Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It’s about to change

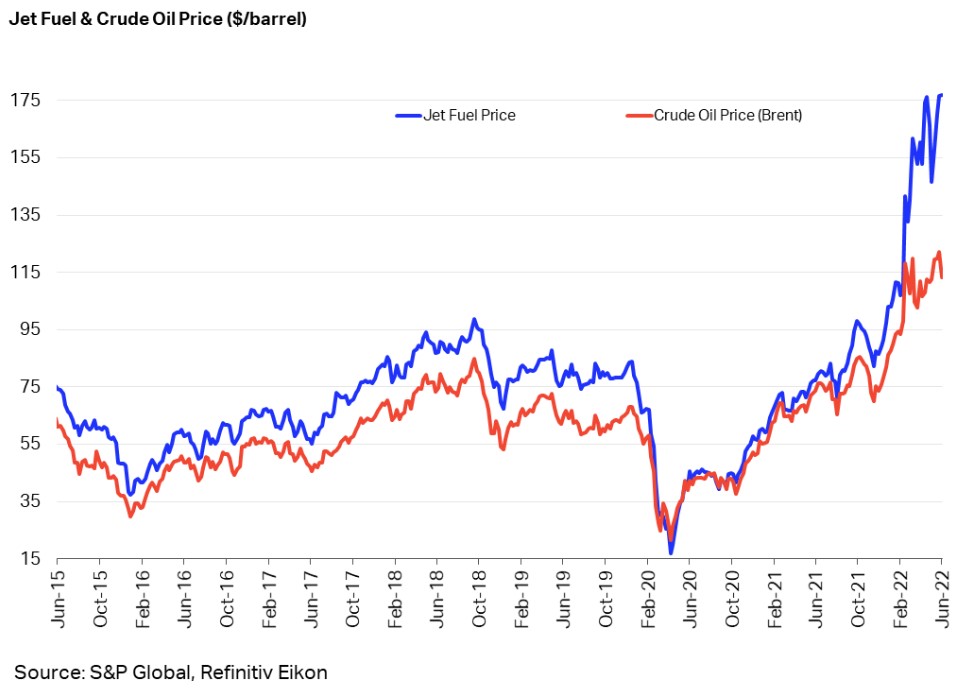

Crack spread about as low as it has been over the last two years, revenue may be weaker in Q3. Time for BDCO to reduce debt, to keep costs down.

https://www.iata.org/en/publications/economics/fuel-monitor/

Welcome back, everybody.

I've been here since we were at just over a buck, and have sold a few thousand and then bought them back. I like the management, and the fact that management owns about 80% of the shares. I'm sure they are going to continue to do the right thing for sharehlders, which will make them wealthy along with us.

BDCO turned out to be a winner after all :)

remember when it was 25-45 cents

This moves more or less with other refiners who move more or less with the crack spread.

https://www.energystockchannel.com/quotes/?a=chart&ticker=$CRACK321&period=5y&title=5+Years

That said - there are some who believe that small refiners will benefit from the SCOTUS decision re Chevron. This will help both on the RIN purchases but then again this stock is so small - who knows. (somebody does but its not me).

Hello guys starting to get interested in this thing again

hweb2 Over a number of years there have been big sell-offs without a limit and then the pps has more or less recovered - hard to explain.

I told you, it has happened before. Quite a few times. Intraday drop of 40% or more. Because some savage is dumping. On low volume even. But you don't have to believe me.

As for the price, $8 is probably too high anyway. $5 seems more like fair value.

Ha there's no way to know that is all. A stock crashing nearly 70% in a few weeks on no company news ain't normal. And it prob ain't just crappy market conditions. Because they're not that crappy. Nasdaq over 17,000. Dow pushing 40K. And junky stocks like ASNS flying daily. If anything, I'd call this market extremely frothy!

No. Crappy market. That is all.

Stock touched $8 a few weeks ago. Today it dropped as low as $2.50. Seems like more than weak market conditions. As if something negative has leaked out...but I'm not sure what. Nice rebound today at least. Congrats to those who bought the selloff!

Crappy market. This stock does that on occasion.

Anyone know why the recent selloff?

The stock price seems to be down roughly 40% compared with the highest pps not many weeks ago. Sell in May and go away?

But what happens to the Kissick debt now that he’s dead? They’re paying it down with a reduced interest rate and installments of 0.5M, but I wonder if that will continue with his death.

Income down dramatically compared with last year: Income per common share:

"Basic

$ 0.44 $ 1.12"

It's amazing that after 2 years making money like water, they still have a number of loans in default. And I see they are building inventory again.

10Q is filed.... it's on the IHUB site, under news

There seem to be both few sellers and few buyers. The pps is down 9% from the pps you mention. I don't regret I sold my last 2,000 shares because I have made several good investments since then. But I would have been better off than I am if I hade retained all my 44,000 shares from a few years ago.

All my gains now long term, so I can let it ride.

I've got a little more than 20,000 shares, although my average cost is a little higher than yours.

As BDCO continues to pay down debt, the company becomes even more attractive, IMO

indeed nice ride ![]() i'm in at 1.45 for 1333 shares and not selling yet

i'm in at 1.45 for 1333 shares and not selling yet

Starting to feel sorry for those who sold off their BDCO shares, when they thought it was at its high point last year.

Here we are today at 6.90, and I'm now up an average 300%. And it looks like blue skies, with few sellers at these prices.

And now that Q1 is over, BDCO should have another decent quarter.

Crack spread for Jet fuel was between $21 and $30 for most of the quarter.

https://www.iata.org/en/publications/economics/fuel-monitor/

Looks like they can continue to generate somewhere between .50 and .60 in earnings /quarter under current conditions.

Good day, nice to see the debt pay down!

Earnings out today. https://archive.fast-edgar.com/20240401/ARZDT22CZC22I9Z2222L2ZZZCDPCZ6T86262/

Earnings .59/sh Q4 vs. .47/sh Q3

Debt reduced by 9 million for the year, with 5 million of that in Q4.

Good report, with earnings solid, debt down and improved refinery uptime.

This is a great little company, and I'm glad I kept a bunch of shares to keep enjoying the ride.

John Kissick is dead. Wonder how happens to the BDCO notes held.

Ringrock The quiet board suggests little interest in this stock. The audited annual financials are due very soon. That may have been the reason why some have bought shares in the hope that the pps will pop as a result of better numbers than the stock market expects.

Got a little volume today… board’s been very quiet

down "I'm looking forward to a positive report for this quarter, and for the year, with earnings somewhere around .40- .45/ share for the quarter." That is very close to my guess for the third quarter. I agree that these shares look cheap. Nevertheless I sold my 2,000 shares about 3 weeks ago. I am up not much less than 100% in my new more risky investment. After having burnt my fingers in TMNA and TIO I will not recommend it to anybody.

Crack spread for jet fuel remains inn a range of $25-38. For perspective, that is not as high as the historic highs in 2022, but considerable better than the spread during the Q2 2023 period, when the spread was in the $15-20 range.

https://www.iata.org/en/publications/economics/fuel-monitor/

In the Q3, when the spread rebounded to the $30-40 range, BDCO actually had higher earnings than the Q2 2022, when the spread was even higher, in the $35-45 range. So the company is becoming more profitable, even at a slightly lower spread.

I suspect part of the reason is they are slowly but surely reducing the debt load. I'm looking forward to a positive report for this quarter, and for the year, with earnings somewhere around .40- .45/ share for the quarter. That would make for a second year of annual earning of about $2/share.

At $2/share in earnings, we are trading at a PE of just over 2. Still very cheap.

There is also tax loss selling right now, and with almost everything else up, people gotta sell oil stocks.

'Tis the season.....

Happy to make someone else's tax loss selling my bargain-priced shares.

I've decided to wait and post my prediction of BDCO earnings for the quarter after the company posts actual earnings. Much easier to make an accurate prediction at that point.

I will say this, at $4/share and below, I've been buying more shares. Even at just .50/quarter in earnings, the PE here is 2.

I think we will have some quarters at around $.50 earnings, and others higher.

Oil companies, as reported this morning on CNBC, are severely oversold and BDCO is oversold as well.

Would really appreciate your thoughts on Q4 earnings.

Thanks

downtheharch I assume you refer to me. What you attribute to me is false. I did not KNOW what the results would be and never claimed that I did. What I stated, which was true, was that I guessed in advance what it would be, and that the guess was quite close to the number that turned out to be the case. This was quite a rough guess on my part. I have a weak memory and I forget most information in a few weeks. Therefore I now forget the crack spread during the third quarter. My impression is though that it is not very different from what has been during the current quarter. This would suggest earnings between 40 and 50 cents during the current quarter. I remember though that earnings per share were surprisingly high during the same quarter last year, exceeding one dollar per share. I don't know if this had something to do with the time of the year. If it had a guess could be that the numbers will be a bit better in this quarter than in the preceding quarter.

Maybe we should ask the poster who claimed he knew what the results for Q3 would be, but waited until after the Q3 numbers were posted by the company to declare his prediction was correct.

Re: 4th Q financials

Any thoughts on earnings for this quarter?

The global average jet fuel price rose, propelled by much higher prices in North America where jet demand was expected to be high because of the Thanksgiving holiday weekend.

Thanks for the update.

Hopefully that may help move the share price at some point. I am curious, though, about what else it's going to take. Since the company does no promoting, is the news about a sale to a Biggie what it's going to take to significantly move things?

After a slight dip in October, the crack spread for jet fuel, BDCO's primary product, is once again climbing.

Over $35/ barrel according to IATA tracking

https://www.iata.org/en/publications/economics/fuel-monitor/

retired "Predictions and hopes are all we have until the facts come. :)" I agree.

Now now boys. Hale to the queen, king or dictator. Whatever fits. Predictions and hopes are all we have until the facts come. :)

down It is easier to imply that I lie than to trust what I state it appears. I claim that I expected earnings per share would be in the range 40 - 50 cents weeks before any information was available. In the European country where I live veracity and integrity are valued. I have experienced time and again that US posters don't believe me when I state that I am invested in stocks and at the same time present negative assessments of the companies. I am happy that I live in a country where honesty is esteemed.

Always easier to predict earnings AFTER the 10Q is filed! My revised prediction is that earnings for BDCO will be $.47 for Q3

gosox I had expected it to be between 40 and 40 cents but did not publish my expectation since the poster who is supposed to have a better ability to assess this question expected more or less twice my expectation. I therefore expected to be found fault with because too pessimistic if I had ventured a figure. In actual fact it turned out that my assessment was realistic.

Solid performance.

I'm holding as long as they continue improving the debt situation and generating solid profit.

It looks like if conditions remain relatively stable, they are generating about $2.00/year in earnings.

The stock should be selling for at least 4-5 times earnings, which is more like $8-10/share.

BDCO remains undervalued, IMO

Re: Today's 10Q

Any thoughts on the 10Q? Earnings of .47 for the Quarter and $1.69 for the year.

Thanks for your election work. Democracy is under constant attack here and your work is important and much appreciated.

|

Followers

|

72

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

4323

|

|

Created

|

03/30/05

|

Type

|

Free

|

| Moderators | |||

Blue Dolphin Energy Company is a publicly traded Delaware corporation, headquartered in Houston, primarily engaged in the

refining and marketing of petroleum products to be used as jet fuel, or as "a light sweet crude."[2]

The company also provides tolling and storage terminaling services. 60 acres of assets, which are located in Nixon, Wilson County, Texas

primarily include a 15,000 bbl/d (2,400 m3/d)[3] crude distillation tower and more than 1.0 million barrels of petroleum

storage tanks (collectively the “Nixon Facility”). Pipeline transportation and oil and gas operations are no longer active.[4][5]

Since 2006 through 2014, according to the chief executive regarding this facility, in-kind with his other similar

facility at the time, “...there were some issues with the EPA (Environmental Protection Agency) that we were not made

aware of, and those issues have yet to be resolved.”[6]

As of 2014, 45 workers were employed at this facility.[7]

Lazarus ENERGY is a Subsidiary of Blue Dolphin

https://www.lazarusenergy.com/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |