http://finance.yahoo.com/q/h?s=CF+Headlines

## STOCK ANALYSIS ##

Analyst Research (nasdaq.com): http://www.nasdaq.com/symbol/CF/analyst-research

Guru Analysis (nasdaq.com): http://www.nasdaq.com/symbol/CF/guru-analysis

Stock Report (nasdaq.com): http://www.nasdaq.com/symbol/CF/stock-report

Competitors (nasdaq.com): http://www.nasdaq.com/symbol/CF/competitors

Stock Consultant (nasdaq.com): http://www.nasdaq.com/symbol/CF/stock-consultant

Stock Comparison (nasdaq.com): http://www.nasdaq.com/symbol/CF/stock-comparison

Investopedia (investopedia.com): http://www.investopedia.com/markets/stocks/CF/?wa=0

Research Reports (otcmarkets.com): http://www.otcmarkets.com/stock/CF/research

Basic Tech. Analysis (yahoo.com): http://finance.yahoo.com/q/ta?s=CF+Basic+Tech.+Analysis

Barchart (barchart.com): http://www.barchart.com/quotes/stocks/CF

DTCC (dtcc.com): http://search2.dtcc.com/?q=CF+Industries+Holding%2C+Inc.&x=10&y=8&sp_p=all&sp_f=ISO-8859-1

Spoke company information (spoke.com): http://www.spoke.com/search?utf8=%E2%9C%93&q=CF+Industries+Holding%2C+Inc.

Corporation WIKI (corporationwiki.com): http://www.corporationwiki.com/search/results?term=CF+Industries+Holding%2C+Inc.&x=0&y=0

## FUNDAMENTALS ##

Call Transcripts (nasdaq.com): http://www.nasdaq.com/symbol/CF/call-transcripts

Annual Report (companyspotlight.com): http://www.companyspotlight.com/library/companies/keyword/CF

Income Statement (nasdaq.com): http://www.nasdaq.com/symbol/CF/financials?query=income-statement

Revenue/EPS (nasdaq.com): http://www.nasdaq.com/symbol/CF/revenue-eps

SEC Filings (nasdaq.com): http://www.nasdaq.com/symbol/CF/sec-filings

Edgar filings (sec.gov): http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001324404&owner=exclude&count=40

Latest filings (otcmarkets.com): http://www.otcmarkets.com/stock/CF/filings

Latest financials (otcmarkets.com): http://www.otcmarkets.com/stock/CF/financials

Short Interest (nasdaq.com): http://www.nasdaq.com/symbol/CF/short-interest

Dividend History (nasdaq.com): http://www.nasdaq.com/symbol/CF/dividend-history

RegSho (regsho.com): http://www.regsho.com/tools/symbol_stats.php?sym=CF&search=search

OTC Short Report (otcshortreport.com): http://otcshortreport.com/index.php?index=CF

Short Sales (otcmarkets.com): http://www.otcmarkets.com/stock/CF/short-sales

Key Statistics (yahoo.com): http://finance.yahoo.com/q/ks?s=CF+Key+Statistics

Insider Roster (yahoo.com): http://finance.yahoo.com/q/ir?s=CF+Insider+Roster

Income Statement (yahoo.com): http://finance.yahoo.com/q/is?s=CF

Balance Sheet (yahoo.com): http://finance.yahoo.com/q/bs?s=CF

Cash Flow (yahoo.com): http://finance.yahoo.com/q/cf?s=CF+Cash+Flow&annual

## HOLDINGS ##

Major holdings (cnbc.com): http://data.cnbc.com/quotes/CF/tab/8.1

Insider transactions (yahoo.com): http://finance.yahoo.com/q/it?s=CF+Insider+Transactions

Insider transactions (secform4.com): http://www.secform4.com/insider-trading/CF.htm

Insider transactions (insidercrow.com): http://www.insidercow.com/history/company.jsp?company=CF

Ownership Summary (nasdaq.com): http://www.nasdaq.com/symbol/CF/ownership-summary

Institutional Holdings (nasdaq.com): http://www.nasdaq.com/symbol/CF/institutional-holdings

Insiders (SEC Form 4) (nasdaq.com): http://www.nasdaq.com/symbol/CF/insider-trades

Insider Disclosure (otcmarkets.com): http://www.otcmarkets.com/stock/CF/insider-transactions

## SOCIAL MEDIA AND OTHER VARIOUS SOURCES ##

PST (pennystocktweets.com): http://www.pennystocktweets.com/stocks/profile/CF

Market Watch (marketwatch.com): http://www.marketwatch.com/investing/stock/CF

Bloomberg (bloomberg.com): http://www.bloomberg.com/quote/CF:US

Morningstar (morningstar.com): http://quotes.morningstar.com/stock/s?t=CF

Bussinessweek (businessweek.com): http://investing.businessweek.com/research/stocks/snapshot/snapshot_article.asp?ticker=CF

$CF DD Notes ~ http://www.ddnotesmaker.com/CF

Wind, solar, and hydro are reductions in carbon utilization. Burning fuel is a conversion of hydrocarbons or cellulose to water, carbon dioxide, and ash.

Photosynthesis and limestone formation are carbon sequestration.

Scientists theorize that a mass extinction occurred 250 million years ago, because the Earth spewed the unused hydrocarbons all at once.

My research suggests that the event created massive HABs in the ocean, and those HABs are now called "oil, gas, and coal"

Global Warming is basically the same explosion in a more controlled and controllable form, and should be called a "greenhouse effect, IMHO.

BTW, one could likely set up a solar power grid to take calcium and carbon dioxide, and turn it into limestone.

I know nothing about the technology and really don't have the time for study. Best I know, we either heat the water to make steam that in turn makes electricity or we use the power of water for the same purpose. I have no idea what the life expectancy is for the Hoover Dam, so until then I think our country will continue with wind and solar.

I agree, completely. Infrastructure and location.

Bad logistics.

No, I actually developed a way to sequester carbon from the atmosphere, and mitigate the effects using things like fertilizer, seawater, and sunlight.

It's usually referred to in general dialogue as "Aquaculture" or "Mariculture."

I believe I have solved the problem of HAB's which are a major impediment to such work.

I like my combustion motorized vehicle and have no intentions of giving it up at the moment. I'm sure there are many others out there in the same position as I who would agree. I just can't afford a Tesla and wouldn't want to deal with range issues. I take it your against the Keith Stone Pipeline?

We have LNG terminals, we just need more. I think gas is flared because we can't store it. If the developer is flaring gas, they're going after the liquid. Gas producing wells are simply shut in until demand and pricing power returns. All my humblest opinion.

I spent a lot of time learning how to grow food in Seawater.

I blame "science" for chasing down polar bear carcasses and dangerous effects to the current ecosystem, instead of entering the "brave new world" of progress in a greenhouse economy.

Conspiracy theory, humanitarian effort, take your pick. I don't care to speculate. I think we're in agreement on the coal buildout, in that it will take long and incur many costs.

I do not blame sciene for people starving, that is more of a governing problem in other countries, imo. Here in the states, 50% of our population is foodstamp dependant. If anything, blame food shortages on the weather, namely drought conditions.

You might also note that LNG requires a massive buildout, which is why they flare the gas. Nobody wants to live near an LNG terminal or a Nuclear Power reactor.

Might be a good idea to believe Putin when he says he's on a humanitarian mission. The build out would take ten years.

I became interested in fertilizer because I use it to grow shrimp and algae. I sequester excess carbon in the form of Scampi. Do you suppose that the environmentalists will ever consider how many people are starving because of their near sighted policies?

That's great if the process exists in masses, otherwise the build out. And, only if you have a diesel engine. I think we'll instead focus on LNG exports. We have plenty, we can't store it and much of it is burned at the well tip. Then there's that carbon footprint that's bad for the environment and our current administration does not support the coal industry. Also, if the Ukraine fert plants have to convert, they won't be able to compete with our domestic producers as their price point/margin would get destroyed. Here in the U.S., it's cheaper to import steel from China than to produce it domestically. Good talking points tho.

The same process which make fertilizer out of coal can make clean diesel.

It's called the Fischer-Tropsch process. The process requires the sulphur to be removed before the catalysts will convert the energy to diesel. Coal gas can be modified to be a plug in replacement for Natty.

The EU will not impose sanctions anytime soon, imo. The EU is currently energy dependant on the Ruskies? Try running a vehicle on coal, I don't think it will work.

The EU is not ready to impose sanctions on Russia, and the only way Obama can get them to do so, would be to open the coal fields.

Russia is #1 gas producer in the world, #2 oil producer. The EU is their biggest customer, so not sure what to make of what you write.

I don't do conspiracy theory!

A few articles spelled out the problems with getting in Russia's space. Germany depends on their oil and gas, and I think the UK does, a little. We know that fertilizer costs will rise, or they will have to learn how to use Coal again, or buy from China.

So you think Obama will rob Peter to pay Paul? He could finally give up the war on Coal to support the fascists in the Ukraine.

(A few articles suggest that the takeover of the Ukraine was orchestrated by a fascist group, with American support)

"While producers in Ukraine stand to benefit from a reduction in the cost of natural gas from Russia" - Interesting Indeed!

|

Followers

|

8

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

103

|

|

Created

|

02/13/08

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |