Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Remember this $SQ insider buy from August 5th that we alerted a few weeks back? Already up +20% on his $25M position.

By: TrendSpider | September 1, 2024

• Remember this $SQ insider buy from August 5th that we alerted a few weeks back?

Already up +20% on his $25M position.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Right shoulder forming?

By: TrendSpider | August 17, 2024

• $SQ Right shoulder forming?

Read Full Story »»»

DiscoverGold

DiscoverGold

Insiders buy for one reason and one reason only...

By: TrendSpider | August 16, 2024

• Insiders buy for one reason and one reason only...

Because they think the stock will go up. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Board Member Buying the Dip Again. Insider Botha Roelof purchased $25,000,000 in shares this week

By: TrendSpider | August 9, 2024

• $SQ BOARD MEMBER BUYING THE DIP AGAIN

Insider Botha Roelof purchased $25,000,000 in shares this week.

The last time he bought was in November 2023, right before a MASSIVE rally.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood is all hype.

Cathie Wood & Ark Invest's Sells 440,647 Shares of Block Inc. (SQ)

By: Ark Invest Daily | August 6, 2024

• Cathie Wood and Ark Invest's trade activity from today 8/6.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 328,858 Shares of Block Inc. (SQ)

By: Ark Invest Daily | August 5, 2024

• Cathie Wood and Ark Invest's trade activity from today 8/5.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ nice move here. 70 then 74 next resistance levels

By: Options Mike | July 14, 2024

• $SQ nice move here.

70 then 74 next resistance levels.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Wedge breakout + 200D SMA reclaim...

By: TrendSpider | July 12, 2024

• Wedge breakout + 200D SMA reclaim...

Not too shabby! $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Nice candle, maybe over 66 it's a long

By: Options Mike | July 7, 2024

• $SQ Nice candle, maybe over 66 it's a long

50D at 57.4 close

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull of the Day: Block (SQ)

By: Zacks Investment Research | July 5, 2024

With the Q2 earnings season set to ramp up following the fourth of July holiday, Block (SQ) is a tech stock that looks poised for a rebound leading up to its quarterly results in early August.

The innovative provider of point of sales solutions (POS) appears to be overlooked as SQ has now fallen -26% from its 52-week high of $87 a share in March.

Still, the expansive growth Block was able to display in Q1 is thought to have continued and strong financial results can of course lead to upward momentum for stocks.

Keeping this scenario in mind, Block’s stock currently sports a Zacks Rank #1 (Strong Buy) and is the Bull of the Day.

Q2 Sneak Preview

Investors are always looking for stocks that are expected to post robust quarterly growth and improved financial fundamentals and Block is on this radar.

Another quarter of double-digit top and bottom-line growth appears to be in the cards with Q2 sales projected to rise 13% to $6.29 billion and EPS projections of $0.75 would reflect a 92% increase from $0.29 a share in the comparative quarter.

Block is becoming a staple of the new American economy

Notably, Cash app's popularity has been the primarily catalyst to Block’s expansion along with hardware POS offerings such as its patented Square Reader machines with the company having a comprehensive commerce suite that fuels entrepreneurship by helping sellers grow their businesses.

CEO Jack Dorsey has also strived for other routes to keep up Block’s relevance and expansion from acquiring hip-hop mogul Jay-Z’s tidal music platform in 2021 to offering crypto-related services. In addition to develping a full bitcoin mining system Block provides a Bitcoin Hardware Wallet which offers storage for bitcoin holders.

Loosely speaking, Block may be a more affordable option for investors seeking exposure to bitcoin than Coinbase (COIN Quick QuoteCOIN - Free Report) while being a safter choice in regards to other crypto miners such as Marathon Digital (MARA Quick QuoteMARA - Free Report) or Riot Platforms (RIOT Quick QuoteRIOT - Free Report) . That notion is only magnified when considering Block’s diverse business operations along with the fact that the price of Bitcoin has soared in the last year and currently sits over $60,000.

Price of Bitcoin

Image Source: Microsoft Bing via Refinitiv

Growth Trajectory

Overall, Blocks total sales are projected to increase 15% in fiscal 2024 and are slated to expand another 12% in FY25 to $28.22 billion. More impressive, annual earnings are now expected to soar 73% this year to $3.11 per share versus $1.80 a share in 2023. Plus, FY25 EPS is projected to climb another 30% to $4.04.

Better still, Block’s stock is trading at 20.7X forward earnings and at 1.7X sales which are much more reasonable valuations than the stretched premiums it has commanded in the past.

Bottom Line

Block is once again becoming one of the most appealing business services companies to invest in at the moment. While it may be too soon to call Block’s stock an absolute steal at current levels, a sharp rebound looks justified considering the company’s attractive growth trajectory and innovative business offerings.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ has also been red just once in July since going public back in 2015...

By: TrendSpider | July 5, 2024

• $SQ has also been red just once in July since going public back in 2015...

Technicals & Seasonality starting to align here.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Any month now...

By: TrendSpider | June 1, 2024

• $SQ Any month now...

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 210,591 Shares of Block Inc. (SQ)

By: Ark Invest Daily | May 14, 2024

• Cathie Wood and Ark Invest's trade activity from today 5/14.

Read Full Story »»»

DiscoverGold

DiscoverGold

It's hip to be square

Cathie Wood & Ark Invest's Sells 110,334 Shares of Block Inc. (SQ)

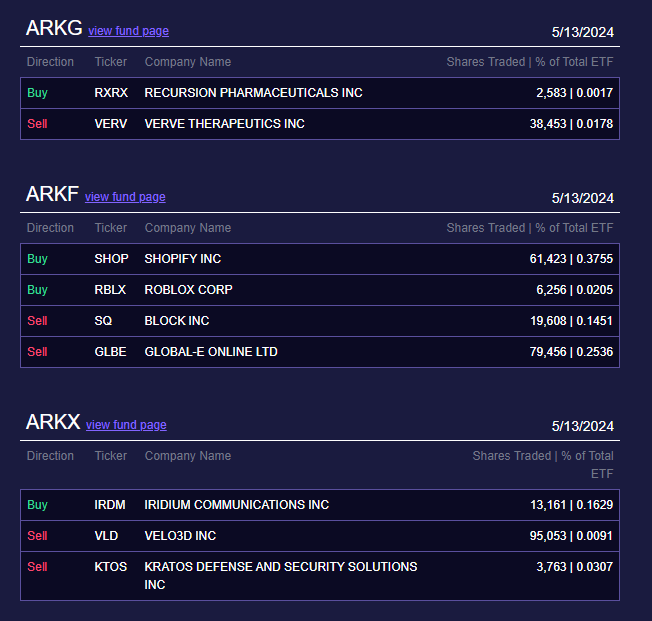

By: Ark Invest Daily | May 13, 2024

• $SPX seemingly range bound between 0.75 and 1.0 std dev. Waiting to see signs of direction.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block (SQ) Stock Higher on Quarterly Beat, Forecast

By: Schaeffer's Investment Research | May 3, 2024

• The fintech company plans to buy more Bitcoin (BTC)

• Analysts and options traders are responding to the results

Fintech stock Block Inc (NYSE:SQ) is up 3.8% to trade at $72.98 at last check, after the company announced better-than-expected first-quarter earnings of 85 cents per share on $5.96 billion in revenue. In addition, Block revealed plans to buy more Bitcoin (BTC) and hiked its annual forecast.

Needham raised its priced target to $105 following the results, and TD Cowen adjusted up to $92, both of which are healthy premiums to SQ's current perch. The majority of analysts are bullish on the equity, with 29 of 37 in coverage recommending a "buy" or "strong buy."

Options traders are piling on as well, with 41,000 calls and 23,000 puts exchanged so far -- overall volume that is six times the intraday average amount. The most popular contract is the weekly 5/3 75-strike call.

On the charts, today's pop is losing steam at Block stock's 30-day moving average -- a trendline that acted as resistance for most of April. Nevertheless, the equity still boasts a more than 24% year-over-year lead, and added roughly 53% during the past six months.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Just Reported Earnings: Double Beat

By: Evan | May 2, 2024

• SQUARE $SQ JUST REPORTED EARNINGS

EPS of $0.74 beating expectations of $0.73

Revenue of $5.96B beating expectations of $5.82B

Read Full Story »»»

DiscoverGold

DiscoverGold

Market Chatter: Block Under Probe for Alleged Compliance Malpractices

10:46:23 AM ET, 05/01/2024 - MT Newswires

10:46 AM EDT, 05/01/2024 (MT Newswires) -- Block (SQ) is said to be under probe for alleged compliance lapses at its Square and Cash App units, NBC News reported Wednesday, citing two unnamed sources familiar with the matter.

NBC said prosecutors from the Southern District of New York are looking into the company's documents and internal practices after a former employee disclosed certain malpractices within the group. According to the former employee, Block collected insufficient information for Square and Cash App customers' risk assessment, Square processed thousands of transactions involving countries with economic sanctions, and Block processed cryptocurrency transactions for terrorist groups.

The former employee provided about 100 pages of supporting documents to NBC and said Block did not correct the processes when informed of the transactions, the report added. NBC said a second source familiar with the company's practices and monitoring programs backed the former employee's allegations.

According to NBC, a Block spokeswoman said the company voluntarily reported the transactions described by the former employee to the Office of Foreign Assets Control under the US Treasury and that the company maintains a "responsible and extensive compliance program."

Block did not immediately respond to MT Newswires' request for comment.

(Market Chatter news is derived from conversations with market professionals globally. This information is believed to be from reliable sources but may include rumor and speculation. Accuracy is not guaranteed.)

Block $SQ Not a bad setup to keep your eyes on heading into next week

By: TrendSpider | April 26, 2024

• Not a bad setup to keep your eyes on heading into next week. $SQ

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 212,715 Shares of Block Inc. (SQ)

By: Ark Invest Daily | April 25, 2024

• Cathie Wood and Ark Invest's trade activity from today 4/25.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ One of the hotter weekly setups heading into April

By: TrendSpider | March 28, 2024

• $SQ One of the hotter weekly setups heading into April.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 95,178 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 25, 2024

• Cathie Wood and Ark Invest's trade activity from today 3/25.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 188,519 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 21, 2024

• Cathie Wood and Ark Invest's trade activity from today 3/21.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 42,608 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 20, 2024

• Cathie Wood and Ark Invest's trade activity from yesterday 3/20.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 9,437 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 19, 2024

• Cathie Wood and Ark Invest's trade activity from today 3/19.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Sells 110,659 Shares of Block Inc. (SQ)

By: Ark Invest Daily | March 18, 2024

• Cathie Wood and Ark Invest's trade activity from today 3/18.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Breaking out to new 52-week highs right out the gate this morning!

By: TrendSpider | March 13, 2024

• $SQ Breaking out to new 52-week highs right out the gate this morning!

Read Full Story »»»

DiscoverGold

DiscoverGold

$SQ Keep an eye on Block this week, C&H setup with 8 new analyst buy ratings following last month's earnings report.

By: TrendSpider | March 11, 2024

• $SQ Keep an eye on Block this week, C&H setup with 8 new analyst buy ratings following last month's earnings report.

Read Full Story »»»

DiscoverGold

DiscoverGold

Jack Dorsey's plan to reshape Square

Kate Fitzgerald

Fri, February 23, 2024 at 12:50 PM MST·5 min read

https://finance.yahoo.com/news/jack-dorseys-plan-reshape-square-195021334.html

After retaking day-to-day control as CEO of Square last fall, Jack Dorsey, who also heads Square's parent company, Block, surprised analysts with fourth-quarter profits that exceeded expectations, in part through aggressive cost-cutting. And he's just getting started.

Next, Dorsey aims to overhaul the 15-year-old Square app so that it works more cleanly with Block's booming peer-to-peer Cash App to act like a bank for sellers and others.

Block's goal is for Cash App to become one of the top providers of banking services to U.S. households earning up to $150,000 annually. The company will beef up the financial tools it offers, and make the P2P app the go-to banking source for Square sellers, Dorsey told analysts during a conference call to discuss earnings Thursday.

"We're going to start putting our Square customers first and foremost in the Cash App, and you'll really see the power of our combined ecosystems and a combined network," Dorsey said, noting that Cash App P2P features position the entity to operate as a "social bank."

The plan hinges on expanding features within Block's Cash App and the Cash App Card to close the distance between its own offerings and those of a bank. Block plans to add mobile check deposit, bill payment and wire transfers, Dorsey said in a shareholder's letter also released Thursday.

Cash App already offers a Visa debit card, two-days-early direct deposit, cash deposits, instant discounts on debit spending and an FDIC-insured savings account with no minimum balance and free overdraft insurance. Cash App also offers short-term credit through Borrow, as well as stocks and bitcoin services. Its banking services are supported by Sutton Bank and Lincoln Savings Bank.

As Block's consumer banking ambitions expand, so will scrutiny of the firm's payments security and regulatory compliance. Reports recently circulated that two whistleblowers have filed a complaint with the Financial Crimes Enforcement Network, the Securities and Exchange Commission and the Commodities Futures Trading Commission about Cash App's potential use by criminals for money laundering and terrorism financing.

Dorsey told analysts that Block is investing more deeply in security and compliance this year, adding that it means "continued focus on risk and fraud management, including protecting our customers from bad actors who attempt to abuse our platform through vectors like scams and phishing attacks," but he did not directly confirm any regulatory probes. Block did not respond to emailed inquiries about this topic.

Many of Dorsey's moves are aimed at shoring up internal operations that had frayed over the last decade when Dorsey wasn't directly managing the company, culminating in the sudden exit last year of Square's longtime CEO Alyssa Henry.

Robert Anderson, a Square founder, is rejoining the company "to focus on making design at Square world-class again," Dorsey said.

A top priority this year will be tightening the integration across Square sellers, Cash App and Afterpay, the company's buy now/pay later arm. Block immediately plans to eliminate "four or five" different versions of the Square app that previously targeted different user groups, creating a single app called Square, with tabs for users to access services targeting sole proprietors or restaurants, for example.

Block also plans to promote Afterpay within Cash App by displaying BNPL offers there, and also by inviting Afterpay app users to fund BNPL purchases with the Cash App Card, he said.

To boost growth at Square, the firm is trying out a new "pay as you go" model, offering some sellers free point-of-sale hardware in exchange for a higher card-processing rate. Square is also offering restaurants a bundle of business-management software tools at a discounted rate, and offering sellers new incentives for referrals.

Asked about the possibilities for expanding Square distribution through banks, Dorsey noted that years ago Square partnered with JPMorgan Chase to distribute Square readers through Chase's bank branches and "it wasn't that effective."

Noting that some banks are succeeding in distributing mobile payment acceptance tools through branches, Dorsey said he's still open to the idea, but it's secondary to the immediate need to modernize Square itself, including through the use of generative AI.

"[AI] is going to be extremely impactful for us as we look at everything that we're doing and all the tools that we're building and how much more productive it makes all of our engineers," Dorsey said. Additionally, AI "allows us to ship faster, allows us to correct mistakes much faster and really be ahead of the market," he said.

Block's gross profit for the fourth quarter was $2 billion, up 22% over the same period a year earlier. Cash App generated $1.2 billion, up 25% year over year. Square alone contributed $828 million to gross profit, up 18% year over year.

For the full year, Block's gross profit was $7.5 billion, up 25% over 2022.

Block raised its 2024 profit forecast by more than $200 million, and the company now expects to produce gross profit of $8.65 billion, which would be 15% above 2023.

The company has also cut staff through layoffs and attrition so employees number under 12,000, a level Dorsey plans to keep in place for the next several years, he said.

"We sense that work is underway to enhance growth by improving product velocity," said analysts at JPMorgan in a Thursday note to investors, adding: "The overall momentum of Cash App is impressive."

What to Expect from This Fintech Firm's Earnings

By: Schaeffer's Investment Research | February 21, 2024

• Block is expected to report earnings after tomorrow's close

• The stock has a tendency to move higher after quarterly results

Block Inc (NYSE:SQ) is slated to step into the earnings confessional after the market closes tomorrow, Feb. 22. Wall Street is anticipating the fintech concern's earnings to come in at 47 cents per share on revenue of $5.43 billion, representing a year-over-year gain for both figures.

Looking at Block's earnings history, its shares were higher after five of its past eight post-earnings sessions, including a 10.7% pop after its November report. In the last eight quarters, SQ averaged a swing of 8.9%, regardless of direction. This time around, the options market is pricing in a much larger move of 18.2%.

Ahead of the vent, Block stock is down 2.6% to trade at $64.03 at last glance. The $64 level and its 80-day moving average are both keeping the equity's pullback in check, as is stands well above its annual lows near the $38 area. While SQ is up 11.6% over the last six months, it sports notable double-digit percentage losses in 2024 and over the last 12 months.

Despite this year's underperformance, call traders have taken an increased interest in the stock. This is per Block stock's 10-day call/put volume ratio of 3.06 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than all but 6% of readings from the past year, showing calls being snatched up at a much faster-than-usual rate in the last two weeks.

Read Full Story »»»

DiscoverGold

DiscoverGold

Fintech Stock Block (SQ) for Options Bulls

By: Schaeffer's Investment Research | February 2, 2024

• SQ looks like a perfect pick for call traders

• Square stock has layers of support in place

Fintech stock Block Inc (NYSE:SQ) is finding support near its 160- and 200-day moving averages, and recently experienced a double bottom on the hourly chart. Now in the midst of a roughly 20% pullback from its massive 2023 end-of-the-year run, a confluence of weekly moving averages are supporting SQ on the charts which makes now an intriguing time to speculate on the equity's next move higher.

Earlier in the week the stock pulled back near the 60-strike -- the second-largest put open interest 9OI) level -- and bounced off that area, nearly overtaking the peak put strike level of 65 before the weekend. There's room for analyst sentiment to turn higher, too, as 15 of 47 still rate SQ a "hold" or "sell."

Now looks like the ideal time to bet with options too, as Block stock's Schaeffer's Volatility Scorecard (SVS) tally of 90 -- out of a possible 100 -- indicates it tends to outperform options traders' volatility expectations. Our recommended call option leverage ratio of 5.3, and would double on a 20.2% pop in the underlying shares.

Read Full Story »»»

DiscoverGold

DiscoverGold

BTIG Upgrades Block to Buy From Neutral, Price Target at $85

7:54 AM ET, 01/30/2024 - MT Newswires

Wedbush Upgrades Block to Outperform From Neutral on Pricing Leverage, Raises PT to $90 From $70

7:22 AM ET, 01/30/2024 - MT Newswires

Block $SQ 50D in play, and then 200D at this point

By: Options Mike | January 15, 2024

• $SQ 50D in play, and then 200D at this point.

Read Full Story »»»

DiscoverGold

DiscoverGold

Hello again SQ is on my list

Cathie Wood & Ark Invest's Sells 231,102 Shares of Block Inc. (SQ)

By: Ark Invest Daily | December 27, 2023

• Cathie Wood and Ark Invest's trade activity from today 12/27.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ has reached its most overbought level in more than 6 years

By: Barchart | December 26, 2023

• Block $SQ has reached its most overbought level in more than 6 years.

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Buys 158,334 Shares of Block Inc. (SQ)

By: Ark Invest Daily | December 20, 2023

• Cathie Wood and Ark Invest's trade activity from today 12/20.

Read Full Story »»»

DiscoverGold

DiscoverGold

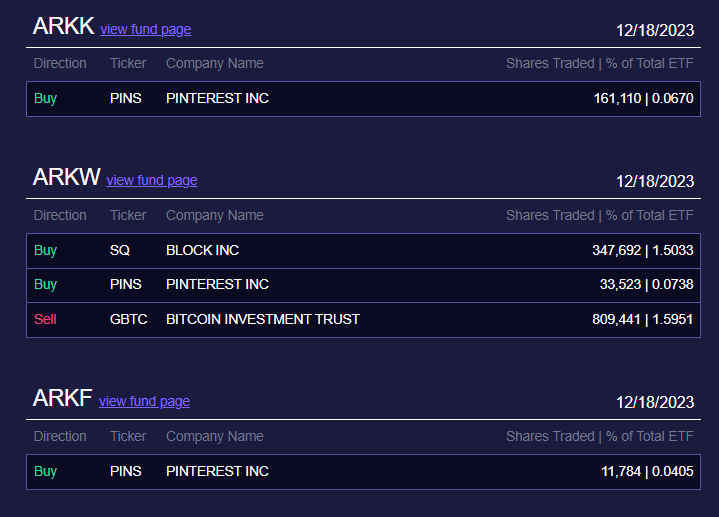

Cathie Wood & Ark Invest's Buys 347,692 Shares of Block Inc. (SQ)

By: Ark Invest Daily | December 18, 2023

• Cathie Wood and Ark Invest's trade activity from today 12/18.

Read Full Story »»»

DiscoverGold

DiscoverGold

After Hours in bullish move

Block (SQ) could 'comfortably achieve' +16% gross profit growth next year - Mizuho

By: Investing | December 12, 2023

Mizuho analysts raised the firm's price target for Block (SQ) to $99 from $90 per share in a note Tuesday, maintaining a Buy rating on the stock.

The investment company's meticulous bottom-up model will help underwrite Block's 2024 gross profit.

"Consider our granular bottom-up models for SQ's major ecosystems. The models suggest that SQ could comfortably achieve +16% total company GP growth next year," explained the analysts.

For Square, the Mizuho analysts said they used the "historical capture of incremental V & MA volumes to help predict nearly $3.5bn of GP (ex-BNPL) in 2024 (+12% growth)." For Cash App, they "model each individual product, including Instant Deposit, Cash Card, and others" and overall, "expect +18% GP growth to $4.2bn (ex-BNPL)."

"Together (including BNPL & Corporate), we estimate $8.7bn of total company GP in 2024 (+16% growth)," said the analysts, adding that the price target was lifted due to better cost control and increased comfort around medium-term GP growth.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Kissing that juicy gap... Hot but so far doesn't care

By: Options Mike | December 10, 2023

• $SQ Kissing that juicy gap... Hot but so far doesn't care.

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ What I refer to as Imbedded Overbought.. 68 Next resistance, 8D not even touched last month .. sto strong

By: Options Mike | December 3, 2023

• $SQ What I refer to as Imbedded Overbought.. RSI screaming and doesn't care..

68 Next resistance, 8D not even touched last month .. sto strong.

Read Full Story »»»

DiscoverGold

DiscoverGold

Clearbridge Investments LLC Makes New Investment in Block, Inc. (SQ)

By: MarketBeat | November 26, 2023

• Clearbridge Investments LLC purchased a new position in Block, Inc. (NYSE:SQ) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 1,107,468 shares of the technology company's stock, valued at approximately $73,724,000. Clearbridge Investments LLC owned approximately 0.18% of Block as of its most recent filing with the Securities and Exchange Commission (SEC)...

Read Full Story »»»

DiscoverGold

DiscoverGold

Block $SQ Nice winner in this one, out now. gap filled 60 then the 200D next levels

By: Options Mike | November 19, 2023

• $SQ Nice winner in this one, out now. gap filled 60 then the 200D next levels.

Might look at it again on dip to the 8D and hold.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

104

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2988

|

|

Created

|

11/18/15

|

Type

|

Free

|

| Moderators DiscoverGold | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |