Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Cathie Wood & Ark Invest's Sells 203,659 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 12, 2025

• Here's what moves Cathie Wood and Ark Invest made in the stock market today 3/11.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 376,607 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 10, 2025

• Here's what moves Cathie Wood and Ark Invest made in the stock market today 3/10.

Read Full Story »»»

DiscoverGold

DiscoverGold

$XYZ down here much better than $80's $90's deeply oversold

By: John Wayne | February 26, 2025

• $XYZ down here much better than $80's $90's deeply oversold.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block Australia shares slide on weak Q4 earnings

By: Investing.com | February 23, 2025

Block Inc (NYSE:XYZ) shares fell sharply in Australian trade on Monday, tracking declines in their U.S. peers after the payments firm clocked weaker-than-expected fourth-quarter earnings.

Block’s 2025 guidance also largely failed to impress, sparking a steep decline in its U.S. shares on Friday.

This spilled over into Australian trade on Monday, with shares (ASX:XYZ) sliding as much as 13% to A$108.09 in Sydney trade. Broader Australian markets were flat, with the ASX 200 trading sideways.

Block’s earnings per share for the December quarter were 71 cents, less than street estimates of 87 cents. Revenue of $6.03 billion also came in below expectations of $6.29 billion.

Profit growth in Block’s Cash App business- its main revenue earner- fell to 16% in Q4 from 25% a year earlier. The company is grappling with heavy competition in the digital payments space, amid an increased push into the sector from tech giants including Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOGL).

Block is also facing a decline in consumer spending, amid concerns over slowing economic growth, high inflation, and policy uncertainty over U.S. President Donald Trump’s trade policies.

Block’s push into the Buy now pay later sector is expected to drive the company’s next leg of growth, especially after it acquired Australia’s Afterpay in 2022.

Read Full Story »»»

DiscoverGold

DiscoverGold

$XYZ If this can close a red-to-green move, I like it a lot

By: TrendSpider | February 3, 2025

• If this can close a red-to-green move, I like it a lot. $XYZ

Read Full Story »»»

DiscoverGold

DiscoverGold

$XYZ Stuck the landing today, let's see if this breakout has any legs

By: TrendSpider | January 29, 2025

• Stuck the landing today, let's see if this breakout has any legs.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block (XYZ) The daily chart shows XYZ forming a bull flag after reclaiming the 50-day EMA, supported by a bullish MACD cross...

By: TrendSpider | January 26, 2025

• Block, formerly Square, changed its ticker to XYZ on January 21, 2025, reflecting its diverse ecosystem, including Cash App, Afterpay, and TIDAL. The daily chart shows XYZ forming a bull flag after reclaiming the 50-day EMA, supported by a bullish MACD cross. Price has since consolidated on a large volume shelf, threatening a breakout. A measured move puts the price in the neighborhood of $120/share—roughly 30% above Friday’s close of $88.

DiscoverGold

DiscoverGold

US state regulators fine Block Inc $80 million for insufficient money laundering controls

By: Investing | January 15, 2025

WASHINGTON (Reuters) - Block Inc has agreed to pay a fine of $80 million to a group of 48 state financial regulators after the agencies determined the company had insufficient policies for policing money laundering through its mobile payment service, Cash App.

The multi-statement settlement would also see the fintech firm bring in an independent consultant to review its Bank Secrecy Act and anti-money laundering program, and report back to the states on any deficiencies. The company has also agreed to take corrective actions internally, according to the Conference of State Bank Supervisors, which announced the settlement.

In a statement, a Block spokesperson said the issues were principally related to Cash App's prior compliance program, and the company has significantly increased investment in compliance and risk management.

"We share our regulators’ commitment to addressing industry challenges and will continue to invest across our operations to help promote a safe and healthy fintech ecosystem," the spokesperson said.

Block's mobile payment platform, Cash App, had 56 million monthly users as of December 2023, according to recent public filings. The app saw over $248 billion in inflows in 2023.

The state regulators did not offer specifics about the shortcomings, but simply said they had identified issues with the company's compliance program.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block, Inc. announces plans to change ticker symbol from $SQ to $XYZ

By: TrendSpider | January 9, 2024

• Block, Inc. announces plans to change ticker symbol from $SQ to $XYZ

...bullish?

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ testing liquidity zone again...

By: Peter DiCarlo | January 9, 2025

• $SQ testing liquidity zone again

Weekly price action rejected. I would let this sell off and wait for confirmation of a bottom.

This could be great in the coming months.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ There's a lot to like here

By: TrendSpider | January 4, 2025

• There's a lot to like here. $SQ.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Let the SMAs catch up and then its back to our regularly scheduled programming

By: TrendSpider | January 3, 2025

• Let the SMAs catch up and then its back to our regularly scheduled programming. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ 6 years later: Same price, +638% more revenue

By: TrendSpider | December 23, 2024

• 6 years later:

Same price, +638% more revenue. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ - Market Movers

By: TrendSpider | December 22, 2024

• SQ is showing a notable shift in momentum after breaking through and retesting a resistance level that has capped its price for over two and a half years. Despite trading 69% below its 2021 ATHs, SQ has quietly delivered nine consecutive quarters of revenue growth, which now sit at record levels. If the retest holds, SQ looks ripe to transition into a Stage 2 uptrend as it outperforms the majority of the S&P500 on a quarterly basis.

DiscoverGold

DiscoverGold

$SQ Don't fade the cloud

By: TrendSpider | December 9, 2024

• Don't fade the cloud. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Monthly Chart vs. Quarterly Revenue Sleeping giant

By: TrendSpider | December 1, 2024

• $SQ Monthly Chart vs. Quarterly Revenue

Sleeping giant.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ pulling back on low volume into a key weekly pivot...

By: TrendSpider | November 30, 2024

• $SQ pulling back on low volume into a key weekly pivot...

It's either retest & go or a failed breakout from here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 110,712 Shares of Block Inc. (SQ)

By: Cheddar Flow | November 27, 2024

• Here's what moves Cathie Wood and Ark Invest made in the stock market today 11/27.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block Inc $SQ needs a weekly close above $90

By: TrendSpider | November 18, 2024

• $SQ needs a weekly close above $90.

Read Full Story »»»

DiscoverGold

DiscoverGold

Kathy Baby, ya just lost 1.25 Million. Ya sold 1 day too soon. 😄

Cathie Wood & Ark Invest's Sells 232,063 Shares of Block Inc. (SQ)

By: Cheddar Flow | November 4, 2024

• Cathie Wood and Ark Invest's trade activity from today 11/4.

Read Full Story »»»

DiscoverGold

DiscoverGold

Says the guy who keeps saying NVIDIA is going to go down. Why should we listen to you?

Cathie Wood & Ark Invest's Sells 243,549 Shares of Block Inc. (SQ)

By: Cheddar Flow | October 31, 2024

• Cathie Wood and Ark Invest's trade activity from today 10/31.

Read Full Story »»»

DiscoverGold

DiscoverGold

THIS PIG IS SO OVER!!!!!!!!!!!!!!!!!!!!!!!!!1 MUAHAHAHAHAHAHAHAHA!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!1

When a Managing Partner at Sequoia Capital (who is also a $SQ insider) buys the dip, it’s worth paying attention

By: TrendSpider | October 28, 2024

• When a Managing Partner at Sequoia Capital (who is also a $SQ insider) buys the dip, it’s worth paying attention.

Read Full Story »»»

DiscoverGold

DiscoverGold

Not all insiders are created equal, but the ones with a good track record are worth watching: This one at $SQ bought aggressively back in November 2023 just before a massive run

By: TrendSpider | October 19, 2024

• Not all insiders are created equal, but the ones with a good track record are worth watching:

This one at $SQ bought aggressively back in November 2023 just before a massive run.

Fast forward to the August dip & they were back at it again, now up +35% just two months later.

Read Full Story »»»

DiscoverGold

DiscoverGold

Miss Wood should be kicking herself bout now.

Cathie Wood & Ark Invest's Sells 23,473 Shares of Block Inc. (SQ)

By: Ark Invest Daily | October 17, 2024

• Cathie Wood and Ark Invest's trade activity from yesterday 10/16.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 17,816 Shares of Block Inc. (SQ)

By: Ark Invest Daily | October 16, 2024

• Cathie Wood and Ark Invest's trade activity from yesterday 10/15.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ looks just about ready to follow in $PYPL's footsteps...

By: TrendSpider | September 30, 2024

• $SQ looks just about ready to follow in $PYPL's footsteps...

