Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Seriously???? A board to recommend long term holds on penny stocks?!!! If you've held one for more than 3 weeks you've screwed up!!

Case in point, the guy who started this board had put 3 penny stocks to hold long term. Look at them now...

PLOWmaster’s Penny Thoughts Compiled https://investorshub.advfn.com/boards/read_msg.aspx?message_id=148901914

EXROF - Exro technologies EXROF - 6/10-2019 - https://investorshub.advfn.com/boards/read_msg.aspx?message_id=149303588

VATE - Elev8 Brands Inc. - https://investorshub.advfn.com/boards/read_msg.aspx?message_id=149255583

AMMX - AmeraMex International Inc - 5/18/2019 - https://investorshub.advfn.com/boards/read_msg.aspx?message_id=148898543

RARE OTC PINK FUNDAMENTALS PLAY

Bravada International (BRAV )

https://www.bravada.com/

Rapidly growing and profitable for 3 years.

Extremely undervalued.

No Toxic Debt

OTC PINK CURRENT

https://www.otcmarkets.com/stock/BRAV/security

NO COMMON SHARE PENDING DILUTION As of December 31, 2020

No outstanding promissory, convertible notes or debt arrangements:

No offerings or issuances of securities.

No debt convertible into equity securities, private or public.

No shares or any other securities or options to acquire such securities, issued for services.

https://backend.otcmarkets.com/otcapi/company/financial-report/277199/content

In March 2021 the CEO Converted his Preferred B, C and D shares into 1,170,000,000 common shares.

The CEO’s shares are restricted to selling only 1% of the OS per quarter – 18.74 million.

NO RS CONSIDERED UNTIL 2022

04/19/2021 PR

BRAVADA International Announces That It Will Not Consider a Reverse Split Until 2022

https://www.otcmarkets.com/stock/BRAV/news/BRAVADA-International-Announces-That-It-Will-Not-Consider-a-Reverse-Split-Until-2022?id=298803

BRAV is not a share selling scam.

The CEO is very conservative.

NO DILUTION FOR OVER 8 YEARS

The OS was unchanged for over 8 years.

BALANCE AT Dec 31, 2020 704,566,667

BALANCE AT Dec 31, 2013 704,566,667

BALANCE AT Dec, 31 2012 700,200,000

https://backend.otcmarkets.com/otcapi/company/financial-report/118089/content

https://www.otcmarkets.com/stock/BRAV/security

b]COMMON SHARE STRUCTURE

AS OF 03/25/2021

Authorized Shares ----4,990,000,000

Outstanding Shares --1,874,556,667

Restricted Shares -----1,178,361,735

Float -------------------------696,194,932

PREFERRED SHARE STRUCTURE As Of 04/12/2021

Preferred Series A

(%100 Owned by the CEO Danny Alex for Voting Rights Only)

Number of Shares Authorized 5,000,000

Number of Shares Outstanding 5,000,000

Conversion: None

Conversion at Option of Holders: None

Automatic Conversion: None

Liquidation Rights: None;

https://www.bravada.com/corporate-information/

Preferred series B

Number of Shares Authorized 3,000,000

Number of Shares Outstanding NONE

Preferred Series C

Number of Shares Authorized 1,000,000

Number of Shares Outstanding NONE

Preferred Series D

Number of Shares Authorized 1,000,000

Number of Shares Outstanding NONE

https://www.bravada.com/corporate-information/

ASSETS AND LIABILITIES As Of 12/31/2020

---------------NO TOXIC DEBT----------------

TOTAL ASSETS __________$1,092,347

Total Liabilities ______________$53,762 (Short Term Loans)

Total Checking/Savings ______$115,710

03/25/2021 PR

“BRAVADA International is in an excellent position with strong free cash flow from operations and we expect to have almost $200,000 of cash on hand at the end of March 2021. We have managed to grow our assets..."

https://www.otcmarkets.com/stock/BRAV/news/BRAVADA-International-Announces-a-Delay-in-Its-Reverse-Split-and-Provides-Shareholders-Insight-into-The-Company-from-CEO?id=295130

ANNUAL REVENUE / NET INCOME

--------Profitable Since 2018----------

Total REVENUES 2020 $4,088,966 Net Income $399,752

Total REVENUES 2019 $2,699,744.23 Net Income $59,162.46

Total REVENUES 2018 $2,691,821.91 Net Income $250,149.10

Total REVENUES 2017 $983,959.02 Net Income --$94,847.77

Total REVENUES 2016 $1,264,114.12 Net Income --$325,490.48

Total REVENUES 2015 $1,127,279.86 Net Income -$575,260.70

---THE CEO---

DANNY ALEX

CEO and Founder

Podcast with Danny Alex, CEO of BRAVADA International May 7, 2021

https://www.twitch.tv/waypointjohn

Meet CEO Danny Alex

https://www.bravada.com/message-from-the-ceo-danny-alex/

Message from CEO Danny Alex

https://www.bravada.com/ceo-danny-alex/

Interview with CEO Danny Alex

50 Innovative Companies to Watch 2020

https://thesiliconreview.com/magazine/profile/bravada-international-next-gen-women-fashion-trends

Comprehensive Shareholder Communication Program

Answers To Your Emails

https://www.bravada.com/answers/

Questions "Contact Us" page

https://www.bravada.com/contact-us/

THE BUSINESS

BRAVADA International is an internet and media company that owns and curates online properties through a proprietary methodology of creating, developing and operating retail and wholesale websites that provide an exciting blend of consumer level and B2B products and services.

BRAVADA owns and operates a number of websites in the women’s fashion industry, personal protective equipment space and consumer pets supplies both retail and wholesale and has a number of additional online properties in development. The Company owns all parts of the website’s operations including the domain and website and inventories the products at its warehouse in downtown Los Angeles. BRAVADA also performs all of its own fulfillment and shipping duties for all of its online orders.

THE BUSINESS IN PROGRESS

This is why many are holding long positions in BRAV.

04/08/2021 PR

In addition to its 3 recently released websites, USAFashion.com, WomensFashionWholesale.com and WorldofPets.com, BRAVADA intends to launch 5 additional websites in 2021, each in various stages of development, in wholesale and retail. The launch of these websites will culminate into BRAVADA’s large-scale signature project that will be discussed at a future date.

“To date, we have disclosed only a small part of our long-term business plan and intend to release details of its full breadth through 2021,” replied Danny Alex, Founder and CEO of BRAVADA International. “I have been constructing BRAVADA’s business plan for the last 4 years, assembling the many pieces required for its deployment and execution. I believe that there is significant opportunity for BRAVADA to set itself apart as a multi-faceted media and internet company with a business plan that is both unique and ambitious.”

https://www.otcmarkets.com/stock/BRAV/news/BRAVADA-International-CEO-Danny-Alex-Calls-2021-a-Defining-Year-for-the-Company-with-Multiple-Online-Properties-in-Devel?id=297316

$IDEX Ideanomics CEO Says The Co Is Looking To Enter To The School Bus Sector In Europe

$IDEX Ideanomics CEO Says The Co Is In The Commercial Fleet Operator Space

$IDEX Ideanomics CEO Says King Of Malaysia Is One Of The Primary Investor In The Co

30 Day Assessment Report from Amfil Technologies, Inc. CEO Rogen K. Chhabra

Press Release | 12/28/2020

TORONTO, ON, Dec. 28, 2020 (GLOBE NEWSWIRE) -- via NewMediaWire -- Amfil Technologies, Inc. (OTC: FUNN) is pleased to provide the following shareholder update.

Per the previous shareholder update, this assessment constitutes the stated report to be given for the first 30 days of the CEO transition plan. It has been an incredibly active month; reviewing initiatives, projects, financials, meetings with contractors, auditors, and all levels of staff. While this report will give a comprehensive overview of the current trajectory for Amfil, certainly some areas will still need more review and strategic thought. Shareholders can expect continued communication in future reports.

First 30 day Key Accomplishments

2021 Q1 filed with attorney opinion letter on compliance

Listed as Pink Current with OTCMarkets

Restructured a portion of debts with favorable terms and negotiated interest free forbearances on another portion

Signed engagement letter with Wipfli LLP accounting firm for FY 2019 and FY 2020 audits

Negotiating the terms of the first dispensary operation buildout

Hired a project manager to facilitate the opening of Tucson as expeditiously as possible. The new manager will be on sight full time after the first of the year

Site visit to Tempe to as part of continuous improvement within operations

Fulfilled prizes to contest winners just in time for the holidays

Increased authorized shares to be compliant with obligations

Listed in house published games on Loblaws and Walmart websites

Initial review of all Amfil projects and initiatives for strategic assessment

Comprehensive review with all levels of staff for 360 feedback on company

Communication

Recognizing, establishing and maintaining shareholder confidence is an important facet for investor relations, I have responded as promptly as time allows to anyone that has reached out by email or by phone. While one can expect a certain allowance for confidence as a new CEO; maintaining it can only be accomplished through consistency over time. This initial 30-day assessment provides the first data point for follow through in communications going forward. The intention is to set the tone for shareholders' expectations as I continue to lead Amfil as its new CEO.

Audit/Uplist

Certainly, completion of audits and subsequent uplist is paramount to Amfil’s continued growth and future success. To that end, I have signed an engagement letter with Wipfli LLP accounting firm to perform the FY 2019 and FY 2020 audits. Wipfli has 2400 associates in 48 offices spanning across North America and around the world. They are a top 20 auditing firm in the US. (https://www.wipfli.com/) Realistic discussions have occurred regarding timing of completion. The firm has requested supporting financial and other documents. A conference call is scheduled for the first week of January for the firm to assess the scope and expected timeframe of the project. As soon as a reliable projected completion date can be provided, it will be made publicly known. When the audit is complete we will proceed with the process for uplisting to the OTCQB. We are excited to have reached an agreement with such a robust accounting firm as we move Amfil to the next and much more appropriate tier in the OTC Marketplace.

Evaluations of all subsidiaries and initiatives

Snakes & Lattes

‘Tempe’ - The venue is operating at 50% of capacity based on COVID restrictions. Revenue has been higher than 50% of pre-covid numbers. To improve the opportunity, we have been granted a permit to expand our outside seating to hold an additional 30 customers, and we have successfully secured a grant to build the outdoor space. Measures have been taken to scale back labor costs in proportion to what is required to meet the current demand. ‘Tempe’ is the first Snakes & Lattes in the USA and has proven to be a good model for continued expansion. It has also shown us places where improvement is required in bookkeeping and accounting practices to stay consistent with all other venues. Those improvements are being implemented. Tempe also received a PPP loan and used the proceeds according to guidelines required for forgiveness. A forgiveness request has been submitted and is expected to be approved in the near future.

‘Tucson’ - A target date of March 15, 2021 has been set for opening. This is based on current projection for finishing construction, training staff, and finalizing permitting. If new information provides a necessary adjustment to the target, it will be reported in real time accordingly. A full time project manager will be on site from the first week of January until it is complete. A grand opening date will be announced in due course.

‘Guelph’ - Construction is proceeding. No opening date will be announced at this time, but shareholders can expect significant progress before the 3 month assessment report in March.

‘Chicago’, ‘Midtown’, ‘Annex’, and ‘College’ - all are temporarily closed except for takeout as a result of COVID 19 restrictions. Management in each location is engaging with customers through online trivia and other means to retain customer attention in preparation for reopening. Amfil purchased the assets of Gaming Cafe, LLC in Chicago and continues to operate under and with full ownership of that entity. In due course, we will make any adjustments when necessary on the corporate structure for that entity. A grand opening announcement will be given for ‘Chicago’ as soon as practically possible after reopening and operating at 100% capacity.

Morning - Amfil purchased assets of morning in 2018 with the intent of vertical integration in the board game space to create synergy with the Snakes & Lattes boardgame cafes. While there has been some success within international markets for our initial game board offerings, Morning has not proven to be the desired profit generator to date. There may be a viable future for Morning, but priority attention should be placed on Snakes & Lattes cafes that have proven to be able to generate significant revenues. Morning and other vertical integration efforts will be revisited after the cafes are stabilized in terms of revenue.

Loblaws - Our in house titles of ‘Kill the Unicorns’ and ‘Red Panda’ are listed on Loblaws’ website. The agreement to list 300+ new titles with Loblaws will be revisited during 2021.

Wal-Mart - Our in house titles are listed for sale on their website. Any additional negotiations for negotiating and fulfilling a purchase order will be revisited in 2021 after the board game cafes stabilize post COVID restrictions.

Gro3

The Gro3 product is the result of a joint venture between Advanced Ozone Integration, Inc and Amfil to manufacture and distribute air cleaning and water purification technology for indoor and outdoor grow operations in the Cannabis sector. To date, three units have been purchased and installed. While these units have proven the efficacy of the product and have greatly satisfied customer expectations, recent discussions have been had between the companies to determine the best way to proceed. At this time, I do not have enough information to predict the outcome of the initiative. Additional reports on this venture will be reported in 2021 as time for continued assessment and strategic thought must be given.

Dispensaries

An agreement was struck in August 2020 with highly accomplished cannabis dispensary entrepreneur David Berkovitz and Tokin Dispensaries Inc. to open Kiosks/Dispensaries in the Greater Toronto Area. The first location has already been secured. David and I are negotiating the terms of the first buildout which will likely become the central hub of our dispensary operation. Long term we have a goal to open many more; including kiosks adjacent to current Snakes & Lattes locations. We also plan to open them adjacent to Ontario convenience store locations with another company with whom we have a working relationship. The business model is very promising in that each location will require relatively small square footage and low labor costs with a high expected margin on the products sold. David Berkovitz, Tokin and Amfil are incentivized to move this project forward and excited about the prospects of what is to come. Progress on this initiative will be reported within the planned March 3 month assessment.

Interloc Kings

Interloc Kings continues to operate in the hardscaping and snowplow business. It continues to generate consistent moderate revenue. It is self sustaining, and requires little effort from the corporate side. Initiatives for opportunities and growth will not be prioritized until after the planned spin-off is complete.

USA expansion team

From January 18, 2020 to November 25, 2020

My previous role with Amfil was Head of USA Expansion from January 18, 2020 until I was named CEO. In the month and a half before the world locked down due to the pandemic, I had traveled for site inspections and made progress with LOI’s being negotiated across Denver, Los Angeles, New Orleans, and had many other potential venues in the works. The unknown variables spawned by COVID in early March made it far more difficult for landlords to entertain negotiations and for joint venture partners to invest in our entertainment concept. Expansion was certainly not scrapped; but travel became difficult, and the progress was unavoidably slow. Although my agreement called for compensation only in terms of a successful expansion, my efforts were shifted to helping Amfil uncompensated in any way I could. This included but was not limited to:

Securing PPP funds for Tempe

Helping Morning with relief assistance from the French government

Successfully seeking rent abatements in Tucson and Tempe

Negotiating debt relief with various creditors.

USA Expansion from now and moving forward

With COVID uncertainties beginning to settle, I expect opportunities in 2021 to pick up space and get venues open that we positively know the public is craving. But we should not rush or overextend ourselves. Expansion must happen, but we will first focus priorities on maintaining a balance to get all existing and planned locations open and profitable.

Franchising

Future franchising has the potential to be an incredible and unprecedented growth opportunity. However, before we can consider franchising, the audit and uplist must be completed. Even post audit and uplist while franchising might be a chosen route, we will assess franchising prospects at that time. The assessment will compare that path to the alternative moving forward with continued 100% corporate ownership of all locations. The option most beneficial for Amfil and its shareholders will be the path taken.

Spin-off

Amfil plans to spin off the Cannabis and Hardscaping sectors with Board Game Cafes and board game manufacturing and distribution sectors to stay together and benefit from vertical integration. Shareholders will receive proportional shares of the new company and benefit from the value expected from the spin-off. As completion of a spin-off is critical for institutional investment and the growth of Snakes and Lattes operations, it is absolutely on the road map. That said, there is no current timeframe for the spin-off. Many discussions and much work needs to occur first to accomplish this mission. The progress towards the goal will be reported in future assessments, but a target date will not be given until it has moved from the horizon to the forefront. Rest assured we are marching towards the horizon.

Revenue and Debt

Amfil was generating a 10 figure annual revenue prior to COVID restrictions. While we expect to meet and exceed those numbers as the restrictions are lifted, it is difficult to realistically evaluate and make a plan going forward until all current and planned venues are open and running at 100% capacity. In the meantime, I have taken steps to negotiate debt to work for the company in a healthy manner as we transition towards an exciting fiscal 2022 with even more enthusiasm for fiscal year 2023 and beyond.

Employee / Partner feedback

I believe in the collective knowledge of our workforce. The folks running the day to day operations possess much insight and wisdom of what is happening in the trenches, and can often be the greatest source of information in the spirit of continuous improvement. I have reached out to as many staff members as I can, and plan to make it part of my regular due diligence to maintain an open line of communications for the overall betterment of the company.

What is truly heartening, is that I have been overwhelmed with the positive reaction of managers, employees and joint venture partners falling under the Amfil umbrella. Their passion for our brands are unmatched, and I am excited for a promising future with our team.

Items not considered for further development

While none of these listed entities should be new news for shareholders, the goal of this report was to be comprehensive and give a complete view of all companies' current and previous projects.

NSI - The agreement was made approximately 3 years ago between Natural Stuff and Amfil is null. It will not be a focus for 2021 and there are no plans to revisit this agreement. It is critical Amfil pursues other endeavours more likely to generate revenue and return a profit.

Ku Kum - While we certainly wish Chef Joseph Shawana much success in all his culinary endeavors, the partnership established in 2017 between Ku Kum and Amfil is null at this time with no intent to revisit. Amfil needs to focus all critical resources and effort into the most profitable channels to maximize our future growth and success.

Guyana Mining licenses - There has been no pursuit for years and no current or future intent to pursue any further mining. Company time and resources are better spent on our board game cafe, cannabis, and hardscaping sectors.

Final note

While the intention of this report is to give a comprehensive overview of all current projects, there is so much going on with Amfil I am sure there are unanswered questions. As previously mentioned in my first update, shareholder conference calls are needed. This will be a 2021 calendar year initiative, I will establish such a plan and report in the 3 month March assessment. I expect to fill in more details as we see where we are with COVID and all other initiatives. Between now and the next assessment, shareholders can expect to receive news on any pertinent items, via Twitter or newswires. Those communications have their own frequency and we will make no specific announcements prior to release. The purpose of the next March assessment is to provide a quarterly update cadence that can be relied upon for all company on-goings. Right now, execution is critical and the top priority.

I am incredibly encouraged by what I’ve seen thus far, and the prospects for the future of the company are very bright and real. It is clear we have a lot of work before us; but our company and brand is strong, energizing and capable. I am truly filled with excitement and optimism for the future of Amfil. In the meantime, I will continue to hold myself accountable to shareholders for the plan I have laid out. My best efforts will be toward improving all aspects of Amfil for the benefit of all stakeholders (Shareholders and Amfil employees) through consistency of execution and communication. As always, I will remain accessible as best possible via email and phone.

About Snakes & Lattes

For further updates from the Snakes & Lattes and its parent company, Amfil Technologies Inc please follow us on Twitter @AmfilTech

For more information regarding the company, and its related subsidiaries please visit the following websites:

Amfil Technologies Inc. www.amfiltech.com

Snakes & Lattes Inc. www.snakesandlattes.com

Morning (Snakes & Lattes Publishing SAS) https://www.morning.us

GRO3 Joint Venture http://gro3systems.com

Interloc-Kings Inc. http://www.interloc-kings.com

About Us:

Amfil Technologies Inc. is the parent company to three wholly owned subsidiaries.1). Snakes & Lagers Inc. holds the trade name and is the owner of Snakes & Lattes Inc. which currently operates 3 tabletop gaming bars and cafes located in Toronto, Ontario and 1 in Tempe, Arizona. The company is in the process of expanding throughout North America. Snakes & Lattes Inc. was the first board game bar and cafe in North America, is believed to be the largest in the world and has the largest circulating public library of board games in North America for customers to choose from. For more information on Snakes & Lattes Inc. feel free to visit the website at www.snakesandlattes.com.

2). The EcoPr03 GRO3 Antimicrobial System was jointly developed between Amfil Tech and A.C.T.S. Inc. which rebranded its technology under Advanced Ozone Integration as an extension of the existing ozone technology being utilized in the food and beverage industry and integrated by A.C.T.S. into companies such as Pepsi, Nestle, Sysco, Sun Pacific and many others. The system is a triple-function sanitization unit capable of naturally eliminating 99.9% of water and airborne pathogens and the typically problematic pests that wreak havoc for cultivators (like aphids, whiteflies and spider mites), as well as bacteria, fungus, microbes and mold on surfaces, all without chemicals. The unit can also constantly regulate a given facility's water supply, oxygenating the water and maintaining a consistent PPM infusion of ozone that prevents the formation of algae, bacteria or mold (allowing for comprehensive water recycling), simultaneously removing the need to use pesticides and/or dangerous, often carcinogenic products to treat production problems, as is common throughout the industry today. This environmentally-friendly solution also eliminates odors, while slightly reducing the air temperature, lowering energy consumption by the HEPA filtration and HVAC systems and could potentially allow for a facilities process to be labeled certified organic in the U.S.A. when the crop is no longer considered illegal on the federal level, otherwise "Clean Green" or "Certified Kind" in the meantime. The EcoPr03 GRO3 Antimicrobial System passed product review by a registered USDA certifying agent for use in California as well as Pennsylvania and surrounding states. The subsidiary has developed a strategic partnership with Roto Gro, the creator of proprietary rotary hydroponic technology. More information on this product line can be found at www.gro3systems.com

3). Interloc-Kings Inc. is a hardscape construction company servicing the Greater Toronto Area. This subsidiary is an authorized Unilock installer. Unilock is North America's premier manufacturer of concrete interlocking paving stones and segmental wall products. Interloc-Kings Inc. has an A+ Rating with the Better Business Bureau (BBB) and a 10/10 rating on homestars.com. Specializing in stone and wood installations between $5,000 and $150,000 per project, Interloc-Kings Inc. has become a top, high quality installation company of outdoor living areas in the GTA. More information on this subsidiary can be found at the website www.interloc-kings.com

Safe Harbor Statement

This news release contains statements that involve expectations, plans or intentions (such as those relating to future business or financial results, new features or services, or management strategies) and other factors discussed from time to time in the Company's OTC Market or Securities and Exchange Commission filings. These statements are forward-looking and are subject to risks and uncertainties, so actual results may vary materially. You can identify these forward-looking statements by words such as "may," "should,", "will", "expect," "anticipate," "believe," "estimate," "confident," "intend," "plan" and other similar expressions. Our actual results, such as the Company's ability to finance, complete and consolidate acquisition of IP, assets and operating companies, could differ materially from those anticipated in these forward-looking statements as a result of certain factors not within the control of the company such as a result of various factors, including future economic, competitive, regulatory, and market conditions. The company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Contact:

Rogen Chhabra, CEO

Amfil Technologies Inc.

Telephone: (601) 326 0805

Email: rogen@snakesandlattes.com

Or

Ben Castanie

Snakes & Lattes Inc.

Telephone: (416) 500 2911

Email: ben@snakesandlattes.com

Monument Mining (TSXV:MMY) Oversold and undervalued gold producer 10 bagger, Imo

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

Monument MIning Limited V.MMY

Alternate Symbol(s): MMTMF

https://stockhouse.com/companies/quote?symbol=v.mmy

Mengapher Copper Porphryry.......Interesting article

These copper/gold /silver porphrys are much more important than i had

realized.

That impression was derived from low grades of these porphrys, but

research on recoveries shows about 90 % copper and about 65 % for gold.

Mengapher has 50.9 million tons of ore , containing 394,000 tons of

copper which is close to 900 million lbs.

It also contains 409,000 ounces of gold plus millions of ounces of

silver.

At 2 million tons per year, its mine life would be about 25 years.

What is also positive is that the overburden is magnetite rich in iron

ore.

Removal of this overburden can be expensive but with lots of magnetite

iron ore in the overburden soils which has been and can be profitably

sold, this process can carry on until the skarn rock is fully exposed,

with progits directed towards paying for the mill.

Mengpaher will need more drilling to upgrade the 43-101 categories to

measured from Indicated, but this too can be paid for by the sale of

magnetite soils.

I dont know what Monument might get for its 100 % owned Mangapher

project.

I would hope at least $40 million US up front and a 2-3 % NSR on future

production.

Contained in this would be 1.2 million tons of stockpiled magnetite

which should convert ,upon concentration and milling,to about 200,000

tons or so of 62 % iron fines valued at about $27 million US at current

iron ore prices.

by nozzpack (519) thanks good info

December 09, 2020 - 08:33 AM

Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future years the weather is good no curtain needed - ![]() )

)

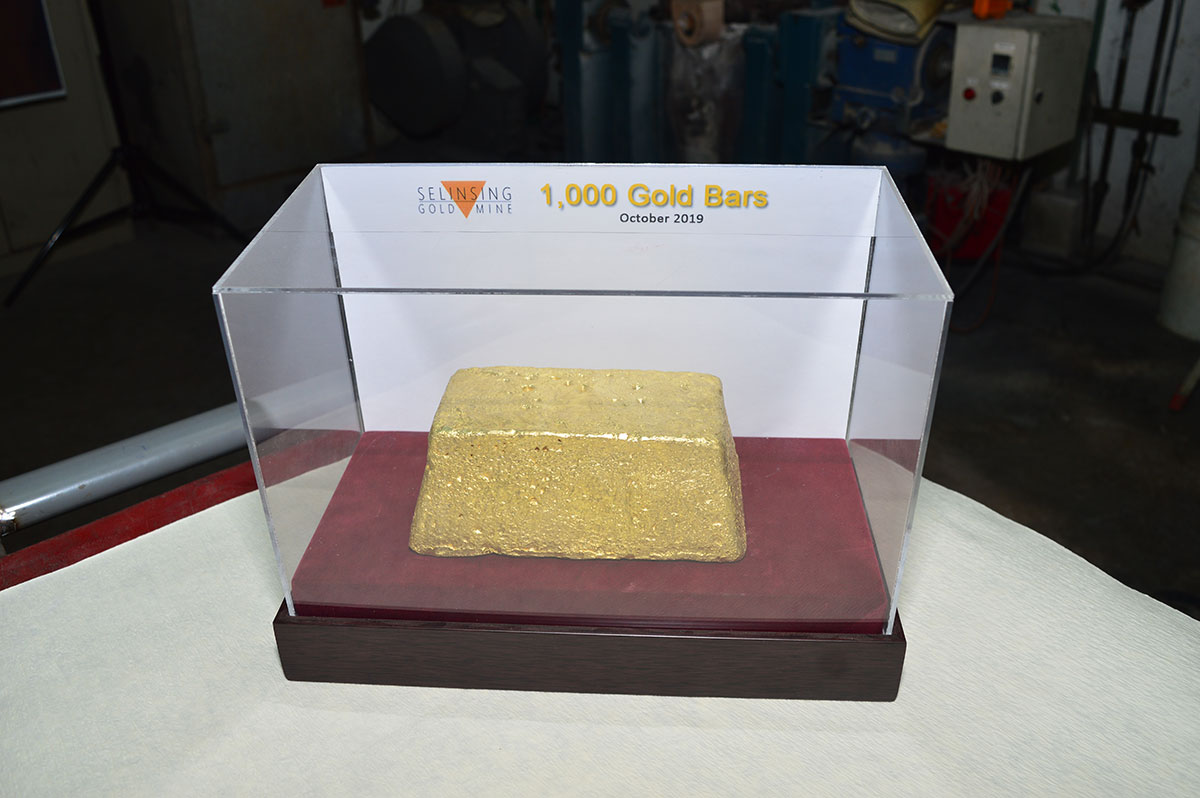

1,000th Gold Bar Pour Photo Gallery ![]() ) It's a great Mother ore start

) It's a great Mother ore start

https://www.monumentmining.com/news-media/photo-gallery/

Market Cap $30 mil. - No Debt - someone has to be kidding ![]() )

)

is it the fact ???

What a Great Gold Mines bargain ![]() )

)

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered ![]() )

)

Imo!

Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Previous | Next

LQMT after 20 years, an industry is born. For the first time in the companies extended history it began shipping volume orders in July. It took 20 years to commercialize this space age material, but now it's here .

BWVI News, they are getting on it and making it happen!

Blue Water Ventures International 2020 Season is in Motion

Press Release | 07/28/2020

Jacksonville, FL, July 28, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Blue Water Ventures International, Inc. (OTC:BWVI): Greetings from our BWVI team. It has been a difficult environment in 2020, with COVID-19 affecting most everyone and every business in one way or the other. Blue Water Ventures International, Inc. and project partner Swordfish Partners, LLC are pleased to report the start of the 2020 dive and recovery season. The recovery vessel Blue Water Rose is now on her way to Virginia Beach, where the crew will dive to recover samples from a 1911 wreck site. BWVI anticipates a ten-day window to complete the survey and recovery of samples.

BWVI will then move back to the “SB Pulaski” site off Wrightsville Beach, North Carolina. Keith Webb, President of Blue Water Ventures, commented, “Our Captain and crew have worked hard in the off season to upgrade our deep dive re-breather system that will enable us to spend longer periods of time while diving so deep. This deep-water dive opportunity opens the door to an abundance of wrecks with untouched cargos and riches.”

Our team is ready to bring more history back to the surface and share in the journey of the SB Pulaski and its final days at sea back in 1838. A story that can be told not only through what has been written but what has been and will be found from the Pulaski site as we continue our mission to recover more of its story. We have had successful seasons finding many historic and valuable pieces with some of the earliest rare, US minted gold shipwreck coins recovered to date which were successfully sold to collectors. We are excited to get back to what we do best, while keeping the public and shareholders abreast of our recovery efforts with enhanced corporate communications. We believe we have only just scratched the surface on the SB Pulaski and its cargo with much left to be discovered. The team is thrilled to be back at it and look forward to reporting back in the near future.

We also plan to relaunch our new website very soon as well as have our financials released which will bring Blue Water back current with OTC markets. Also of note, the shares outstanding as of today are 68,797,013 and we are happy to report that after 8 years of being public we have remained committed to keeping our share structure intact with non-toxic funding and plan on this being the case moving forward. Blue Water looks forward to updating shareholders as we get into motion and are pulling up artifacts, valuables, and learning more of the SB Pulaski history. Follow up on Facebook for updates as we are on the water.

For more timely updates, and info regarding the most up-to-date recoveries be sure to follow our Facebook page at the link below.

https://www.facebook.com/BlueWaterVenturesInternational/

About Blue Water Ventures International, Inc.:

The Company is engaged in the business of conducting archaeologically sensitive recoveries of cargo and artifacts from shipwrecks. Its operations to date have focused on shallow water search and recovery projects in less than 150 feet of water. The Company is now expanding its focus to include deep-water salvage of historic and modern-day shipwrecks.

Keith Webb

904-215-7601

kw@bwvint.com

SSFT: Insane volume today from the google filing. Just shy 30 Million!

Just getting started! I swear this going to get acquired, Classic Silicon Valley style.

$SSFT

SSFT: Now with GOOGLE

8-K filed

https://www.otcmarkets.com/filing/html?id=14212370&guid=0r1FUqB4i2ybith

Item 8.01 Other Events

Sonasoft Corp. recently entered into an agreement with Google (Nasdaq: GOOGL). Sonasoft will be involved in the development of services and products for Google Cloud Learning Systems.

So first FIS, (Fidelity) and now Google...

https://www.otcmarkets.com/filing/html?id=14151883&guid=0r1FUqB4i2ybith

Item 1.01 Entry into a Material Definitive Agreement

Sonasoft Corp. recently entered into a multi-year strategic alliance with FIS (NYSE: FIS), one of the world’s leading providers of financial services technology. Sonasoft will develop and implement AI applications and solutions.

Clearly SSFT is getting in with the big dogs

TREP volume 95% green

Holding HOD

Massive fundamentals

Would love Swing traders

Alert by FZH on twitter

Great SSFT Article

https://geekinsider.com/sonasoft-and-driving-artificial-intelligence-in-enterprise-forward/?utm_campaign=coschedule&utm_source=twitter&utm_medium=geekinsider&utm_content=SonaSoft%20and%20Driving%20Artificial%20Intelligence%20in%20Enterprise%20Forward

Continued validation SSFT is serious and it is going to be on a meteoric rise!

SSFT News! Keeps getting better! Unlimited AI applications. Best R scores, beating the big box AI solutions. Posted deal and ticker tagged with Fidelity FID (8k to SEC even)

Sonasoft AI PoC Demonstrates Significant Savings for Delaware Electric Cooperative

Press Release | 05/19/2020

San Jose, CA, May 19, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Sonasoft Corp. (OTCQB: SSFT) is pleased to announce the successful completion of their proof of concept with Delaware Electric Cooperative (DEC). The PoC leveraged NuGene, Sonasoft’s AI Bot Engine, to give accurate demand forecasts. The PoC demonstrated that NuGene can deliver annual cost savings of up to $1.3m. As a result, DEC has green-lighted a move to production starting June 1st.

“We must adapt to the wants and needs of our members,” said Bill Andrew, President and CEO of DEC. “They want quality power, minimal interruptions, competitive costs, and immediate response. I am 100% convinced that AI is key to our future success and existence. The potential for AI applications is endless. I see applications that include operations, engineering, customer service, billing, public relations, and accounting. I do not see a limit to these applications once we establish some successful applications that co-ops can fully embrace. The work we have done with Sonasoft has shown how AI can deliver an application that delivers immediate value.”

Delaware Electric Cooperative’s transmission services are provided by the region’s investor-owned utility or (IOU). One of the biggest costs to the Co-op’s business is coincident peaks. A coincident peak (CP) happens when DEC’s peak demand coincides with that of the regional transmission zone. These CP events determine DEC’s demand costs each month. To try and avoid them, DEC instigates load control (LC) and issues “Beat-the-Peak” notices to its members, encouraging them to reduce their highest-demand appliances.

DEC doesn’t want to trigger LC events unnecessarily. However, they also need to try and avoid unplanned CP events, which can cost over $1m in the peak summer season. In this PoC, Sonasoft NuGene was tasked with creating an AI bot to deliver 3 key predictions:

1. Long-range (1-2 week) predictions of likely peak and non-peak days

2. Short-term (24 hours) predictions of the precise peak type and timing

3. A specific recommendation for when to trigger an LC event

The overall aim was to reduce unnecessary LC events whilst ensuring DEC never missed a CP event. In order to do this, NuGene uses accurate real-time weather variables including temperature, humidity, sunlight intensity, wind velocity, atmospheric pressure and storm paths, along with historical data of electric consumption, to accurately forecast electric consumption.

“NuGene is uniquely suitable for creating bots like this,” said Ankur Garg, Chief AI Officer at Sonasoft. “NuGene uses deep learning to understand historical data and identify patterns in it. These patterns are then used to create an AI prediction model that runs as a stand-alone bot. The power of NuGene is that it does all this autonomously, checking all its hypotheses for causation and testing thousands of AI models to find the most accurate. That’s why we refer to NuGene as our AI Bot Factory.”

NuGene trained the forecasting bot on DEC’s historical data and then validated it with the data for 2019. It was able to deliver a 12% improvement in peak predictions compared to DEC’s existing methodology. It was also able to reduce unnecessary LC events by 5%. The model was able to deliver R2 (aka R-squared) scores of between 0.921 and 0.947. R2 measures how accurately the model is predicting reality. To put this in context, many advanced AI models manage scores of less than 0.9.

Moving forward, DEC will use Sonasoft’s AI solution to accurately predict peak usage and minimize the number of load control events. This will allow the utility company to further reduce costs, increase member satisfaction, and deliver reliable power to its members.

Notes

1. Sonasoft was founded in Silicon Valley in 2003. For more information about the company, please visit: https://www.sonasoft.com

2. Sonasoft NuGene is a unified AI platform that can process any type of data and generate autonomous AI models. For more information about Sonasoft’s Artificial Intelligence (AI) Solutions, please visit:

https://www.sonasoft.com/products/artificial-intelligence-ai/

3. For investor-specific information, please visit: https://www.sonasoft.com/investors/

Investor Contact:

Mike Khanna

CEO Sonasoft Corporation

Phone: (408) 708-4000

BWVI PR Recovery season starting, they know exactly where to go, and will be bringing up millions. Low float, OS not diluted for years and year. Legit operations, respected in industry around the world.

Blue Water Ventures International Announces 2020 Recovery Season

Press Release | 04/08/2020

Jacksonville FL, April 08, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Blue Water Ventures International, Inc. (OTCPK:BWVI) announces 2020 Pulaski Recovery Season to commence in May and continuing throughout the dive season, including full scale surveys of both North Carolina and South Carolina sites and additional areas of interest. All plans going forward are contingent on confirmation that the current COVID-19 outbreak has been contained and the public is given the all clear to return to business as usual. The Company is using this time to complete major upgrades on the recovery vessel, Blue Water Rose, and the work is on schedule to date.

The Company and its project partner, Endurance Exploration Group, are looking forward to the Skinners Auction House online auction of several of the time pieces recovered from the Steamboat Pulaski. The watches selected for the sale can be viewed at https://www.skinnerinc.com/auctions/3364T , the online auction will be available starting April 6 and close April 14, 2020.

Keith Webb, CEO of Blue Water Ventures International, states, “The start of this year has been unlike any other for us all. We offer our best wishes for a speedy and smooth transition back to normal for everyone going forward. The Blue Water team is looking forward to going back to the Pulaski site and making lots of exciting news this coming season. Stay tuned!”

About Blue Water Ventures International, Inc.:

The Company is engaged in the business of conducting archaeologically sensitive recoveries of cargo and artifacts from shipwrecks. Its operations to date have focused on shallow water search and recovery projects in less than 150 feet of water. The Company is now expanding its focus to include deep-water salvage of historic and modern-day shipwrecks. For more information go to http://www.bwvint.com

About Endurance Exploration Group, Inc.:

Endurance Exploration Group, Inc. (OTCPK:EXPL) specializes in historic shipwreck research, subsea search, survey and recovery of lost ship containing valuable cargoes. Over the last 5 years, Endurance has developed a research database of over 1,400 ships that are known to be lost with valuable cargoes in the world oceans. For more information go to http://www.eexpl.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Such forward-looking statements are subject to certain risks and uncertainties including, but not limited to ability to further strengthen our balance sheet, ability to raise funding for continued operations, ability to successfully and profitably locate additional wrecks and cargo, ability to establish ownership, and other factors. Therefore, actual results may differ materially from those indicated or implied by such forward-looking statements. Except as required by law, the Company disclaims any obligation to publicly update such statements.

Keith Webb

904-215-7601

kw@bwvint.com

FUNN to begin reopening PR

Amfil Technologies Inc. Is Pleased To Provide Updates On The Snakes & Lattes Inc. Subsidiary Including Location Openings And Newly Implemented Safety Procedures

Press Release | 05/13/2020

Amfil Technologies Inc. (OTC: FUNN) is pleased to provide shareholders with the following update:

As shareholders are aware, the three brick and mortar Snakes & Lattes locations in Toronto, Ontario and the fourth in Tempe Arizona were temporarily closed in accordance with government regulations and in an effort to protect our employees and valued customers. As restrictions are being lifted in Arizona the company is gearing up for re-opening. As of Monday May 11th 2020 restaurants were given the go-ahead to re-open and we will be re-opening the Snakes and Lattes Tempe location next week with staff trained to follow the new protocols and procedures. From what was seen this week so far in the area, attendance has been overwhelming at local locations which gives confidence that the re-opening will be very successful. We also expect the Toronto locations to re-open later this month, pending the anticipated government permission. Throughout the temporary closures, the company has received government assistance through the PPP (USA) and CEBA (Canada) programs which are very friendly on the company and there will be more to come on this.

In accordance with infection prevention and control (IPC) measures, the company has constructed a three-phased opening to exercise caution, minimize risk for employees and guests, and to prevent the spread of COVID-19. The phases are as follows:

Phase 1: Opening for take-out and delivery services only

Phase 2: Open for regular business with reduced hours

Phase 3: Fully open for business

All phases include enhanced cleaning and sanitization protocols and processes. Additional cleaning staff will support these protocols, increasing the frequency of cleaning of heavily trafficked areas and hard surfaces including entrances, checkout counters, restrooms and break rooms. The company is exploring additional measures that can be taken to protect employees and patrons, including requiring all individuals within the location to wear protective equipment (masks). The phased opening will allow the company to evaluate the need for these measures and the willingness of the public to tolerate them.

Moreover, a staggered opening allows the company to adjust to market demands, avoid any issues with negative public opinion, and ensure we are doing everything we can to ensure our employees and guests safety. Additionally, the phased opening allows the location to control food and labour costs, ensuring that staffing levels are appropriate and relative to customer demand. While there are still a lot of unknown variables, we anticipate being fully operational in the first half of June 2020.

We are prepared to address the needs of each location on a case-by-case basis to combat any potential health concerns and will follow the recommended infection prevention and control (IPC) protocol.

We are acutely aware that the provision of games pose additional problems related to IPC protocols. We have been actively trying to problem solve these issues to ensure the safest environment for patrons who wish to enjoy the games.

The process for game usage is still being developed and perfected. Briefly, however, games will be kept in sealed bags and given to customers by game gurus to ensure that nobody else has had contact. Every time a guest plays a game, the game is cleaned and put aside in quarantine for 72 hours or 3 full days. After 3 days, a certified sticker will be added to the bag, indicating that the game is 100% safe to play. We have numerous copies of the most popular titles so the company does not anticipate this effecting the game library as we can always ship down more from other locations or the distribution warehouse if needed.

Additionally, guests will be fully aware of the processes and protocols being taken to protect them. For example, after guests vacate a table, it will be fully sanitized (booth, chairs, tabletops, etc) and signage will be placed on the table indicating that it has been sanitized using X product in compliance with IPC guidelines.

Depending on how the re-launch of Snakes and Lattes Tempe goes, the three locations in Toronto would follow a similar opening procedure based on the feedback and knowledge gained from Tempes opening.

Additional updates to follow shortly.

For further updates from Snakes & Lattes and its parent company, Amfil Technologies Inc., please follow us on Twitter @AmfilTech

SSFT: SEC filing with 80 BILLION DOLLAR COMPANY FIDELITY

https://www.otcmarkets.com/filing/html?id=14151883&guid=NrMHUFIrHfV0tth

Item 1.01 Entry into a Material Definitive Agreement

Sonasoft Corp. recently entered into a multi-year strategic alliance with FIS (NYSE: FIS), one of the world’s leading providers of financial services technology. Sonasoft will develop and implement AI applications and solutions.

----

And that isn’t any tester this is a serious 5 year contract!

And this isn’t any tease it’s Edgar filing with the SEC

Getting the ticker tag of FIS in there isn’t a small thing anymore it is way more regulated than it use to be!

MORE TO COME FROM BIG NAMES FOR SSFT

QB Company, audited financials, the next one coming by end of month

TREP perfect stock to buy and Hold

Soon to be SEC reporting

Same management as DFCO

Any penny stock companies selling N-acetyl-cysteine, N-acetylcysteine, N-acetyl cysteine, and N-acetyl-L-cysteine out there?

Buy Recommendation - GLDLF - GoldMining, Inc. - OTCQX - 1.07

Howdy All ... I am a little late getting in here, but it is my newest Precious Metal Addition to my Portfolio.

GoldMining IPO'd in 2011, and has spent the better part of 10 years picking up distressed mining territories. It has a Great Management team, and is prefectly positioned for the Impending major move up in Precious Metals.

Having said that, Precious Metals have been impacted by the Oil Futures Debacle, and we now have a Great Buying Opportunity ...

The Other Precious Metal Stocks I own in Market Value Order are ...

BMXI - BrookMount Exploration Inc. (Gold)

GSV - Gold Standard Ventures

AG - First Majestic Silver Corp.

SLVRF - Silver One Resources Inc.

FFMGF - First Mining Finance Corp. (Gold)

EXK - Endeavour Silver Corp

LODE - Comstock Mining, Inc. (Gold)

CEF - Central Fund of Canada - Sprott Gold/Silver Fund

GLD - SPDR Gold Shares ETF

SLV - iShares Silver Trust ETF

I fully expect the Major markets start to crater the Week of April 27th or the week of May 4th ... I am being very defensive ... Watch the 10 Year Bond Yield ...

Best of Luck All - Shermann

QEP QEP RESOURCES INC COM

This stock is on the move......DD

Screaming Buy Opportunity ... BMXI - BrookMount Exploration Inc.

This is the little Gold Company that can. An O/S under 400,000 for this Indonesian Gold Stock at a Penny ... A low cost of extraction ..

When the DJIA falls under 16,000, and it will ... Gold will see a new bull market, and it will be huge for gold with all the Money printing going on ... This could easily go to .10

I have been investing in Precious Metals since the Late 1970's, and all we need to look at here is the accumulation going on.

Was going to wait until Friday on this one, but folks need to start accumlating now ... In a Couple of Months we will all be saying WOW!!!

Disclaimer - I own 350,000 shares at .0105, and am still accumulating accordingly.

Best of Luck all!!! - Shermann

Screaming Buy Opportunity - UNEQ

I do not put these out that often, but the current economic climate has really given us all great opportunitiee to make money. It appears that the Powers that be let UNEQ go today. Which is wonderful as it is a Friday, and I am sure folks will notice it over the weekend ...

I am in this because I think there will be a Reverse Merger which has been delayed by the Economic Crisis. UNEQ is updating all their financials, and compenies do not do this for no reason.

UNEQ has hit the bottom, and VS. a lot of other stocks, Money can be parked here.

If there is a Reverse Merger, UNEQ could shoot up to .01 in a day or 2 ... And probably a Nickel within a week ... You can all do the math here, but it is a tremendous Risk / Reward investment.

Disclaimer - I own 14 Million shares at an Average of .00065

Have a Great Weekend All!!! - Shermann

I second your post.....

Unreal potential with PCTL.

The first quarter 2020 should be something to behold...never mind the whole year. Glad I'm in with a big bag full.

Roll PCTL Roll

$ALYI ALYI Confirms African Electric Vehicle $100 Million Financing Update

https://finance.yahoo.com/news/alyi-confirms-african-electric-vehicle-150700019.html #ICO #Bitcoin #Crypto

DD Update for FUNN by Plowmastre

Exactly, I’ll bet updates this week even, it’s been a couple so about time. Regardless Q2 is very soon and looking forward to that!

Nothing is going to stop FUNN from growing and growing. Even the complaints we have seen are always FOCUSED FORWARD. They keep growing, knocking out milestone after milestone. So even with some complaints, they just don’t stop the GROWTH AND SCALE! They have established a ton of infrastructure, hold a solid and growing reputation as a Brand for both entertainment / service, retail and fulfillment. The mountains of positive evidence for FUNN continues to pile up!

We simply continue to grow and build. Always forging ahead regardless of topic du jour.

1) We have 3 years of audited financials proving the growth from sub millions to $8+ million and over $10 Million in FY19. I would generally expect a new upscaled auditor is announced in Jan. as well. Looking forward to having a new auditor to take us to the next level.

2) We have grown immensely since those initial audited financials have been in place, adding scaled functionality (e.g. accounting) as well as capability (e.g. production)

3) We have locations packed every night and massive amounts of reviews, photos, videos that continue to pour in weekly. 1000’s of customers every single week!

4) We have 750%+ retailer growth (Over 70 now) and it continues to grow

5) We have 10000%+ SKU growth(Over 580 now) and it continues to grow

6) We acquired and developed AN ENTIRE SELF PUBLISHING OPERATION. We have a whole supply chain set up with a strong manufacturer and logistics shipment line

7) We have received GRO3 POs, and have installed with Kavalara, proving the product in the field!

8) Cineplex has INCREASED their business with us, a multi-billion company with 13k employees and millions of customers, exposing Snakes to a large audience.

9) We have a staff of 200+ and its not slowing down as more functions and capabilities are created.

10) We have massively increased warehouse space, and looking to expand in to USA for space.

11) Snakes IS the only public BGC company and the market leader for BCGs, ‘The Mothership’ of BCGs as cited in articles and industry.

12) We are supporting all of this without any mass dilution and there has been no toxic financing in FUNNs history.

13) From Financial Statements, we can see the company is generating a gross profit and using the money to develop the company, exactly what you want your growth company to do. (avoiding taxes and minimizing the need for further financing)

14) WALMART is a customer. They value their space, and do DD before taking on suppliers. Snakes has a good relationship with WALMART and they enjoy the first couple months of exclusivity. Regardless of KTU, WALMART is a friendly customer.

15) We have A TON of 3rd party news and reviews, and how much excitement there is around Snakes, especially when a new location becomes announced.

16) They have the WHOLE Supply Chain: Design-Production-Distribution-Retail-Service

17) They have shipped LARGE PRODUCTION ORDERs of KTU and Red Panda for the holidays world wide. The Board Game market has grown to $12 BILLION, and we have a ton of retail shops now carrying our product.

18) We have the second USA location going up, Tuscon, the demoing has started and construction is underway. They even recently tweeted on the construction with photos. The permits are in. There will be many new locations all over the US coming!

19) Snakes is popular in so many aspects of the Gaming community. Many special events and designer nights. All these inroads are synergistic with core operations and continue to further deepen the brand + its industry weight

20) KTU KS backers received their games and posting online positive reviews. In fact some pretty clever unboxing videos have even been made. This is a core customer base, who will continue to be loyal to our next KS self published games.

21) We hired a whole new accounting team to manage FY19 and beyond under the new corporate level accounting system. This system is now upscaled for years in the future.

22) We have changed our ticker to FUNN, as the premiere sub Snakes will become its own entity. An incredible and focused investment package which higher level investors can better consume and invest in.

23) From recent updates, we see FUNN making the strategic changes for scaling the business, learning what is the most lucrative and efficient things to focus on and set those for scale.

24)We now have another location coming in the form of an existing BGC conversion in Guelph, Ontario! There will be more and more of these as single BGC’s recognize the brand strength of Snakes and want to be a part of the success!

25)We SOLD KTU and Red Panda retail orders in the holidays, high margin product! Sales only CONTINUES to ramp UP!

26)We will get the information while we wait for the FY19 to reclassify as SELLER and get MILLIONS back in to our recognized revenues. The shipments have arrived will be distributed and more continue to come

27) We survived the stop sign and come out stronger, after more than a year. A very rare show of strength down at this level, we are now Pink current and moving towards QB

28) Many Many Retailer popping up all over the globe selling our self publish Games, these retailers are even higher margins for FUNN than the giant single Walmart orders

29) We have upscaled our attorney to Greenberg Taurig, a top ranked USA and Global law firm. These are the kinds of moves made while growing and scaling.

This is not faith, speculation or conjecture. This is evidence. These are all verifiable facts.

RBSM released the initial 3 years of audits, they aren't going to stop having audits suddenly, I’m sure the next audit will be announced (even if RBSM again, which i’m guessing it won’t be but i don’t know.)

This is where due diligence is important, combined with all evidence available, to create a risk profile. Risk profiles are also personal to an investors risk tolerance. There are plenty who will wait for the QB before investing. They will pay a significantly higher premium, and that's okay. They will still be early, just their multiples will be a lot less than the earliest investors as it should be, but it works for them.

For me i'm in from the earliest I could have been once I discovered this gem and did the dd: I have combined a ton of research, poured over the evidence, utilizing my experience and knowledge of the market places and growth companies and believe I have created a highly supported positive outlook. I have searched for other outlooks, with a supported narrative, but have yet to find one.

We will get to the QB, it won't be forever, it won't even be that much longer, just the moment from now until will feel like an eternity. It always does.

Once the FY19AF comes out, we uplist to a more appropriate marketplace suited for growth companies. All history will vanish in an instant. Markets are forward focusing, the institutional investor will absolutely not give one shit what anyone thought of Roger this whole time. The amount of money that will come in will dwarf the entirety of the pink market place investor community. They will see the infrastructure that has been built, the distribution, the supply chain, the business model, the revenues and they will say 'I WANT SOME OF THAT'. That is the future here, that is what will happen.

CWNR, HMLA, PCTL and RBNW are all great low float and extremely cheap penny stocks to buy now and hold! They’re all around 0.01 cent or below, and they all have the potential to be over $1.00! Specially CWNR and HMLA!

FUNN following up with tweets on self published games!

https://twitter.com/AmfilTech

PCTL

For those not already in. PCTL low float revolutionary tech. already in major hospitals. Has been exported to England. Awesome entry point before the top blows off. Very good base of longs. check it out.

FUNN News! Continued growth and scale! They just keep expanding! Building an empire of board game distribution.

https://www.otcmarkets.com/stock/FUNN/news/Amfil-Technologies-Inc-Through-Its-Subsidiary-Snakes--Lattes-Inc-Acquires-Fulfillment-Operations-of-Starlit-Citadel-the-?id=249175

Amfil Technologies Inc., Through Its Subsidiary Snakes & Lattes Inc., Acquires Fulfillment Operations of Starlit Citadel, the Second Largest Board Game Fulfillment House in Canada

Press Release | 12/12/2019

TORONTO, ON, Dec. 12, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE – Amfil Technologies Inc. (OTC: FUNN), is pleased to announce that its largest subsidiary, Snakes & Lattes Inc., has acquired the fulfillment operations of the second largest house in the board game fulfillment industry in Canada, Starlit Citadel Logistics, second only to Snakes & Lattes itself.

Starlit is a large fulfillment house in the Canadian market with a long list of well-known customers such as Stonemaier Games, Roxley, Gloomhaven, and Indie Board and Cards. Starlit is considered the second largest fulfillment house for board games in Canada. Starlit Citadel closed its retail location at the beginning of this year and switched focus solely to the fulfilment/logistics services side of the industry. They have been servicing the industry since 2011.

Starlit has a good reputation in the industry and has uniquely positioned itself with logistics operations on the west coast near 2 of the main ports of entry, Long Beach CA and/or Vancouver, BC. Having the logistics centers on the west coast cuts precious time, especially with orders coming from Asia.

This acquisition will reaffirm and significantly increase Snakes & Lattes’ position as the largest board game fulfillment house in Canada. Immediately this will expand the customer base, increase sales, and provide immediate cost savings with national carriers such as FedEx, UPS, Canada Post, and various other freight forwarding companies.

This acquisition will be completed for a total of 1.2M shares of restricted stock and is expected to add significant value to the business and company. This concludes a long business relationship between Snakes & Lattes Inc and Starlit Citadel Logistics, both companies’ founders know the business well and can see the incredible value that will be added by combining the two largest players in the industry in Canada.

Ben Castanie, founder of Snakes & Lattes, states, “We are very pleased to have closed this deal with the nice people behind Starlit Citadel and look forward to a continued relationship moving forward that now adds a west coast operation in Canada to the fulfillment side of the Snakes & Lattes business.”

For further updates from Snakes & Lattes and its parent company, Amfil Technologies Inc. please follow us on Twitter @AmfilTech

For more information regarding the company, and its related subsidiaries please visit the following websites:

Amfil Technologies Inc. www.amfiltech.com/

Snakes & Lattes Inc. www.snakesandlattes.com/

Morning (Snakes & Lattes Publishing SAS) https://www.morning.us/

GRO3 Joint Venture http://gro3systems.com/

Interloc-Kings Inc. http://www.interloc-kings.com/

BWVI Recovery season continues they’re posting pictures on Facebook and news is coming out there’s a lot a little things going behind the scenes for more news and different revenue streams just besides recovering the treasure directly

Old seller almost out bottoms been in for a while and in general it’s quiet until it’s not but there will be a storm coming soon

$BWVI

SSFT strong buy! Their quarterly is coming up and there will be more news soon they’ve got so many things in the pipe it’s ridiculous. Go to their homepage look at the collaborative partners, you’re going to see over $1 trillion in market cap.

This AI company continues to kick ass and make top performance metrics, it’s getting discovered quickly and the news is following. This thing has two choices go multi dollars or get acquired

$SSFT

FUNN back to Pink Current and Tucson permits ACTIVE.

Company continues to grow and scale. News will be coming fast now.

Next Stop is QB after the FY19 audits. There will be a ton of news in between now and then. They’ve already got three years of audits under their belts, there is zero doubt the next one won’t get completed.

$FUNN

The stock charts say a lot about GMGI. They do not have any toxic debt. They have 7 straight quarters of consistent revenue growth and profitability. and technically are trading at a trailing 6 PE as a sub-penny.

Here is a link to todays financial release.

Golden Matrix Reports Net Income of $545,888 on Record Revenues of $881,845 for the First Fiscal Quarter of 2020

EXCELLENT VIDEO BY PINK DIAMOND ON SHMP

I believe for SHMP to put out this they are ready to start there second run !

https://www.youtube.com/embed/Qkp2oTY3WU4 ;

11/17 Updates: FUNN BWVI SSFT

FUNN: ITS ON! PERIOD!

https://twitter.com/AmfilTech

After two years of Gaza Strip level warfare, FUNNs Audit for FY18 is DONE!!!!

The entire focus of the company is going to shift forward again.

You simply WILL not believe how much awesome stuff is coming here.

GO DUE YOUR DD ON THIS ONE PERIOD!

SSFT:

https://www.sonasoft.com/

With the NEW Engine AURA up and running, notice.. SALESFORCE IS A PARTNER ON THEIR WEBSITE??? (along with a little company you may have heard of: Microsoft!)

IT is ONLY going to get BIGGER and BETTER Here!

BIGGER NAMES

BIGGER CONTRACTS

This company is buy and kick back no worries, going multi dollars or will get bought out at a premium. Do NOT underestimate how well this Silicon Valley success story is unfolding!

BWVI:

We are in the recovery season, and there are a few things in the works yet to be told. The prices is VERY low right now from a couple old holders getting out, should have never been this low. I'm accumulating as I can. Its quiet yes, its quiet yes its quiet yes

UNTIL ITS NOT

Go do your DD on these 3!

SSFT NEWS: Sonasoft Launches AURA, the World’s First AI-Powered People Support Engine

I have NO DOUBT SSFT is going MULTI DOLLARS in the long run.

https://investorshub.advfn.com/uimage/uploads/2019/11/14/ehlasfunn_chart.png

AURA, an AI-first people support engine that supports tools like Salesforce and ServiceNow increasing productivity by as much as 30%

San Jose, California, Nov. 15, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Sonasoft Corp. (OTCQB: SSFT), a leader in innovative artificial intelligence (AI) and data management solutions, today announced AURA, the first AI system that works alongside all your existing systems to give your entire team unrivaled insights and assistance. From HR to customer support, your team relies on tools like Salesforce, Zendesk or Zoho. Rather than reinvent the wheel, AURA works alongside these existing tools and adds a layer of intelligent automation. It uses Sonasoft’s AI technology to enhance and extend the capabilities of these tools, allowing you to resolve issues faster, work more efficiently, and increase productivity.

AURA stands for Anticipate, Understand, Resolve and Assist. It will anticipate your requirements by analyzing past actions and events and creating detailed forecasts. It understands humans, adding powerful chatbot capabilities and natural language processing to your existing tools. It will resolve issues automatically based on learning how your team has resolved them in the past, freeing up your team to concentrate on what matters. Above all, it will empower your whole team, from customer support agents and HR operatives to engineers and salespeople.

AURA is only possible because of Sonasoft’s unique AI platform, NuGene. No other AI platform is able to cope with such a rich and broad mix of data. The result is a system that will transform how your people-facing teams work and allow you to shift resources from call centers to more productive tasks. It helps your team cut through the noise, deflecting and resolving issues before they arise. For instance, it might actively spot a user having login problems and provide them with advice on known workarounds. Or it can intercept a support request, analyze it, and provide helpful advice based on AURA’s knowledge of your systems. Before this, case deflection would simply use text recognition and find help articles that might be relevant, but most often aren’t.

According to Olive Huang, research vice president at Gartner, “By 2021, 15% of all customer service interactions will be completely handled by AI, an increase of 400% from 2017.” Frank Velasquez, CEO of Sonasoft, said, “We have developed AURA with input from some of the world’s biggest software companies. AURA is a paradigm shift for people support systems. Rather than solving a specific problem, we have built an AI that learns to anticipate and understand your needs and resolves your issues before they happen.” Ankur Garg, Chief of AI, said, “NuGene is a revolutionary approach that understands that sequences of events are critical to understanding the real world. This allows AURA to gain unrivaled insights and understanding from all of your data.”

About Sonasoft