Read Full Story »»»

DiscoverGold

DiscoverGold

Remember this $SQ insider buy from August 5th that we alerted a few weeks back? Already up +20% on his $25M position.

By: TrendSpider | September 1, 2024

• Remember this $SQ insider buy from August 5th that we alerted a few weeks back?

Already up +20% on his $25M position.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Right shoulder forming?

By: TrendSpider | August 17, 2024

• $SQ Right shoulder forming?

Read Full Story »»»

DiscoverGold

DiscoverGold

Insiders buy for one reason and one reason only...

By: TrendSpider | August 16, 2024

• Insiders buy for one reason and one reason only...

Because they think the stock will go up. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Board Member Buying the Dip Again. Insider Botha Roelof purchased $25,000,000 in shares this week

By: TrendSpider | August 9, 2024

• $SQ BOARD MEMBER BUYING THE DIP AGAIN

Insider Botha Roelof purchased $25,000,000 in shares this week.

The last time he bought was in November 2023, right before a MASSIVE rally.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood is all hype.

Cathie Wood & Ark Invest's Sells 440,647 Shares of Block Inc. (SQ)

By: Ark Invest Daily | August 6, 2024

• Cathie Wood and Ark Invest's trade activity from today 8/6.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 328,858 Shares of Block Inc. (SQ)

By: Ark Invest Daily | August 5, 2024

• Cathie Wood and Ark Invest's trade activity from today 8/5.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ nice move here. 70 then 74 next resistance levels

By: Options Mike | July 14, 2024

• $SQ nice move here.

70 then 74 next resistance levels.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Wedge breakout + 200D SMA reclaim...

By: TrendSpider | July 12, 2024

• Wedge breakout + 200D SMA reclaim...

Not too shabby! $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Nice candle, maybe over 66 it's a long

By: Options Mike | July 7, 2024

• $SQ Nice candle, maybe over 66 it's a long

50D at 57.4 close

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull of the Day: Block (SQ)

By: Zacks Investment Research | July 5, 2024

With the Q2 earnings season set to ramp up following the fourth of July holiday, Block (SQ) is a tech stock that looks poised for a rebound leading up to its quarterly results in early August.

The innovative provider of point of sales solutions (POS) appears to be overlooked as SQ has now fallen -26% from its 52-week high of $87 a share in March.

Still, the expansive growth Block was able to display in Q1 is thought to have continued and strong financial results can of course lead to upward momentum for stocks.

Keeping this scenario in mind, Block’s stock currently sports a Zacks Rank #1 (Strong Buy) and is the Bull of the Day.

Q2 Sneak Preview

Investors are always looking for stocks that are expected to post robust quarterly growth and improved financial fundamentals and Block is on this radar.

Another quarter of double-digit top and bottom-line growth appears to be in the cards with Q2 sales projected to rise 13% to $6.29 billion and EPS projections of $0.75 would reflect a 92% increase from $0.29 a share in the comparative quarter.

Block is becoming a staple of the new American economy

Notably, Cash app's popularity has been the primarily catalyst to Block’s expansion along with hardware POS offerings such as its patented Square Reader machines with the company having a comprehensive commerce suite that fuels entrepreneurship by helping sellers grow their businesses.

CEO Jack Dorsey has also strived for other routes to keep up Block’s relevance and expansion from acquiring hip-hop mogul Jay-Z’s tidal music platform in 2021 to offering crypto-related services. In addition to develping a full bitcoin mining system Block provides a Bitcoin Hardware Wallet which offers storage for bitcoin holders.

Loosely speaking, Block may be a more affordable option for investors seeking exposure to bitcoin than Coinbase (COIN Quick QuoteCOIN - Free Report) while being a safter choice in regards to other crypto miners such as Marathon Digital (MARA Quick QuoteMARA - Free Report) or Riot Platforms (RIOT Quick QuoteRIOT - Free Report) . That notion is only magnified when considering Block’s diverse business operations along with the fact that the price of Bitcoin has soared in the last year and currently sits over $60,000.

Price of Bitcoin

Image Source: Microsoft Bing via Refinitiv

Growth Trajectory

Overall, Blocks total sales are projected to increase 15% in fiscal 2024 and are slated to expand another 12% in FY25 to $28.22 billion. More impressive, annual earnings are now expected to soar 73% this year to $3.11 per share versus $1.80 a share in 2023. Plus, FY25 EPS is projected to climb another 30% to $4.04.

Better still, Block’s stock is trading at 20.7X forward earnings and at 1.7X sales which are much more reasonable valuations than the stretched premiums it has commanded in the past.

Bottom Line

Block is once again becoming one of the most appealing business services companies to invest in at the moment. While it may be too soon to call Block’s stock an absolute steal at current levels, a sharp rebound looks justified considering the company’s attractive growth trajectory and innovative business offerings.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ has also been red just once in July since going public back in 2015...

By: TrendSpider | July 5, 2024

• $SQ has also been red just once in July since going public back in 2015...

Technicals & Seasonality starting to align here.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Any month now...

By: TrendSpider | June 1, 2024

• $SQ Any month now...

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 210,591 Shares of Block Inc. (SQ)

By: Ark Invest Daily | May 14, 2024

• Cathie Wood and Ark Invest's trade activity from today 5/14.

Read Full Story »»»

DiscoverGold

DiscoverGold

It's hip to be square

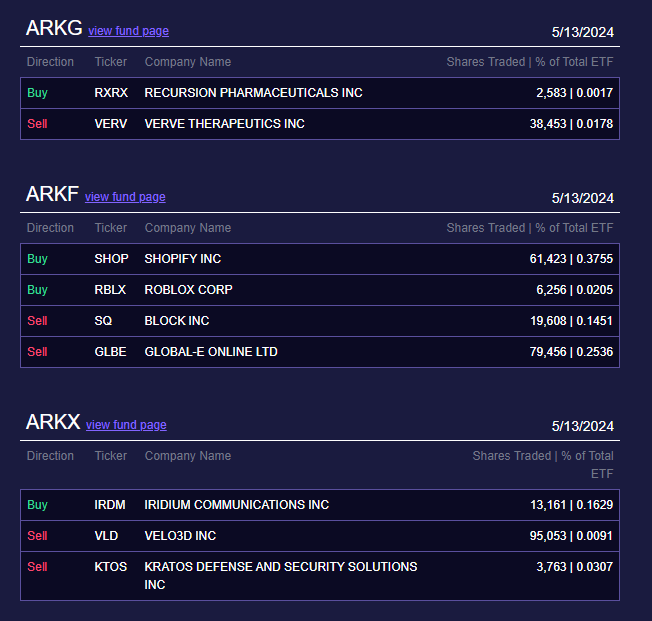

Cathie Wood & Ark Invest's Sells 110,334 Shares of Block Inc. (SQ)

By: Ark Invest Daily | May 13, 2024

• $SPX seemingly range bound between 0.75 and 1.0 std dev. Waiting to see signs of direction.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block (SQ) Stock Higher on Quarterly Beat, Forecast

By: Schaeffer's Investment Research | May 3, 2024

• The fintech company plans to buy more Bitcoin (BTC)

• Analysts and options traders are responding to the results

Fintech stock Block Inc (NYSE:SQ) is up 3.8% to trade at $72.98 at last check, after the company announced better-than-expected first-quarter earnings of 85 cents per share on $5.96 billion in revenue. In addition, Block revealed plans to buy more Bitcoin (BTC) and hiked its annual forecast.

Needham raised its priced target to $105 following the results, and TD Cowen adjusted up to $92, both of which are healthy premiums to SQ's current perch. The majority of analysts are bullish on the equity, with 29 of 37 in coverage recommending a "buy" or "strong buy."

Options traders are piling on as well, with 41,000 calls and 23,000 puts exchanged so far -- overall volume that is six times the intraday average amount. The most popular contract is the weekly 5/3 75-strike call.

On the charts, today's pop is losing steam at Block stock's 30-day moving average -- a trendline that acted as resistance for most of April. Nevertheless, the equity still boasts a more than 24% year-over-year lead, and added roughly 53% during the past six months.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Just Reported Earnings: Double Beat

By: Evan | May 2, 2024

• SQUARE $SQ JUST REPORTED EARNINGS

EPS of $0.74 beating expectations of $0.73

Revenue of $5.96B beating expectations of $5.82B

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

107

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3018

|

|

Created

|

11/18/15

|

Type

|

Free

|

| Moderators DiscoverGold | |||

| Volume: | 4,237,193 |

| Day Range: | 53.903 - 58.46 |

| Last Trade Time: | 1:01:41 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |